Sui DeFi Ecosystem Overview: 10x TVL Growth in 4 Months, Breakthroughs and Future of the Move-Based New Public Chain

TechFlow Selected TechFlow Selected

Sui DeFi Ecosystem Overview: 10x TVL Growth in 4 Months, Breakthroughs and Future of the Move-Based New Public Chain

As a new blockchain launched during a bear market, Sui is quietly growing and gradually climbing the blockchain TVL rankings.

Author: TechFlow

Bitcoin has surged past the $44,000 mark. Amid the euphoria of a bull market return, the TVL rankings among public blockchains are quietly shifting.

Sui, a new blockchain launched during the bear market, is "quietly leveling up," steadily climbing the public chain TVL leaderboard.

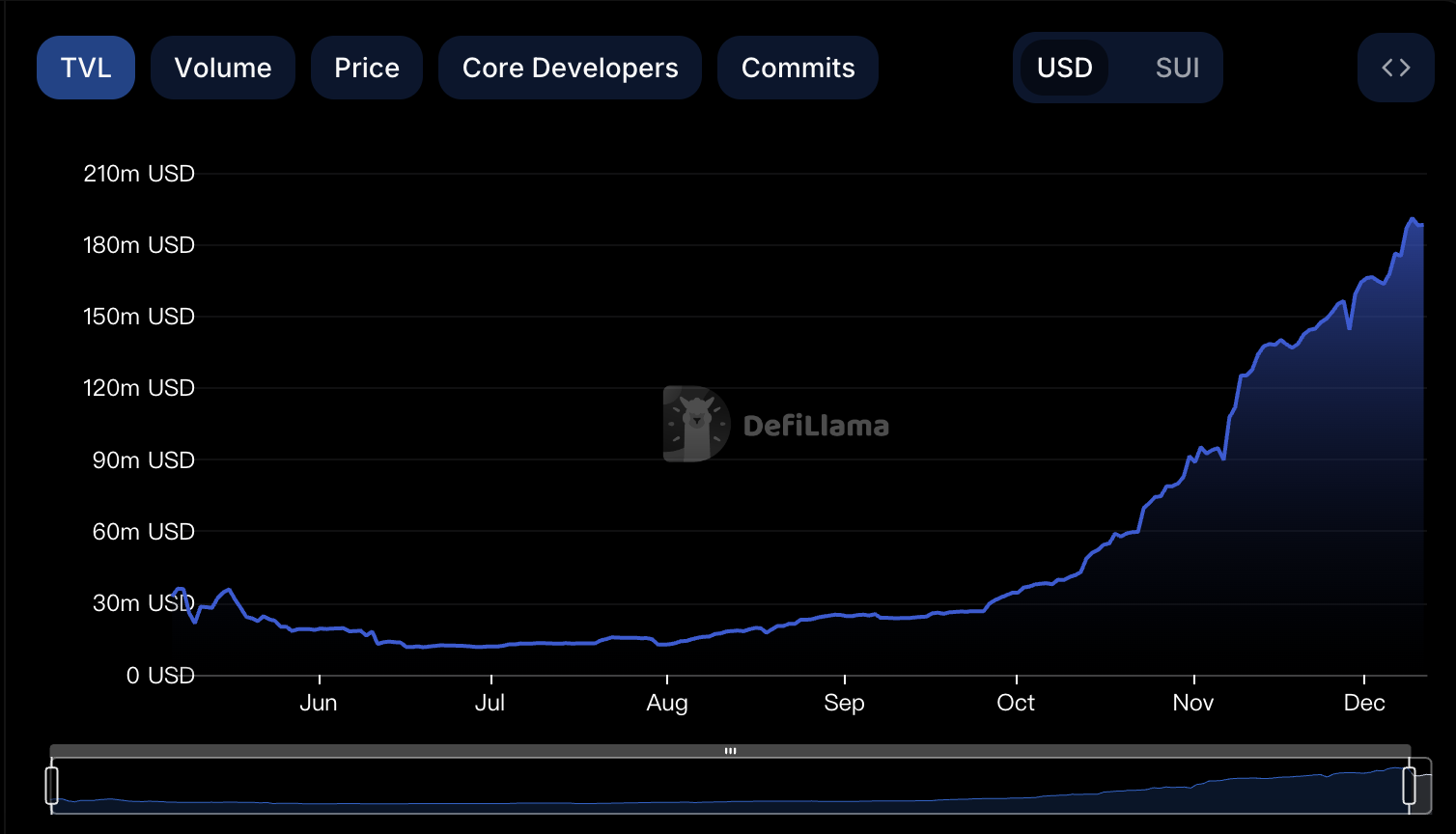

On December 15, Sui’s total value locked (TVL) surpassed $150 million—more than a tenfold increase over the past four months—and continues to grow rapidly.

