2024 Bull Market Outlook: What Do Top Institutions Think?

TechFlow Selected TechFlow Selected

2024 Bull Market Outlook: What Do Top Institutions Think?

In 2023, the entire cryptocurrency industry moved past the lows and despair of the bear market and began a small bull run.

Author: Huohuo

2024 is a year full of hope for the crypto market, with everyone's attention focused on promising new sectors within the space — and top-tier institutions are no exception. At the beginning of the year, numerous organizations released their research reports, offering professional and detailed outlooks for 2024 that are highly valuable as reference points.

Baihua Blockchain has reviewed research reports from 23 leading institutions (including Messari, a16z, Coinbase, MT Capital, etc.), aiming to summarize and identify "institutional consensus" to increase predictability. The findings are compiled below:

Top Ten Sectors Widely Anticipated

1) Bitcoin Ecosystem Revival

Following the launch of Ordinals—a digital content encoding method based on Bitcoin—in December 2022, inscriptions and the broader Bitcoin ecosystem gained significant momentum. In 2023, the Bitcoin ecosystem experienced strong growth, with Bitcoin’s dominance (its share of total cryptocurrency market capitalization) rising from 38% in January to around 50% in December, making it one of the most noteworthy ecosystems in 2024.

Institutional forecasts generally express optimism about the development of the Bitcoin ecosystem this year:

Bitwise, a mainstream U.S.-based crypto index fund manager, predicts that Bitcoin’s price will surpass $80,000 in 2024;

Coinbase believes institutional investment will remain primarily focused on Bitcoin at least through the first half of 2024, as ETF approvals will drive strong demand from traditional investors entering the market.

Other institutions also hold positive views, mainly due to the following factors:

The U.S. Securities and Exchange Commission (SEC) has approved spot Bitcoin ETFs, and the next major event—the April Bitcoin halving—is approaching, which is expected to bring significant shifts in supply and demand;

The Bitcoin ecosystem will continue advancing through infrastructure upgrades and enhanced programmability, including base-layer protocols like Ordinals, as well as Layer 2 and other scalability solutions such as Stacks and Rootstock.

2) Growth of Ethereum Layer 2

Beyond the Bitcoin ecosystem, Ethereum—as the pioneer of smart contracts—has seen its Layer 2 developments consistently highlighted by institutions as a key trend for 2024. This is especially true given Vitalik Buterin’s release of Ethereum’s 2024 roadmap and the upcoming Dencun upgrade, which have already triggered sharp increases in token prices for Ethereum L2 projects like ARB and OP.

Competition among public blockchain ecosystems has always been intense. In 2023, chains like Solana and Avalanche developed rapidly, even outpacing Ethereum at times. However, Ethereum, as the market leader, is now pushing forward aggressively. Most institutional forecasts expect that once the Dencun upgrade is complete, gas fees will drop significantly, potentially triggering an explosive growth of the Ethereum Layer 2 ecosystem in 2024. Bitwise, for example, believes Ethereum’s major upgrades could reduce average transaction costs below $0.01, laying the foundation for more mainstream applications.

If upgrades proceed smoothly, leading Ethereum L2 projects (such as Optimism, Arbitrum, and Base) will be able to compete effectively with other Layer 1 blockchains in terms of performance.

Additionally, according to Vitalik Buterin’s long-term vision, zero-knowledge proofs represent the future of Ethereum’s Layer 2, with zkSync and StarkWare being two particularly promising projects in this space.

3) Development of the Solana Ecosystem

In 2023, the Solana blockchain ecosystem performed impressively, building a solid foundation for long-term growth through both technical progress and community engagement. Its breakout success attracted substantial user activity and capital inflows.

Institutions predict that in 2024, more projects will choose to build on or migrate to Solana, fueling continued expansion of its ecosystem. This is due to Solana’s strengths across multiple dimensions—including TPS, gas fees, and active community users—making it highly resilient.

