Do We Still Need Blockchain Today? Reflections from the Perspectives of Money and AI

TechFlow Selected TechFlow Selected

Do We Still Need Blockchain Today? Reflections from the Perspectives of Money and AI

In any case, humans will need blockchain.

Author: 100y

Translation: TechFlow

Will the unknown parts in the image reconnect and follow the same trajectory as before?

Humans are remarkable beings. While biological evolution progresses extremely slowly, humans have changed the world at an astonishing pace through science and technology. Imagine today's life compared to life a thousand years ago. Although our physical appearance is similar and cognitive abilities haven't changed much, the gap in living standards is enormous.

However, no matter how rapidly the world changes, humans are ultimately limited by bodies and genes composed of organic and inorganic materials. Struggles for wealth and power driven by instinct, class conflicts, wars to rebuild international order, and cycles of wealth and debt have persisted throughout history, and are likely to continue. Human responses and behavioral patterns toward these issues are unlikely to change significantly over time.

This perspective suggests that by studying historical human behavior and reactions to major events, we can predict future patterns. While we cannot absolutely predict the future, unless there is a dramatic shift in human biology or a fundamental transformation in our collective thinking—such as global enlightenment through universal adoption of Buddhism—we can use the past to make informed guesses about future trends.

Numerous published books analyze the unchanging aspects of human society and our consistent reactions to historical events. For example, Morgan Housel’s “Same As Ever” offers insightful explanations on the persistence of human thought processes from a micro perspective. On the other hand, Ray Dalio’s “Principles for Dealing with the Changing World Order” analyzes the repetitiveness of empire histories from a macro angle. Both books are highly recommended for readers interested in understanding these enduring patterns.

In this context, this article aims to explore some major and inevitable trends currently facing humanity and their potential impact on society, drawing comparisons with similar historical situations. This article particularly focuses on the weakening status of the US dollar and the rise of Artificial General Intelligence (AGI), pointing out that both may pose significant risks due to excessive centralization. Therefore, I believe blockchain technology, which inherently promotes decentralization, will play a crucial role in the future of human society. Each section of this article will delve into how the blockchain industry, led by Bitcoin, will ultimately shape our world.

1. The Inevitable Topic: Money

1.1 The Collapse of Reserve Currencies Is Inevitable

Money is a social contract established to facilitate transactions. Its legitimacy depends on the balance of power within the international order and participants’ trust. Since human thought and emotional systems haven’t undergone major changes over long periods, the future monetary system is likely to follow historical precedents.

Most people today are accustomed to the US dollar as the global reserve currency, using it unquestioningly in daily life. America’s dominance in military, financial, scientific, and various other fields has solidified the seemingly eternal status of the dollar. However, humans tend to be overly confident about things they haven’t personally experienced. A brief exploration of the nature and history of money reveals that the lifespan of a global reserve currency is typically shorter than expected.

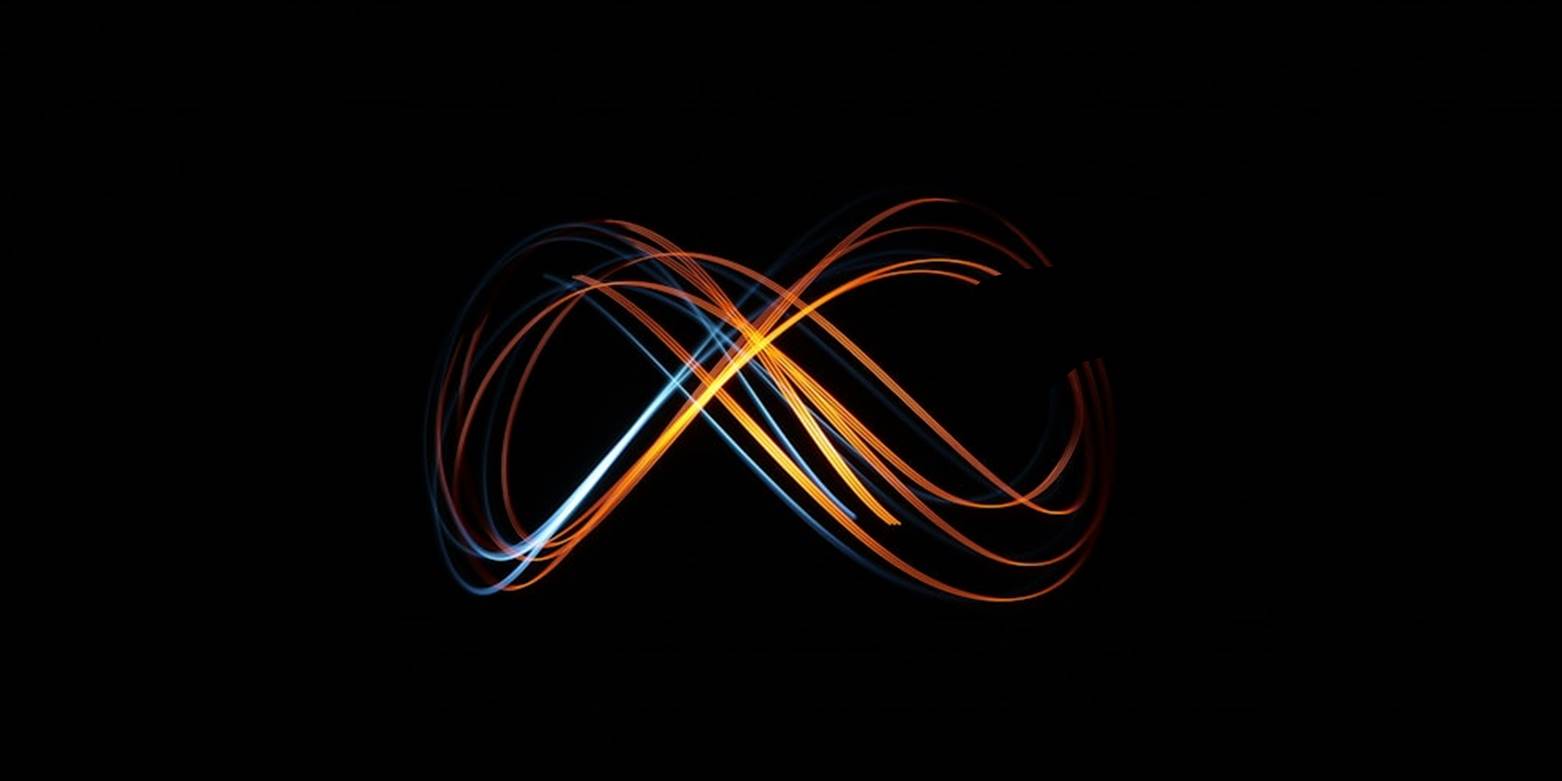

Since the establishment of the Bretton Woods system in 1944, the US dollar has been the sole global reserve currency—but only for about 80 years so far. Before assessing the current state of the dollar, it’s meaningful to review previous global reserve currencies. Before the dollar, it was the British pound; before that, the Dutch guilder.

