Elon Musk reignites the meme craze—what's really behind the surge of memes?

TechFlow Selected TechFlow Selected

Elon Musk reignites the meme craze—what's really behind the surge of memes?

Who controls the meme, controls the universe.

By: Day

Recently, with Elon Musk's boost on Twitter, meme assets such as Troll and Zuzalu have surged in popularity. But what exactly are memes? Why are meme assets gaining traction? And how should we view these meme-based digital assets?

What Are Meme Assets?

The term "meme" originates from Richard Dawkins' book The Selfish Gene, referring to the basic unit of human culture. It can be any form of information, idea, or behavior that spreads from person to person through imitation and replication. A "meme" aims to convey a specific phenomenon, theme, or meaning and resonates within society. With the evolution of the internet, today’s "memes" are no longer limited to traditional text or images but also include digital forms such as tokens and NFTs.

These memes spread rapidly, widely, and entertainingly across social media and online networks, becoming a vital part of internet and pop culture. They express emotions, opinions, humor, and satire, while reflecting current social trends and cultural phenomena.

The core concept and appeal of meme assets stem from meme culture. Meme assets attract investor attention by leveraging humorous and entertaining meme images, concepts, or ideas. They function as social infrastructure—driven by communities through collective promotion and viral dissemination, quickly spreading throughout the industry. The uniqueness of meme assets lies in their community-driven nature, offering relatively fair distribution compared to institution-backed tokens. Community members actively participate in and propel the development of these assets, making their success closely tied to community engagement.

Why Are Meme Assets Gaining Popularity?

The blockchain industry has long moved past its wild early days. A few years ago, launching multiple projects might have been seen as unfocused or unreliable—but now, it's often viewed positively. Launching a new project is considered favorable because prior successful ventures serve as credibility; people assume if previous projects were good, the new one won’t be bad either—this interconnected network of projects is euphemistically called an 'ecosystem.'

In this environment, the industry is dominated by giants with complex relationships. Early-stage institutions have grown into behemoths, each backed by extensive networks of vested interests. If you lack connections, resources, or backing, no one pays attention—retail investors don’t know you, and institutions certainly won’t trust you. There’s a stark difference between identical products depending on whether they have institutional support. For example, if well-known firms like Paradigm or Binance invest in your project, people will flock to it regardless of quality. After all, institutional endorsement means access to resources and connections. How can a no-name, resource-free product compete?

Top-tier institutions are churning out assembly-line projects, collectively reaching market caps of tens or even hundreds of billions of dollars (remember, a $1 billion+ valuation earns the title 'unicorn' in Web2). As large-cap, low-circulation projects dump supply, high-quality projects see inflated valuations without corresponding price movements. Retail investors not only miss out—they become the final holders, left holding bags in silence.

In this context, meme assets have replaced the altcoins of years past as a crucial bottom-up force in the industry. Their rise is inevitable—and deeply intertwined with retail investors’ anti-VC sentiment. The surge of BRC20 assets this year was partly due to the Bitcoin ecosystem, but more importantly, because token distribution was relatively decentralized and “fair,” preventing any single institution from monopolizing profits. Instead, those gains went directly to retail investors. This wealth effect fueled widespread enthusiasm and adoption.

Elon Musk: The Godfather of Memes

If there's one figure impossible to overlook when discussing meme culture, it’s Elon Musk. Musk has a deep connection with memes. Dogecoin, currently the leading meme coin, owes much of its success to Musk’s relentless promotion. He has publicly supported Dogecoin numerous times, and every tweet triggers widespread discussion and attention. After Dogecoin soared into the top ten cryptocurrencies during the last bull run, Musk’s influence in the blockchain space reached its peak. A single tweet from him can cause massive price swings in meme coins, sometimes sparking market frenzy. His frequent crypto- and memecoin-related tweets make him a focal point for retail investors.

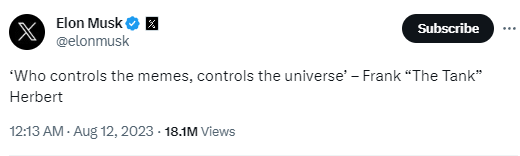

Translation: "He who controls the meme, controls the universe." – Frank "Tank" Herbert

Musk currently has nearly 169 million Twitter followers. A small but dedicated group monitors his account 24/7, ready to launch on-chain projects or create new meme tokens at the first sign of a hint. Within just one or two minutes of a new post—or even a profile setting change—several speculative “shitcoins” named after the tweet content appear on-chain (mainly Ethereum). Some particularly meaningful or repeatedly mentioned references can see their market cap skyrocket from几十 dollars to tens or even hundreds of millions within days. Notable examples include Q*, grok, and recently, troll.

