5 Projects in the Sei Ecosystem with Potential Airdrops and Growth Prospects

TechFlow Selected TechFlow Selected

5 Projects in the Sei Ecosystem with Potential Airdrops and Growth Prospects

5 promising Sei ecosystem projects covering applications such as lending, DEX, perpetual DEX, and liquid staking platforms.

Author: andrew.moh, Crypto KOL

Translation: Felix, PANews

Sei is a DeFi-focused Layer 1 blockchain built using the Cosmos SDK and Tendermint Core, aiming to create better infrastructure. The Sei token (SEI) has surged 700% over the past two months. The Sei ecosystem is currently in its early development stages. This article highlights five promising projects by crypto KOL andrew.moh (data as of January 4).

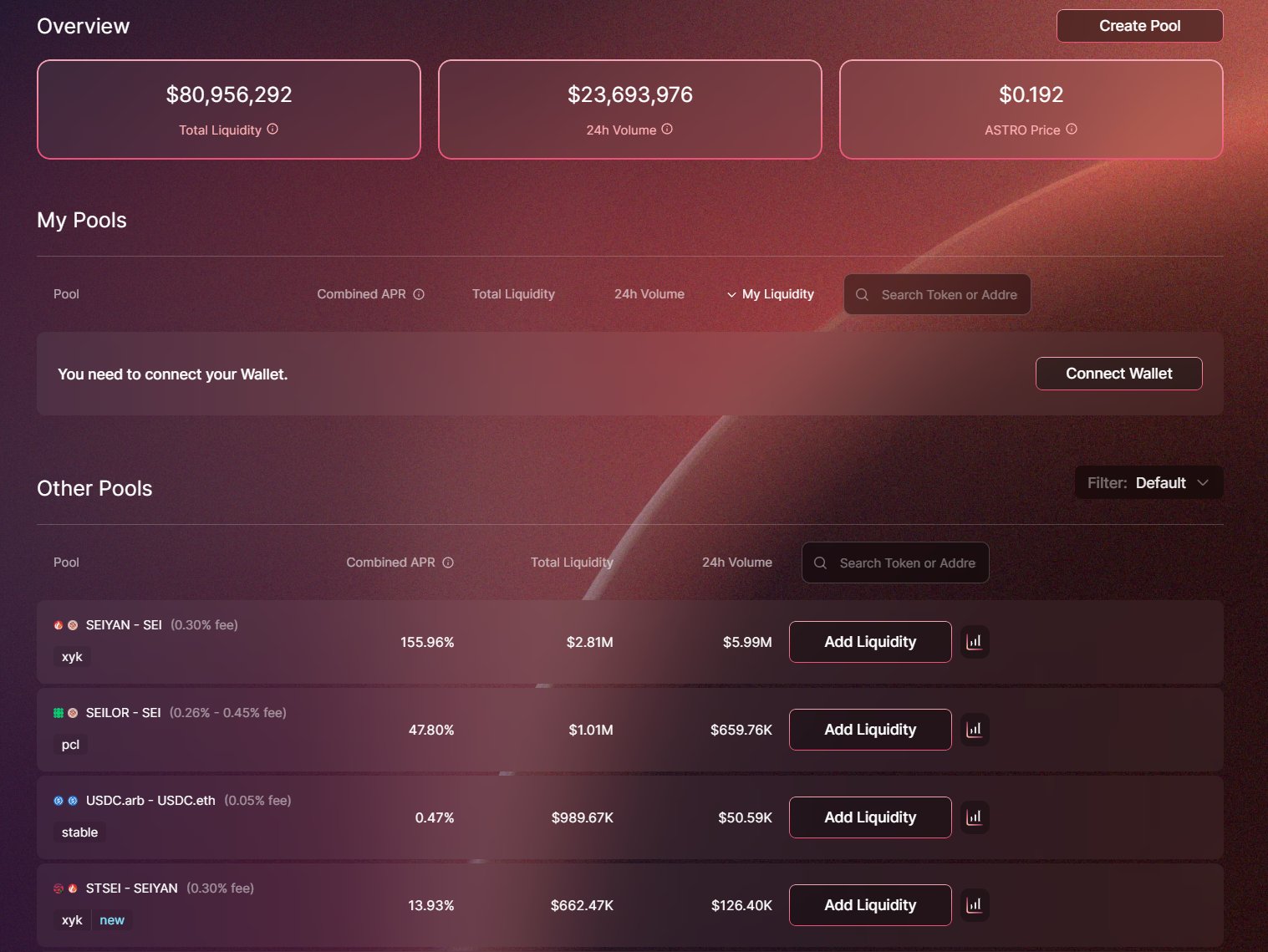

Astroport (ASTRO)

Astroport is a next-generation AMM built on Cosmos. Backed by Delphi Digital, Astroport offers users more than just a platform for trading tokens—it provides passive income opportunities through its liquidity pools. Astroport supports three main types of pools:

