BitgetPoolX: Passive income with no downtime all year round

TechFlow Selected TechFlow Selected

BitgetPoolX: Passive income with no downtime all year round

The more you pledge, the richer you become.

PoolX is Bitget's latest staking mining platform, where users can stake designated cryptocurrencies to earn popular tokens distributed hourly based on each user’s proportional stake. Since the launch of its first project, CHATAI, on April 8, Bitget PoolX has rolled out a total of 10 projects—nearly one per day—with average annualized returns ranging from 10% to 45%, averaging around 35%. Considering that each staking cap is limited to either 10,000 BGB or 10,000 USDT, this means users who participate in PoolX staking every day could accumulate substantial overall returns.

What is PoolX’s biggest advantage?

Many wonder why Bitget would launch another product similar to Launchpad and Launchpool. The answer lies in user demand.

It should be noted that over the past period, Bitget Launchpool has generated significant wealth effects. Typically, participating in a Launchpool yields two types of returns: first, token-based gains derived from both the number of project tokens earned through staking and their potential price appreciation; second, rewards from staking tokens (primarily BGB, as staking stablecoins like USDT generates little to no additional yield).

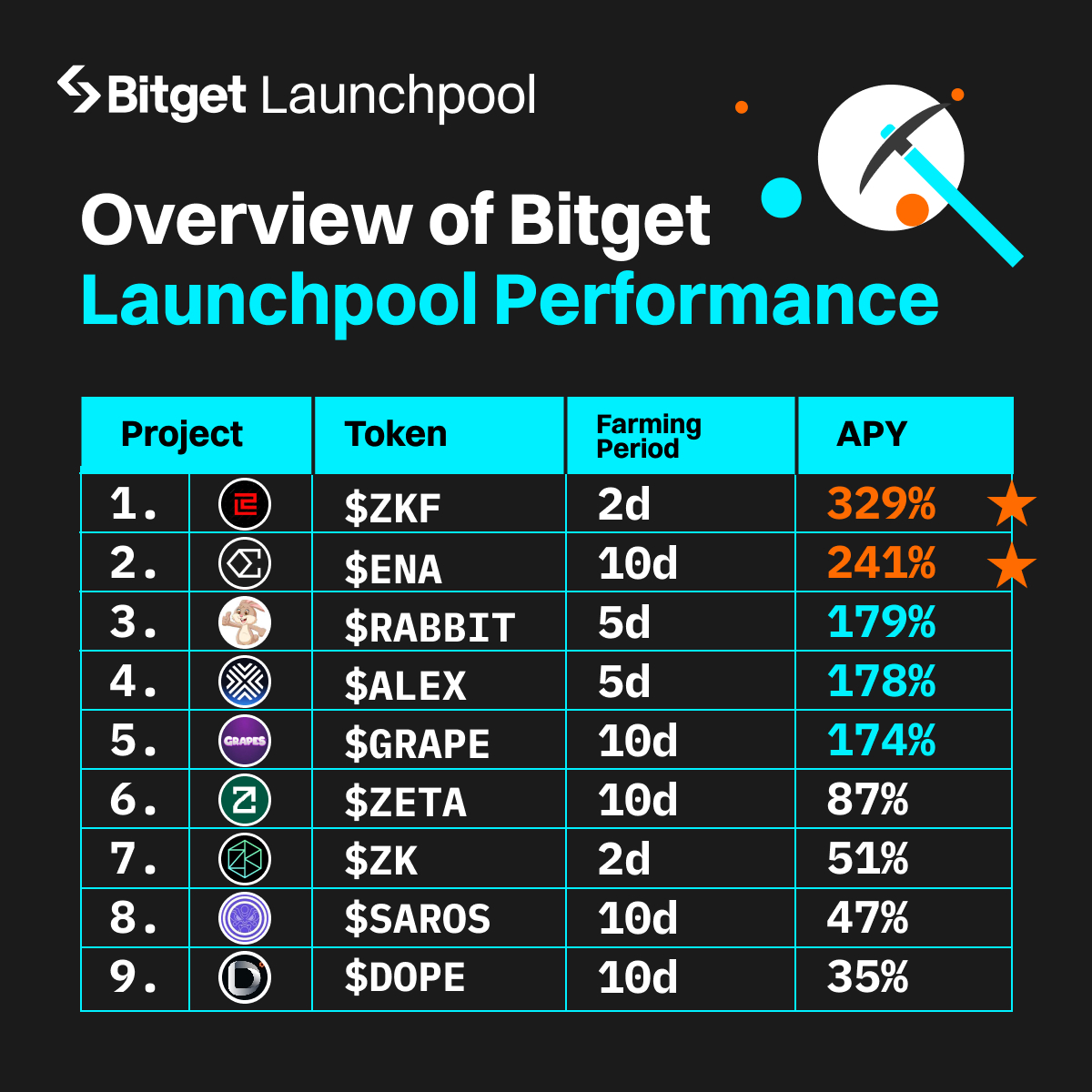

Taking recent Launchpool campaigns as examples, over half of the projects achieved APYs in triple digits, with an average annualized return reaching 146%. Due to massive participation, the BGB price has also risen sharply—setting seven all-time highs last year. Priced at just $0.18 on January 1, 2023, BGB surged by 282.8% within less than a year. So far this year, BGB has repeatedly hit new ATHs, reaching $1.38.

Against the backdrop of high token yields and a continuously rising BGB price, user demand for Bitget to launch more Launchpool events has grown increasingly strong. Therefore, the introduction of PoolX effectively meets user demand for staking-based financial products. Moreover, PoolX launches far more frequently than Launchpad or Launchpool, allowing users to “farm” rewards almost daily.

