The Evolution of On-Chain Data and Signal Trading Tools Amid the MEME Craze

TechFlow Selected TechFlow Selected

The Evolution of On-Chain Data and Signal Trading Tools Amid the MEME Craze

Including information platforms for primary markets, sentiment analysis, and trading opportunity tools for secondary markets.

Written by: Bing Ventures

Meme coins did not fully dominate the bull market in 2021, but they are now taking center stage. This reflects how increasingly competitive the crypto market has become in attracting and retaining user interest. For example, concepts like NFTs and GameFi/SocialFi were initially more appealing than meme coins, yet ultimately gained traction primarily due to projects' ability to address specific market demands and drive off-platform user acquisition. Projects such as Axie Infinity and StepN successfully attracted large numbers of non-traditional crypto users through unique earning mechanisms and novel user interactions. However, the surge of meme coins in this current bull cycle is far more "direct."

This shift in market dynamics is also influencing the fields of signal trading and on-chain data analytics. Signal trading and on-chain data analysis are crucial tools for cryptocurrency investors, offering early insights into market movements and investor behavior. By leveraging these technologies, investors can gain a competitive edge and make smarter decisions based on real-time data and actionable signals. These tools not only enhance investors’ abilities to identify trends and manage risks but also promote the discovery of hidden opportunities within the fast-paced crypto market.

This article from Bing Ventures will introduce various analytical tools—covering primary-market information platforms, secondary-market sentiment analysis, and trading opportunity tools—and summarize the development trends they reflect. Overall, we believe innovation at the tool level must be closely integrated with user interface design and market access strategies. In the long run, new protocols that create genuine user value and drive broad adoption through unique social dynamics and financial incentives are likely to dominate the market. For instance, integrating artificial intelligence elements and novel user interaction models could be key directions for future innovation, enhancing user experience while attracting new market participants by creating unprecedented value.

