10,000 BTC worth just $25? The untold story of the Bitcoin pizza

TechFlow Selected TechFlow Selected

10,000 BTC worth just $25? The untold story of the Bitcoin pizza

"Holding coins in a laid-back, Buddhist-like manner" may no longer be the best choice.

By Haotian

This is truly a story sadder than sadness itself.

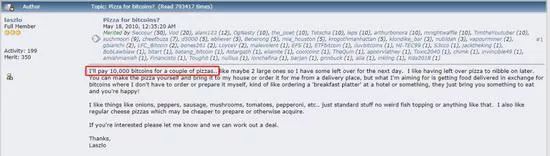

On May 18, 2010, programmer Laszlo posted online seeking to exchange 10,000 bitcoins for two large pizzas. Three days later, cryptography enthusiast jercos spent $25 buying two pizzas and sent them to Laszlo, receiving 10,000 bitcoins in return.

Looking back at the context of that time, perhaps this story wasn't so tragic:

1. It had only been a little over a year since Bitcoin's genesis block was mined. Bitcoin was merely a tool for cryptography enthusiasts to tip each other, with no fiat value attached—few probably imagined using it to make purchases. Laszlo, a brilliant programmer, broke new ground by giving Bitcoin a practical price tag through pizza, unintentionally advancing the process of cryptocurrency monetization. He became the first person ever to buy real goods with Bitcoin, securing his place in history.

2. At that time, mining competition was minimal. Laszlo used GPU instead of CPU mining, earning 1–2 blocks per hour, with each block rewarding 50 BTC. On May 17 alone, he earned 1,400 bitcoins. Given the low cost and high returns of early mining, he likely accumulated many thousands of bitcoins. Exchanging some for pizza might not have seemed like a big deal.

3. Anyone who had access to cryptocurrencies back then and continued mining consistently over the past decade, adding even modest investments along the way, would likely have achieved financial freedom by mainstream standards—even if they missed Bitcoin, catching just one of Litecoin, Ripple, Ethereum, etc., would probably have sufficed.

Yet, the sad story still unfolded:

1. After enjoying his first taste of purchasing pizza with Bitcoin, Laszlo later spent another 40,000 BTC on more pizza. When Bitcoin reached $1, he sold all his remaining holdings to buy a new computer.

2. Today, Laszlo remains a software engineer at GoRuck, an online retail company based in Florida—his job hasn't changed much from nine years ago when he first bought Bitcoin.

3. Jercos, who received the 10,000 BTC, didn’t hold until December 2017 when Bitcoin peaked near $20,000. He sold the coins after achieving more than tenfold returns.

Many recent entrants to crypto likely feel regret, wishing they’d joined earlier—perhaps achieving financial freedom by now. But seeing this pizza-for-Bitcoin tale should teach you one lesson: once something is missed, it’s gone. There’s no point dwelling on "what ifs."

Such stories aren't unique to the world of digital currencies.

You’ve probably heard about Xiao Wang from Beijing, who sold a small courtyard house for less than 300,000 yuan, went abroad, worked hard, and earned 6 million yuan—only to return home and discover the old house was now worth 80 million, causing him to collapse and be hospitalized.

Or take Li Zekai, son of tycoon Li Ka-shing, who sold his 20% stake in Tencent to South Africa’s MIH Group in 2001 for $12.6 million—missing out on over 40 billion yuan in future gains.

And so on...

In any investment involving appreciating assets subject to value fluctuations—including gold, jewelry, art, antiques, stocks, and real estate—regrets over missed opportunities are endless. As the saying goes: once a deal is done, hands must be released; mistakes in affection cannot be undone. Once an asset enters the market, it must follow established market exchange principles.

Bill Gates once said: real wealth = mindset + time. Indeed, acquiring wealth always requires enduring the test of time—and during that period, paper profits and losses serve as the ultimate test of your mindset and understanding.

From the Bitcoin pizza incident, we can draw several key insights:

1. Rational Investing Has Limits; Upgrading Cognition Is Essential

It may seem like everyone is laughing at a fool—but in truth, most people are ordinary.

Many say that if those 10,000 bitcoins hadn’t been spent on pizza, selling at the 2017 peak would have yielded at least $160 million. So casually, people speculate about Laszlo’s psychological scars, labeling him a fool who narrowly missed becoming a billionaire.

But if most people lived Laszlo’s life, 99% would make the same choices. Just as we envy those who invested in Bitcoin at $300–$500, assuming they’re now financially free. In reality, even among early adopters, very few actually achieved true financial independence. Most either lost their private keys; sold early after 10x–100x gains; or, after missing Bitcoin entirely, became disillusioned and turned hostile toward crypto altogether.

Ultimately, those who truly profited from crypto weren’t driven by rational investment logic—but by blind faith and unconventional conviction. If they are winners, it’s because of superior foresight and mental resilience against financial volatility.

