Shared Security: Making "Decentralized Trust" Tradable

TechFlow Selected TechFlow Selected

Shared Security: Making "Decentralized Trust" Tradable

In a shared security blockchain, validators are solely there to earn rewards and do not influence the governance or decision-making of the new blockchain.

Author: MixWeb3

Shared security means one or more blockchains can enhance their own security by sharing the "decentralized trust source" of another blockchain, enabling decentralized launch and operation. This lowers the barrier to entry and operational costs for launching a blockchain from scratch, helps prevent plutocratic control, and allows teams to focus more on value innovation in Web3.

As is well known, blockchains are machines of trust, and the essence of blockchain lies in decentralized trust. Public chains have remained in the spotlight because their business model revolves around providing decentralized trust to smart contracts—an essential characteristic that most people fail to recognize. In other words, decentralized trust is a service public chains offer to smart contracts; the gas we pay during on-chain interactions is essentially payment for this decentralized trust. As a result, the entire public chain sector has achieved valuations exceeding trillions of U.S. dollars.

Shared security aims to extend "decentralized trust" from a single blockchain to many others. It transforms what was previously a self-built decentralized trust via PoW/PoS into a flexible third-party service that can be purchased on demand. For the first time, decentralized trust becomes as rentable and flexible as cloud computing or cloud storage—becoming part of a Web3 project’s operating expenses rather than its primary goal. Teams can thus focus more intently on core business innovation.

At the same time, decentralized trust underpins chain security. As the number of blockchains and on-chain assets grows, the market size for decentralized trust will become enormous—likely starting at hundreds of billions of dollars.

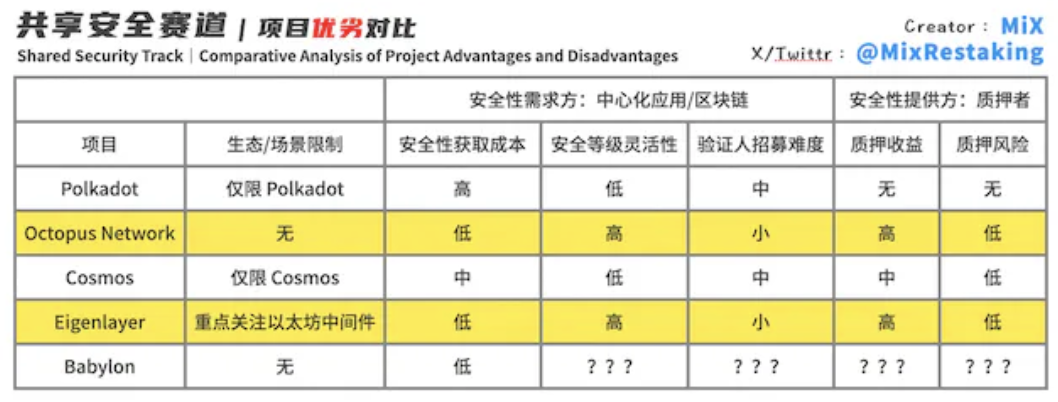

Currently, prominent projects in the shared security space include Polkadot, Octopus Network, Cosmos, EigenLayer, and Babylon. Each project offers distinct solutions with unique strengths and weaknesses, shaped by their respective technological contexts and target use cases.

Polkadot

A “self-sale” model of decentralized trust, exclusively offered to “Polkadot ecosystem parachains”