Primary Market Tools

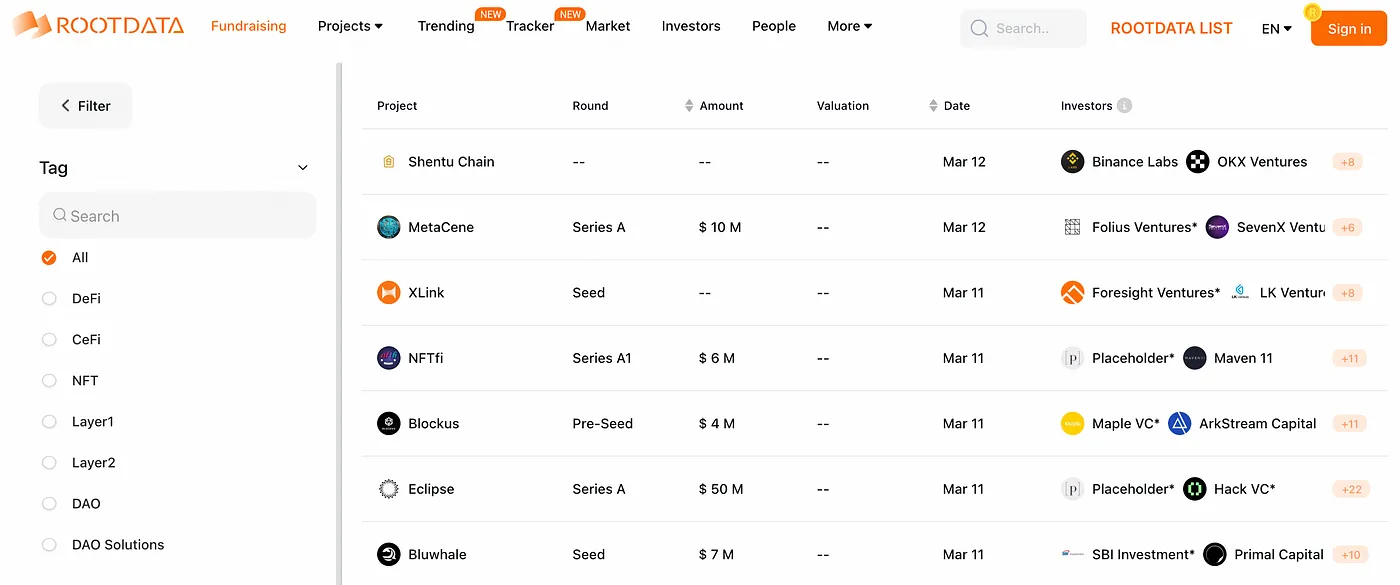

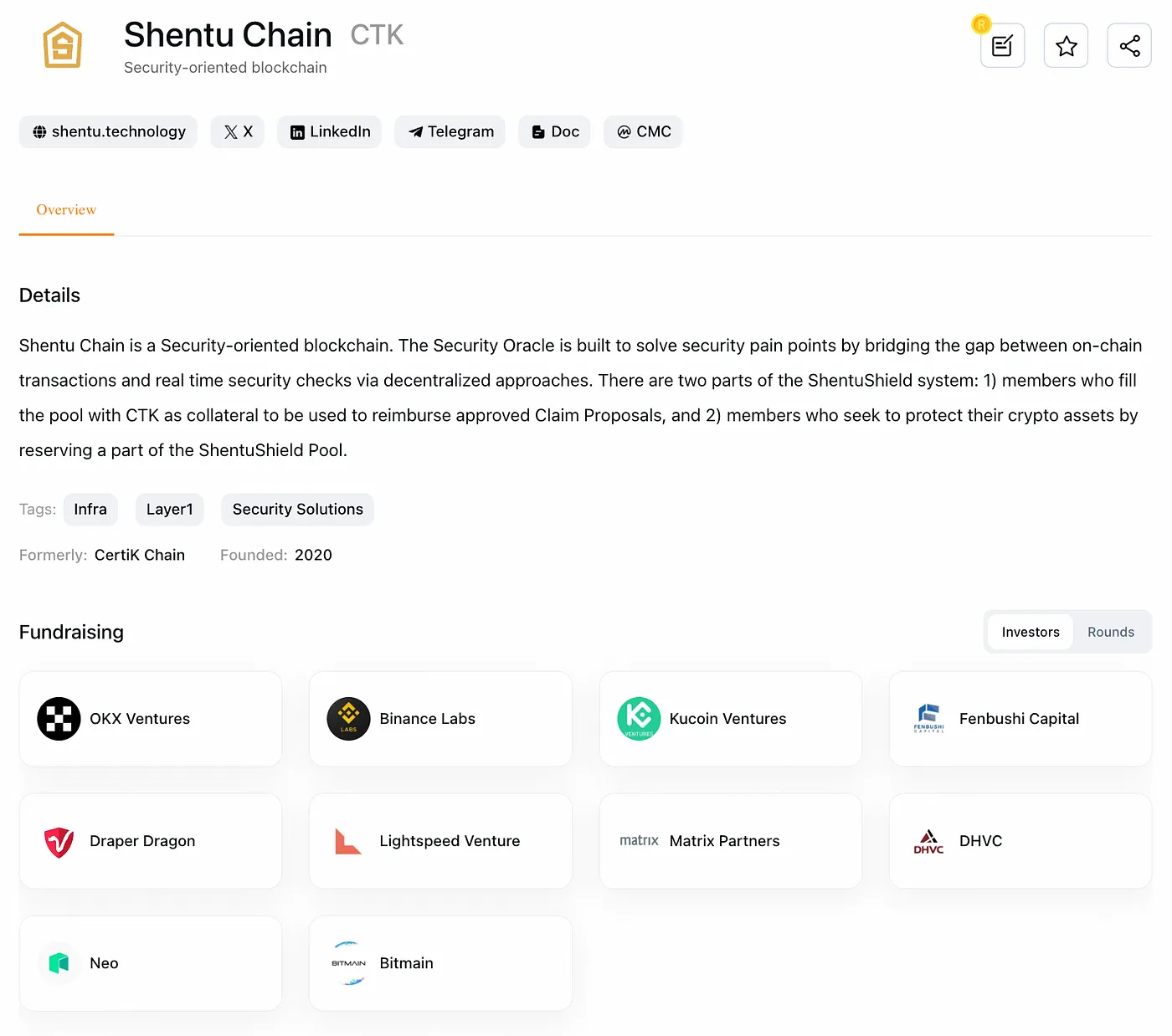

RootData

Fundraising Overview

RootData collects information on all market fundraising activities and ensures immediate updates. Users can also observe fundraising performance across different sectors by filtering accordingly.

After entering a project’s page, users can view detailed funding information, including which venture capital firms have invested.

The interface offers various filters, allowing users to select projects based on criteria such as funding progress, amount raised, region, and more.

Signal Trading

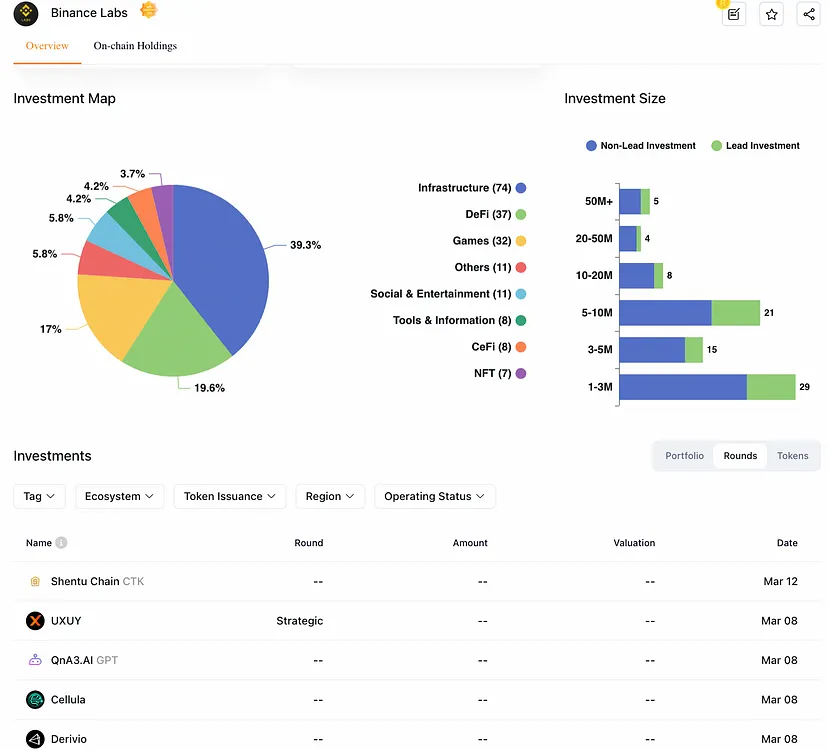

Users can analyze current investment intentions and trends among venture capital firms to judge or predict where the market focus may shift in the future.

Users can also dive deeper into individual VCs’ investment records, including their portfolio distribution and past investments.

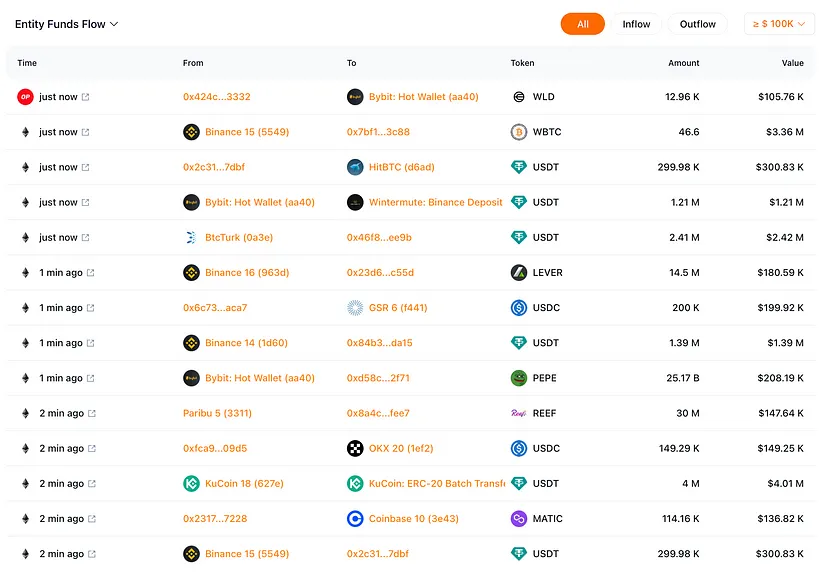

Institutional Wallet Transfer Tracking

RootData also tracks wallet transaction records of institutions—including VCs, exchanges, and market makers—enabling users to monitor institutional fund flows.

Signal Trading

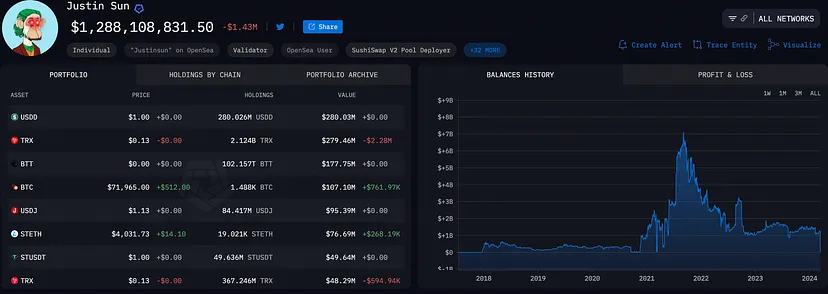

Institutional fund inflows and outflows often carry significant meaning. Take DWF Lab, for example—a hybrid VC and market maker whose partnered projects frequently experience aggressive price pumps. Observing deposits from a project to DWF Lab’s address may indicate a strategic investment; conversely, DWF Lab transferring funds to an exchange could signal profit-taking after a pump. Analyzing these fund flows can reveal underlying market strategies and intentions.