-

Constant product pools

-

Stableswap invariant pools

-

Liquidity bootstrapping pools

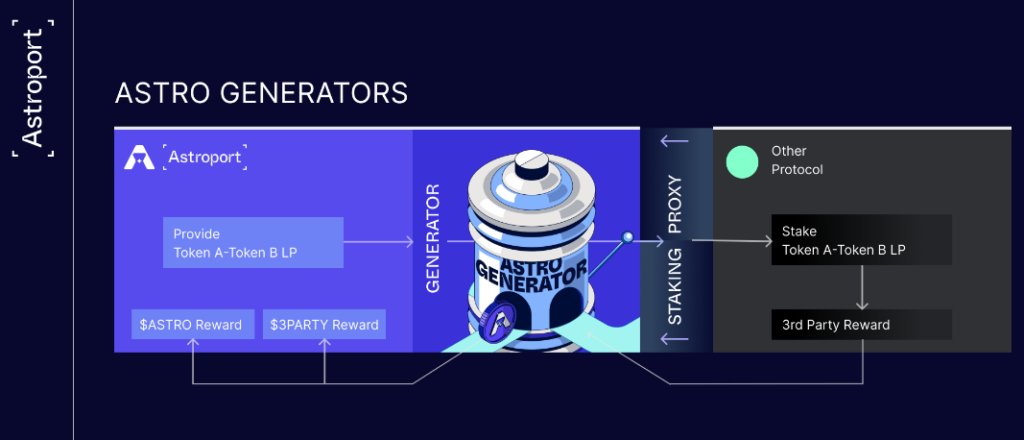

Astroport offers strategies and products to help users maximize profits from liquidity. Here's how it works:

-

Users deposit LP tokens into ASTRO Generators.

-

The ASTRO Generator sends the LP tokens via proxy staking contracts to third-party staking contracts.

-

When users claim rewards, the proxy staking contract receives them from the third party and forwards them to users.

-

The ASTRO Generator also distributes ASTRO tokens to users.

This strategy, known as dual liquidity mining, saves users time by eliminating the need to move funds across multiple platforms.

ASTRO Token

-

Current price: $0.1922

-

All-time high (ATH): $0.3 (-36.3%)

