Luna of This Bull Run? A Deep Dive into Berachain's Brilliant Design

TechFlow Selected TechFlow Selected

Luna of This Bull Run? A Deep Dive into Berachain's Brilliant Design

Berachain will lead DeFi innovation, creating DeFi protocols with high liquidity and high capital efficiency.

Author: Uncle Jian

I. Introduction

Launched at the end of 2021, Berachain is an EVM-compatible Layer 1 blockchain focused on DeFi, built on the Cosmos SDK and utilizing a Proof of Liquidity (PoL) consensus mechanism.

Development History

Berachain originated as a meme chain stemming from the Smoking Bear NFT series, initially launched in August 2021 as the Bong Bears NFT collection. This was later re-based into new collections: Boo Bears, Baby Bears, Band Bears, and Bit Bears.

After experiencing multiple market cycles, the core members of the Berachain team came to deeply appreciate the critical role liquidity plays in DeFi. They believe that, compared to decentralization, scalability, security, and interoperability, liquidity forms the foundational layer. Motivated by this insight, the team decided to design their own Layer 1 blockchain, incorporating strengths from successful DeFi projects while avoiding their shortcomings—thus giving birth to Berachain. The team subsequently developed the Proof of Liquidity (PoL) validation mechanism, which indirectly laid the foundation for Berachain’s three-token model.

On November 28, 2023, Berachain began its internal test phase.

On January 11, 2024—the same day spot Bitcoin ETFs were approved—Berachain officially announced the launch of its public testnet, "Artio." According to official announcements, over 30 native protocols are currently under development, and cross-chain projects such as Pendle, Redacted, Sudoswap, and Abracadabra plan to deploy on both the Berachain testnet and mainnet.

Rumors suggest Berachain will launch its mainnet in Q2 2024.

Funding Overview

On April 20, 2023, Berachain raised $42 million in a funding round led by Polychain Capital, with participation from Hack VC, OKX Ventures, and others, achieving a valuation of $420 million.

Team Background

Berachain was established by an anonymous team. Its co-founders include Smokey the Bera, Papa Bear, Homme Bera, and Dev Bear. Recently, Baloo the Bera, former engineering lead at Mysten Labs, joined as Vice President of Engineering. Other team members remain unknown. Most of the team have been involved in crypto since around 2015, possessing deep understanding and experience in DeFi and blockchain development. Despite being anonymous, securing $42 million in funding indicates strong connections and credibility within the crypto ecosystem.

II. Mechanism Overview

According to co-founder Smokey the Bera, Berachain was created specifically to solve on-chain liquidity issues. A chain without sufficient liquidity quickly becomes a "ghost town"—a lesson learned by the team after the DeFi Summer.

Let's now explore how Berachain uses innovative design to tackle on-chain liquidity challenges.

