Analyzing the Internal Logic of PayPal's Stablecoin Payments and the Evolutionary Path Toward Mass Adoption

TechFlow Selected TechFlow Selected

Analyzing the Internal Logic of PayPal's Stablecoin Payments and the Evolutionary Path Toward Mass Adoption

This article will attempt to analyze the internal logic behind PayPal's turn toward crypto.

Author: Will Awang

On May 31, 2024, PayPal announced the launch of its stablecoin, PayPal USD (PYUSD), on the Solana blockchain. This marks another major milestone following PYUSD’s initial debut on Ethereum’s mainnet in August last year. It not only provides users with a new, efficient payment method but also offers significant insights into the future direction of the global payments industry.

While researching and writing the Web3 Payments Research Report, and engaging with various industry players, one fundamental question kept arising: Is stablecoin-based payment truly necessary? The launch of PYUSD on Solana presents a pragmatic answer from PayPal regarding financial freedom:

“People want to pay however they wish. Current payment networks struggle to meet this demand. Crypto can fulfill it—and it works. As a fintech company committed to advancing payment innovation, we’re introducing a stablecoin payment solution to meet people's real-time, frictionless payment needs.”

This article aims to analyze PayPal’s underlying logic in embracing crypto, the stablecoin payment framework enabled by PYUSD on Solana, and the strategic evolution toward mass adoption of PYUSD—offering insights for industry stakeholders. Feedback and discussions are welcome.

1. Why PayPal is Turning to Crypto

As a global leader in digital payments, PayPal brings over two decades of experience in facilitating transactions worldwide. Over these years, alongside the growth of e-commerce, PayPal has not only established itself as a trusted intermediary ensuring transactional security but has also driven widespread adoption of internet-based digital payment systems.

PayPal’s core mission remains unchanged—advancing payment innovation so everyone can pay exactly how they want.

However, until now, payment innovation has operated within the same foundational financial infrastructure that emerged with the internet. Despite ongoing efforts to deliver global, instant, and seamless transactions, reality often falls short:

Online payment settlements still take time (averaging 2–3 days in the U.S.), with banks, markets, and service providers operating only on business days, further delaying processing. Employers face challenges paying increasingly distributed workforces. A growing globally mobile population struggles to send cross-border remittances affordably and efficiently. Businesses feel these frictions acutely, while consumers endure frustrating delays in what should be instantaneous payments.

In short, people today cannot pay the way they truly desire.

This is precisely why PayPal is turning to crypto—the answer is simple: it meets demand and it works.

Cryptocurrencies and blockchain technology bring us closer to fulfilling the ideal of payments: fast, low-cost, and borderless. This next-generation financial/payment infrastructure enables PayPal to better serve its 400 million users by empowering everyone to transact freely.

More than a decade after the emergence of cryptocurrencies and blockchain, PayPal stands again at a pivotal moment in payment history—one reminiscent of the early 2000s internet era, filled with immense potential and opportunity.

Just as PayPal brought payments online before, it is now bringing payments on-chain.

(flywheeldefi.com/article/paypal-steps-on-chain-with-pyusd)

2. Global Payment Challenges Require Solutions

Current payment rails and messaging protocols—such as ACH, SEPA, and SWIFT—form the backbone of the global payment network. They enable large-scale, cross-border, cross-time-zone transactions and ensure relative smoothness. However, existing systems force trade-offs between 1) settlement speed and 2) cost efficiency, such as:

-

Fund transfers incur fees, and intermediaries require pre-established agreements and liquidity reserves;

-

Cross-time-zone operational hours (business days) and batch processing mean payments may take days to settle;

-

Net settlement models are ill-suited for small, high-frequency transactions.

But adults don’t have to choose—we want both: highly efficient settlements at low cost.

People simply want easier ways to pay. Businesses want to pay suppliers without worrying about settlement delays; individuals want to send money to distant family members without high fees or multi-day waits. Today’s financial infrastructure fails to meet the need for rapid transactions. PayPal does not want its users to lose value during these delays.