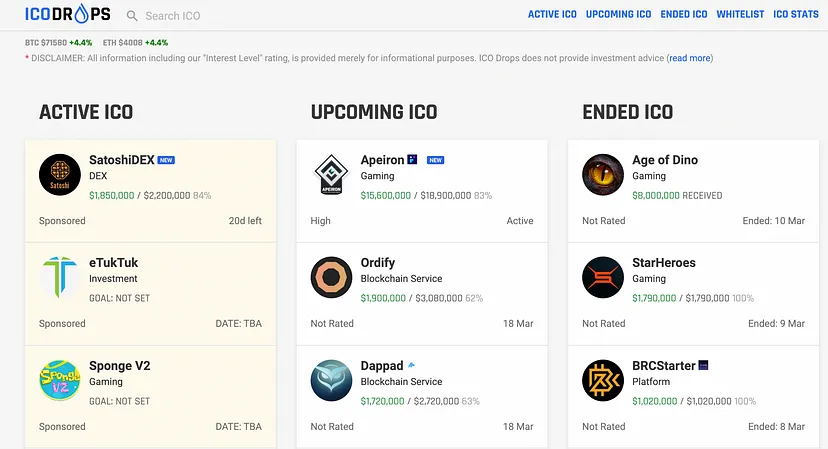

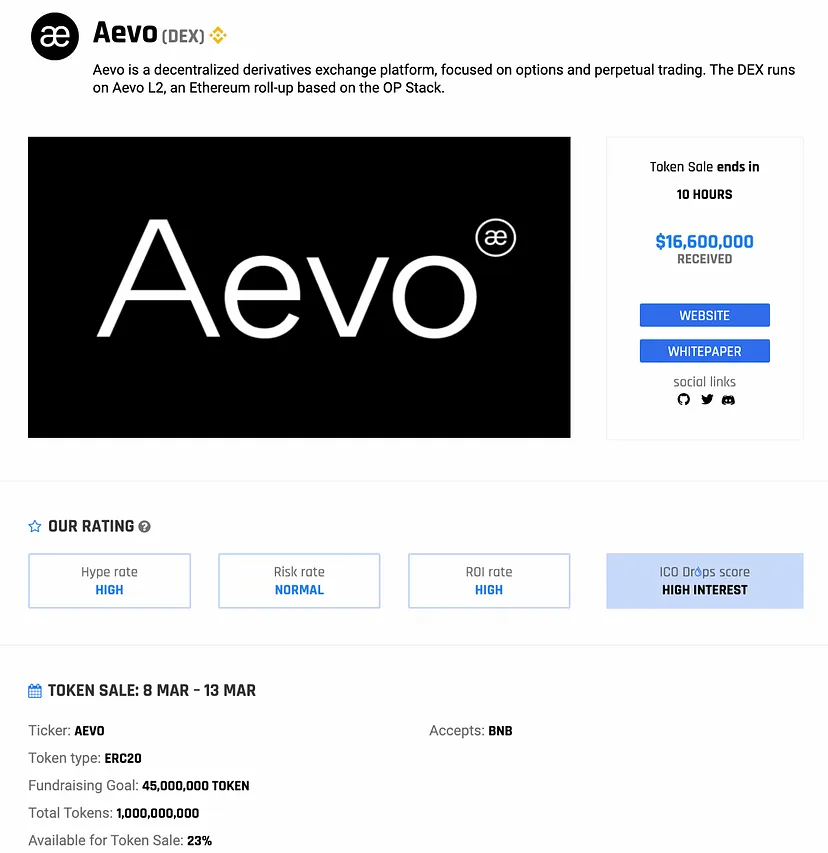

ICODrops

ICO Information

ICODrops covers upcoming, ongoing, and recently completed ICOs.

Clicking into a project page allows users to review token sale details, including timing, basic tokenomics, and allocation breakdowns for presales.

Signal Trading

Essentially, ICODrops enables users to browse various primary-market projects and participate in whitelist lotteries, giving them access to first-tier market opportunities comparable to those of venture capitalists.

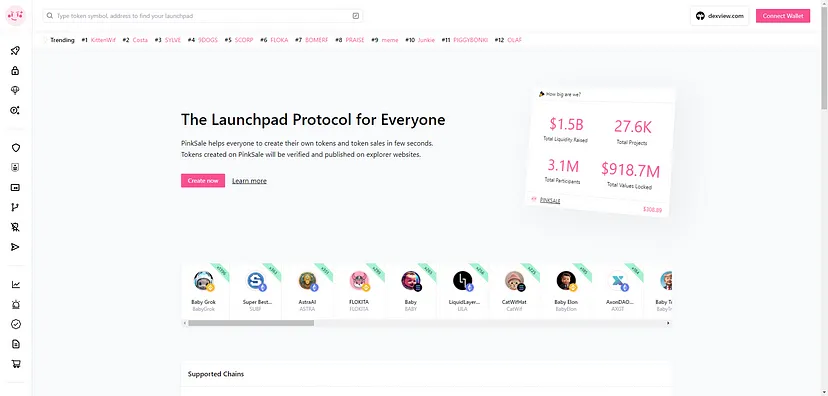

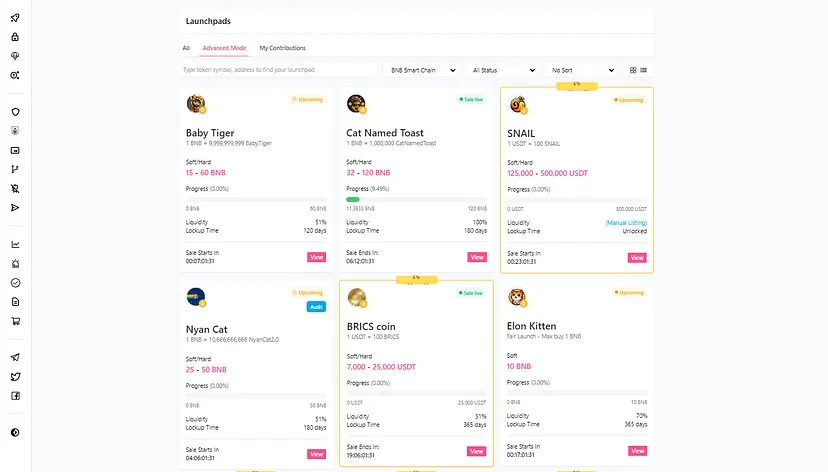

PinkSale

PinkSale is a protocol connecting projects and users, enabling users to launch their own tokens and conduct initial token presales (IDOs) without needing any coding knowledge. Project teams simply navigate the PinkSale interface and click through to design and deploy their token and launch process.

PinkSale includes additional features to support full token launches, such as listing tokens on PinkSwap and PancakeSwap, locking liquidity pools (LP), and adding vesting periods to increase investor trust.