(The recurrence of reserve currency history)

The rise and fall of great powers like the Netherlands and Britain, along with their tenure as global reserve currency holders, followed very similar patterns. They both began rising after defeating declining great powers. Victory drove the development of capitalism and ushered in the Industrial Revolution, advancements that enhanced national competitiveness and laid the foundation for them becoming reserve currency nations.

However, history repeatedly shows that the wealth and prosperity brought by holding global reserve currency status often sow the seeds of decline. Increasing account deficits and widening income inequality weakened national competitiveness, accelerating debt accumulation. Eventually, massive debts from war and currency devaluation forced these once-great powers to cede reserve currency status to emerging powers.

(Mount Washington Hotel in Bretton Woods | Source: Wikipedia)

The United States, currently the world’s leading superpower, has also followed a similar trajectory. After the Civil War, America strengthened its competitiveness through the Second Industrial Revolution, capitalist development, and geopolitical advantages. During and after World War I and World War II, the U.S. surpassed declining Europe in wealth and prosperity, reaching new heights. With victory in WWII all but certain, the U.S. convened a conference to restructure the postwar financial order under the Bretton Woods system, establishing the dollar as the reserve currency under a gold standard.

However, reserve currency economies based on hard currency face a dilemma. To use the dollar as the primary currency in international trade, sufficient supply is required, which necessitates a deficit from the reserve currency nation. While gold reserves remain constant, the increasing issuance of dollars inevitably leads to currency devaluation and undermines international trust in the reserve currency. This issue is known as the Triffin Dilemma.

The Cold War with the Soviet Union, the Vietnam War, and the oil crisis exacerbated trade deficits and inflation. When the U.S. could no longer meet gold redemption demands, President Richard Nixon terminated the dollar’s convertibility to gold in 1971. This caused gold prices to surge from a fixed $35 per ounce to $850 per ounce by 1980, marking the beginning of the fiat currency era and a period of high inflation.

Fortunately, thanks to Paul Volcker’s unprecedented high-interest rate policy—reaching 20% annually—and the successful establishment of the petrodollar system, the dollar regained strength. This recovery paved the way for a period of economic prosperity in the U.S. during the 1990s.

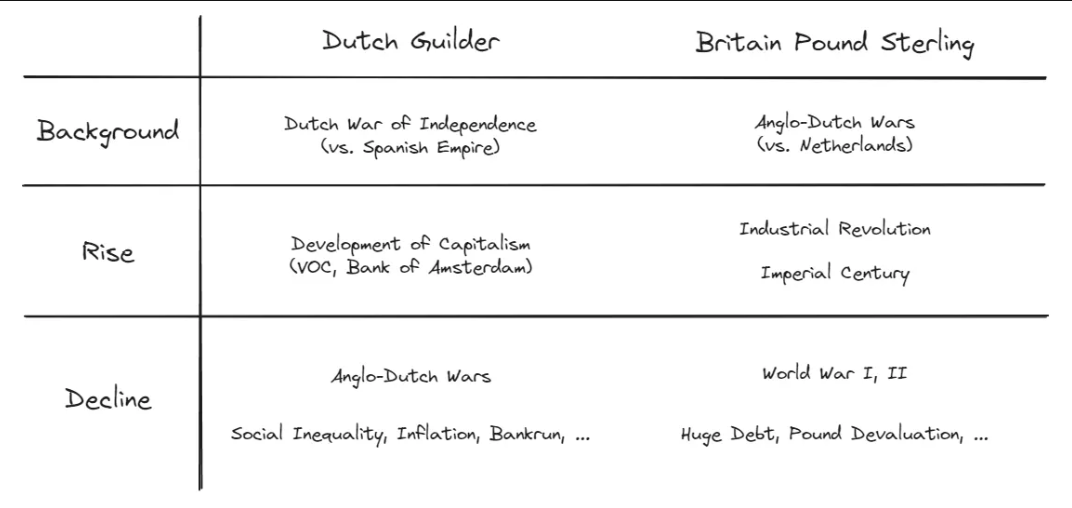

(Source: FRED)

However, after the end of the Bretton Woods system, the way the dollar was issued fundamentally changed. Whenever funds were needed, the government began issuing treasury bonds, which the Federal Reserve printed money to buy, causing the money supply to increase rapidly. Government debt surged from $391 billion in 1971 (34% of GDP) to $34 trillion by the end of 2023 (120% of GDP). During the financial crises of 2008 and 2020, the government accumulated massive debt through this mechanism, leading to sustained dollar depreciation.

How long can such massive government debt last? This question raises several possible scenarios. One possibility is the emergence of an inflation fighter like Paul Volcker, who might take drastic measures to reduce debt even at the cost of severe economic recession. Alternatively, disruptive innovations like AI could boost supply and production, exerting sustained deflationary pressure on the economy and thus extending the dollar’s lifespan.

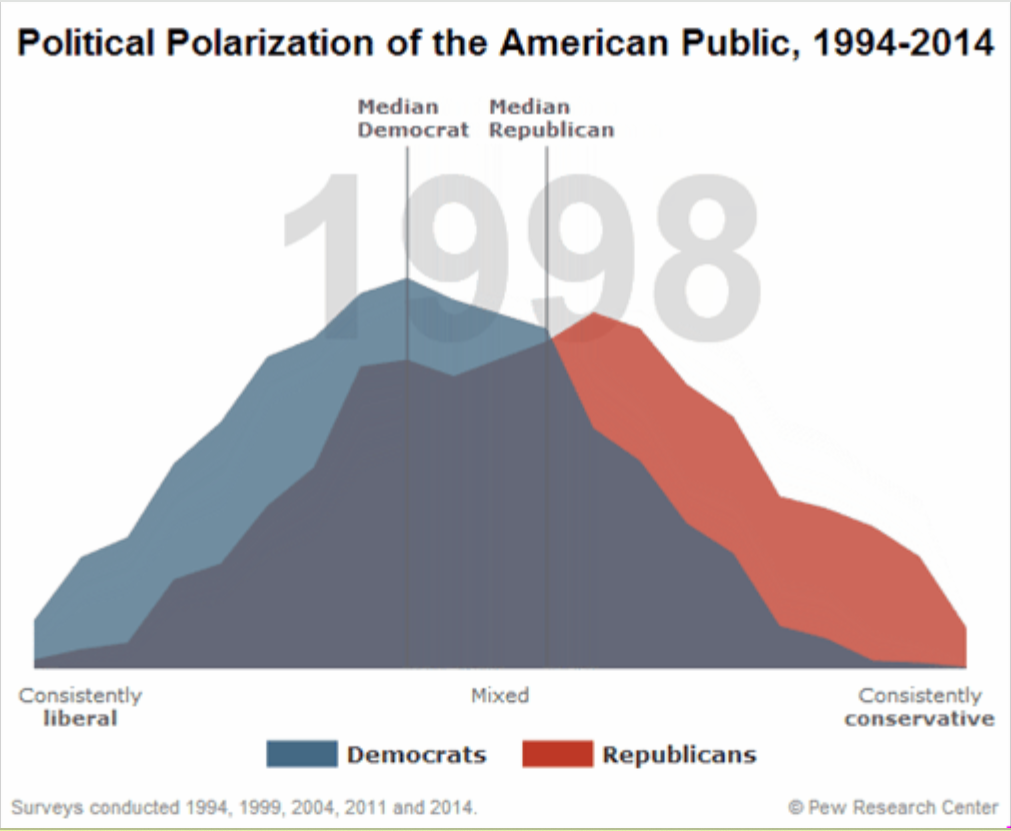

(Political polarization | Source: Pew Research Center)

