Author: Tiger Research Reports

Translation: TechFlow

Key Takeaways

-

India continues to lead global cryptocurrency adoption, driven by strong institutional participation and regulatory adjustments, despite challenges such as high taxation and temporary exchange bans.

-

Indonesia has surged from 7th to 3rd place in global crypto adoption rankings. This growth is fueled by increased use of decentralized exchanges (DEX), active institutional trading, and local regulations that encourage blockchain innovation.

-

Southeast Asia demonstrates diverse cryptocurrency use cases. Singapore leads in stablecoin adoption and merchant services, the Philippines focuses on play-to-earn gaming and remittances, while Vietnam prioritizes peer-to-peer (P2P) exchanges.

1. Introduction: Dynamic Shifts in Cryptocurrency Adoption

Southeast Asia and India have emerged as global leaders in cryptocurrency adoption. The region has become a hub for blockchain activity, a trend driven by grassroots user engagement, rising professional trading, and growing institutional interest. As decentralized finance (DeFi) and centralized exchanges (CEX) expand globally, Southeast Asia not only keeps pace but often leads in crypto innovation.

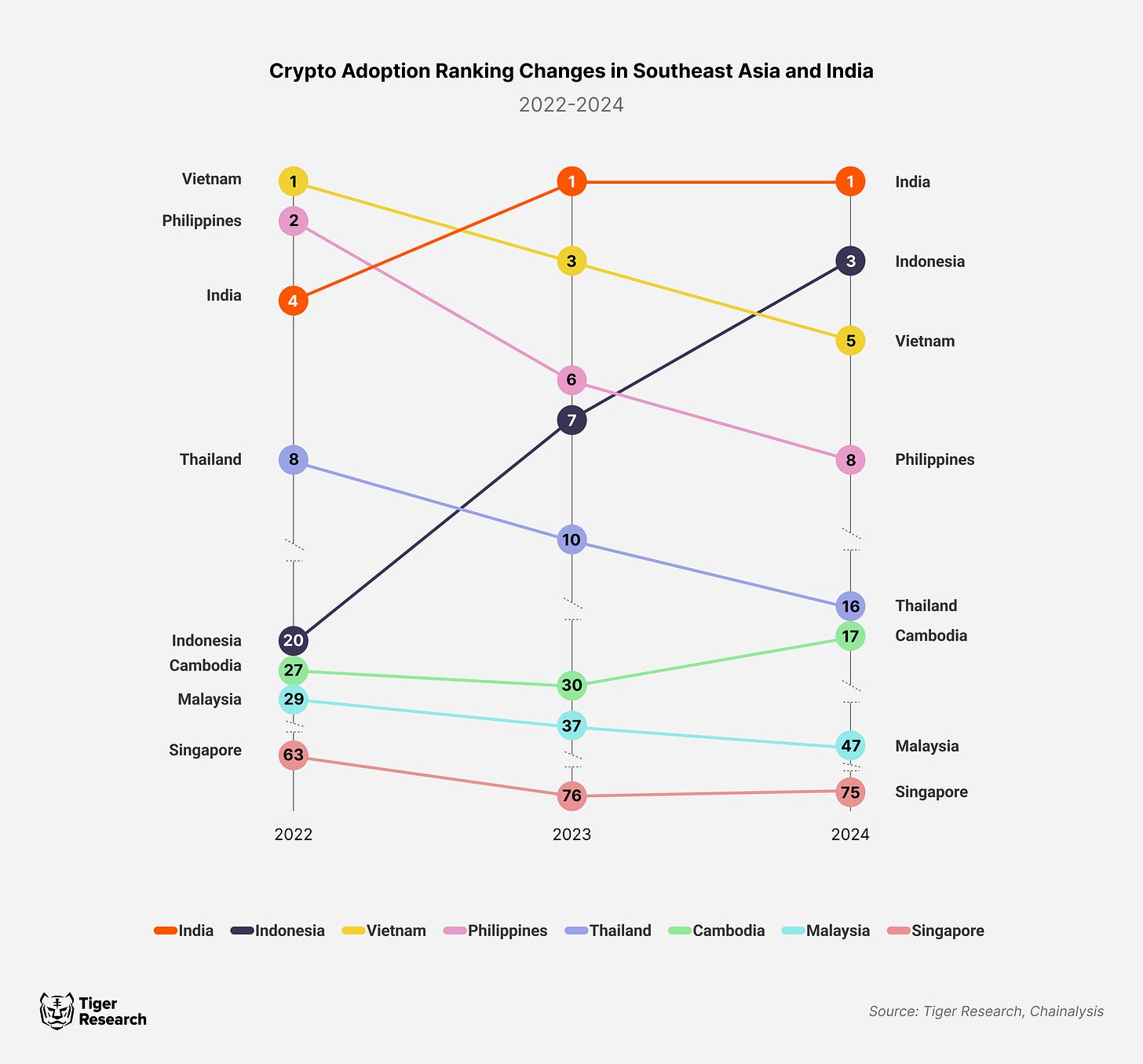

The Chainalysis Global Crypto Adoption Index highlights the region's significant impact on the Web3 industry. Malaysia and Singapore still lag behind other Southeast Asian nations in crypto adoption, while Cambodia has jumped 13 places. Indonesia now ranks third, reflecting rapid growth in crypto adoption, whereas Vietnam, the Philippines, and Thailand have seen slight declines.

