Klaytn and Finschia, major crypto giants from South Korea and Japan, merge their mainnets—how will Asian power reshape the global ecosystem?

TechFlow Selected TechFlow Selected

Klaytn and Finschia, major crypto giants from South Korea and Japan, merge their mainnets—how will Asian power reshape the global ecosystem?

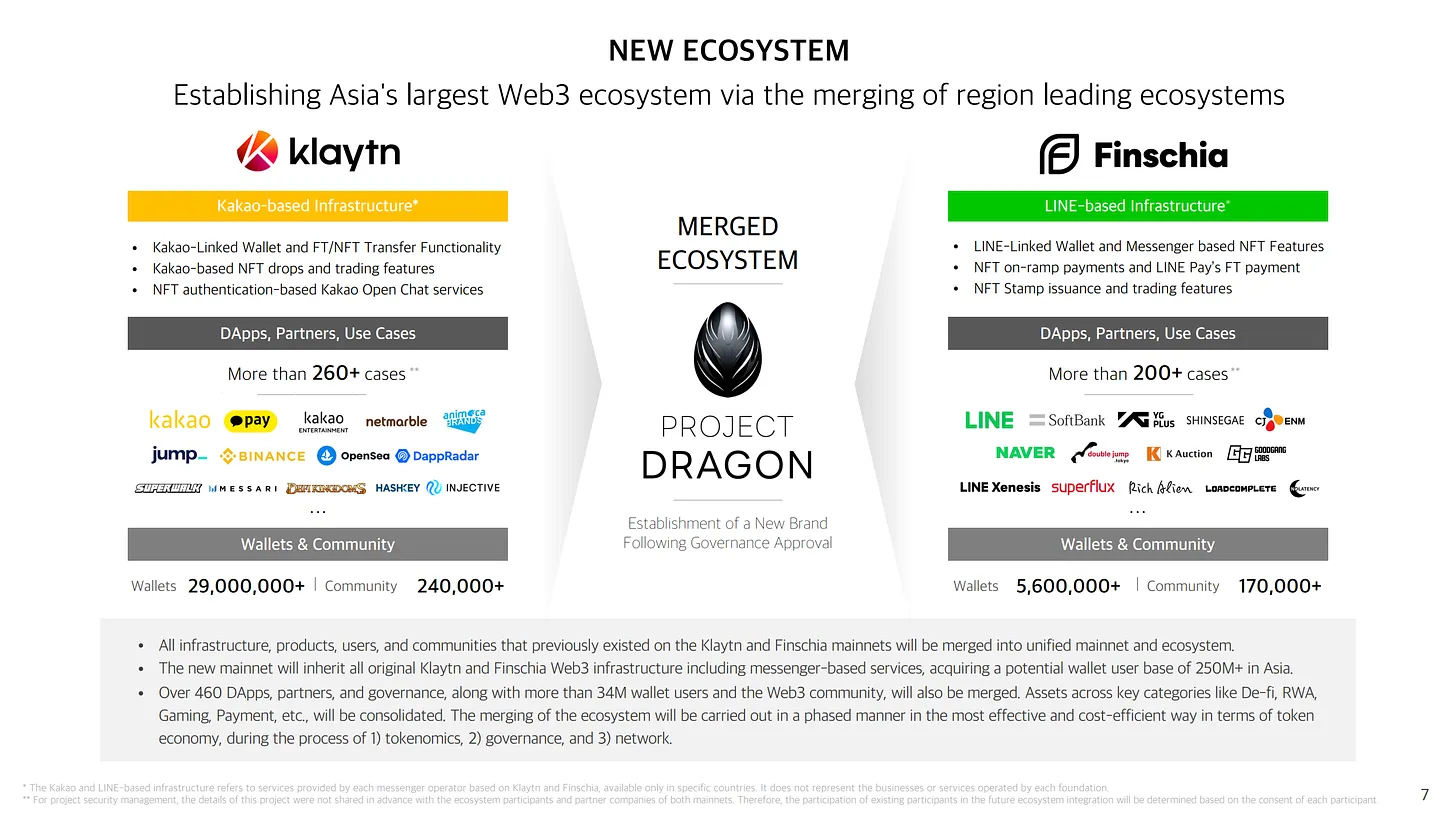

Klaytn and Finschia each have unique strengths in their respective fields, and their relationship is generally seen as complementary to each other's weaknesses.

