Viewpoint: The liquidity summer for the macro economy may arrive, and sufficient patience will be key to success

TechFlow Selected TechFlow Selected

Viewpoint: The liquidity summer for the macro economy may arrive, and sufficient patience will be key to success

With the right time perspective, proper portfolio management, and sufficient patience, the likelihood of messing up becomes very small.

Author: Raoul Pal

Translation: TechFlow

There’s been some chatter about the "banana zone" (referring to price moving past an inflection point and rising, resembling a vertically oriented banana with a curved bottom and straight top), so let me clarify.

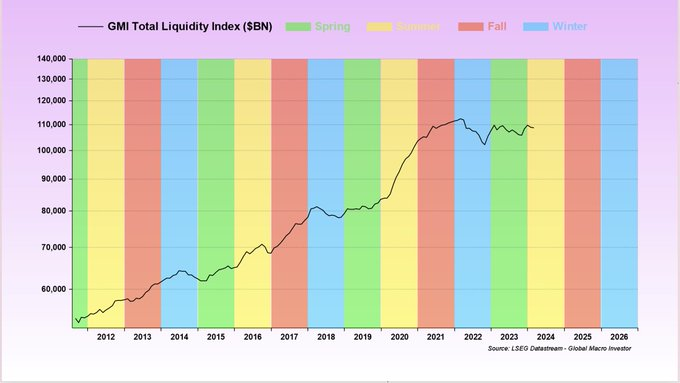

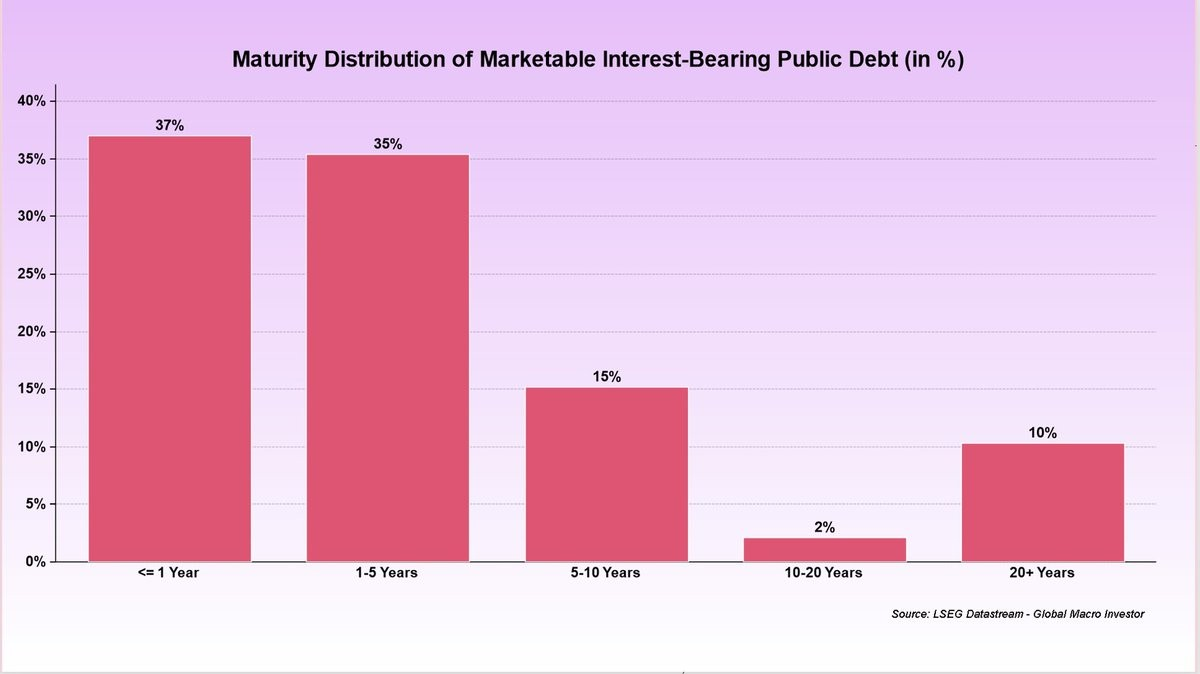

The macroeconomic summer and autumn are driven by the global liquidity cycle. Since 2008, the global liquidity cycle has demonstrated clear periodicity. Why start from 2008? That year, multiple countries reset their interest payments to zero and adjusted debt maturity periods to 3–4 years, creating a perfect macro cycle.