2. Key Changes from 2023 to 2024

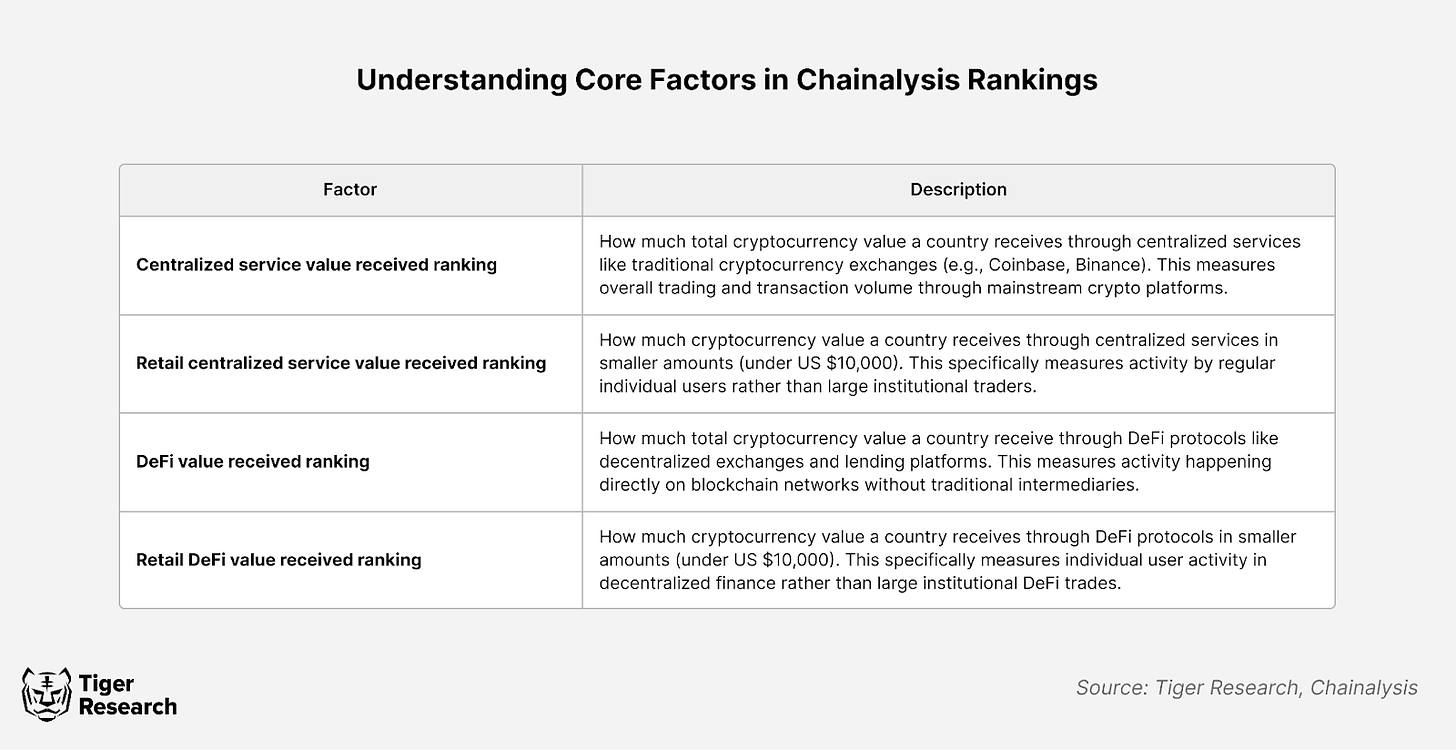

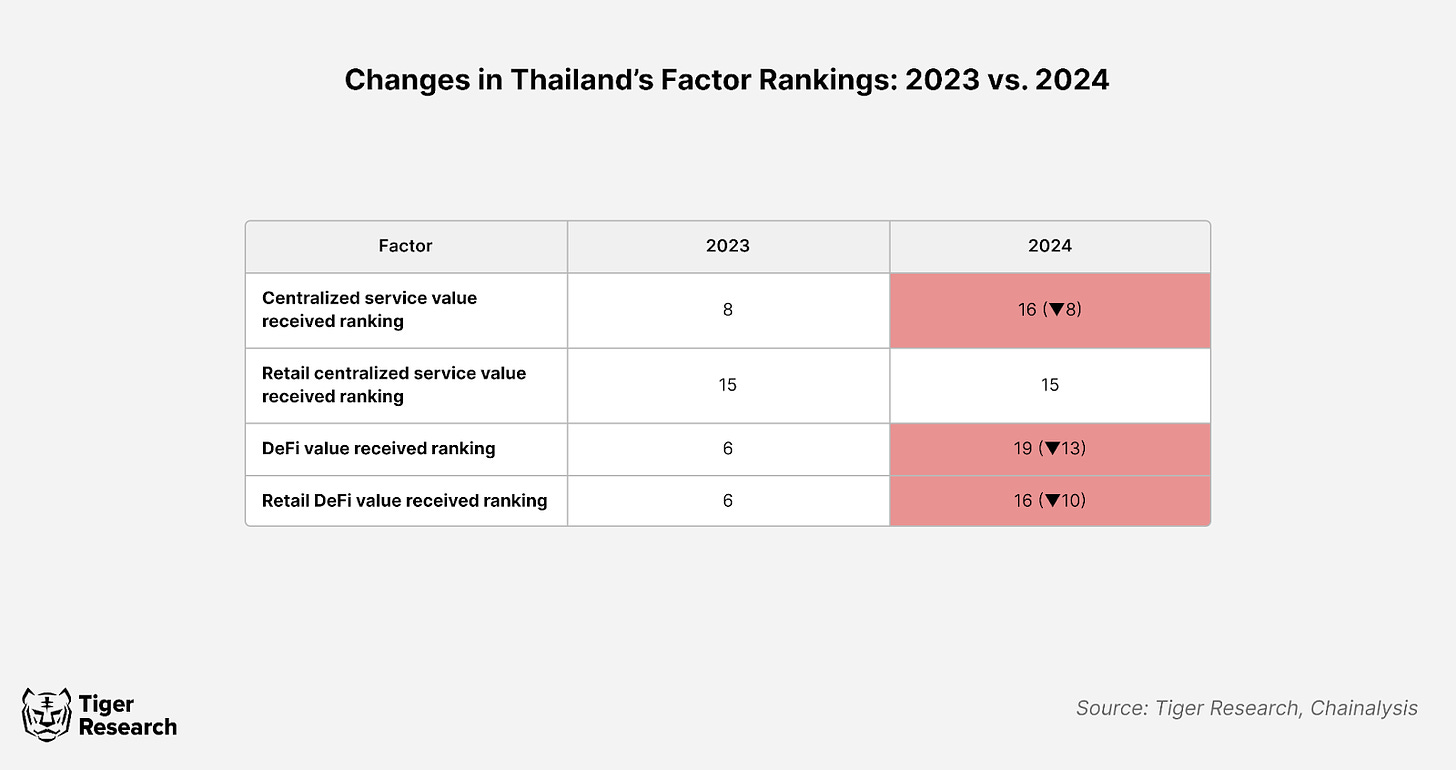

Chainalysis calculates the index based on four core metrics: 1) value received by centralized services, 2) value received by retail users via centralized services, 3) value received by DeFi protocols, and 4) value received by retail users via DeFi.

This report provides an in-depth analysis of these four components of the Global Crypto Adoption Index, offering insights into evolving trends in Southeast Asia and India. It compares key shifts between 2023 and 2024 and explores underlying drivers behind changes in adoption rankings.

