Sell or Hold? Data Reveals the Right Move for Wormhole Token Airdrop

TechFlow Selected TechFlow Selected

Sell or Hold? Data Reveals the Right Move for Wormhole Token Airdrop

Wormhole is a leading interoperability provider, particularly well-positioned in the non-EVM space.

Author: zerokn0wledge

Translation: TechFlow

Recently, Wormhole successfully launched $W, which is undoubtedly a massive event. With a 10 billion USD FDV, it is currently the largest interoperability protocol in the market.

So should you sell your $W airdrop or hold it? We can dive into the data to find the answer to this critical question.

It’s important to understand that Wormhole is not just a bridge—I’ve discussed this before, click here for more details.

As Emperor Osmo pointed out, the narrative here is simple:

-

A new token

-

Well-executed airdrop

-

Upcoming ecosystem airdrops

These three factors could drive the price of W upward.

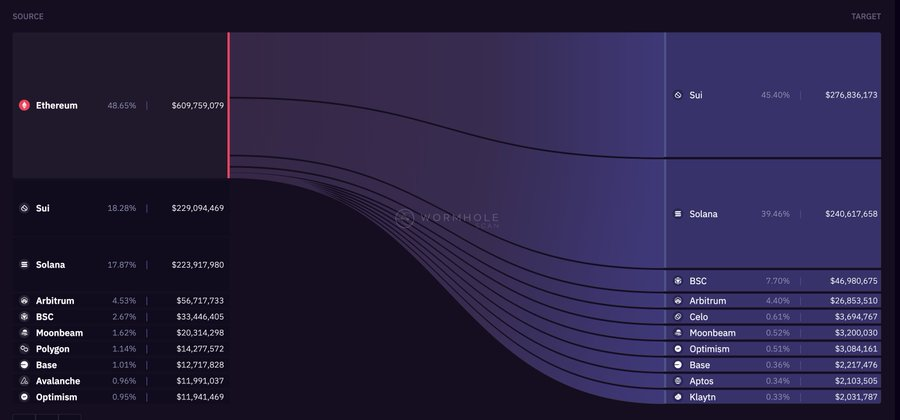

Wormhole is the leading interoperability provider, especially well-positioned in the non-EVM space. Over the past 30 days, Ethereum has been the chain with the highest value bridged via Wormhole. The primary destination chains are Sui and Solana.

From another perspective, the situation is similar. Ethereum is the network with the most assets bridged through Wormhole.

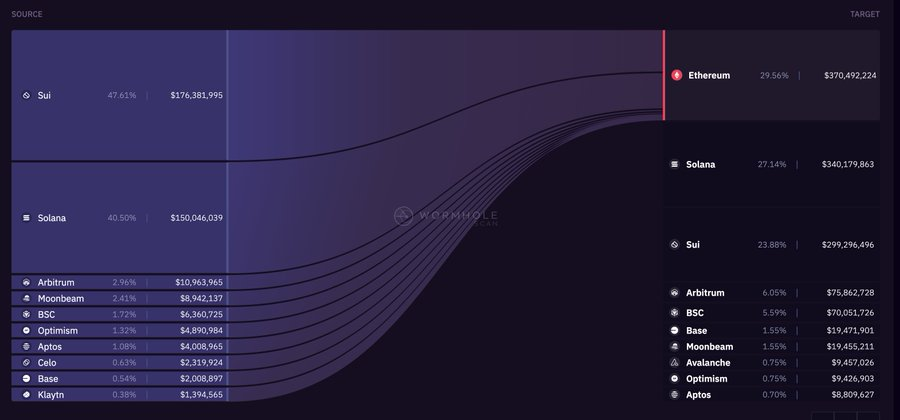

Again, the main contributors are Sui and Solana.

