Why can't retail investors make money in today's crypto market?

TechFlow Selected TechFlow Selected

Why can't retail investors make money in today's crypto market?

The "traditional" crypto market no longer has 500x price gains—now there's a more interesting casino.

Written by: Regan Bozman

Translated by: TechFlow

Why do people keep saying this cycle is already over? Why does everyone feel so much pain? We can boil all these issues down to one point: under the current market structure, retail investors can no longer make real money.

Random thoughts on returning to our roots and moving beyond the current cycle

The reason retail investors are absent in this market cycle is actually simple—because "traditional" crypto markets (like infra tokens) no longer offer 500x price gains. There’s now a more attractive casino with better memes, easily accessible at their fingertips.

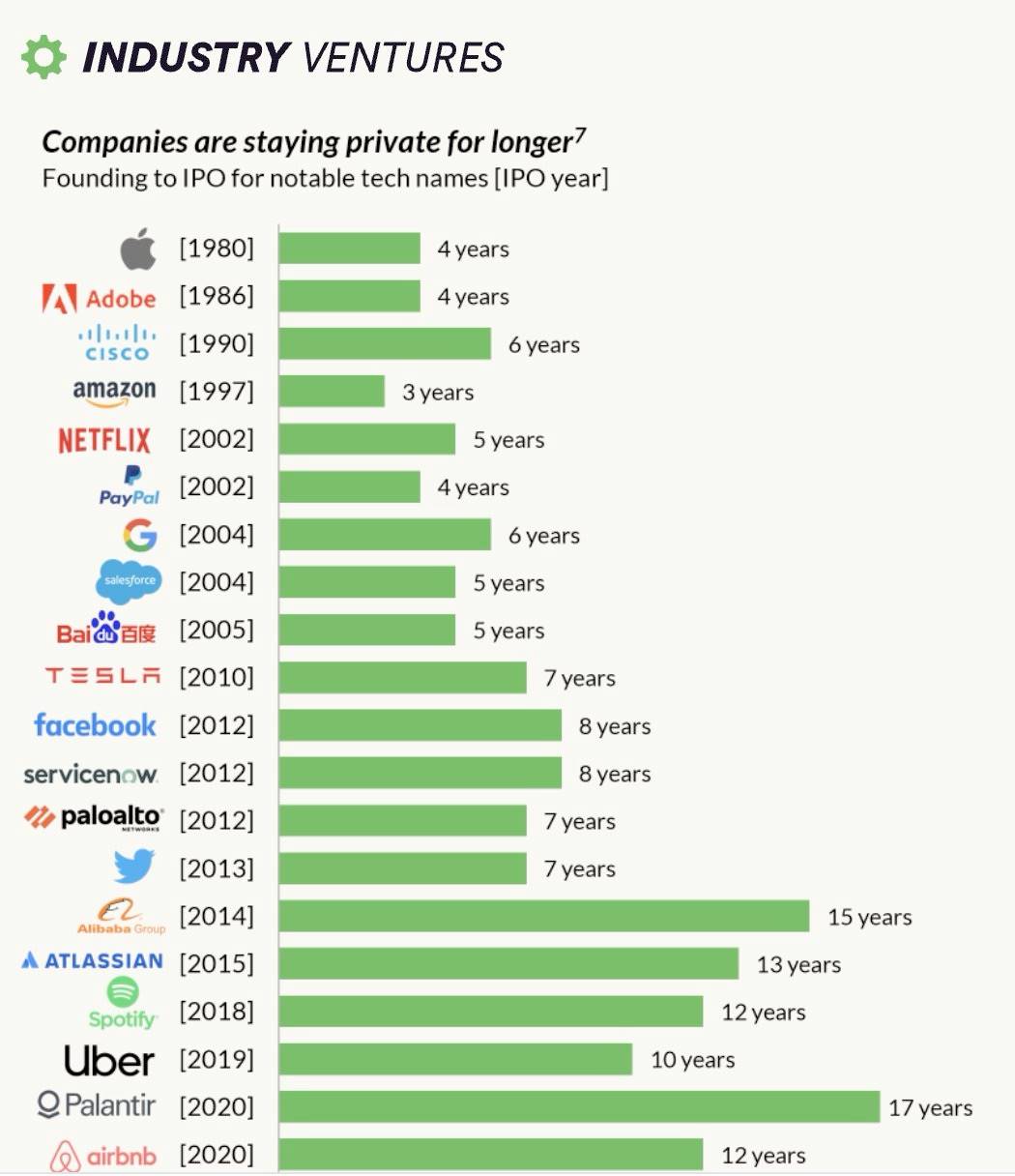