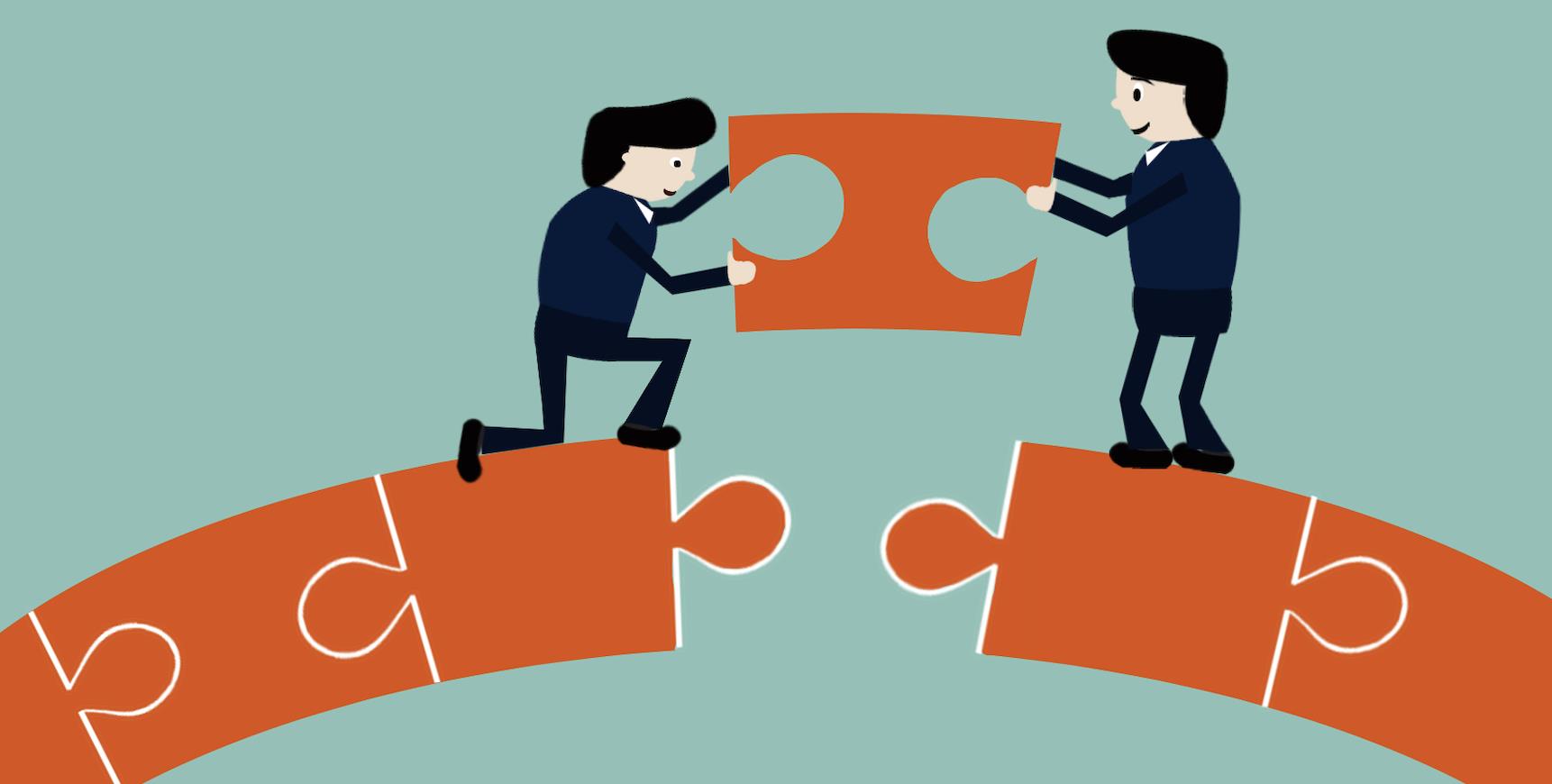

Polkadot Shared Security Architecture Diagram

Founded in 2016, Polkadot was the first project to propose and implement shared security.

Polkadot’s shared security mechanism involves parachains bidding for slots on the relay chain, which then provides security through its validator set, granting them equivalent security levels. This allows Substrate-based chains to immediately access Polkadot’s multi-billion-dollar-level security, solving the long bootstrapping period required for new blockchains to establish security independently. However, because only Polkadot’s high-tier security is available—and due to the auction-based slot allocation—the startup cost for new chains remains prohibitively high, making it extremely unfriendly for early-stage startups with limited funding and team resources.

Recent years have shown that most Polkadot parachains do not require such a high level of security. Moreover, the two-year exclusive slot model leads to very low utilization efficiency of the relay chain’s “decentralized trust” resource. Polkadot clearly recognizes this issue.