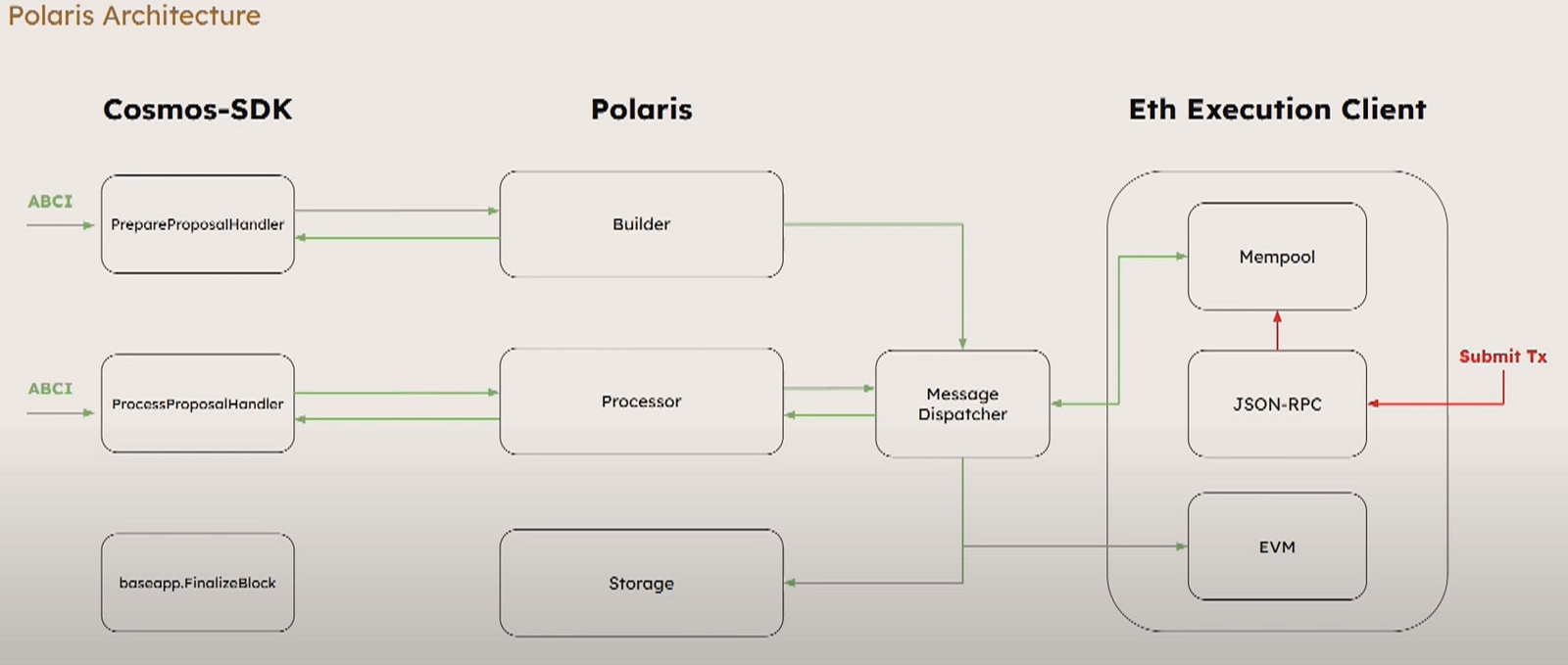

Polaris EVM

Berachain is built on Polaris EVM, where Polaris serves as the EVM-based operating system layered on top of the Cosmos SDK. Polaris connects the EVM and Cosmos SDK via message passing, decoupling block construction, processing, storage, and execution. It also enables developers to create state precompiles and custom modules, allowing them to build more efficient and powerful smart contracts.

Advantages of Using Polaris EVM Framework?

1) Ethereum Developer Friendly

Being EVM-compatible, Berachain offers a familiar environment for Ethereum developers, making it easier to attract developers from other EVM chains.

2) Strong Cross-Chain Interoperability

As a Cosmos-based chain, Berachain naturally supports IBC. As one of the most robust cross-chain communication protocols, IBC removes barriers for external liquidity to flow into Berachain.

Proof-of-Liquidity (PoL) Mechanism

The team aims to address liquidity issues by leveraging the PoL mechanism to attract major asset liquidity into Berachain.

