How to legally buy and sell cryptocurrency in Hong Kong?

TechFlow Selected TechFlow Selected

How to legally buy and sell cryptocurrency in Hong Kong?

In Hong Kong, cryptocurrency is entirely a "sunlight" topic.

Author: Jin Jianzhi

Cryptocurrency occupies a very awkward position within mainland China. Due to certain regulatory issues, individuals buying and selling cryptocurrencies domestically face various concerns: How can they find a trustworthy method for depositing funds? How can they withdraw funds safely without having their bank cards frozen? How can they seek legal remedies if disputes arise? How should they explain the source of their cryptocurrencies to public security or judicial authorities? In Hong Kong, however, none of these issues pose significant problems—cryptocurrency is fully an “above-board” topic. In Hong Kong, there are multiple legal ways to buy and sell digital assets.

Cryptocurrency Exchanges

As of the publication date of this article, two platforms have obtained Hong Kong’s Virtual Asset Service Provider (VASP) license: Hashkey and OSL, with one additional platform, HKVAX, receiving provisional approval.

In short, Hashkey and OSL are licensed exchanges approved by the Securities and Futures Commission (SFC) of Hong Kong. Users can directly register accounts, deposit funds, place trades, and withdraw funds on these exchange platforms to trade cryptocurrencies. Users do not need to overly worry about actions that might harm investor interests, as every move made by these exchanges is under SFC supervision, and users may file complaints or report violations to the regulator at any time.

However, according to regulatory requirements set by the Hong Kong SFC aimed at protecting investors, professional investors and retail investors have access to different types of cryptocurrencies. Taking Hashkey Exchange as an example, users opening accounts on Hashkey can choose among four categories: retail investors (commonly known as individual retail traders), individual professional investors (with investment portfolios of no less than HK$8 million or equivalent foreign currency), corporate professional investors (with investment portfolios or total assets of no less than HK$8 million or HK$40 million respectively, or equivalent foreign currency), and institutional professional investors. Retail investors are limited to fiat-crypto trading pairs of major cryptocurrencies such as BTC and ETH, while professional investors can trade using stablecoins and access all cryptocurrency trading pairs available on the exchange.

Over-the-Counter (OTC) Trading

Cryptocurrency OTC providers refer to institutions or individuals offering over-the-counter trading services. OTC trading refers to buying and selling cryptocurrencies outside formal exchanges, typically involving cash or other fiat currencies. OTC trading takes several forms:

-

Online platforms: Websites, social media, and messaging apps connect buyers and sellers, providing matchmaking, escrow, and settlement services.

-

Physical stores: Brick-and-mortar shops offer cash-to-crypto or crypto-to-cash services, usually without requiring identity verification or compliance procedures.

-

ATMs: Self-service kiosks located in public areas allow users to buy or sell cryptocurrencies using cash or bank cards.

