Chaindege Smart Money Weekly (12/27): Trading volume and liquidity are flowing into Solana's Meme tokens

TechFlow Selected TechFlow Selected

Chaindege Smart Money Weekly (12/27): Trading volume and liquidity are flowing into Solana's Meme tokens

Bonk's trading volume increased 20-fold, while ETH-based tools saw trading volume drop by about 80%.

Author: ONCHAIN WIZARD

Translation: TechFlow

Chainedge has released its weekly Smart Money report, diving deep into the latest trends in the cryptocurrency market, particularly the significant shift in trading volume and liquidity from Ethereum to Solana-based meme coins.

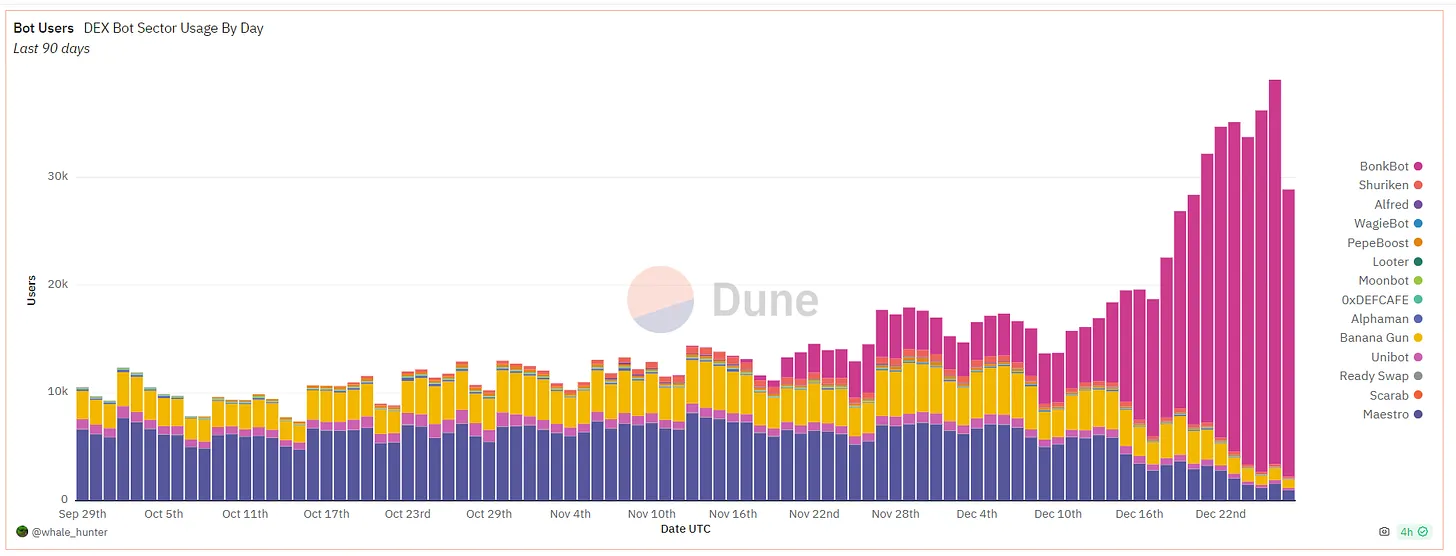

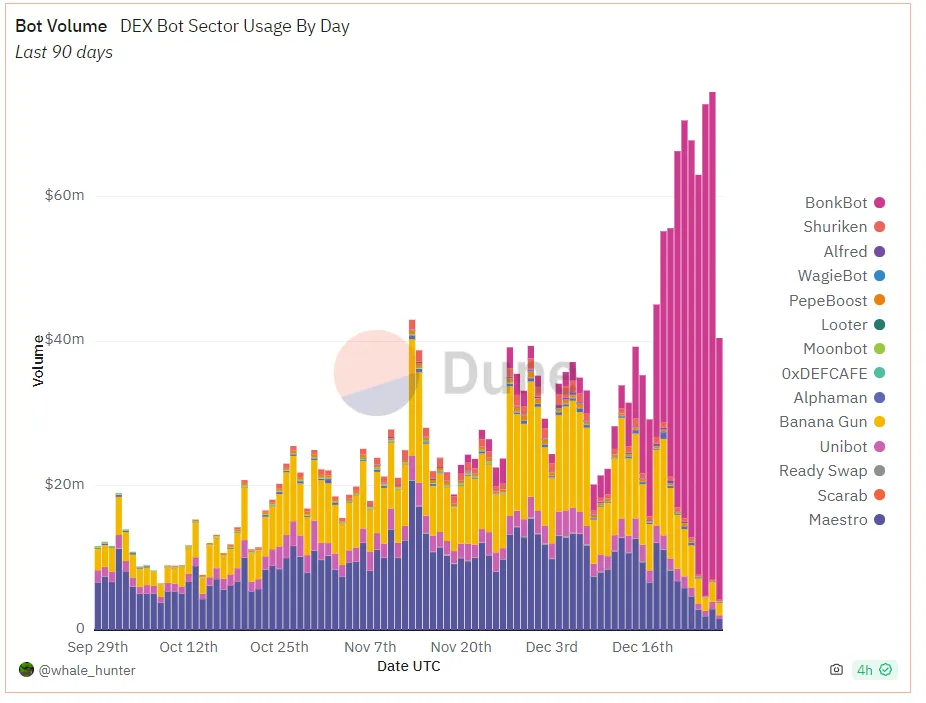

Before we begin this article, it's crucial to note that for the past two weeks, the market for trading any token on ETH/ARB/AVAX has been extremely weak. All trading volume, users, and liquidity have shifted toward炒作meme coins on SOL. The best way to visualize this shift is by examining changes in user numbers and trading volume on Telegram trading tools.