-

Current market cap: $81 million

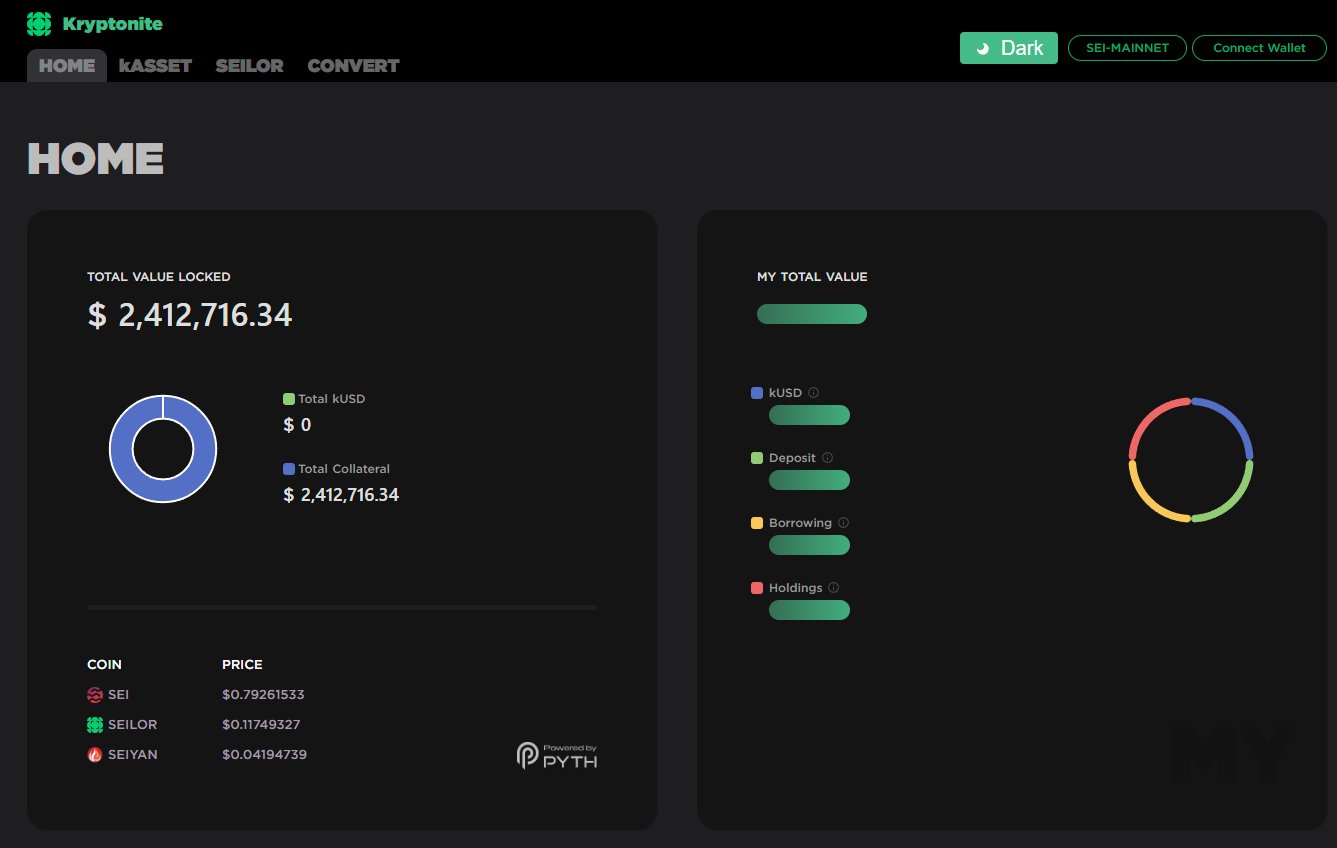

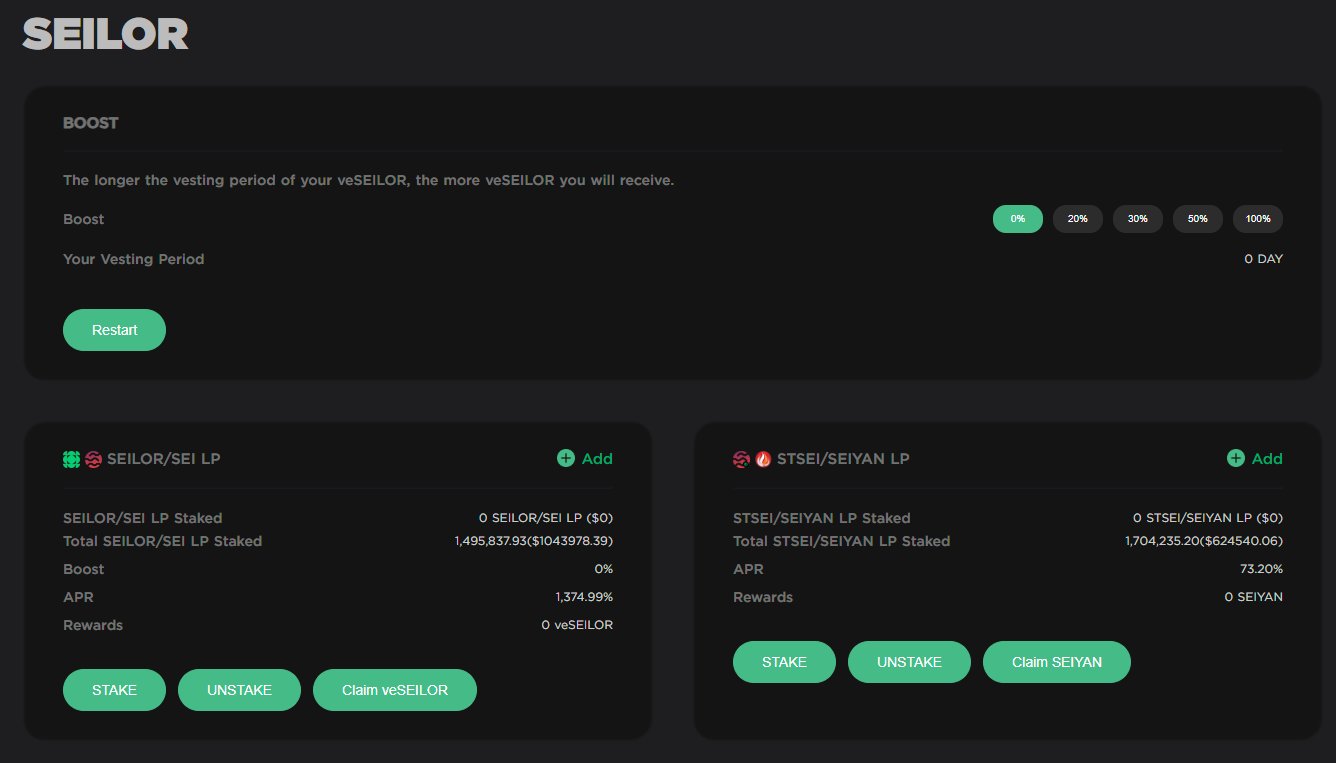

Kryptonite (SEILOR)

Kryptonite Finance is a liquid staking platform offering an integrated money market where users can earn compounding returns on SEI while leveraging positions. Kryptonite provides two methods: lending and staking. Users can deposit stablecoins or stake kAssets to earn rewards.

Kryptonite has recently added the stSEI–SEIYAN token pair. Within 12 hours of launch, over $600,000 in liquidity was provided via stSEI–SEIYAN. This pair marks the first use case enabling liquid staking for SEI.