However, as previously stated, money is a social contract. Therefore, when the international community begins losing confidence in the U.S. and its currency, the decline of the dollar will begin. Inevitable inflation associated with being a reserve currency may intensify domestic and international social issues such as income inequality and political polarization, further eroding trust in the dollar. While there are currently no clear signs of the dollar’s demise, growing concerns suggest this scenario is increasingly plausible.

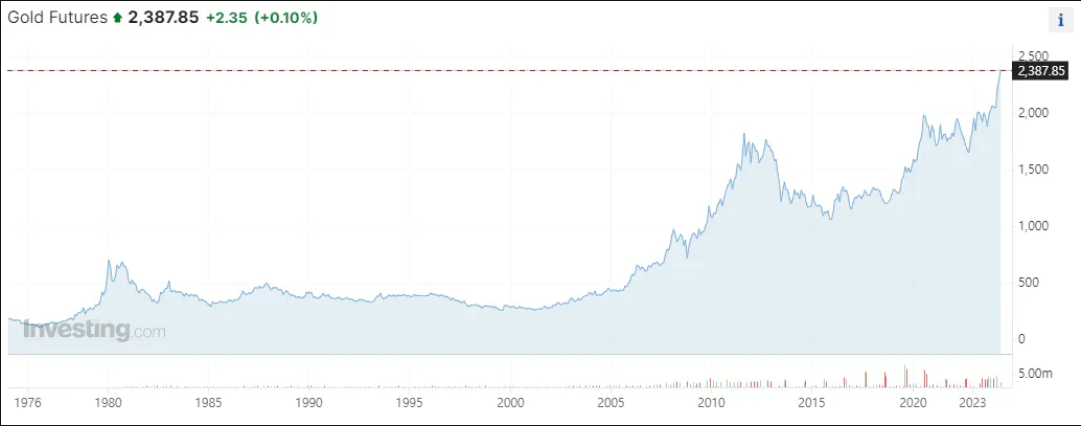

(China loves gold | Source: Investing.com)

It’s not just inflation—geopolitical issues could also weaken the dollar’s position. In response to Russia’s invasion of Ukraine, Western countries excluded Russia from the SWIFT banking system, blocking its ability to settle trades in euros or dollars, and froze half of Russia’s USD foreign exchange reserves. These actions undermine trust in the dollar among other nations. For instance, since the start of the Russia-Ukraine conflict, China has steadily sold off U.S. Treasury bonds while accumulating gold, reducing its reliance on the U.S.

History proves that power dynamics around money remain unchanged. Unless an unprecedented perfect monetary policy emerges, any reserve currency will eventually lose its status. While no one can predict the exact timing, the dollar will one day face its end. I can only hope this moment comes later rather than sooner, and more smoothly than abruptly.

1.2 Bitcoin as Hard Money

As the dollar gradually loses credibility, assets like gold naturally gain attention. Gold has been valued from ancient times to the modern era due to its scarcity and unchanging physical properties. During major conflicts, gold is recognized internationally as the most reliable ultimate asset. Hence, central banks always maintain certain gold reserves.

(Russians queuing at banks during war | Source: AP)

Today, individuals can invest in gold through various means such as mining company stocks, gold futures, and gold ETFs. These investment methods are generally effective in countries with developed financial markets. However, if you live in a country with underdeveloped financial markets or are directly caught in war or revolution, investing in gold may be severely restricted. These investment avenues don’t involve direct ownership of gold and carry counterparty risk during international turmoil. Additionally, purchasing and storing physical gold isn’t easy.

(Source: Kaiko)

In such cases, Bitcoin can serve as an excellent hard asset similar to gold. It has a limited supply, is not controlled by any single entity, and is especially easy to store and transfer—even in dire circumstances like wartime. For example, during Russia’s invasion of Ukraine on February 24, 2022, BTC/UAH trading volume and price surged, trading at a 6% premium over the international rate. Even in less extreme cases, countries with unstable national currencies show high demand for Bitcoin. In Turkey, where annual inflation is around 70%, Bitcoin trades at a premium similar to gold. These examples demonstrate that Bitcoin can indeed function as a hard asset.

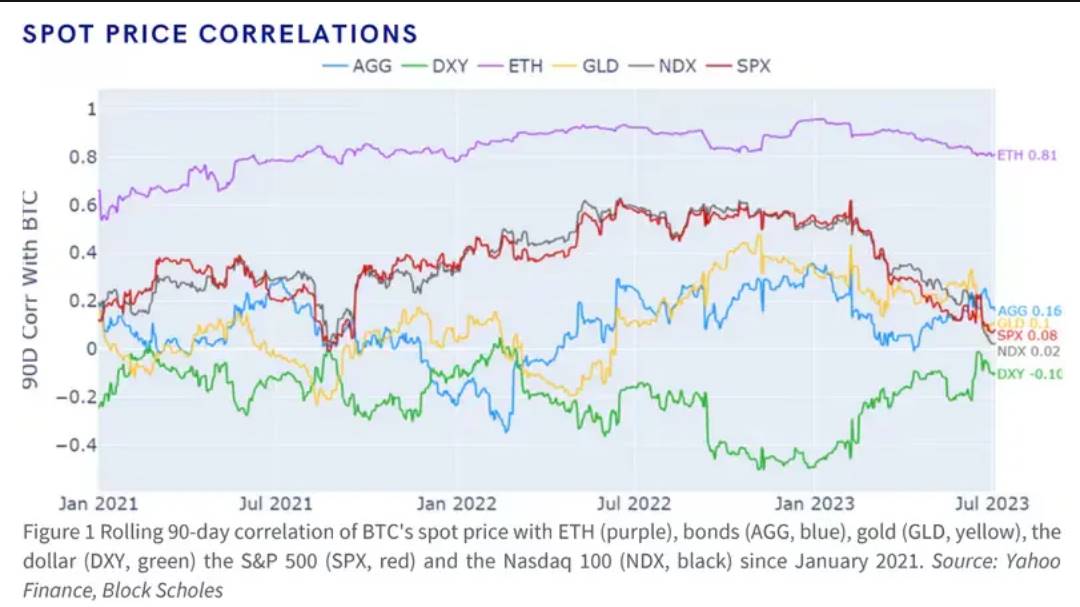

(Source: BlockScholes, Yahoo)

From the above examples, we can see Bitcoin’s immense potential as hard money in the future. But does this mean citizens of developed countries protected by stable monetary systems have no need to include Bitcoin in their portfolios? Even outside crisis scenarios, allocating part of a portfolio to Bitcoin offers substantial diversification benefits. As shown in the chart, although Bitcoin’s correlation with other assets like gold, stocks, and the dollar fluctuates over time, it typically exhibits distinct price volatility. This uniqueness makes holding cryptocurrencies like Bitcoin a favorable choice.