Secondary Market Tools

Santiment

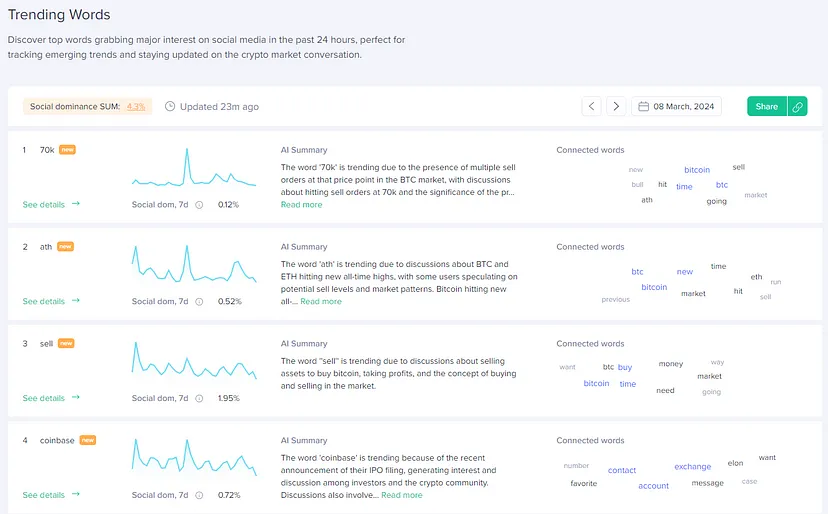

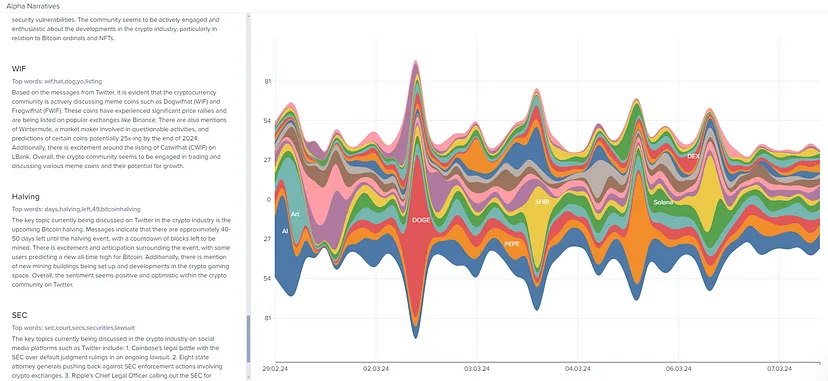

Santiment focuses on identifying trending topics around cryptocurrencies across the web, aiming to eliminate information inequality within the Web3 space.

Web3 Keyword Trends

Santiment uses AI technology to aggregate the most searched keywords online, accurately reflecting public interest and hotspots.

Presented via heatmaps to illustrate current market alpha narratives.

Signal Trading

The platform provides a macro-level overview, helping users understand current market trends and investment narratives.

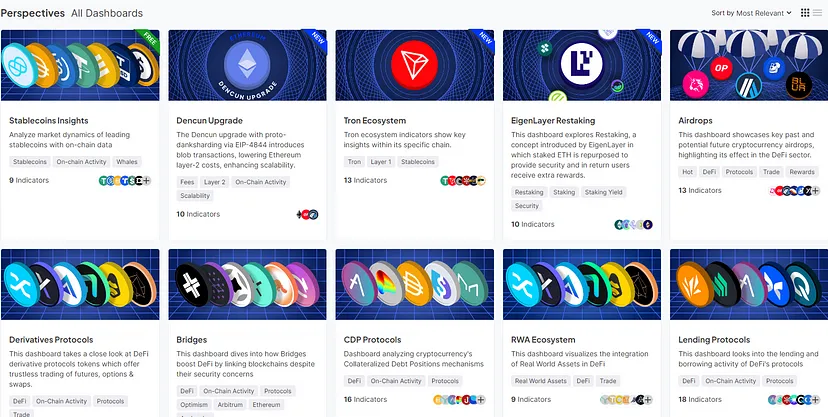

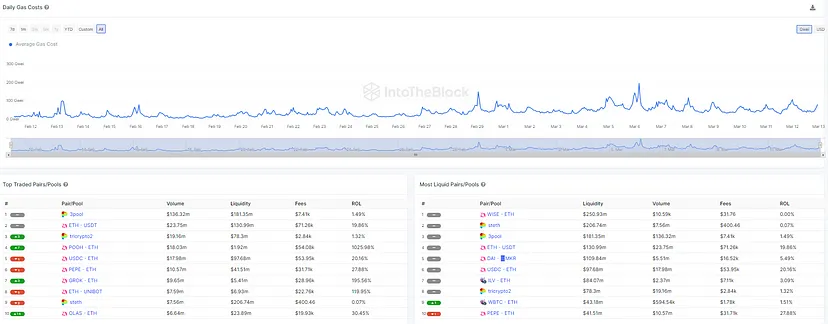

IntoTheBlock

IntoTheBlock aggregates various DeFi-related information, including project metrics and token trading activity.

Project Data

The platform consolidates performance data for currently trending market sectors, keeping users updated with the latest project insights.

Information also includes current network gas fees and trading pair performance across various DeFi protocols.

Signal Trading

The strength of IntoTheBlock lies in its comprehensive data coverage, presenting all sector metrics in one place so users can devise strategies based on up-to-date project information.

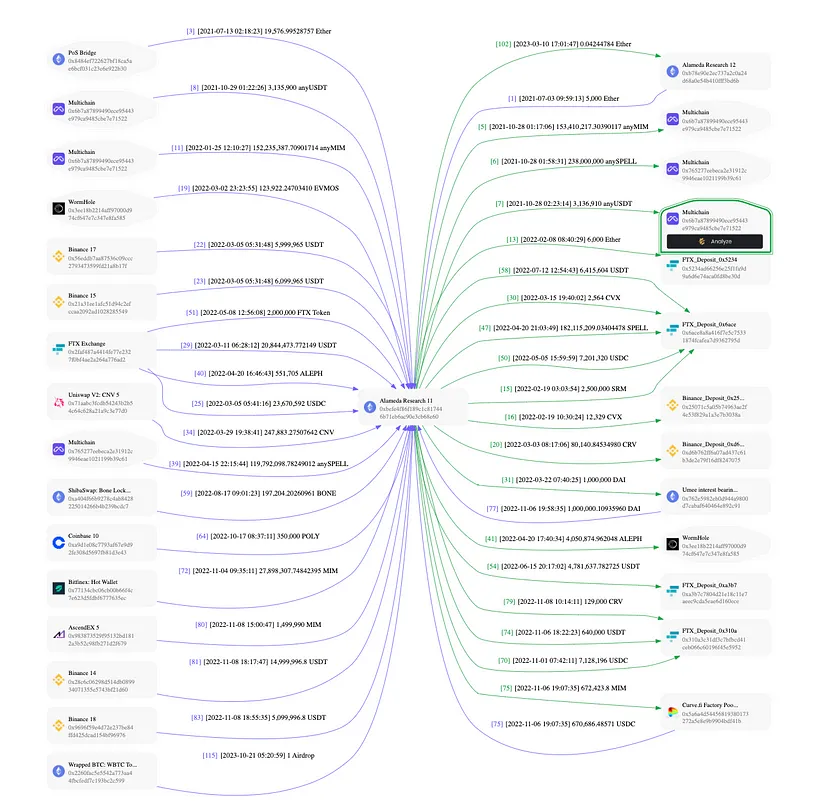

Arkham

Arkham is an on-chain data tracking platform focused on visualizing blockchain transactions and systematically de-anonymizing them.

