2023 is not the end of Dubai Web3, but the beginning

TechFlow Selected TechFlow Selected

2023 is not the end of Dubai Web3, but the beginning

Like Singapore, Dubai serves as a Web3 hub with world-class infrastructure, a well-developed financial industry, and a clear regulatory framework.

"Five years ago when I came to Dubai, there was no ecosystem. Now there are projects, capital, exchanges, and communities."

— A crypto entrepreneur who has lived in Dubai for six years.

I. Advantages and Disadvantages of Web3 Development in Dubai

What are the advantages of doing Web3 in Dubai?

-

Zero taxation: Zero tax rate, zero personal income tax, zero corporate income tax (for businesses with annual net profits not exceeding 375,000 AED). "On April 1, 2022, India imposed a 30% income tax on all cryptocurrency revenues, then added a 1% tax on digital asset purchases effective July 1. Japan also levies a 30% corporate tax on crypto assets, including unrealized gains. This means tokens must be taxed once they enter public markets—even if no actual income has been generated."

-

Strategic geographical location: Web3 is inherently global. Located in the GMT+4 time zone, Dubai enjoys favorable time differences with both Western countries and Southeast Asia, making international travel convenient. It serves as an ideal commercial hub connecting Middle Eastern, Asian, European, and African markets.

-

Clear regulations and open policies: High acceptance of the crypto industry, frequent supportive policy releases, well-defined regulatory frameworks, open policies, and simple visa processing. "Compared to Singapore or the U.S., obtaining visas in Dubai is extremely convenient."

-

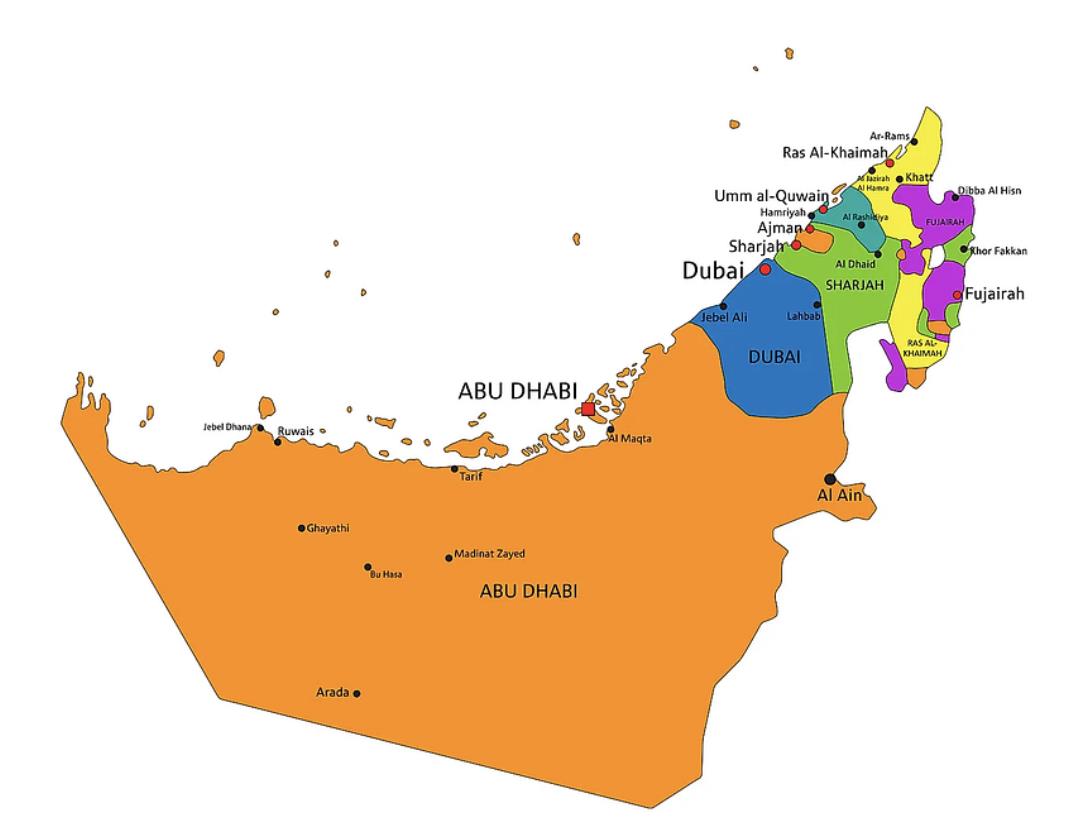

High safety level: Ranked among the top ten safest regions globally. "According to data from Numbeo, Abu Dhabi has been rated the world's safest city for five consecutive years, while Sharjah and Dubai rank sixth and seventh respectively."

-

High degree of internationalization: With over 90% expatriate population, Dubai boasts high levels of international integration and inclusivity. "Web3 is naturally borderless, international, free, and open."

-

High per capita income: The UAE (Dubai) ranks 31st globally in GDP per capita at $44,315, indicating strong commercial monetization potential for companies operating here.

Disadvantages of Web3 development in Dubai?