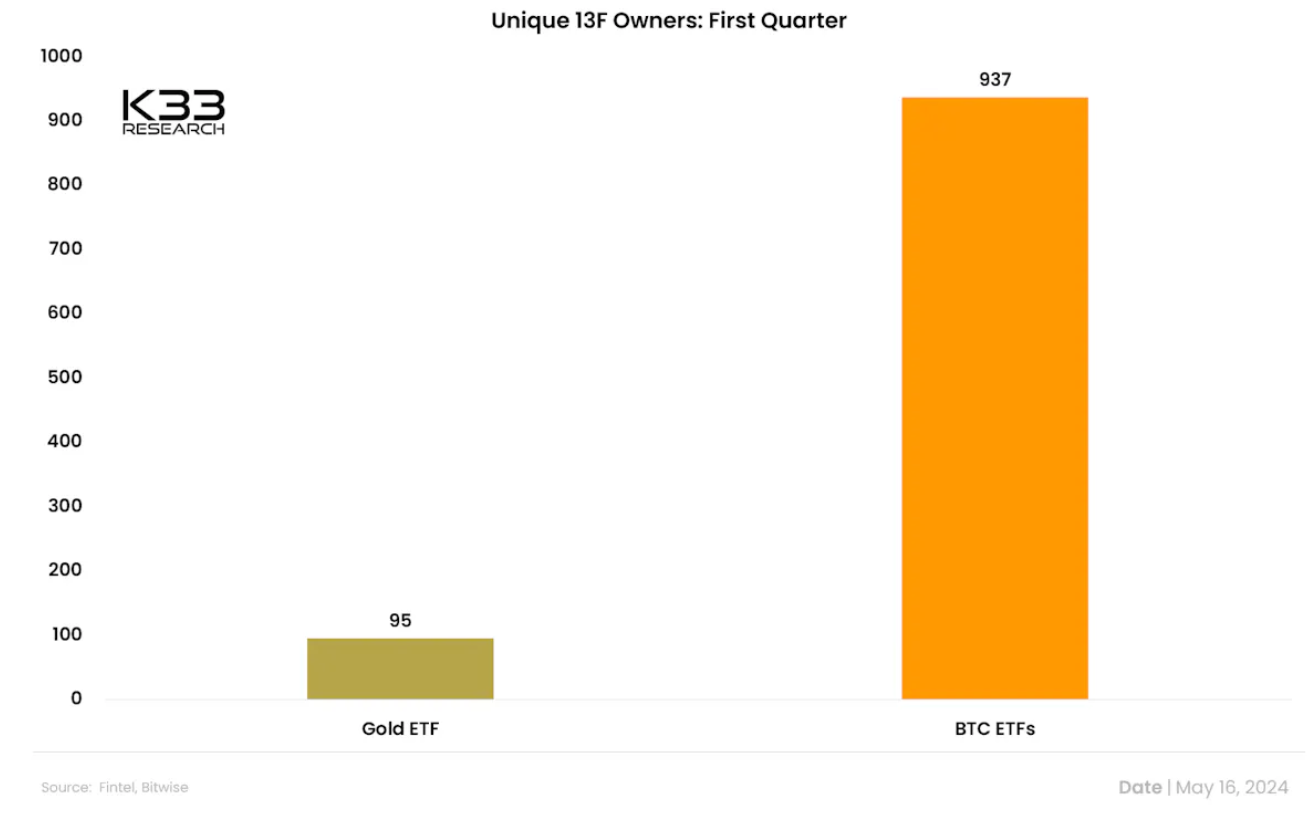

(Source: K33 Research)

Indeed, many U.S. financial institutions have recently added BTC ETFs to their portfolios. According to K33 Research, 937 institutions reported holding Bitcoin ETFs in their 13F filings in Q1 2024. These include well-known firms like JP Morgan, UBS, and Wells Fargo, as well as the Wisconsin Investment Board, which acquired approximately $160 million worth of BTC ETFs. This trend indicates that Bitcoin is increasingly viewed as a store of value.

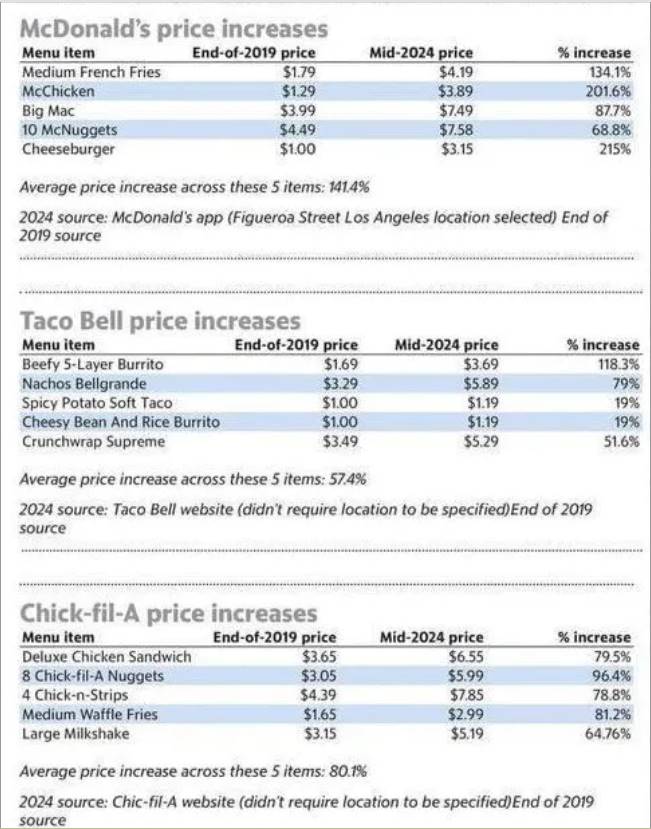

(Surging fast food prices)

While the inflationary effects of quantitative easing during the COVID-19 era have yet to fully dissipate, the U.S. is again increasing liquidity ahead of the upcoming presidential election. The U.S. Treasury is expanding fiscal spending and plans to conduct its first bond buyback in over two decades starting May 29. Meanwhile, the Fed is also slowing down quantitative tightening.