Bonkbot (Solana’s primary TG bot) had fewer daily users than Maestro on December 13th. Since then, its user base has grown sixfold, reaching 36,000 yesterday. As of yesterday, Bonk’s share of TG bot users increased from 34% to 91%. In terms of attention, liquidity, and trading volume, this marks a major shift, contributing to weak or even declining price action for ERC20 tokens.

From a trading volume perspective, this shift is even more pronounced. On December 13th, Bonk’s trading volume was $3 million, while Maestro and Banana combined totaled $27 million. Yesterday, Bonk’s trading volume reached $67 million, whereas Maestro + Banana together amounted to only $5.6 million. In other words, Bonk’s volume grew 20-fold, while ETH-based tools saw an approximately 80% decline.

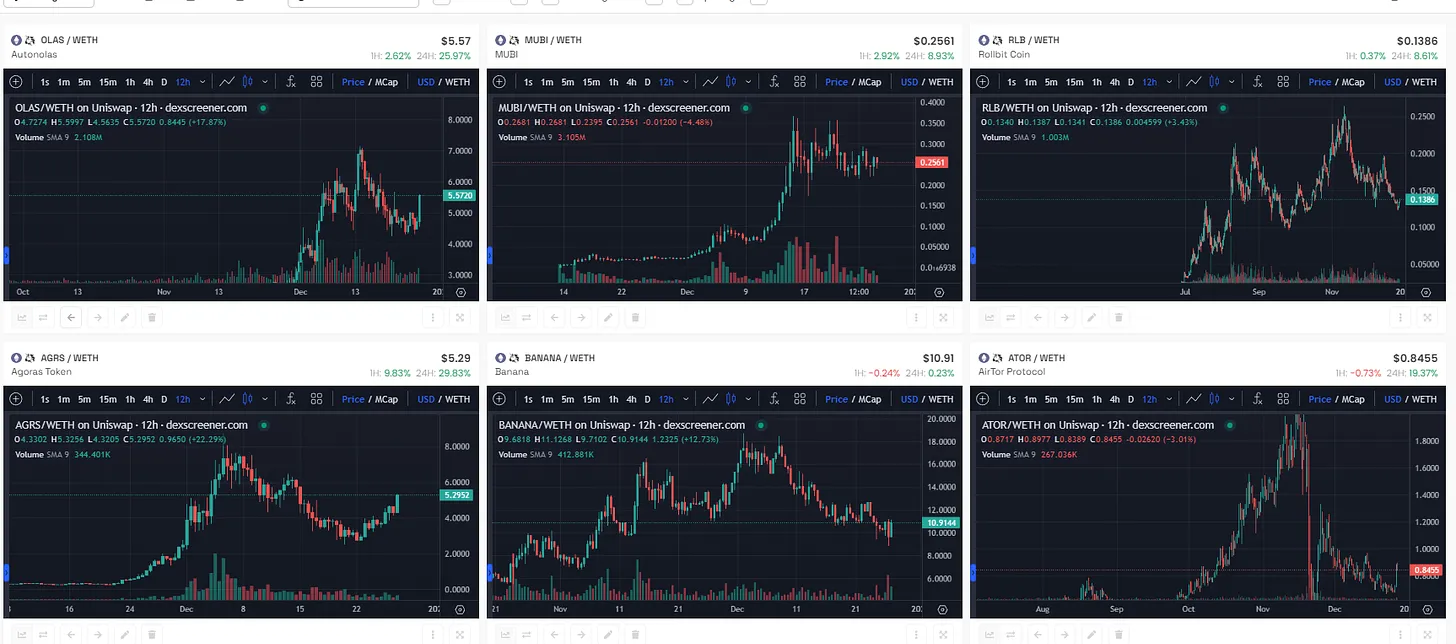

As expected, most popular ETH DEX tokens peaked around the 13th and have since entered a downtrend. Therefore, if you're looking for signs of an ETH recovery or a reversal in ERC20 token prices, monitoring DEX trading bot dashboards to see where degens are moving is a smart move.

chainEDGE Weekly Report: December 27, 2023

Based on the number of holders with over $10,000, the current favorites among smart money are OLAS, AGRS, MUBI, BANANA, $VAULT, MXH, and HYPR. Overall, as attention, trading volume, and liquidity have shifted away from ERC20 tokens, holdings of smart money tokens have shown a broad downward trend.