2.1 India: The Crypto Giant

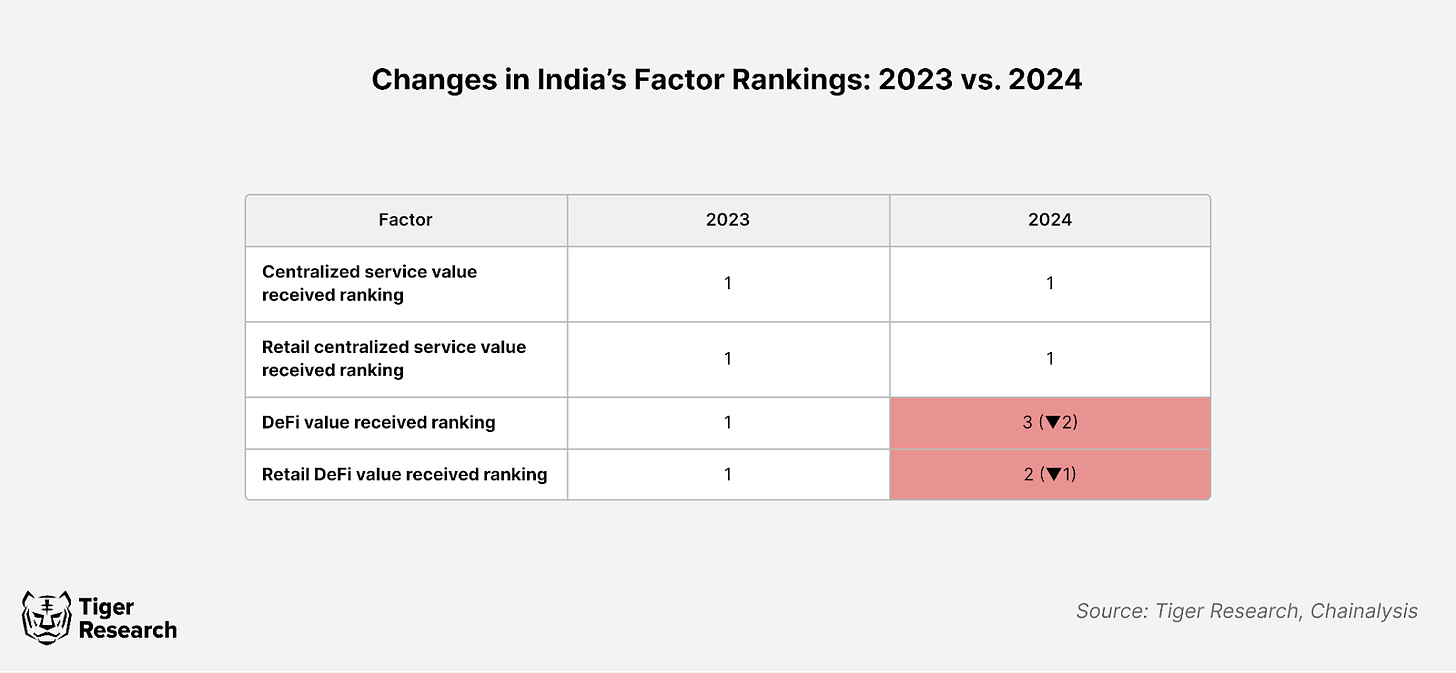

India retained its top position in the Global Crypto Adoption Index for both 2023 and 2024, further solidifying its leadership in the crypto space. While its centralized service metrics remained stable, its DeFi indicators slightly declined due to increased activity in other countries. Notably, Indonesia and Nigeria have accelerated their crypto adoption, with Nigeria completing over $30 billion in DeFi transactions last year.

Although there were regulatory developments affecting centralized services, their overall impact was limited. In December 2023, India’s Financial Intelligence Unit issued notices to nine offshore exchanges—including Binance—regarding impending regulatory actions. Subsequently, the Ministry of Electronics and Information Technology (MeitY) began implementing URL blocks restricting access for Indian users.

However, a report by the Esya Centre found that the effects of these blocks were short-lived, as users continued accessing exchanges through pre-downloaded apps, some of which remained available even after government bans.

Tax policies remain unchanged, with a 30% tax on crypto capital gains and a 1% tax deduction at source (TDS) on all transactions, yet trading activity remains robust. By 2025, India’s position in blockchain is expected to strengthen further with MeitY’s launch of the National Blockchain Framework (NBF) in 2024. This government-backed initiative leverages permissioned blockchain technology to enhance security, transparency, and trust in public services.

Support continues to focus on structural applications rather than investment incentives, as tax policies are expected to remain unchanged. As a result, market participants are calling for tax reductions in the 2024–25 budget to create a more favorable investment environment. However, the impact of these measures—particularly on investment-related adoption factors—remains uncertain.

