Bull Market Profit Rule: Focus on Token Hype Trends, Not Fundamentals

TechFlow Selected TechFlow Selected

Bull Market Profit Rule: Focus on Token Hype Trends, Not Fundamentals

After all, in the crypto world, strong price performance is roughly equivalent to a good project.

Author: ONCHAIN WIZARD

Translation: TechFlow

In the cryptocurrency space, for 99% of tokens, the only thing that matters is market attention. Personally, I came to Web3 from traditional finance and had to shift my mindset—from valuing profitability and fundamentals—to accepting that "99% of tokens have no intrinsic value but can be arbitrarily priced." Let’s look at a fascinating example: INJ.

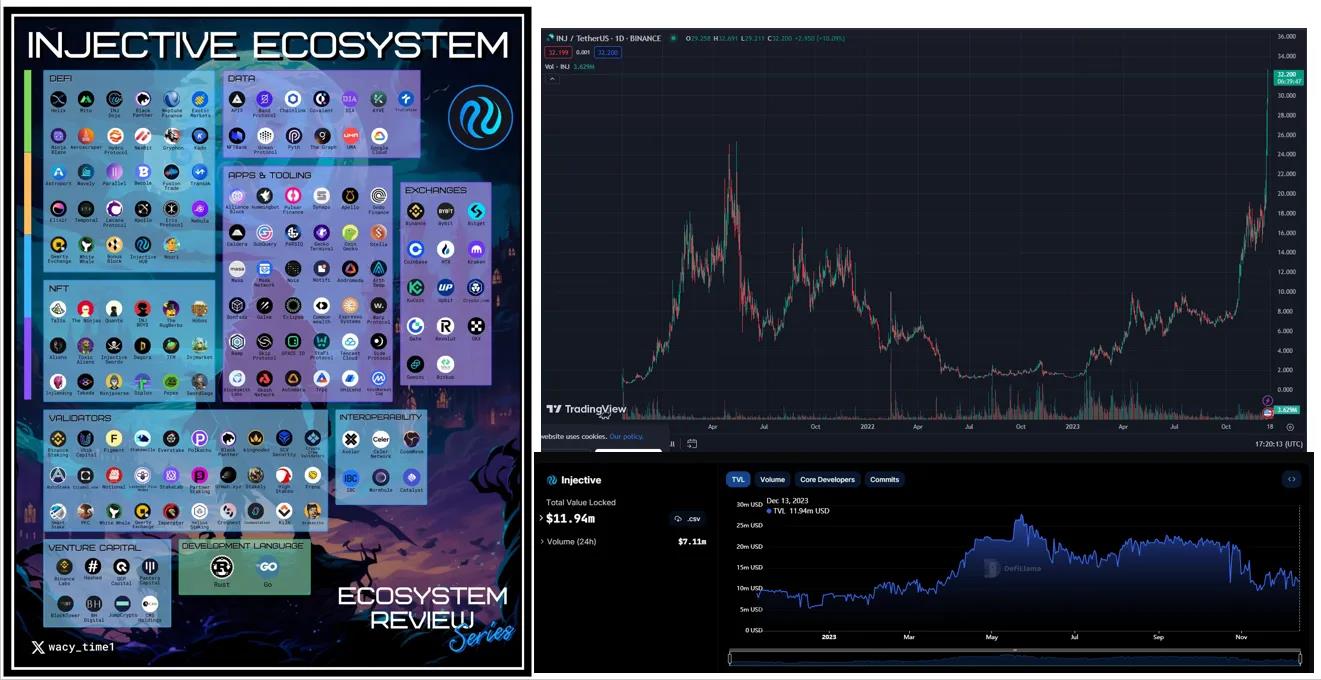

Looking at the impressive ecosystem on the left side of the image below, one might assume this ecosystem is thriving, and INJ’s year-to-date 32x price increase would reinforce that belief. However, its TVL has remained largely flat throughout the year, and core developer activity has been declining. So why did the token surge 32x? Did the INJ team discover a cure for cancer? No. The price went up, which attracted more attention; as more attention (and capital) flowed into INJ, the token price kept rising—creating a self-reinforcing positive cycle.

