Bull markets are full of bumps—why you shouldn't turn bearish now

TechFlow Selected TechFlow Selected

Bull markets are full of bumps—why you shouldn't turn bearish now

Perhaps we're not in a "copycat bear market," but rather witnessing a market return to high-quality assets.

Written by: Regan Bozman

Translation: TechFlow

We've just launched the greatest spot ETFs of all time, Bitcoin halving has occurred, Trump has gone completely wild—and you're still bearish? Investors are simply expressing their pain rather than conducting objective analysis. Let's look back at how far we’ve come and where we’re headed—how much further do we have to go?

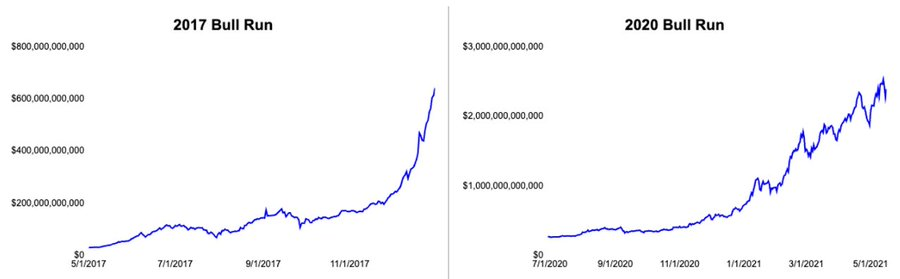

Every bull run experiences months of volatility, and this one is no different.

There are two perspectives on the current situation:

(A) Rotation into high-quality assets

(B) All infrastructure venture tokens are ruined

I believe A is correct.

Let’s analyze the current situation: Why do people think we’re in a bear market? Why are they wrong? And why do we still have so much room to rise?

People say this cycle is over because the things they want to go up aren’t going up:

-

memes

-

BTC

90% of VCs were under-allocated to these assets, and most new venture tokens have performed poorly in 2024.

Clearly, capital flows are an important part of this story—but many venture tokens launched with massive supply overhangs.

But capital flows aren’t the only part of the story—the way tokens are currently being issued is also extremely flawed.

-

If you launch at $1B and reach $5B six months later, you’d be thrilled;

-

But if you launch at $10B and drop to $5B six months later, you’ll feel disappointed.

I won't write another 47 tweets explaining why launching at specific price points, shorting, or high FDV/low float issuance is stupid. But this kind of issuance strategy, along with macro flows, is a key reason behind the current bearish sentiment. It's truly terrible!

We’ve set ourselves up for this “bear market”!