2.2 Indonesia: Surge in Crypto Participation

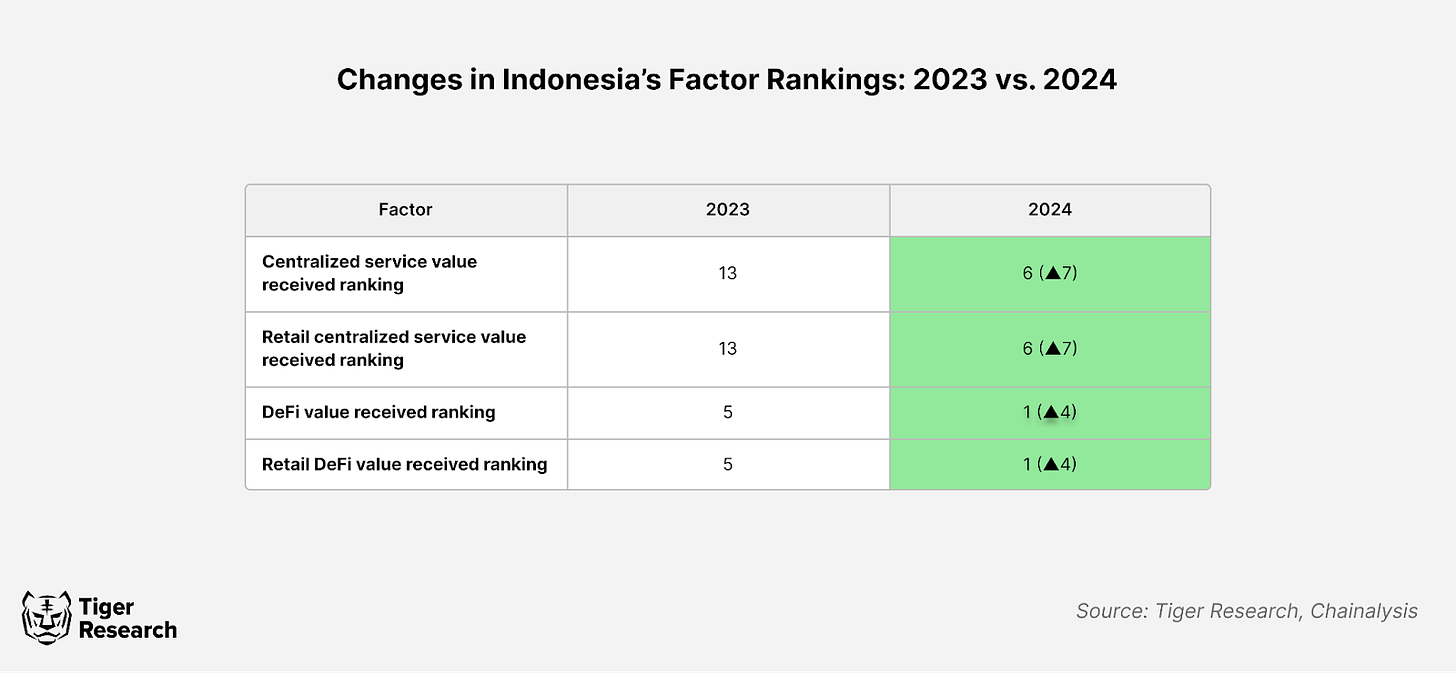

Indonesia made remarkable progress in the Global Crypto Adoption Index, jumping from 7th place in 2023 to 3rd in 2024, with notable improvements in both centralized and DeFi rankings. Continued growth in centralized services this year could further boost its ranking next year.

According to Chainalysis data, Indonesia outpaces other Southeast Asian nations in growth rate. In 2023, it recorded a surge of 207.5%. Data from Indonesia’s Commodity Futures Trading Regulatory Agency (Bappebti) shows this growth was driven by centralized exchanges like Indodax and Tokocrypto, benefiting from stricter listing rules in traditional stock markets. Users have shifted their trading preferences from conventional markets to alternatives such as cryptocurrencies.

A detailed analysis of transaction sizes on local exchanges reveals that over one-third (43.0%) fall between $10,000 and $1 million. Additionally, Indonesia has the highest proportion of transfers between $1,000 and $10,000 among all countries. The high volume of mid-to-large-sized transactions indicates that professional traders dominate Indonesia’s crypto market.

Rapid growth in DeFi is largely attributed to Indonesia’s young, tech-savvy population. Millennials and Gen Z are particularly eager to experiment with decentralized financial solutions. Their active participation has led DEX platforms to account for 43.6% of the country’s total trading volume, reflecting a preference for financial systems free from traditional banking constraints.

To increase future adoption rates, the current tax system needs reform. Indonesia imposes a 0.1% income tax and a 0.11% VAT on all domestic crypto transactions. These relatively high rates constrain growth in centralized services, pushing more users toward harder-to-regulate DeFi platforms. Adjusting taxes to more reasonable levels could significantly boost crypto adoption across the country.

2.3 Vietnam: Sustained Growth Amid Economic Uncertainty

Vietnam dropped from 3rd to 5th in the Global Crypto Adoption Index between 2023 and 2024. This decline stems mainly from competitive pressure from neighboring countries like Indonesia, which have accelerated institutional adoption and established clearer regulatory frameworks. Although Vietnam improved slightly in centralized services, it stagnated in DeFi, indicating slower progress in Web3 development.

Key reasons for Vietnam’s drop include: 1) intense competition from nearby Southeast Asian nations, 2) lack of large-scale institutional involvement in the local market, and 3) slow regulatory progress supporting the crypto industry. Unlike Indonesia, which actively promotes blockchain innovation through supportive regulations, Vietnam has been hesitant to introduce new policies or relax strict rules to foster sectoral growth.

Vietnam’s restrictive policies include limitations on cryptocurrency advertising and the absence of a clear licensing framework for exchanges. Regulatory uncertainty has caused capital and talent to migrate to more crypto-friendly jurisdictions, negatively impacting Vietnam’s global ranking.

Despite these institutional and regulatory challenges, grassroots crypto adoption in Vietnam remains strong. This growth is primarily driven by active participation in peer-to-peer (P2P) exchanges and DeFi platforms. According to a Triple-A report, approximately 21.2% of Vietnamese own cryptocurrency, ranking second globally in ownership rate. Vietnam also exhibits high DeFi usage, accounting for 28.8% of transaction volume, highlighting reliance on decentralized platforms amid tight capital controls. This bottom-up engagement underscores crypto’s role in bridging financial service gaps for individuals and small businesses.