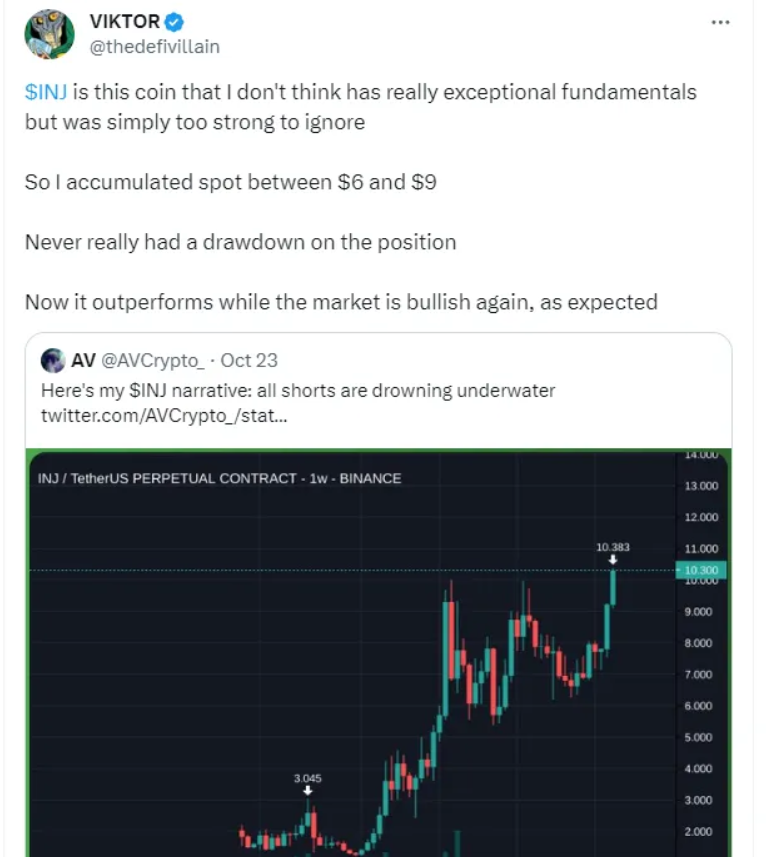

You could even go back and see smart people like Viktor reaching the same conclusion (and after this post, the token rose another 3x): fundamentals aren’t there, yet the token price continues to climb.