After its mainnet launch, Sui faced significant controversy. On one hand, its token price remained weak; on the other, like all new chains, it struggled with an uneven ecosystem—some low-quality projects and speculative ventures parasitizing the network, chasing quick profits from new narratives.

From the beginning, Sui positioned itself as “one of the most attractive blockchains for Web3 game developers,” thanks to its underlying architecture being naturally suited for building large-scale blockchain games:

On-chain NFT Data Storage: Game NFT metadata on Sui is not stored on centralized servers or IPFS, but rather as code-level “Objects” on-chain, controlled by smart contracts. All NFT metadata can be accessed directly on-chain, maximizing decentralization.

Dynamic Attribute Updates for NFTs: Sui features a unique dynamic attribute NFT design. An NFT smart contract on Sui consists of two parts: “Fields” and “Dynamic Fields.” The former includes immutable attributes such as name, image URL, and creator; the latter allows certain NFT properties to be modified after player authorization. This enables in-game NFT upgrades and minting.

Given that gaming is one of the most accessible scenarios for attracting massive user adoption, it was naturally supported and encouraged by the Sui team. As a result, Sui was initially labeled as a “gaming/NFT blockchain.”

This might be a misinterpretation.

In my view, any public blockchain ecosystem attempting to bypass DeFi and jump straight into building a large-scale on-chain NFT or gaming ecosystem is delusional.

Because DeFi is the foundational infrastructure for every public blockchain.

Whether pure PFP NFTs or in-game NFT items and tokens, they all possess asset characteristics. Any asset inherently has financial attributes—tradability, use as collateral for lending—all of which depend on DeFi infrastructure and liquidity. Often, NFT booms are even amplified by DeFi leverage. That’s why DeFi Summer preceded the NFT craze.

While Sui initially focused on attracting game developers, it never defined itself solely as a “gaming chain.” Shortly after mainnet launch, it adopted DeepBook, a native liquidity layer with built-in liquidity pools supporting DeFi applications, ensuring Sui is also a top-tier platform for DeFi.

The tenfold growth in Sui’s TVL within four months is the direct outcome of these efforts—the DeFi ecosystem on Sui is now growing robustly.