SEILOR Token

-

Current price: $0.1236

-

ATH: $0.1294

-

Current market cap: $28.3 million

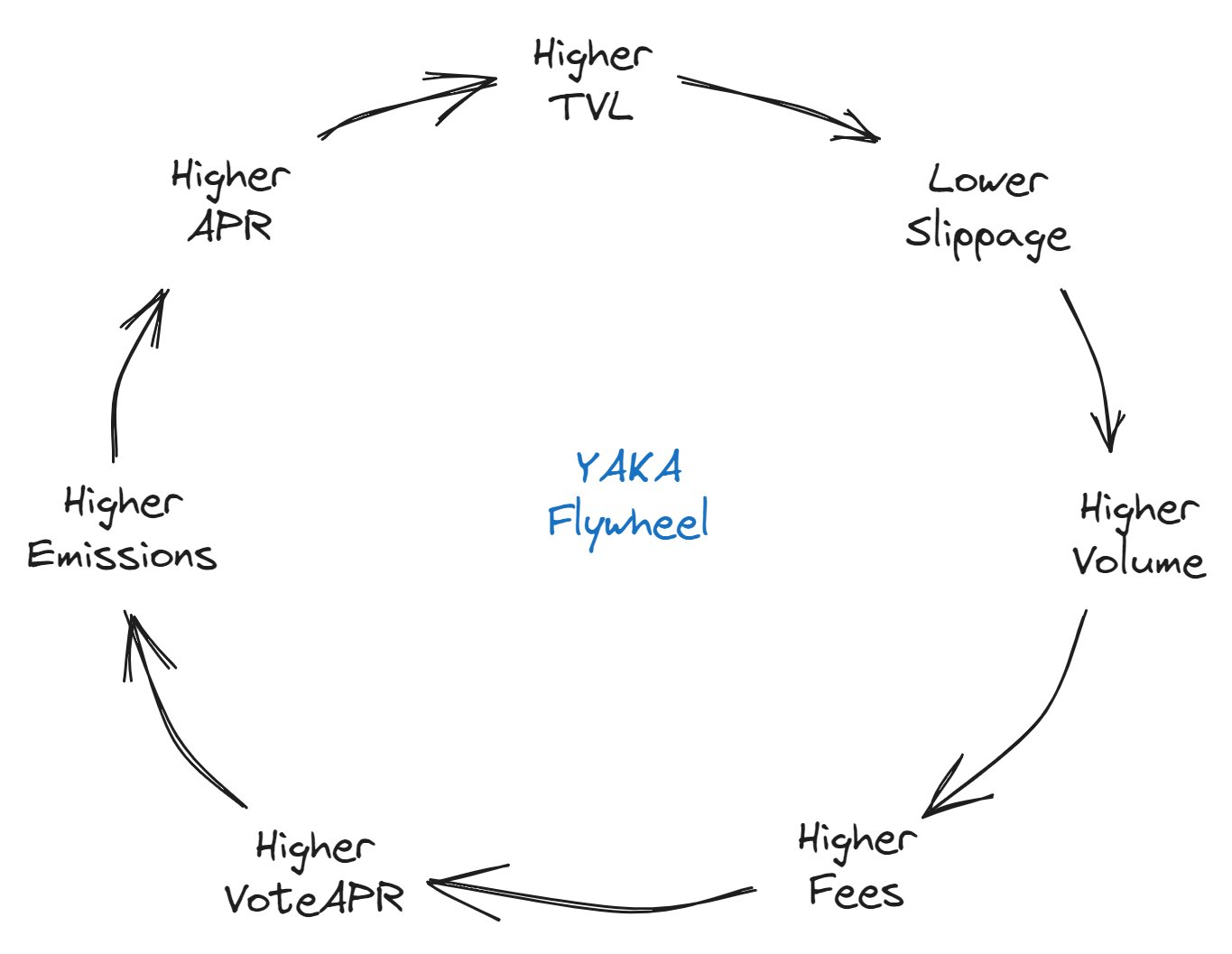

Yaka Finance

Yaka Finance is a unique DEX whose Launchpad uses a Ve(3,3) model built on Sei. Yaka Finance aims to develop solutions that seamlessly complement Sei’s capabilities, thereby expanding its impact within the DeFi space.

By prioritizing RWA and leveraging Sei’s strengths, YAKA Finance aims to become a central hub for DeFi liquidity on the Sei network. The ve(3,3) model incentivizes all participants in the Yaka ecosystem, including "veYAKA" voters, LPs, traders, and protocols.

Yaka is currently still in testnet phase and has not issued any tokens. However, early supporters are expected to receive airdrops.

