Starknet is set to unlock and airdrop tokens in the first quarter of 2024. Which ecosystem projects are worth watching?

TechFlow Selected TechFlow Selected

Starknet is set to unlock and airdrop tokens in the first quarter of 2024. Which ecosystem projects are worth watching?

We all live in the gutter, but some of us are still looking at the stars.

By TechFlow

It's unclear whether the founder of Starknet was inspired by Oscar Wilde’s famous quote, but this Layer2 "star" is set to shine brightly in the first quarter of 2024.

On December 1, 2023, the Starknet Foundation announced that it had taken a snapshot for its token airdrop and would distribute STRK tokens to certain active users and contributors in Q1 2024, while also unlocking previously distributed tokens.

As a result, many investors are positioning themselves early within the Starknet ecosystem, hoping to uncover hidden gems—some investing in Rabbit (RBX), others backing Lords (LORDS), and many simply waiting with wallets open for an airdrop.

So, what potential investment opportunities exist in the StarkNet ecosystem today?

What Makes StarkNet Different?

In the Layer2 landscape, StarkNet stands among the "Four Heavenly Kings" alongside Arbitrum, Optimism, and zkSync.

Compared to Arbitrum and Optimism, StarkNet uses zk-Rollup technology, allowing transaction bundling without needing to know validators, and eliminating the seven-day waiting period when transferring assets across chains.

StarkNet balances privacy and scalability exceptionally well—particularly in protecting user transaction data and security—a feature lacking in most current Layer 2 scaling solutions.

Compared to fellow zk-based protocol zkSync, which uses zk-SNARKs for its zero-knowledge proofs (offering smaller proof sizes and lower gas costs), Starknet employs zk-STARKs, providing greater transparency and enhanced security.

Additionally, zkSync is EVM-compatible and uses Solidity as its programming language, lowering the barrier to entry for developers. In contrast, Starknet uses its own language, Cairo, and does not support EVM. However, projects like Warp and Kakarot are actively building zkEVMs on StarkNet, enabling developers to deploy more easily using tools such as Kakarot.

StarkNet features native account abstraction, freeing users from complex seed phrases and private keys, resulting in a significantly improved user experience.

In summary, StarkNet has its own programming language, Cairo, making it less EVM-compatible and raising the development barrier. Yet, its advantages in high throughput and low transaction costs allow it to excel in specific domains.

For example:

On-chain gaming: High throughput and low fees make StarkNet an ideal platform for fully on-chain games, forming one of its core narratives.

Smart contract wallets: Native account abstraction enables contract wallets on StarkNet to offer functionalities similar to hardware wallets.

On-chain AI: StarkNet’s architecture allows off-chain computation with on-chain verification of generated proofs.

Derivatives trading: dYdX originally chose StarkWare as a technical partner.

Which Starknet Protocols Are Worth Watching?

The Starknet ecosystem spans multiple sectors including DeFi, NFTs, GameFi, cross-chain bridges, and smart contract wallets, with over 170 projects currently under development.

Most of these projects remain in early stages—put simply, the majority have not yet launched tokens. RabbitX and Lords are among the few that have already issued assets.

RabbitX

RabbitX is a permissionless perpetual exchange built on Starknet. It supports order book trading with up to 20x leverage.

Built using low-latency ZK-STARK technology, RabbitX delivers extremely fast confirmations, zero gas fees, and inherits full security from Ethereum L1.

According to the latest data from DefiLlama, RabbitX ranks as the second-largest on-chain derivatives trading platform, trailing only dYdX.

Liquidation Mechanism

RabbitX offers a robust liquidation framework. Its margin requirements are: maintenance margin at 3%, and forced liquidation margin at 2%. Based on this, RabbitX implements a three-tier waterfall system for handling liquidations:

-

Tier 1: When an account's equity falls below the maintenance margin (3%), partial liquidation occurs until equity recovers above the threshold. During this time, users cannot place new orders, cancel existing ones, or withdraw funds.

-

Tier 2: If equity drops below the forced liquidation margin (2%), the position is closed at zero price (setting equity to zero).

-

Tier 3: If the RabbitX insurance fund goes negative, opposite positions are automatically reduced at zero insurance fund price. This deleveraging step activates only when the fund's net value dips below zero.

