Notcoin, Binance's friendly signal to community coins

TechFlow Selected TechFlow Selected

Notcoin, Binance's friendly signal to community coins

Binance's latest Launchpool project, Notcoin, represents a bold move by Binance and a friendly signal toward community-driven tokens.

By Ri Yue Xiao Chu

Binance's latest Launchpool project, Notcoin, represents a bold move by the exchange—an encouraging signal toward community-driven tokens. Perhaps in the future, market cycles will place greater emphasis on such projects, with fewer institutional coins designed to harvest retail investors, and more highly liquid, community-held projects being promoted.

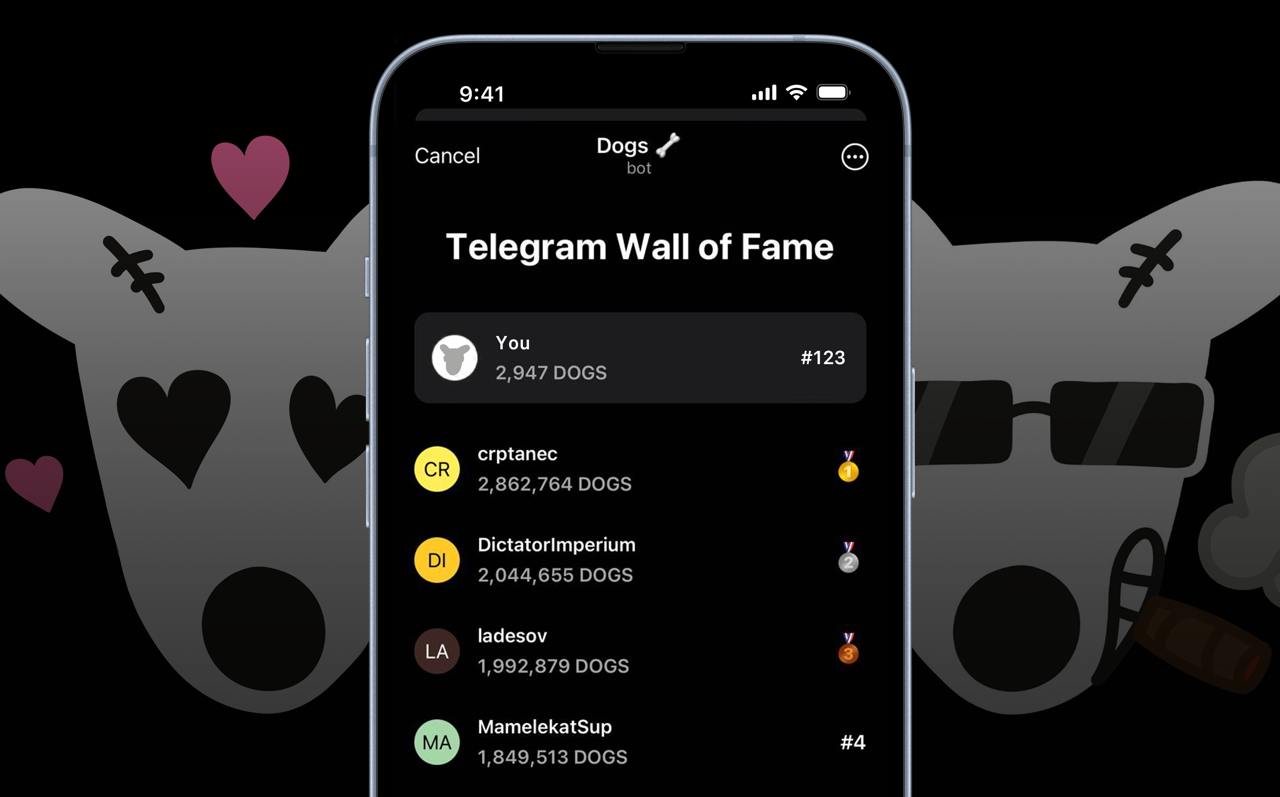

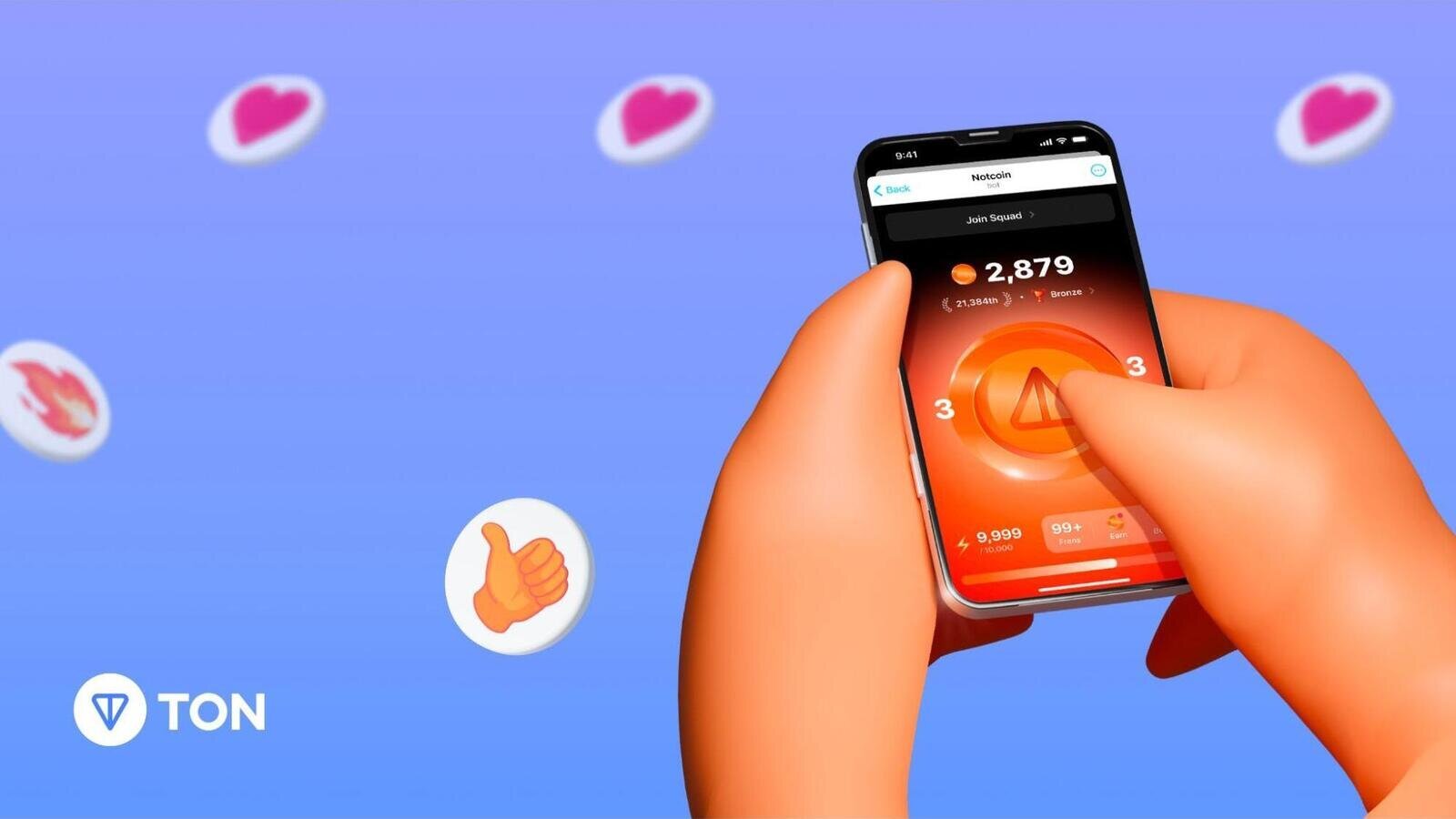

Notcoin is a Telegram-based game. Despite having 5 million daily active users, its core mechanic is simple: Tap-to-Earn. Users earn points/tokens by tapping—repeatedly… (omitting 100 million taps here).

If your immediate reaction is “what garbage is this on Binance?”, then you probably only believe in so-called “value coins.” But be careful—many of these value coins won’t generate profits for you in this bull run.

Recently, high-market-cap institutional coins have faced widespread criticism. This is the new playbook in this bull cycle: identify a promising tech narrative + solid team, raise large amounts at high valuations, attract yield farmers to boost key metrics, list on exchanges, and then let project teams and institutions cash out heavily during the bull market. In the end, it’s retail investors—those buying in on exchanges—who get hurt.

As a result, more and more people are turning to MEMEs. But that isn't necessarily a good thing either. If no one builds real products, the industry stagnates. Yet to build, most teams can't avoid relying on institutions—from idea to product development and launch, significant funding is required.