Institutional expectations for Solana in 2024 focus on several key areas:

Technical upgrades such as Tinydancer, which enables lightweight clients allowing validators to verify blocks at lower cost, thereby enhancing decentralization;

Performance improvements including higher throughput, better user experience, and deployment of new token standards, all contributing to greater robustness;

Launch of new products, increased on-chain liquidity, and expanded developer tools driving prosperity in Solana’s DePIN ecosystem.

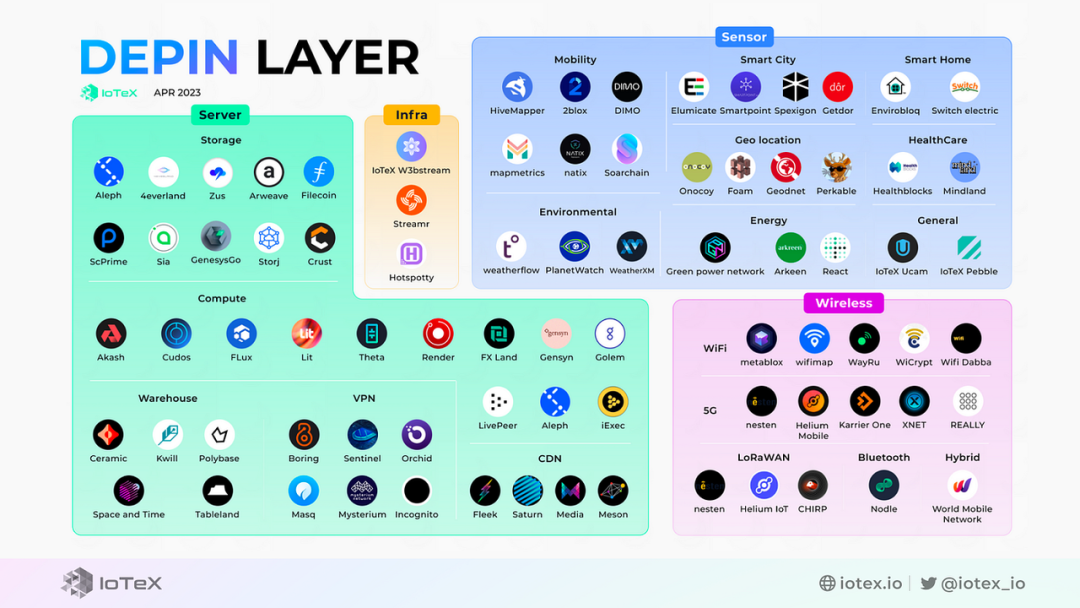

4) DePIN (Decentralized Public Internet Network)

DePIN, or Decentralized Physical Infrastructure Networks, represents a novel approach to building and maintaining real-world infrastructure, aiming to create decentralized networks across industries such as telecommunications, energy, mobile communications, and storage. In 2023, there were over 650 DePIN projects, with a combined market cap exceeding $20 billion and annual revenue surpassing $150 million.

Overview of DePIN development in 2023

In 2024, CoinMarketCap, a cryptocurrency data platform, has listed DePIN as a standalone category, reflecting the growing market interest in this sector.

DePIN spans a wide range of fields including server networks, wireless networks, sensor networks, and energy grids. Current forecasts suggest significant growth potential. For instance, Messari estimates the current industry size at approximately $2.2 trillion, projecting it could grow to $3.5 trillion by 2028. Messari specifically highlights the following sub-sectors within DePIN: cloud storage, decentralized databases, decentralized wireless networks, and integration with AI.

However, institutions also note that DePIN’s maturation will require sustained investment, operational development, and collaboration between markets, institutions, and developers before it can gradually integrate into daily life and applications—evolving from complementary to parallel, and eventually replacing existing infrastructure.