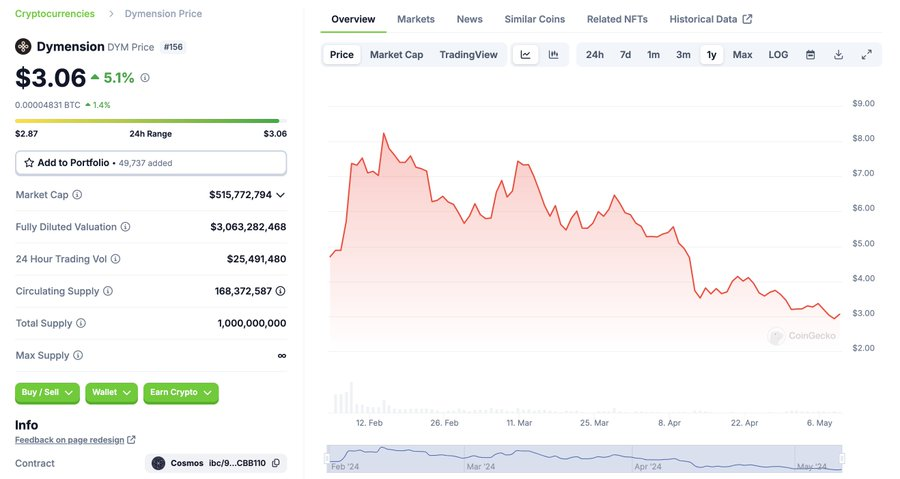

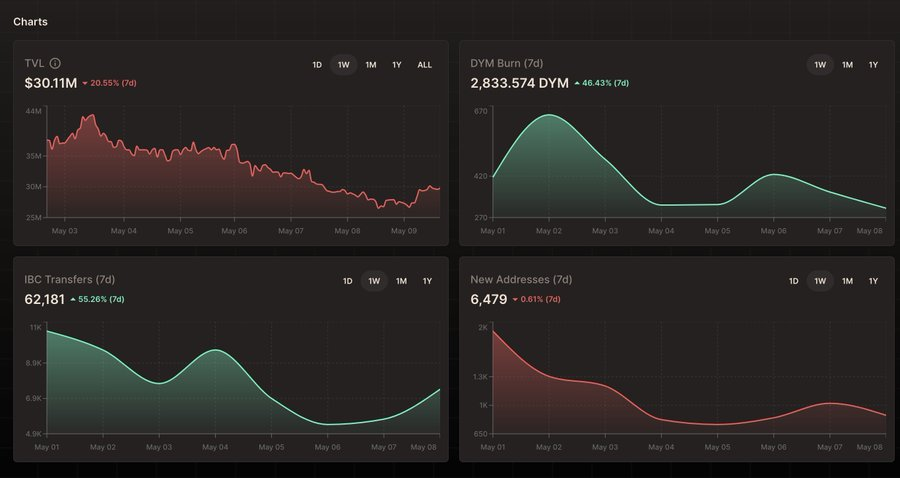

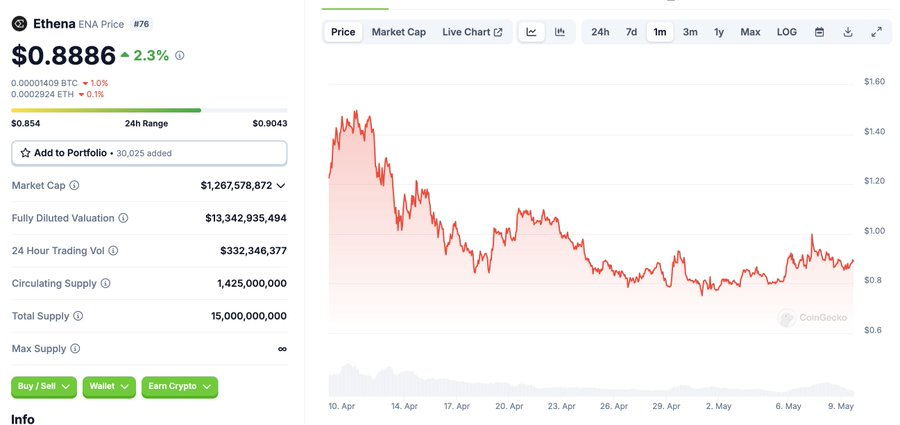

We need truly massive retail inflows to offset dozens of oversized FDV (Fully Diluted Valuation) launches. But right now, retail investors are busy collecting free funds from “Eigen Dad,” leaving no buyers. Charts of tokens like $DYM that only go down are everywhere.

Even venture-backed “blue chips” like $ARB have performed poorly, approaching 2023 bear market lows. I’ve been warning for months—the biggest risk for any token is when VC selling pressure vastly exceeds retail buying inflows, and that’s clearly happening now.

The “bluest” of blue chips—the ETFs.

Most venture firms—including ours—have increased ETH exposure, which has clearly underperformed this cycle. Hence, VCs are unhappy! The timeline looks like a grand funeral.

But I believe the idea that this cycle is dead is wrong!

Past cycles all had months-long periods of consolidation or pullbacks—this isn’t new. If you want 100x+ returns in this industry, you must accept extreme market volatility.

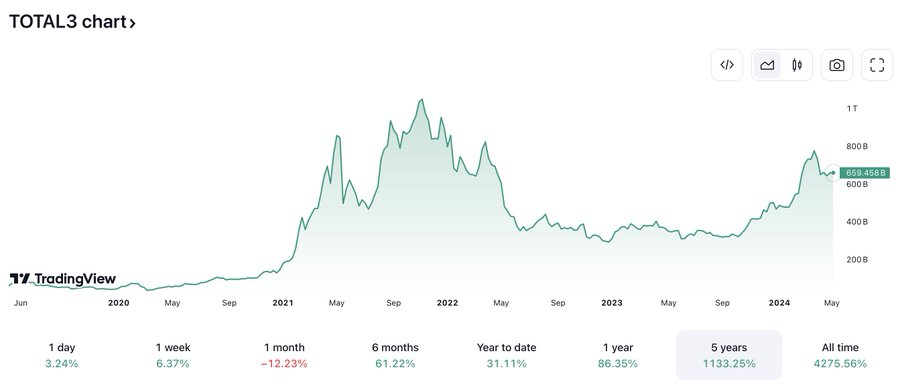

Let’s take a closer look at altcoins. The Total3 Index tracks the top 150 tokens excluding Bitcoin (BTC) and Ethereum (ETH).

Yes, there has been a pullback from local highs, but previous cycles saw multiple drawdowns of equal or greater magnitude.