We’re essentially recreating what has happened in VC/IPO markets, where companies stay private for longer periods—meaning more of their upside remains “private” (e.g., locked within venture capital funds), inaccessible to retail investors.

Crypto briefly reversed this trend, democratizing access to asymmetric upside. But not anymore! L1s and L2s are raising larger sums from venture capitalists. There are no public token sales. VCs make money. Retail investors are marginalized. Perhaps retail disillusionment with this cycle shouldn’t be surprising.

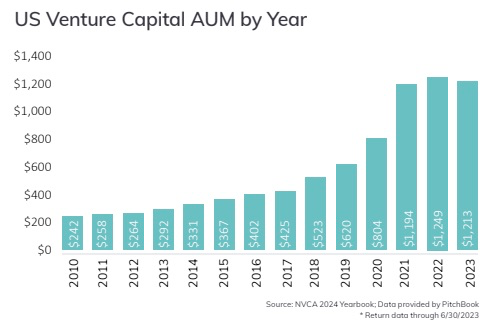

A key reason companies choose to remain private longer is that venture capitalists today have five times more capital than they did a decade ago. Companies can now raise over $1 billion in private markets without bearing the overhead of going public.

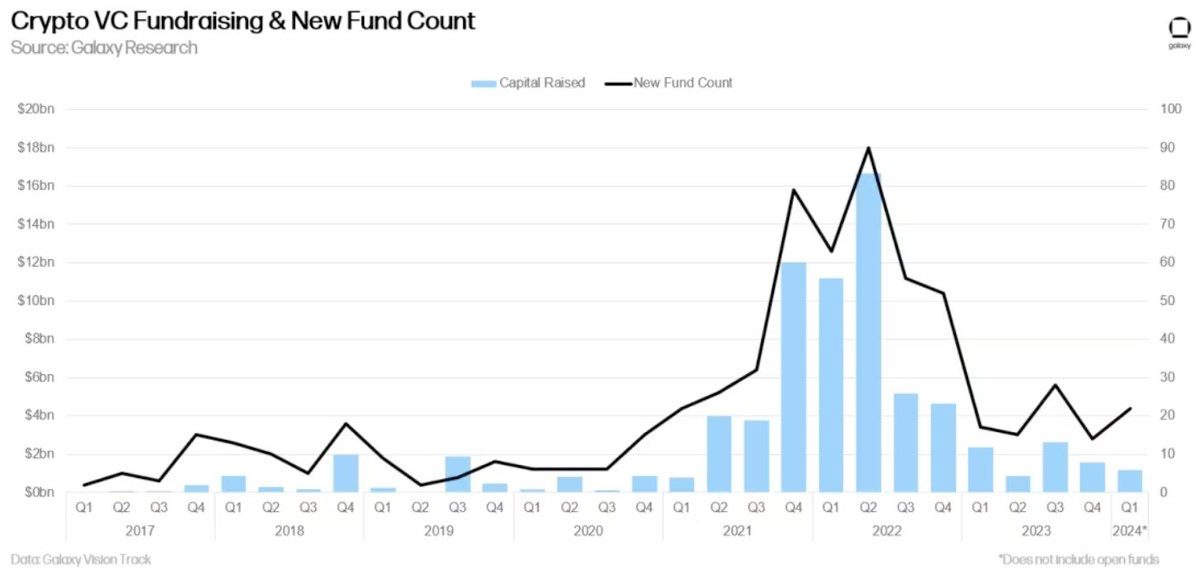

Unsurprisingly, the same trend is occurring in crypto venture capital—there is significantly more capital flowing into crypto VC funds now than there was five years ago.

