Breaking the "Only Down, Never Up" Curse in Token Launches: Why Diamond Hands Are Not the Best Choice?

TechFlow Selected TechFlow Selected

Breaking the "Only Down, Never Up" Curse in Token Launches: Why Diamond Hands Are Not the Best Choice?

Stop listening to bad advice from VCs, consultants, or anyone else.

Author: Regan Bozman

Translation: TechFlow

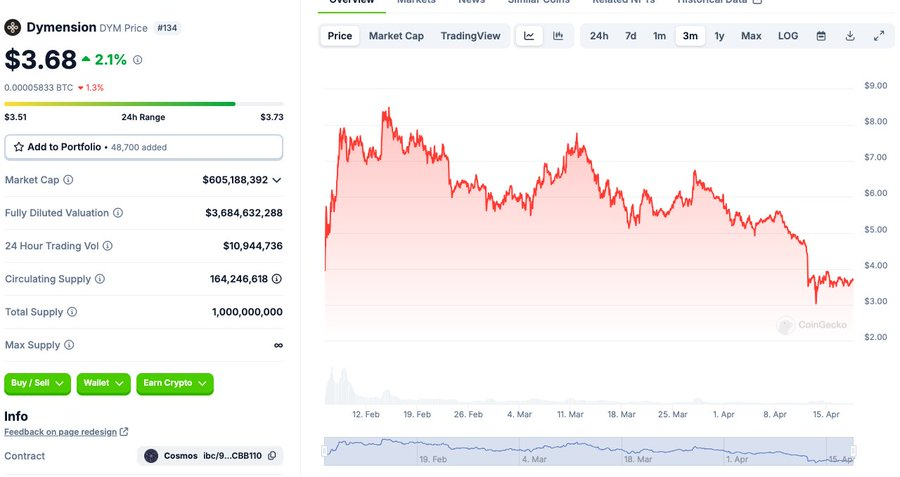

Current token issuance structures promote a "down only" pattern, where token prices are destined to be crushed.

Tokens launch with high FDVs and gradually bleed as airdrop recipients sell, then collapse when venture capital unlocks occur.

Some thoughts on how to break the current pattern

Mike Zajko always describes the worst-case scenario for a team's token trajectory as the ICP chart—if your token price looks like this, you're in trouble long-term.

Reflexivity can be a beautiful thing for protocols—rising prices can help catalyze a genuine community/developer ecosystem.

But the reverse is also true—and it can be extremely brutal.

Before I go further, let’s quickly define a few things. There are two main metrics for token supply:

-

Circulating supply: tokens in circulation

-

Fully diluted supply: the maximum number of tokens

Circulating supply increases over time until it equals the fully diluted supply.

For example, if team tokens are locked at TGE (Token Generation Event), they are added to circulating supply when vesting begins at month 12. They are always part of the fully diluted supply.

Market cap = circulating supply * price; Fully Diluted Valuation (FDV) = fully diluted supply * price.

Market cap measures demand, while FDV is merely a measure of supply.

Market cap is the total value of public demand—it rises and falls with price and, assuming good liquidity, is a reliable indicator.

FDV increases along with market cap because both metrics are based on the current market token price. However, rising market cap doesn’t mean there’s additional demand for those locked tokens.

Holders of locked tokens might actually be happy to sell at much lower prices. Therefore, FDV may not be a very accurate measure of real network value.

There’s an argument that FDV is essentially a meme, given how wildly some tokens trade by FDV (e.g., Worldcoin’s FDV at $50 billion).

This might make sense for retail investors—if you’re actively trading these assets and aren’t caught at unlock events, FDV may not matter much.

But FDV absolutely matters to VCs—they are the ones holding locked tokens! Currently, most VC-funded protocols have one-year lockups followed by 18–36 months of vesting.

VCs should value assets at their expected FDV over 3–4 years since that reflects what they can realistically report back to LPs—but unfortunately, that’s not how this market operates.

So what exactly is this current paradigm I’m talking about?

-

Launch with a high FDV

-

<20% of token supply in circulation

-

No public token sale

-

Massive airdrops

Dymension is a prime example—launched with an $8 billion FDV, 16% circulating, no public sale, and nine-figure airdrops.

Why does this happen?

I think once airdrop mechanics started, this became a way to boost the dollar value of airdrops without issuing more tokens.

And it inflates ego for teams and VCs.

Yes, VCs and teams could sell their locked tokens, but I'm unsure how much actual demand exists for locked tokens, so I doubt this is widespread.

But this hasn't always been how projects launched! Most dominant L1s today started differently:

-

Launched with FDVs under $1 billion

-

Similar unlock structures, but typically shorter vesting periods

-

Retail could buy in at relatively low prices (<$500M FDV)

-

No airdrops

Take NEAR, for example—20% circulating at launch, but community sales began unlocking immediately, with 50% circulating within a year. Launch FDV was $500M–$800M.