5) Integration of AI and Blockchain

The rapid advancement of artificial intelligence (AI) in 2023 has accelerated the development of AI + Web3 services. By early January 2024, the market capitalization of AI-related tokens reached $7.04 billion. Given AI’s increasing adoption, most predictions favor leveraging AI as a core feature to enhance the appeal of blockchain-based crypto platforms.

The sectors currently favored by institutions include:

-

Direct application of AI in crypto: Integration of trading bots, automated payments, and arbitrage bots with blockchain. Use cases include AI agents using crypto infrastructure for payments, smart contracts securely scheduling AI models, and token rewards for individuals fine-tuning models and collecting valuable data. Messari believes advances in AI will increase demand for cryptocurrency solutions.

-

Innovative applications combining AI and crypto technology: Here, AI improves Web3 user experience and efficiency, while blockchain technologies serve as safeguards and transparency layers for AI. Examples include ongoing research and new use cases in zero-knowledge machine learning (ZKML), and games enabling users to train AI agents via ERC-6551.

-

Bankless analyst Jack Inabinet believes that crypto + AI could be an explosive combination. While early activities largely involved low-value projects riding the hype wave, the long-term potential remains immense.

-

Crypto firm DWF believes that guiding societal awareness and understanding limitations of centralized AI will create significant potential for decentralized AI in 2024, positioning Web3 to lead the future of AI.

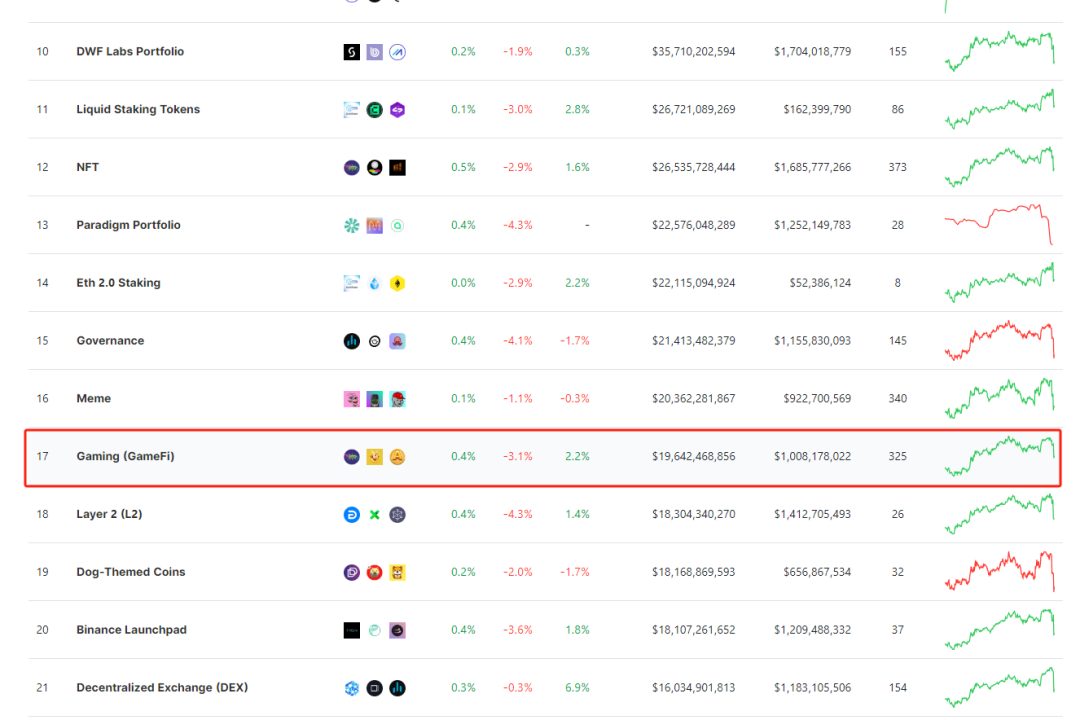

6) GameFi Explosion and Growth of On-Chain Gaming

In 2021 and 2022, on-chain gaming flourished—from "Play to Earn" to "X to Earn"—with breakout projects like Axie Infinity and Stepn gaining massive popularity. In contrast, 2023 was relatively bleak for blockchain gaming. Yet, with improving infrastructure, institutions remain optimistic about the future of on-chain gaming.