Crypto was supposed to fix this!

ICOs were designed to democratize capital formation and broaden access to venture-like returns. They absolutely succeeded at that.

Buying Ethereum at its 2014 ICO price of $0.30 and seeing it reach $3,000 today means a 10,000x return over ten years—outperforming nearly any venture investment during the same period. Anyone on Earth could participate. That was amazing.

Now the industry has clearly grown, so entry prices have naturally risen—but these opportunities haven't disappeared. Solana ($SOL) launched at $0.22 in 2020 and now trades around $140, delivering a 636x return in just four years, likely beating almost every venture return over the past five years.

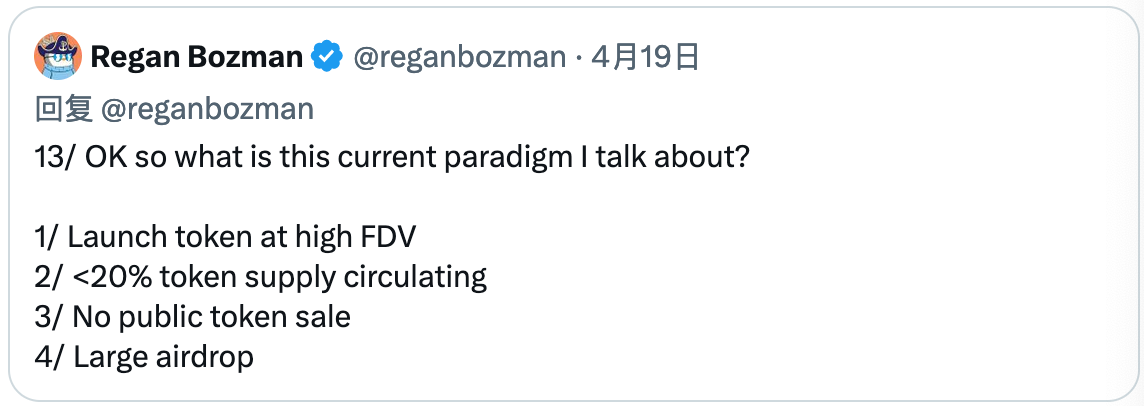

In this cycle, we've drifted far from that market structure. Today, retail investors rarely have the chance to buy tokens before launch or acquire them cheaply on public markets.

Airdrops are an improvement, offering early users some financial upside compared to traditional VC models. But financially, they're limited—by definition, there's only so much you can earn from an airdrop.

We’ve shifted from a market with uncapped upside to one with capped upside—a massive shift. $1,000 invested in SOL’s ICO is now worth $636,000;

while $1,000 invested in Eigen yields only about $1,030… even if it 10x’s, it would only reach $1,300. In the last cycle, you controlled your fate; in this cycle, you’re waiting for Eigen daddy’s handouts.

Financial nihilism means acknowledging that these markets have always been about money. Yes, that money funds technological progress, but it’s precisely that financial incentive that drives the entire industry. Remove the financial aspect, and the whole ecosystem collapses.

There are several things we can do to improve current token distribution models. The key is creating uncapped upside potential for early users and communities.

