A Night of Anxiety: FOMC Highlights

TechFlow Selected TechFlow Selected

A Night of Anxiety: FOMC Highlights

The most likely scenario is that Chair Powell will provide a tone at the press conference consistent with recent Fed communications: the next move could be a rate cut, but emphasizing patience due to persistent inflation data.

Author: Chen Min, MorningFX

Tonight, the U.S. CPI data and the FOMC monetary policy meeting will be released one after another, with less than six hours between them. After the nonfarm payrolls report, we may be heading into another nerve-wracking night.

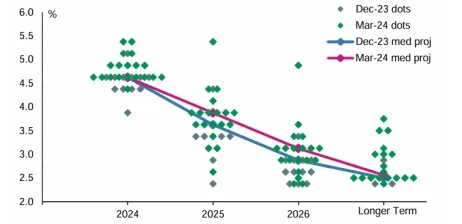

01 Dot Plot

Since the interest rate decision itself holds little surprise (rates are expected to remain unchanged at the June policy meeting), nearly all attention is now focused on the so-called "dot plot" from the meeting.

The outcome can broadly fall into three scenarios:

-

Base case: The median number of rate cuts by end-2024 in the updated dot plot is two

-

Dovish case: The median number of rate cuts by end-2024 in the updated dot plot is three

-

Hawkish case: The median number of rate cuts by end-2024 in the updated dot plot is one

Among these three scenarios, the base case has the highest probability. Based on the voting results from the previous March FOMC meeting, the split between more than three cuts and fewer than two cuts was 10:9. Considering recent hawkish comments from Fed officials, a reduction of one cut in the 2024 dot plot—leaving two cuts—is the most likely base scenario.

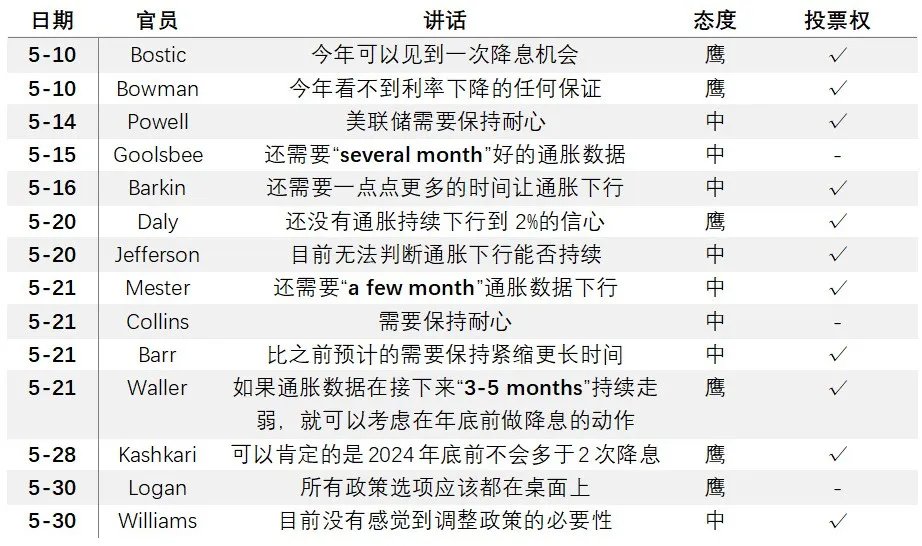

Recent statements from Federal Reserve officials include:

Currently, major foreign financial institutions predict: the 2024 dot plot will be revised upward by 25bp (implying two rate cuts this year), though there remains significant divergence regarding the number of cuts and timing of the first cut.

Regarding longer-term dots, if the 2024 projection shifts higher, the long-term or neutral rate projections may also rise further; under the base scenario, the median dots for 2025 and 2026 could also shift up modestly by around 25 basis points.

02 Meeting Statement and Press Conference

The meeting statement is unlikely to differ significantly from May's version; instead, the post-meeting press conference may become the key focus. Journalists may directly ask Chair Powell questions, and his answers and word choices could provide valuable insights. At the May FOMC meeting, Powell rejected the possibility of a rate hike, which became the main highlight. Following that press conference, Chair Powell was widely perceived as dovish.

However, the most likely scenario is that Chair Powell maintains a tone similar to recent Fed communications during the press conference: the next move could be a rate cut, but given persistent inflation, patience will still be required.

03 Economic Projections

Economic forecasts are more likely to be downgraded: since May, U.S. economic data have generally come in weaker than expected. Q1 U.S. GDP has already been revised downward, and recent indicators such as retail sales, industrial production, PMI, JOLTS job openings, and ADP employment have shown broad softness. Although nonfarm payrolls exceeded expectations, prior-month revisions were downward, and the household survey unemployment rate has risen consecutively—this suggests growth forecasts for the year may be slightly lowered.

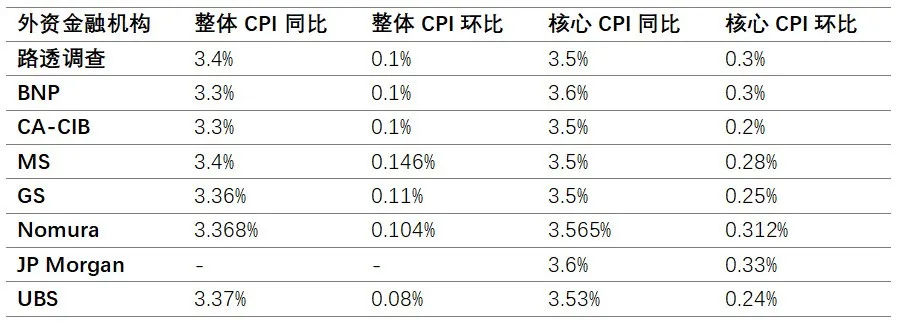

Inflation-related information will likely be closely tied to the CPI data released just hours earlier. Although CPI is published only a few hours before the FOMC meeting, policymakers likely already have a good sense of inflation trends. From recent component data, stickiness in core services and housing remains key drivers of inflation.

Below are CPI forecasts from major foreign banks for reference:

04 Market Reaction

If events unfold according to the base scenario, the foreign exchange market is unlikely to gain much new information from this week’s FOMC meeting.

However, if tonight’s CPI data exceed expectations, leading to a more hawkish FOMC outcome, markets could turn nervous and begin pricing in “no rate cuts this year.” Currently priced-in expectations of 1–2 rate cuts could rapidly drop to less than one. In terms of market reaction, the U.S. Dollar Index and Treasury yields would likely surge quickly, with the dollar index possibly testing its previous high near 106.

If CPI data come in weak, we expect the FOMC meeting to deliver a more neutral message, at least influencing the tone of Chair Powell’s remarks at the post-meeting press conference. In that case, markets are more likely to continue trading within a range amid ongoing volatility.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News