On June 28, 2023, Polkadot 2.0 proposed a more flexible allocation of decentralized trust in terms of both time duration and security level. Based on the smallest unit of “block space” on the relay chain, Substrate chains will be able to purchase specific amounts and durations of block space using DOT tokens, enabling flexible acquisition of decentralized security.

On October 25, the Rococo testnet of the Polkadot relay chain successfully implemented the ability to purchase relay chain block space on-demand. Testing is underway, and the “Agile Core Time,” intended to replace the current slot system, is expected to launch in Q1 or Q2 of 2024.

It's clear that Polkadot treats its relay chain’s decentralized trust as a product sold to Substrate chains joining its ecosystem—whether through DOT staking in version 1.0 or direct purchasing in version 2.0.

In fact, among all shared security projects, Polkadot is the only one choosing to directly sell decentralized trust.

Octopus Network

A bilateral market for decentralized trust, focused on appchains without ecosystem restrictions

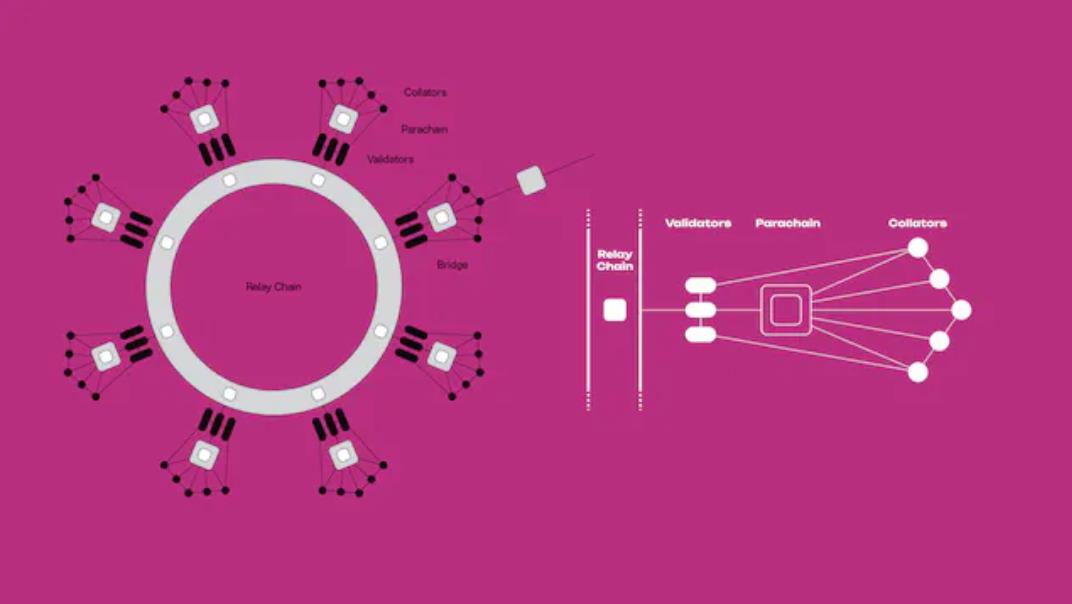

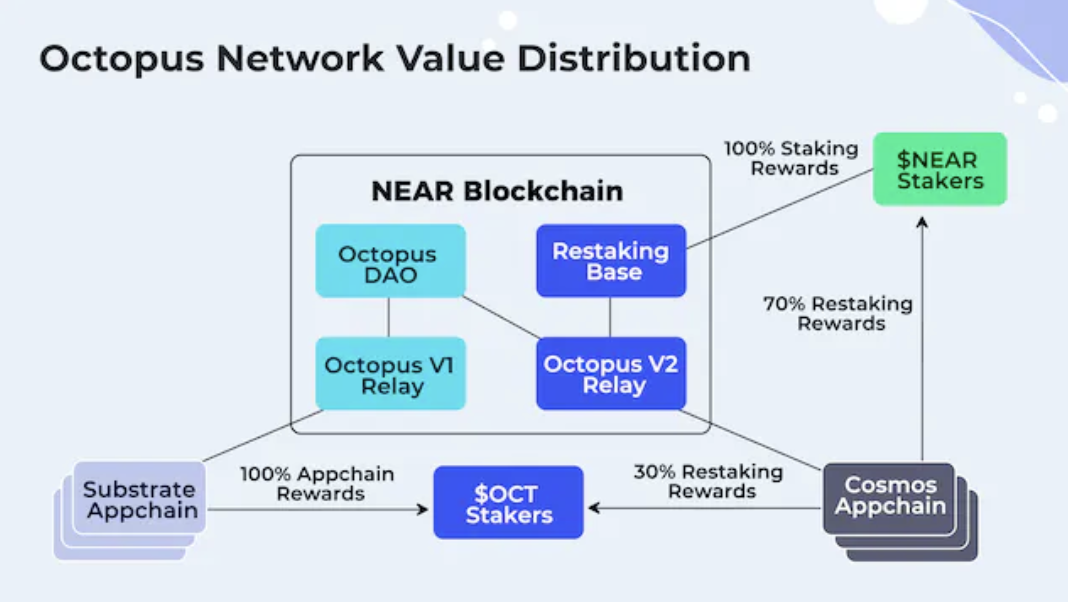

Founded in 2019, Octopus Network specializes in providing shared security services for appchains and pioneered the LPoS (Leased Proof-of-Stake) mechanism.

Octopus Network has created a bilateral marketplace for buying and selling decentralized security: appchains are the demand side and buyers, paying native tokens as rent to validators, who serve as the providers of decentralized trust. This foundational design of a bilateral security market largely established the basic paradigm for subsequent shared security services.

Octopus Network Shared Security Architecture Diagram

-

In Octopus Network V1, validators from Substrate-based appchains stake $OCT from the Octopus Network to secure the appchain, meaning the appchain rents the $OCT’s security via shared staking.

-

In Octopus Network V2, building upon V1, an additional $NEAR restaking mechanism is introduced, allowing $NEAR to be restaked to provide security for Cosmos SDK-based appchains. This upgrade is planned for release in Q4 2023.

At its core, restaking is a shared security mechanism pioneered by EigenLayer. It enables the same assets to be simultaneously staked across multiple “decentralized applications/blockchains” to provide security. Its breakthrough innovation lies in maximizing benefits for three parties: the “decentralized application/blockchain,” the “blockchain providing shared security,” and the “stakers.”

The greatest advantage of Octopus Network’s shared security solution is its focus and flexibility. It solves the high cost and long bootstrapping period associated with traditional PoS security. With the addition of $NEAR restaking in V2, the available security level scales up to the billion-dollar tier.

-

Focus: dedicated to serving appchains where each application operates its own dedicated chain.

-

Flexibility: choice of adjustable security levels.

In fact, Octopus Network has turned NEAR into a highly competitive fat hub within the blockchain internet, becoming a significant latent strength for the NEAR ecosystem.