In the Institute for Supply Management (ISM) index, we can observe the near-perfect periodicity of the business cycle—one of the best indicators for studying macroeconomic cycles.

All of this is part of the "Everything Code," where business cycles repeat almost perfectly as liquidity rises to devalue currencies in response to debt rollovers. Without this mechanism, yields would completely lose their anchor, leading to a debt spiral (something avoided at all costs).

Note: The "Everything Code" refers to a macro theory describing how the global economy operates, particularly focusing on how monetary policy (especially currency devaluation) influences business cycles and debt management.

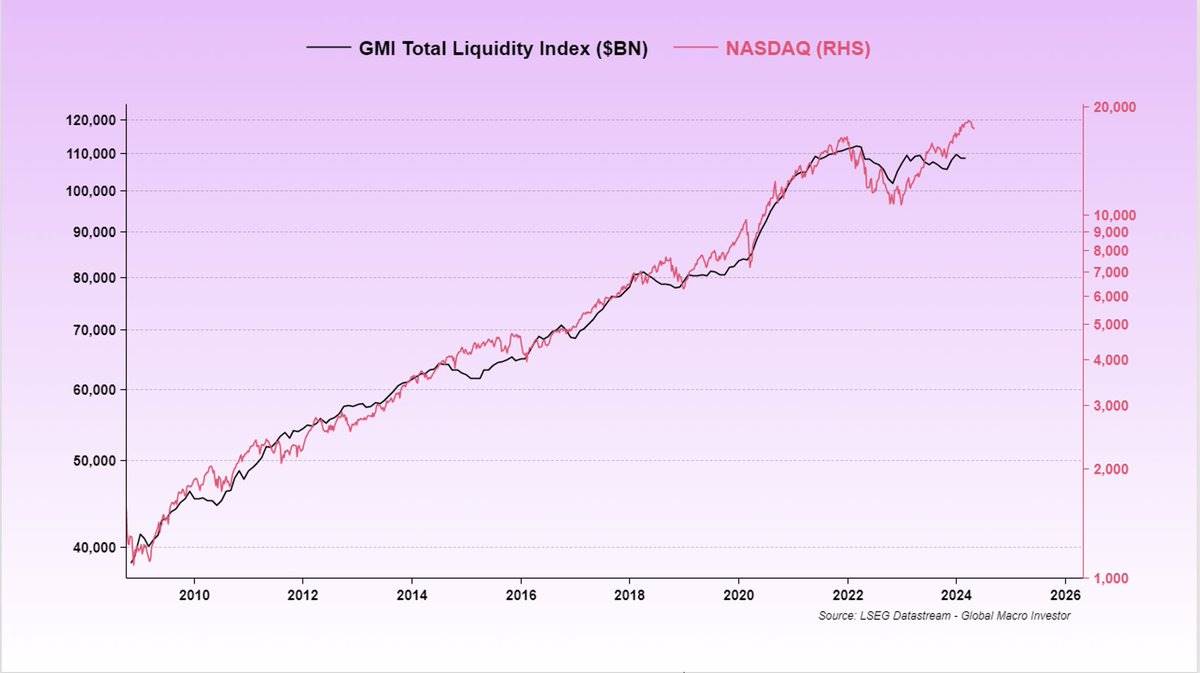

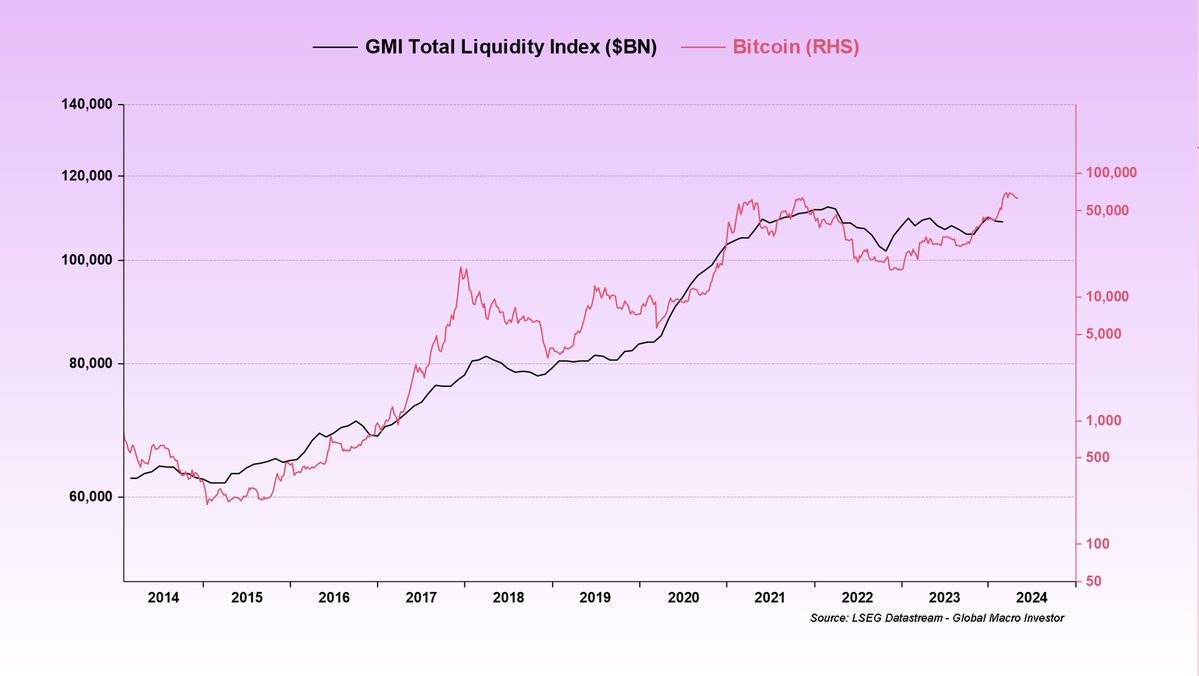

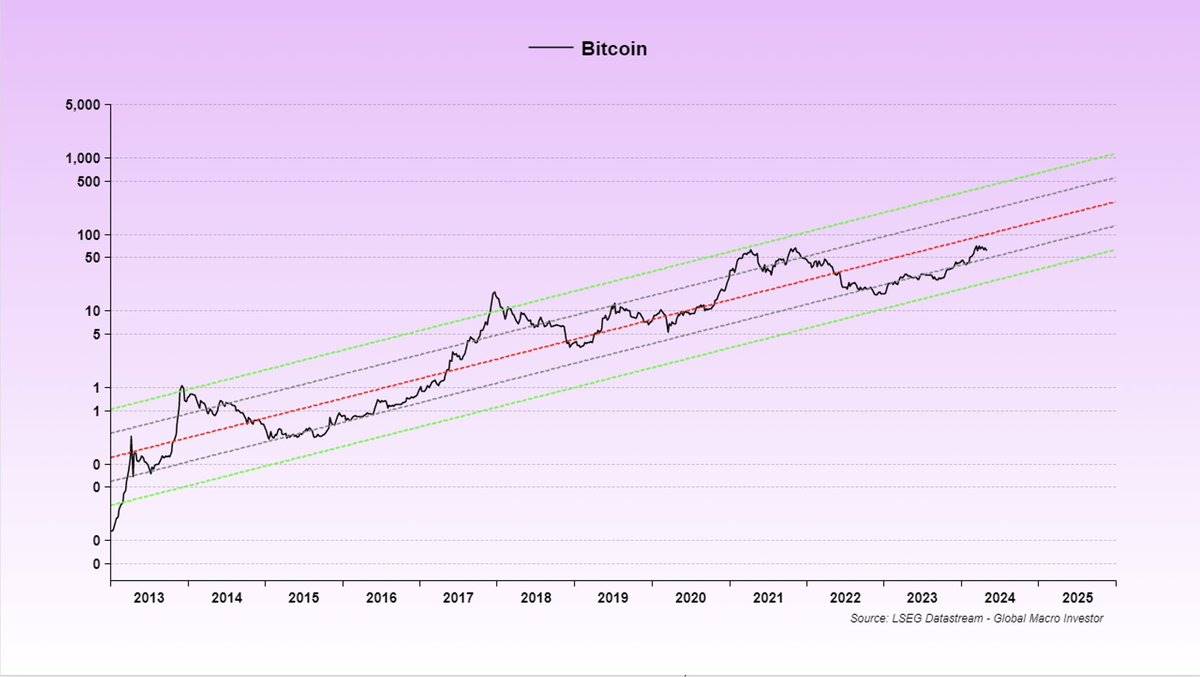

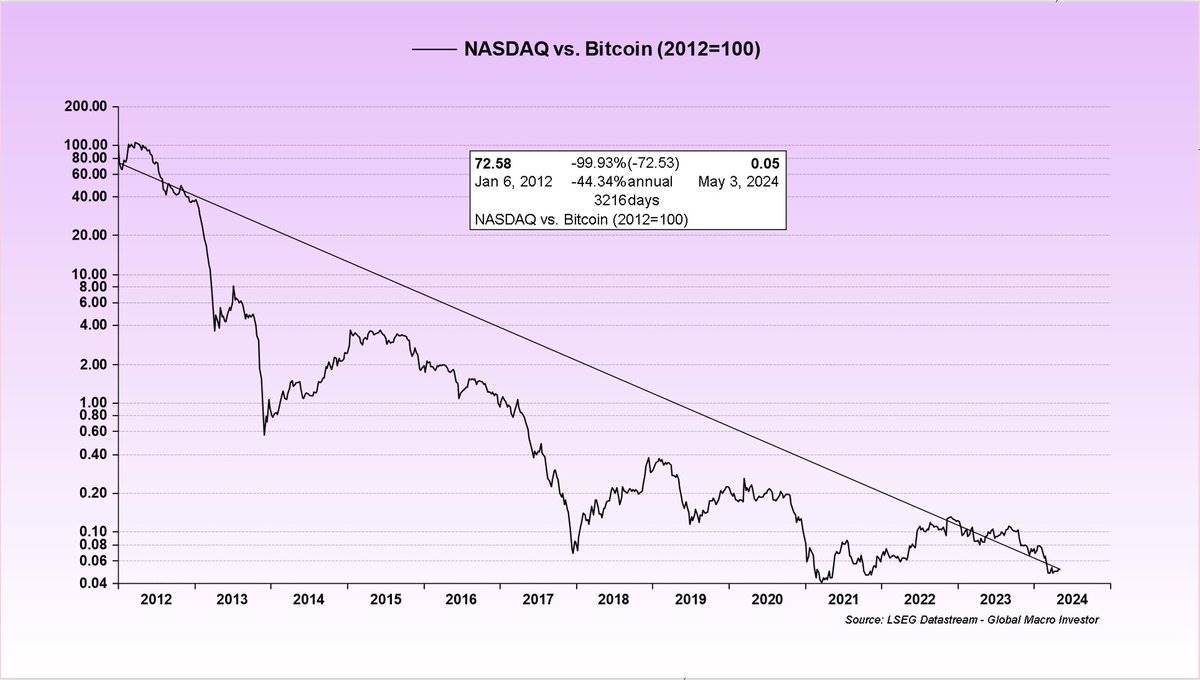

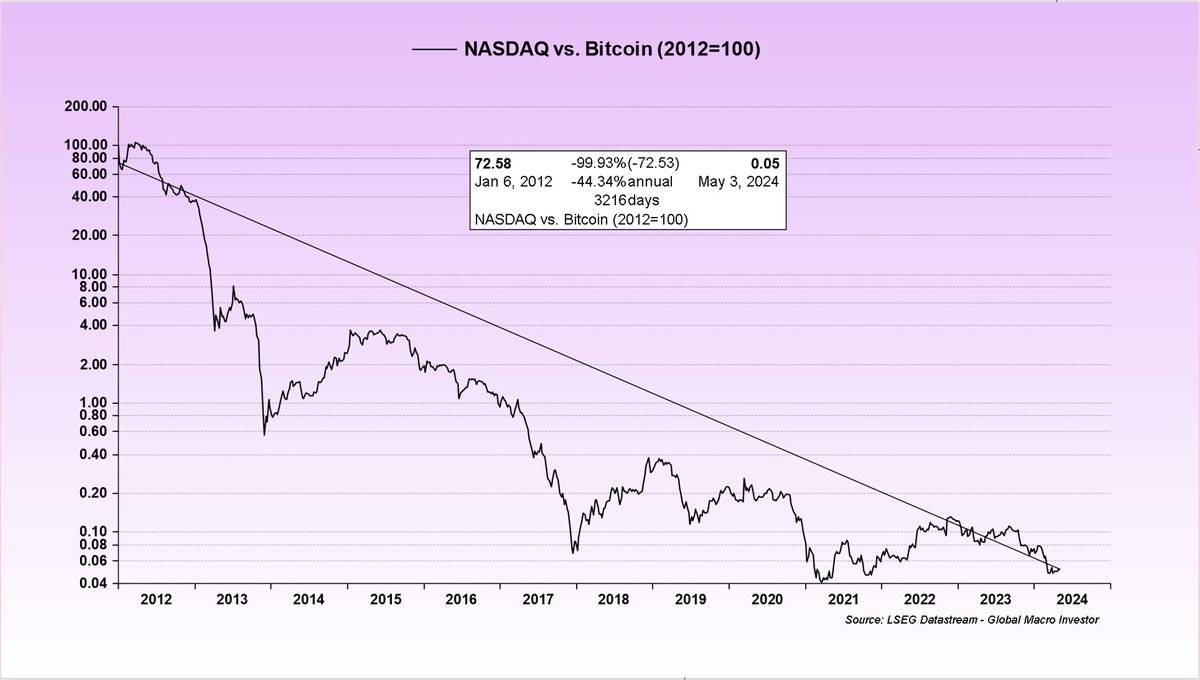