Authors: JAY JO, YOON LEE

Translation: TechFlow

Introduction:

On January 16, 2024, two leading Asian blockchain platforms, Klaytn and Finschia, announced plans to launch a unified mainnet. This initiative aims to combine their respective ecosystems and assets to build an Asian blockchain giant and lead the global Web3 market. This report provides an in-depth analysis of the highlights of the Klaytn-Finschia merger, the advantages and potential of combining the two platforms, and explores the potential risks involved.

Main Content:

On January 16, 2024, two major Asian blockchain platforms, Klaytn and Finschia, announced a significant plan to launch a unified mainnet. The goal is to create an Asian blockchain powerhouse by integrating their ecosystems and assets, aiming to lead the global Web3 market.

Such a combination of two mainnets is unprecedented in the Web3 space, especially considering that both originate from two major technology giants in Korea and Japan—Kakao and LINE. Both Klaytn and Finschia are relatively mature projects with over five years of experience, each possessing distinct cultures, visions, and underlying technologies powering their ecosystems. This report analyzes the key highlights of the Klaytn-Finschia merger and examines the synergies, strengths, and potential of this integration.

Highlights of the Klaytn-Finschia Merger

The Klaytn-Finschia merger is expected to bring three major changes:

-

Issuance of a new unified token

-

Creation of an integrated network spanning Ethereum and Cosmos

-

Establishment of Asia’s largest Web3 governance body, including affiliates of Kakao and Line

First, a new token will be issued to unify the Klaytn and Finschia ecosystems. Holders of both KLAY and FNSA tokens will be entitled to claim the new integrated token based on a predetermined ratio, calculated using the average exchange rate of the tokens over the past two weeks. A new tokenomics model will also be implemented around this token.

Second, an integrated network covering both Ethereum and Cosmos will be created. Klaytn and Finschia plan to build a new compatible network leveraging their respective mainnet technologies and assets. However, due to time and resource constraints, the initial integrated network will be established by issuing an upgraded KLAY-based token within the Ethereum ecosystem, benefiting from Ethereum’s lower entry barriers and broader exchange listings. Subsequently, Cosmos-based technologies and assets will be incorporated to form a fully interoperable network.

Third, decentralization will be further strengthened through the creation of Asia’s largest Web3 governance institution. Under unified governance, user and community representation will be enhanced. The existing governance councils will merge and expand to include up to 100 participants, including affiliates of Kakao and Line.

Additionally, the team has announced ambitious plans to integrate the technological and asset resources of each mainnet to generate greater synergies. These include building infrastructure tailored for institutional needs, strengthening large-scale DeFi infrastructure, and mass migration of Web2 assets onto the blockchain. Notably, the initiative to develop infrastructure for institutional use is particularly promising, as launching traditional financial products via crypto has gained significant attention since the approval of Bitcoin ETFs. Creating a larger, more decentralized project could attract major institutional investors, making it an appealing option for those seeking exposure to Asian cryptocurrencies. Furthermore, the issuance of a “native stablecoin” represents a new business initiative emerging from the integration of mainnets and tokens, drawing increasing attention.

Advantages and Potential of Project Dragon

Securing Global Competitive Advantage

The launch of the integrated Klaytn-Finschia mainnet is expected to combine both parties’ financial and technical resources, creating a strong competitive advantage in the global Web3 market. In particular, one of the key benefits of the merger is the effective utilization of early backers Kakao and Line. Together, these companies serve approximately 250 million users across their messaging platforms, and this extensive user base will play a crucial role in acquiring potential Web3 users.

Moreover, they are expected to gain competitive advantages by fully leveraging communication-based infrastructure. Kakao and Line’s messaging apps function as super-apps encompassing finance, shopping, entertainment, and more. When combined with Web3 technology, they have the potential to generate explosive synergies. Examples include FT/NFT transfers and payments via chat, and NFT-powered profile features. Thus, the integration of the two mainnets is expected to play a vital role in improving adoption and awareness of new technologies.

Enhanced Decentralization

The integration of Klaytn and Finschia could represent a significant step toward further decentralization. Specifically, it is expected to reduce direct ties with founding entities Kakao and Line.

Currently, Kakao-affiliated companies hold over 50% of voting rights in Klaytn’s governance council, while Line-affiliated companies hold over 30% in Finschia. The establishment of a unified foundation is expected to significantly reduce corporate token holdings, thereby naturally alleviating regulatory burdens related to securities. Additionally, reduced voting power from the two parent companies may enhance decentralization—an important factor that could increase the likelihood of listing on more cryptocurrency exchanges.