Visualizer

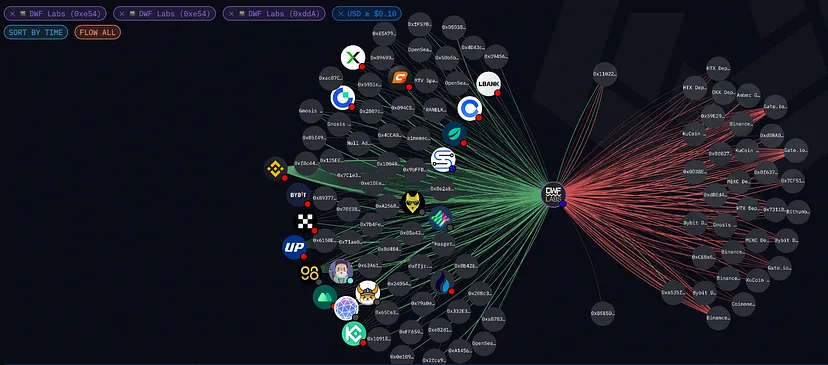

The Arkham Visualizer enables users to track cross-chain fund flows visually. Using filtering options based on blockchain, time, asset type, and transaction size, users can clearly identify inflows and outflows.

The above shows DWF Lab’s wallet fund flows, clearly displaying its interactions with other addresses and revealing institutional capital usage patterns.

Signal Trading

Similar to RootData, Arkham enhances usability through advanced visualization of wallet interactions, enabling users to formulate trading strategies based on Smart Money wallet inflow/outflow records.

Dashboard

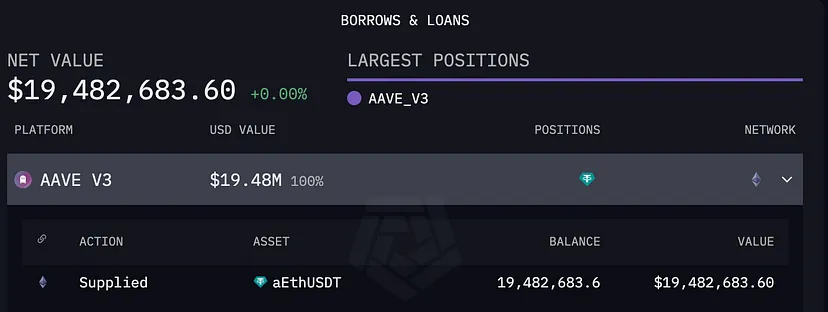

Arkham also offers a Dashboard feature, allowing users to monitor all on-chain transaction records of specific addresses, including holdings, recent trades, and DeFi usage history.

Signal Trading

Similarly, users can observe large transfer records from Smart Money wallets to inform their trading strategies.

Eigenphi

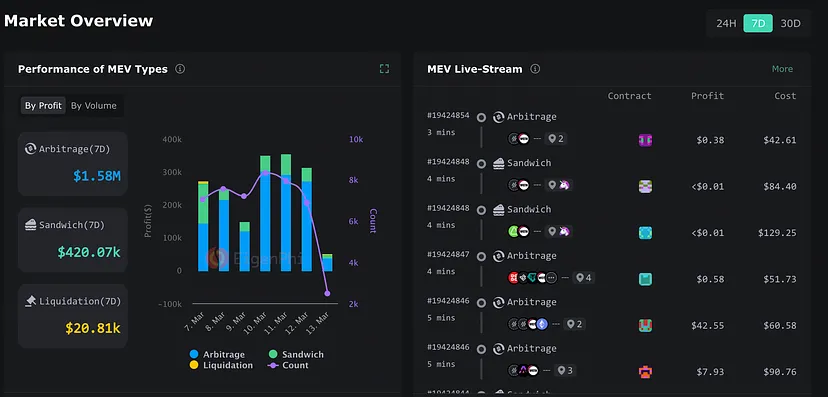

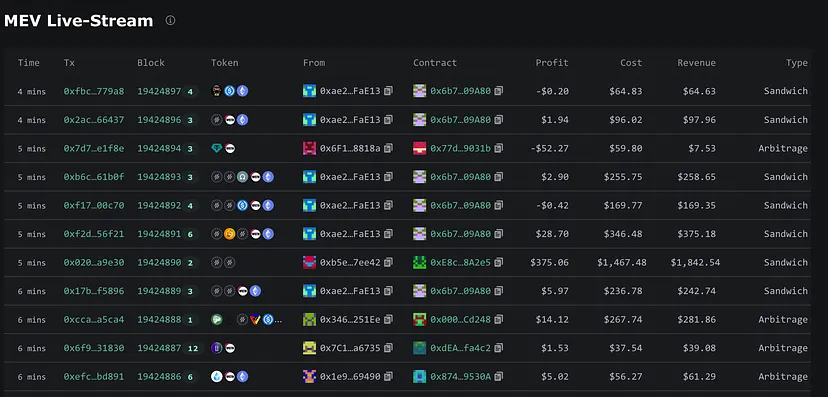

EigenPhi is a research platform dedicated to MEV (Miner Extractable Value) data in DeFi. It specializes in identifying and tracking on-chain MEV capture behaviors such as arbitrage, sandwich attacks, and liquidations. While showcasing the MEV market, EigenPhi also provides detailed information on each MEV transaction.

MEV Performance

The platform provides actual trading volume and gross profit (after miner fees) for various MEV activities, along with their share and growth trends. This gives users a clear and comprehensive real-time overview of the MEV market, showing MEV types involved, initiating contract addresses, revenue, and costs.

Signal Trading

The platform provides researchers with MEV data and offers MEV traders strategic references, indicating which projects or blockchains offer the highest returns.

MetaDock

MetaDock aggregates EVM-compatible blockchain explorers, eliminating the need to search for individual explorers—users can query directly within the plugin.

By opening the “Fund Flow” tab, users can visualize associated accounts and fund flow diagrams. Filters in the top-right corner allow selection of specific transfer addresses/entities or assets.

Signal Trading

This tool simplifies fund flow tracking and serves as a primary source of trading intelligence.