The effect of currency devaluation is to lower the denominator (fiat currency), making asset prices appear to appreciate visually. Below are the performances of the Nasdaq Index (NDX) and Bitcoin (BTC):

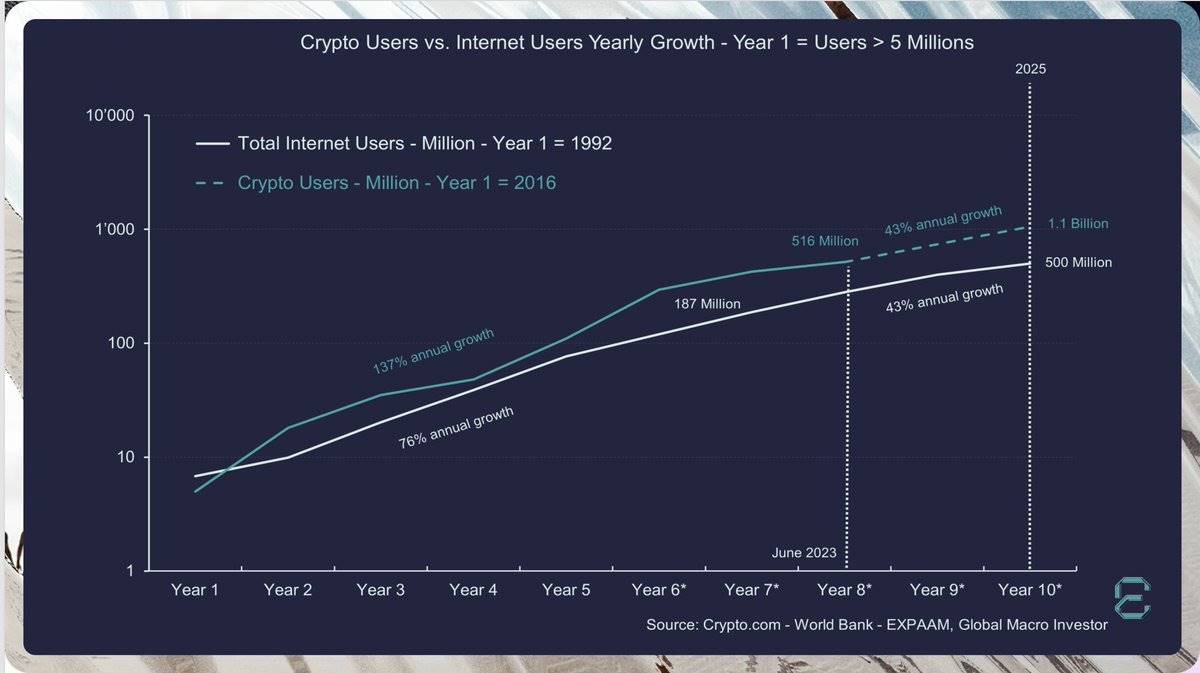

Growth assets (technology and crypto) perform best because they are riding secular adoption trends (Metcalfe's Law).

