Deep Dive into Drift Protocol: The Largest Perpetual Exchange on Solana

TechFlow Selected TechFlow Selected

Deep Dive into Drift Protocol: The Largest Perpetual Exchange on Solana

Drift Protocol has stood out by successfully operating for two years without a native token.

Author: JONASCYANG

Translation: TechFlow

In the field of digital asset trading, perpetual futures as a derivative market have become an essential component of the cryptocurrency ecosystem. This article will delve into the latest developments in the perpetual trading market, with a particular focus on Drift Protocol—a promising new protocol within the Solana ecosystem. By analyzing Drift Protocol’s core design, technical features, and positioning within the Solana ecosystem, we can gain deeper insights into the current state and future direction of the perpetual trading landscape.

Current State of Perpetual Trading

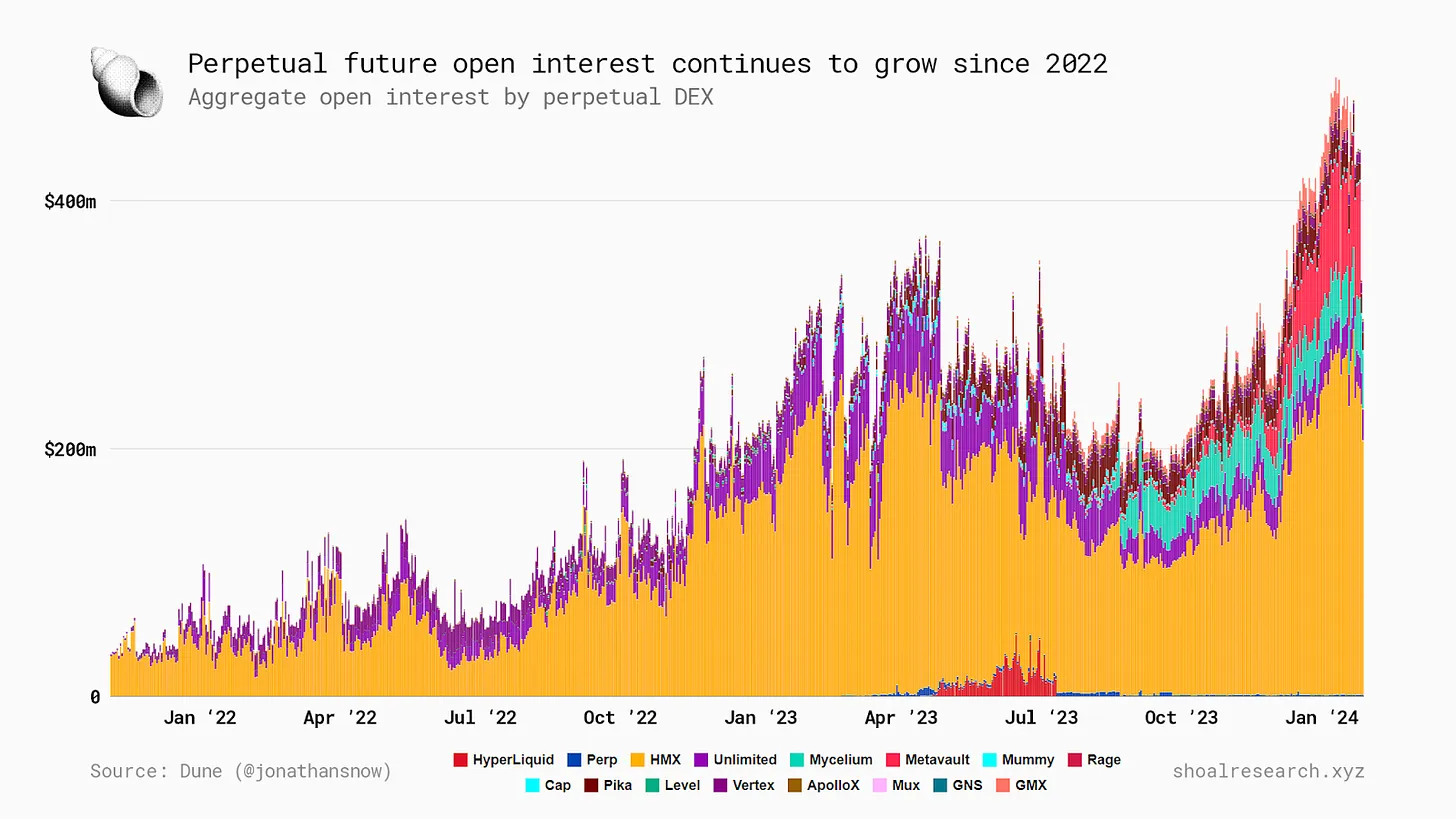

In the realm of perpetual trading, centralized exchanges (CEXs) still dominate. However, it is undeniable that decentralized perpetual protocols have experienced rapid growth over the past two years, achieving nearly a 10x increase in open interest.

Data does not include DYDX

Under these circumstances, competition among perpetual protocols is intense. The rapid growth in trading volume has led developers to view CEXs as profitable and sustainable businesses. Many protocols are making incremental innovations based on GMX and DYDX, particularly in areas such as price sources, fee structures, and user incentives.