Tokenomics

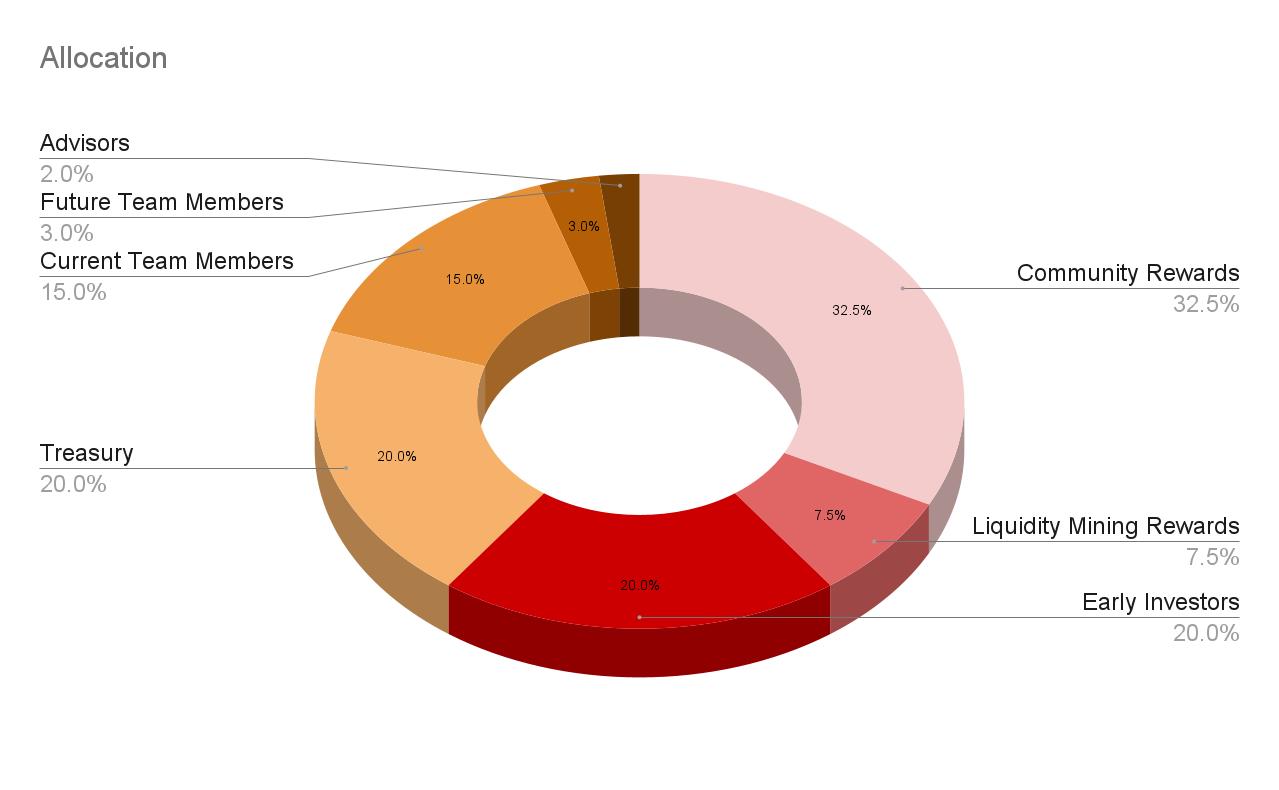

RabbitX launched its utility token RBX with an initial supply of 1 billion. The RBX token is already listed. Below is the token distribution:

-

32.5% allocated to community rewards

-

7.5% for liquidity mining rewards

-

20% to treasury

-

20% to investors

-

15% to current team

-

3% reserved for future team members

-

2% allocated to advisors

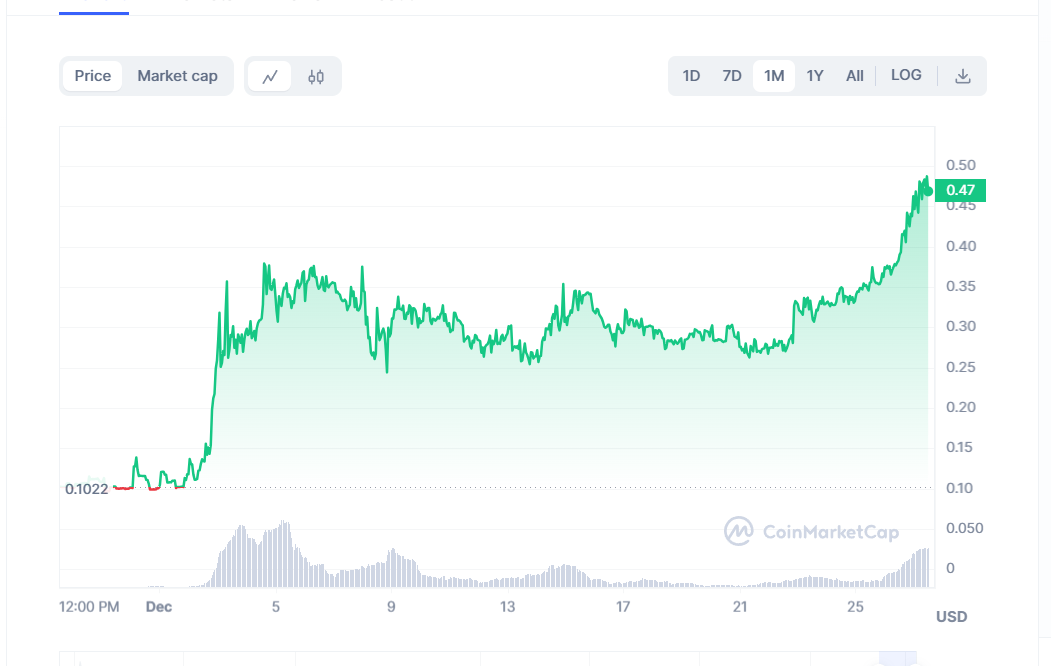

In terms of performance, RBX has shown strong results: +10% in 7 days, +123% in 30 days, and +133% over one year. Its 30-day return clearly outperforms the broader market. RBX currently has a market cap of $46.5 million.

Loot Realm

Starknet is a haven for on-chain gaming, and Loot Realm (Realms.World) is a prime example. The Realms ecosystem includes two main games: Loot Survivor and Realms: Eternum.

Loot Survivor is a rogue-like survival game where players battle monsters while traversing a world. Upon encountering enemies, players must choose between fighting or fleeing, while allocating experience points (XP) to upgrade attributes and extend survival time.

Realms: Eternum is a sandbox strategy simulation akin to Civilization. Players must hold at least one Realm NFT to participate, building kingdoms, raising armies to compete for resources or defend against raids, and constructing buildings within their domain.

Other games based on the Realms universe and ecosystem include Rising Revenant, a survival game, and Arcane Assembler, a time-spell game.

Loot Realm originated from the NFT project Loot. Back in 2021, the team attempted deployment on Arbitrum but faced numerous challenges, realizing that the Ethereum Virtual Machine and Solidity were ill-suited for fully on-chain gaming. They then discovered Starknet, adopted Cairo for development, and restructured the game using a modular controller system.

Gamers will be familiar with the concept of a game engine—an integrated codebase and toolkit that handles tasks like graphics rendering, physics simulation, and network communication through modular APIs, essentially functioning as a SaaS solution.

In traditional game development, Unity and Unreal dominate. Similarly, the fully on-chain gaming space now has its own engines.

MUD is a fully on-chain game engine for EVM, first unveiled at DEVCON in April 2022 and officially released on November 22, 2022, by the Lattice studio.

MUD’s emergence inspired the Starknet ecosystem: “If EVM has it, we can too.” Around the same time, Starknet launched Cairo 1.0 in November. Core contributors to Loot Realms (@lordOfAFew), Cartridge (a Steam-style game distribution platform on Starknet) founder @tarrenceva, and Briq (an NFT building protocol) founder @sylvechv proposed developing a native on-chain game engine for Starknet. By February 2023, Dojo was born—a native, fully on-chain game engine for Starknet.

Thus, the point I'm making is this: Realm is not just an on-chain game on Starknet—it’s an entire ecosystem and the founding father of the Dojo on-chain game engine.