Growth assets (tech and crypto) perform best because they are in long-term trends based on adoption (Metcalfe's Law).

It's twice as fast as internet application adoption (comparing active wallets to IP addresses—not perfect, but a reasonable proxy).

Over the long term, it looks like this. I believe this is the adoption curve driving crypto market cap from $25 billion gradually up to $1 trillion.

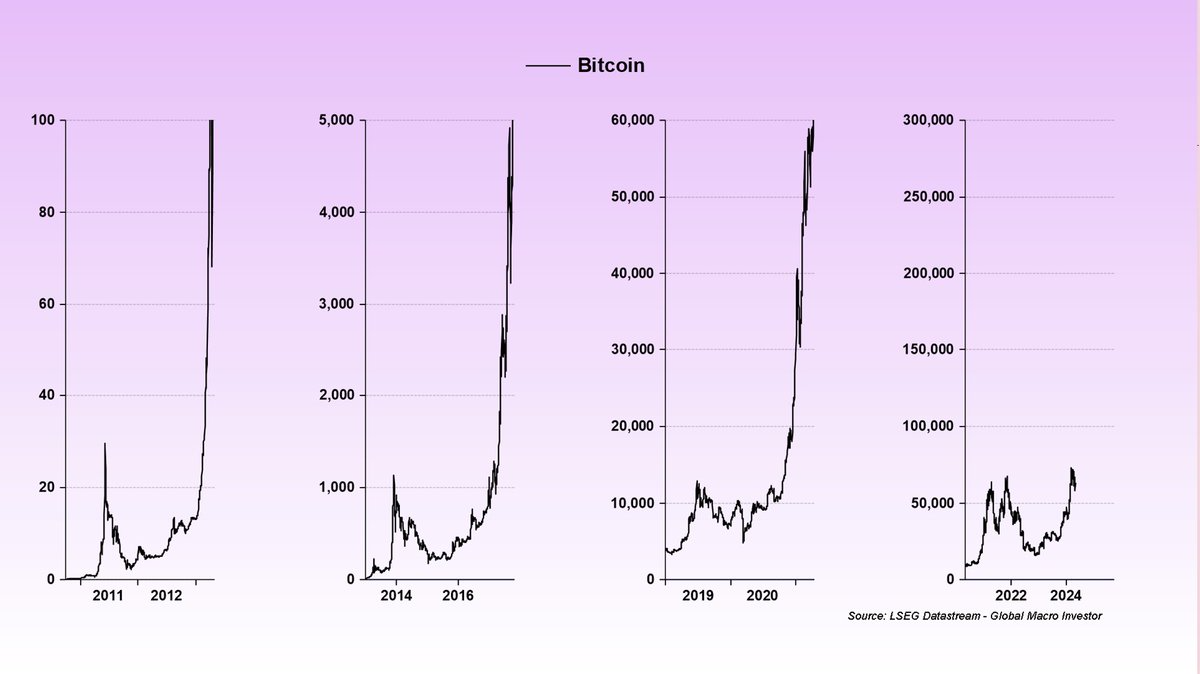

Back to the banana zone—during macro summer and autumn, tech stocks perform very well, having their own small banana zones, with autumn being the most pronounced.

But since crypto outperforms tech, the banana zone is even more pronounced in crypto.

Due to recurring cycles, the transition into macro summer is relatively predictable—again, emphasizing the "Everything Code."

This drives liquidity growth.

Meanwhile, growing liquidity tends to push crypto markets into creating new banana zones.

Given current debt rollovers, elections, and global issues such as those involving China, the likelihood of a major shift is low. However, nothing is perfect—we cannot predict whether the final phase of autumn will be explosive upside or a period of stagnation.

Ah, the mystery of markets... you can't always get what you want. But the Everything Code is the best framework for understanding all of this, and I believe it holds a high probability. Still, there will be surprises along the way (sharp corrections, prolonged sideways markets, etc.).

The mystery of the market is that you can't always get what you want. But the Everything Code is the best framework for understanding it all, and I believe it has a fairly high probability. Yet, there will still be surprises along the way (sharp corrections, extended sideways markets, etc.).

However, if you have the right time horizon, proper portfolio management, and sufficient patience, your chances of messing up become very small.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News