Just like DEXs, every DeFi sector has numerous forks. Excessive fragmentation in the perpetual protocol space intensifies competition due to overly simplistic business models. Currently, failing to leverage the liquidity from perpetual protocols for broader DeFi development means missing out on significant opportunities.

Drift Protocol Overview

Drift is building a decentralized perpetual protocol on Solana using a dynamic vAMM (DAMM) mechanism. Drift v2 launched in mid-2022 and, thanks to its innovative hybrid liquidity solution, has grown into one of the top 5 perpetual CEXs by TVL. Notably, Drift Protocol operated successfully for two years without a native token, setting itself apart from peers. The protocol offers multiple types of derivative markets, including perpetual contracts, spot trading, and lending.

Drift v1 and Its Challenges

vAMM

In most cases, automated market makers (AMMs) are used for swaps, also known as spot trading. Traditionally, AMMs use the constant product formula x * y = k to price assets, where x and y represent the reserve balances of two assets in the liquidity pool, and k represents total liquidity. The key concept here is that k remains unchanged throughout trading due to automatic rebalancing.

Perpetual Protocol is another AMM-based perpetual exchange that initially introduced the concept of virtual automated market makers (vAMM). Unlike traditional AMMs, vAMM trading does not rely on underlying assets. Although it uses the same x * y = k formula, critically, in the vAMM model, k is predetermined and fixed because all trades occur within this virtual pool.

For example, if a user wants to take a 5x leveraged position on SOL with 1,000 USDC, they must deposit 1,000 USDT into a vault. In return, the protocol credits 5,000 vUSDC in the vAMM to purchase SOL, giving the user corresponding exposure to SOL.