From a traditional Web2 perspective, gaming is an exceptionally promising market, deeply integrated into many people’s lives. Moreover, most traditional game users still lack awareness of GameFi (Gaming). From a Total Value Locked (TVL) standpoint, as of this writing (February 1, 2024), the GameFi sector’s TVL stands at only $19.6 billion.

TVL overview across sectors, source: coingecko.com

Regarding GameFi’s growth potential, many anticipate a larger narrative emerging in 2024–2025, attracting greater attention.

For example, Wale Swoosh, researcher at Azuki, believes gaming will be one of the defining trends of 2024. He argues that games have always been—and will remain—a powerful Trojan horse in crypto applications, and is confident that the Web3 gaming trends observed at the end of 2023 will not only continue but intensify in the coming year.

Kelvin Koh, Co-Founder and CIO of Spartan Capital, expects a wave of AAA-grade Web3 games to launch in 2024, bringing millions of new Web3 users.

Overall, institutional optimism toward GameFi centers on two main points:

First, an increasing number of blockchains dedicated to gaming are emerging. Beyond established public chains, newer ones like Oasys and Sui are joining the space;

Second, the involvement of major traditional gaming companies. For example, Oasys has attracted renowned publishers such as Ubisoft Entertainment, Square Enix, Activision Blizzard, and Epic Games into its ecosystem.

7) Advancement of Modularity and Zero-Knowledge Proof (SNARK) Technologies

In 2023, modular blockchains and zero-knowledge proofs (ZKP) saw substantial development, exemplified by projects like Celestia and zkEVM. A clear trend emerged: these narratives began converging, with ZK projects adopting “modular” approaches tailored to specific verticals such as coprocessors, privacy layers, proof markets, and zkDevOps.

Leeor Groen, Managing Director at Spartan, believes privacy and security will be key drivers in Web3. As technology evolves, users will begin recognizing the value of zero-knowledge proofs and modular blockchains—even if they remain unaware that these underpin various applications ranging from digital identity to gaming.

a16z believes the rise of modular tech stacks offers major advantages through open-source and modularity. With formally verified tools becoming widely adopted by developers and security experts, the next generation of smart contract protocols is expected to be more robust and less vulnerable to costly hacks. Mainstream adoption of SNARKs technology is inevitable.

Looking ahead to 2024, institutions and researchers alike expect this trend to continue, with zero-knowledge proofs serving as interfaces between different components of modular blockchain stacks. This provides developers greater flexibility in building dApps while lowering entry barriers. For end users, ZKPs may become a means of protecting identity and privacy—for example, through zk-based decentralized identities.

Another highlight is SNARKs’ ability to generate cryptographic proofs for specific computations, enabling verification speeds far exceeding the original computation time—making SNARK-based projects a top focus for 2024.

8) Mobile and Decentralized Trends May Become Mainstream Channels, Enhancing User Experience

Regardless of the ecosystem, any blockchain aiming for long-term success must ultimately attract new users and encourage existing ones to participate more actively. With market recovery, improved infrastructure, and strategic moves by institutions, widespread user adoption in crypto is widely expected in 2024.

Eddy Lazzarin, CTO at a16z, notes that although crypto UX has long been criticized, developers are actively testing and deploying new tools to reset the front-end experience—such as multi-party computation, simplified passwordless logins, and embedded wallets. These innovations will provide users with safer, smoother experiences when interacting with crypto apps.

