A Comprehensive Analysis of EigenLayer: A Rising Project That Ethereum Loves and Hates

TechFlow Selected TechFlow Selected

A Comprehensive Analysis of EigenLayer: A Rising Project That Ethereum Loves and Hates

EigenLayer is a unique project capable of competing with Celestia and Polygon, while effortlessly engaging with Cosmos.

Author: BiB Exchange

You've probably heard of a project called EigenLayer recently. What exactly is this project? You may already know something about it. In this article, BiB Exchange will provide a comprehensive analysis of EigenLayer—the new darling of the Ethereum ecosystem that inspires both admiration and concern.

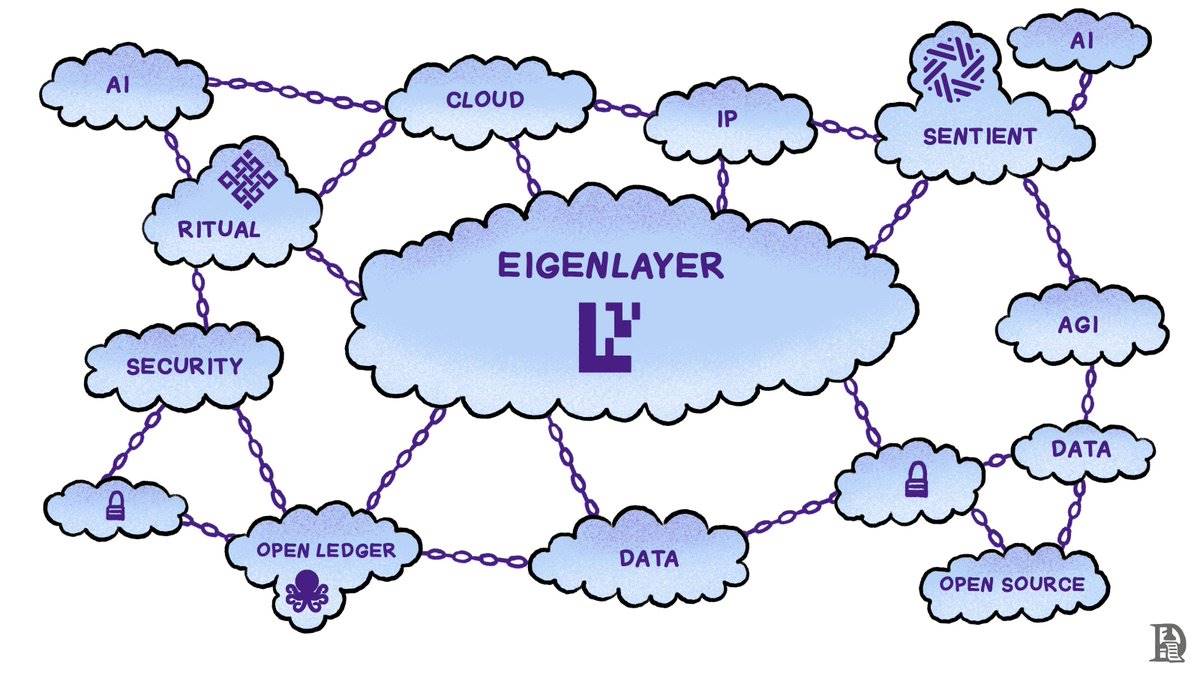

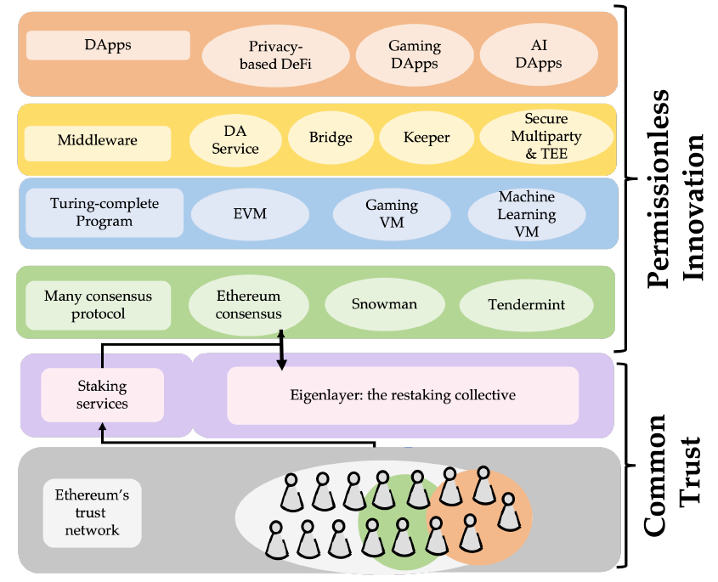

EigenLayer is a tokenized economic security leasing marketplace, primarily offering services such as restaking of LSD assets, node operator staking, and AVS (Actively Validated Services). As a restaking protocol built on Ethereum, EigenLayer delivers Ethereum-grade security to the broader crypto economy based on Ethereum. It allows users to re-stake native ETH, LSDETH, and LP tokens via EigenLayer smart contracts to earn validation rewards, enabling third-party projects to benefit from Ethereum’s mainnet security while earning additional incentives—creating a win-win scenario.

1. Principles

1.1 Starting with Virtual Machines

Conceived in 2013 and launched in 2015, Ethereum revolutionized the blockchain landscape by introducing the Ethereum Virtual Machine (EVM). Ethereum pioneered programmability, allowing decentralized applications (DApps) to be built permissionlessly on its platform. This innovation meant developers didn't need to be trusted—security and liveness were guaranteed by the underlying blockchain, with trust provided by the blockchain itself.