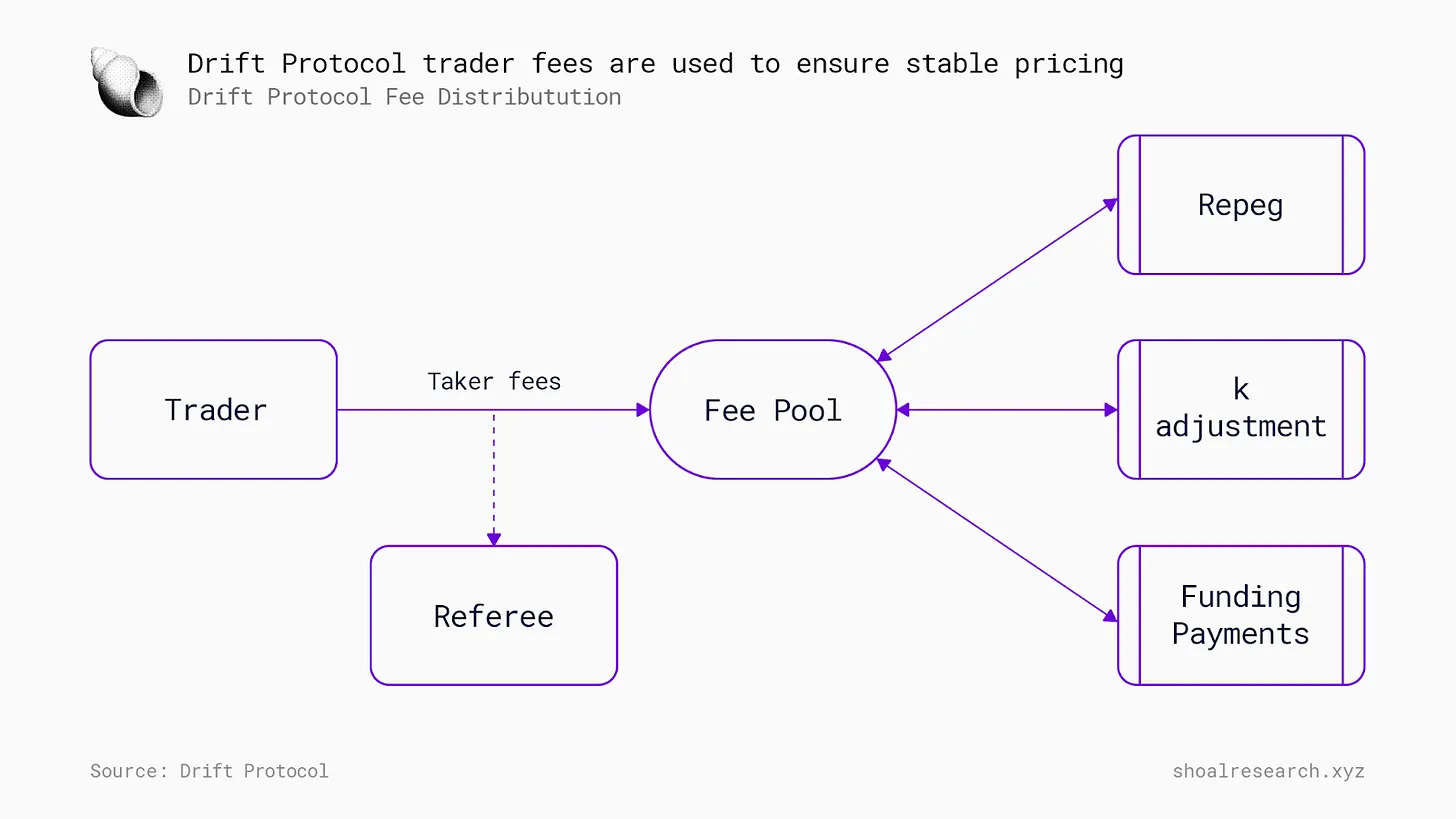

Drift v1 was built upon this concept with two innovations: repegging and adjustable liquidity. Repegging means effectively updating the quote asset's price according to oracle prices (asset prices), enabling trades to execute in regions of deeper liquidity. By operating in deeper liquidity zones, trade execution improves. Oracles provide price data to the vAMM and set it as the latest "terminal (starting) price," then collected fees are added to the pool to meet price adjustments, ensuring sufficient liquidity within the adjusted active price range. In the initial vAMM model, parameter 'k' is set when the pool is created. However, in Drift v1, 'k' can be adjusted multiple times. Simply put, to further deepen liquidity, accrued trading fees are injected into the vAMM pool—similar to adding liquidity to Uniswap v2—leading to an increase in 'k'.

Problems

In traditional spot-AMM or peer-to-pool models, there is always a passive liquidity provider (LP) party whose losses fund traders’ profits. However, in a vAMM setup without passive LPs, traders act as each other’s counterparties—meaning one trader’s profit requires another trader’s loss. As a result, no one wants to be the last trader. Consequently, most participants strategically open and close positions to execute arbitrage strategies, ultimately creating a player-versus-player (PvP) market.

Such a PvP market can function normally as long as there are consistently enough traders. However, when arbitrageurs cannot earn sufficient profits, the market may collapse—that is the problem. The preset 'k' sets the starting price. When the current price exceeds the starting price, positions are net long; otherwise, they are net short. In most cases, fair prices are driven by CEXs, so the vAMM pool needs to use collected trading fees to reprice when the fair price deviates from the starting price. At the same time, funding fees are paid from these collected fees. As deviations grow larger, the cost of repricing and adjusting 'k' increases. While funding fees are capped, the costs of repricing and 'k' adjustment could deplete the insurance fund, reducing arbitrageurs’ profits.

