1intro LBP fails, are KOL buy calls losing influence?

TechFlow Selected TechFlow Selected

1intro LBP fails, are KOL buy calls losing influence?

Clearly, 1intro is suffering from a wave of negative criticism.

By TechFlow

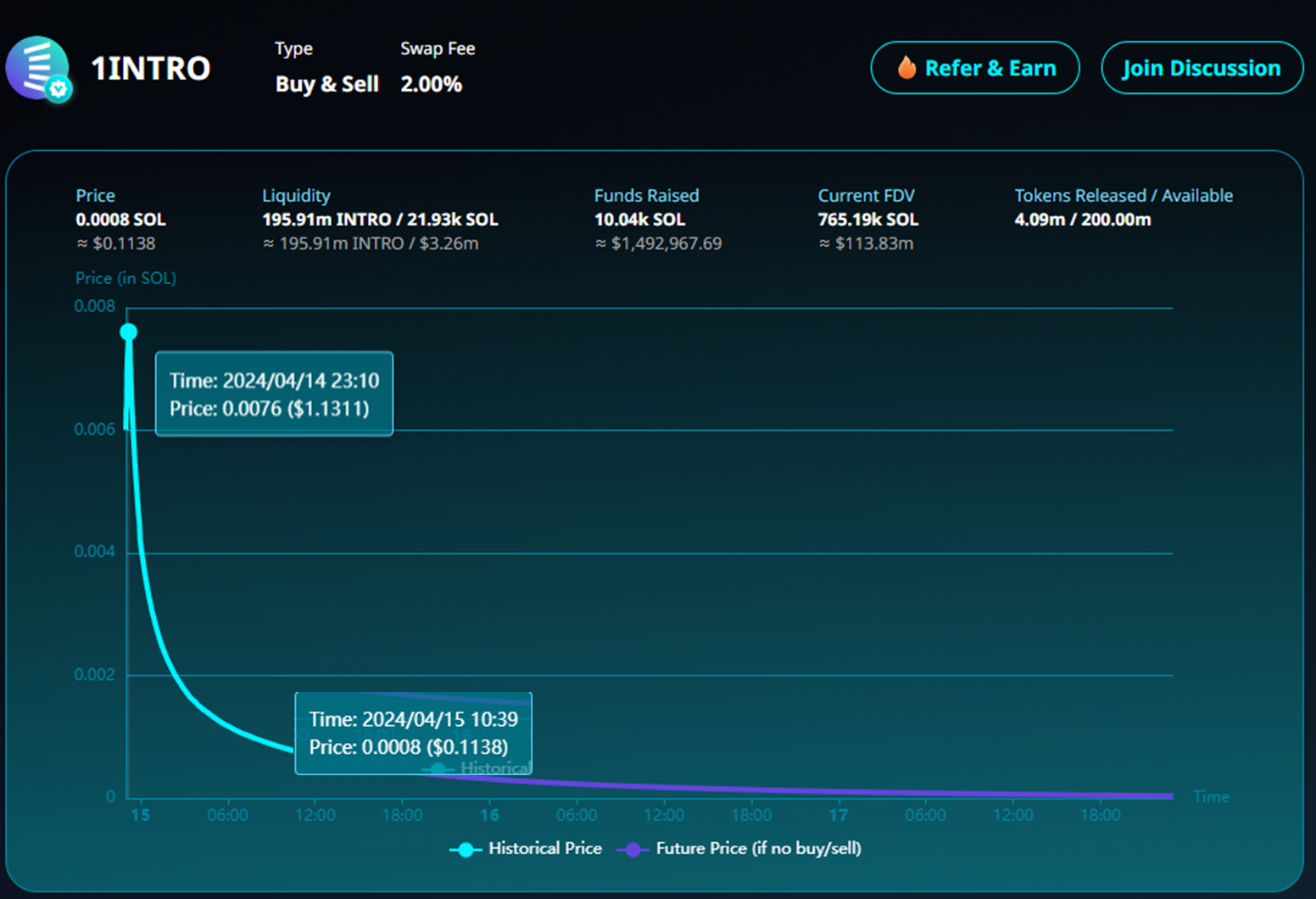

On the evening of April 14, 1intro—the project claiming to be Solana’s first native LBP (Liquidity Bootstrapping Pool)—launched its own token $1INTRO via an LBP auction.

Solana, one of the most active public blockchains this year, has spawned numerous high-return "meme coins" generating significant wealth. However, it's also rife with low-quality projects; many unvetted teams have conducted private sales only to rug pull afterward, leaving investors at a loss.

Thus, a native LBP solution for Solana seemed timely and could fill a gap in both narrative and token issuance within the ecosystem.