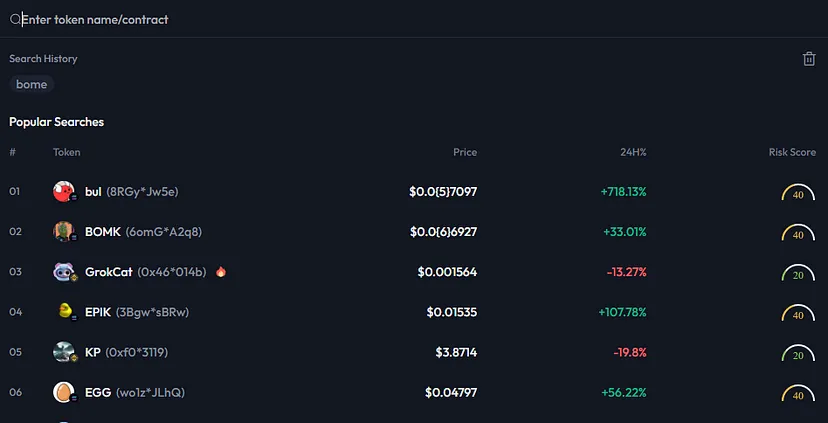

Ave.ai

Ave.ai is an all-in-one Web3 interaction terminal aggregating protocols across Dexes, DeFi, Tokens, and NFTs, committed to delivering a safer, more professional, and seamless Web3 experience.

Search Projects: After logging in, use the search bar at the top to find any crypto project you wish to analyze.

View Project Overview: The project overview page displays key metrics such as market cap, trading volume, and price performance, along with charts showing price trends.

The interface also shows smart contract audit status for security assurance, alongside top holder ratios and addresses, enabling easier tracking of smart money flows and assessing token concentration or dispersion.

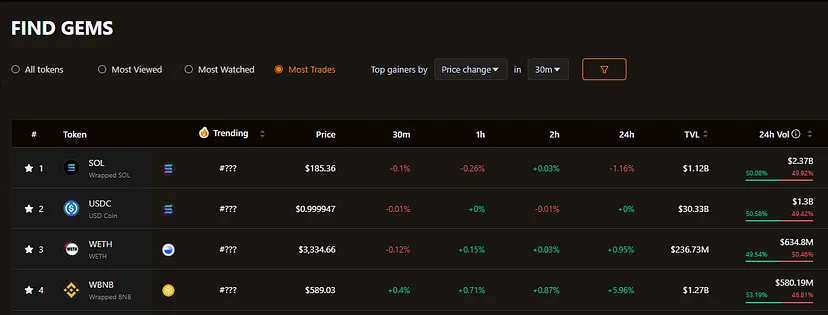

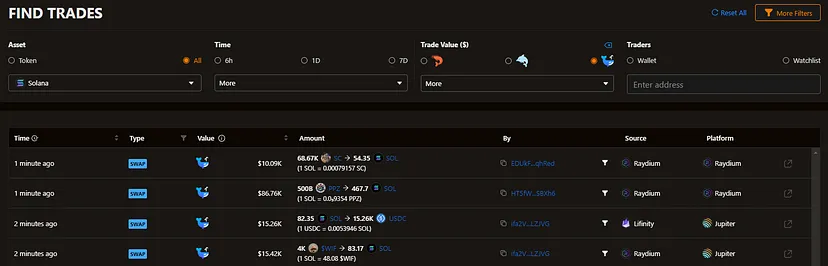

Birdeye

Birdeye is essentially an extended version of CoinMarketCap, covering extensive meme coin data. Users can check prices, volumes, candlestick charts, and more.

Find Gems: This function helps traders discover and filter promising tokens. The UI offers various filters like “Most Traded” and “Most Viewed.” Users can also select “Most Profitable” to find suitable trading pairs.

Find Trades: This interface logs all on-chain trades. A particularly useful feature is the ability to filter trades by size represented as “shrimp,” “dolphin,” or “whale.” Tracking whale wallet flows is a common method for gauging market intelligence.

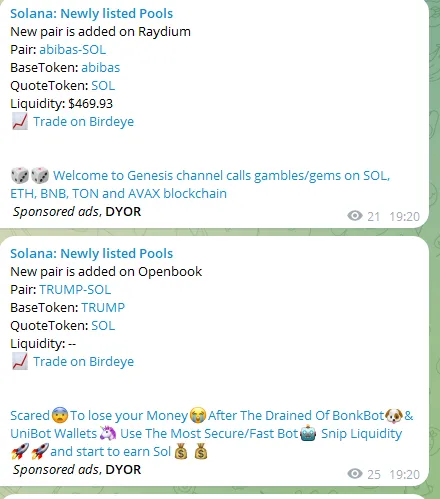

Birdeye Bot: Provides instant access to price, volume, liquidity, and holder count data, meeting traders’ demand for real-time information. The new Pair Bot notifies users of newly listed trading pairs on Birdeye-supported exchanges, giving early access to potential investment opportunities.

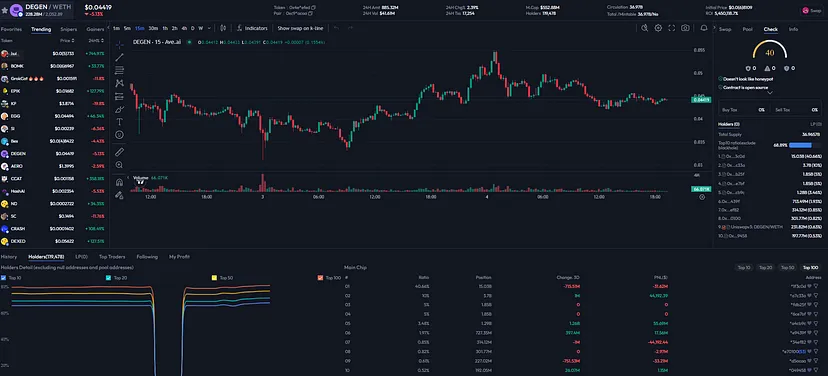

Dextool

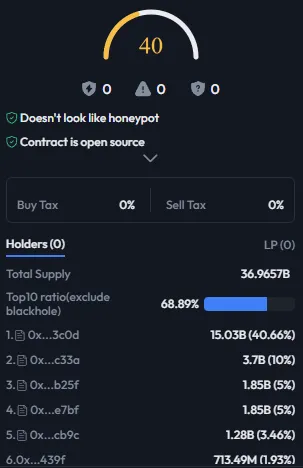

Dextool is essentially a decentralized exchange (DEX) aggregator and a leading information platform for meme coin trading.

Pair Browser

Users can search for any token and its available trading pairs across supported DEXs. For example, searching for a Solana-based token will show a list of Solana liquidity pools. Clicking any pool reveals detailed charts and analytics, including transaction history, reliability ratings from other Dextools users, and personal position tracking.

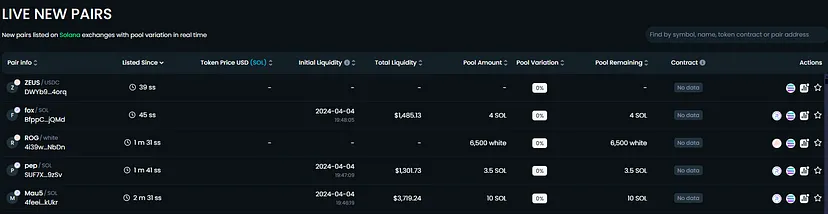

Newly Listed Tokens

The interface displays newly created tokens from social media, giving traders immediate access to fresh trading information.

