With the ETH ETF boom, which DeFi 1.0 projects are worth watching?

TechFlow Selected TechFlow Selected

With the ETH ETF boom, which DeFi 1.0 projects are worth watching?

As a cornerstone of the $ETH ecosystem, DeFi 1.0 may be poised for repricing.

Author: Crypto, Distilled

Compiled by: TechFlow

Recent news about $ETH ETFs has sparked significant market interest in $ETH beta. However, amid strong demand for high-quality, high-liquidity tokens, where are the best opportunities?

DeFi 1.0, despite being rich with genuinely valuable projects, is often overshadowed by high-risk speculative ventures and trendy but substance-lacking memes—and may precisely be where the key lies.

Here’s what matters:

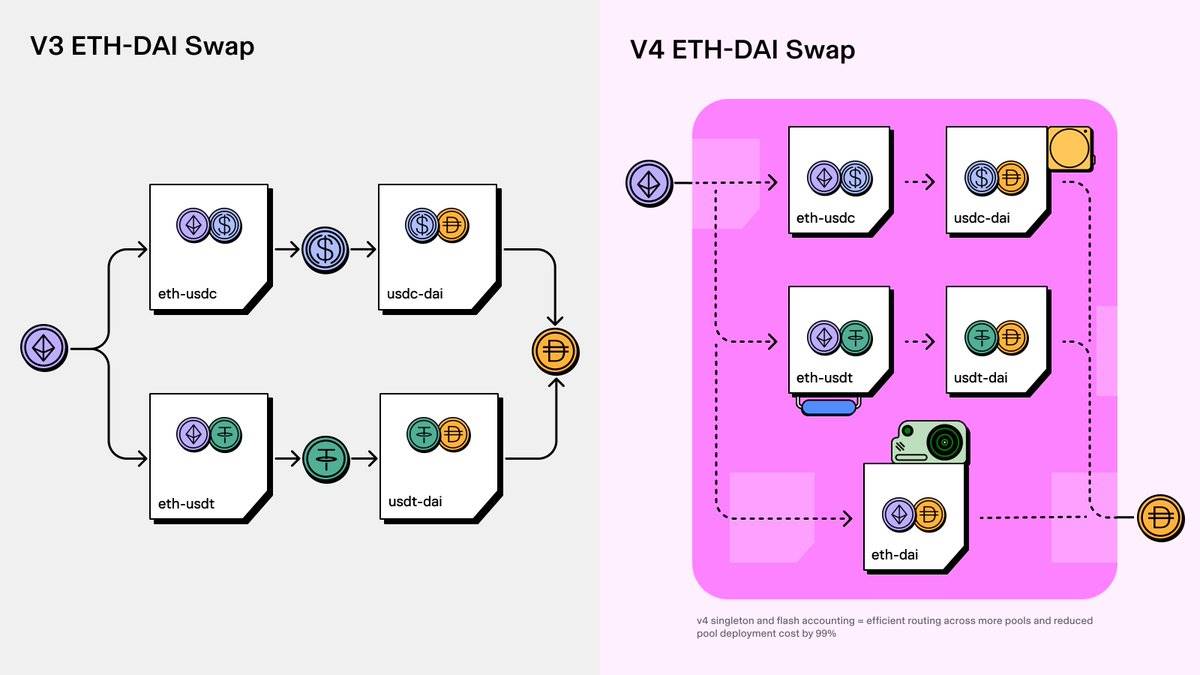

1.$UNI DEX

-

L2 trading volume surged 650% over two years.

-

Uniswap V4 scheduled for launch in Q3.

-

DAO proposed activating a $3.3B "fee switch" in February.

-

Received Wells notice in April.

-

$UNI responded, claiming that 65% of its trading volume consists of clearly non-security assets.

2.$AAVE - Money Markets

-

Third-largest DeFi protocol, with TVL exceeding $10B.

-

Approved to deploy Aave V3 on Solana in Q1.

-

Launched unified cross-chain liquidity solution Aave V4 on May 1; prototyping begins in Q4.

-

Aave's TVL nearly doubled year-to-date.