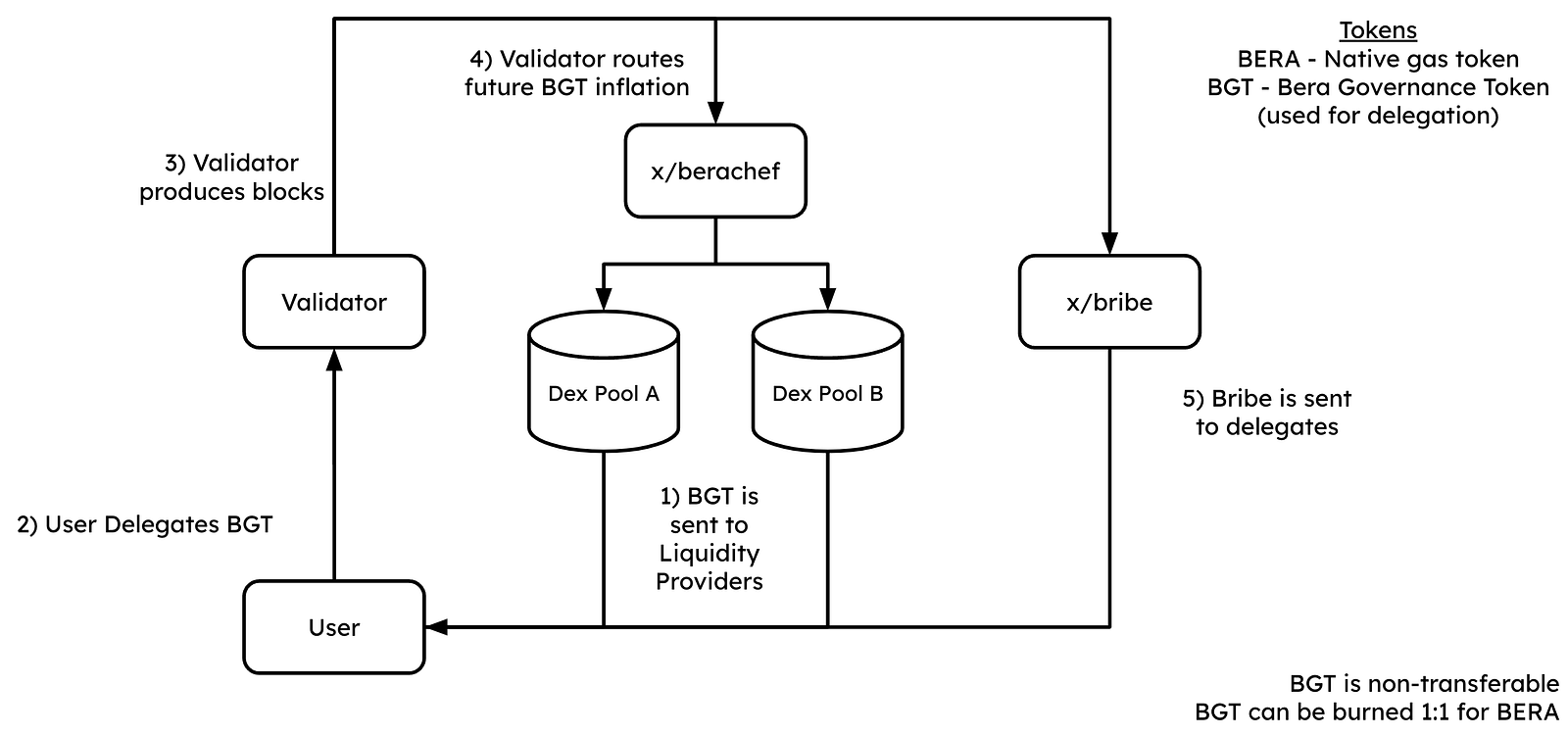

The PoL mechanism works as illustrated above:

1) Users provide liquidity to pools on BEX (Berachain’s native DEX) to earn BGT, the governance token; BGT details are explained in the “Three-Token Model” section;

2) Users delegate BGT to validators, who generate blocks based on the proportional weight of delegated BGT;

3) Both delegators and validators receive rewards (BERA and HONEY) from the network;

4) Validators can vote on inflation rates for BGT across various liquidity pools;

5) Bribes are distributed from validators to their delegators.

What Are the Advantages of PoL Over PoS?

1) Incentivizes Liquidity and Enhances Security

The only way to earn the governance token BGT on Berachain is by providing liquidity to BEX—not through staking any arbitrary token. This strengthens security while simultaneously incentivizing liquidity provision. In contrast, traditional PoS mechanisms may enhance chain security at the expense of reduced liquidity.

2) More Decentralized Inflation

In PoS chains like Ethereum, newly minted tokens are only distributed to ETH stakers. Under PoL, BGT is not directly allocated to validators but instead to liquidity providers of specific assets. This ensures that token emissions aren't concentrated among holders of a single token. Thus, inflation distribution is fairer than in traditional PoS networks, mitigating wealth centralization issues.