Therefore, the dollar will continue to face inflationary pressure and will be massively issued during major economic downturns. Unless the U.S. continues innovating and maintains leadership in military, scientific, and industrial fields, the dollar’s value will inevitably decline over time. Conversely, this will naturally increase Bitcoin’s visibility and value.

However, to become a hard asset like gold, Bitcoin faces a critical challenge: network security scale and profitability. A fundamental element of Bitcoin’s value is the security of its network. The more miners there are, the more secure the network becomes, and the more stable Bitcoin’s value.

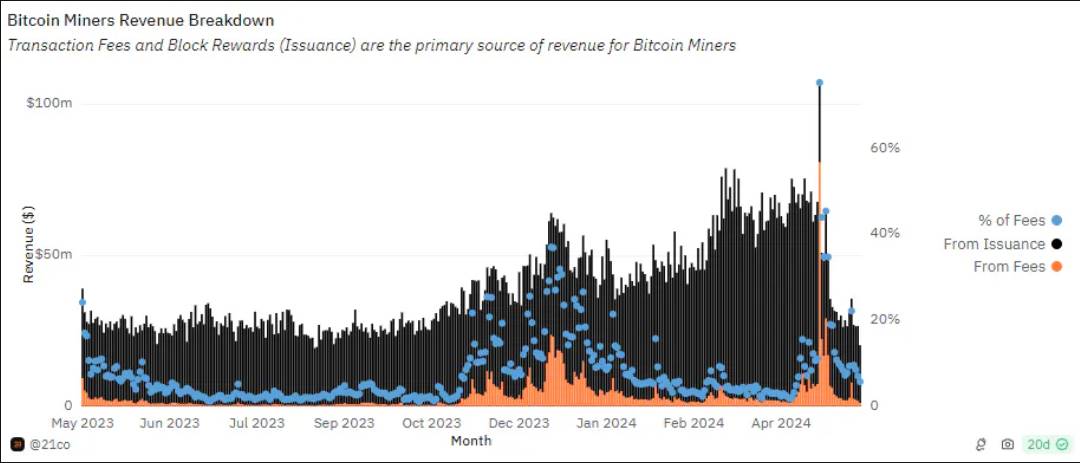

Bitcoin miners earn income primarily in two ways: block rewards and transaction fees. Block rewards are Bitcoins received when a miner successfully mines a block, with a fixed amount that halves every four years. Transaction fees are paid by users when conducting transactions on the Bitcoin network, independent of block rewards.

(Fees should be higher for sustainability | Source: dune, @21co)

For miners to continue participating in the Bitcoin network, their mining revenue must exceed costs. Since block rewards halve every four years, mining income gradually decreases, so transaction fee revenue must compensate for the shortfall. However, unlike networks such as Ethereum and Solana, Bitcoin has limited applications and poor scalability, resulting in lower transaction volumes and reduced transaction fee income. Recently, new token standards like Ordinals and Runes temporarily increased activity on the Bitcoin network, but whether these standards can sustainably and significantly boost transaction fee revenue remains uncertain.

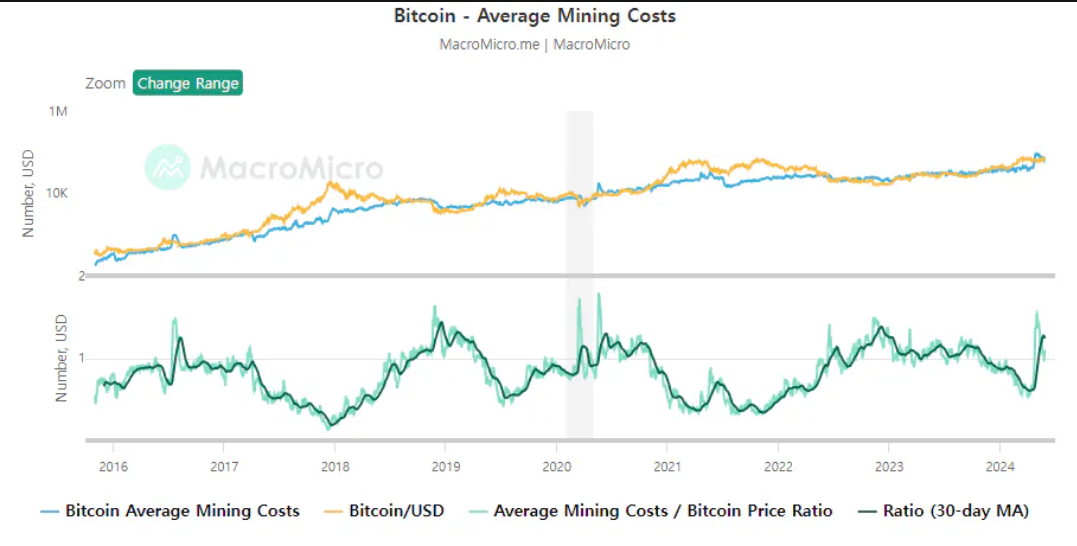

(Source: MacroMicro)

To date, mining revenue has generally exceeded mining costs. However, due to future halvings, block rewards will continue to decrease. Unless 1) Bitcoin’s price increases dramatically, or 2) network activity grows enough to generate more transaction fee revenue, miners may exit the network. This would reduce Bitcoin network security, weaken its intrinsic value, and potentially trigger a vicious cycle of further miner exits and declining security.

This highlights a key difference between gold and Bitcoin. Gold’s intrinsic value is unrelated to profitability, whereas Bitcoin’s intrinsic value directly depends on it. Therefore, ensuring profitability is a long-term challenge that the Bitcoin network must address. While the Bitcoin community currently lacks a clear solution, innovations like Ordinals, Runes, and OP_CAT suggest that transaction fee revenue may grow over the long term.

2. Unlike Before: AI

2.1 AGI’s Impact on Humanity

(Is this truly humanity’s future? | Source: The Matrix)

Historically, unlike money, technological innovations such as AI have always brought significant changes to society. The revolutions of the steam engine, electricity, and the internet transformed global industrial landscapes and profoundly impacted human work and lifestyles. While these technological revolutions brought various social problems during transitions, they ultimately provided humans with more prosperous lives. The steam engine and electricity liberated humans from most physical labor, while digital and internet technologies freed them from simple mental labor.