Of course, these memecoins are extremely dependent on Musk. Reviewing their historical performance reveals most follow a “pump-and-dump” pattern unless Musk mentions them again. Before the BRC20 explosion last year, many preferred playing on Ethereum, where Musk’s tweets were among the most watched signals—even analyzing why he posted something and its contextual origins.

Those Who Want to Be the Next Musk

As sector热度 rises, many project founders are now jumping into the meme game, promoting pure-concept, air-based tokens. Here’s a quick overview of several notable figures—following their tweets may let early adopters profit, while latecomers often end up paying the price. These cases illustrate key characteristics of memecoins.

1) Matt Furie: Creator of Pepe, Matt was behind one of last year’s hottest memes—Pepe and the later-rising Bonk, both surpassing $1 billion in peak valuation. Pepe leveraged the wildly popular Sad Frog image and strong team marketing to quickly push the token onto Binance.

As a result, the creator gained significant attention. In mid-2023, whenever he changed his avatar, bio, or posted a tweet, related memecoins would briefly emerge on-chain, some surging from $10K to tens of millions in market cap—such as Dorkl and Fine. However, after promoting too many projects, the profitability faded, diminishing his influence—though he still occasionally shills new ones.

2) Toly: Anatoly Yakovenko, Solana’s founder. SOL’s strong performance last year drew increased attention to its ecosystem. Bonk, Solana’s first dog-themed memecoin, rose under this spotlight. Silly, another meme project, received repeated endorsements from Anatoly on Twitter—culminating in his dramatic appearance at the Solana Breakpoint conference dressed as a dragon, which ignited full-scale hype around Silly. Additionally, due to SOL’s inherent traffic, anything Anatoly shares tends to gain immediate attention.

3) Sandeep Nailwal: Co-founder of Polygon. After Silly gained momentum, Polygon launched its own memecoin, Pory. On launch day, Sandeep retweeted about it, pushing Pory’s market cap to over $40 million. Later, multiple official Polygon team members publicly supported it, though recent price corrections have brought it down to just a few million.

Beyond these, AVAX’s Coq, Bear, and inscription markets have also seen public support from AVAX officials or affiliates, triggering short-term FOMO from investors. Recently, projects like Lup and Bake have started direct promotions themselves.

Clearly, most meme assets experience only temporary热度. Once the wave passes, they cool down rapidly—with few sustaining momentum. Without ongoing ability to generate buzz, they’re prone to one-and-done cycles, leaving latecomers to absorb losses for early movers. Most of these individuals already command attention and promote projects with clear intent.

Factors Behind Viral Success

Meme assets emphasize concept over technical or financial sophistication. This low barrier to entry is both a strength and weakness—anyone can launch one, resulting in countless projects, yet very few succeed. What makes a meme go viral? What factors contribute to success? Based on known cases, here’s a retrospective analysis—feel free to add more.

1) Attracting External Users Through Hype: Since memecoins are inherently speculative, marketing is critical—and nothing markets better than letting people make money. Profitable users naturally spread the word. Ask outsiders: some may not know ETH or BNB, but almost everyone knows Dogecoin. Why did BRC20 blow up? Partly due to Bitcoin’s ecosystem, but mainly because people made money—and then others rushed in.

2) Simplicity and Clarity: Classic examples include “Bitcoin is gold, Litecoin is silver.” As Li Laoshi once pointed out, what does Litecoin really offer? Just a good name. A catchy slogan cuts through noise and sticks in minds—saving endless explanations.

3) Familiarity and Shareability: This space resembles entertainment—having visibility means 80% success. Pepe’s Sad Frog image was already widely circulated. Other familiar themes include famous founders’ pets, Musk-themed concepts, BRC20’s sats, piin, etc.

4) Innovation: Fresh narratives with novel twists—like HarryPotterObamaSonic 10 Inu (Bitcoin), blending Harry Potter, Obama, and Sonic in an abstract meme coin; aidoge distributing 1:1 to Arbitrum users; rats’ early distribution model.

5) Fairness: Relative fairness—early token distribution gives retail investors a chance to acquire cheap positions. Most BRC20 tokens fall into this category.

These are some common traits among temporarily viral meme assets—all revolving around the word 'traffic.' But ultimately, every project has people driving it behind the scenes.

Summary

While meme assets promise high returns, only a few truly succeed. Most are short-lived, experiencing a quick spike followed by rapid decline—leaving latecomers to bear the losses. Only a select few manage to break out. Nevertheless, meme assets have become an essential part of the industry. Understanding meme culture is crucial for tracking and deeply researching the cryptocurrency space.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News