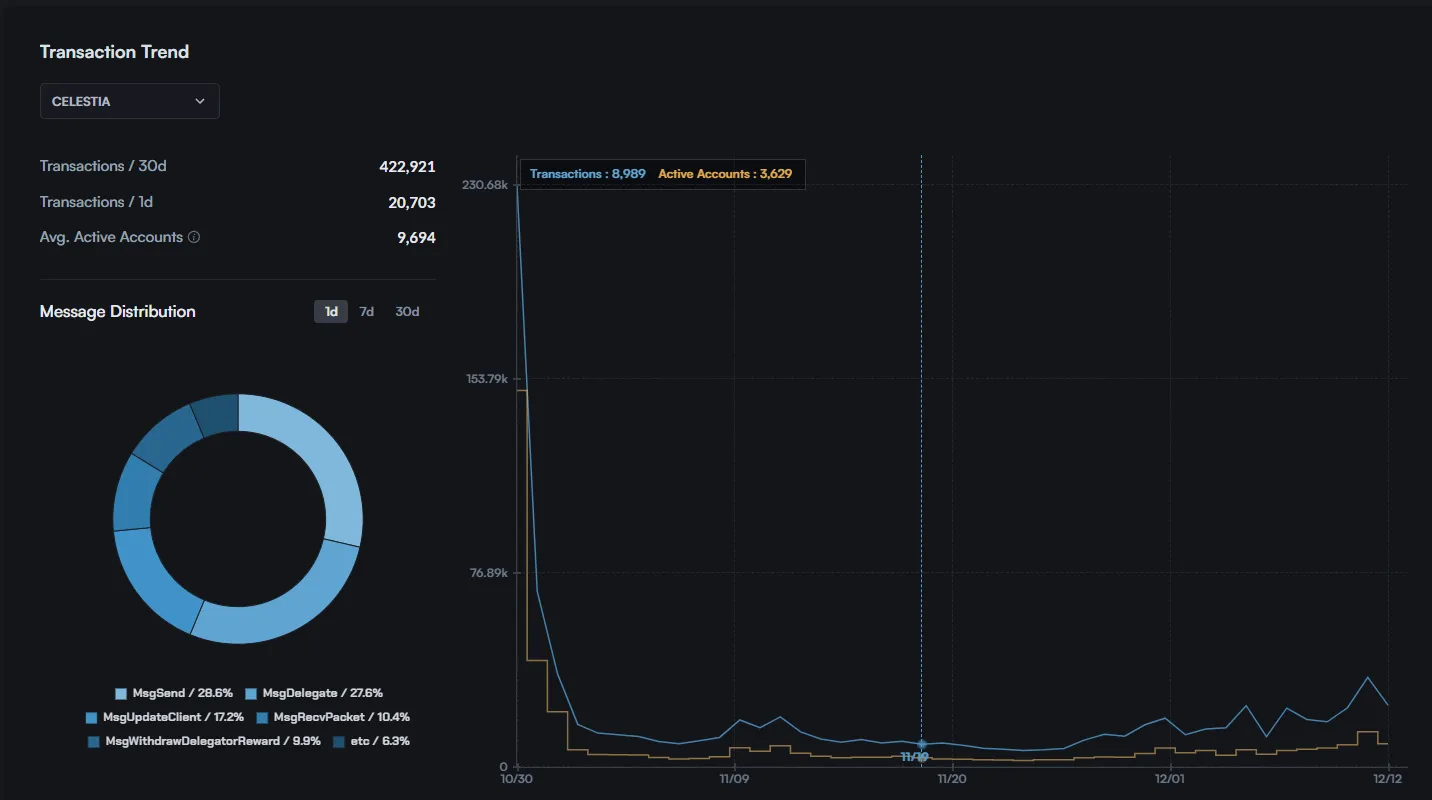

Another example is Celestia (TIA). The project conducted a large-scale airdrop, generating significant market attention. But since the airdrop, transaction counts and active accounts for TIA have mostly declined.