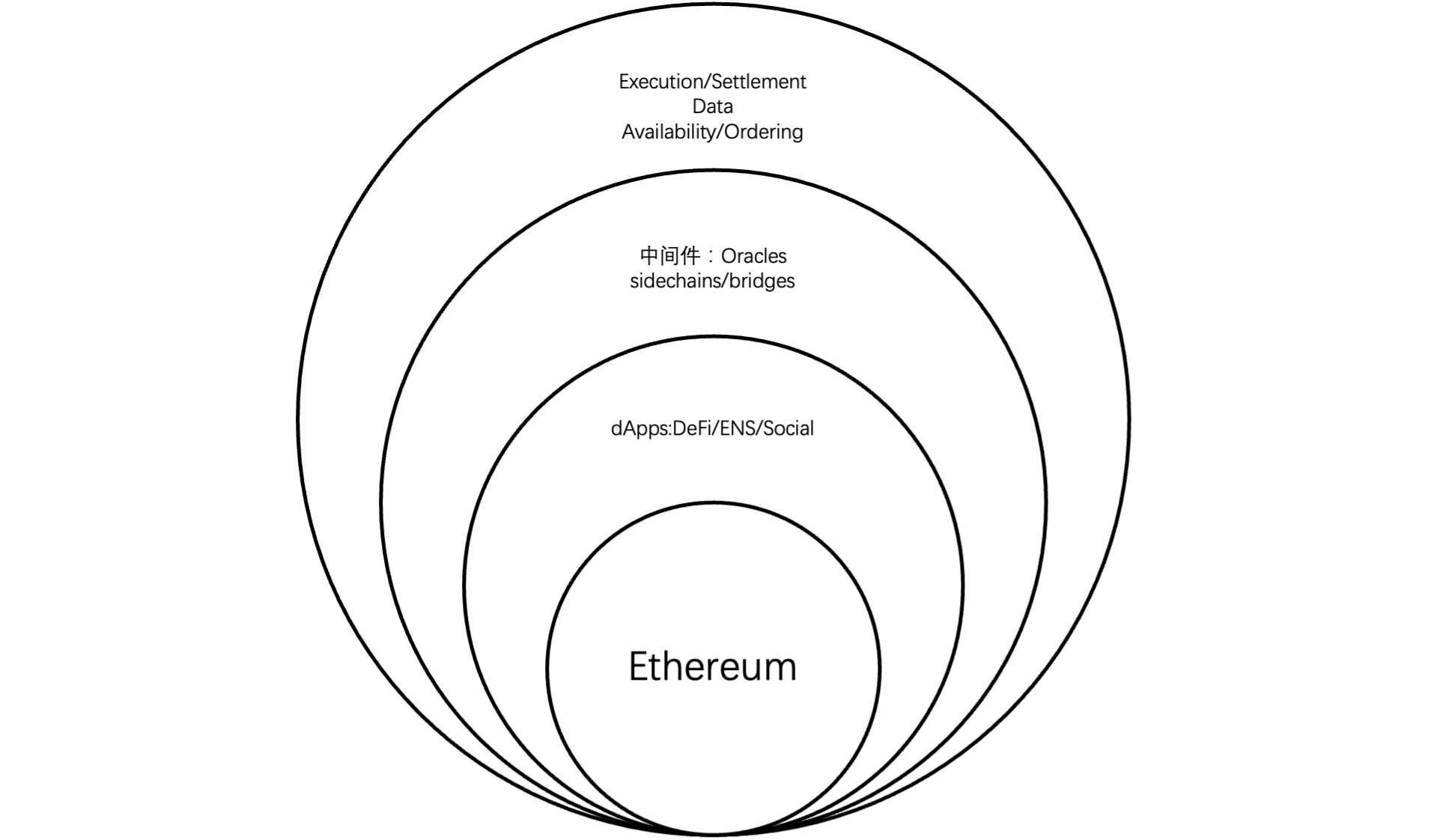

This decoupling greatly accelerated the growth of the anonymous economy, as innovators no longer needed reputation or trust. DApps could be used by anyone who trusts them, while the underlying blockchain could verify their code. Value flows through the blockchain providing trust, which in turn collects fees. As development progressed into the Layer2 era, scalability significantly increased. Rollups outsource execution to single nodes or small groups, while EVM contracts can absorb Ethereum's trust through Ethereum-based proofs.

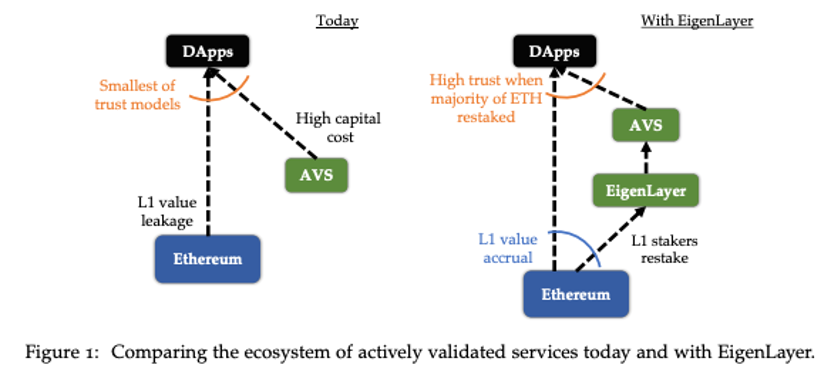

However, traditional validation services clearly lack a trust mechanism. Any module that cannot be deployed or proven atop the Ethereum Virtual Machine (EVM) cannot absorb Ethereum’s collective trust. These modules involve processing inputs external to Ethereum, making their operations unverifiable within Ethereum’s internal protocols.