Sui's DeFi Ecosystem

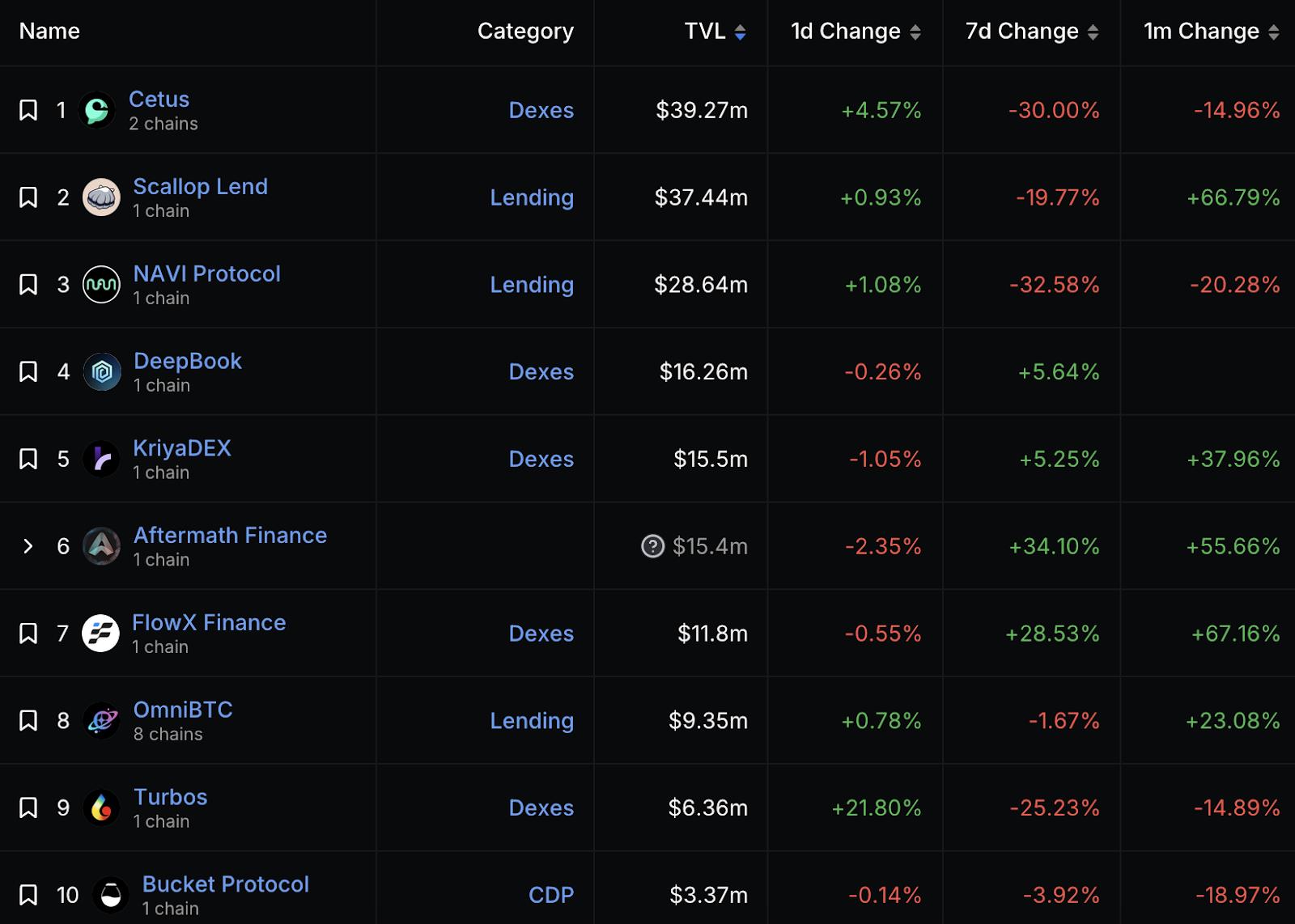

According to DefiLlama data, Sui currently hosts over nine projects with TVL exceeding $5 million, primarily concentrated in decentralized exchanges (DEXs) and lending platforms, seven of which have TVL well above $10 million.

Cetus is undoubtedly the “Sui King.” Built on Uniswap V3’s concentrated liquidity algorithm, it is an AMM-based decentralized trading platform where users can permissionlessly create token liquidity pools and provide liquidity within custom price ranges. Additionally, Cetus offers fee-based farming, a launchpad, and various ancillary products.

Since Q3, Cetus has seen explosive growth across key metrics—its TVL surged from $11 million to over $53 million, while cumulative trading volume recently surpassed $1 billion.

Two main factors drive this rapid growth: First, the continuous influx of emerging projects and new assets into the Sui ecosystem brings fresh DeFi use cases and scenarios, enriching applications and stimulating trading demand on DEXs.

Second, user and trader demand for SUI and native ecosystem assets is rising, and as the leading DEX, Cetus naturally captures much of this traffic.

Cetus has already launched its token and listed it on major CEXs including OKX.

Other leading DeFi protocols on Sui include BlueFin, FlowX Finance, Navi, KriyaDEX, Scallop Lend, and Aftermath Finance.