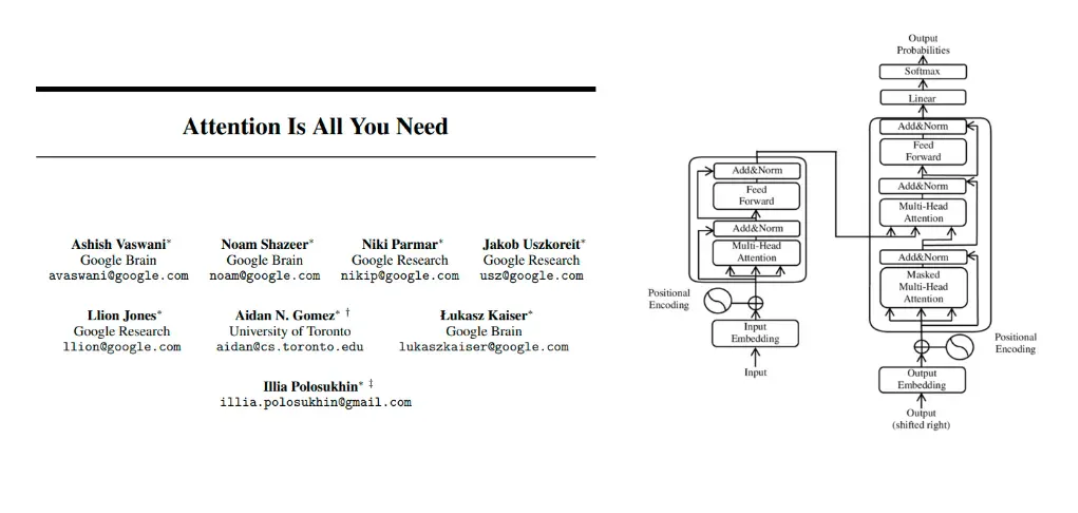

(Fun fact: Illia is someone you know, iykyk)

Since the 1900s, AI technology has been researched, but few breakthroughs occurred. However, after the publication of the 2017 paper introducing the Transformer theory, "Attention Is All You Need," AI development accelerated significantly. This breakthrough made developing large language models (LLMs) easier, bringing humanity closer to Artificial General Intelligence (AGI). Like previous industrial revolutions, AGI development is expected to greatly boost productivity and have profound societal impacts. However, for several reasons, I believe its impact will differ.

First, AGI will liberate humans from nearly all forms of labor. Previous industrial revolutions freed humans from physical labor and simple mental tasks, enabling more people to engage in complex work. However, AGI can handle advanced mental labor, including creative activities like art and music. Combined with advanced robotics, this will drastically reduce human contributions in productive fields.

(Source: Modern Luddite Movement?)

Of course, this doesn’t mean all jobs will disappear. Even in the 21st century, a portion of the population still works in agriculture and fishing, though this proportion is far lower than in the past. While most job types will persist with AGI, the number of people needed to perform them will sharply decrease. For example, one person in the future could do what ten people do today, leading to a significant increase in unemployment. Notably, AI leaders like Elon Musk (Elon Musk) and Sam Altman (Sam Altman) believe AI and robots will handle global productivity, resulting in widespread human unemployment.

Some argue efficiency can be maximized while maintaining current employment levels, but this is a misconception. To achieve this, demand must increase proportionally with the significant productivity gains (supply) offered by AGI. However, for most sectors, this is nearly impossible. New jobs must emerge in areas untouched by AGI, but as mentioned earlier, AGI capabilities extend beyond physical and mental tasks, making this possibility extremely slim.

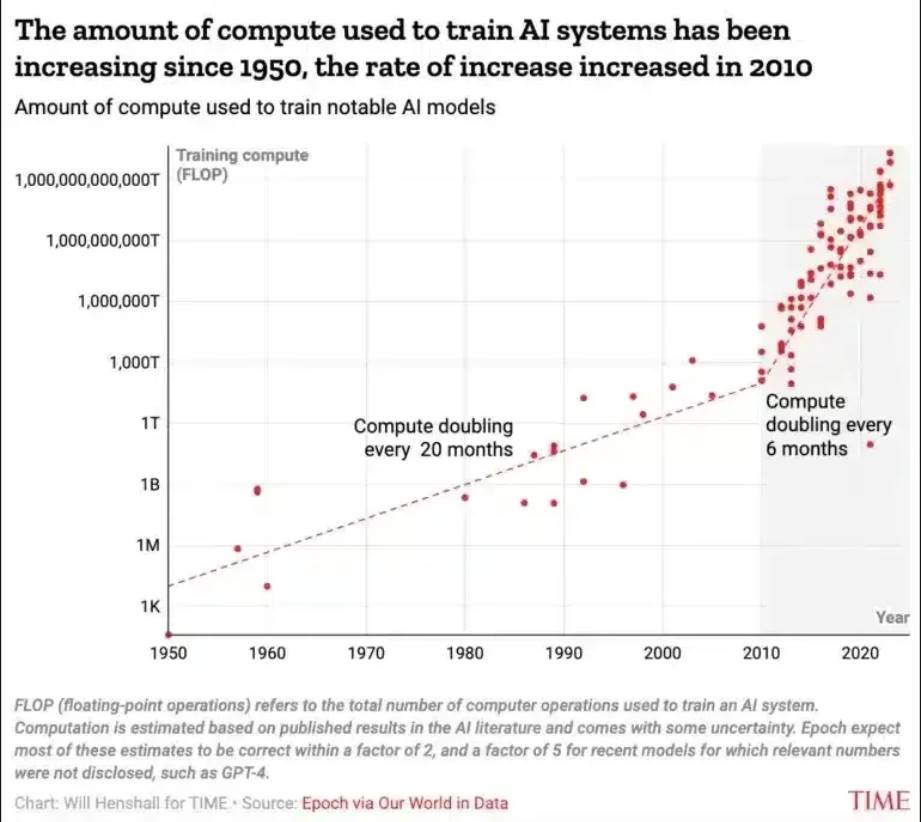

Second, AI is inherently a highly centralized technology. Even before achieving AGI, the AI industry is already heavily concentrated in large tech companies. This is due to the rapid pace of AI development. Since the introduction of transformer theory, language model sizes increased by a factor of 10⁴ between 2018 and 2022. Consequently, significant technological gaps exist among core players in the AI industry.

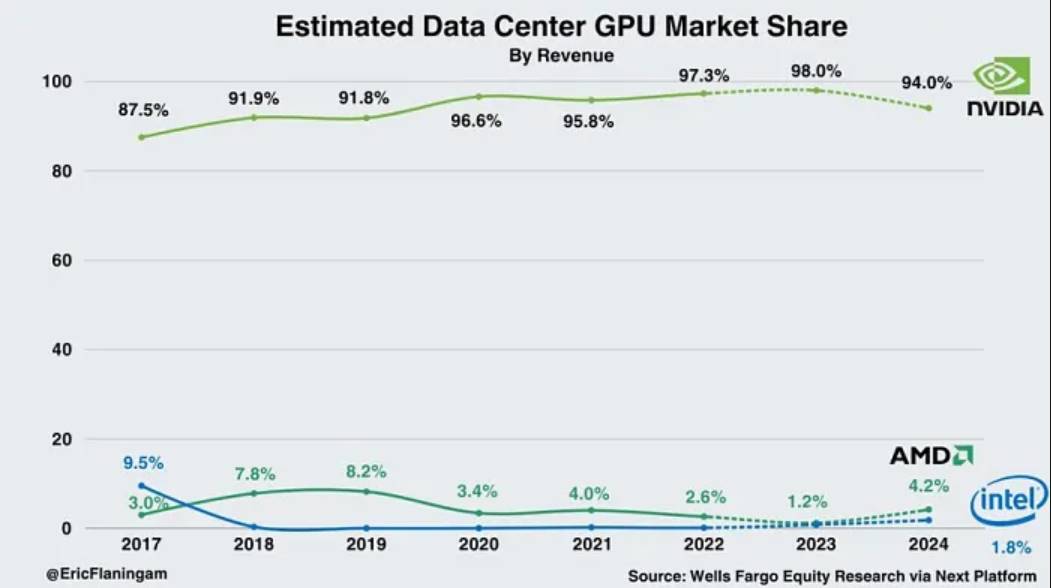

(Source: @EricFlaningam)