Examples include sidechains based on new consensus protocols, data availability layers, new virtual machines, management networks, oracles, cross-chain bridges, threshold cryptography schemes, and trusted execution environments. These modules require active validation services with their own distributed validation semantics. Typically, these Active Validation Services (AVS) are either secured by their native tokens or operate under permissioned models.

1.2 AVS

EigenLayer directly connects Ethereum’s security and liquidity, where AVS plays a crucial role. AVS (Actively Validated Services) generally refers to services verifying individual identities or specific information. AVS can apply across multiple domains like finance, telecommunications, and online services, ensuring provided information is accurate, valid, and lawful.

Thus, the essence of EigenLayer is delegating security verification for middleware, data availability layers, sidechains, oracles, sequencers, and other projects seeking low-cost access to Ethereum-level security to Ethereum node operators—a process known as Restaking. EigenDA is a decentralized data availability (DA) service built using EigenLayer’s restaking mechanism on Ethereum and will be the first layer of Actively Validated Services (AVS).

1.3 Business Logic

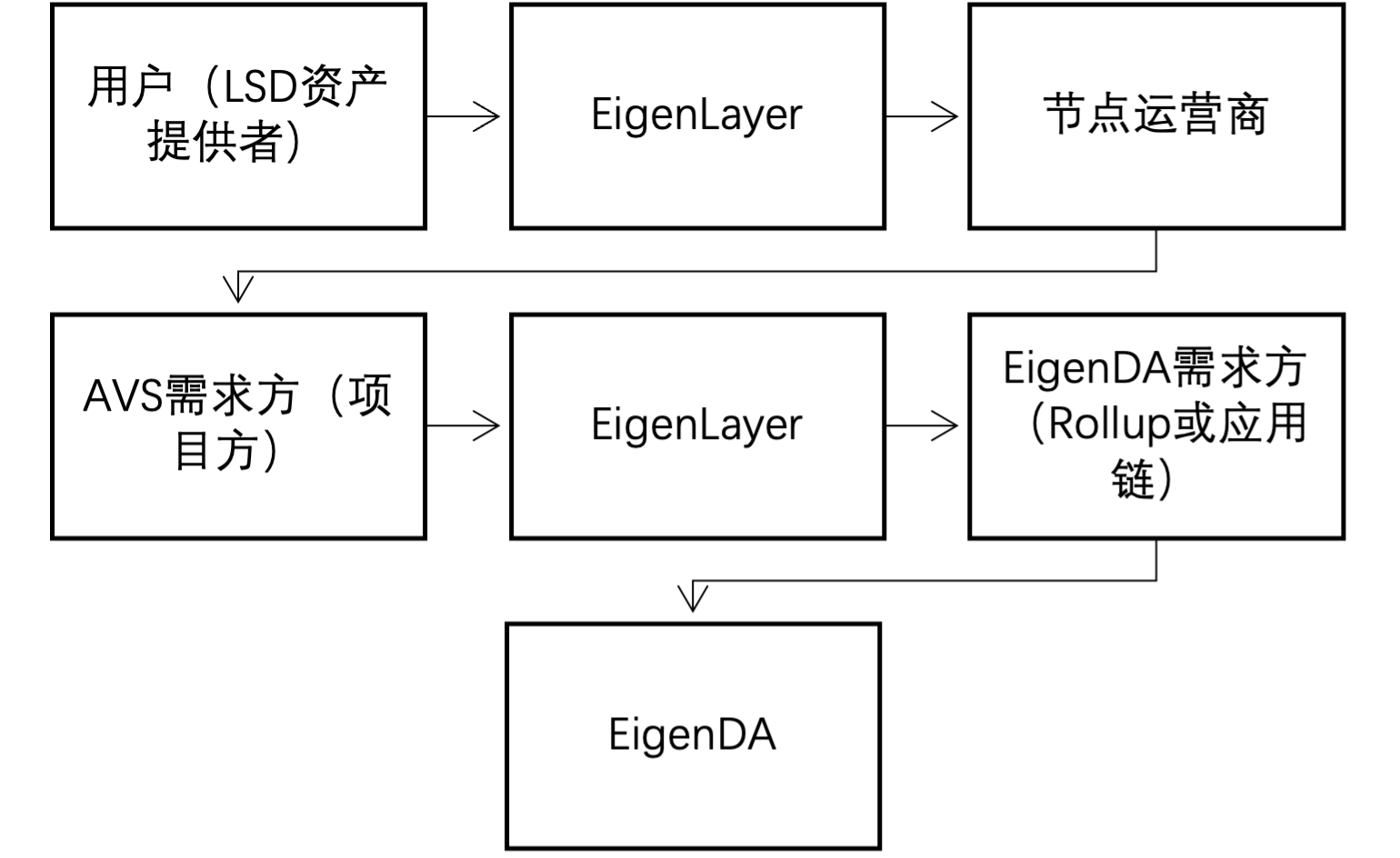

EigenLayer's business logic involves several key concepts including middleware, LSD, AVS, and DA layers. These concepts interweave to form EigenLayer’s complex yet concrete commercial framework. Through its business model—especially features like node operation and AVS services—EigenLayer effectively exports ETH’s security across the entire Ethereum ecosystem. By providing and staking LSD (Liquid Staking Derivatives) assets, users offer additional security support to the Ethereum network.