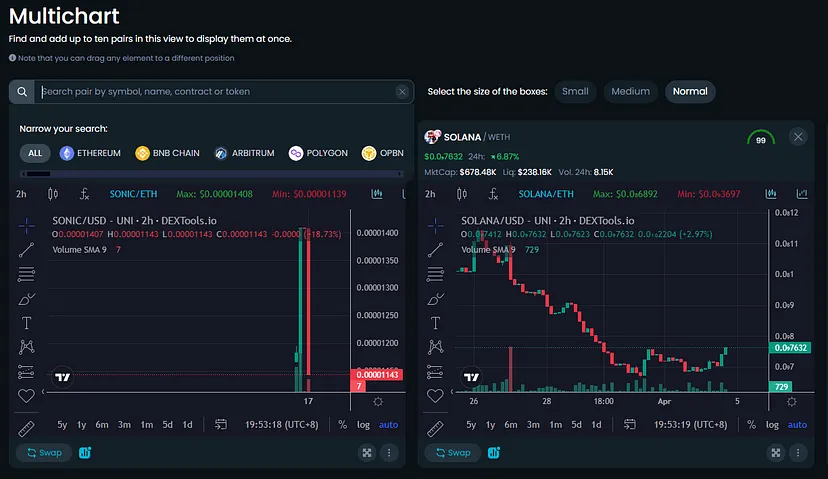

Multichart

Multichart allows users to set up to ten charts for any token pair across specified blockchains and trading venues. Use filters to narrow down assets by blockchain and venue. DEXTools charts support adjustable timeframes and chart types, along with technical analysis tools and indicators.

Leaderboard

The interface highlights the most profitable or popular token pairs for trader reference.

GeckoTerminal

GeckoTerminal is a DeFi and DEX aggregator providing market data and pricing for any token traded across over 900 DEXs and 110+ blockchains. It is developed by the same team behind CoinGecko.

Broad Coverage

A key advantage of GeckoTerminal is its extensive support for blockchains and DEXs, offering more comprehensive and in-depth data for niche projects compared to other platforms. Other functionalities are largely similar to Birdeye and Dextool.

Ave.ai, Birdeye, Dextool, and GeckoTerminal Signal Trading

These three tools are highly similar in nature and have been instrumental in the recent meme coin boom, offering the fastest solutions for trading speed-sensitive meme coins.

GMGN.ai

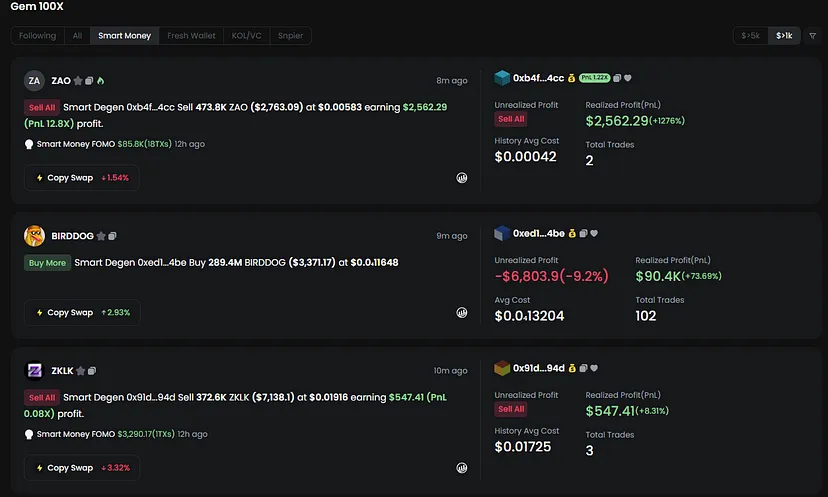

Gmgn.ai is a platform specializing in tracking smart money and degen KOL transaction histories, clearly displaying profitable smart money trades.

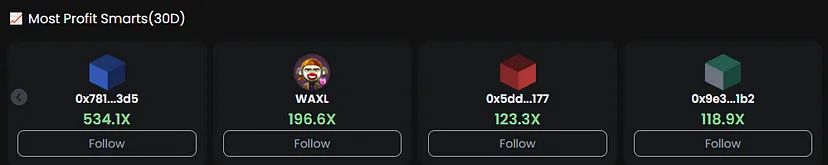

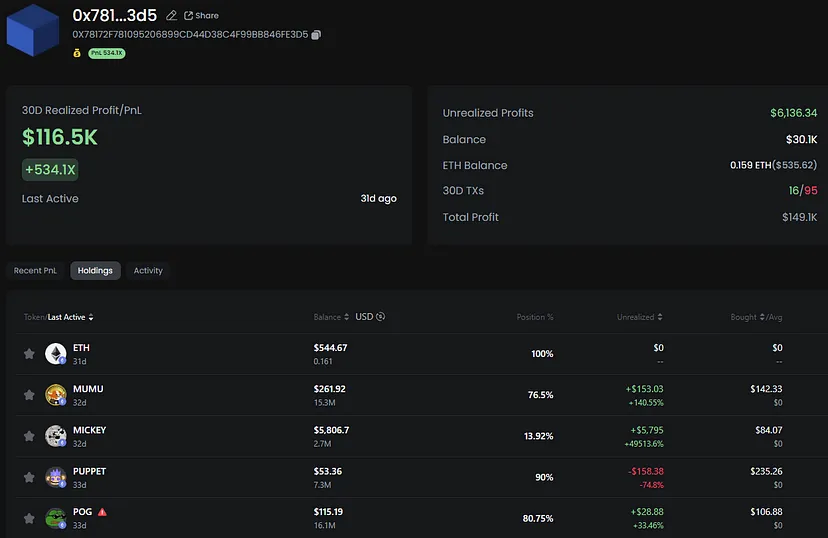

Profitable Smart Money Wallets

The platform automatically tracks the most profitable smart money wallets, displaying their holdings and token trade history, enabling other traders to mimic successful trades.

Real-Time Trade Logs

Real-time logging of smart wallet trades ensures other traders receive timely intelligence.

Degen Bot

Connects via Telegram Bot with notification functionality to stay updated on the latest token trading conditions.

Sniper Bot Products

Sniper Bots are automated programs configured to execute specific tasks at predetermined times. These products are commonly used for participating in online buying/selling, crypto launches, and trading, aiming to precisely capture market opportunities. Key products and performance metrics in this segment can be referenced on this Dune Analytics dashboard.

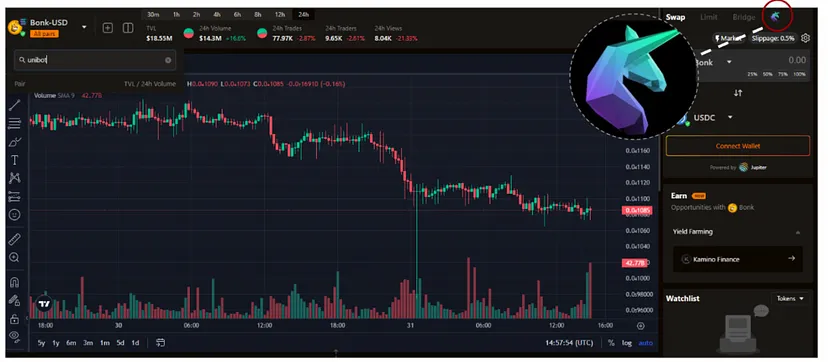

Unibot

Users can interact with Unibot through chat-style interfaces to easily issue on-chain token trading commands, enabling various Uniswap trading activities such as token swaps, copy trading, limit orders, and private transactions. Additionally, Unibot offers real-time alerts for new Ethereum tokens, allowing users to quickly add and sniper new tokens.