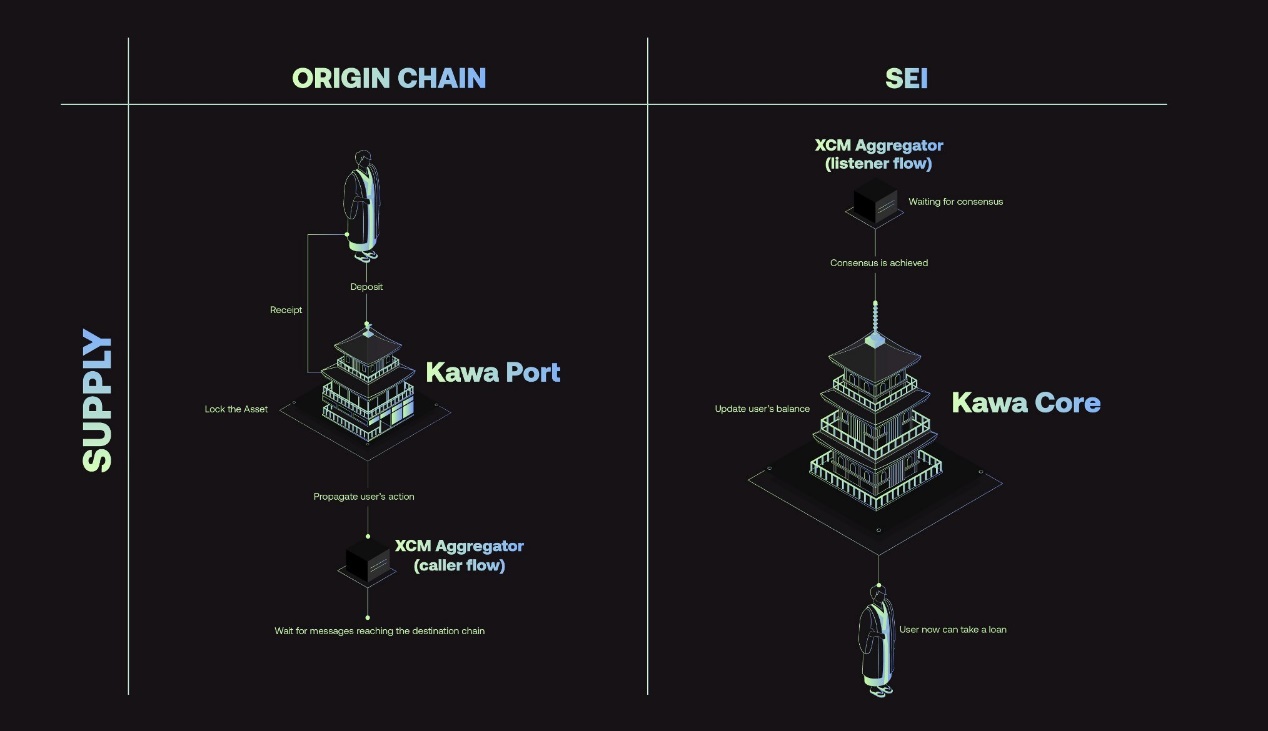

Kawa

Kawa is a cross-chain lending protocol that provides a seamless, decentralized experience for borrowing and lending assets across multiple networks. Kawa offers floating-rate lending to meet the growing demand for blockchain interoperability.

Core components of Kawa:

-

Kawa Core: Manages the state of the protocol.

-

Kawa Ports: Entry and exit points facilitating cross-chain asset transfers.

-

XCM Aggregator: Enhances security against bridge vulnerabilities.

Kawa Ports enable cross-chain asset transfers between blockchains. Each blockchain has its own Kawa Port for locking and unlocking assets, communicating with Kawa Core via the XCM Aggregator.

Key features:

-

Cross-chain transfers: Enable seamless asset movement between blockchains, enhancing interoperability.

-

Communication with Kawa Core: Interacts efficiently with Kawa Core via the XCM Aggregator for streamlined coordination.