If arbitrageurs leave due to unattractive returns, most collected fees go toward offering retail users “better” prices. The issue? No arbitrageurs mean no volume, no fees.

Due to the asymmetric trading model of vAMM, poor leverage management may lead to fund losses through price manipulation. Manipulators could sequentially open two high-leverage positions, pushing the price to a level where the profit from one offsets the loss of the other—the profit coming at the expense of other users. Additionally, discrepancies between positive and negative PnL could lead to insolvency.

Drift v2 Core Design

Drift v2 introduces a hybrid liquidity solution designed to provide more collateral and reduce risks inherent in the vAMM itself. For Drift v2, three types of liquidity ensure optimal pricing for traders during order execution:

-

Just-in-time (JIT) liquidity

-

vAMM liquidity

-

Decentralized order book (DLOB) liquidity

Just-in-Time Liquidity

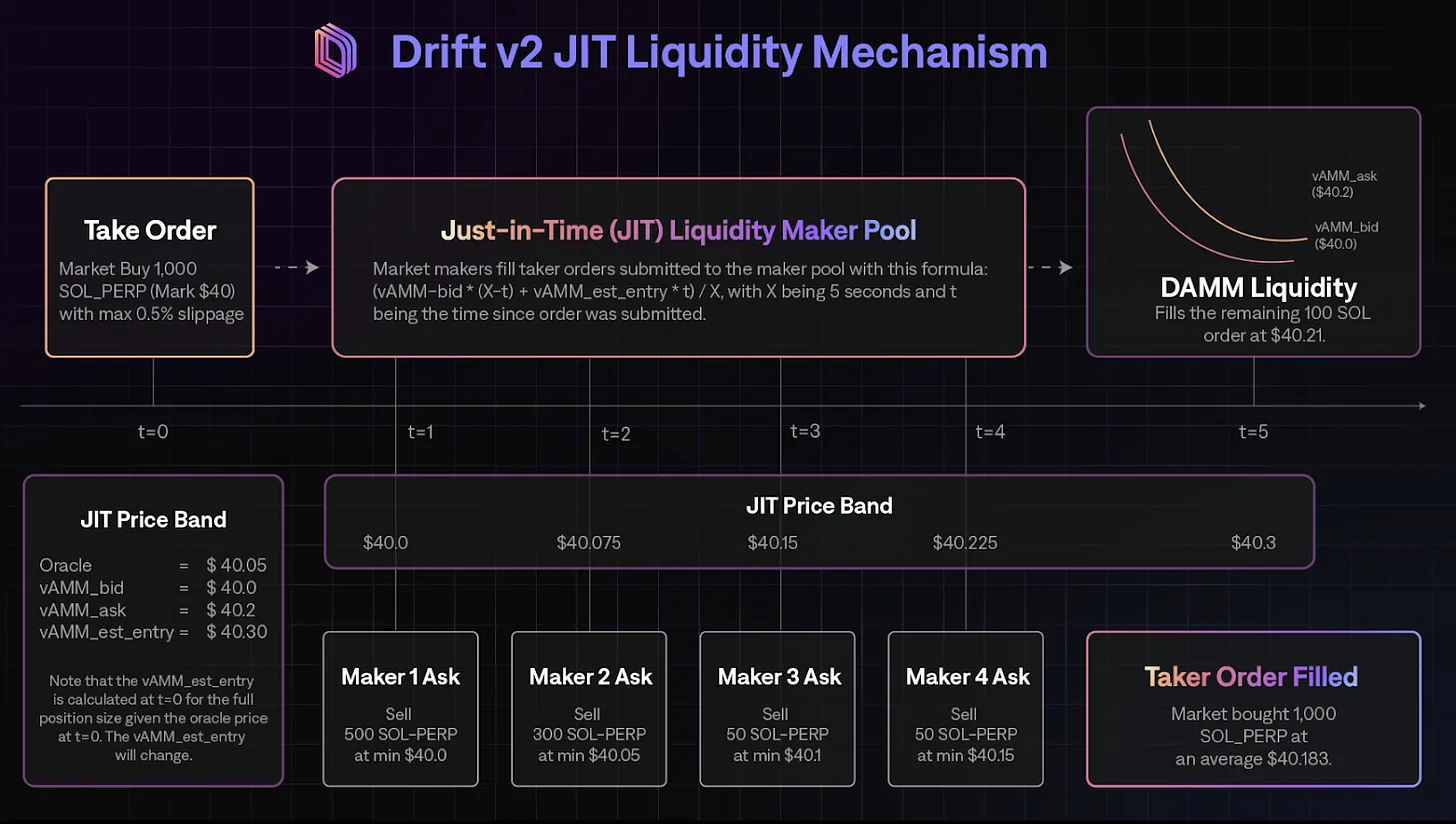

When a trader submits a market order, it is broadcast to a network of market maker guardians, initiating a Dutch auction. By default, the Dutch auction lasts 5 seconds (20 slots), with the starting price determined by oracle prices and the inventory status of the vAMM. During this process, market makers continuously race to front-run each other, with prices moving from most favorable to least favorable for the recipient. JIT auctions offer traders the opportunity to experience zero slippage during trading activity.

vAMM Liquidity

In Drift v2, if no market maker executes a market order, the vAMM acts as fallback liquidity. The Drift v2 AMM includes built-in bid-ask spreads and Drift Liquidity Providers (DLPs). DLPs are passive liquidity providers with active functions, taking offsetting positions against the vAMM. Users can add liquidity to specific pools and receive a share of the fees collected. Built-in bid/ask spreads give the Drift vAMM broader liquidity beyond just filling at the current oracle price during auctions. This process alleviates the high-cost issue of long-short imbalance.

Whether based on vAMM or oracle-driven, perpetual markets remain zero-sum games where traders profit from others’ losses. This contrasts with v1, where traders had “real” liquidity backing their PnL—an important distinction because it provides more collateral. After integrating DLPs into DAMM, liquidity depth improves through increased 'k', with 80% of trading fees distributed as rewards to DLPs.

Drift v2 also introduces a new oracle-based pricing mechanism that optimizes repricing and spread-setting by factoring in volatility and inventory levels. This ensures arbitrageurs actively participate to efficiently balance long and short positions. Price movements in v2 rely on data provided by oracles rather than long-short imbalances.

