Pendle's Surge: Yield Farming, Leveraged Bets, and the Winners in EigenLayer's Restaking Narrative

TechFlow Selected TechFlow Selected

Pendle's Surge: Yield Farming, Leveraged Bets, and the Winners in EigenLayer's Restaking Narrative

As Pendle introduces more LRTs and amid speculation about potential AVS airdrops to LRT holders this year, Pendle is likely to continue dominating this market segment.

Author: CHARLES AND HUMBLE FARMER ARMY RESEARCH

Translated by: TechFlow

Although Pendle has been live for quite some time, it began gaining widespread adoption in early 2023 as the LSD sector flourished, positioning itself as a "yield trading" platform. By splitting assets into principal and yield components, Pendle enables the tokenization and trading of yield. It allows users to purchase assets at a discount (similar to zero-coupon bonds) to generate fixed returns, or speculate on the yield of certain income-generating assets through their principal and yield tokens (similar to interest rate swaps).

Since then, with the emergence of yield-bearing stablecoins and more recently liquid restaking tokens (LRTs), the range of yield tokens has gradually expanded, allowing Pendle to continuously iterate and support yield trading across these crypto assets. Pendle’s LRT markets have been particularly successful, as they essentially allow users to pre-position or speculate on long-term airdrop opportunities—including EigenLayer. These markets have rapidly become the largest on Pendle, far outpacing others:

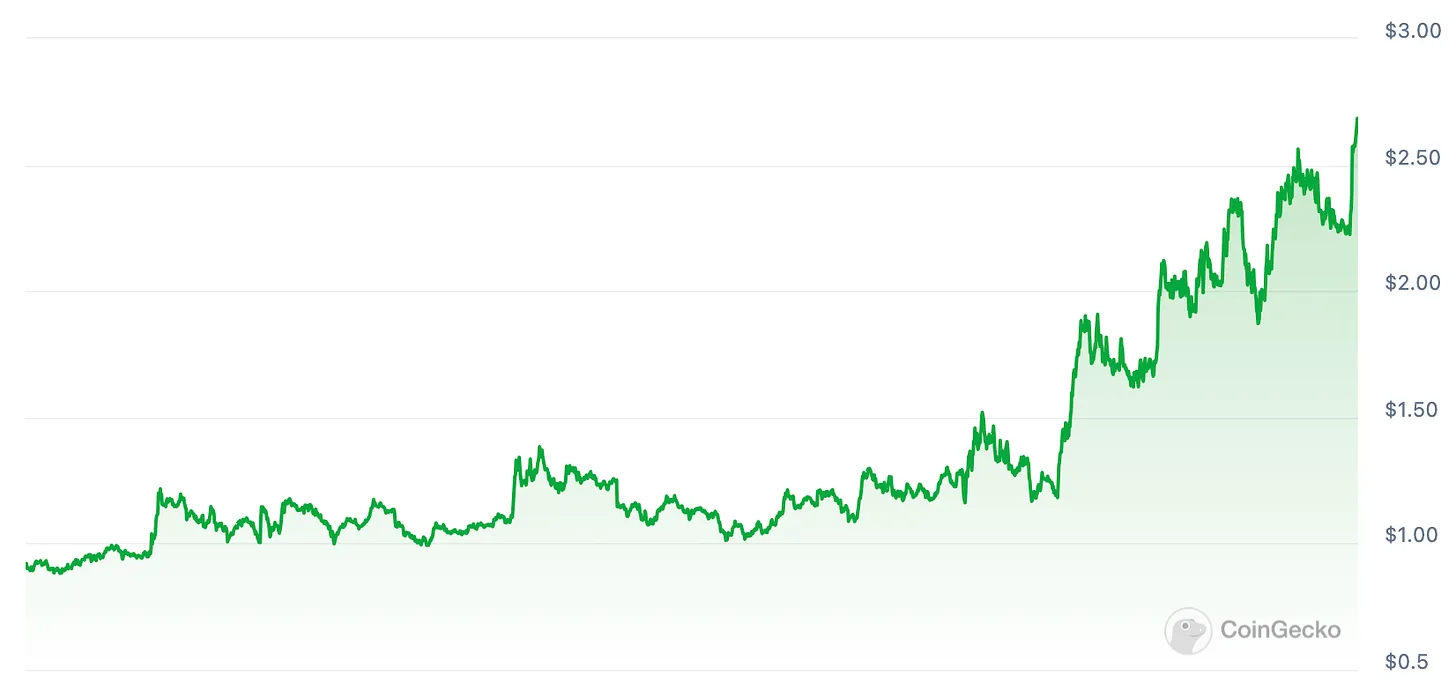

Fueled by the hype around EigenLayer, the product's success has provided positive momentum for the $PENDLE token price:

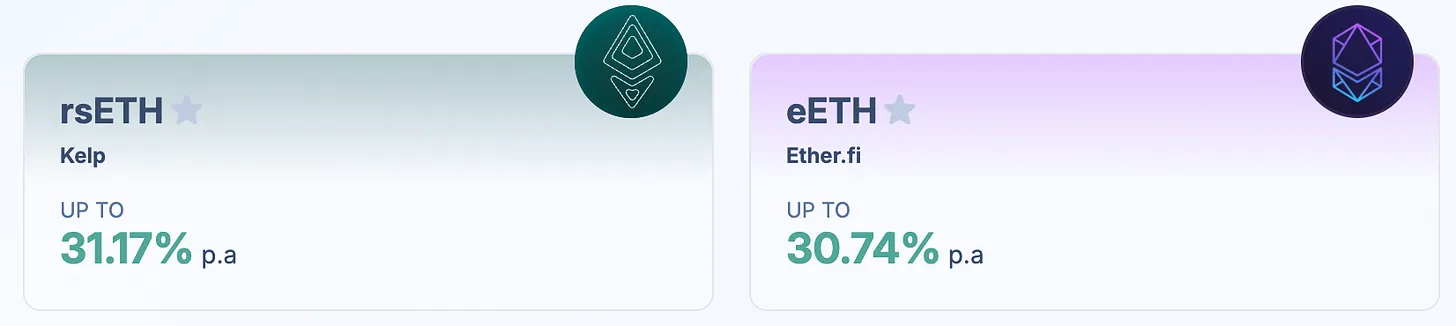

Through customized integration with LRTs, Pendle allows Principal Tokens to capture base ETH yield, EigenLayer airdrops, and any additional airdrops tied to the restaking protocol issuing the LRT. This creates yields exceeding 30% annually for Principal Token buyers:

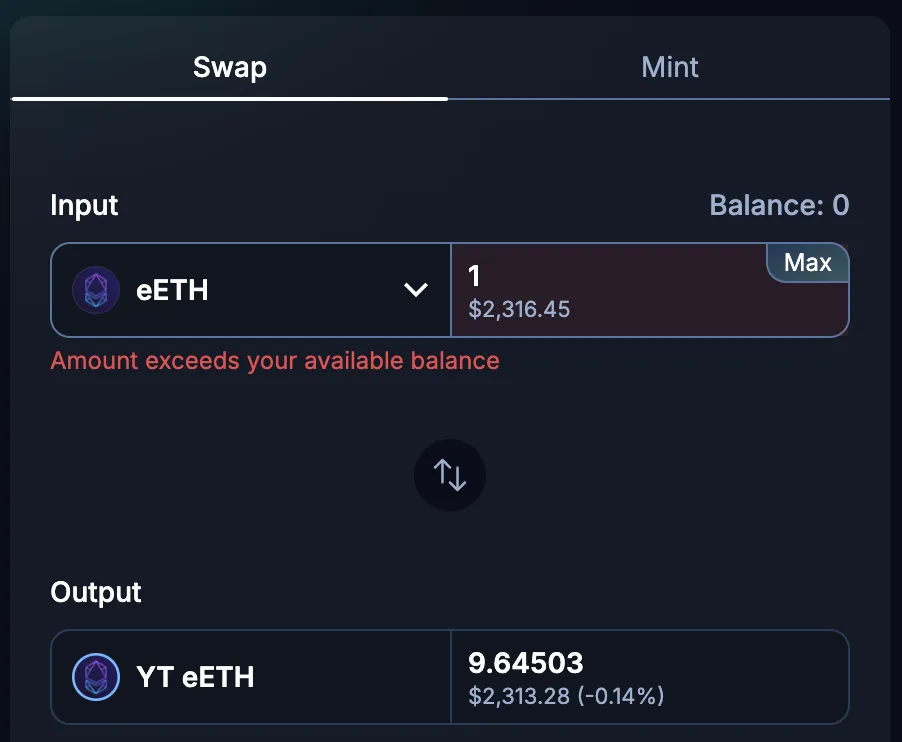

On the other hand, due to how LRTs are integrated into Pendle, Yield Tokens enable a form of “leveraged point farming.” Using Pendle’s swap functionality, we can exchange 1 eETH for 9.6 YT eETH, which accumulates EigenLayer and Ether.fi points just as if holding 9.6 eETH:

In fact, for eETH, Yield Token buyers receive double points from Ether.fi—making this effectively “leveraged airdrop farming”:

Given that Yield Tokens approach zero as maturity nears, Yield Token buyers are essentially betting that the value of EigenLayer and Ether.fi (or Kelp in rsETH) airdrops will exceed the ETH spent to purchase the Yield Tokens.

Considering the anticipated scale of the EigenLayer airdrop and strong demand for liquid staking, it’s no surprise that these LRT markets have garnered the most attention on Pendle. Locking in ETH-denominated airdrop yields and leveraged liquidity mining serve different market segments, but both appear to have substantial demand.

As Pendle introduces more LRTs—and given speculation that AVS-related airdrops may target LRT holders this year—it is likely to maintain dominance in this niche. In this sense, $PENDLE offers excellent exposure to the success of LRTs and the EigenLayer vertical!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News