While robust retail adoption reflects a vibrant crypto community, the lack of supportive regulation remains a barrier to sustainable growth. Without clearer policies to attract institutional players and promote DeFi development, Vietnam risks falling further behind regionally. Nevertheless, given its large base of crypto holders and high DeFi engagement, Vietnam retains the potential to remain a key player in the ecosystem—if it accelerates regulatory reforms.

In response to this demand, Vietnam’s Ministry of Information and Communications and the National e-Government Steering Committee (NEAC) recently launched a national blockchain strategy to accelerate digital transformation across industries. This move positions Vietnam to become a regional leader in blockchain innovation by 2030, signaling a strategic commitment to long-term growth.

2.4 Philippines: Play-to-Earn and Remittances Drive Adoption

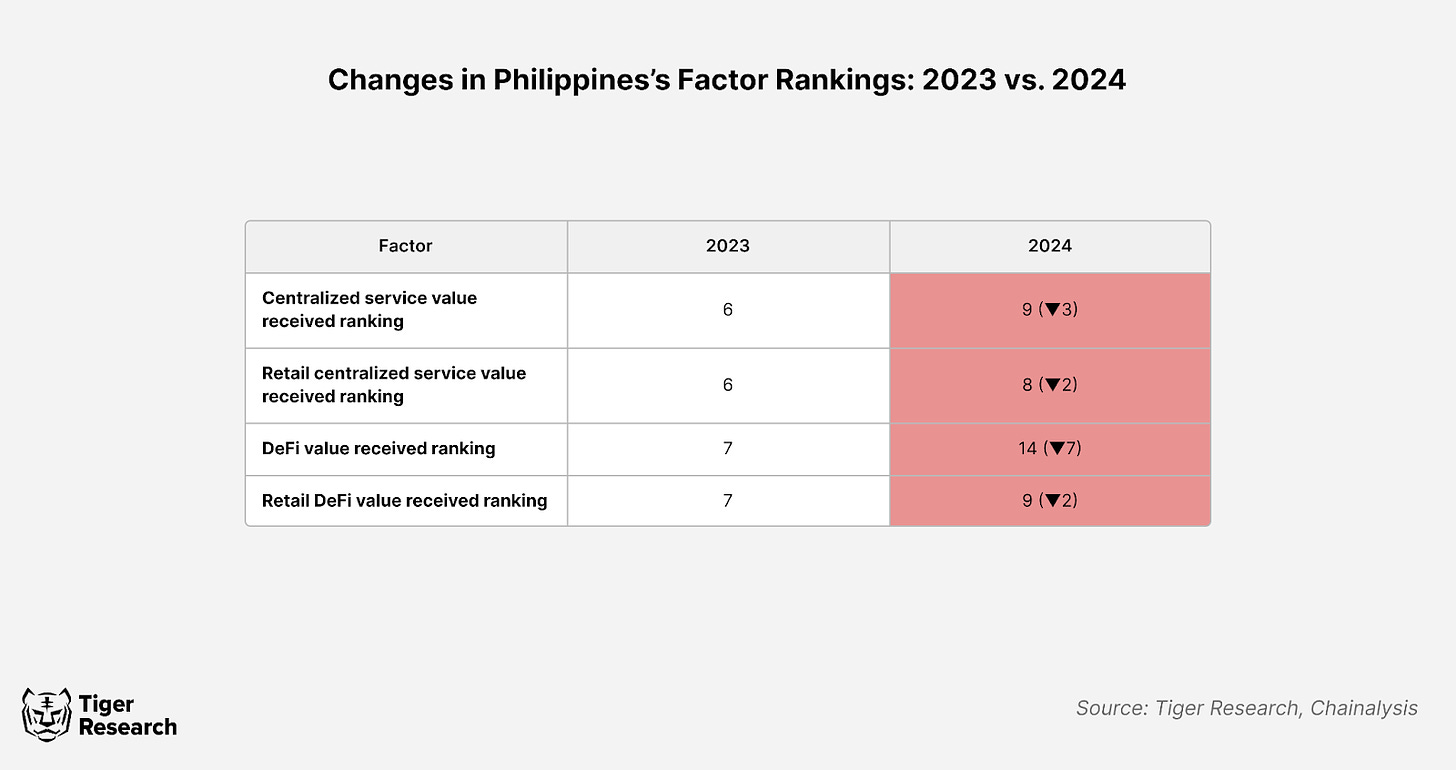

Despite active participation in cryptocurrency, the Philippines slipped from 6th to 8th in the Global Crypto Adoption Index between 2023 and 2024. This decline is primarily due to increasing reliance on centralized exchanges (CEX), whose share of transaction value rose slightly to 55.2% in 2024. While the Philippines excels in CEX activity, progress in DeFi and institutional trading has been relatively slow. Compared to countries like Indonesia that have advanced in institutional adoption and regulatory clarity, the Philippines faces challenges in maintaining competitiveness.