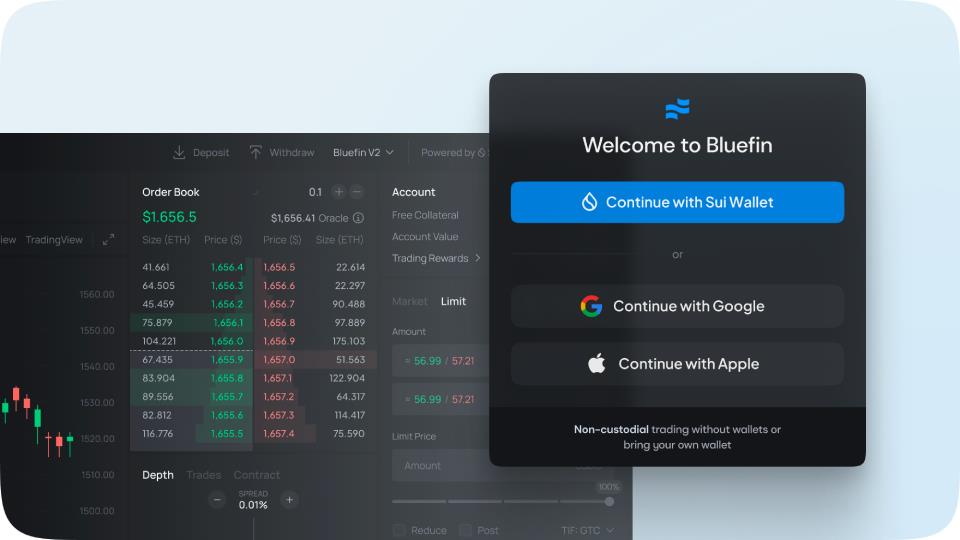

BlueFin (formerly Firefly, dTrade) is a decentralized perpetual contracts protocol based on off-chain order books, backed by top-tier investors such as Polychain and Wintermute.

Built on Sui, Bluefin v2 offers scalability and wallet-less trading experiences comparable to centralized exchanges.

BlueFin aims to deliver a familiar CEX experience within DeFi—a vision they believe can only be realized on Sui.

Unlike other L1s that only support parallel execution, Sui enables parallel ordering and execution—achieving throughput exceeding 125,000 transactions per second, with network availability unaffected by other apps or users.

Additionally, to lower user barriers, BlueFin integrates ZKLogin—a native Sui feature allowing users to log into Web3 apps using existing Web2 identities (e.g., Google), with privacy protected via zero-knowledge proofs.

Bluefin averaged $103 million in daily trading volume in December, capturing over 80% of Sui’s DEX market share. Its v2 version has gas fees under $0.005, currently fully subsidized by the Bluefin Foundation.

FlowX Finance is an ecosystem-centric DEX built on Sui. The development team introduced unique features such as analytics, Farming-as-a-Service, real-time price charts, and notification bots.

The project received funding from the “Sui Foundation” and won the community favorite award at the “Sui x KuCoin Hackathon.” On November 30, it completed a community IDO round raising $940,000. Users participating in the protocol are expected to receive airdrops, with NFTs serving as proof of early usage.

Navi Protocol is a lending protocol on Sui. It launched its mainnet on July 27 and now boasts a TVL of $35 million (including borrowings), accumulating 740,000 users, and winning first place in the DeFi category at the SUI x KuCoin Summer Hackathon.

On December 8, NAVI Protocol announced the NAVI Bonus campaign—staking SUI or USDC via OKX DeFi into NAVI Protocol unlocks exclusive additional APY of up to 10%.

Navi Protocol has received investment support from Sui’s official entity Mysten Labs, Vietnam’s largest crypto wallet Coin98, and exchange Gate. It holds extensive community resources and users, particularly in Vietnam.

KriyaDEX is Sui’s first derivatives exchange, sponsored by the Sui Foundation. It comprises KriyaSwap (a spot AMM with native bridging) and Kriya DEX (an order-book-based perpetual DEX), supporting perpetual contracts, futures, and options with up to 20x leverage.

KriyaDEX also offers reward opportunities for liquidity providers (LPs), including rewards in SUI and a prize pool of 1,000,000 $KRIYA tokens.

Scallop is a full-stack money market on Sui, offering lending, flash loans, trading UI tools, swapping, cross-chain bridges, and SDKs for professional traders. It emphasizes security, composability, and comprehensive support.

Its standout feature is a unique lending model featuring protected collateral pools, market tokens, a three-tier dynamic interest rate model, and multi-oracle strategies.