Cosmos

A community-governed bilateral market for decentralized trust

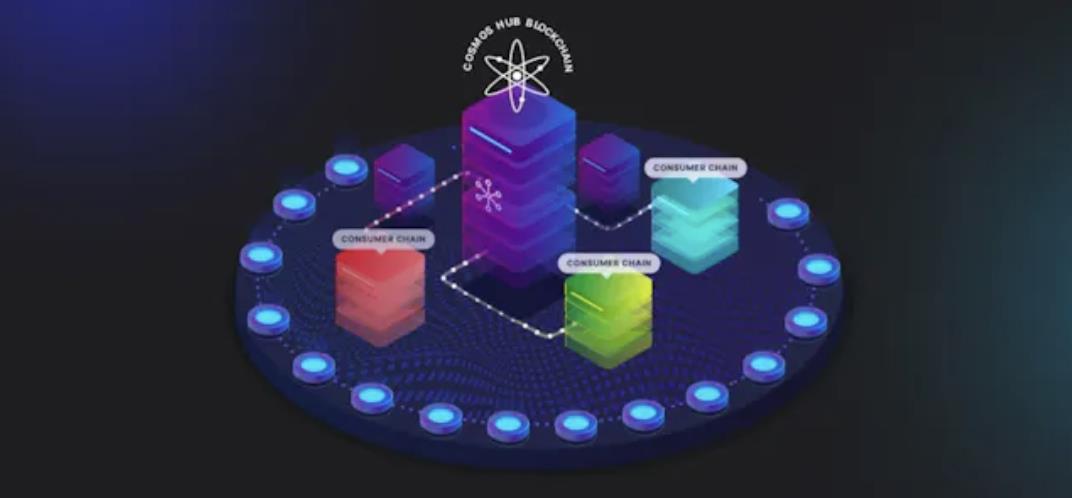

Cosmos, founded in 2014, was the first to introduce the concept of a multi-chain network. However, it wasn’t until March 15, 2023, that it launched its Replicated Security mechanism, finally completing its shared security offering.

Consumer Chains gain security through the Replicated Security mechanism

The core logic of Cosmos Replicated Security treats all Cosmos validators as a unified group. Once approved by community vote, validators can run separate validator nodes for consumer chains within the Cosmos ecosystem using their already-staked $ATOM, thereby providing decentralized security. This approach draws inspiration from Octopus Network’s bilateral market model and incorporates EigenLayer’s restaking concept, but differs significantly in flexibility, leading to two key issues:

-

Consumer chains must demonstrate value accrual to the Cosmos Hub to win sufficient votes and community approval. For example, Neutron serves as the DeFi hub of the Cosmos ecosystem.

-

Consumer chains must pay rent for Cosmos Hub’s $2 billion-level security, creating substantial economic pressure.

Recently, there was an interesting proposal in the Cosmos community: Stride, a liquid staking protocol running on replicated security, proposed merging into the Cosmos Hub, converting all $STRD tokens into $ATOM and becoming a satellite chain of the Cosmos Hub. Although the proposal ultimately stalled, it cast a shadow over the viability of the replicated security model.