The Philippines emphasizes P2E (play-to-earn) gaming and remittances as primary crypto use cases. In 2023, P2E games and gambling accounted for 19.9% of total network traffic, reflecting the country’s focus on this niche market rather than broader DeFi adoption. This specialization gives the Philippines a leading edge in P2E and remittances, but limits its growth potential compared to nations diversifying their crypto ecosystems.

Moreover, the regulatory environment lacks comprehensive policies for DeFi and institutional crypto development. Nonetheless, the Philippines’ unique strengths in P2E gaming and remittances ensure it continues to play an important role in Southeast Asia’s crypto landscape, though there remains room for improvement in regulation and institutional advancement.

2.5 Thailand: Stable Regulation but Declining Adoption

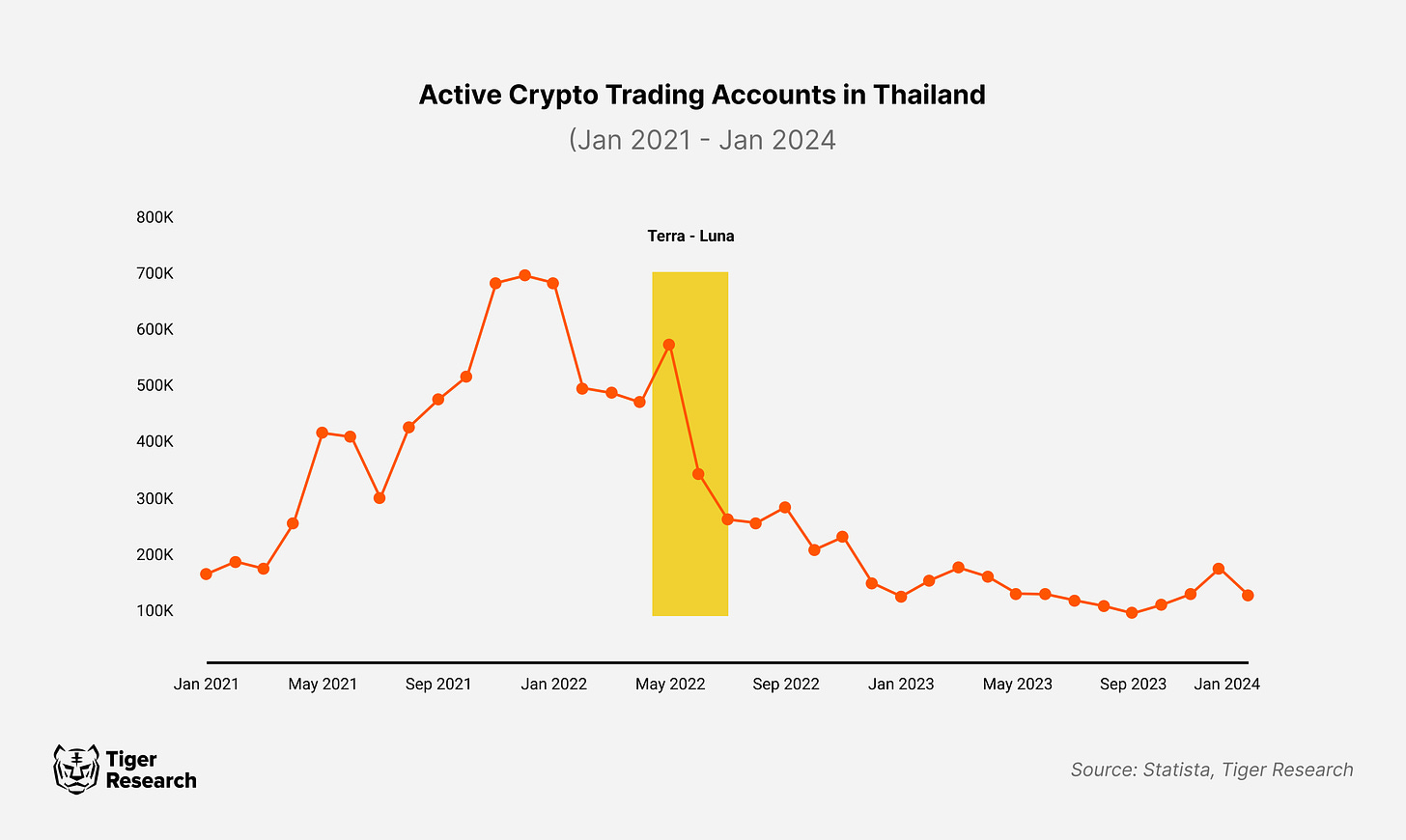

Thailand’s crypto market continues to evolve, despite dropping from 10th to 16th in the Global Crypto Adoption Index between 2023 and 2024. This decline is mainly due to reduced value in centralized services, although retail activity remains steady—indicating waning institutional participation. DeFi activity has also decreased significantly. Given Thailand’s per capita GDP PPP growth rate of just 1.4%, the lowest in the region except for Singapore, this drop is particularly concerning.

