Staking, Restaking, and LRTfi: Composable Capital Efficiency and Neutrality

TechFlow Selected TechFlow Selected

Staking, Restaking, and LRTfi: Composable Capital Efficiency and Neutrality

Composable capital efficiency has driven the development of staking and restaking at both primary and secondary levels, while enabling deep DeFi applications of staking yields through tokens such as LSTs.

Author: LongHash Ventures

Translation: Baicai Blockchain

Key Points of This Article:

-

Composable capital efficiency and staking as a crypto-native risk-free rate

-

Staking, Restaking, and LRTfi

-

Addressing centralization and externalities in Staking and Restaking

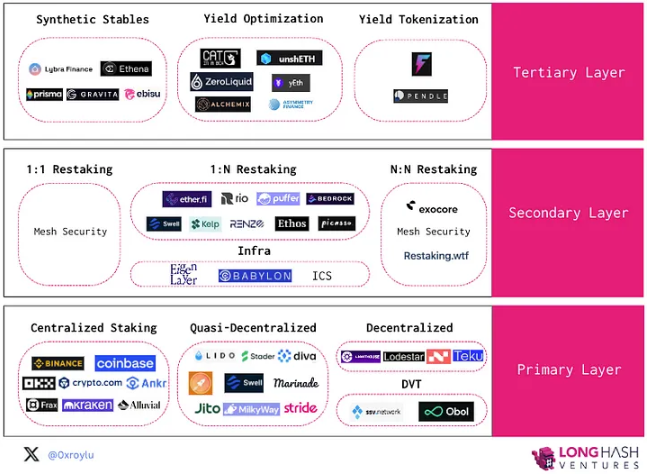

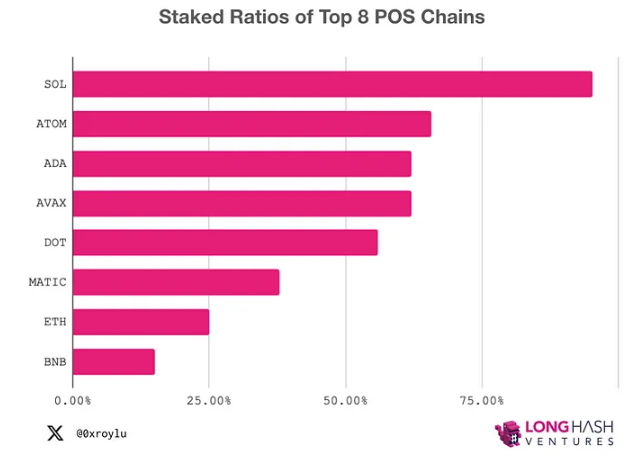

In our research, the primary layers of Ethereum, Solana, and Polygon are maturing, while staking mechanisms on Bitcoin and Cosmos continue to evolve. In Ethereum, there may be two potential outcomes: if Ethereum's value is preserved, an oligopoly might form where top participants approach 33% market share but do not exceed it; otherwise, if Ethereum’s value is not maintained, this could lead to the establishment of LST (Layer 2 networks). Meanwhile, ICS (Inter-Chain Standard) in Cosmos remains in its early stages, while Solana has already reached a 90% staking rate.

The secondary layer of restaking has triggered a race for high yields, with capital flowing toward projects offering the highest returns—particularly into LRT (Layer 2 staked token) pools. As the first Layer 2 networks adopting staking mechanisms, Blast and Manta created global buzz, instantly attracting over $1 billion in total value locked (TVL). However, when supply is abundant and demand strong, expected yields from AVS (Automated Vault Strategies) and restaking Layer 2 networks remain uncertain. Moreover, restaking mechanisms within Bitcoin, Cosmos, and Solana are all still in their infancy.

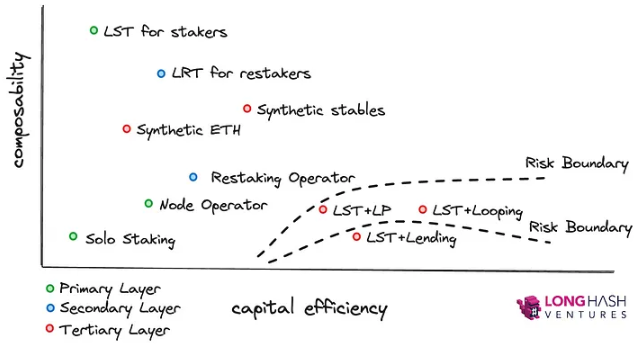

At the third level, synthetic stablecoins, yield optimization, and yield tokenization represent directions aimed at increasing innovation diversity. At this layer, capital efficiency and risk outweigh composability. The key success factor here is achieving the broadest possible composability with minimal risk.