3) Aligns Asset Issuance Protocols with Validators

The PoL mechanism encourages cooperation between protocols and validators so that:

-

Validators can influence the allocation of BGT to incentivize liquidity for specific asset pools

-

Protocols help validators gain more governance power by bribing BGT holders

Three-Token Model

Berachain’s three tokens are BGT (governance), BERA (gas), and HONEY (stablecoin).

BGT: Governance token, non-transferable, earned solely by providing LP for certain assets on BEX.

BERA: Gas token, obtained either through 1:1 one-way burning of BGT or as validator rewards.

HONEY: Native over-collateralized USD-pegged stablecoin, serving as the medium for protocol revenue distribution.

Operational Flow

-

Users provide liquidity (BERA, HONEY, or other pairs) on Berachain and earn BGT rewards

-

By delegating BGT governance rights to validator nodes, users earn BERA + HONEY

This three-token model systematically enhances liquidity by:

-

Decoupling the governance token (BGT) from the chain’s gas token (BERA)

-

Making liquidity provision on BEX the sole method to obtain BGT

This means Berachain supports staking of mainstream assets from other chains—unlike PoS blockchains that only offer staking rewards for a single designated token. Berachain thus offers greater diversity in stakable assets to earn BGT, further stimulating liquidity.

Berachain’s three-token model draws valuable lessons from past DeFi projects. For instance, its decentralized governance approach takes inspiration from Curve, encouraging competition among asset issuers for governance control. Meanwhile, HONEY adopts Terra’s concept of a native stablecoin to boost overall protocol liquidity.