Tokenomics

LORDS is the ERC-20 token powering Realms.World. It can be used to acquire resources, summon armies, construct buildings, and perform various other actions within the Realmverse. LORDS is earned through different in-game activities and can be traded on resource markets.

The total supply of LORDS is capped at 500 million, distributed as follows:

-

57.5% allocated to in-game emissions

-

22.5% to Bibliotheca DAO (development studio)

-

10% to Journey contracts

-

5% to development fund

-

5% for LP incentives

In terms of performance, LORDS has delivered impressive returns: +65% in 7 days, +359% in 30 days, and +687% over one year—far outpacing the broader market. LORDS currently holds a market cap of $23.7 million.

Projects Without Tokens

Aside from RabbitX and Realms.World, most protocols in the Starknet ecosystem have not yet launched tokens.

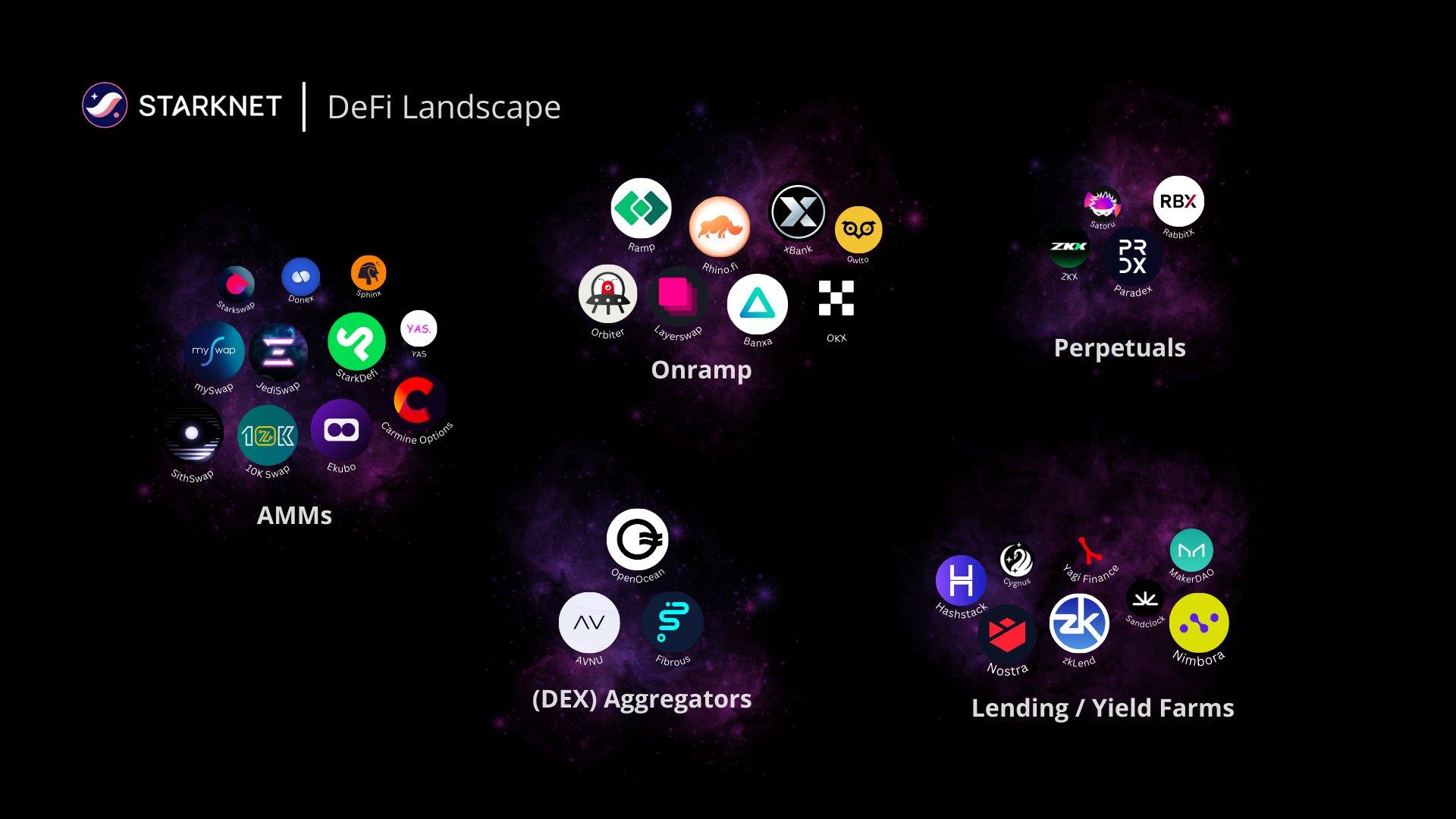

Recently, the official team shared a chart highlighting major DeFi applications on Starknet. Drawing from that, this article examines key protocols worth watching across five DeFi sectors: cross-chain bridges, AMMs/DEXs, aggregators, lending, and derivatives.

Cross-Chain Bridges

StarkGate

StarkGate is Starknet’s native, official cross-chain bridge. Each supported token connects via L1 and L2 bridge contracts communicating through Starknet’s message-passing mechanism. These bridges enable users to trade ETH and ERC-20 tokens using Starknet Alpha and its STARK-based computational compression.

Currently supports five major tokens: $USDC, $USDT, $WBTC, $DAI, $ETH.

Official link: https://starkgate.starknet.io/

Orbiter

Orbiter supports asset transfers between Ethereum and multiple L2s, enabling movement from chains like zkSync and Optimism to Starknet.

Orbiter Finance involves two roles: Sender (sender) and Maker (liquidity provider). When a sender initiates a transfer, the maker supplies liquidity. A smart contract ensures safety—if a maker causes failure through malicious behavior, the sender can file arbitration using the maker’s bond and receive overcompensation.

Notably, Orbiter’s token issuance plan remains uncertain. The founding team initially hinted at launching a token but later backtracked.

Official link: https://www.orbiter.finance/home

layerswap

layerswap supports bridging across multiple networks including Starknet, zkEVM, ImmutableX, Arbitrum, and Optimism. Users can instantly transfer ETH, USDC, and other tokens from centralized exchanges like Coinbase, Binance, and Kraken to all major L2s.

Official link: https://www.layerswap.io/app

