Interpreting India's Blockchain Market: Investment Activity Remains Relatively Low, Tax Reform Most Critical

TechFlow Selected TechFlow Selected

Interpreting India's Blockchain Market: Investment Activity Remains Relatively Low, Tax Reform Most Critical

The most critical issue currently facing India's blockchain market is the need for comprehensive tax reform.

Authors: Ryan Yoon & Yoon Lee, Tiger Research

Translation: Felix, PANews

Key Points:

-

India's blockchain market continues to grow: With a young population, strong tech talent pool, and supportive government policies, Web3 technologies are widely adopted in India, ranking first in the 2023 Global Crypto Adoption Index.

-

Tax reforms and regulatory changes: In Q1 2024, India’s tax and regulatory environment for the Web3 and blockchain industry saw significant shifts, including high TDS (Tax Deducted at Source) rates, adjustments to capital gains taxation, and increased oversight of cryptocurrency exchanges.

-

Investment and ecosystem development: Despite regulatory uncertainty, India’s Web3 ecosystem continues to attract investment and evolve. While new investments in the blockchain sector were notably scarce in Q1, several projects remain under active development.

1. Current State of India’s Blockchain Market

As highlighted in our previous report "Overview of India's Web3 Market," India is rapidly emerging as a key player in the global blockchain landscape. Several factors drive this growth: 1) a youthful demographic, 2) abundant technical talent, and 3) government policies favorable to technological innovation. Moreover, with a population exceeding 1.4 billion, India offers an ideal environment for widespread adoption of Web3 services. According to Chainalysis’ 2023 Global Crypto Adoption Index, India ranked first globally—up from fourth place the previous year—reflecting the momentum in its Web3 market.

India’s Web3 ecosystem is thriving, supported by over 1,000 active startups, particularly concentrated in major Web3 hubs like Bangalore. Although investment amounts declined in 2023, investment frequency remained stable, signaling sustained market growth. Additionally, the Indian government is progressively adopting Web3 technologies, piloting digital rupee initiatives through CBDC programs and advancing the development of a National Blockchain Framework. This shift from initial restrictions to active support underscores growing recognition of blockchain’s potential and a commitment to nurturing a healthy technology ecosystem.

2. Developments in Q1 2024

2.1 Expected Changes in Taxation Regime

Participants in India’s blockchain market urged the government during the upcoming 2024–25 budget session to reduce the 1% TDS (Tax Deducted at Source) on crypto transactions and lower the 30% capital gains tax on profits.

Source: CoinDCX

TDS poses a particularly heavy burden on investors, as it imposes a 1% tax at the point of transaction. For example, if you sell Bitcoin worth 1,000 rupees, a tax of 9.8 rupees will be deducted—1% of 998 rupees remaining after a 2-rupee transaction fee (assuming a 0.2% fee).

According to a report by the Esya Centre, trading volumes in India plummeted by 90% following the introduction of crypto taxation in 2022. In response, industry groups such as the Blockchain Association of India and Bharat Web3 Association have called on the government to reduce TDS to 0.01% and allow offsetting of crypto losses against profits, similar to practices in traditional stock markets.

The interim budget announced in February disappointed India’s blockchain industry by maintaining the 30% tax on crypto profits and the 1% TDS. These decisions, made ahead of national elections, were expected not to bring major changes to the tax structure. However, post-election policy adjustments in April/May offer hope for reform. The industry remains optimistic about potential changes, which could include clearer regulations, elimination of the 1% TDS, and an overall reduction in tax rates.