Among these tokens, those that have seen accumulation (or at least flat holding levels) since December 13 include:

-

OLAS (up 2%)

-

MXH (a newer token)

-

HYPR (flat)

In terms of newer tokens held by smart money wallets with $20,000 or more:

-

KOI $103K / 5 wallets (i.e., 5 smart wallets hold $103K worth of KOI)

-

MXH $298K / 27 wallets

-

MARK $181K / 5 wallets

-

FI $167K / 5 wallets

-

OMNI $159K / 8 wallets

-

RSTK $102K / 7 wallets

-

MZERO $64K / 6 wallets

-

vMINT $47K / 4 wallets

-

TUX (operation) $26K / 2 wallets

-

UEFN $20K / 12 wallets

Overall, we’ve observed the entire market—and smart money—shifting toward memes on Solana and more fundamental projects on Ethereum. Drilling deeper, the sectors seeing capital inflows are artificial intelligence, BRC20, followed by more specific plays like HYPR, BANANA, and MXH.

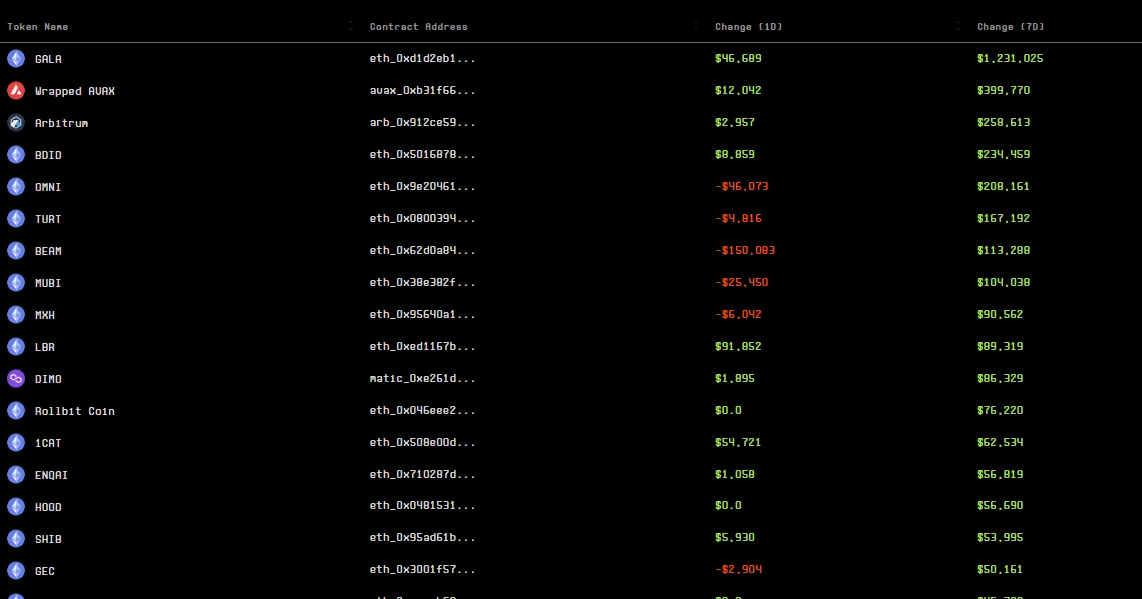

Looking at exchange flows from the past week, interest in tokens on EVM chains like AVAX and ARB has cooled, with focus shifting back primarily to ETH. Notably, BDID, OMNI, TURT, MUBI, MXH, LBR, 1CAT, and ENQAI each saw over $50,000 in net buying.

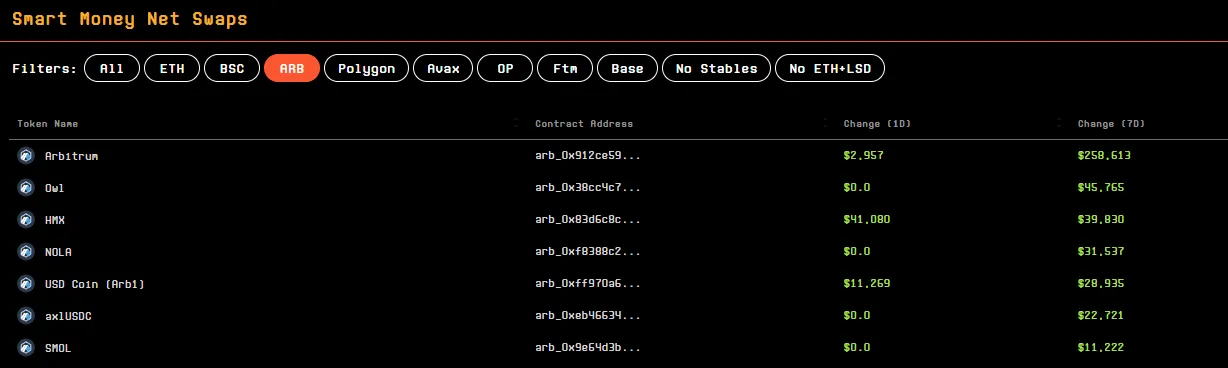

From non-ETH traffic, OWL, HMX, NOLA, and SMOL emerged as leaders on ARB, while traffic across other major EVM chains remained relatively weak.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News