SOL started with ~20% circulating, but ~75% circulating after one year. Initial FDV ranged between $300M and $500M.

You could buy $SOL for under $5 for many, many months.

$LINK launched at hundreds of millions FDV and traded below $1B FDV for the first 18 months.

These tokens all had strong communities and solid holder bases with relatively low entry costs. What are we even talking about when we refer to those legendary crypto communities?

Let me be blunt: Community means making money alongside your online peers. In crypto, few strong communities exist without profit.

Think back to the ICP chart—do you really believe a strong ICP community exists? Absolutely not.

What happens next?

Token prices only rise when buyers outnumber sellers.

So who are today’s market buyers? Definitely not institutions!

Yes, there are some liquidity funds and crypto VCs buying tokens, but there isn’t much capital flowing into liquid markets.

Excluding ETH/BTC, annual inflows max out at $10–15 billion.

Just this week, three tokens launched with combined supplies exceeding $5 billion—no chance institutional bids can absorb that volume.

Ultimately, the end buyer for all these tokens is retail.

But here’s the problem: retail interest in high-valuation, low-circulation tokens is extremely limited. Two issues exist:

-

First, these tokens are expensive. No one thinks buying at double-digit FDV is a bargain.

-

Second, through large airdrops, retail gets tokens for free! So why would they buy more?

The most anticipated token launches this year

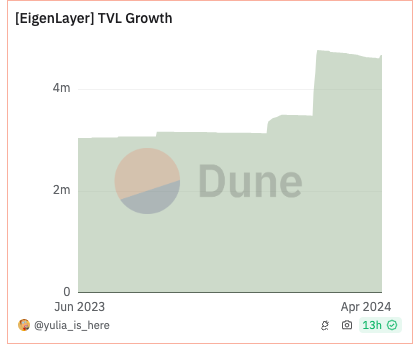

EigenLayer is likely launching with an FDV over $10 billion. I’d bet most knowledgeable ETH holders are already farming EigenLayer.

Over 3% of ETH has already been deposited, and a $5+ billion ecosystem has formed around the airdrop narrative.

Logically, if you want the EigenLayer airdrop, you probably already own ETH.

If you have ETH, you’re likely using it right now to earn Eigen tokens! So a large portion of potential buyers will get tokens for free.

Sure, people can buy more—there will obviously be some non-zero purchasing activity—but I’m skeptical it’s a massive market.

Personally, I have a significant portion of my ETH across various LRTs or Eigen positions hoping for a decent airdrop.

If it launches at $20 billion FDV, will I buy more? The answer is clearly no.

Then who’s the other buyer segment?

Retail investors who want exposure to EigenLayer but couldn’t acquire tokens for various reasons. Obviously, the buyer pool isn’t zero, but I don’t believe there’s a large crowd eager to buy $EIGEN at $25 billion FDV.

So we’ve established that the buyer audience is limited.

What about sellers?

If your FDV is high enough, VCs will obviously sell!

If you went from a $100M seed round to a $20B FDV, taking profits off the table makes perfect sense!

Retail investors are aware of this dynamic and track it closely! Token unlocks are well-documented—click here to dive deeper.

Are airdrop recipients selling? I haven’t seen extensive data on selling rates from this airdrop cycle, but there’s a clear psychological principle: people value free things less than things they paid for.

Most airdrops are also based on the nominal value of deposited/staked assets, so they represent small portfolio allocations. For example, if you deposit 1 ETH into Eigen, you might earn points worth 0.05–0.01 ETH—meaning little to most airdrop farmers.

That’s why we’re stuck in a downward-only paradigm. I’m not trying to pick on these projects—I don’t know what else they could do. I think they all act in good faith, and Eigen is a novel product.

How do we break this pattern?

I believe we need three things to escape this model:

-

Linear unlocks

-

Public token sales

-

Build cool stuff

6MV did excellent research showing smaller unlock events generally impact price less than large ones.

I think the right approach is 20–25% circulating at TGE with 36-month linear vesting.

Besides, public token sales should be adopted. Allow retail to buy your project at scale—Near’s token sale demand was so high it crashed CoinList twice.

Clearly, there was massive demand before TGE! Allowing the community to accumulate $5K–$25K in tokens beyond airdrops would buy far more loyalty.

Finally, build cool things. Projects performing well this cycle tend to be highly novel—like Ethena or Jito. Not sure if this holds for the rest of the cycle, but intuitively, it seems plausible.

Maybe retail is tired of being force-fed the tenth parallel DA modular solution.

VCs can complain about meme coins causing them trouble, but if they assume prior-cycle market structures will persist forever, the real problem lies with them.

I remain highly bullish—we’re actively deploying. This isn’t a macro bearish take.

It’s a warning: buying into the current token issuance structure clearly won’t lead to long-term success.

I’ve been bringing these protocols to market for a decade and have witnessed dozens of times what works and what doesn’t.

Stop listening to bad advice from VCs, consultants, or anyone telling you it’s smart to buy at peak FDV.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News