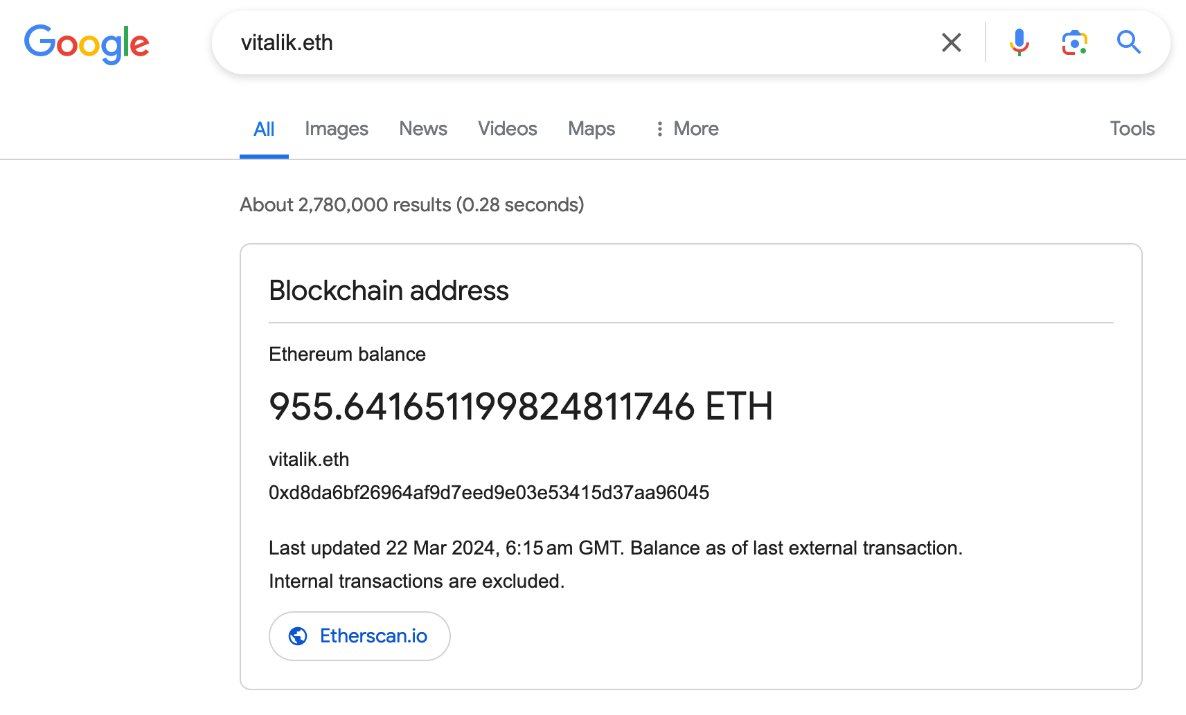

3.$ENS - Naming Service

-

In February, ENS partnered with GoDaddy to simplify wallet-to-web linking.

-

In March, Google integrated wallet balances with Ethereum Name Service (ENS) domains on $ETH.

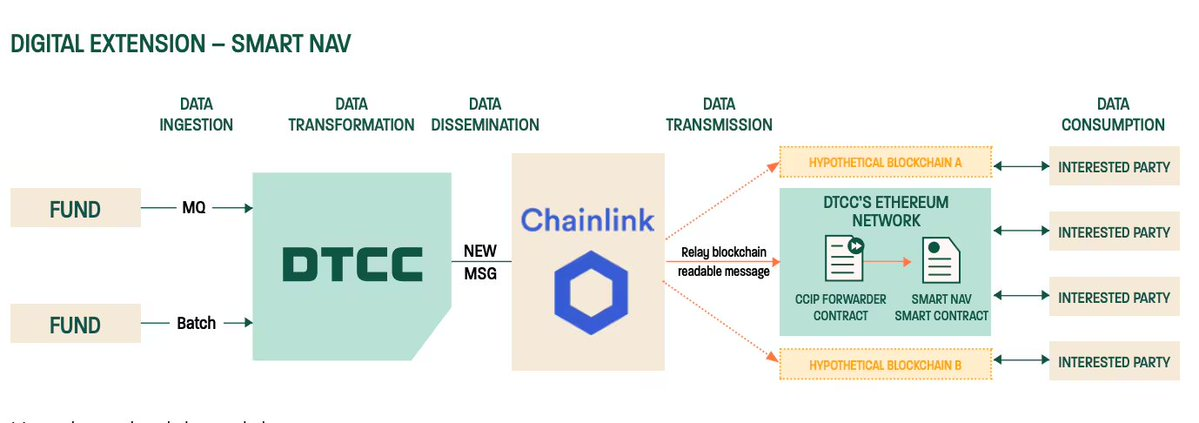

4.$LINK Oracle

-

In April, $LINK launched the cross-chain bridge application "Transporter," enhancing token transfer security.

-

In May, DTCC completed a $LINK pilot to accelerate fund tokenization across multiple blockchains.

-

Participants included Franklin Templeton, Invesco, JPMorgan, State Street, and others.

5.$MKR - The DAO Behind $DAI

-

May: $MKR unveiled its "endgame" strategy.

-

Introduced two new stablecoins: NewStable and PureDAI, aiming to surpass $DAI.

-

NewStable focuses on utility and scalability, backed by RWAs.

-

PureDAI aims for decentralization, backed by assets like ETH.

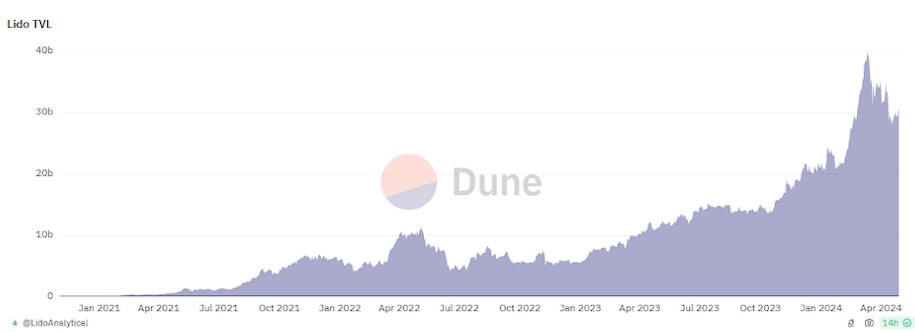

6.$LDO Leading Liquid Staking

-

In February, $LDO TVL surpassed $30B.

-

By April, $LDO reached 1M+ validators.

-

As the leading liquid staking protocol, $LDO manages over 25% of all staked ETH.

-

Tailwind: ETH staking growth is 20x faster than ETH issuance.

Final Thoughts

-

As foundational pillars of the $ETH ecosystem, DeFi 1.0 may be poised for repricing.

-

The market landscape is dynamic; remain cautious as ETF developments unfold.

-

As always, not financial advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News