-

Semiconductor Design: Unlike the consumer GPU market, NVIDIA almost monopolizes the data center GPU market used for AI model training and inference. This dominance is partly due to its CUDA toolkit, widely used by AI developers. Surging demand for NVIDIA’s H100 GPUs has extended delivery cycles. Leveraging this advantage, NVIDIA enjoys a gross margin as high as 78%, and its upcoming Blackwell GPU, expected by the end of 2024, will further cement its lead. Although AMD Xilinx and Intel Altera are expanding FPGA businesses, and tech giants like Microsoft, Google, and Meta are developing their own AI semiconductors (ASICs), these solutions still lag behind GPUs in market maturity and readiness.

(Source: Counterpoint)

-

Semiconductor Manufacturing: The foundry industry responsible for manufacturing designed semiconductors also shows severe imbalance. NVIDIA’s A100 requires a 7nm process, while the H100 needs 4nm. Processes below 10nm are almost monopolized by TSMC, Samsung, and Intel, with A100 and H100 mainly produced by TSMC. TSMC has committed to producing NVIDIA’s H100 for at least the next three years, and given various factors, the gap between leading foundries and others is expected to widen further.

-

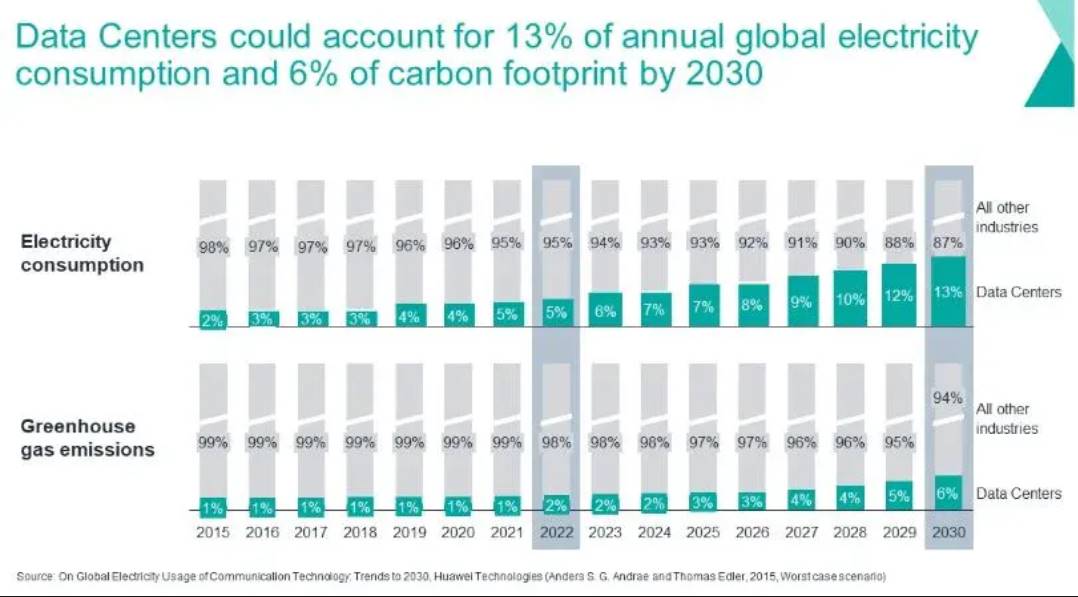

Computing Power: AI companies require massive computing power for training and inference. This demands large quantities of AI semiconductors like H100s, extensive data centers, and substantial electricity. Huawei estimates that by 2030, AI data centers will consume 13% of global electricity and account for 6% of carbon footprint. Costs are also substantial; as Jensen Huang noted in NVIDIA’s GTC 2024 keynote, training the GPT-MoE-1.8T (GPT-4) model requires 8,000 H100 GPUs and 90 days. Thus, due to the need to protect AI semiconductors and bear huge electricity costs, industry centralization is inevitable. Cloud services like AWS and Azure offering H100-based computing power are also unavoidably centralized.

-

AI Models: While some AI models like Meta’s Llama and Google’s BERT are open-source, many others are closed-source. Compared to open-source models, closed-source models like OpenAI’s GPT and Anthropic’s Claude often provide better system development and customer support but bring disadvantages in cost and transparency due to centralization.

-

Data: Training AI models like LLMs requires massive datasets. Legal arrangements, such as Google paying $60 million annually to use Reddit’s data, exist, but numerous lawsuits over unauthorized data use in AI training have heightened interest in data sovereignty.

In summary, centralization is inevitable in theAIindustry, and achieving economies of scale is crucial. As the AI industry becomes more centralized, some micro-level issues may arise, such as excessive corporate profit-seeking, unethical data usage, single points of failure like server outages, and opacity of AI models. At the macro level, as the boundary between humans and AI blurs, we may face social chaos with many people losing jobs. I believe blockchain technology, which inherently pursues decentralization, can act as a counterbalance to AI, addressing challenges arising from AI centralization. Let’s explore how blockchain can be applied to the AI industry.

2.2 Blockchain Can Fix AI

Satoshi Nakamoto introduced Bitcoin in 2008 advocating decentralization in response to unchecked monetary issuance by central banks. Blockchain technology can also be applied in various ways to the AI industry, where economies of scale drive centralization.

Among the five highly centralized elements mentioned earlier, semiconductor design and manufacturing require concentrated expertise and large-scale production facilities, leaving little room for blockchain solutions. However, blockchain can be effectively applied to “computing power,” “AI models,” and “data.” Additionally, it can tackle issues like rampant misinformation (including deepfakes) and support basic income policies for populations facing mass unemployment. Let’s explore the potential applications of blockchain technology in the AI pipeline.

Among the five highly centralized elements mentioned earlier, semiconductor design and manufacturing require specialized expertise and large manufacturing facilities, leaving limited space for blockchain solutions. However, blockchain has broad application prospects in computing power, AI models, and data. Moreover, blockchain can address misinformation issues like deepfakes and support basic income policies for populations facing mass unemployment. Below are potential applications of blockchain in the AI field.