Based on the diagram above, we can outline the business logic simply:

i. LSD Asset Providers: Users restake tokens like stETH, rETH, cbETH on EigenLayer to provide AVS services to node operators and earn extra yield.

ii. Node Operators: Acquire LSD assets via EigenLayer to provide node services to projects needing AVS, earning node rewards and transaction fees from project teams.

iii. AVS Demanders (Project Teams): Projects purchase AVS services through EigenLayer instead of building their own, reducing costs.

iv. EigenDA Demanders (Rollups or App Chains): Rollups or application-specific chains obtain data availability services via EigenDA.

v. Role of EigenLayer: Reduce the cost for projects to independently build trust networks, expand use cases for ETH LSD, improve capital efficiency and returns on LSD assets, and increase demand for ETH.

1.4 Relationships Among Participants

At the same time, we can identify the required participants here. According to the official whitepaper, EigenLayer’s role in the block structure is illustrated below:

The relationships among key participants are therefore as follows:

-

LSD Asset Providers: Seek additional returns and are willing to stake LSD assets to node operators.

-

Node Operators: Obtain LSD assets from EigenLayer to provide AVS services to projects and receive node rewards and fees.

-

AVS Demanders: Project teams requiring AVS services buy them through EigenLayer rather than building their own.

-

EigenDA Demanders: Rollups or app chains needing data availability services.

2. Concerns Over L2 Data Availability (DA)

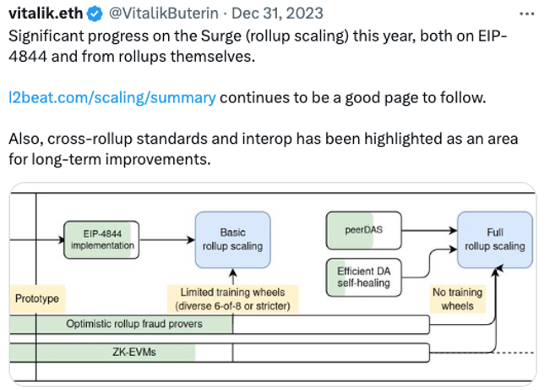

The 11th AMA session by the Ethereum Foundation research team focused on why EIP-4844 was necessary and how Ethereum plans to solve liquidity fragmentation and composability issues on Layer2. This has long been emphasized by Vitalik Buterin.

This is one of Ethereum’s biggest challenges. If there were no Layer2 solutions, would they choose Ethereum for DA or something else? It seems Ethereum feels somewhat helpless, facing competition from Celestia. If other Layer2s stop using Ethereum for DA, Ethereum might slowly fade away. Therefore, Ethereum must accelerate the Cancun upgrade to reduce Layer2 costs.

Vitalik stated: "The key to rollups is unconditional security: even if everyone turns against you, you should still be able to withdraw your assets. If DA depends on external systems (outside Ethereum), this becomes impossible."

Some have questioned this statement, arguing that Vitalik is thinking strictly within Ethereum’s framework without stepping outside. There are similar views in the market—that Layer2 doesn’t necessarily need to publish DA data onto Ethereum to prevent sequencer “data withholding.” Alternatives like third-party DA providers such as Celestia could suffice.

We can visualize four critical levels of DA across external systems relative to ETH via the chart below.

Hence, a major focus of the Cancun upgrade is EIP-4844. Once implemented, Ethereum full nodes will automatically discard some historical data, meaning Layer2 data older than 18 days won’t be backed up across all ETH nodes. At that point, censorship resistance during user withdrawals will no longer approach trustlessness as it does today. Previously, users could prove their Layer2 asset status via Merkle Proofs and achieve trustless withdrawals on Layer1.

2.1 Data Availability

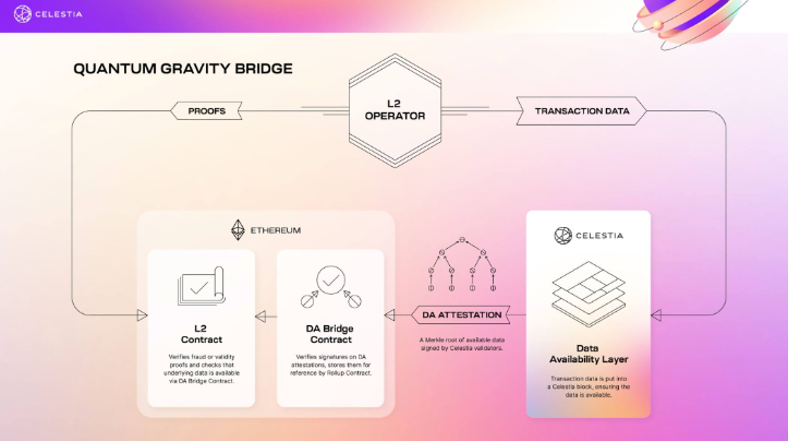

First, let’s examine what Celestia’s DA architecture looks like.

Quantum Gravity Bridge is an Ethereum Layer2 solution that drastically reduces DA storage costs on Ethereum’s main chain by leveraging Celestia-provided data availability (DA) verification. The process includes L2 operators publishing transaction data to Celestia’s main chain, Celestia validators signing the Merkle Root of the DA attestation, and sending it to a DA Bridge Contract on Ethereum for verification and storage. Consensus propagation of Data Blobs on Celestia is achieved via P2P networks and Tendermint, though high-speed download/upload requirements for full nodes result in relatively low actual throughput. Quantum Gravity Bridge uses this method to maintain data availability while lowering costs.