But as expectations rose, so did the disappointment.

If you search “1intro” on Twitter, you’ll find that just 1–2 weeks ago, numerous KOLs were heavily promoting the project with great anticipation.

Yet the price action during the LBP tells the most honest story.

At launch, $1INTRO surged to a peak of $1.13—equivalent to a fully diluted valuation (FDV) of around $1 billion—before rapidly crashing. By morning, the price had fallen to approximately $0.11.

Meanwhile, the LBP, which was initially targeting a $20 million raise, had raised only $4 million by the time of writing—a painfully slow pace.

Why did a project so enthusiastically backed by KOLs fail to generate market excitement?

Sky-High Valuation and PR Backlash

Price reflects all available market information, and clearly, 1intro is facing intense negative sentiment.

Three hours after launching its LBP, 1intro’s official Twitter account posted impressive-looking stats: 5,000 participants and 6,300 SOL raised.

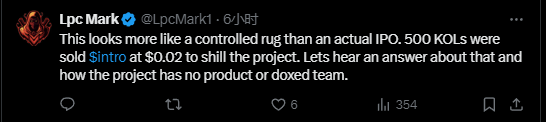

But beneath these glossy numbers, the comment section was flooded with skepticism—most notably, criticism over the fact that KOLs reportedly acquired their tokens at just $0.02 per token.

Even at the current price of $0.11, KOLs already enjoy a 5x return. If we consider the initial peak of $1.10, their profit reaches an astonishing 50x.

Good news travels slowly; bad news spreads fast. Once the market digested this information, lack of enthusiasm—and the stalled price decline—became easy to understand.

And the claims about KOLs’ low acquisition cost don’t appear baseless.