Currently, Unibot generates revenue through two main channels: bot transaction fees and taxes on its native token UNIBOT.

First, Unibot charges a 1% fee per transaction, with 40% distributed to token holders. Second, all UNIBOT token trades incur a 5% tax, of which 1% of trading volume is allocated to token holders, provided their balance exceeds 50 UNIBOT to qualify for rewards.

Unibot on Solana

Recently, Unibot launched a similar Telegram Bot on the Solana network. Leveraging its established brand advantage, the project offers several standout features:

Built-in ETH-SOL Cross-Chain Bridge: Effectively merges the original Ethereum-based Unibot with its Solana counterpart, becoming the first dual-chain supported bot project.

Partnership with Birdeye: Seamlessly supports trading for all projects listed on Birdeye. This integration is arguably a game-changer for user experience and a pivotal factor for Unibot’s success in the Solana ecosystem.

Unibot on Base

Following the significant reduction in transaction fees on the Base chain after the Cancun upgrade, it has emerged as another hotspot for meme coin activity after Solana. As an experienced Sniper Bot, Unibot has seen increased trading volume on Base.

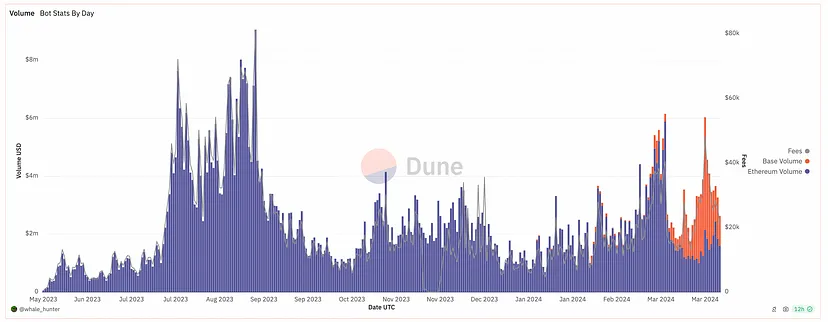

Protocol Performance

It is evident that Base has replaced Ethereum as the preferred public chain for meme coin trading. Its peak trading volume reached $3.88 million on March 30, accounting for over 60% of the project’s total revenue.

Banana Gun

Banana Gun offers two core services: trading and sniping. The trading feature allows users to securely purchase tokens already listed on-chain, while the sniping function enables early purchases during new token launches. Banana Gun supports Ethereum, Solana, Blast, and Base. Below are detailed explanations of its key features:

First Bundle or Fail (FoF): Targets the first purchase (block 0) at the start of trading, requiring at least 10 wallets to activate. Not applicable for MEV or Deadblock launches.

FoF Backup: If FoF fails during MEV or Deadblock launches, the backup function executes a purchase in the next available block using backup miner tips.

Slippage: Allows price fluctuations between 0–99% in uncapped launches. Setting it to 100 equates to “infinite” slippage.

Degen Mode: When enabled, allows purchasing “honeypot” tokens to deter zombie users. If activated, the bot ignores safety tax settings and proceeds even if the token cannot be sold afterward.

MaxTx or Revert: Limits purchases to a maximum spending cap. If a token’s max transaction exceeds this amount, the trade reverts.

Minimum (MinToken): Sets a minimum token quantity or percentage for purchase. If the max spend doesn’t meet this threshold, the transaction fails.

Anti-Rug Mechanism: Attempts to sell tokens before potential scams if taxes exceed safe thresholds or fraudulent signs appear.

Transfer on Blacklist: If a user’s wallet is blacklisted, this feature transfers tokens to a pre-set “transfer wallet.”

Pre-Approve: Automatically approves tokens after sniping to enable faster selling.

Snipe Settings: Allows adjustment of current snipe configurations without affecting other pending or future snipes.

Bot Transaction Fees: Banana Gun charges fees for bot-powered trades: (1) 0.5% for manual buys; (2) 1% for auto-snipe trades. 50% of all collected bot fees are distributed to token holders, creating a passive income stream that incentivizes bot usage.

Additional Cashback: Users conducting trades via the bot are eligible for extra cashback. The cashback amount is calculated as: fee paid × multiplier, with multipliers ranging from 0.05 to 1. This means users can receive up to 100% of their paid fees back, depending on a randomly generated multiplier.

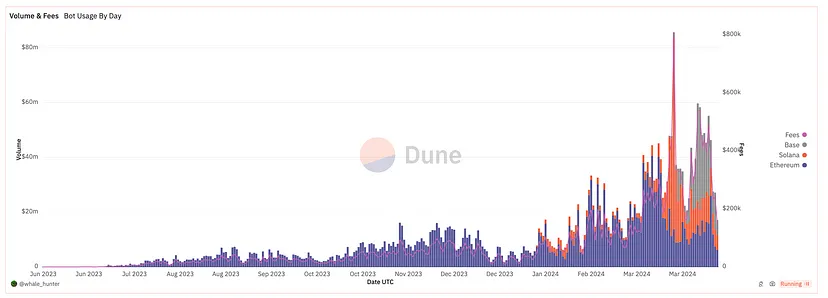

Protocol Performance

Similarly, Base chain trading volume surpassed both Solana and Ethereum, peaking at $35 million on March 29.

BonkBot

BONKbot is a Telegram-based trading bot built on the Solana network, enabling users to trade in the simplest and fastest way possible. The project uses the $BONK token, originally launched as a free Christmas airdrop to the Solana community in 2022. Since then, $BONK adoption has grown exponentially, expanding into DeFi, gaming, payments, and beyond. As the official partner of the $BONK community, BONKbot offers users a suite of features:

Minimum Holding Value: Users can set a minimum portfolio value threshold below which tokens are hidden. This is especially useful when users do not wish to sell certain tokens, even if they are stuck (“bag-held”). Click to edit.

Auto-Buy: Once a token address is pasted, the system immediately executes the purchase, skipping confirmation steps.

Button Configuration: Users can customize buy/sell buttons on the dashboard. Simply click each button to edit.

Slippage Settings: Users can customize slippage for buys and sells. Slippage refers to the difference between expected and executed price, and proper configuration helps control trading costs. Click to edit.

MEV Protection: BONKbot partners with Jito Labs to offer advanced MEV protection, defaulting to accelerated transactions and front-running defense. Two modes are available:

-

Turbo Mode: Transactions are sent via Jito to ensure maximum speed with front-running protection. If standard transmission is faster, MEV protection won’t engage.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News