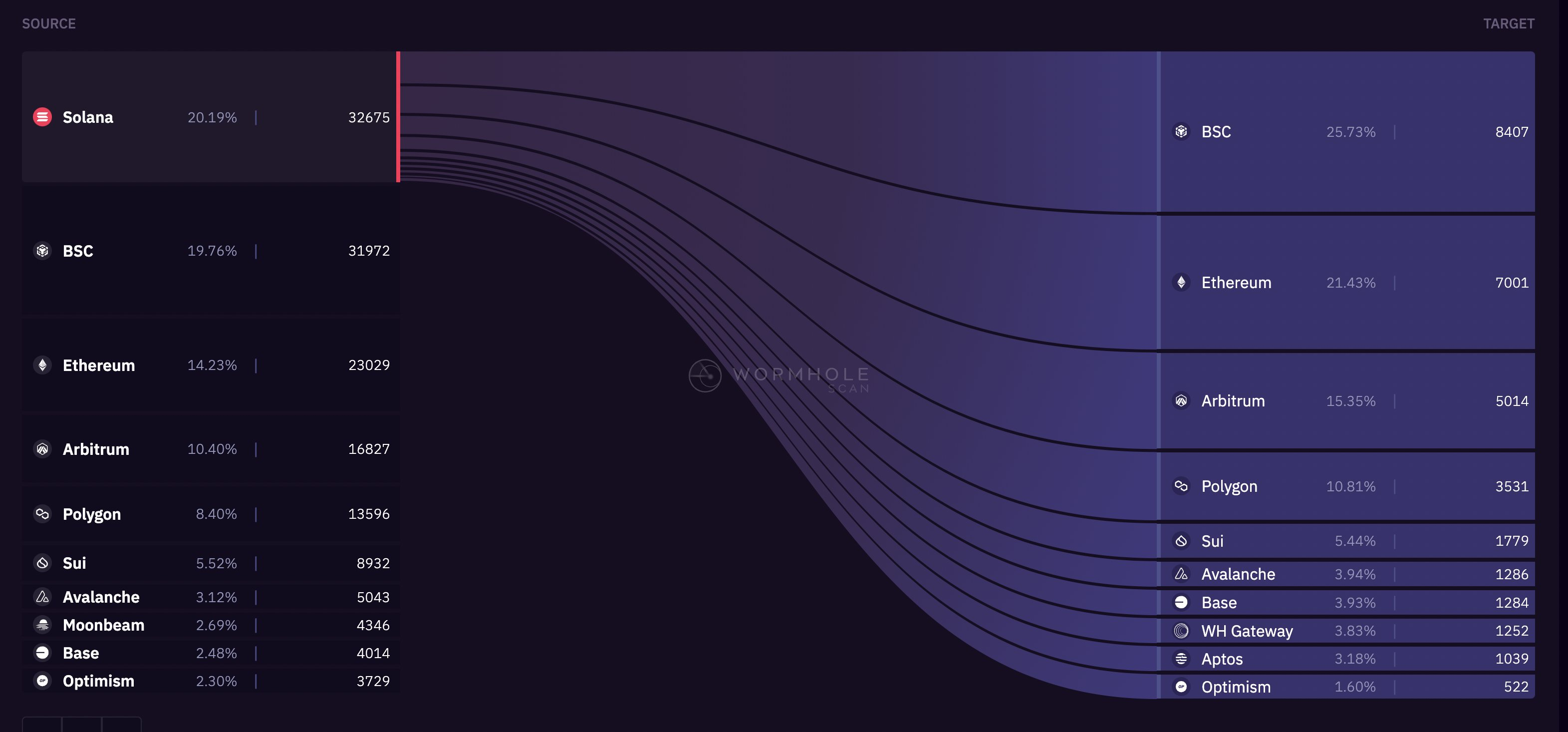

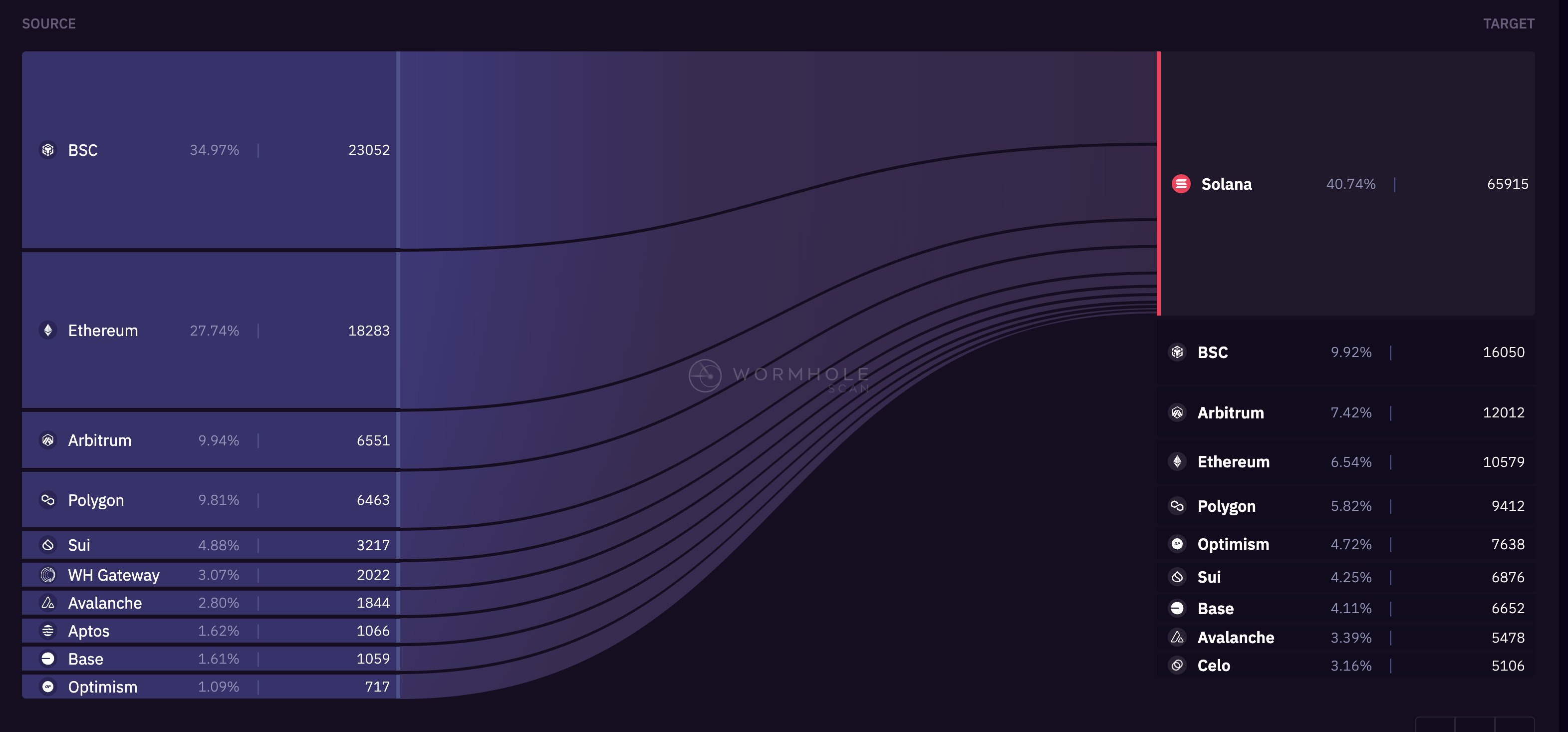

If we look at transaction counts, the picture changes slightly. Solana is the chain with the highest volume of Wormhole transactions, mostly flowing to BNB Chain, Ethereum, and Arbitrum.

Solana also dominates inbound Wormhole transactions. The largest shares come from BNB Chain and Ethereum.

This suggests SOL is highly popular among retail users. On the other hand, low transaction volume but high transaction value on Sui indicates whale activity.

This further proves Wormhole's strong position in the non-EVM space and in chains that will be central during this cycle.

As modular scaling deepens, users and liquidity are increasingly fragmented across alternative execution layers—an overall bullish trend.

