How Bitget's Latest Launchpool Unlocks Hidden Wealth Opportunities

TechFlow Selected TechFlow Selected

How Bitget's Latest Launchpool Unlocks Hidden Wealth Opportunities

Platform tokens often have greater upside potential and room for imagination when a bull market arrives.

At the start of the new year (January 3), Bitget, a "dark horse" among centralized exchanges (CEX), announced the launch of its latest Launchpool project—ZKfair (ZKF). Market attention quickly focused on the event, driving the price of BGB upward. By 4 p.m., it had broken through $0.6 and continued rising above $0.64.

On January 4, within just 20 minutes of opening, Bitget’s Launchpool received over 81 million BGB in deposits. What sparked such strong user enthusiasm? And how lucrative have Bitget's previous Launchpool offerings been? This article will unpack the wealth-generating mechanics behind Bitget Launchpool and introduce this round’s featured project.

What is Launchpool?

Launchpool is often directly translated as staking or liquidity mining. As the name suggests, users stake or provide a certain token to earn newly issued tokens. During the last DeFi summer, yield farming was extremely popular, and many centralized exchanges (CEXs) launched similar products. The key difference between Launchpool and Launchpad is that Launchpad involves initial token issuance—also known as an Initial Exchange Offering (IEO). However, fundamentally, both models allow users to stake or deposit a specific token to receive new project tokens.

To some extent, both Launchpool and Launchpad can be categorized as financial products and are among the most hyped trends in the crypto space. Because IEOs tend to generate more dramatic wealth effects, users often overlook the “steady happiness” offered by Launchpool—an oversight that leads many to miss out on consistently profitable, low-risk opportunities.

Analysis of Returns from Participating in a Bitget Launchpool

Typically, investors participating in a Launchpool earn returns from two sources: first, gains from the project’s native token, including both the amount of tokens earned through staking and potential appreciation in value; second, returns generated from the staked token itself.

ZKfair (ZKF) Token Earnings

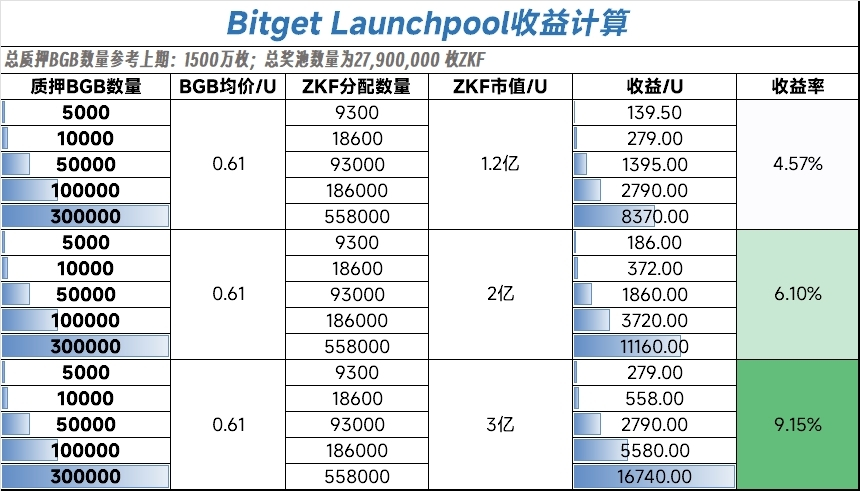

Take ZKfair (ZKF), the latest Launchpool project launched by Bitget yesterday, as an example. A total of 27,900,000 ZKF tokens are available for distribution over a two-day mining period, with hourly settlements. Users need only stake a minimum of 50 BGB to share in the 27,900,000 ZKF rewards.

Additionally, users can invite others to participate and share in a bonus pool of 100,000 ZKF. For each successfully invited friend who registers and participates in the new user staking pool, the referrer earns 1,000 ZKF (up to a maximum of 5,000 ZKF).

As shown in the image, the more BGB staked, the greater the allocation of ZKF. Based on estimates of ZKF’s market capitalization after listing, user returns are projected to range between 4.57% and 9.15%. Even assuming a conservative post-listing valuation of $120 million, staking 10,000 BGB (approximately $6,000) would yield $279 in profits—a clear risk-free gain. More importantly, Bitget Launchpool distributes ZKF every hour based on BGB holdings, allowing users to immediately sell their ZKF upon receipt. This gives participants full flexibility to decide their next move based on ZKF’s post-listing performance.

If we calculate returns based on the maximum single-account staking amount, potential profits become even higher. Beyond receiving a larger share of ZKF, the staked token itself often delivers even more impressive returns. This brings us to the second component of earnings—the BGB return—which many investors tend to overlook but which can actually represent a significantly larger profit source.

The Overlooked BGB Return

In fact, for staking or liquidity mining products, the choice of staking token is critical. When these products were first introduced, many CEXs used BTC, ETH, or stablecoins as the required staking assets. To join Launchpool or Launchpad events, users often bought these tokens with idle funds in their accounts. However, during this period, if Bitcoin or Ethereum experienced a market downturn, any gains from newly acquired tokens could easily be offset—or even exceeded—by losses in the value of BTC or ETH, resulting in net losses despite successful participation.

CEXs quickly recognized this issue and began using their own platform tokens as the primary staking asset for Launchpool and Launchpad programs. Thus emerged a win-win model.

Returning to Bitget’s current Launchpool: the official announcement was made at 4 p.m. on January 3. Immediately after the news broke, BGB’s price surged from $0.6 to $0.64—an 8% increase—and has since approached $0.65. In other words, even without receiving any ZKF allocation, simply buying BGB ahead of the event would have yielded at least a 10% return.

Does this happen every time a Launchpool or Launchpad launches? Not always—but Bitget has consistently delivered strong returns in this area. Last month, Bitget announced its Launchpad project TonUP on December 15, when BGB was trading around $0.5. Following the announcement, BGB began a steady climb and reached $0.7 during the subscription period—marking its seventh all-time high (ATH) in 2023.

Summary

Since its inception, Bitget Launchpool has hosted a total of 60 projects. Aside from a few early exceptions, most have used BGB as the staking token. Beyond the returns from distributed project tokens, BGB’s outstanding performance throughout 2023 has added substantial additional gains—making the difference mostly one of degree rather than outcome. Currently, the market is entering the early stages of a bull run. Crypto investors may consider allocating assets to platform tokens that performed well during the bear market, belong to platforms on an upward trajectory, and offer multiple layers of expected returns. Such platform tokens often possess greater upside potential and room for growth when the bull market fully materializes. By strategically diversifying investments and selecting promising platform tokens, investors can reduce risk while achieving superior returns.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News