Aftermath Finance is a multifunctional DeFi product aiming to become Sui’s liquidity and transaction hub. It won the Sui Builder Hero award and first place at the Sui Liquid Stake Hackathon.

On one hand, Aftermath is a trading platform enabling the creation of liquidity pools with more than two tokens and flexible weights—ideal for low-liquidity tokens, custom LP pairs, bridged assets of newly launched tokens, or decentralized index/portfolio management systems.

Moreover, Aftermath has built a DEX aggregator integrated with all protocols on Sui, capable of finding optimal trade routes between any two assets.

Recently, Aftermath launched its own liquid staking token—afSUI. Users can stake SUI to receive afSUI and use it across the Sui DeFi ecosystem. Initial use cases include protocols like Cetus, Scallop, and Bucket Finance.

Currently, afSUI is the largest liquid staking token on Sui, with a total of 1,559,463 SUI staked into afSUI.

Notably, apart from Cetus, many of these projects have not yet issued tokens, presenting potential airdrop opportunities.

Reviewing these projects, most originated from Sui hackathons and received grants from the Sui Foundation—making them bona fide core contributors.

Tracing back to its origins, Move—a new programming language—was originally developed by Facebook for the Diem blockchain, envisioned as new infrastructure for global finance. From inception, Move was designed as a language for running digital assets, renowned for high TPS and suitable for large-scale commercial applications.

After Diem’s demise, Sam Blackshear, the creator of Move, became Sui’s CTO and further refined the language for Sui.

Sui employs a dual-consensus model—dependent transactions are ordered and processed sequentially, while independent transactions are executed in parallel. This gives the network a decisive edge in transaction processing, enabling TPS far exceeding other blockchains.

Thus, Sui validators do not face the same computational pressures as those on Ethereum or Solana. Transactions like mass NFT mints are separated from DeFi-related transactions—they bypass consensus, freeing up validator and consensus resources, thereby providing a less congested yet stable environment for processing and deploying DeFi transactions.

Therefore, technically speaking, Sui is not only suitable for building gaming and NFT ecosystems but also a paradise for DeFi developers.

Challenges and Future of New Public Blockchains

Judging from news updates, the Sui team is likely one of the busiest among public blockchain ecosystems this year.

They’re constantly managing public relations crises while hosting hackathons and events worldwide.

March: Sui hosted a Builder House in Vietnam;

April: Sui hosted a Builder House in Hong Kong;

May: Sui co-launched a summer hackathon with KuCoin Labs;

June: Sui hosted Builder Houses in Kyoto and Seoul;

July: Sui hosted a Builder House in Paris;

August: Sui hosted a liquid staking hackathon and a Hacker House in San Francisco;

September: Sui hosted a Builder House in Singapore;

November: Sui held Sui Devconnect in Turkey;

…

All these hackathons and Builder Houses serve one goal: attracting more developers to build on Sui. This reflects the current dilemma facing Sui and Aptos: Move, as a new language, suffers from a severe shortage of developers.

Compared to EVM-compatible chains using Solidity or Solana using Rust, Move always carries some learning and migration cost—bringing us back to a classic challenge: How can a new blockchain ecosystem attract new developers?

Based on previous bull market experiences, the fastest way is wealth effects. When prices rise and capital flows continuously into the ecosystem, financially incentivized developers rush in. However, this method only delivers temporary glory.

Price should be the outcome of ecosystem growth—not its driver. When price becomes the catalyst, it attracts speculators. Once prices falter, the ecosystem may collapse overnight. Ultimately, teams must go back to fundamentals—diligently building developer communities, conducting education, establishing trust, and cultivating loyalty. This will be a long-term journey.

I once spoke with a new Move language developer and asked why he didn’t choose the mature Solidity for development.

His answer was simple yet powerful: “Looking ahead, blockchain needs 100x scaling, not just 10x improvements from L2 patches. New languages and new L1s definitely have their chance.”

Sui is undergoing the painful transformation typical of new blockchains—a process inevitably marked by struggles against price volatility, token unlocks, market cycles, and community sentiment—until it reaches a tipping point and enters a virtuous flywheel where ecosystem growth and price appreciation reinforce each other.

DeFi development has already shown results. Wishing Sui success as it breaks through on its transformative journey.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News