Here, EigenLayer acts as a platform fundamentally dedicated to exporting Ethereum (ETH) security and innovating in data availability (DA). By introducing the Blob space data structure, it overcomes past limitations of relying on calldata for data storage and enhances Ethereum’s mainnet data availability capabilities. Pure Rollup refers to schemes that solely place DA on-chain, requiring a constant 16 gas per byte, accounting for 80%-95% of Rollup costs. With Danksharding introduced, on-chain DA costs will drop significantly.

Compared to calldata’s full-node storage model, Blobs are designed for temporary storage by partial nodes, greatly increasing the amount of data Layer2 can submit to the main chain per batch, boosting TPS. Since storage is temporary, data efficiency improves and storage costs plummet. Enhanced DA capability—with one month of temporary storage—is more than sufficient given OP-Rollup’s seven-day fraud proof window.

Layer2’s transaction volume submitted to the main chain will surge, significantly reducing per-user fees. Before the Cancun upgrade, regardless of how high Layer2 claims its TPS is, most figures come from test environments. Poor real-world Gas fee experiences make Layer2 seem unworthy of its name.

2.2 Centralization of Sequencers

Decentralization of sequencers has remained a market focal point. Surprisingly, even dominant Layer2 players like OP Rollup have only achieved “soft decentralization” through consortium-style social consensus.

Metis, a provider of decentralized sequencer solutions, already ranks third in TVL among L2s. Decentralizing sequencers affects transaction credibility and mainnet interaction security on Layer2. Ignoring this foundational issue makes post-Cancun upgrades in TPS and gas fees feel like castles in the air—someone else will eventually solve the sequencer decentralization challenge.

2.3 Layer2’s Gradual Modular Evolution Threatens Legitimacy

When the Layer2 market reaches a certain scale, the narrow definition of legitimate Ethereum Layer2 may break down. Post-Cancun, third-party DA solutions like Celestia will penetrate Layer2 ecosystems.

OP Stack prioritizes shared sequencers, while ZK Stack focuses on shared prover systems. Both their native DA capabilities and third-party options like Celestia, along with limited mainnet DA, fall within ZK’s strategic territory.

2.4 EigenLayer Provides DA

This is where EigenLayer steps forward. Given many dApps deploy on Layer2 and require data interaction or data availability services from EigenLayer, its integrated Layer2 solutions include Celo transitioning from L1 to Ethereum L2, Mantle and its BitDAO ecosystem products, Fluent offering zkWASM execution layer, Offshore providing Move execution layer, and Optimism’s OP Stack currently using the EigenDA testnet.

EigenDA is a generalized DA solution, similar to Celestia and Polygon Avail. However, EigenDA differs slightly in approach. EigenLayer uniquely reconstructs data availability, creating a novel DA model. By introducing AVS services, projects gain needed functionality without building their own AVS. This innovation lowers project costs and provides a more efficient, scalable DA solution for the entire Ethereum ecosystem. EigenLayer’s breakthroughs open new possibilities for blockchain ecosystem development.

3. Competition and Challenges

3.1 Competition from Polygon + Celestia

Competition comes not just internally but externally. Polygon+Celestia has begun challenging Ethereum. Over the past 18 months, the explosion of Rollup technology has enabled advanced DeFi users to experience unprecedented UX—faster confirmations and cheaper transactions.

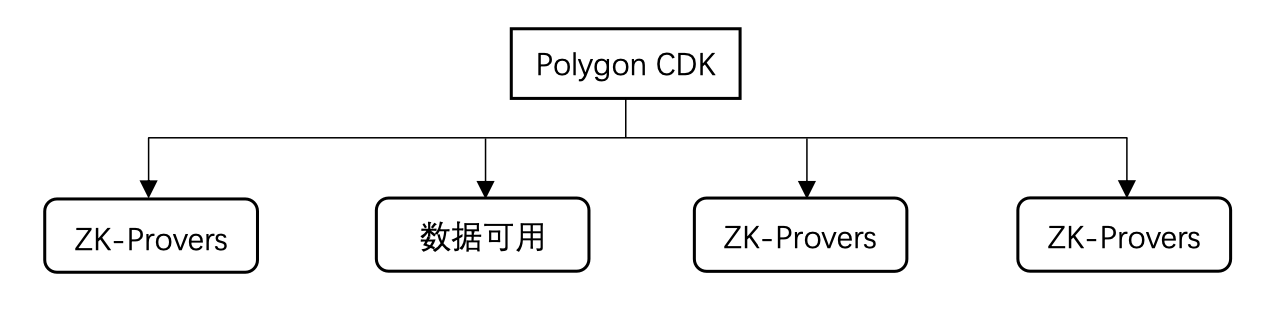

Polygon’s Customizable Development Kit (CDK) enables rapid development of modular blockchains. CDK’s modular approach lets developers select specific components for customized blockchain designs, achieving interoperability between chains. The four main parts of Polygon CDK are ZK provers, data availability, virtual machines (VM), and sequencers. This combination gives developers flexibility to tailor blockchains to their needs.

Celestia and Polygon Labs announced integration of Celestia’s data availability layer with Polygon CDK. This collaboration will further improve Ethereum L2 transaction efficiency and lower fees. DeFi users will enjoy better experiences. Integration with Celestia is expected to dramatically cut Ethereum L2 transaction fees, possibly below $0.01, enabling smoother trading environments.

3.2 Cosmos’ Ambiguity

Fragmentation of liquidity and composability across rollups (more broadly across L2s, including validation) remains problematic. Each rollup (e.g., Arbitrum or Optimism) operates as an execution “silo”: isolated pre-confirmations, sequencing, state, and settlement. They’ve lost Ethereum’s universal synchronous composability—the core driver of network effects.