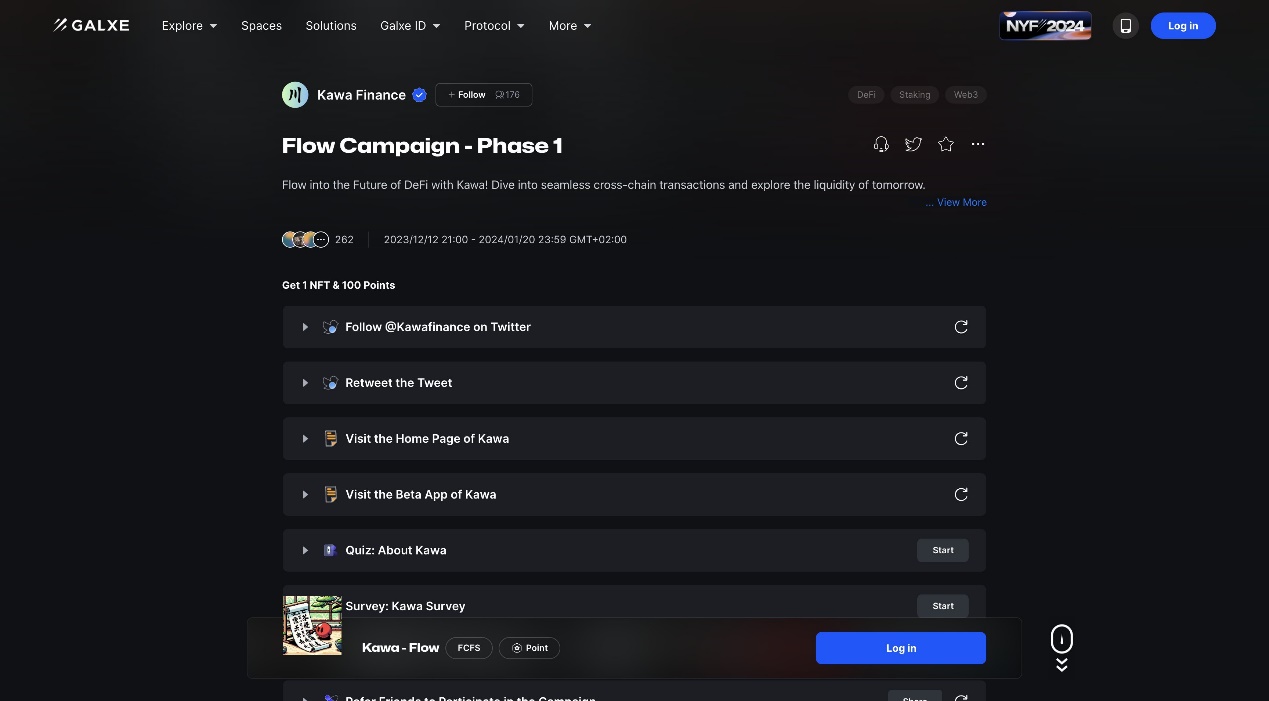

Kawa has entered the testnet phase, and the team has just launched a Galxe campaign. Early users have the opportunity to earn rewards.

Levana Protocol (LVN)