III. Key Ecosystem Projects

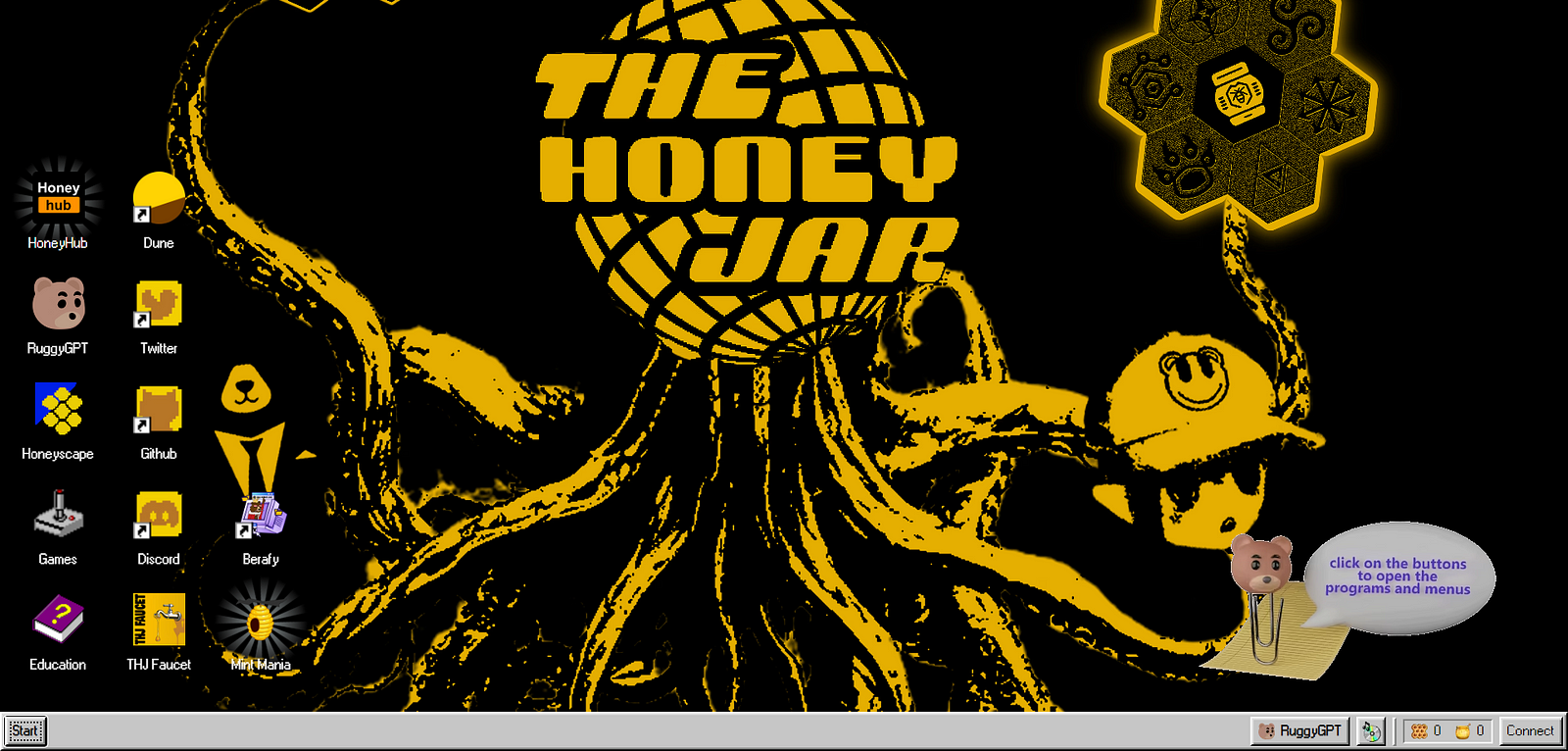

the honey jar

the honey jar serves as the gateway to the Berachain ecosystem, wielding significant influence within the community. It focuses on user education, incubating and promoting ecosystem projects, and facilitating collaborations. Its website is styled like a computer desktop, with all Berachain-related information organized into various “applications.”

Currently, the honey jar has launched the Honey Comb NFT, though no specific utilities have been promised. However, as a core community NFT project for Berachain, Honey Comb aggregates benefits from multiple projects. Holders may receive airdrops, whitelist access, APY boosts, and free NFT mints—all derived from partnership agreements within the Berachain ecosystem.

Equally important to monitor are the projects mentioned by the honey jar and its founder Jani on Twitter.