-

Few developers: Dubai’s total population exceeds 3 million, but its native population is small, resulting in even fewer local developers—most come from India.

-

Limited number of prominent investors: Few well-known local investment firms provide sufficient funding; leading crypto investors remain primarily based in Europe and the U.S.

-

Extremely hot summers: Dubai experiences long, scorching, humid, arid summers with partial cloud cover, while winters (November to March) are pleasant, dry, and mostly sunny. Many people find Dubai’s summer heat unbearable and unsuitable for living.

-

Economic vulnerability: Dubai has an outward-oriented economy heavily reliant on trade, finance, and tourism, with extremely weak industrial foundations. Its dependence on global economic cycles results in poor resilience during macroeconomic shocks, raising doubts about its long-term prospects.

However, some of Dubai’s disadvantages in Web3 development are gradually turning into non-issues.

In terms of capital, although local funding may be hard to secure, Western capital is flowing into Dubai. As widely known, current U.S. policies are unfriendly, prompting many American funds and professionals to relocate to Dubai—especially from India and Russia. Capital naturally flows toward freer jurisdictions.

Regarding developer availability, where there are blockchains and capital, projects will follow. While Dubai won’t see explosive growth in developers, more and more projects are establishing operations there. Additionally, the Middle East, Africa, and South Asia (MEASA) region has over 3 billion people, and the Dubai International Financial Centre (DIFC) is a key financial hub for MEASA.

Like Singapore, Dubai functions as a Web3 hub with world-class infrastructure, a mature financial sector, and clear regulatory frameworks. Despite its relatively small domestic population, it has broad regional influence. While Singapore targets Southeast Asia, Dubai serves the Middle East, Africa, and South Asia.

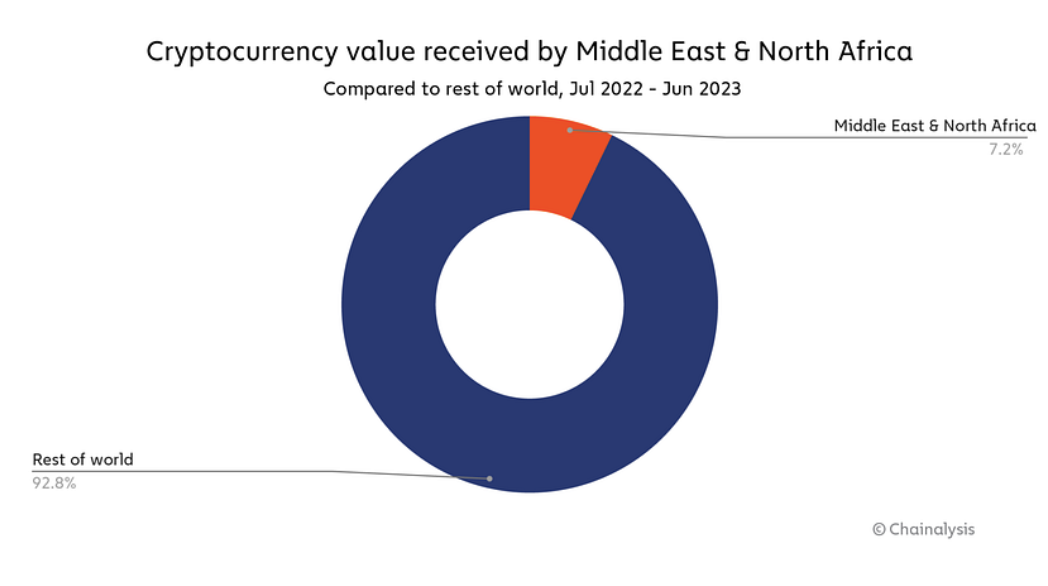

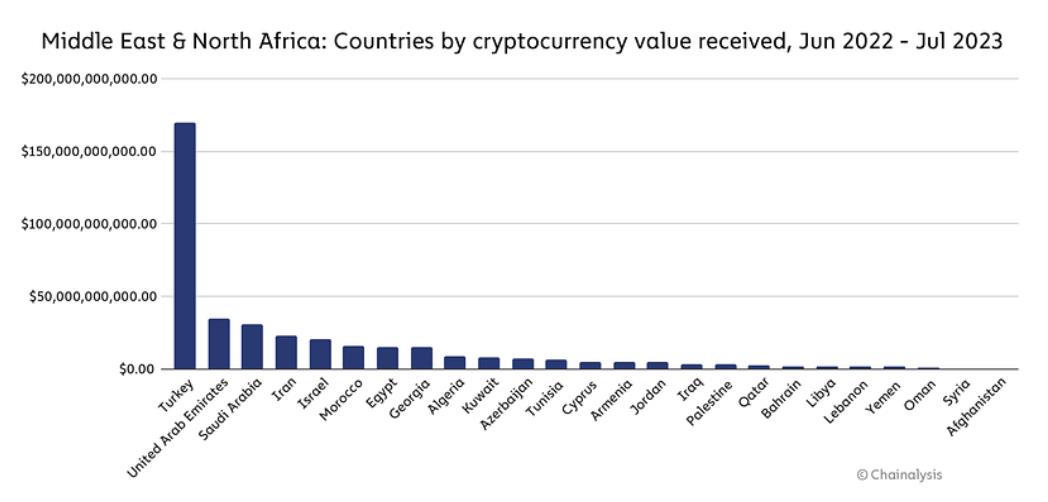

From July 2022 to June 2023, on-chain transaction value in the broader Middle East and North Africa (MENA) region reached approximately $389.8 billion, accounting for nearly 7.2% of global volume.