Today, cryptocurrencies and blockchain technology offer a new payment rail that simplifies clearing and settlement, enabling fast, cheap, and accessible payments.

We must leverage crypto and blockchain payment solutions to address legacy issues in traditional finance: 1) slow settlement times; 2) high transaction costs; and 3) incompatibility with underbanked and unbanked populations globally.

3. PayPal’s Stablecoin Payment Solution

(PayPal’s stablecoin could lead crypto into the mainstream)

Stablecoin Definition: Most cryptocurrencies suffer from high price volatility, making them unsuitable for payments—Bitcoin, for example, can swing dramatically in a single day. Stablecoins solve this by maintaining stable value, typically pegged 1:1 to fiat currencies like the U.S. dollar. They combine the best of both worlds: minimal daily fluctuations and access to blockchain benefits—efficiency, affordability, and global reach.

PayPal’s PYUSD represents a new stablecoin payment solution designed to drive next-generation financial innovation. Built on PayPal’s deep expertise in payments and the high-performance Solana blockchain, PYUSD enables instant settlement, reduces transaction costs, ensures strong security, and supports genuine global payments.

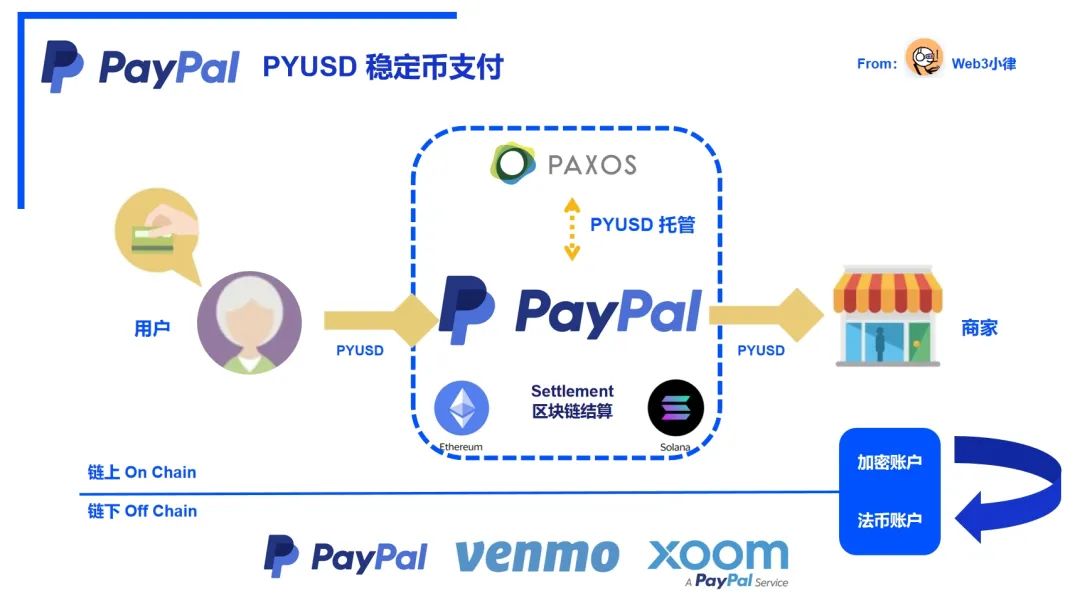

PYUSD is a blockchain-based stable-value instrument (1:1 USD-backed) introduced by PayPal to resolve current inefficiencies in the global payment system. Eligible U.S. users can buy, sell, send, receive, and use PYUSD for payments:

-

Seamlessly transfer and transact PYUSD within the PayPal and Venmo ecosystems, offering smooth on- and off-ramps;

-

Use PYUSD as a payment option for online purchases at millions of PayPal merchants worldwide;

-

Utilize PYUSD for cross-border P2P payments via Xoom (PayPal’s international money transfer service);

-

Use PYUSD outside PayPal’s ecosystem—for example, on cryptocurrency exchanges (e.g., Crypto.com) and wallets (e.g., Phantom);

-

Leverage PYUSD for innovative use cases, such as serving as a fast, low-cost fundraising tool for venture capital firms like Mesh.