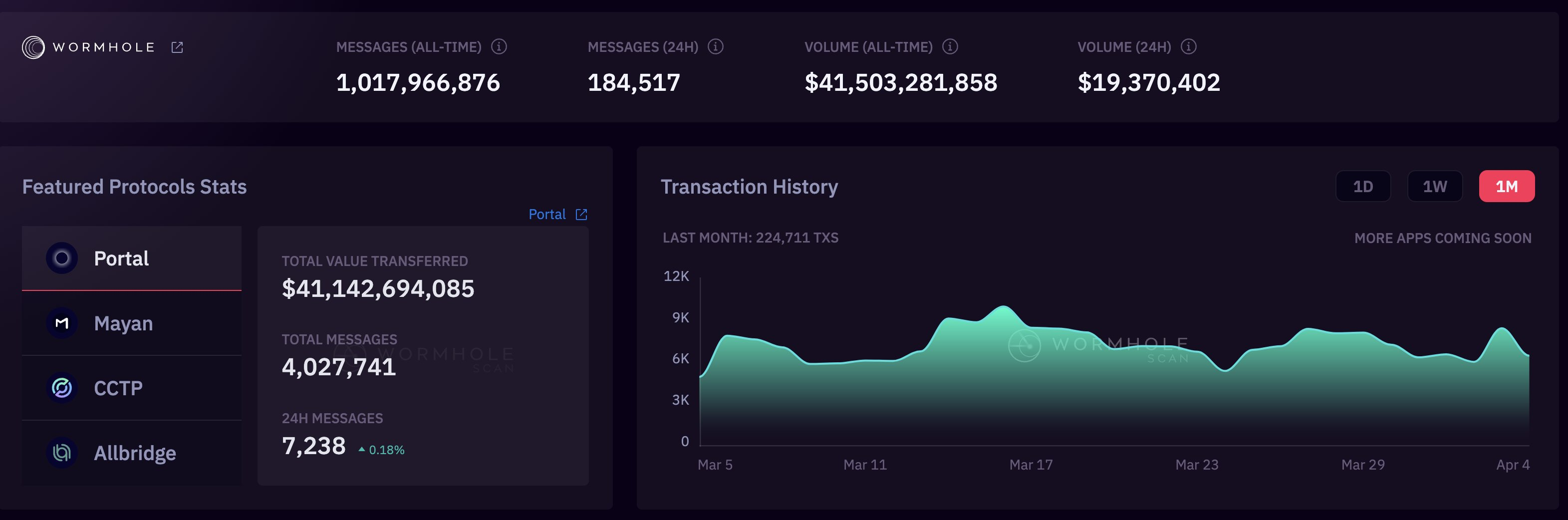

Wormhole’s leadership across the entire interoperability landscape is strongly supported by data: over 1 billion cross-chain messages sent and verified through the protocol, with more than 41 billion USD in value bridged.

But where is all this activity coming from? Or more importantly, if I stake W, who will airdrop to me? (More on this later)

Let me quickly walk you through the Wormhole ecosystem.

Multichain Lending

-

@Curvance (not yet launched)

-

@PikeFinance (not yet launched)

-

@MayanFinance (not yet launched)

-

@FolksFinance (not yet launched)

Multichain DEXs

-

@CatalystAMM (not yet launched)

-

@Backpack (also a wallet, not yet launched)

-

@infinex_app (not yet launched)

-

@C3protocol (not yet launched)

Cross-Chain Bridges

-

@portalbridge_ (not yet launched)

-

@0xcarrier (not yet launched)

Oracles

Liquidity Mining

-

@superformxyz (not yet launched)

L1 Chains (only a few top ones out of 30+)

-

@monad_xyz (not yet launched)

-

@berachain (not yet launched)

And this isn’t even everything—Wormhole’s ecosystem will be massive.

Once $W staking goes live (confirmed in Discord) and this airdrop narrative gains traction, things will get wild.

Meanwhile, the Wormhole team continues building relentlessly—expanding chain support and developing cutting-edge technologies like native token transfers and ZK-powered trust-minimized message verification.

All of the above points to a very bullish outlook for W. Now, let’s revisit the original question: do you still want to sell your $W?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News