A Brief Overview of the Bitcoin Network Ecosystem and Opportunities

TechFlow Selected TechFlow Selected

A Brief Overview of the Bitcoin Network Ecosystem and Opportunities

The Lightning Network did not invent new cryptographic methods nor use novel Bitcoin scripts, yet it cleverly实现了 offline payments.

First, an important point: the driving force behind this bull market will be the BTC ecosystem.

The previous two bull markets were centered around the ETH ecosystem. This time, more opportunities will focus on the Bitcoin network ecosystem. Without further ado, here's a summary of practical insights and new project opportunities. Don't be rigid—many high-quality new projects require digging through multiple information channels. The projects mentioned here are not necessarily the only ones worth attention.

Lightning Network Ecosystem

The Lightning Network is a new off-chain transaction system for Bitcoin that enables users to transact directly without relying on central institutions like banks.

As a Layer 2 solution for Bitcoin, it scales micro-payments and daily transactions. By leveraging smart contracts and payment channels, two parties can conduct fast Bitcoin transactions at nearly zero cost.

The Lightning Network was first proposed in 2015 by Joseph Poon and Tadge Dryja and is considered the most significant innovation since Bitcoin’s inception.

It leverages Bitcoin’s security features to enable high-speed, real-time transaction processing off-chain. Users can make direct peer-to-peer payments or indirect payments routed through the network.

The Lightning Network does not introduce new cryptographic methods or novel Bitcoin scripts, yet it cleverly achieves offline payment functionality. Below are some applications within the Lightning Network ecosystem.

Lightning Labs

(1) Basic Information

Lightning Labs develops software that powers the Lightning Network. Their open-source, secure, and scalable Lightning system allows users to send and receive funds more efficiently than ever before. Lightning Labs also offers a range of verifiable, non-custodial financial services built on the Lightning Network. The lab bridges the open-source software world with next-generation Bitcoin financial applications.

(2) Funding History

2022-04-05: Lightning Labs completed a $70 million Series B round;

2020-02-05: Lightning Labs completed a $10 million Series A round;

2018-03-16: Lightning Labs completed a $2.5 million seed round;

October 18: Announced the launch of the first mainnet version of Taproot Assets, an asset protocol on Bitcoin and the Lightning Network.

We recommend paying attention to projects related to Lightning Labs and those connected to its founders.

(3) Project Information

Official Twitter: Lightning Labs

Website: https://lightning.engineering/

TaprootAssets (Taro)

This is an asset protocol launched by Lightning Labs on October 18. Why highlight this protocol? Because it enables asset creation on the Lightning Network, allowing assets to be sent quickly and in large volumes at minimal cost. For example, it supports issuing fungible tokens (like stablecoins) and NFTs. Below are some projects in the Taro ecosystem:

Nostr

Nostr is a decentralized social media protocol designed to create a censorship-resistant global social network. It does not rely on trusted central servers; instead, all users run their own clients. With this client, users can publish content by posting messages, signing them with their private keys, and sending them to other servers, which then propagate the content.

Jack Dorsey, co-founder of Twitter, donated approximately 14.17 BTC (around $245,000) to the decentralized social network Nostr to further fund its development.

Primal

A social application built on the Nostr protocol, Primal combines a Twitter-like interface with the open-source Nostr protocol, prioritizing censorship resistance, account ownership, and decentralization. On July 12, 2023, Primal raised $1 million in funding.

Nostr Assets Protocol

Nostr Assets Protocol is an open-source protocol that brings Taproot assets and Satoshis (the smallest unit of Bitcoin) into the Nostr ecosystem. Once introduced, users can send and receive these assets using Nostr’s public and private keys at the protocol layer. Settlement and security still rely on the Lightning Network. The protocol itself does not issue assets but serves as a bridge to bring existing assets into Nostr.

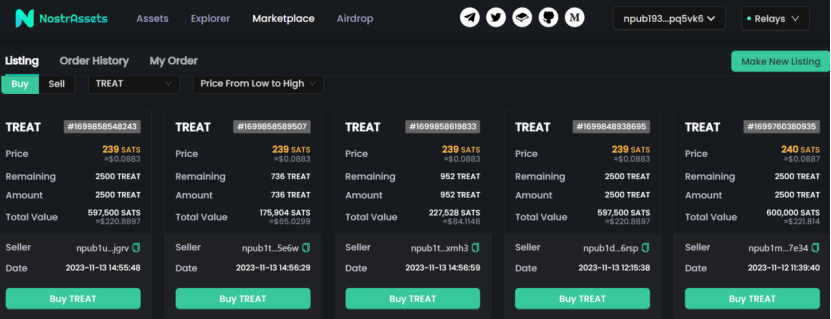

Below is the price chart of trick.

Nostr is about to release its token minting feature—keep an eye on the first token created.