PYUSD is building authentic commercial use cases for stablecoins, delivering an almost frictionless and trustworthy payment experience expected by mainstream consumers and merchants.

4. PayPal’s Roadmap to Mass Adoption of Stablecoin Payments

Leveraging nearly 20 years of global payment compliance expertise and PYUSD’s stringent regulatory standards, the PayPal + PYUSD combination elevates prior stablecoin transactions into true stablecoin payments—the kind the world actually needs.

When PayPal was founded, its mission extended beyond enabling payments—it aimed to introduce and popularize a new technology: digital payments. Today, that vision is fully realized, with digital payments embedded everywhere in daily life. This success story offers valuable lessons and fresh perspectives for rolling out PYUSD. Specifically, PayPal envisions mass adoption unfolding in three stages:

-

Awareness;

-

Utility;

-

Ubiquity.

4.1 Awareness Through Introduction

Payments are deeply rooted in habits and routines, so change must be gradual and steady—it won’t happen overnight. Introducing a new payment method involves both behavioral and technological shifts.

The first step toward mass adoption is awareness—simply informing people that this new technology exists.

In this phase, the target audience is early adopters—crypto holders, who make up about 15% of the global population and are relatively easy to reach. This explains why PayPal launched PYUSD on Ethereum in late 2023—to spark awareness among early adopters.

Now, launching PYUSD on Solana—the second-largest blockchain by market cap and known for high performance—ensures visibility among the most active and engaged crypto communities, sending a clear message: “PYUSD is here.”

Additionally, integration with PayPal and Venmo apps introduces PYUSD to over 100 million U.S. users. Future collaborations with crypto exchanges and payment partners will extend PYUSD’s reach beyond PayPal’s ecosystem.

Drawing from past successes, PayPal understands that cognitive awareness is the essential first step in mainstreaming any new payment mechanism.

4.2 Utility Through Integration

The next stage in adopting new payment technology is achieving utility—transforming initial awareness into real-world usability.

For example, PayPal initially gained traction by integrating with eBay, establishing trust between strangers conducting online transactions.

Today, payments must be fast and affordable. While launching PYUSD on Ethereum boosted its visibility, it did not fully satisfy all requirements for PYUSD to fulfill its mission as a digital commerce payment tool—efficiency, economy, and global accessibility.

Therefore, PYUSD’s move to Solana unlocks practical utility.

(PayPal launches USD-pegged stablecoin on Solana: A new chapter in blockchain payments)

Solana is a high-performance blockchain built for finance, payments, loyalty programs, and more. It ranks among the most adopted blockchains, averaging 40.7 million transactions per day in Q4 2023, with 2,500 active developers. Its open-source, programmable, and composable architecture creates vast opportunities and powerful network effects.

By leveraging Solana, PYUSD gains significantly faster settlement, lower costs, greater scalability, and robust global support. Combined, these advantages allow users to realize genuine payment utility:

-

Real-time settlement: Most PYUSD transactions settle within seconds;

-

Low transaction fees: Transactions on Solana cost just a few cents, regardless of amount;

-

Settlement finality: Merchants no longer risk chargebacks due to insufficient funds;

-

24/7 availability: Accessible every day of the year;

-

Interoperability: PYUSD works across gateways, networks, and wallets beyond PayPal;

-

Programmability and composability: PYUSD is built on the widely adopted SPL token standard, meaning any product supporting SPL automatically supports PYUSD. Developers can experiment and build freely inside and outside PayPal’s ecosystem. Consumers, merchants, and institutions gain rich third-party experiences using PYUSD in diverse payment and financial applications;

-

Massive user base: PYUSD is available to eligible U.S. PayPal customers.

Thus, launching PYUSD on Solana advances long-term adoption of stablecoin payments, transitioning PYUSD from awareness to tangible utility.

With PYUSD now live on both Ethereum and Solana, increased developer and ecosystem participation—combined with practical functionality in PayPal and Venmo apps—will generate more user-friendly, actionable use cases.