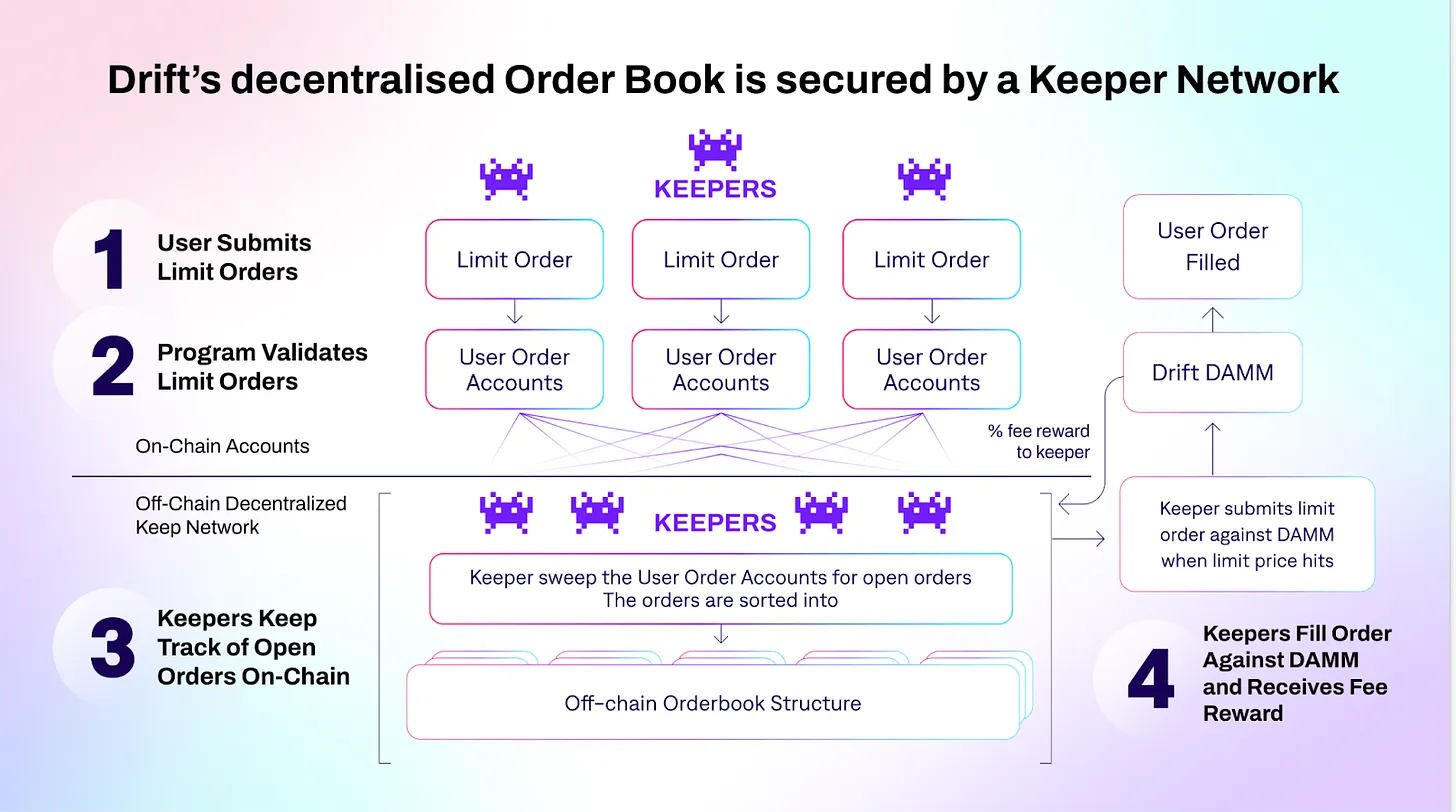

Decentralized Order Book (DLOB) Liquidity

Drift v2 offers a decentralized order book network. The underlying mechanism is simple: a group of bots called Keepers are responsible for recording, storing, matching, and executing submitted limit orders. Each Keeper bot maintains its own off-chain order book. Orders are ranked by price, duration, and position size. When an order reaches its trigger price, the Keeper submits a transaction against the DAMM. In return, Keepers earn a portion of trading fees determined by a mathematical formula (explained in detail elsewhere). Notably, if buy and sell orders have identical parameters (e.g., buying 1 SOL at 110 USDC vs. selling 1 SOL at 110 USDC), Keepers can directly match them without going through the vAMM, improving efficiency.

Overall, to address solvency concerns, Drift v2 decentralizes order execution across real liquidity sources such as JIT, DLP, and direct order matching in DLOB—implying greater collateralization.

Additional Features

Spot Trading

Drift v2 supports spot trading and spot margin trading. Unlike perpetual trading, all forms of spot trading are backed by real underlying assets. For instance, spot trading liquidity comes from the OpenBook DEX. Moreover, spot and margin trading allow users to increase leverage on their spot positions by borrowing assets on Drift v2. Both methods primarily aim to hedge perpetual positions.

Swap

Swaps on Drift rely on Jupiter routing to deliver the best prices to users. However, liquidity originates from Drift v2 itself. Users can also utilize flash loans to increase leverage in swaps.

Lending

Drift’s lending module works similarly to Aave, employing an over-collateralization mechanism. When you deposit assets into Drift, they automatically generate yield.

Growth Catalysts

Incentive Expectations

Drift launched its v1 in 2021. To date, Drift has operated without a native token, missing early opportunities to incentivize user adoption. Nevertheless, Drift v2 has already achieved over $5 billion in total trading volume and serves nearly 100,000 users.

On January 24, 2024, Drift announced it would join the points-meta initiative, launching its own points system for a three-month period. With a strong team and a history of rapid product iteration, we believe Drift Protocol will capture greater market share and trading volume following the rollout of its points program.