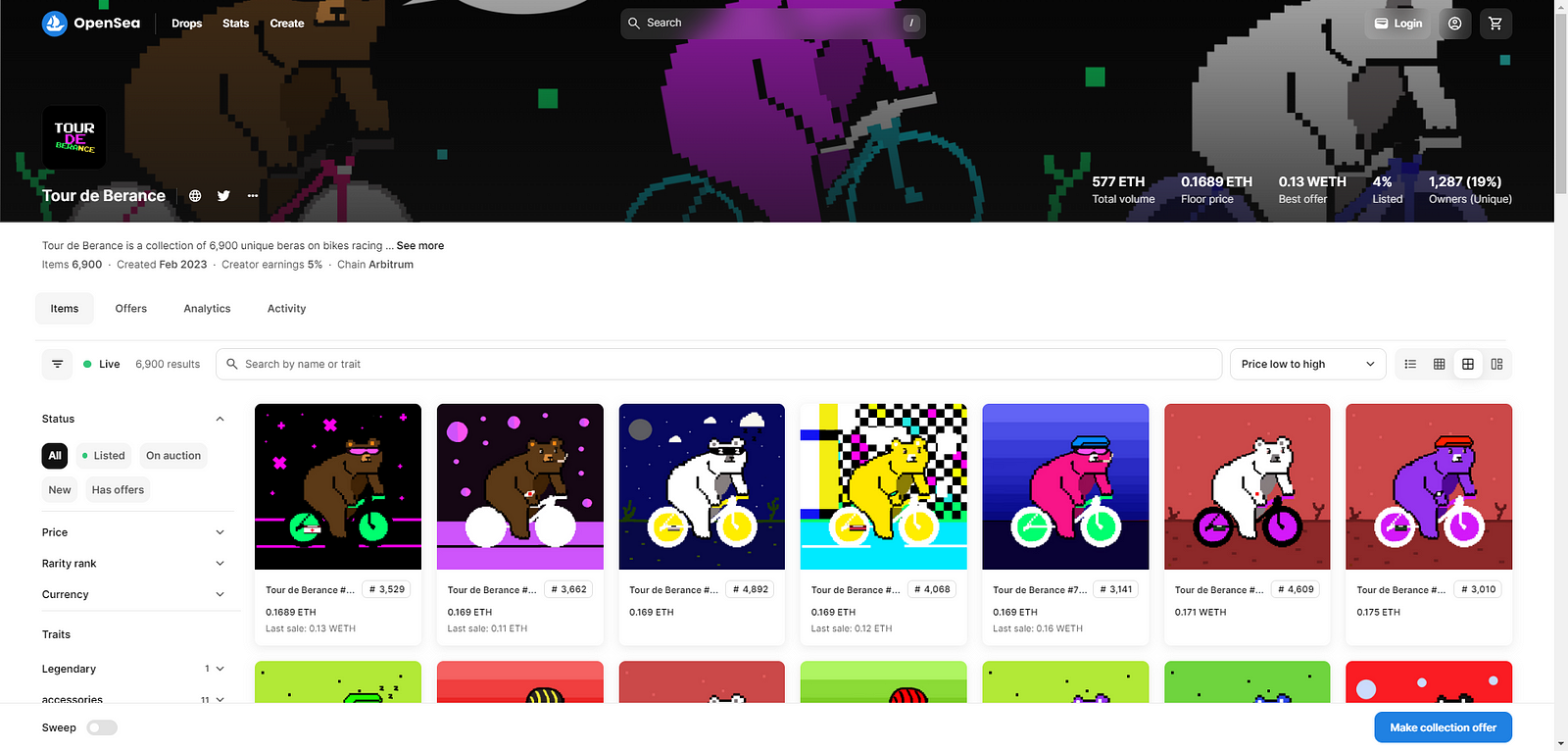

Beradrome

Beradrome is a DEX and restaking liquidity market on Berachain, featuring ve(3,3) tokenomics, built-in bribery, and voting mechanisms. A year ago, the team launched an NFT collection called “Tour de Berance,” humorously nicknamed “Beras on Bikes.” The team has explicitly stated that holders of this NFT series will receive rebase benefits upon Berachain’s mainnet launch and may qualify for future airdrops of BERO or hiBERO tokens. Additionally, Tour de Berance holders have already received oWIG airdrops from another project launched by the team on Base chain.

