What token will be the next to hype up an ETF?

TechFlow Selected TechFlow Selected

What token will be the next to hype up an ETF?

Why do so many people choose SOL? Because it has "consensus support."

Last Friday, a poll was launched asking: "After $BTC and $ETH, which token do you think will be next to get an ETF?" The result showed that 63.6% of respondents chose SOL.

Following the approval of the ETH ETF, market enthusiasm for SOL has indeed grown significantly⤵️

🔸 Geoffrey Kendrick, Head of Foreign Exchange and Digital Asset Research at Standard Chartered Bank: Approvals for crypto ETFs such as SOL and XRP could arrive by 2025.

🔸 Anthony Scaramucci, Founder and Managing Partner of SkyBridge Capital: We will be ready to launch a SOL ETF.

🔸 Brian Kelly, CEO of BKCM, said on CNBC: Solana could be the next cryptocurrency to receive an ETF.

Why did so many people choose SOL?

Clearly, it's because it has "consensus support."

And consensus, simply put, is reflected in market capitalization. Looking at this single dimension—by checking CoinGecko’s Top 10 or Top 5—SOL does appear to be the most likely candidate.

What is SOL’s biggest problem?

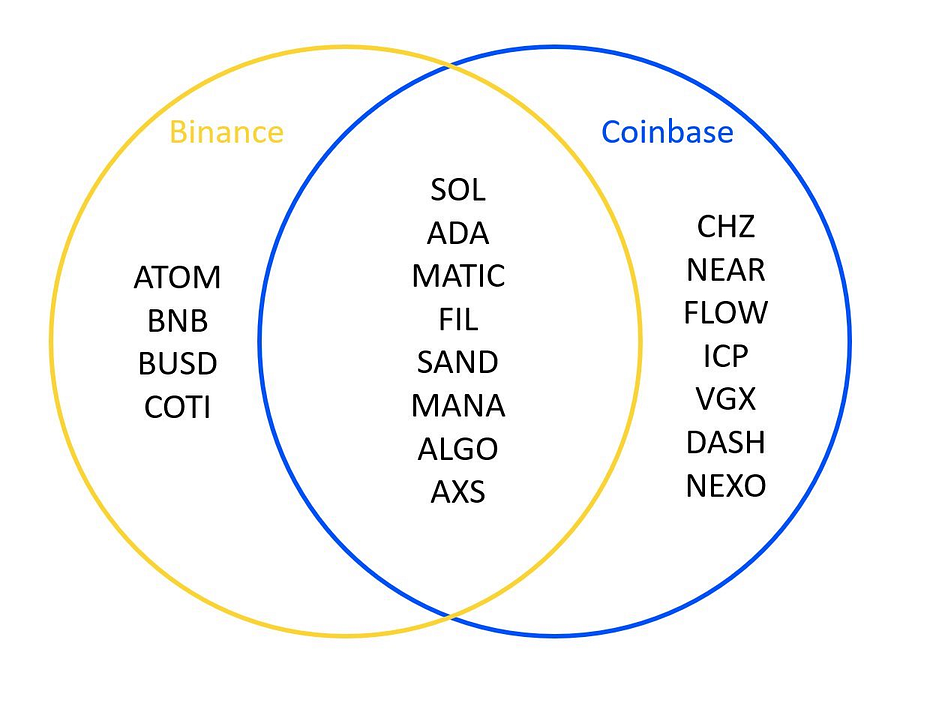

On 2023/6/5, in the Binance case, the SEC classified SOL as a security.

On 2023/6/6, in the Coinbase case, the SEC again classified SOL as a security.

Why would being classified as a security make it difficult to approve an ETF? What’s the connection?

In the U.S., securities are regulated by the SEC and must comply with a series of regulations, including registration, disclosure requirements, and potential trading restrictions. The process is much stricter.

For example: SEC = supermarket🏪, cryptocurrency = fruit🍎, ETF = fruit basket🧺

🔸 If considered non-security, it's like labeling the fruit as "regular fruit," easily placed into the fruit basket.

🔸 If considered a security, it's like labeling the fruit as "special fruit," requiring compliance with more supermarket rules and thus making it harder to place into the fruit basket.

A year ago, the SEC labeled SOL as a security. It's unlikely they would immediately reverse that stance now (after all, they have their pride). Therefore, a SOL ETF is impossible in the short term.

Additionally, in these two lawsuits, other tokens deemed securities include BNB, BUSD, ADA, MATIC, ATOM, FLOW, ICP, and 18 other tokens in total. For the same reason, these tokens also cannot pass ETF approvals in the near future.

But there’s good news — FIT21 Bill

On May 22, 2024, the FIT21 bill passed in the U.S. House of Representatives by a vote of 279 to 136. Its long-term significance for the industry is no less than the ETH ETF approval (even though market attention has been relatively low).

Key points of the FIT21 bill for us👇

🔸 Clearly defines two types of digital currencies and their regulatory agencies:

Decentralized tokens = digital commodities, regulated by CFTC

Non-decentralized tokens = securities, regulated by SEC

🔸 Definition of decentralization:

No single entity can control the entire blockchain network

No individual holds more than 20% of the digital asset or voting rights

FIT21 improves the overall regulatory framework for digital currencies and expands industry freedom. Especially the two points excerpted above, it clearly paves the way for more ETFs.

To learn more about the FIT21 bill, read the article by a16z:

https://a16zcrypto.com/posts/article/fit21-why-it-matters-what-to-do/

Summary

The U.S. is famously changeable—just because a token is currently labeled a security doesn’t mean it will always be defined as such.

Returning to our original topic—what will be the third cryptocurrency to gain ETF approval—I believe SOL remains one of the most likely candidates. Whether that happens within the next year or the next three to five years depends on the progress of the FIT21 bill (the legislative process: House ✓ → Senate → Presidential signature) and how exactly the definitions of "digital commodity" and "security" are implemented along the way.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News