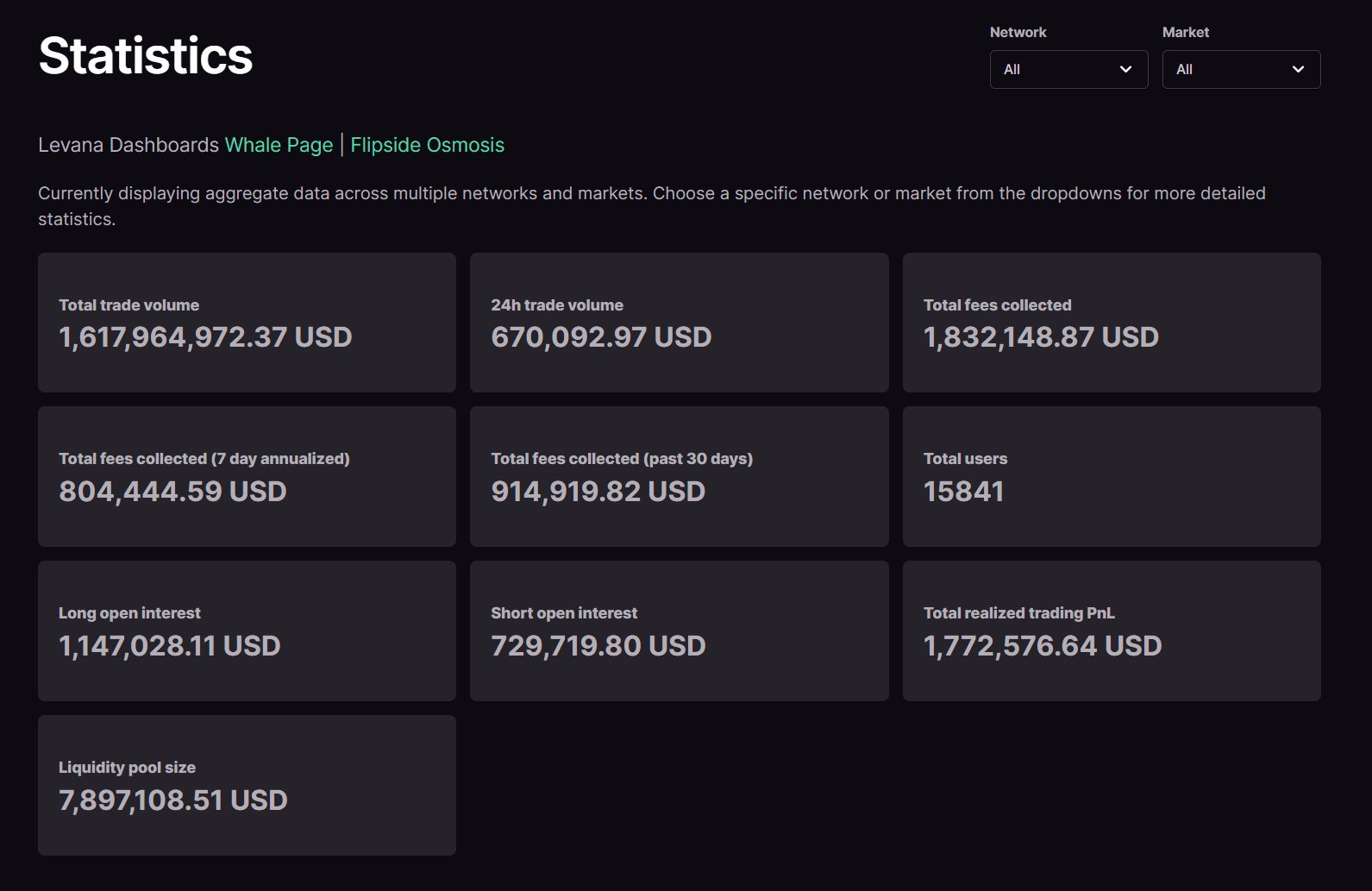

Levana is a perpetual contracts and leveraged trading protocol designed to manage risk while benefiting traders and LPs. Levana addresses issues found in existing models such as virtual AMMs.

Levana's newly launched Well-Funded Perps Model is a novel perpetual system that tackles challenges related to bridging, stablecoin risks, and insolvency. Additionally, it supports thousands of assets across multiple blockchains.

Key metrics:

-

Total trading volume: Over $1.6 billion

-

Total users: 15,000+

-

Total trading fees: $1.8 million

LVN Token

-

Current price: $0.2189

-

ATH: $0.8946 (-75.6%)

-

Current market cap: $18 million

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News