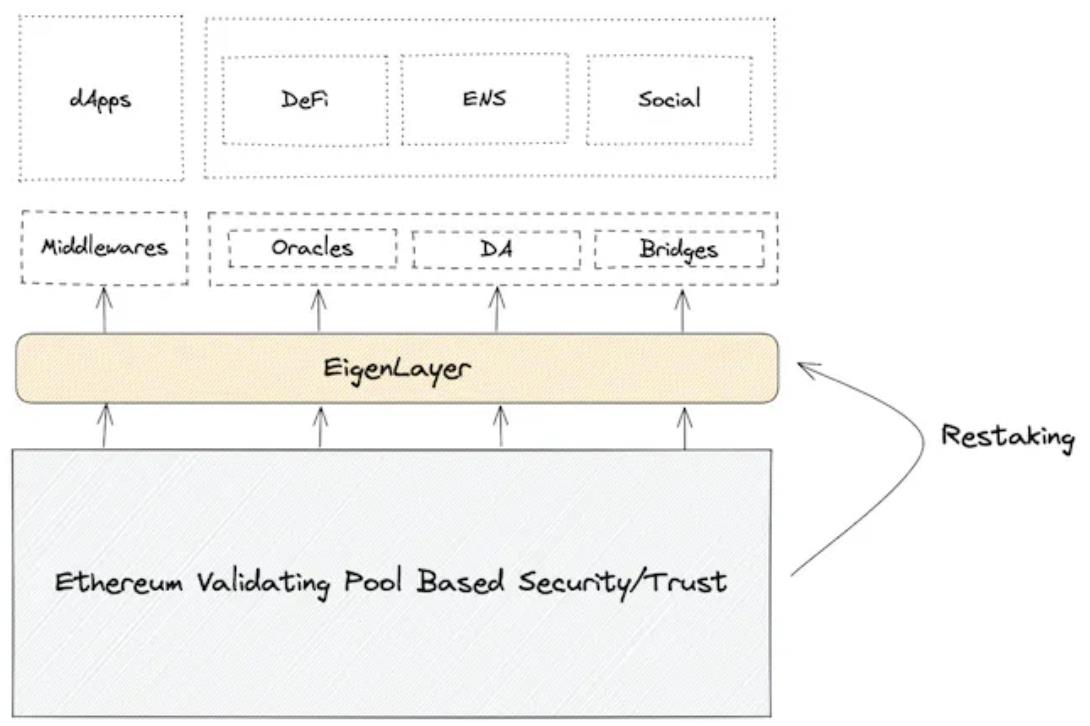

EigenLayer

A bilateral market for decentralized trust serving Ethereum middleware

Founded in 2021, EigenLayer brings Ethereum-grade trust to middleware by allowing ETH already staked on Ethereum to be restaked onto Ethereum middleware, enabling these layers to share Ethereum’s nearly unshakable economic security. EigenLayer pioneered the restaking mechanism, which inspired the $NEAR restaking feature in Octopus Network’s V2.

EigenLayer Restaking Base Architecture

Its main advantages lie in two areas:

-

Focused on shared security for Ethereum middleware, addressing a critical gap in the overall economic security of the Ethereum ecosystem.

-

Flexible adjustment of security levels—middleware protocols can dynamically acquire and scale staking amounts and security levels according to their stage of development.

Babylon

Based on BTC | Possesses the largest decentralized trust pool in a bilateral market for decentralized trust

Founded in 2022, Babylon sets its sights on Bitcoin. Babylon is an independent PoS blockchain where Bitcoin holders can stake and restake their BTC via Babylon to secure blockchains in need of security, earning staking rewards in return. On the other hand, secured blockchains manage and control their security settings on Babylon.

Even amid a deep bear market, BTC represents over $500 billion in assets. Combined with the inherent security advantages of PoW and the vast amount of idle liquidity in Bitcoin, this forms Babylon’s core value proposition: possessing the largest and most undisputed decentralized trust pool in the blockchain world.

We can analyze the strengths and weaknesses of these projects based on the core advantages of “shared security”:

For security seekers—new decentralized applications/blockchains

-

Lower cost of acquiring security, avoiding excessive token inflation and dilution of value. Independent PoS chains typically require annual token inflation of around 10% to reward validators, which dilutes token value and creates continuous selling pressure in secondary markets.

-

Flexible security levels. Blockchains can adjust their security level based on use case and development stage. Typically, lower security suffices in early stages; as the appchain’s economy and asset base grow, governance can approve higher security payments, and technical teams can adjust block rewards accordingly to quickly achieve stronger security.

-

Easier validator recruitment, enabling faster blockchain launch. During initial stages, native tokens don’t need broad value consensus to recruit validators, saving teams years of effort and millions in funding, bypassing the validator recruitment phase entirely and enabling rapid, secure appchain launches.

For security providers—stakers

-

Lower staking risk: Staking with widely accepted assets like $DOT, $OCT, $NEAR, $ATOM, and even more robust ones like $ETH and $BTC reduces the risk of asset devaluation compared to staking with a new appchain’s native token.

-

Higher staking returns: Mechanisms like restaking and replicated security allow stakers to earn multiple revenue streams.

Beyond these points, there’s another crucial yet often overlooked deep advantage: “preventing blockchains from falling under plutocratic control.”

In traditional PoS systems, validator groups gradually accumulate governance power due to continuous token emissions, eventually forming plutocracies. They may even vote to increase block rewards, boosting their own income while raising the chain’s security costs. In contrast, blockchains using shared security mechanisms do not require validators to stake governance-capable native tokens. This fundamentally prevents validators from controlling the blockchain. With shared security, validators are purely profit-driven participants who earn rewards without influencing governance or decision-making, thus avoiding the awkward situation of blockchains being dominated by their validator sets.

Given the unprecedented reduction in startup risks and costs for entrepreneurs, adopting shared security for blockchain launches is becoming an inevitable trend. Only by exponentially lowering the barriers to launch and operate blockchains can we accelerate innovation in Web3 once again.

Thus, shared security is poised to become one of the most critical infrastructure services in the crypto space.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News