Decentralized Computing

Training and inferring AI models require massive computing power and hardware. Large tech companies continuously purchase GPUs like NVIDIA’s H100 for model training, exacerbating global hardware shortages. While cloud-based AI model training and inference services like AWS and Azure offer data centers, they operate in a monopolistic form, charging users high margins. To address these challenges, new services leveraging blockchain to provide decentralized computing power have emerged.

For example, Akash and io.net allow users to contribute their hardware’s computing power to the platform in exchange for incentives. Some protocols specialize in specific services. For instance, Gensyn focuses specifically on training AI models. General decentralized computing services can lower costs by utilizing idle hardware, but executing stateful computations (like AI model training) in a decentralized manner is challenging. Gensyn addresses this issue through concepts like probabilistic proof of learning and graph-based precise point protocols. While Gensyn focuses on training AI models, Bittensor specializes in AI model inference. Users submit tasks, and Bittensor’s decentralized nodes compete to deliver the best results.

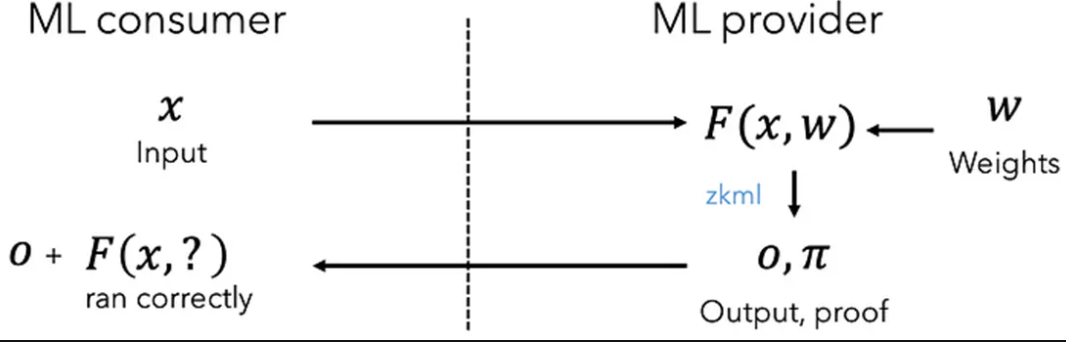

zkML

zkML combines zero-knowledge (zk) cryptography with machine learning (ML), promising to enhance the privacy and transparency of AI models. Many AI models currently operate in closed-source modes, leaving users uncertain whether these models use correct weights and execute inference properly. By applying cryptographic techniques like ZK-SNARK (Zero-Knowledge Succinct Non-Interactive Argument of Knowledge) to ML models, it becomes possible to prove that AI models correctly executed inference without revealing their weights, thus achieving privacy and computational integrity.

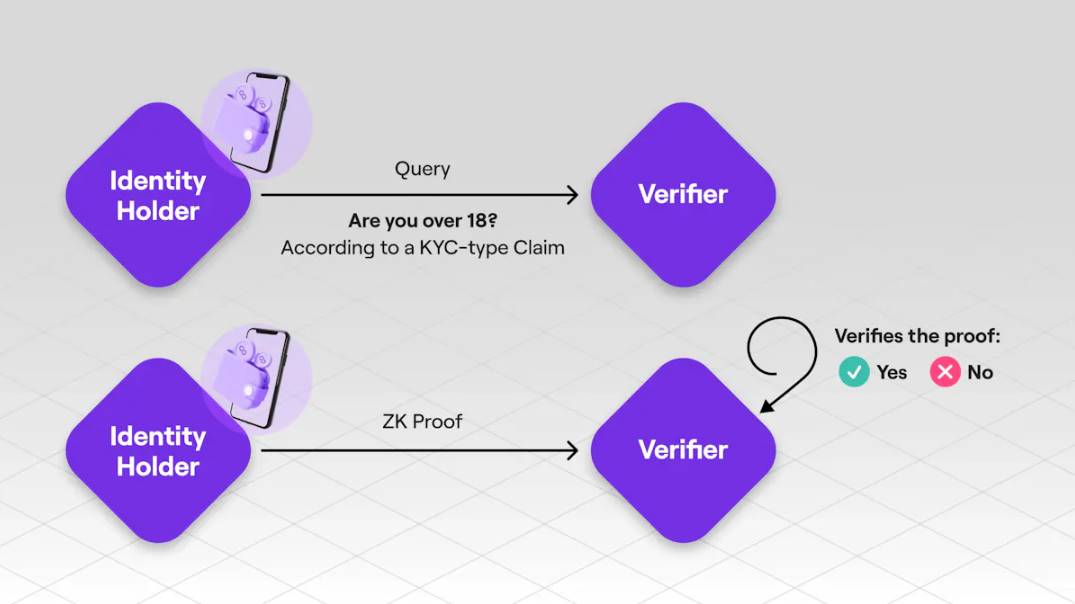

(Source: Polygon ID)

ZK-SNARK is a powerful cryptographic technique that can prove the validity of arbitrary computations without revealing input data. To illustrate, consider a real-world example: proving someone’s age online. Typically, this requires complex KYC verification involving disclosure of personal information like name and ID. With ZK technology, this process can be simplified and made more private. Once a user verifies their age through an official entity, they can generate and submit a ZK proof whenever they need to prove they’re over 18. This proof contains no personal information but still assures the verifier of the user’s age, making identity verification more secure and simpler.

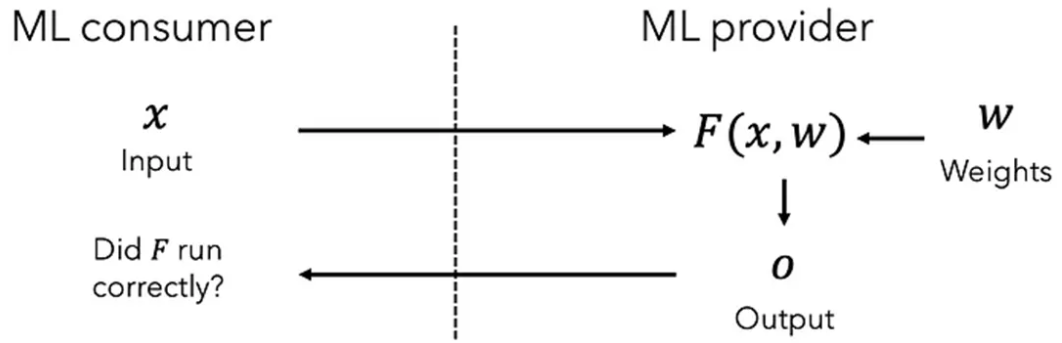

(Top: Standard ML, Bottom: zkML | Source: @danieldkang Medium)

Applying the same concept to ML models, consumers using closed-source ML models cannot determine whether the model honestly performs computation on given inputs. By integrating ZK-SNARK, ML providers can assure

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News