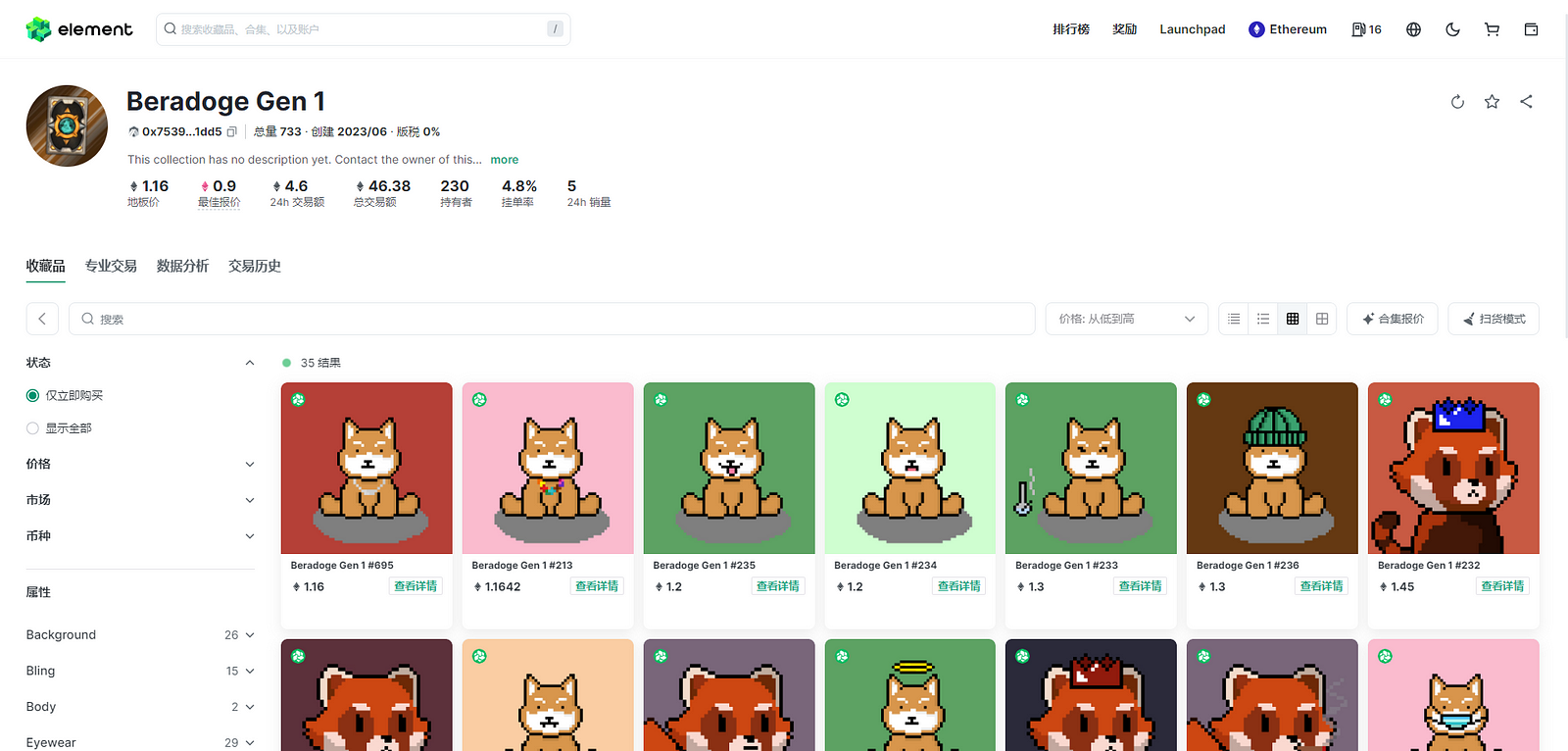

Beradoge

Beradoge (BDOGE) is a highly anticipated meme project on Berachain. It features two NFT collections: “Beradoge Gen 1” and the recently minted “Mibidiots.” According to the team, holding these NFTs entitles users to either “a bunch of useless things” or “a bunch of BDOGE.” There are also rumors that BDOGE airdrops might extend to NFT holders from other Berachain projects.

Sudoswap

Sudoswap is a cross-chain NFT AMM liquidity market that raised $12.5 million in a private funding round at the end of 2022. Its innovation centered on enhancing NFT liquidity aligns perfectly with Berachain’s core philosophy. Sudoswap has announced plans to deploy on Berachain once the mainnet launches. Upon Berachain’s official release, Sudoswap is expected to support bridging of blue-chip NFTs, bringing many high-profile NFTs onto Berachain with incentives—making it one of the first NFT markets to commit to the ecosystem.

Beramonium

Beramonium is Berachain’s gaming offering, launching an idle RPG titled “Gemhunters.” In this game, players assign tasks to their Beramium Genesis beras to collect gems, which can be redeemed for NFTs from other prominent Berachain projects such as Honey Combs and Beradoges. The NFT mint price is set at 0.045 ETH.