Perhaps we’re not in an “altcoin bear market,” but rather a rotation into higher-quality assets. I mentioned Dymension earlier—last I checked, they had only one client and added fewer than 10k users last week. Maybe such projects shouldn’t command double-digit valuations.

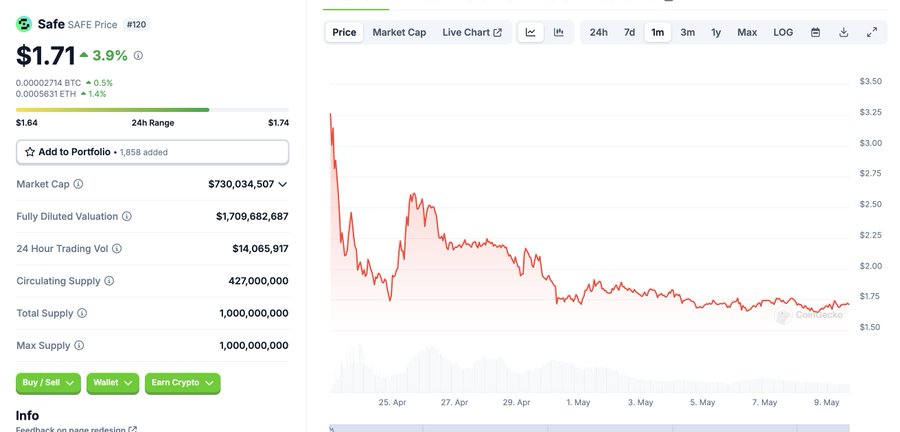

Teams that issued tokens in smarter ways have performed better. For example, $SAFE launched during volatile conditions but with 42% circulating supply, resulting in a price chart that’s more stable and appears to have genuine price discovery around $1.7B FDV.

Teams building cool stuff are also doing well. Take Ethena, for instance—it’s highly innovative and outperforming most other projects. So maybe it’s not that all venture tokens are doomed—only redundant zk modular DA solutions are.

The current trend is shifting from redundant infrastructure toward consumer-facing applications, which is very healthy. I believe public market valuations will reflect this shift over the course of the cycle.

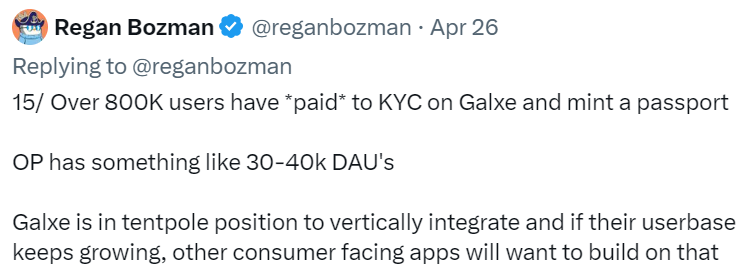

Leading user-facing applications will define this cycle as they vertically integrate and capture more value.

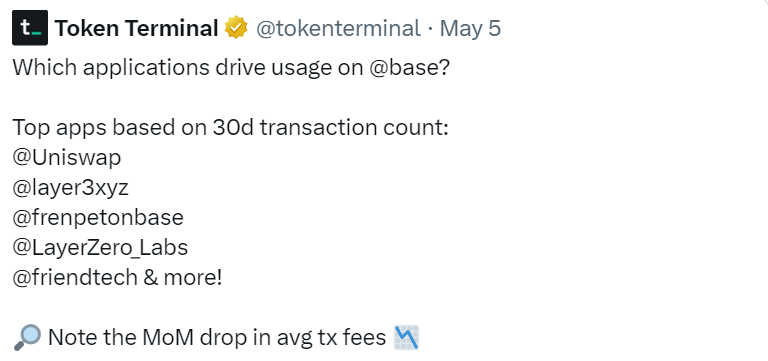

Layer3 announced its token this morning. It’s already the second-largest application on Base after Uniswap. The winners of this cycle will be those with unique distribution—and @layer3xyz definitely belongs in that category.

Shoutout to Fantasy.top and Pump.fun for consistently leading the charge—they haven’t even launched a token yet, and that’s when the real fun begins.

We still have much further to go. Financial advisors may require over 90 days to add new equities to their approved allocation lists, and ETFs were only approved 120 days ago.

Institutional time-weighted average price (TWAP) investing has only just begun.

Bitcoin ETFs are still not included in most macro strategies. Given the market cap of crypto, the amount of capital in these ETFs is astonishing.

At least until November, cryptocurrency becoming a U.S. election issue is bullish for the market.

More attention brings more market participants.

Of course, some of that attention might be negative—many people hate crypto—but in that case, you probably don’t have any downside anyway :)

Sorry to disappoint those who hate us—we remain bullish.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News