AMM/DEX

Ekubo

Ekubo is an automated market maker specifically designed for Starknet, featuring concentrated liquidity, scalability, and efficient capital utilization. Leveraging Starknet’s architecture, Ekubo delivers optimal swap execution and superior returns for liquidity providers. All Ekubo pools reside within a single contract, reducing storage fragmentation and lowering transaction costs.

Notably, Ekubo leads Starknet in TVL with $8 million.

Official link: https://ekubo.org/

Brine (now renamed tanx.fi)

tanx.fi is a decentralized order-book exchange built on StarkEx, offering gas-free and fast trading. It enables users to track portfolios, analyze PnL, and trade seamlessly. tanx.fi caters to quantitative traders, CeDeFi platforms, and institutional users.

The whitepaper explicitly states that the $SALT token will soon launch. Stay tuned via official Twitter and website updates.

Official link: https://tanx.fi/

JediSwap

JediSwap is a permissionless, composable AMM on Starknet, allowing users to provide liquidity for trading pairs and earn fees. It supports Swap, add/remove liquidity, and ZAP functionality (enabling users to convert any single token into a JediSwap LP position in one Starknet transaction).

JediSwap holds $7 million in TVL, ranking second on Starknet.

Official link: https://www.jediswap.xyz/

10KSwap

10KSwap is an AMM protocol built with Cairo. 10K aims to revolutionize AMM performance by leveraging rollup capabilities, bringing lower fees, reduced friction, better liquidity to the L2 world, and accelerating DeFi adoption. 10KSwap allows token holders to freely create trading pairs without paying high fees.

Official link: https://10kswap.com/

SithSwap

SithSwap is the next-generation AMM on StarkNet, supporting both volatile and stable swaps with ultra-low slippage, near-zero fees, and full Ethereum-level security. SithSwap offers two types of pools:

-

Dynamic Pools use a UniV2-style mechanism, ideal for highly volatile asset swaps

-

Stable Pools optimize low-volatility assets, minimizing slippage and enhancing capital efficiency and trader yield

Official link: https://app.sithswap.com/

Aggregators

AVNU

AVNU is a decentralized trading protocol and liquidity infrastructure designed to always deliver optimal execution strategies for traders and dApps on Starknet (and broader L2s). It searches across multiple DEXs to find the best routes, minimizing slippage. Additionally, its RFQ (Request for Quote) system integrates market-maker liquidity, improves price discovery, eliminates slippage, and provides MEV protection.