Li Xiaolai once joked that waking up could mean gaining or losing hundreds of millions overnight. To maintain a coin-based investment strategy amid such extreme swings reflects a level of cognitive depth most of us cannot match.

On February 25 last year, Laszlo used the Lightning Network to spend 0.00649 BTC to buy two more pizzas. Regarding the loss of potential billions, Laszlo expressed no regret—and said the pizza tasted great.

His calm, carefree attitude is truly admirable.

2. High-Multiple Opportunities Still Exist, But Low-Capital Rags-to-Riches Chances Are Gone

History doesn’t repeat itself, but it often rhymes.

Many use the pizza story to warn others to “hold tight” and avoid repeating such historic mistakes. But this fear is somewhat overblown. Bitcoin’s multi-million-fold rise was a once-in-a-generation phenomenon. Later, Ripple saw similar astronomical growth. More recently, Ethereum, Litecoin, BNB, and other major cryptocurrencies have delivered extraordinary returns.

Take Binance Coin (BNB) as an example: launched in July 2017, it initially suffered a failed debut, dropping as low as 0.6 yuan, yet now trades around 230 yuan. While not as explosive as Bitcoin, it represented another rare, accessible chance for wealth creation—one that few actually seized. Online forums are full of frustration, complaints, and noise from those who missed out, echoing how Bitcoin skeptics sounded years ago. Come on, let’s lip-sync together: “That guy looks weird… he looks like a dog.”

Will there ever be another investment opportunity like Bitcoin?

Most likely not. For most people, what’s lacking isn’t high-return potential—it’s the chance for low-capital underdogs to rise. Unlike real estate, stock markets, or angel investing, early Bitcoin required negligible capital. Real estate or stocks may offer high multiples too, but the upfront cost is unaffordable for most. For example, 20 years ago, Beijing apartments cost just 2,000 yuan per square meter—an unimaginably low price today. But back then, with average monthly wages under 1,000 yuan, how many could afford it?

Now that Bitcoin is widely recognized, many want to invest—but prices above 50,000 yuan deter most. Even if you tell them Bitcoin might reach 1 million or even 10 million yuan per coin someday, very few will sell homes or cars to bet everything on it (and even if they do, it’s not advisable).

Influenced by the pizza story, many now try to replicate its success with altcoins, hoping low-cost bets on tokens with 100x or 1,000x potential will bring financial freedom. Sadly, most lack Bitcoin’s core traits: limited supply, irreplaceability (consensus), and continuous value appreciation in circulation.

Today, many so-called “100x coins” are not open-source, have modifiable code, or are outright pump-and-dump schemes manipulated by insiders. Most investors end up being fleeced—then the same scammers rebrand and run the same scam again, never letting victims break even.

This reveals a harsh contradiction in current crypto investing: valuable assets require high entry costs, while low-cost options are often deceptive.

3. “HODLing” May No Longer Be the Best Strategy

Mainstream media still heavily promotes holding crypto for massive long-term returns, creating a widespread misconception: the best crypto strategy is passive “HODLing,” and trading only increases risks of missing out or getting trapped.

While historical data suggests HODLing yields the highest returns, Bitcoin was originally envisioned as a medium of exchange—a peer-to-peer electronic cash system where usage matters more than storage. Laszlo’s pizza transaction strengthened Bitcoin’s utility and played a pivotal role in its development.

Of course, Bitcoin’s block size limits and confirmation delays hinder widespread daily use. But solutions like sidechains and the Lightning Network aim to address these issues. Current price volatility stems from information asymmetry, as early holders gradually offload coins to new investors—a process expected to last 3–5 years or longer.

During this transition, early adopters may still benefit from premium pricing. Eventually, as holdings become more evenly distributed, “stored” Bitcoin may diverge from “circulating” Bitcoin. Bitcoin could become “digital gold,” while stablecoins and others dominate everyday transactions. At that point, the Bitcoin pizza event may become a legendary anecdote. And then, perhaps, people will truly feel the regret of having missed an era.

The next 3–5 years represent the optimal window to enter—not simply by spending 5,000 yuan to buy 0.1 BTC, because even a 20x gain won’t change much. Instead, combine investment with learning blockchain technology and upgrading your understanding. Seek opportunities at the intersection of blockchain and traditional applications. Build confidence through enhanced industry insight—this approach is far more meaningful than mere speculation.

For young dreamers hoping to turn their fortunes around in crypto, pure “HODLing” may no longer suffice. Learn basic finance, understand the cycles of bull and bear markets, make regular dollar-cost averaging investments during downturns (low cost, low risk), collaborate on swing trades during the shift from bear to bull (to compound and grow capital), and cash out at the peak of the bull run. That’s the right way to navigate the crypto market.

Daring to buy represents a breakthrough in cognition; knowing when to sell is the skill to truly seize the moment.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News