Portal Finance

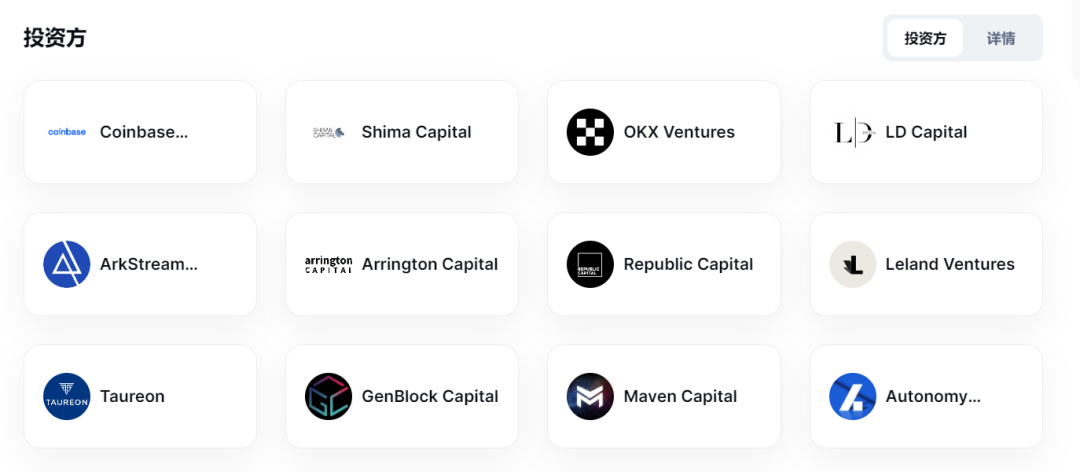

Portal is DeFi built on Bitcoin, enabling anonymous, zero-knowledge transactions via a cross-chain DEX, making trades unstoppable. It eliminates the need to mint wrapped tokens (such as wBTC, wETH) or take counterparty risks with intermediaries. Portal moves provable cross-chain contract execution to Layer 2 and Layer 3, combining the speed and liquidity of centralized alternatives with Bitcoin’s trust-minimized security.

September 21, 2021: Portal Finance raised $8.5 million, led by Coinbase Ventures.

The Portal Swap SDK is now ready for launch, enabling developers to build Portal DEX functionality and integrate it into chains and dApps!

ORDINALS (Currently the Hottest BTC Ecosystem)

We previously covered Ordinals in May—a comprehensive concept. Ordinals was created by Casey Rodarmo, introducing a numbering scheme for satoshis that enables tracking and transferring individual sats. These numbers are called Ordinals.

Satoshis are numbered in the order they are mined and transferred from transaction inputs to outputs following a first-in-first-out principle. Both the numbering and transfer schemes depend on sequence—the former on mining order, the latter on transaction input/output order.

Two months after the release of the Ordinals protocol, Twitter user @domodata proposed a token standard on Bitcoin via the Ordinals protocol—BRC-20. That’s how BRC-20 came into being. ORDI, the first token launched by domo as an experiment, became a legendary 10,000x meme coin. Initial minting cost was just $1–3.

Currently, there are two main applications under ORDINALS: NFTs and inscriptions (i.e., BRC-20).

Although the inscription space includes more than just BRC-20—there are also BRC-100, ORC-20, SRC-20, etc.—after six months of market validation, we can see that aside from BRC-20, none of the others have gained meaningful traction.

Currently, ORDI has achieved listing goals, while SATS aims next for Binance. In terms of market cap, both could enter the top 50 in the future. However, the "zoo" coins carry high risk—most meme coins from May didn’t survive, and this cycle favors community-backed new tokens.

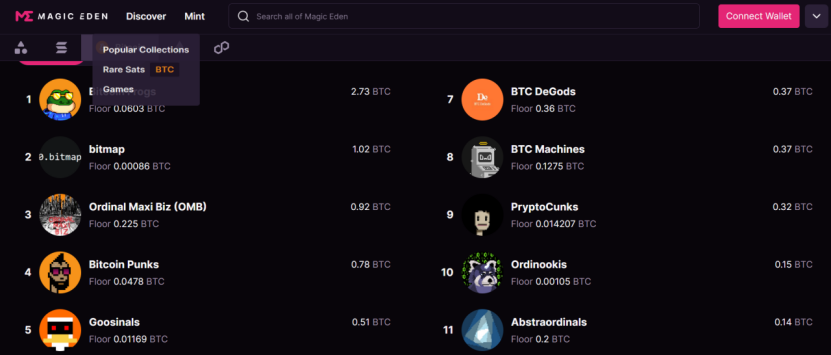

After discussing BRC-20 in the inscription space, let’s look at pixel NFTs—an essential part of Ordinals. Whether on Ethereum or Bitcoin, NFTs are inherently harder to trade than tokens and pose a higher barrier for average users, as many struggle to grasp the value of an image. Nevertheless, we recommend participating early—even if it seems hard to understand, it mainly involves learning new tools, which isn’t overly difficult.