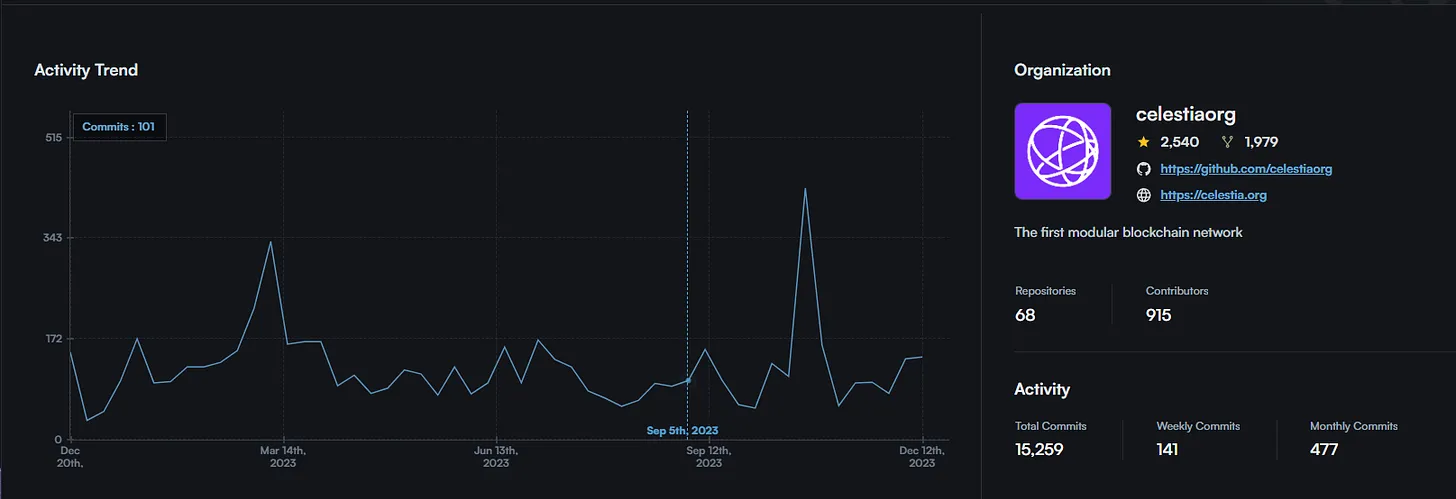

Development activity shows the same downward trend.

But again, it doesn't matter. In crypto, strong price action equals a good project.

There's an old saying in crypto: nothing markets your token better than a rising price—and these are just two examples. The sole advantage these projects have is capturing the attention of crypto traders. These aren't tokens I personally like to trade, but I’ve seen them discussed continuously on my Twitter/X feed for 2–3 months.

For those who only trade on DEXs, we know which projects are getting attention—like trending tokens on Dexscreener (and related filters). Going further, you should build your mental framework—both qualitatively and quantitatively—around the question: “How do I trade the attention surrounding token X?”

If a token has ranked in the top 5 on Dexscreener’s trending list for 3–4 consecutive days and then suddenly “disappears,” what do you think will happen to its price? It will fall. Take GFY (trending for at least 3 consecutive days), for instance—once attention (and associated trading volume) began to fade, the token quickly dropped 85%. Clearly, market attention matters even more with memecoins, as attention is nearly their only source of value.

Now let’s compare MUBI. Last week, following comments by Bitcoin core developer Luke, widespread discussion emerged around the idea that “BRC20 is dead.” MUBI lost attention, trading volume, and upward momentum within 3–4 days. However, note that MUBI has now bounced off its support level, and as attention and volume return, it has nearly tripled in price.

Perhaps you’re already convinced of this investment logic. For me personally, this remains an area I constantly need to improve—whether opening new positions, setting stop-losses, or doubling down.

You can also build alternative models for tracking market attention. Whether I’m buying a brand-new token with little information or a mature ecosystem token, here are the questions I ask myself:

-

Has this token’s attention peaked? If so, I probably shouldn’t touch it.

-

Will this token or narrative continue to gain attention?

-

From a qualitative standpoint, where is this token in its “attention cycle”?

-

For example, DOGE reached peak attention on the day it was mentioned on SNL, then fell 90% over the next two years. But now, it appears to be entering a new cycle, with attention gradually increasing. (Editor’s note: SNL is a famous American comedy and variety television show.)

Once you start viewing crypto investing through this lens, you’ll understand why AI shell projects (or near-shell projects) can surge from $2 million to $100 million in market cap within days, weeks, or months—while your favorite DeFi token remains stagnant. I wrote about this in “The Chameleon Investor”, but having built chainEDGE and observed which tokens generate the highest P&L trades and top-performing traders, it’s clear that in crypto, attention trumps everything. Returning to AI, one reason I’m personally bullish is that there aren’t many public stocks available to hype AI. Cryptocurrencies, however, are perfectly suited for this. Add some AI-related tech, and projects can easily reach tens or even hundreds of millions in market cap within days, weeks, or months due to pure hype.

But how do I put this into practice? First, if you’re not already monitoring trending tokens on Dexscreener, start doing so now. You don’t have to buy them, but you need to track on-chain capital flows. Over the past few weeks, money has rotated between AI, BRC20, AVAX, memecoins across various chains, and now back into BRC20. For any token you currently hold, you should clearly assess: (1) Has my token’s market热度 peaked? (2) Is my token part of a trending narrative but not rising in price? (3) Does my token currently lack market热度, but I believe it will rise for specific reasons?

In other words, pay attention to the flow of market热度 in crypto.