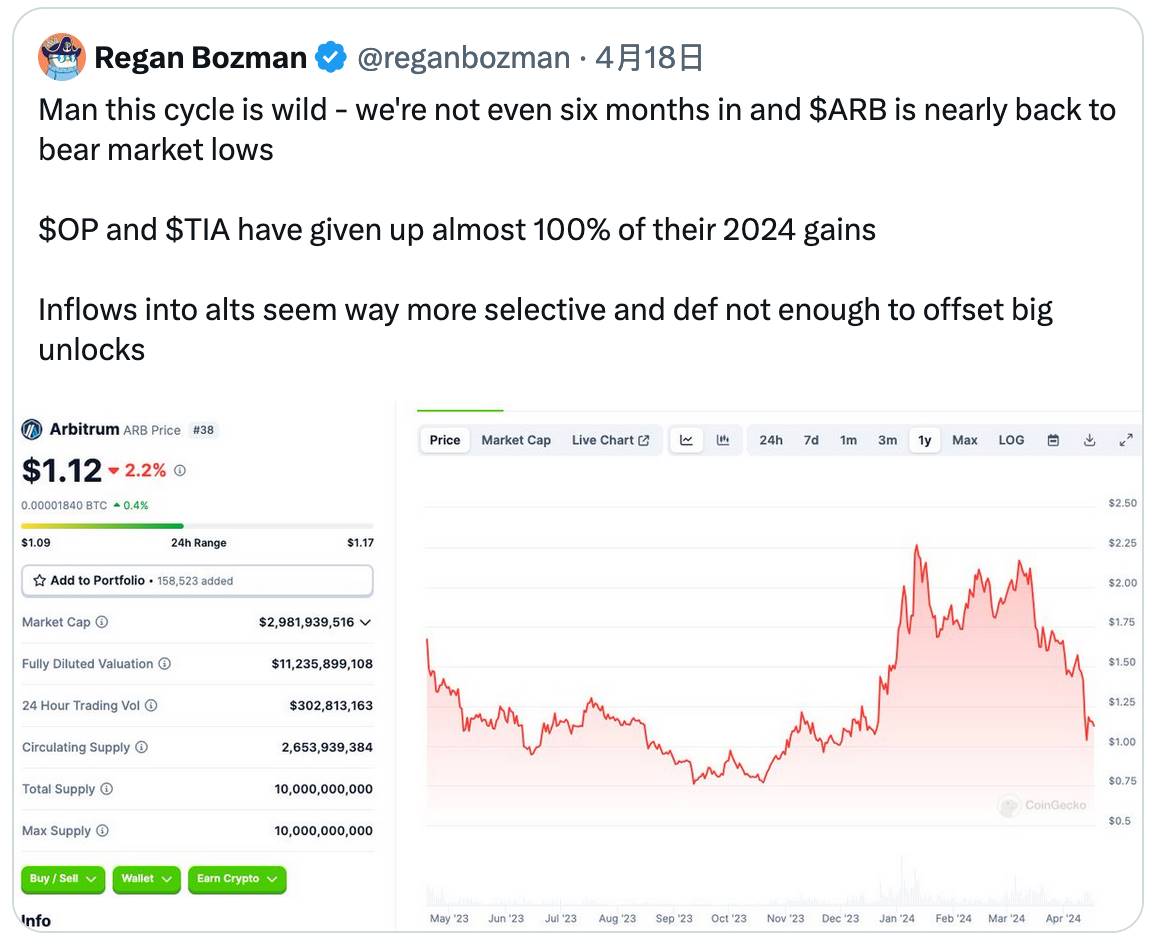

Moreover, there are deeper structural issues in the market—massive fundraising by L1s and L2s leading to multi-billion dollar valuations before launch. This creates two problems: (A) significant sell-side pressure; (B) a high floor price at launch.

I believe one of the structural problems facing most altcoins this cycle is that VC sell-off pressure isn't being offset by retail inflows. If $500 million was raised pre-launch, that translates into $500 million of selling pressure (and potentially much more if the token appreciates).

Raising large amounts privately at high valuations means you're trying to offload at even higher valuations. This may result in a scenario where the only way is down.

The relationship between venture investors and retail investors doesn’t need to be adversarial. Everyone made money on $SOL.

However, it becomes much harder when you try to inject excessive VC capital into illiquid markets. And it becomes nearly impossible when you remove uncapped upside from the most important market participants.

We can blame and argue about meme coins, but that completely misses the point. Meme coins aren’t the problem—the current market structure is. Let’s return to our democratic roots and fix what’s broken in today’s markets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News