Recently, EigenLayer announced it will serve Cosmos-based app chains, allowing future network projects to simultaneously benefit from Cosmos SDK’s flexible architecture and Ethereum’s security. Many Cosmos innovations leverage validator sets for supplementary tasks. Yet maintaining a quorum of economically secure validators is notoriously difficult. EigenLayer addresses this by offering an economic stake platform—enabling any stakeholder to contribute to any PoS network. By reducing cost and complexity, EigenLayer paves the way for L2s to harness expressive innovations from the Cosmos stack.

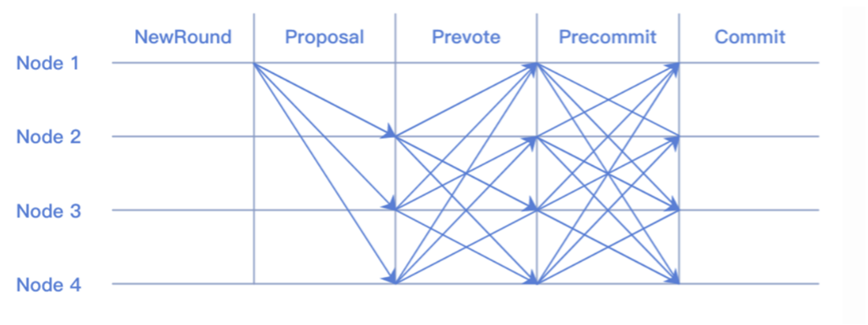

Cosmos emphasizes modularity and interoperability—addressing Ethereum’s weakness—centered around ecosystems using Tendermint consensus and IBC protocol for cross-chain communication. Each chain uses Tendermint for consensus and transaction execution. Integration simplifies blockchain development, offering cohesive environments, though potentially limiting flexibility for diverse application needs.

Through the above Tendermint integration diagram (think of it as Byzantine agreement), interconnected blockchain networks operate under Cosmos' umbrella, emphasizing collaboration and interaction among chains. Thus, Cosmos’ application-specific innovations perfectly complement EigenLayer’s complex staking community and capital base. Deeper cooperation promises highly creative synergies, expanding Ethereum’s functionality and empowering Cosmos builders to apply their talents within the world’s largest programmable staking economy.

Ethereum and Cosmos initially pursued different goals, but their technical evolution is converging. Both face common challenges—MEV, liquidity fragmentation, and broad decentralization. Cosmos continuously evolves as an experimental bridge; Ethereum is validated as a composable settlement layer. Then came EigenLayer. By offering an economic stake platform—allowing any stakeholder to contribute to any PoS network—it reduces cost and complexity, effectively unlocking expressive innovations from the Cosmos stack for L2s.

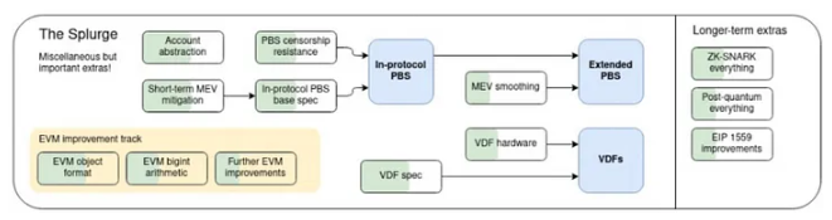

MEV (Maximum Extractable Value) has always been a central topic for Ethereum, deeply influencing its roadmap and protocol design. To counter MEV-induced centralization pressure, Ethereum adopted proposer-builder separation (PBS). Currently, PBS is implemented off-chain via MEV-Boost, using a trusted commit-reveal scheme. Ethereum plans to integrate fixed PBS (ePBS) into the base layer to eliminate reliance on trusted third parties and achieve more decentralized PBS.

In Cosmos, MEV is also a concern, prompting implementation of more advanced ePBS solutions. For example, Osmosis experiments with arbitrage profit-sharing mechanisms, while Skip tests Block SDK—a decentralized block builder and proposer commitment design. Separating components like consensus, data availability, and execution contrasts with traditional monolithic blockchains. Modularity allows independent development, optimization, and scaling of each component, offering customizable, efficient frameworks. Handling large data volumes, modular architectures enhance scalability, efficiently managing high-throughput demands.

Vitalik Buterin’s Ethereum roadmap as of December 2021

EigenLayer, by connecting Ethereum and Cosmos, introduces a new wave of innovation. The Cosmos community can leverage Ethereum’s decentralized security and liquidity, while Ethereum draws inspiration from Cosmos’ experimental innovations. This convergence opens new possibilities for both ecosystems. Technically, MEV remains critical for both, with ongoing exploration of solutions. Interoperability is another key focus, especially given Cosmos’ modular nature. As their designs converge, they increasingly learn from and adopt elements of each other.

EigenLayer lowers barriers for Ethereum to utilize Cosmos innovations, particularly by offering an economic stake platform so L2s can leverage validator sets for supplementary work. This paves the way for greater innovation and collaboration between the two ecosystems. By merging Ethereum and Cosmos tech stacks, EigenLayer enables a symbiotic relationship full of possibilities. Such integration not only advances both platforms but could foster more creative and resilient ecosystems.