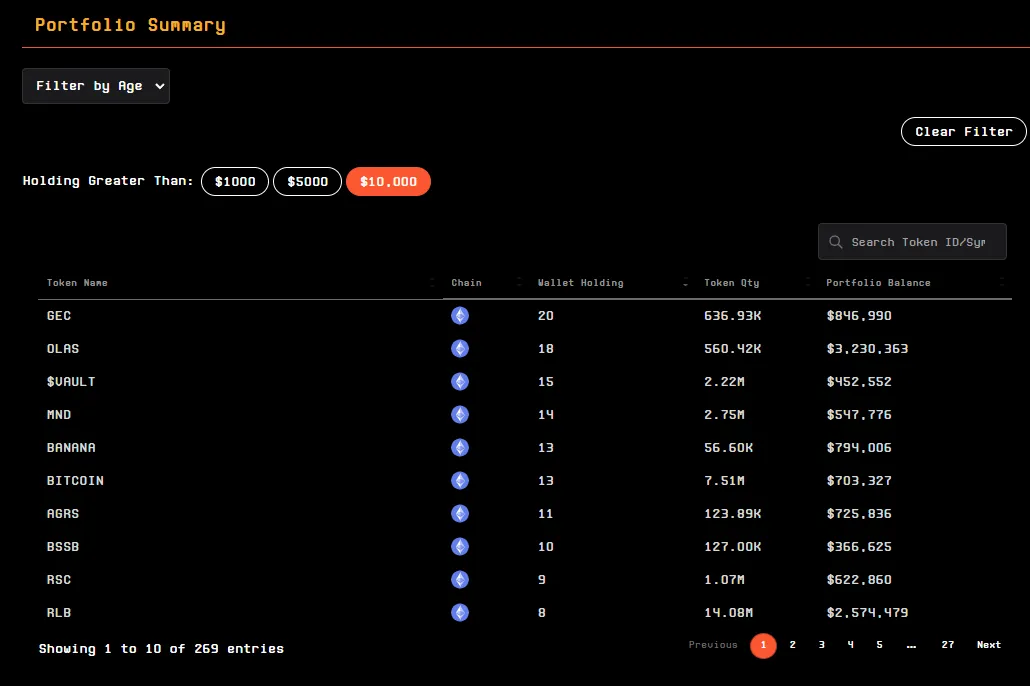

Investors can use chainEDGE to track crypto market热度. I spent 18 months building this tool, and a common misconception is that you must be a 24/7 on-chain fanatic or use bots to benefit from it. But you can also use our holder data and screening features to find projects “undervalued relative to potential attention.” For example, I regularly use our holder data to identify tokens with over 10,000 holders. Then I look for tokens where this number is growing—or ones I haven’t seen before—while also monitoring the percentage of “smart money” holdings relative to market cap. These simple filters are user-friendly for both full-time crypto enthusiasts and those with busy lives, families, etc.

Going further, you can use our tools to spot early-stage tokens that you believe will later achieve high market热度. You can filter by token launch date to try identifying early opportunities (we discovered projects like JOE, WEBAI, MBX, AEGIS, PALM, HYPR, and BSSB early).

In the future, we’ll optimize platform features and roll out a more advanced version of chainEDGE.

Finally, I believe in crypto, market热度 is everything. Instead of diving deep into a project’s roadmap and ecosystem, take a higher-level view and ask: “Why would anyone care about this project?”

Let me offer one final example to highlight another crucial point: in crypto, there’s no such thing as overvalued or undervalued. LBR, the most successful LSDfi project, has created over $165 million in circulating supply of its own stablecoin, yet its market cap is only $26 million.

Meanwhile, some tokens with high market热度:

-

AI

-

OLAS $3.6 billion

-

AGRS $248 million

-

PAAL $169 million

-

ATOR $80 million

-

GROK $80 million

-

AIX $26 million

-

ENQAI $27 million

-

MND $26 million

-

-

BRC20

-

MUBI $157 million

-

BSSB $40 million

-

TURT $20 million

-

Ultimately, leveraging market热度 is crucial for success in crypto investing. I believe热度 outweighs fundamental analysis, and factors like community sentiment play a significant role in determining token value.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News