The Solana Advantage

Solana’s resurgence in 2023 has been exciting, especially toward year-end.

-

High-quality projects like Jito have brought more liquidity to Solana.

-

Thanks to Solana’s technical advantages, meme coins have flourished—Bonkbot earned $10 million in fees in December, and BananaGun launched its own Solana version.

-

Narratives around DePIN and RWA have brought increased visibility to Solana.

The surge in TVL, users, and on-chain activity driven by Solana’s ecosystem expansion will serve as a fundamental driver for Drift’s growth. Drift will have more opportunities to capture yields generated by DeFi protocols, while the launch of active assets will create demand for leveraged trading.

Potential Opportunities

We observe many perpetual DEXs growing via different strategies. Drift’s leadership position within the Solana ecosystem is one of its greatest strengths. Since the start of the meme season, increasing numbers of long-tail assets have emerged with substantial trading volumes and solid liquidity. If Drift lists more popular tokens akin to HyperLiquid, it could become Solana’s primary degen hub.

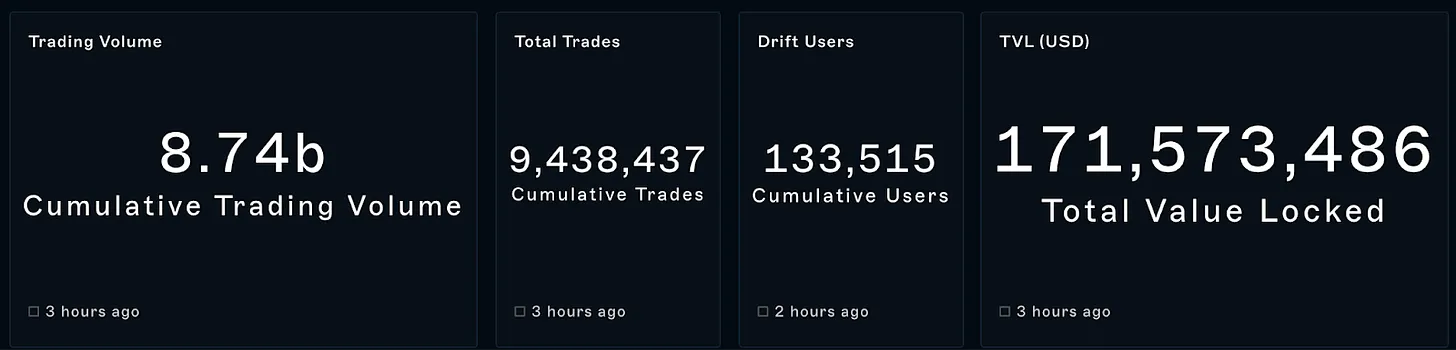

Drift v2 currently holds $171 million in TVL, ranking fifth in the derivatives category on DeFiLlama. Of this TVL, DLP accounts for approximately $16 million, the market maker vault holds $16 million, and the insurance fund vault contains $10 million. The remainder consists of depositors’ assets. Drift currently serves 133,000 users and has facilitated over 9.4 million transactions, indicating a robust asset and user base.

Although daily trading volume ranges between $50 million and $100 million, it still lags significantly behind competitors in other ecosystems. Meanwhile, low trading willingness and unattractive yields from sub-products reduce user engagement. We believe trading activity will improve once Drift rolls out its incentive programs. As a product at the Series A stage, higher profit growth driven by token incentives could boost base yields for depositors, creating a flywheel effect.

Conclusion

From v1 to v2, we can clearly see a trend of continuous improvement in Drift’s vAMM solution—specifically, the integration of real liquidity and enhanced oracle intervention in pricing. While this may seem to contradict the original vAMM design philosophy, combining real liquidity with vAMM can actually enhance user experience, especially when trading long-tail assets. With the introduction of tokens and a points system, Drift is poised to become increasingly profitable.

However, Drift also faces clear drawbacks. Thanks to Solana’s high performance, the hybrid liquidity solution has turned trading on Drift into an order-flow model. As a result, Keepers and DLPs—as liquidity providers—do not enjoy equal standing during trade execution, diminishing DLP appeal. We believe the upcoming token launch may unlock further potential for improvements.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News