3.4 Competitive Products on LSDFi Platforms

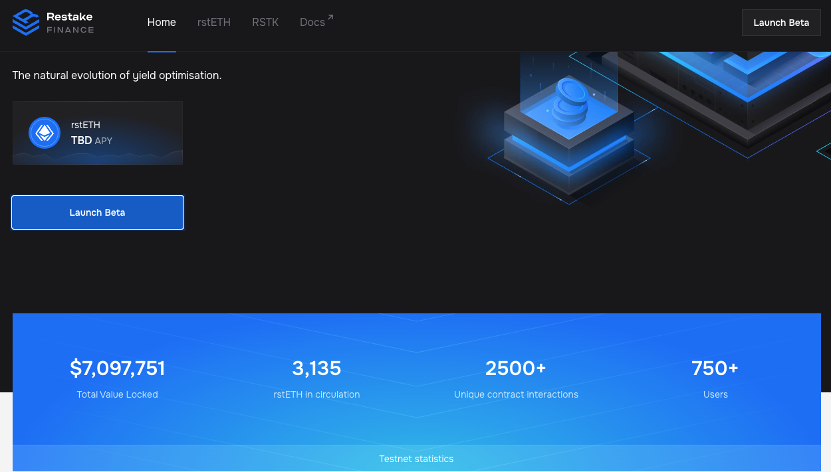

Competitor and Partner: Restake

Built on EigenLayer, this project offers modular liquid staking solutions. Through innovative methods, users earn staking rewards from both Ethereum and EigenLayer without locking assets or managing complex infrastructure. Managed by a decentralized autonomous organization (DAO), it primarily focuses on yield-generating strategies.

Through the newly launched restaked ETH token (rstETH), it facilitates liquidity restaking of LSTs (like stETH) within EigenLayer. Holding rstETH seamlessly earns staking rewards from both Ethereum and EigenLayer, estimated between 3%-5% and over 10%.

Its token RSTK (max supply 100 million) serves utility and governance functions within the ecosystem. Directly tied to EigenLayer’s success and revenue, it reflects platform growth. Fees are fixed at 10%, with 5% going to stakers and 5% to the platform treasury.

The project emphasizes decentralizing crypto trading and community governance. Through its unique Stake & Yield mechanism, Restake offers attractive returns to holders and enables governance via community voting. Prioritizing security and sustainability, it provides users with a reliable trading ecosystem.

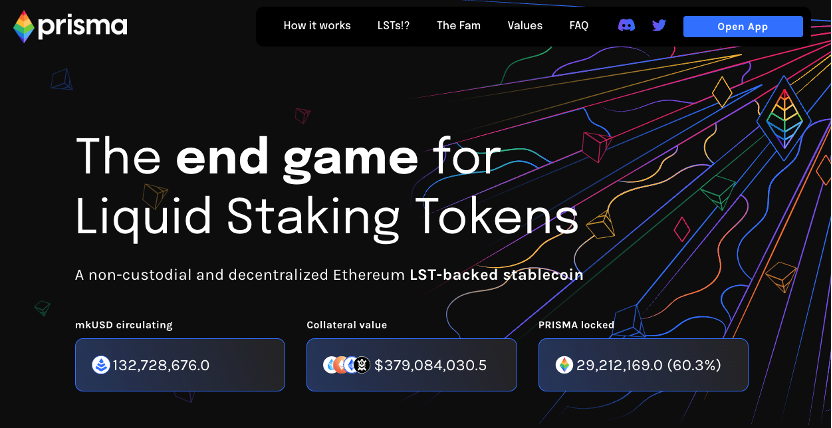

Prisma Finance

Focused on Ethereum liquid staking derivatives, users can fully collateralize various LSDs (wstETH, rETH, cbETH, sfrxETH) to mint the stablecoin mkUSD. Multiple LSDs—wstETH, rETH, cbETH, and sfrxETH—are eligible for mkUSD minting, earning LSD returns. Depositing into stability pools yields high APR. Maintaining mkUSD debt earns weekly PRISMA rewards. mkUSD is a relatively stable asset, generating additional income for users.

PRISMA (total supply 300 million); ways to earn PRISMA include pool deposits, mkUSD minting, maintaining mkUSD debt, and staking Curve/Convex LP. Locking PRISMA earns protocol fees and increases voting power, with maximum lockup period of 52 weeks.

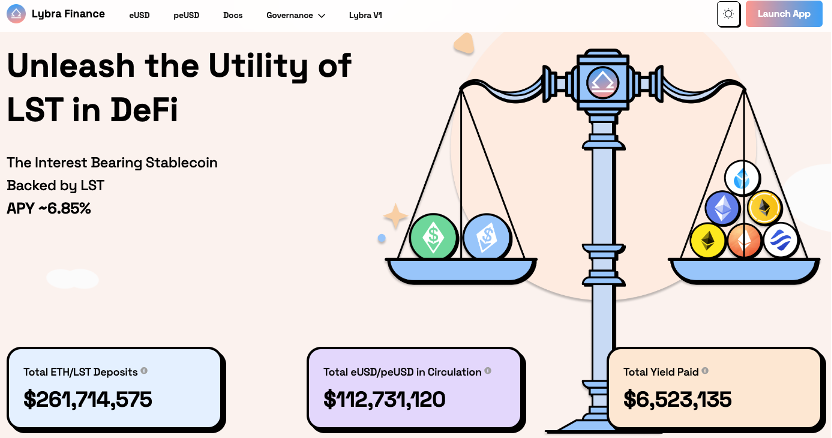

Lybra.finance

Lybra is an LSDFi platform focusing on stabilizing the crypto market through liquid staking derivatives (LSD).

It offers a unique stablecoin eUSD, backed by ETH assets, generating stable interest for holders. Leveraging LSD income, users earn steady returns in eUSD. It also launched peUSD, an omnichain version of eUSD, expanding choices for liquid staking tokens. rETH and WBETH serve as collateral for eUSD and peUSD, enhancing flexibility.

