CoinFund portfolio company founders' 2024 predictions: 70% optimistic about crypto market, AI remains fastest-growing sector

TechFlow Selected TechFlow Selected

CoinFund portfolio company founders' 2024 predictions: 70% optimistic about crypto market, AI remains fastest-growing sector

In this article, founders of over 30 projects invested by CoinFund share their insights on the 2024 cryptocurrency market.

Author: Jules Mossler

Translation: TechFlow

As 2023 comes to an end and 2024 approaches, people have differing views on the development of Web3 in the coming year.

In this article, founders of over 30 projects invested in by CoinFund share their insights into the cryptocurrency market in 2024.

Are they optimistic or pessimistic about the overall crypto market? Which sectors do they collectively favor?

“Where are we now in the evolution of cryptocurrency, and what happens next?”

This is clearly a classic question in the cryptocurrency space, as technology continues to evolve.

Web3 enthusiasts and developers are the bedrock of the future. They tirelessly demonstrate their vision for what’s ahead and rush to clarify misconceptions before mainstream media and the public fully grasp Web3. If you want to understand how cryptocurrency will develop, the best way is to ask those actively working in the field.

CoinFund Portfolio Founders’ Predictions for 2024

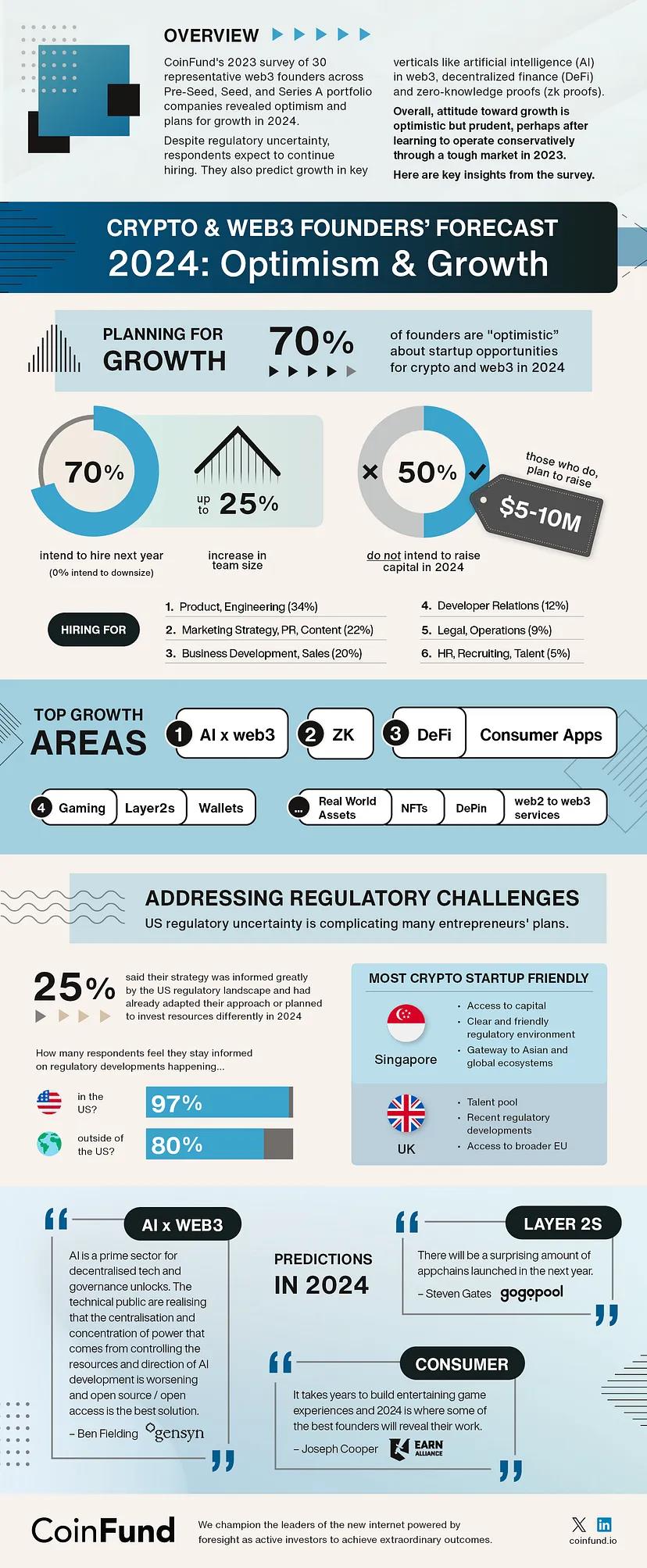

In November 2023, CoinFund surveyed founders or CEOs from 30 portfolio companies to gather their perspectives on the outlook for Web3 in 2024.

The main findings were: A majority of founders plan to expand hiring next year and remain optimistic about the future of Web3 across various domains—from blockchain and artificial intelligence to zero-knowledge proofs.