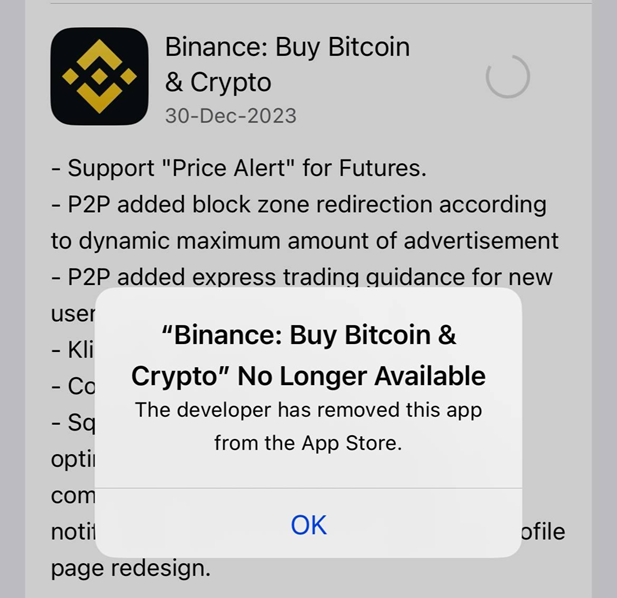

2.2 Blocking Global Crypto Exchanges

Source: Cointelegraph

In December 2023, India’s Policy Commission issued notices to nine crypto exchanges for violating anti-money laundering laws. Further regulatory actions unfolded in January 2024 when the Financial Intelligence Unit (FIU) directed major global exchanges—including Binance, Kraken, and OKX—to remove their apps from Indian app stores. Both Apple App Store and Google Play promptly complied, removing the relevant applications. OKX also announced in March that it would cease operations in India by April 30, highlighting the significant challenges crypto exchanges face under the current regulatory framework.

Last year, when Coinbase stopped accepting new Indian customers, it marked a turning point in the country’s crypto exchange regulatory landscape. Coinbase CEO Brian Armstrong attributed the decision to informal pressure from India’s central bank.

Fortunately, in March of the same year, KuCoin announced it had become the first global exchange to receive approval from the FIU—a significant regulatory milestone. This approval allows KuCoin to onboard users within the established regulatory framework. These developments in Q1 reflect a shift in India’s regulatory intensity.

2.3 Development of Investment Ecosystem

Despite regulatory uncertainties, India’s Web3 ecosystem continues to develop. Recently, the Core Foundation launched a $5 million innovation fund to boost India’s Web3 ecosystem. Solana and CoinDCX also initiated a $3.2 million developer support program. Such large-scale support initiatives demonstrate confidence in the Indian market.

2.4 New Funding

Source: AFK Gaming

Stan, an Indian blockchain esports company, raised $2.7 million in a Pre-A round in January from CoinDCX and other investors. Stan is building a blockchain gaming community and has announced the launch of its own marketplace platform alongside official NFT releases.

In Q1 2024, there was a noticeable lack of new investments in the blockchain sector. This slowdown may be attributed to two main factors: surging global interest in AI technologies and capital flows toward them, along with ongoing regulatory uncertainty within India.

2.5 Other Developments

Despite efforts to support the Web3 and blockchain ecosystem, companies are relocating their operations to regions like Dubai and Abu Dhabi. This shift is largely driven by the desire to escape India’s ambiguous regulations and strict tax policies. Dubai, in particular, attracts crypto firms with incentives such as exemptions from income and corporate taxes.

Indian crypto exchange Mudrex now offers Indian investors access to U.S. spot Bitcoin ETFs, supporting products from BlackRock, Fidelity, Franklin Templeton, and Vanguard.

Finally, CoinDCX merged with the defunct Koinex, resolving asset withdrawal issues for Koinex users and acquiring part of its user base. As India’s first unicorn crypto exchange, currently valued at $2.15 billion, CoinDCX is expected to expand its influence further following the merger.

3. Conclusion

The most pressing issue currently facing India’s blockchain market is the urgent need for comprehensive tax reform. While investor inflows might seem to merely inflate prices without driving meaningful market development, they also hold the potential to contribute to a healthier market environment and provide substantial backing for groundbreaking projects.

Moreover, the policy direction set by India’s newly elected government post-elections will be crucial in reshaping the future of the country’s blockchain market. The election outcomes and subsequent policy decisions could become pivotal turning points, determining whether the market can overcome current challenges and unlock its full potential.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News