LBR (total supply 100 million) is an ERC-20 token on Arbitrum and Ethereum. Token uses include governance, yield enhancement, and ecosystem incentives. esLBR is a locked version of LBR with equal value, capped by total LBR supply, non-tradable but granting voting rights and shares of protocol revenue. esLBR holders actively shape Lybra’s direction and development. They receive 100% of protocol revenue, increasing potential returns. Compared to the previous two projects, Lybra stands out due to its cross-chain capabilities, giving it access to larger markets.

4. Development and Outlook

As discussed earlier in the DA section, demand-side drivers like the Cancun upgrade and OP Stack openness accelerate the growth of small-to-medium rollups and app chains, increasing demand for low-cost AVS. The modular trend boosts demand for affordable DA layers, expanding EigenDA usage and thus driving demand for EigenLayer. On the supply side, rising Ethereum staking rates and growing numbers of stakers provide abundant LSD assets and holders, who seek higher capital efficiency and returns on their LSD holdings.

4.1 Product Progress

Regarding product progress, EigenLayer’s public interface is frankly underwhelming—not very user-friendly or flexible. From a user perspective, the inability to earn tangible staking rewards in the short term, coupled with unclear reward structures, may hinder user growth.

EigenLayer creates an open market where validators can choose whether to join each module and decide which ones deserve additional collective security. This free-market structure allows new blockchain modules to leverage resource disparities among validators. Currently, however, the open market’s external-facing product page hasn’t been developed well, mostly promoted from a project-operational standpoint. That said, participating in events reveals integration of restaking functionality: users can restake tokens like stETH, rETH, cbETH to join the EigenLayer ecosystem.

4.2 Business Model

Two LSD deposit campaigns attracted strong participation, quickly reaching caps, indicating user interest in potential airdrop rewards. EigenLayer has accumulated around 150,000 staked ETH, visible on its website as total TVL.

Eigenlayer official site staking status as of January 27, 2024 (5:am UTC)

EigenLayer primarily takes a commission from AVS service fees, distributing 90% to LSD depositors, 5% to node operators, and retaining 5% as platform revenue share.

4.3 Future Development

The value of ETH staked on Ethereum is approximately $42 billion, with the overall on-chain capital size ranging between $300–400 billion. The scale of projects served by EigenLayer is expected to reach $10–100 billion in the near term. All projects requiring token staking, game-theoretic consensus maintenance, and decentralization are potential users. Market sentiment toward EigenLayer is highly positive. Using Lido’s current 25x P/S ratio as a benchmark, newer narratives often command higher premiums initially, estimated at 20–40x. A conservative valuation suggests EigenLayer could become a $1–2 billion project in the future.

EigenLayer has completed three funding rounds totaling over $64 million. Its latest Series A round was led by Blockchain Capital, with participation from Coinbase Ventures, Polychain Capital, IOSG Ventures, and others, valuing the company at $500 million. While precise market sizing is difficult, optimistic projections suggest it could reach tens of billions within three years. If the market grows at a 37% CAGR, revenues could exceed $25 billion by 2030.

5. Risks and Challenges

EigenLayer also faces challenges such as technical complexity and uncertainty in market adoption. Although EigenLayer currently dominates the AVS market unchallenged, potential competition and risks inherent in being a middleware layer cannot be ignored.

Collective Security Re-staking Issues: Current AVS face challenges regarding re-staking collective security. EigenLayer establishes a new mechanism allowing validators to gain security via re-staked tokens rather than their own, earning extra income through providing security and validation services.

Open Market Mechanism Issues: EigenLayer introduces an open market where validators choose whether to join modules and allocate collective security. This selective dynamic governance provides a free-market structure for launching new add-on functionalities.

New AVS Launch Challenges: Innovators launching new AVS must build new trust networks for security—a potentially daunting task.

Value Fragmentation Issues: As each AVS develops its own trust pool, users pay fees to these pools, leading to fragmented value leakage.

Capital Cost Burden: Validators securing new AVS bear capital costs—including opportunity cost and price risk. AVS must offer sufficiently high staking returns to cover these costs, a challenge for many.

Lowered Trust Models for DApps: The current AVS ecosystem weakens DApp trust models, as apps dependent on specific modules become attack targets. Security drawbacks from restaking mechanisms may affect AVS adoption to some extent.

LSD Collateral Risk: Projects using LSD assets as security collateral must consider credit and security risks associated with LSD platforms themselves, adding another layer of risk.

Despite showcasing advantages of innovative restaking protocols, the aforementioned risks must be considered. Additionally, EigenLayer’s centralized governance model could lead to governance complexities, slow decision-making, and other negative impacts.

Conclusion

EigenLayer’s concept of exporting ETH security highlights interconnectivity within blockchain ecosystems. This interoperability helps build stronger, more secure blockchain networks, laying a solid foundation for future development. By providing security and trust layers supporting multiple modules like consensus protocols and data availability layers, EigenLayer has completed three funding rounds with a $500 million valuation. As an innovative protocol, it holds significant future potential.

Early participation methods in this project have likely been widely shared across news outlets, social media, and influencer recommendations, so we won’t elaborate further here. BiB Exchange believes EigenLayer is not merely an independent platform but an integral part of the Ethereum network—an exceptional project capable of competing with Celestia and Polygon, while engaging constructively with Cosmos. Of course, criticism and skepticism exist. This article provides detailed explanations of relevant principles, encouraging readers to form independent judgments and place greater emphasis on the restaking ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News