In fact, this is PoolX’s greatest strength. While Launchpool may occur biweekly and Launchpad perhaps once every two months, PoolX happens EVERY DAY! Based on the average APY of PoolX projects, if a user maximizes their participation with 10,000 BGB per project, they can expect to earn approximately $60–$70 per project. Clearly, these are not eye-catching sums individually, but the key is that it happens EVERY DAY.

How to make the most of these staking financial products?

For users, staking-based financial products generally fall into the category of risk-free arbitrage investments. When choosing which to participate in, users can follow a priority order: prioritize Launchpad and Launchpool due to their higher returns—the staked tokens can either be sold or used in various savings services such as Bitget Wealth Management. After Launchpad and Launchpool conclude, users can move on to PoolX. Although its returns are lower than the former two, the abundance of projects makes it a solid option for accumulating incremental gains over time.

Additionally, if users prefer not to sell their staking-earned tokens, they can deposit them—including USDT and over 200 other cryptocurrencies—into Bitget Wealth Management, choosing between flexible or fixed-term deposits, all offering yields significantly higher than those of other exchanges.

Let’s assume a principal of $100,000 and estimate the approximate returns after participating in Launchpool, PoolX, and Wealth Management:

• After 10 days in Launchpool, with an annualized yield of 146%, assets grow to: 104,000 USDT;

• Followed by 10 days in PoolX, with an annualized yield of 35%, assets increase to: 104,997 USDT;

• Then deposited into Wealth Management for 10 days at a 4% annualized yield, assets rise to: 105,112 USDT.

With this combination strategy, you could earn at least $5,000 per month on Bitget (based on a $100,000 principal).

In Conclusion

Overall, staking financial products are largely similar in nature. Launchpad offers the highest individual project returns, PoolX excels in frequency and quantity of opportunities, while Launchpool strikes a balance between the two—offering decent volume and attractive yields. Users can decide which product to join based on their respective launch cycles. Ultimately, the choice among them boils down to earning more versus slightly less—but as quintessential examples of risk-free arbitrage, they all represent optimal options for users to maximize their "free yield."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News