4.3 Ubiquity Through Assimilation

The final stage of adopting any new payment technology is ubiquity—where the technology becomes seamlessly integrated into everyday life. At this point, users adopt it effortlessly and unconsciously—they simply pay however they want.

For PayPal, digital payments became ubiquitous by enabling secure, reliable, standardized P2P, B2B, and B2C transactions across 200+ countries, evolving alongside digital globalization.

5. Use Cases for PYUSD Stablecoin Payments on Solana

Turning vision into reality—enabling free and flexible payments—requires concrete applications. Let’s examine some real-world use cases for PYUSD.

5.1 Cross-Border Peer-to-Peer Transfers (P2P)

Today, personal economic ties span the globe more than ever. Yet, cross-border individual money transfers represent a massive and growing market full of untapped potential. In 2023, remittances to low- and middle-income countries reached $669 billion (World Bank), but these services remain expensive.

With PYUSD, senders can directly transfer funds to recipients via Solana wallets, settling nearly instantly at near-zero cost.

Even for recipients without a Solana wallet, senders can partner with PYUSD-enabled payment service providers to reduce remittance costs. These providers connect to local banking systems, allowing recipients to easily convert PYUSD into bank deposits or cash—enjoying near-instant, low-cost global remittance services.

5.2 Business-to-Business Payments (B2B)

Due to the complexity of cross-border payments—with multiple intermediaries and correspondent banking networks—most B2B payments take days to settle. Fees can also be high depending on the transfer method.

By leveraging PYUSD’s programmability, businesses can build services that enable near-instant, cost-effective cross-border transfers with minimal technical overhead. Teams can even create smart contracts to manage PYUSD flows between accounts, improving speed and accuracy in supplier payments—or any other contract-bound B2B transaction.

Moreover, adopting PYUSD doesn’t require businesses to hold or directly interact with it. Payment service providers can design B2B products that deliver a fiat-like user experience.

5.3 Global Merchant Payments (B2C)

PYUSD greatly simplifies global payments. Instead of navigating complex networks involving regional bank accounts, multiple currencies, correspondent banks, and digital wallets, merchants can receive PYUSD directly into any compatible wallet. Additionally, programmable smart contracts enable businesses to automate payment workflows more efficiently—even enabling real-time payroll disbursements.

5.4 Micropayments

Traditional payment systems struggle with micropayments due to high fees. Platforms handling small transactions often resort to batching, which introduces complex engineering, increases risk, and prevents acceptance of micro-transactions.

With PYUSD on Solana, merchant platforms can easily process micropayments in near real-time and at negligible cost. This opens up numerous use cases: tipping, in-game purchases, and micro-payments to content creators based on views or reads.

5.5 Web3 Payments

Many Web3 merchants—such as NFT marketplaces and blockchain gaming platforms—lack connections to traditional bank accounts and require robust, non-volatile payment solutions. PYUSD combined with PayPal’s infrastructure meets this need perfectly.

6. Final Thoughts

Jose Fernandez da Ponte, Senior Vice President of Blockchain, Cryptocurrency, and Digital Currencies at PayPal, said: “The creation of PayPal USD is designed to revolutionize commerce once again by offering a fast, simple, and inexpensive way to pay for the next phase of the digital economy. Offering PYUSD on the Solana blockchain further advances our goal of delivering a stable-value digital currency purpose-built for commerce and payments.”

We observed that since PYUSD’s launch on Ethereum last year, activity remained limited, mostly confined within PayPal’s Super App. Now, launching on Solana signals either an intent to break into broader markets or a deeper exploration of scalable use cases. One thing is certain: the killer app of Web3 may already be here—and it’s payments!

As previously stated in our Web3 Payments Research Report: The greatest opportunity in crypto may not lie in viewing it as crypto—but as a new set of payment tools.

Payments carry the critical mission of bridging on-chain crypto systems with off-chain fiat economies. Through tokenization powered by blockchain technology, traditional monetary systems gain renewed value, overcoming previously insurmountable boundaries—potentially transforming the global economy forever.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News