Official link: https://www.avnu.fi/

Fibrous

Fibrous aggregates all AMMs on StarkNet into one interface, enabling users to swap at the cheapest rate via optimized routing algorithms.

Fibrous also integrates several projects, including Ekubo Lightning Accounts and mySwap’s concentrated liquidity.

Official link: https://fibrous.finance/

Lending Protocols

zkLend

zkLend is a crypto lending protocol built on StarkNet, combining zk-rollup scalability with fast transactions and cost savings via Ethereum security. zkLend meets demands for high-speed, low-cost trading and supports multiple tokens including ETH/wBTC/USDC.

The protocol offers a dual approach: a permissioned, compliance-focused solution for institutions, and a permissionless service for DeFi users—without sacrificing decentralization.

The official site clearly lists a total token supply of 100 million and outlines its distribution, indicating clear plans for a future token launch. Follow official Twitter and website for updates.

Official link: https://zklend.com/

Nostra

Nostra is a one-stop DeFi solution built on Starknet, enabling users to lend, borrow, and trade cryptocurrencies. Nostra’s liquidity layer consists of the Nostra Money Market, UNO (Starknet-native stablecoin), and Nostra Swap (a stablecoin DEX). Integrating these products allows users to access liquid crypto assets permissionlessly at any time with minimal price impact.

-

The Nostra Money Market is the core product, continuously supplying liquidity to the ecosystem and generating yield for Nostra Swap and UNO minters.

-

Nostra Swap is the next-gen stablecoin trading platform supporting UNO’s peg and growth. LPs providing liquidity on Nostra Swap can also earn yield by lending their stablecoins on the Nostra Money Market.

-

UNO is the first native stablecoin on Starknet, overcollateralized with interest-bearing ETH. UNO can be used across DeFi, gaming, NFTs, and real-world payments.

Official link: https://nostra.finance/

Hashstack

Hashstack is Starknet’s most capital-efficient undercollateralized lending protocol, featuring:

-

Multi-chain interoperability

-

Enhanced oracle security using TWAP mechanisms

-

Optimized liquidations for safer asset recovery

-

Smart loan limits based on dApp liquidity

Notably, Hashstack has already launched its $HASH token and conducted an airdrop for mainnet V1 users from November 27, 2023, to January 22, 2024. More details available on the official site and Twitter.

Official link: https://hashstack.finance/

Derivatives

Paradex

Paradex is a cryptocurrency derivatives exchange and Starknet’s first appchain. Paradex offers perpetual futures trading with deep liquidity, capital efficiency, and high performance, while maintaining transparency and self-custody. All complex logic is validated on L2.

Recently, Paradex surpassed $2 billion in historical trading volume.

Official link: https://www.paradex.trade/

ZKX

ZKX Protocol is a decentralized perpetual futures exchange running on StarkNet. Community-built and user-centric, ZKX leverages zk-STARK technology to gain competitive advantages over other DEXs—offering CEX-like scalability and benefits such as account abstraction and low-cost transactions.

Unlike other DEXs, ZKX introduces a unique risk-mitigation tool called “deleveraging” to protect users from sudden market volatility. In extreme cases, the platform triggers liquidations to prevent larger losses.

Additionally, the ZKX token is scheduled to launch in 2024.

Project website: https://zkx.fi/zh

Conclusion

During the crypto bear market, Starknet stayed focused and made significant progress over the past year. According to Nethermind’s industry review, Starknet showed notable improvements in key metrics throughout 2023:

-

Active accounts increased from 2,126 to over 69,000

-

Block creation time reduced from 2,000 seconds to 97.09 seconds

-

Total funds bridged via StarkGate grew from under $6,000 to $109 million

-

Full-time developer count reached 166

Perhaps with Starknet’s upcoming token launch, ecosystem incentives from the foundation, and a recovering market, these figures will grow further in 2024—benefiting not only Starknet but the broader Layer2 ecosystem as a whole.

Start researching and observing when few are paying attention. How the ecosystem evolves from here is something we’ll watch together.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News