MEME Coins' Rise Through the Lens of Ponzi's Three-Disk Theory

TechFlow Selected TechFlow Selected

MEME Coins' Rise Through the Lens of Ponzi's Three-Disk Theory

MEME coins are essentially a temporal mismatch of funds.

Author: CaptainZ

The Three Schemes Theory is a Ponzi cognition model proposed by Crypto Skanda. This article explores the causes of three bull markets based on this theory: MEME coins are mutual aid schemes, DeFi is dividend schemes, and ICOs are split schemes.

What Is the Three Schemes Theory?

According to Crypto Skanda, one of crypto's greatest values lies in democratizing and making Ponzi schemes tradable for the first time.

Anyone can launch a scheme and trade it. Setting aside external factors, each crypto bull market is driven fundamentally by innovation in Ponzi mechanics. By studying these innovations and understanding their first principles, you can identify alpha at the macro-trend level within the market.

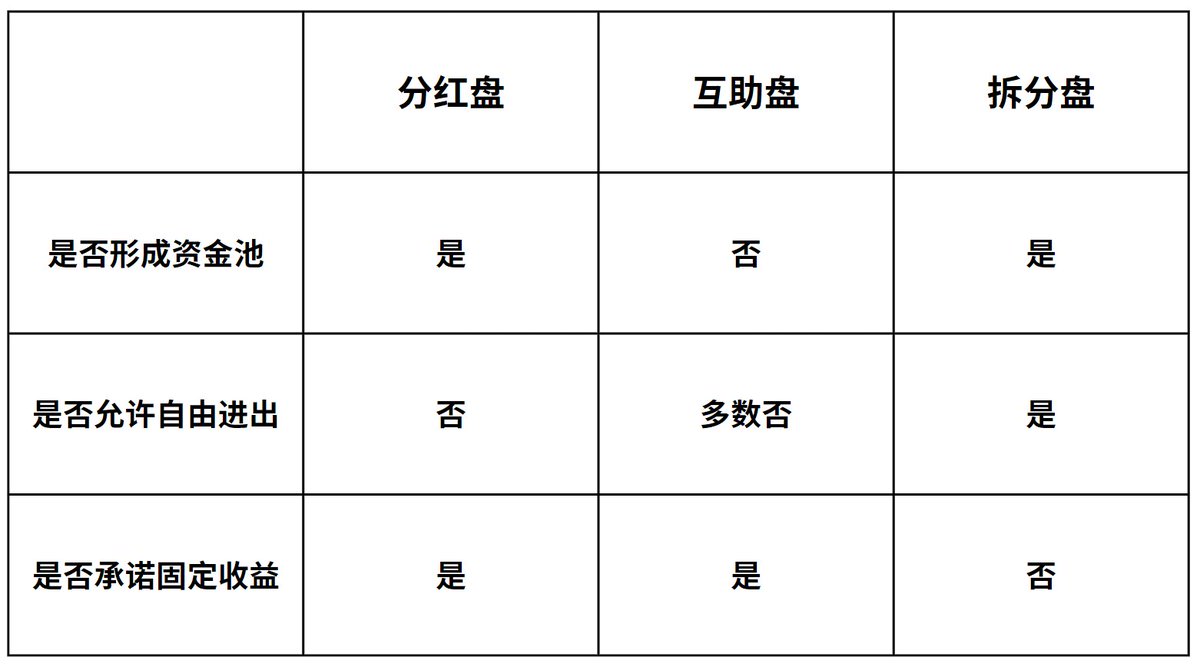

Though Ponzi schemes appear complex, they ultimately boil down to only three models: dividend schemes, mutual aid schemes, and split schemes. All Ponzis are combinations of these three. He calls the analytical method based on this logic the "Three Schemes Model." These schemes may appear individually or combined, each with its own strengths and weaknesses, along with corresponding launching, operating, and collapse dynamics.