So we seem stuck in a dilemma—but it’s not unsolvable. This new model has one defining feature: low circulating supply at launch, but very high FDV. Take Starknet as an example: its circulating market cap was only $800 million—lower than even meme coins like Wif—while its fully diluted valuation reached $12.1 billion. A low circulating supply allows project teams to easily manipulate price action, then use positive news or bull-market liquidity to offload large holdings. Therefore, one solution is to increase circulation ratio at TGE and reduce allocations to teams and institutions.

As the world’s largest exchange, Binance’s every move influences the entire industry. It cannot fully embrace memes—that would discourage serious builders. Nor can it reject top-tier innovative projects; imagine if Binance didn’t list Arbitrum or Optimism—wouldn’t that be strange? However, Binance can send strong signals through its support of certain types of projects.

At the end of last year, Binance launched FairLaunch mode on Launchpool, significantly increasing circulating supply at TGE. This means that for the same initial market cap, the FDV becomes several times smaller. The current project, Notcoin, perfectly aligns with this high-initial-circulation philosophy—100% of tokens are initially circulating, with 78% allocated to miners, distributed among 35 million cumulative users and 5 million daily active ones.

To be honest, does Binance really want more high-market-cap projects? In those cases, all the money goes to project teams and institutions, while exchange users end up being exploited. Binance’s stance is quite clear—the CEO once liked two of my articles: one about FairMode, another advising people to stay away from high-market-cap institutional coins. The message speaks for itself.

The gameplay of Notcoin is easy to understand: tap the screen repeatedly within Telegram to accumulate coins. There are several ways to boost earnings:

1) Join a squad. Players can form teams to mine together. You receive a bonus when joining a squad.

2) Invite friends. Earn rewards based on how much your referrals earn—the higher their score, the greater your bonus.

3) Ads: Notcoin includes advertising tasks. Completing these earns additional coins.

4) Leagues: There are five tiers—Bronze, Silver, Gold, Platinum, and Diamond. As you cross point thresholds, you automatically level up and receive rewards.

The Notcoin team has hinted at future plans on Twitter, possibly including trading features and ads for other projects. After all, Notcoin is already the largest user-facing project on TON. With such massive reach, further expansion is certainly possible.

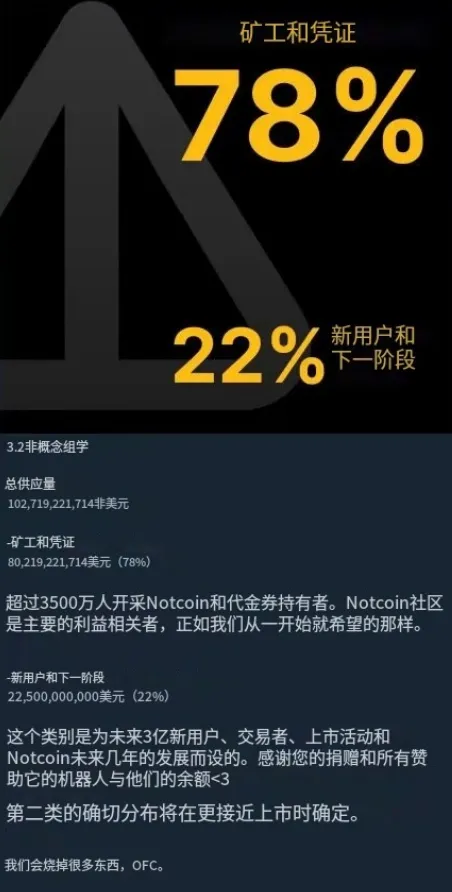

Regarding tokenomics, Notcoin has a total supply of 102,719,221,714, and will be fully circulating upon listing. Token distribution is as follows:

-

78% to miners

-

9% to ecosystem fund

-

5% to community incentives

-

5% to developers

-

3% to Binance Launchpool

From this allocation, several key characteristics stand out:

1) Large allocation to the community—78% to miners alone. If we count Launchpool participation as a form of retail mining, the total rises to 81%.

2) Only 5% allocated to developers—far below the typical 20% seen in many other projects.

3) No allocation to investors—yes, none at all.

The official team provided another statistic: 22% will be reserved for future user growth initiatives. So at TGE, the vast majority of tokens will be distributed. We’ll continue tracking on-chain data and provide updates accordingly.

The key point is this: people have suffered long enough under VC-backed tokens. It’s time for change. Let’s see more community-owned coins emerge.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News