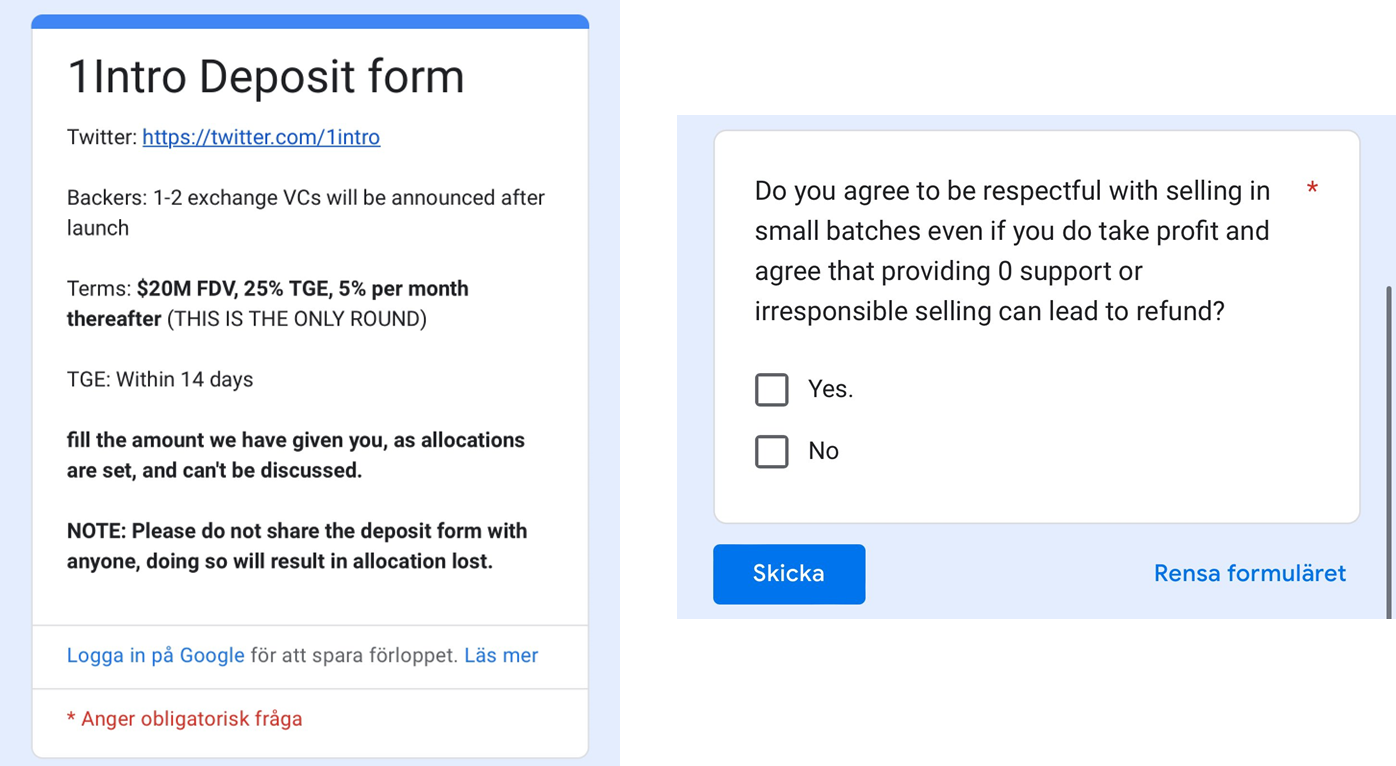

ZachXBT (@zachxbt), a well-known on-chain investigator, publicly called out 1intro, revealing internal documents and forms from the project’s KOL fundraising round. These clearly stated:

Total FDV: $20M, with 25% of tokens released at TGE and the remainder unlocked monthly at 5%.

Given that 1intro has a total supply of 1 billion tokens, this confirms a KOL purchase price of exactly $0.02—making ZachXBT’s findings highly credible.

If the current price holds until the end of the LBP, KOLs will still net a 5x gain. With 25% unlocked immediately, up to $5 million worth of tokens could hit the market instantly, creating immediate selling pressure.

Ironically, another leaked screenshot revealed that 1intro had already asked KOLs to sign a preemptive agreement stating:

“Do you agree to sell your tokens in small batches respectfully… and do you agree that irresponsible selling may result in a requirement to refund funds?”

Clearly, the team anticipated that KOLs would dump their tokens, so they tried to impose behavioral rules upfront to mitigate fallout.

But this isn't particularly clever—it's essentially a coordinated scheme between the project and KOLs to promote the token while securing outsized early profits, with the only constraint being that they must "eat politely" to avoid backlash.

Unsurprisingly, this sparked further outrage.

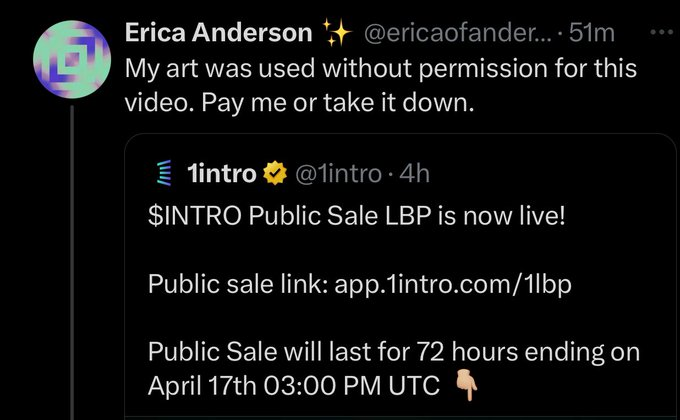

Video artist Erica Anderson pointed out that 1intro used her creative work in promotional materials without her consent.

Meanwhile, @soleconomist, a developer from another Solana-based project called sanctum, launched a rare direct critique, calling 1intro’s project description confusing and meaningless:

“1INTRO redefines the financial ecosystem on Solana through an intelligent platform that uses AI to enhance liquidity bootstrapping pools (LBP), DEXs, and token deployment, thereby improving user experience and operational efficiency. By significantly refining and simplifying our services, AI ensures a smooth, inspiring, and secure journey for our users.”

He added that such descriptions recklessly throw around AI buzzwords and bluntly commented: “What the hell does this even mean? It’s complete gibberish.”

With early KOL allocations priced too low on one side, and amateurish marketing missteps on the other, all that remains is a struggling LBP left exposed in the storm of public criticism.

Still, using KOLs for promotion isn’t inherently wrong.

For crypto projects, from conception to launch, some early tokens must be sold—either to VCs for funding or to KOLs for marketing reach.

Today’s projects are increasingly recognizing that in this new cycle, KOLs wield growing influence and can significantly boost visibility. Sharing part of the upside with them is understandable—but economic design and messaging must balance interests across all stakeholders.

High starting valuation, poor communication, excessive paper profits for KOLs—after cycles of bull and bear markets, retail investors aren’t naive. They won’t willingly become bagholders.

In the end, the on-chain investigator summarized several red flags about 1intro—perfect as a cautionary checklist for retail investors:

-

New account with abnormally high follower count

-

Minimal interaction with the Solana ecosystem

-

Every KOL commenting under official posts

-

Lack of technical documentation

-

Name resembles the well-known DeFi project 1inch

-

Too short a token unlock period

For investors: Avoid any project matching these criteria. For founders: Don’t repeat these mistakes.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News