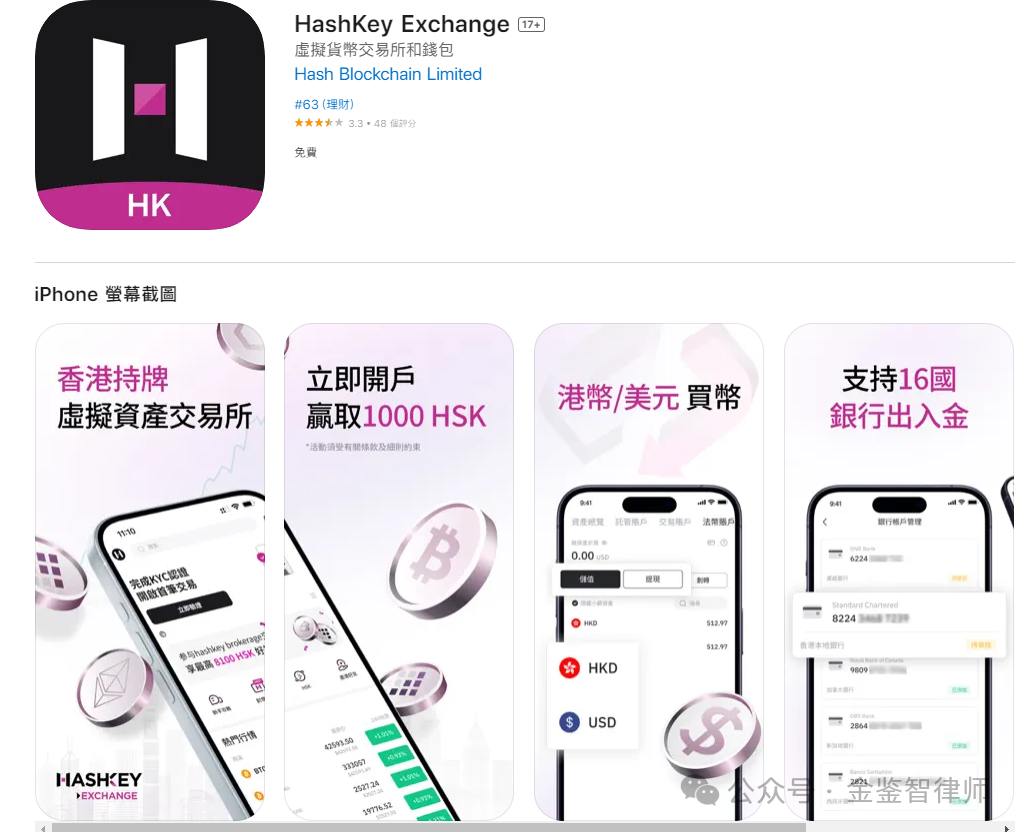

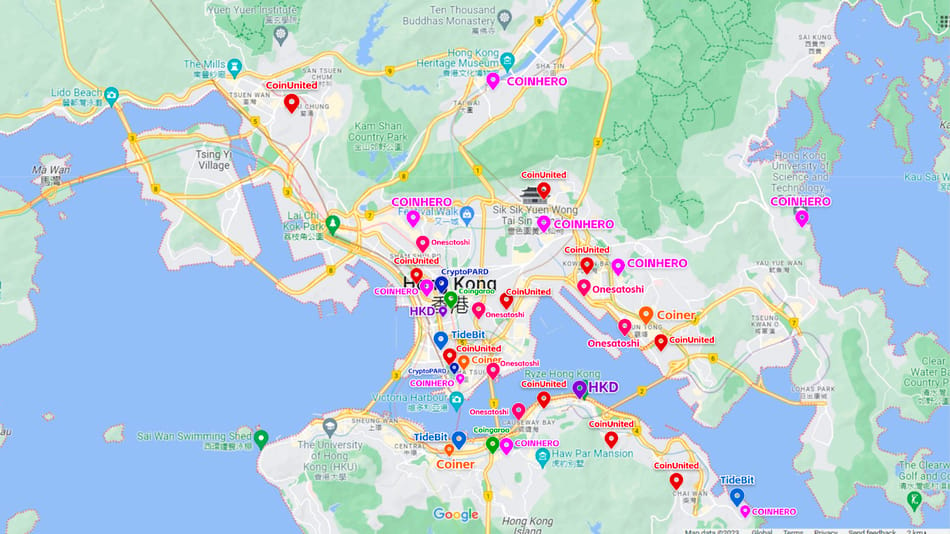

Based on preliminary field observations from Hong Kong law enforcement agencies, approximately 200 physical OTC shops (including those operating via ATMs) are currently active across Hong Kong, along with around 250 online service providers actively facilitating virtual asset transactions. According to Chainalysis research, money changers play a significant role in OTC crypto trading, accounting for the majority of the $64 billion in digital assets flowing through Hong Kong as of June.

Most OTC physical stores and ATMs generally do not require KYC procedures. Transactions are simple—cash exchanged directly for cryptocurrency—and completed within minutes. This provides cryptocurrency users with convenient, flexible, and private transaction methods, making them particularly popular among mainland Chinese users.

Notably, on February 2, 2024, Christopher Hui, Financial Secretary of Hong Kong, stated that the government sees a need to bring OTC activities under regulation. For users, this means that buying and selling cryptocurrencies via OTC will become safer. Any illegal or non-compliant behaviors by OTC providers can now be reported directly to regulators.

(Image source: TokenInsight)

Securities Firms (Brokerages)

Mainland A-share investors are certainly familiar with opening brokerage accounts through major securities firms to trade stocks on the Shanghai and Shenzhen stock exchanges. Similarly, in Hong Kong, cryptocurrencies can also be traded through brokerages. Indeed, an increasing number of Hong Kong-based brokerages are expanding into cryptocurrency services, including Futu Securities, Tiger Brokers, Victory Securities, Interactive Brokers, Nanwa Securities, Longbridge Securities, Fuqiang Securities, and Wah Fu Kin Yat Securities.

Among them, Victory Securities, a long-established Hong Kong brokerage and listed company on the Hong Kong Stock Exchange, has received approval from the SFC to provide virtual asset trading and advisory services to retail investors. In short, traditional brokerage clients can now trade cryptocurrencies directly through the brokerage platform. According to an interview with Chen Peiquan, Executive Director of Victory Securities, the firm will soon launch an app that “integrates the traditional financial trading experience—for example, equities and bonds—with cryptocurrency trading, allowing clients to allocate various asset classes on a single platform.” This means seamless integration between stock trading and crypto trading.

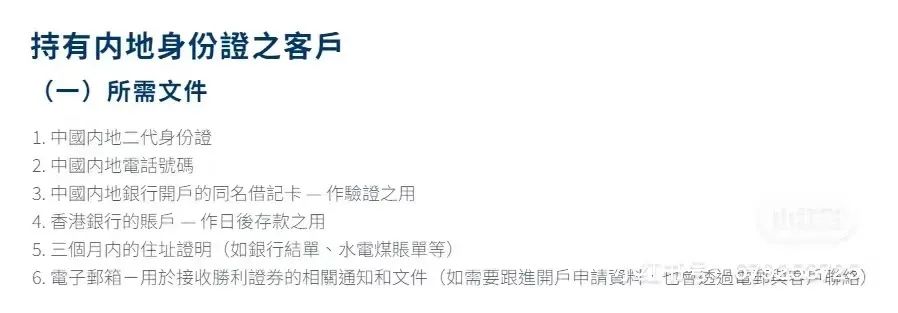

According to Victory Securities’ official website, mainland residents only need to provide the following documents to open an account. The most challenging parts are obtaining a Hong Kong bank account and a proof of overseas address issued within the last three months. Once the account is opened, users can use fiat currency to buy and sell major cryptocurrencies through the brokerage.

(Image source: Victory Securities official website)

When verifying identities, it's important to distinguish between guests and registered users. Guests may not require real-name authentication, but users who post content must undergo real-name verification. It should be noted that decentralized wallets cannot be equated with real-name authentication, as decentralized wallets remain anonymous. Therefore, if users are required to log in or link using a decentralized wallet, additional valid identification—such as phone number, email, or ID document—must still be collected to meet real-name verification requirements.

Summary

As virtual assets gain legal recognition in more countries and regions, legitimate channels and methods for investors to participate are gradually expanding. We hope this article provides useful reference and guidance for interested readers. It should be emphasized that as Chinese citizens, one must still comply with mainland regulations regarding cross-border movement of assets. For further inquiries regarding compliant cryptocurrency asset allocation, please contact ManQin Law Firm.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News