1. Composable Capital Efficiency and Staking as the Crypto-Native Risk-Free Rate

Composability is a hallmark of Web3, characterized by frictionless interaction, low minimum thresholds, and self-custody. By contrast, in traditional finance, yield stacking faces significant friction. For example, using government bonds as collateral for borrowing introduces multiple friction points such as third-party custodians, case-by-case LTV ratio assessments, and high minimum requirements that justify labor costs involved—just to name a few.

The emergence of LSTs (Liquid Staking Tokens) unlocks composability between consensus-layer yields and execution-layer DeFi activities. This composable nature enabled the DeFi summer of 2020. Three years have passed, and today composability feels so natural that it is almost taken for granted. We now expect seamless yield stacking to enhance capital efficiency—for instance, staking via minting LP tokens (super-liquid staking) or depositing LP positions by minting LSTs to stack yields.

Self-custody, low minimums, and frictionlessness—these features are unique to Web3 and highlight the potential for broader financial market efficiency improvements. Imagine being able to tokenize your stock holdings and use them as liquidity provider (LP) assets on stock exchanges. Imagine tokenizing your real estate equity and easily re-staking it for yield. Through LSTfi, we catch a glimpse of what composable finance could mean for traditional markets.

Through LSTfi, we gain insight into what composability could mean for traditional finance.

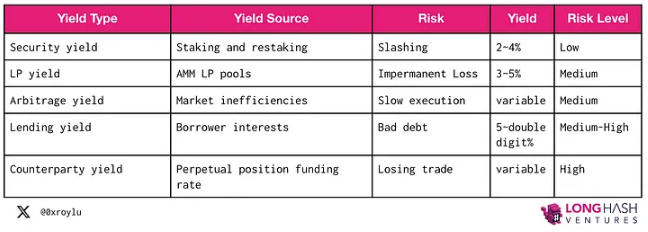

At a fundamental level, there are five types of yield sources in crypto, and they are stackable—that is, composable. An IOU token from one yield source can serve as the input token for another.

Of course, risk accompanies reward. Among these five basic yield sources, staking yield is the safest. Since Ethereum began staking, only 226 out of 959,000 node operators have been penalized. On the other hand, although sovereign government bonds are often touted as the lowest-risk investment, recent defaults have occurred in Italy, Spain, Portugal, Ireland, and Greece—not to mention repeated defaults by Venezuela and Ecuador. Even U.S. Treasury bonds—the gold standard—technically defaulted in the 1930s when the U.S. abandoned the gold standard and printed unlimited money to repay debts. Sovereign bond defaults relate to a country’s ability to repay debt and carry risks more akin to “lending yield” than “staking yield.” While sovereign bond yields are based on expectations of future debt repayment, staking yields correlate directly with current network usage levels.

For this reason, we consider staking to be the risk-free benchmark rate in crypto.

On top of staking lies the capital efficiency engine that powers the rocket of yield stacking. We’re already seeing innovations such as L2 networks like Blast and Manta offering staking-backed guarantees, cross-domain restaking protocols like Picasso and Babylon, and LST looping systems like Gravita.

The composable nature of LSTs will drive further innovation in yield-stacking design.

2. Staking, Restaking, and LSTfi/LRTfi

Staking is the security foundation of PoS chains and serves as the risk-free benchmark rate in Web3.

Justin Drake attributes two purposes to ETH: economic security and economic bandwidth. Through combinations with various DeFi and restaking activities, LSTs and LRTs allow the same ETH to participate in both purposes simultaneously.

Where economic security is concerned, PoS chains must protect decentralization and neutrality to mitigate potential collusion. Designing protocols under game theory to maintain decentralization and neutrality is a delicate balancing act. We’ll return to this tension shortly.