In South Korea, the Act on Reporting and Using Specific Financial Transaction Information prohibits cryptocurrency exchanges from listing crypto assets issued by affiliated parties. In the past, Klaytn struggled to list on Upbit due to Kakao’s stake in Dunamu—the operator of Upbit. Similarly, Com2Us’ ownership of Coinone made listings there difficult. With this integration, there is cautious speculation about whether the newly merged token can be listed on Upbit.

Expanded Global Reach

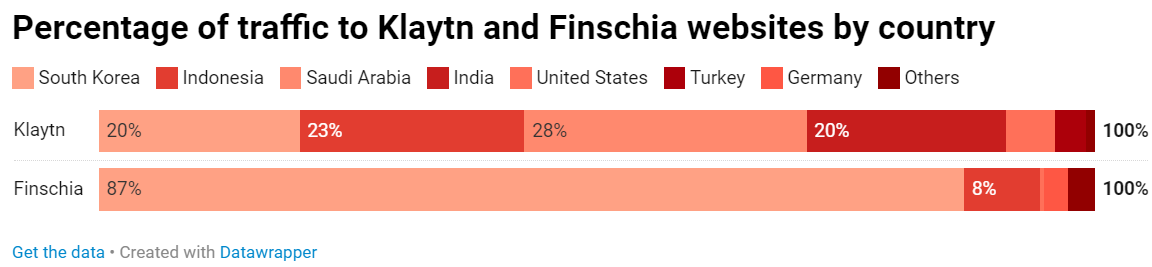

Percentage of website traffic for Klaytn and Finschia by country

The integration of Klaytn and Finschia is expected to significantly enhance global reach. Kakao already holds strong influence in South Korea and Vietnam, while Line dominates in Japan, Thailand, and Indonesia. Both Klaytn and Finschia are competitive within their respective regions. Traffic analysis of their official websites over the past three months shows dominance in different markets. Their unification is expected to create a project encompassing the entire Asian ecosystem and rapidly expand its global footprint.