- Dividend Scheme: A single lump-sum investment that generates returns through linear payouts over time;

- Mutual Aid Scheme: A sends money to B, B sends to C, C sends to A, creating a mismatched cash flow cycle, with profits settled per transaction;

- Split Scheme: An asset is continuously divided into new assets. New lower-priced assets attract incremental capital, and gains are realized through asset appreciation.

From a design logic perspective, the characteristics of the three schemes are as follows:

MEME Coins Are Mutual Aid Schemes

The core of traditional mutual aid schemes lies in misaligned cash flows. This model typically involves multiple participants transferring funds sequentially to form a circular flow. Generally, a user receives more money from the next participant than they paid to the previous one, thereby earning more than their initial investment. The project party usually earns revenue by taking a cut (fee) from each transaction.

Among the three models, this Ponzi structure is the most decentralized because once the rules are set, no central "manager" needs to intervene—essentially, the fee acts like a tax.

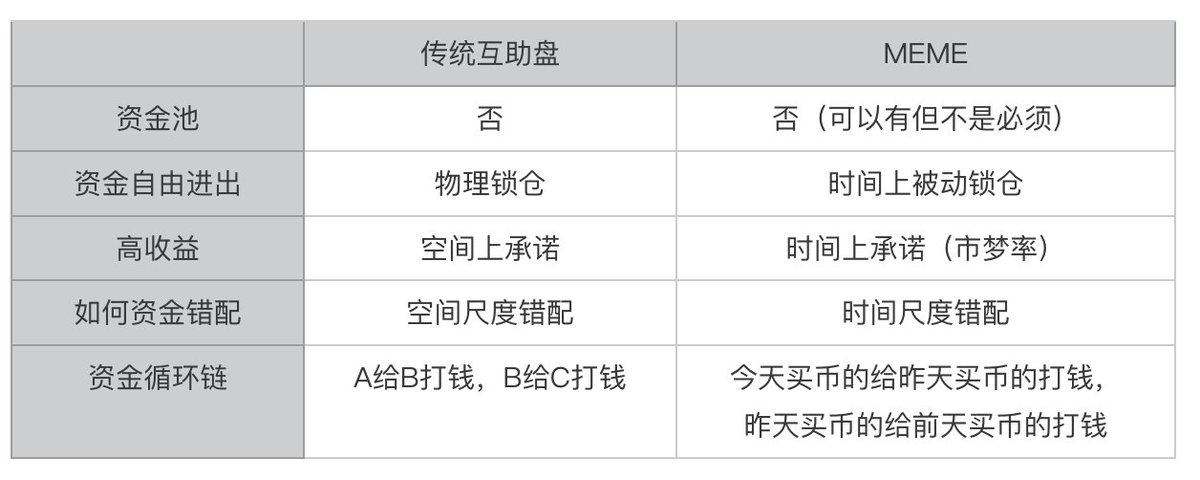

Traditional mutual aid schemes rely on spatial misalignment of funds, so they don’t require a pooled fund and typically do not allow free entry/exit, but must promise high returns. So why are MEME coins considered mutual aid schemes?

We generally believe MEME coins have two key attributes:

Fair Launch: Open participation for everyone (everyone helps each other);

Full Circulation: No reserved tokens by the team;

Attributes such as “cultural value” or “extremely large supply” are not essential.

In reality, MEME coins represent a temporal misalignment of funds. Suppose, in a bull market context, a certain MEME coin keeps rising strongly—this means today’s buyers (paying higher prices) send money to yesterday’s buyers, who in turn profit from those who bought earlier at even lower prices. Due to the unidirectionality of time, this creates a form of “passive locking” (one cannot step into the same river twice). Thus, we arrive at the following comparison:

DeFi Is a Dividend Scheme

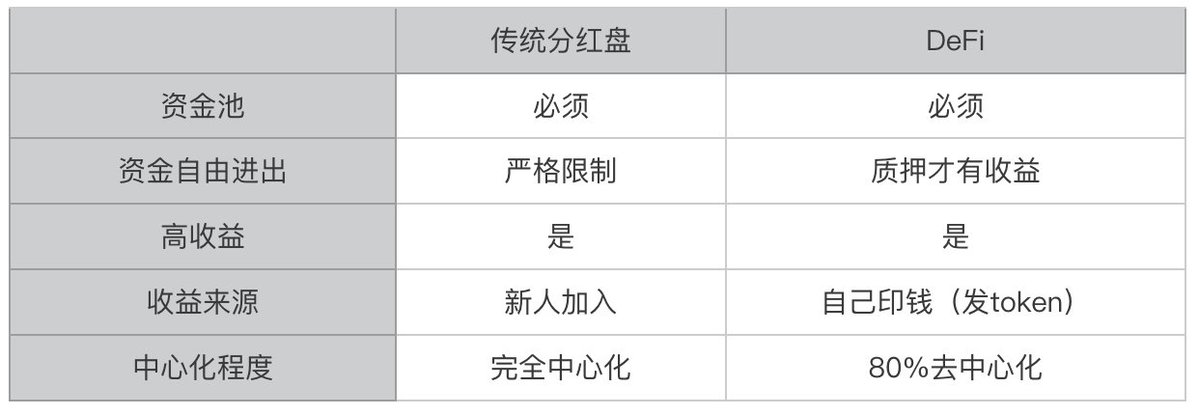

DeFi was the core narrative of the last bull run (2020). Technically, it refers to encoding financial rules into smart contracts (a way blockchain technology integrates with specific domains). From a token economics standpoint, it distributes protocol tokens via liquidity mining: deposit money into the protocol and earn tokens.

For example, the two most important aspects in finance are trading and lending, giving rise to Uniswap and Compound. In Uniswap, users deposit pairs of Token A and Token B as LP liquidity into pools to earn rewards. In Compound, users deposit lendable tokens into pools to earn interest. Rewards are mostly in the form of protocol tokens, with small amounts in real yield (stablecoins).

DeFi is a classic dividend scheme, since the fundamental logic of a dividend scheme is “a single lump-sum investment generating linear returns over time”—doesn't this perfectly match what we just described? We illustrate this with the diagram below:

ICO Is a Split Scheme

ICO was the dominant narrative during the previous bull cycle (2017). The basic idea was writing a whitepaper for any concept across any domain, then raising funds by issuing a token—leading many to mistakenly believe that the sole application of blockchain was “launching tokens” (another way blockchain technology combines with various fields). As a result, numerous bizarre tokens emerged during that period, such as “launching a token for environmental protection,” “for computers,” or “for charity,” among others.

As we know, a split scheme continuously divides one asset into new ones, attracting new capital through lower-priced offerings, with profits achieved via asset appreciation. Isn’t this exactly how ICOs functioned? If we view the entire cryptocurrency sector at that time as a giant scheme, the emergence of various ICOS represented splitting the original crypto asset into new investment vehicles (new ICO tokens) through “new stories,” thus drawing in fresh capital. Hence, we again present the following comparison:

Crypto Is Just Scheme Land

If we ignore specific technological evolution and focus solely on token economics, the past decade indeed seems to reflect the evolution of Ponzi models. We could even interpret Bitcoin mining as a form of dividend scheme (staking mining hardware to generate BTC rewards).

So has the evolutionary sequence been: Dividend Scheme (BTC mining) → Split Scheme (ICO) → Dividend Scheme (DeFi) → Mutual Aid Scheme (MEME)? And simultaneously, projects have become increasingly decentralized.

On another note, if we treat MEME coins as an entire sector, the growing number of MEME coins themselves exemplify a split scheme. Therefore, we might say that MEME represents a hybrid of (Mutual Aid Scheme + Split Scheme).

Perhaps the mutual aid scheme is the true answer behind this bull market’s ethos of “no responsibility to bail each other out” (Restaking is a dividend scheme, DePin is a dividend scheme, Layer2 is a split scheme—clearly retail investors in this cycle only want to play mutual aid schemes).

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News