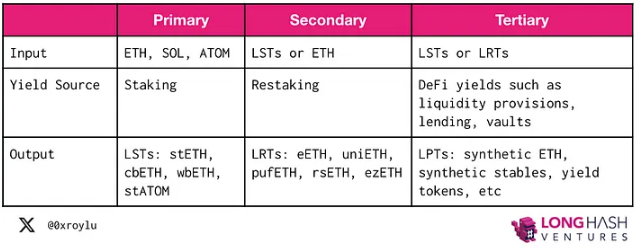

First, let’s take Ethereum as an example of a PoS chain to understand this stacking process. At the primary layer, users can stake their ETH and receive LSTs such as stETH, cbETH, wbETH, and rETH. At the secondary layer, LSTs or ETH can be restaked to provide security for other staking services, earning LRTs such as eETH, uniETH, and pufETH. Then, at the third layer, LSTs and LRTs are combined with various DeFi activities for yield stacking.

To understand the incentives driving adoption, we answer three questions:

-

Which strategy combination generates the highest yield? This relates to capital efficiency.

-

Which output token achieves the deepest liquidity and participates in the widest range of DeFi activities? This relates to composability.

-

Which strategy offers the safest source of yield? This relates to risk mitigation.

Thus, composability and capital efficiency are the main drivers of adoption, while risk acts as a boundary condition limiting choices.

3. Primary Layer – Staking

At the primary layer, validators deposit native tokens—such as ETH, ATOM, and SOL—to secure PoS networks and earn transaction fees as rewards.

Since staking represents the lowest-risk form of yield generation in crypto, we expect Ethereum (with a 23% staking rate) to eventually catch up with Solana (90%) and Atom (70%), representing a market expansion reaching hundreds of billions or even trillions of dollars.

Staking falls into three categories: centralized, semi-decentralized, and decentralized. Centralized and semi-decentralized staking trades custody for convenience and composability. Decentralized staking—also known as solo staking—is most secure for the protocol but difficult to maintain and lacks composability. In theory, self-hosted nodes could issue LSTs, but due to lack of composability, no rational actor would buy them.

1) Posting Collateral

In regular solo staking, validators generate two key pairs—one for validator keys and one for withdrawal keys—and send 32 ETH to the Ethereum 1.0 deposit smart contract. Base fees are burned, and tips go to validators. Only 8 validators per epoch—or about 1,800 per day—can be activated.

Staking pools like Rocket Pool, Diva, and Swell allow independent node operators to support staking pools funded by stakers’ deposits. From an operator’s perspective, lower collateral requirements mean higher capital efficiency, as they earn a commission from deposited ETH. Essentially, lowering collateral increases leverage.

-

Rocket Pool: 8 ETH collateral

-

Stader: 4 ETH collateral

-

Puffer: 1 ETH collateral

It is estimated that node operators can earn up to 6–7% in ETH rewards and up to 7.39% in staking pool token rewards.

On Polygon, validators require permission. They must apply to join the validator set and can only enter when an approved validator unbonds. On Solana, validators can join permissionlessly, and the Solana Foundation provides optional clusters for validators. Solana also officially tracks the number of minority validators holding over 33% of staked SOL.

In centralized exchange (CEX) staking, the collateral posting mechanism is opaque. Retail stakers may provide full collateral, while centralized node operators can pass all potential penalties onto retail stakers. However, stakers also automatically benefit from smoothing effects, often resulting in higher yields than solo staking.

2) Earning Rewards

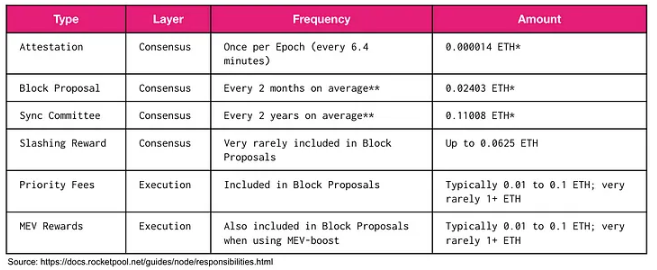

Every 2–3 days, the Ethereum Beacon Chain settles and distributes rewards to validators. Beyond consensus-layer rewards, validators can also earn execution-layer rewards through priority fees and MEV. Protocols like Jito on Solana leverage MEV to boost yields for their LSTs.

MEV share redistributes MEV from block producers back to validators, who can then distribute rewards to stakers. Eventually, MEV burn mechanisms may be implemented to return value to ETH holders. Fundamentally, MEV redistribution raises philosophical questions around fairness. But currently, MEV can be used to increase staking rewards.