Source: Tiger Research

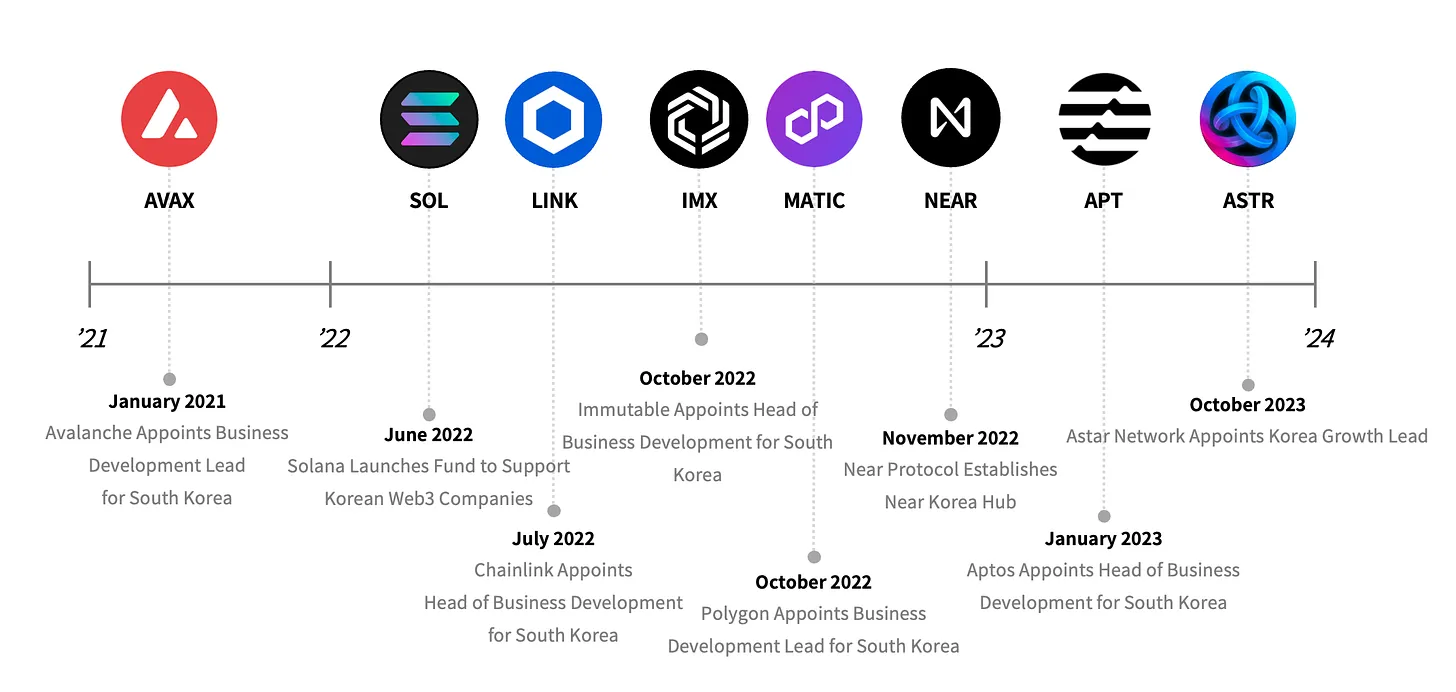

Their integration is not only significant for global markets but also strategically important for their home markets in Korea and Japan. Currently, both countries are hotspots in the global Web3 landscape, with projects like Avalanche and Solana actively expanding into these regions. Launching a joint Klaytn-Finschia foundation is therefore a strategic move. Rather than competing against each other, they are expected to collaborate synergistically within the same market, gaining an edge over external competitors.

Synergistic Relationships and Development

Klaytn and Finschia each possess unique strengths in their respective domains, often seen as complementary to each other’s weaknesses. Klaytn has an advantage in infrastructure development. According to their technical roadmaps, Klaytn launched KAS (Klaytn API Service) in 2020, providing rapid access to endpoints, whereas Finschia did not open its endpoints until December 2023—three years later. Additionally, there is a significant difference in the number of GitHub repositories on each mainnet: 702 for Klaytn versus 16 for Finschia. While this does not definitively prove technical advancement, it does indicate that Klaytn holds a relative advantage in infrastructure technology due to its longer history of experimentation and development.

Brown & Friends

In terms of products, Finschia outperforms Klaytn. It hosts some of Asia’s largest Web3 product assets, including NFT profiles on Line Messenger, stamp-based NFTs, and an NFT marketplace. Moreover, it plans to launch a social app powered by AI technology and a new Web3 game featuring the Brown & Friends characters.

The two projects clearly excel in different areas. By combining their mainnets, the teams are expected to generate positive synergies by leveraging each other's strengths in less familiar domains. This will strengthen their operations and enable them to explore diversified business models.

Potential Risks

The risks associated with mainnet integration cannot be ignored. As with any Web2 merger, integration requires time and effort. In particular, merging two foundations with differing cultures, visions, and technical infrastructures is expected to be an extremely complex process, especially if completed within a short timeframe.

Furthermore, dApp services within these ecosystems are expected to face significant challenges. Large-scale efforts such as infrastructure overhauls will place a heavy burden, especially given limited time and resources. This could erode trust in the ecosystem and potentially lead to project departures.

Web3 ecosystems consist of diverse participants; combining various stakeholders resembles national unification more than corporate mergers. Therefore, it remains uncertain whether a unified foundation can be launched quickly. There is also a risk that the teams may miss critical windows for mass adoption due to the complexities of mainnet integration.

Another concern is delisting from major global cryptocurrency exchanges such as Binance. Klaytn and Finschia expect delisting risks to be minimal due to their technical compatibility and focus on EVM-based networks widely supported by exchanges. However, some argue that because the integration involves not just changes to the underlying network but also introduces new governance structures and ecosystems, a new listing review process may be required.

While trading continued during WeMix’s migration from Klaytn to its own Ethereum-based mainnet, the Klaytn-Finschia integration is far more complex. Hence, the potential risk of delisting cannot be overlooked.

Since liquidity provision is the most critical factor in Web3, delisting issues could negatively impact the ecosystem. Effective risk management to prevent exchange delistings is therefore essential.

Conclusion

The merger of large-scale projects like Klaytn and Finschia represents a highly unusual and significant event in the Web3 ecosystem. The integration has sparked considerable expectations and concerns. However, from the perspectives of market expansion and technological advancement, the outlook is generally optimistic. The creation of a major blockchain representing Asia is expected to be highly competitive on a global scale. Additionally, enhanced decentralization—such as reduced reliance on founding developers—is likely to increase interest from institutional investors.

However, ideals and reality often differ. Business and technology are not the only factors shaping a Web3 ecosystem. Web3 is a complex and dynamic market composed of many different participants, including end users, investors, and builders. While it may be impossible to satisfy all stakeholders, it is necessary to establish reasonable standards that take into account the interests of each party.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News