The main reason for the decline is the reduction in active crypto trading accounts following the Terra-Luna collapse, which also dampened DeFi participation. Additionally, the political ban on pro-crypto figure Pita Limjaroenrat raises questions about his future influence on Thailand’s crypto market, potentially affecting both regulatory direction and public sentiment toward cryptocurrencies.

It should be noted that Chainalysis adjusts rankings based on per capita GDP purchasing power parity (PPP). Without this adjustment, Thailand’s crypto market would appear larger than several other countries. Thailand maintains a solid regulatory foundation and has recently taken steps to encourage institutional involvement, signaling continued government support for the sector. Initiatives such as the digital asset sandbox represent important progress in integrating digital assets within a structured regulatory framework.

2.6 Cambodia, Singapore, and Malaysia

Cambodia, Singapore, and Malaysia—none ranked in the top 20—show divergent trends due to differing national approaches to the crypto industry.

Cambodia rose 13 places in the 2024 Global Crypto Adoption Index, reaching 17th place, primarily due to performance in centralized service usage. While the exact reasons are unclear, they may relate to growing local interest in crypto and potential illicit activities. At the end of August 2024, Chainalysis researchers noted that Hun To’s platform Huione was involved not only in crypto scams but also in over $49 billion worth of black-market crypto transactions since 2021. Ongoing involvement in crypto gray zones may have attracted substantial inflows into Cambodia.

Singapore moved up from 77th to 75th in 2024, reflecting efforts to improve regulatory transparency, institutional adoption, and crypto-friendly merchant services. Stablecoin XSGD exceeded $1 billion in transaction volume in Q2 2024, driven by platforms like dtcpay and Grab. Regulatory advancements by the Monetary Authority of Singapore (MAS), including the rollout of a stablecoin framework and strengthened crypto custody rules, have enhanced Singapore’s appeal as a secure, regulated crypto environment.

Malaysia fell from 38th to 47th, mainly due to intensified regional competition. However, Malaysia remains committed to advancing Web3 and blockchain technologies. Despite slower progress in institutional adoption and DeFi expansion, Malaysia is positioning itself as a Web3 gaming hub through various initiatives. Notably, the collaboration announced by MDEC, EMERGE Group, and CARV at the IOV2055 seminar aligns with the country’s digital transformation goals.

3. Conclusion: Shifting Crypto Landscapes in Southeast Asia and India

Southeast Asia and India continue to lead global grassroots cryptocurrency adoption. Despite regulatory hurdles, India maintains its lead in innovation and institutional engagement, while countries like Indonesia are rapidly catching up. Indonesia’s surge in DeFi activity and favorable regulatory climate signal a shift in the regional balance of crypto power.

The Philippines and Vietnam remain key crypto markets, each with distinct strengths. The Philippines relies heavily on gaming and remittance applications, while Vietnam depends on P2P exchanges and decentralized trading. Singapore’s shift toward retail and merchant crypto applications further illustrates the diversity of use cases across the region. In contrast, the declining rankings of Thailand and Malaysia reflect intensifying regional competition.

Looking ahead, regulatory dynamics in these countries will profoundly shape crypto adoption across Southeast Asia and India. Rising institutional adoption and strong grassroots participation underscore the region’s status as a vital global hub for digital assets.

Disclaimer

This report is prepared based on information believed to be reliable. However, we do not provide any express or implied warranty regarding the accuracy, completeness, or suitability of the information. We assume no responsibility for any losses arising from the use of this report or its contents. Conclusions and recommendations are based on information available at the time of preparation and may change at any time without notice. All projects, estimates, forecasts, targets, opinions, and views mentioned in this report are subject to change and may differ from those of other individuals or organizations.

This document is for informational purposes only and should not be construed as legal, business, investment, or tax advice. Any reference to securities or digital assets is for illustrative purposes only and does not constitute investment advice or an offer to provide investment advisory services. This material is not intended for investors or potential investors.

Terms of Use

Tiger Research permits fair use of its reports. The principle of “fair use” generally allows specific content to be used for public interest purposes, provided the commercial value of the material is not impaired. If usage falls under fair use, prior permission is not required. However, when citing Tiger Research reports, users must 1) clearly credit “Tiger Research” as the source, and 2) include the Tiger Research logo (black/white). Reformatting and republication require separate negotiation. Unauthorized use may result in legal action.