Validator rewards tend to be highly volatile. Due to inherent randomness in validator selection, rewards may be unevenly distributed. On Ethereum, deterministic randomness involving the previous block hash and seed is used to select the next validator.

To address this, Rocket Pool offers a smoothing pool on an opt-in basis. The smoothing pool accumulates rewards from participating validators. As a rule of thumb, if a validator’s small pool contains fewer nodes than those in the smoothing pool, it is more likely to achieve higher returns via the smoothing pool. For projects like Lido, smoothing functionality is built directly into smart contracts.

On centralized exchanges (CEX), smoothing is automatic, and stakers can expect stable returns over time.

3) Penalties

Penalties are rare events. Since Ethereum staking began, only 226 out of 959,000 node operators have been penalized.

Validators may face penalties if they 1) fail to produce blocks, or 2) fail to submit attestations within expected timeframes. These slashing amounts are relatively small. Typically, validators can resume earning rewards within hours equal to their downtime. Slashing penalties, however, are far more severe.

Slashing occurs when any of the following three conditions are met: 1) Double signing: signing two different beacon blocks for the same slot. 2) Attestation surround: an attester signs an attestation surrounding another. 3) Attestation double vote: signing two different attestations for the same target. A validator includes evidence of misbehavior in a block, socializes it with the validator set, and slashing begins once all validators sign off on the evidence.

During a slashing event, the following consequences may occur:

-

Initial penalty: 1/32 of effective balance is slashed

-

Correlation penalty: If multiple violations occur within a short timeframe, up to the entire effective balance may be slashed. Quadratic penalties deter collusion.

-

Exit: Validator enters withdrawal mode for 8,192 epochs (approximately 36 days)

DVT (Distributed Validator Technology) aims to reduce slashing risks and improve staking pool security by protecting validators from failing to produce blocks or attestations. DVT leverages distributed key generation (DKG), multi-party computation (MPC), and threshold signature schemes (TSS) across redundant validator sets.

SSV (Shared Secret Validation), part of the DVT network, is a fully open, decentralized, and open-source public good currently being tested by protocols like Lido. Obol uses Charon as a non-custodial middleware handling communication between validator clients and consensus clients. Diva uses its own DVT implementation to support its LST in a permissionless manner, allowing anyone to run nodes. Puffer’s Secure-Signer is a remote signing tool funded by the Ethereum Foundation, designed using Intel%20SGX to prevent slashable offenses. Puffer’s Secure-Signer manages validator keys on behalf of consensus clients.

From a capital efficiency standpoint, running multiple clients via DVT consumes computational resources. In practice, the same hardware can participate in multiple DVT sets. Crucially, DVT enhances protocol security so that even if a group of node operators goes offline or behaves abnormally, the staking pool continues functioning correctly.

Cosmos Interchain Security employs an interesting approach to penalties (Proposal #187). Since ICS is still in early development, governance votes must resolve all potentially punishable events. Although intended to prevent security contagion from consumer chains to the central hub, governance currently relies on human arbitration rather than code-based decisions.

4) Withdrawals

On Ethereum, up to four exits are allowed per epoch. Because entry and exit limits are mismatched—8 validators per epoch for entry vs. 4 for exit—long withdrawal queues may form. Once initiated, withdrawals require validators to wait 256 epochs.

On Solana, delegation is established. Standard delegation to staking pools requires a cool-down period before withdrawals. However, liquid staking via staking pools does not require a withdrawal cool-down period.

4. Looking Ahead

As Ethereum’s staking ratio increases, assuming network usage remains constant, the base yield should gradually converge toward 1.8%, which is the minimum yield set by the Ethereum Foundation. However, increases in gas fees and MEV may partially offset this trend.

Typically, opportunity cost would prompt stakers to stop staking when yields fall below other available options. However, LSTs (Liquid Staking Tokens) can mitigate opportunity cost because holders can simultaneously participate in both economic security and economic bandwidth. Therefore, despite lower returns, stakers are likely to continue depositing and use their LSTs in DeFi to earn additional yield.

Due to declining staking yields on Ethereum, another phenomenon is centralization. Independent stakers will find their returns steadily decreasing, eventually falling below hardware operating costs.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News