Despite positive sentiment, a quarter of respondents said regulatory uncertainty in the United States significantly impacts their strategies for 2024. As these entrepreneurs adjust resources and plans in response to U.S. regulations—and view jurisdictions like Singapore as more supportive of innovation—the U.S. risks losing technological leadership and the economic influence of building the new internet.

The survey respondents effectively represent CoinFund's portfolio, collectively having raised nearly $1.5 billion in funding.

Founders are optimistic yet cautious—likely a lesson learned from conservative operations during the previous two years of bear market. Seventy percent expressed optimism about entrepreneurial opportunities in cryptocurrency and Web3, with 70% planning to hire more staff next year and no one intending to lay off employees.

Half of the surveyed founders do not intend to raise capital next year. Among those who do plan to fundraise (20%), funding needs are likely to range between $5 million and $10 million.

2023 was a year of rapid blockchain advancement. Teams truly committed to long-term Web3 development deepened their focus, with many newly funded companies working on infrastructure improvements to enhance efficiency and scale blockchains—preparing the industry to meet mainstream consumer demands. Founders ranked the following areas as expected to grow fastest in 2024:

1) Web3 x AI;

2) ZK;

3) DeFi and consumer applications;

4) Gaming, Layer2s, and wallets;

RWA, NFTs, DePin, and services connecting users from Web2 to Web3 follow closely behind.

When it comes to choosing where to launch a startup, have you considered Singapore? Seven founders identified Singapore as the most favorable jurisdiction for crypto startups today. They cited efficient capital flows, clear and welcoming regulatory frameworks, and its strategic position as a gateway to Asian and global ecosystems. The UK also received praise due to recent regulatory developments and access to broader EU markets. Despite challenges such as difficulties in small business banking and opaque regulation, the U.S. was commended for its dense talent pool, networking opportunities, and strong infrastructure support for startups.

Evan Kohlmann, founder and CEO of Cloudburst Technologies, stated: “For startups, the most friendly country in the world is the United States—but if the U.S. doesn’t work to adopt standardized cryptocurrency regulations like other countries around the world, the legal environment won’t allow crypto businesses to operate.” Nearly all respondents (97%) described themselves as “informed or semi-informed” about U.S. regulatory dynamics; 80% were similarly aware of regulatory developments outside the U.S. A quarter of respondents said their growth strategies are heavily influenced by U.S. regulation.

Additional Founder Predictions for 2024:

Growth

Ben Fielding, Co-Founder of GenSyn

The next wave of Web3 applications will solve real-world problems where decentralization offers unique value.

Danny Zuckerman, Co-Founder of 3boxlabs

Web3 growth won’t come from a single killer app, but from a set of killer use cases—because Web3’s defining feature is composability: leveraging assets and data across multiple applications. Two trends will make this more achievable in 2024:

-

PWA + key management models will dramatically speed up consumer adoption of Web3 apps

-

Improved availability and scalability of Web3 data stacks will enable fuller composability

AI

Nick Emmons, Co-Founder and CEO of Upshot

Decentralized AI will become the fastest-growing category in crypto within the next 18 months. Developers will heavily leverage AI when building the next generation of decentralized applications.

Consumers

Doug Petkanics, Co-Founder and CEO of Livepeer

The convergence of AI, social media, and blockchain lays the foundation for mass consumer adoption of Web3. If AI drastically lowers the barrier to creating media at scale—such as videos and music—then human creativity becomes even more valuable. Blockchain is particularly well-suited for instant global coordination of people to provide cultural curation. This could result in media formats that are more innovative, engaging, and compelling than TikTok-style short videos—ushering in a new form that disrupts existing social media.

Aké Andre, Founder and CEO of Crypto Rogue Games, builder of Naramunz

In 2024 and 2025, Web3 gaming will gain widespread consumer acceptance—a shift that could impact Web3 even more profoundly than free-to-play did for the gaming industry. This will drive a wave of mergers and acquisitions, as larger blockchain gaming studios recognize that smaller teams, empowered by AI, have become leaner and stronger. New business models centered on rewarding players for progressing through games will unlock greater profitability.

Noah Diskine Kline, Founder and CEO of Wincast

The future of blockchain depends on eliminating entry barriers for the broader consumer. Currently, blockchain is presented as a revolutionary technological leap, but the technology remains too abstract. If blockchain companies can concretize and simplify technical concepts, and put their products into the hands of people who previously dismissed Web3 entirely—or avoided it due to complexity—then blockchain will achieve mass adoption.

Luke Truitt, Co-Founder and CEO of Bridgesplit

In 2024, downward pressure on cryptocurrency regulation will be limited. Therefore, Web3 products that leverage crypto to deliver more traditional financial, economic, and social functions will see significant growth.

DeFi & RWA

Aaron Nevin, Founder and CEO of Moonmortgage

2024 will be the year TradFi makes a major move into Web3. Any product supporting TradFi has a chance to succeed. More user-friendly ETH staking solutions may see increased opportunities.

Graham Rodford, Founder and CEO of Archax

In 2024, we may begin to see tokenized real-world assets integrated with DeFi.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News