Overall, institutional optimism rests on two primary reasons:

On one hand, a major theme during the recent bear market has been improving usability and accessibility of crypto technology. The added burden of managing cryptocurrencies—wallets, private keys, gas fees, etc.—is not suitable for everyone, hindering industry maturity unless critical UX challenges are overcome. Developments around account abstraction, for example, aim to improve wallet recovery mechanisms and create fail-safes against simple human errors like lost private keys.

On the other hand, Ethereum’s Dencun upgrade is expected to reduce rollup transaction fees by 2–10x, leading many to believe more dApps will pursue "gasless transactions," allowing users to focus solely on high-level interactions.

9) Regulatory Policies

Over the past year, the crypto industry has faced increasing regulatory scrutiny. As the sector grows, compliance with regulations has become an unavoidable challenge.

Many institutions predict that in the new year, with leadership transitions and elections in various countries, additional regulatory policies will emerge.

Ji Kim, General Counsel and Global Policy Head at the Crypto Innovation Council (CCI), believes one of the bigger stories in 2024 will be jurisdictions competing to become leading hubs for digital assets and the future financial system.

Gillian Lynch, EU Lead at Gemini, believes that despite differing views on crypto and blockchain, most agree the industry needs a regulatory framework centered on consumer protection, balanced with clear, consistent rulebooks that ultimately foster innovation.

Stuart Alderoty, Chief Legal Officer at Ripple, expects the SEC’s lawsuit against Ripple’s XRP token to conclude in 2024, though its regulatory strategy may continue targeting other prominent figures. The U.S. Congress will strive to reach a broad agreement on crypto regulation, though the optimal path remains uncertain.

Sectors Receiving Less Attention

RWA and NFT are relatively controversial sectors, with mixed predictions and fewer mentions overall.

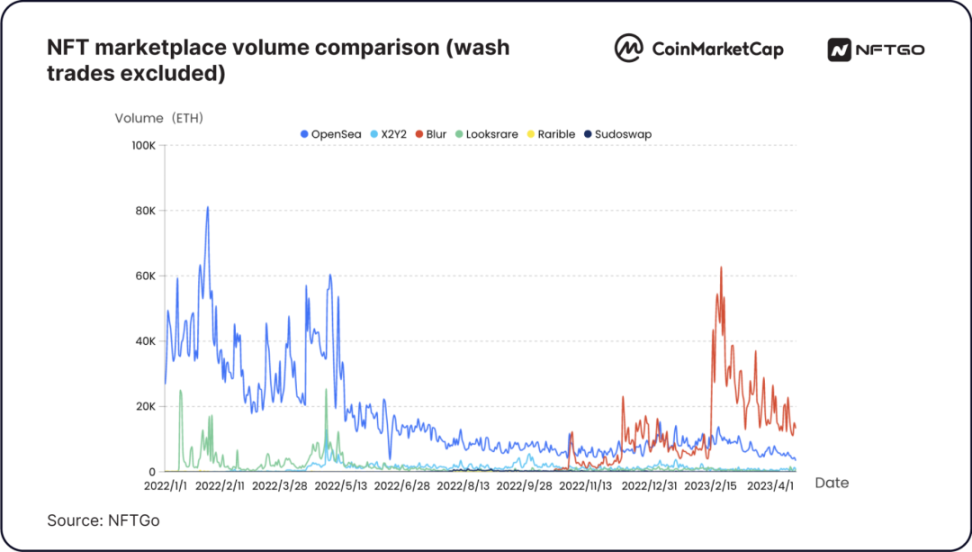

1) NFT

Compared to the booming inscription trend, NFTs remained sluggish throughout 2023. Except for a few standout projects, even top-tier blue-chip NFTs struggled with rebounds rather than reversals. Take BAYC as an example: its average price started the year at 71 ETH but fell to under 30 ETH by year-end.