We believe pixel NFTs under ORDINALS remain undervalued and could produce NFTs rivaling BAYC and PUNKs in the future.

RGB Track

Proposed in 2019 by developers Giacomo Zucco and Dr. Maxim Orlovsky, RGB is a smart contract system focused on Bitcoin and the Lightning Network. It brings the complex programmability and flexibility of platforms like Ethereum to the Bitcoin and Lightning Network protocols (LNP) and the broader Bitcoin ecosystem.

Current main applications include:

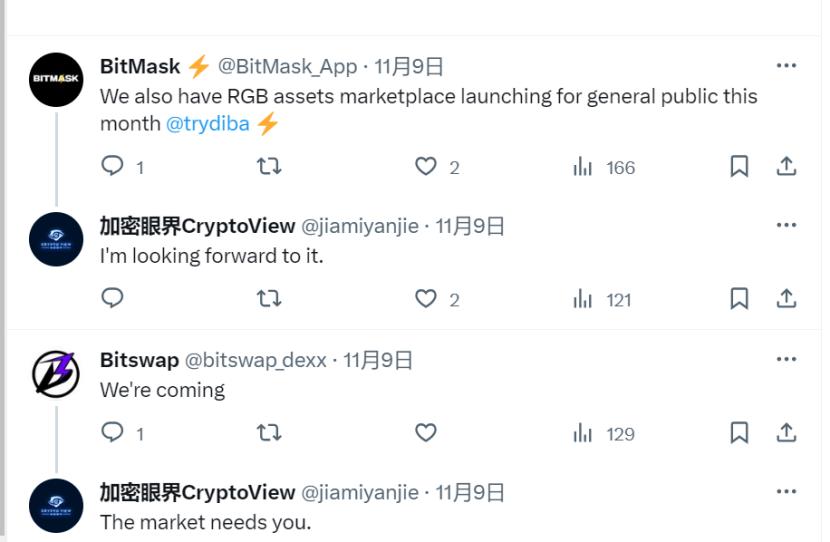

Bitmask and Diba

Bitmask is a Bitcoin and Lightning Network wallet. DIBA is a Bitcoin NFT marketplace enabling users to trade any asset issued via Bitcoin smart contracts on Layer 2 networks such as the Lightning Network.

They are partners.

They will publicly launch the RGB asset marketplace DIBA this month.

These two projects are pioneers in the current RGB market. We suggest keeping an eye on their developments and staying involved.

Bitlight Labs (Cosminmart)

Bitlight Labs builds infrastructure based on the RGB protocol and deploys multiple applications on the Lightning Network, including Bitswap and Bitlight Wallet. The project operates a closed loop—using wallet infrastructure to attract users who then trade on its own swap platform. It’s a well-executed model. We’ve privately discussed investment opportunities with the team and found them to be competent and action-oriented.

However, progress may be slightly slower.

Infinitas

Website: https://www.iftas.tech/

Infinitas integrates the RGB protocol and Lightning Network into a Bitcoin application ecosystem, aiming for enhanced privacy, superior throughput, and ultra-low-latency transaction processing.

Reportedly, Infinitas will have its native economic incentive model, initially distributing tokens via mining to promote long-term ecosystem growth.

BITVEM

An acronym for “Bitcoin Virtual Machine.” Proposed on October 9 by robin_linus, BitStream is a trustless, decentralized file hosting service incentivized by Bitcoin. It requires no cryptography—clients and servers use an optimistic protocol to atomically exchange file coins. While there are no current applications yet, it’s gaining high attention and is one of the most watched protocols after ORDINALS.

Rootstock

Rootstock is a Bitcoin-based, EVM-compatible smart contract platform. It extends Bitcoin’s functionality to enable smart contracts without compromising the core layer and allows permissionless development of Bitcoin DeFi protocols. The Rootstock Infrastructure Framework (RIF) provides RIF solutions for payments, identity, markets, and more.

DLC.Link

DLC.Link is building infrastructure for native Bitcoin smart contract settlement, initially focusing on currency hedging and lending. DLC.Link is creating bridges and networks that unlock secure, decentralized ways for smart contracts to operate with native Bitcoin—without needing to send BTC to another party or blockchain (i.e., no “wrapped” BTC).

October 2, 2023: DLC.Link completed a $2 million pre-seed round.

TeleportDAO

TeleportDAO is a trustless, general-purpose interoperability protocol that provides infrastructure for developers to build cross-chain applications. With TeleportDAO, users can move any data across blockchains—such as contract calls or messages—and transfer assets like tokens and NFTs.

March 17, 2023: TeleportDAO completed a $2.5 million seed round at a $20 million valuation.

This article focuses on uncovering new ecosystem project opportunities. The projects listed above are worth watching. Bitcoin’s ecosystem extends far beyond these—there are many conceptual ideas, but we currently favor practical, utility-driven projects. If you know of promising early-stage Bitcoin ecosystem projects, feel free to recommend them to us.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News