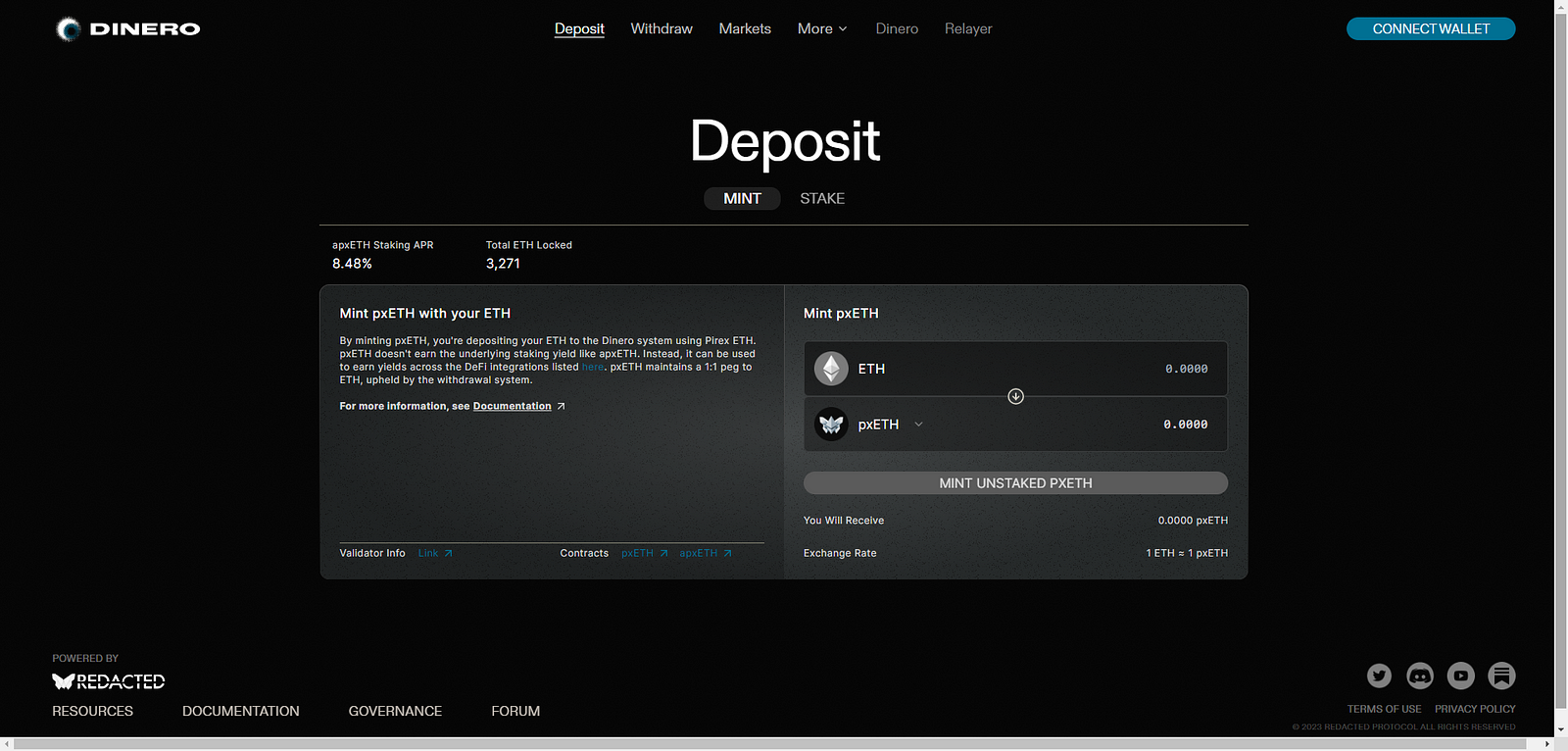

Redacted Cartel

Redacted Cartel is a DeFi yield protocol incubated by the New Order team, with multiple sub-products spanning bribe markets and LSD (liquid staking derivatives). The team has previously announced plans to deploy a new project on Berachain, although further details are not yet available. Given Berachain’s built-in vote-bribery mechanism, DeFi bribe-yield projects like Redacted Cartel are poised to thrive on the chain.

Ecosystem Project List: Link

Conclusion

Berachain’s distinctive three-token economic model separates gas and governance functions, maximizing liquidity release while protecting the interests of active network participants (such as those generating high transaction volumes and gas usage). This resolves the inherent conflict between staking participation in governance and liquidity retention. Therefore, we believe Berachain is well-positioned to lead DeFi innovation and foster highly liquid, capital-efficient DeFi protocols.

Moreover, as user adoption grows and transaction fee revenues increase, Berachain is likely to attract even more users and ecosystem projects. Combined with its governance reward mechanism, this could create a positive flywheel effect.

However, we must remain rational: whether Berachain lives up to expectations depends on its future development—including project execution, ecosystem growth, and protocol security.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News