The NFT marketplace landscape also shifted dramatically. Blur went from fiercely competing with OpenSea at the start of 2023 to nearly monopolizing market share by year-end, while OpenSea—once dominant—captured only 20% of weekly trading volume in December 2023. Despite product updates and community outreach efforts, OpenSea’s attempts to counter Blur had limited impact. With Blur’s rise, debates over zero royalties faded, and discussions about whether creators should earn royalties have largely disappeared.

NFT Marketplace Market Share Comparison in 2023

Some institutions believe consumer brands will leverage NFTs to create new models of user engagement, further boosting liquidity in collectibles and art markets. If GameFi takes off, NFTs—as essential in-game components—could ride that wave. A16z stated that an increasing number of well-known brands are launching digital assets via NFTs for mainstream consumers, and by 2024, NFTs are poised to become standard digital brand assets.

Others argue that NFT trading volumes are unlikely to return to the 2021 peak, as most NFT projects were driven more by hype than sustainable value creation, requiring creators to adjust strategies to remain competitive.

2) RWA

Compared to NFTs, more institutions express optimism about RWA:

A researcher at The Block believes the approval of spot Bitcoin ETFs has sparked heightened institutional interest, widening the bridge between DeFi and TradFi. As more traditional financial instruments move on-chain, tokenized real-world assets (RWA) are seeing greater adoption, hence the bullish outlook.

Bitwise believes RWA will spark a new wave, citing JPMorgan’s plans to tokenize funds and bring them on-chain under Wall Street demand.

Delphi Digital sees RWA as one of the most successful areas in crypto during 2023 and expects continued growth in 2024.

In summary, their reasoning includes:

Facilitating communication between traditional institutions and the crypto world. RWA tokenizes off-chain assets into blockchain-native digital assets, making them easier to understand. Stablecoins are a common RWA application, representing fiat-backed tokenized forms.

Major institutions are increasing investments in RWA, and crypto projects like Chainlink are collaborating with the world’s largest traditional financial institutions to bring vast amounts of RWA on-chain and tokenize them.

RWA is building a financial ecosystem where digital tokens represent tangible assets, making them more accessible and scalable to the general public—not just privileged or institutional investors. RWA covers diverse categories such as private credit, government bonds, real estate, commodities, stablecoins, and insurance, offering vast application potential.

However, skeptics argue:

As interest rates peak, on-chain yields from government bonds have emerged. Cryptocurrencies now offer returns comparable to—or exceeding—those sought by traditional finance investors, but underlying demand still needs deeper exploration. This evolution will take time, making significant breakthroughs in 2024 unlikely.

3) SocialFi

SocialFi blends social media with DeFi. Macroscopically, Web2 has evolved from social to financial functions, while Web3 is shifting from finance toward social.

Looking back at Web2 social media, Twitter took five years to reach 100 million users, and Facebook eight years to hit 1 billion. In comparison, SocialFi remains a relatively new concept.

SocialFi attracted investor attention in late 2021, with projects like Whale, Chiliz, Rally, BBS Network, Showme, and Mirror.xyz gaining fame—some platforms even saw invite codes become highly coveted. However, as the broader market turned bearish, SocialFi activity declined.

Its resurgence came in August 2023, when friend.tech launched a novel social experience on Base Layer 2, allowing users to buy and sell “shares” of others’ X (Twitter) profiles. It peaked at 30,000 ETH in TVL in October and inspired several copycat projects. By financializing Twitter profiles, friend.tech introduced a new token economic model for the SocialFi space.

However, among institutional forecasts, few mention SocialFi’s outlook for 2024. Occasional references cite the spread of decentralization ideals leading to more decentralized social media networks and tools—but whether they achieve mainstream breakout remains to be seen.

Conclusion

Overall, 2023 marked the crypto industry’s emergence from the depths of a bear market, transitioning into a nascent bull phase. Public blockchain ecosystems led by Bitcoin have entered a new stage of development, with fresh narratives and emerging sectors taking turns in the spotlight—laying the groundwork for the next major bull run.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News