Turkey ranked first in transaction volume, followed by the UAE.

II. A Review of Dubai’s Web3 History

Beginning: 2016

In 2016, Dubai established the Global Blockchain Council, which now includes over 30 members comprising government entities, international corporations, and blockchain startups. Tech giants like Microsoft, SAP, and Cisco are all part of this council.

The council announced seven new blockchain proof-of-concept initiatives, including medical records management, secure jewelry trading, property ownership transfer, business registration, digital wills, tourism administration, and freight logistics improvement. Dubai can be considered the blockchain R&D center of the Middle East.

Rising Momentum: 2018

In 2018, Abu Dhabi introduced the world’s first cryptocurrency regulatory framework, aiming to build a forward-looking system that promotes innovation while protecting consumers and ensuring UAE leadership in the crypto space.

Slow Growth Period: 2019–2021

In 2019, the Dubai government launched the “Dubai Blockchain Strategy 2020,” aiming to apply blockchain technology across industries such as finance, real estate, supply chains, and government services.

"The pandemic since 2020 severely impacted Dubai’s economy. At its core, this was due to Dubai’s insufficient internal momentum and heavy reliance on external forces—domestic circulation alone is far from adequate."

Due to the pandemic, Dubai’s Q1 2020 GDP dropped 3.7% year-on-year to $26.2 billion, with tourism down 55%, logistics down 32%, accommodation down 10.5%, and oil-related sectors down 9.7%. However, the financial sector grew by about 3.5%, contributing 12.8% to the economy. As crypto is highly financial in nature, increased government attention and support were only natural.

According to a PwC report, between July 2020 and June 2021, the UAE’s share of the global cryptocurrency market increased by 500%, surpassing $25 billion in transaction volume.

Becoming a Web3 Hotspot: 2022–2023

In March 2022, Dubai released its Virtual Asset Law and established the Virtual Assets Regulatory Authority (VARA). Dubai became the first government entity to enter the metaverse. VARA adopts a lightweight compliance model—Test-Adapt-Scale—and offers relatively relaxed licensing for virtual asset companies. Under VARA’s promotion, Binance, FTX, Crypto.com, Bybit, and others obtained licenses and set up headquarters or branches in Dubai.

In August 2022, Dubai’s ruler personally announced the Metaverse Strategy, aiming to further expand Dubai’s influence in the metaverse. Prior to this announcement, 1,000 blockchain and metaverse companies had already settled in Dubai. Afterward, Dubai projected the creation of 30,000 virtual jobs by 2030, adding $4 billion in economic value.

That same year, Dubai launched a five-year metaverse strategy to become a “Capital of the Metaverse” and rank among the world’s top ten XR and metaverse markets. To achieve this, Dubai ramped up R&D investment in metaverse technologies, cultivated talent, and attracted global tech firms—including AR/VR/MR/XR, digital twin, 5G, and edge computing companies—with goals to create 40,000 metaverse-related jobs and generate $4 billion in annual economic growth within five years.

In August 2023, the Dubai Artificial Intelligence and Web3.0 Campus announced it would issue AI and Web3 licenses supporting activities such as distributed ledger technology services, professional AI research and consulting, IT infrastructure development, technology R&D, and public network services. These licenses will be issued by the Dubai International Financial Centre (DIFC) and offer 90% subsidies to businesses launching in Dubai.

Prediction for 2024: Better than 2023

In September 2023, TOKEN2049—a leading global Web3 and cryptocurrency conference—announced it will be held in Madinat Jumeirah, Dubai, on April 18–19, 2024. As one of the industry’s longest-running conference series, TOKEN2049 has become a landmark event, with past editions hailed as the premier annual crypto gathering.

On October 30, 2023, UAE Minister Essa Kazim (Governor of DIFC) announced that the first “Dubai AI & Web3 Festival” will take place on September 11–12, 2024 at Madinat Jumeirah. The festival will build on the momentum created by the “Dubai AI and Web3 Campus” launched in August 2023 and is expected to attract over 100 exhibitors and 5,000+ global policymakers and industry leaders.

Undoubtedly, Dubai’s Web3热度 in 2024 will only grow stronger compared to 2023. 2023 is not the end of Dubai’s Web3 journey—it’s just the beginning.

III. Comparing Dubai’s Web3 Environment with Other Countries

The author has lived in Singapore, Hong Kong, China, and Dubai for extended periods, so field observations apply only to these four regions.

-

Singapore: Policies appear friendly, but in practice, blockchain companies struggle to open bank accounts. Following several black swan events, Singapore has clearly tightened its stance on the blockchain industry. Events occur frequently—2–4 per week—but quality varies, with noticeable attendee overlap. An advantage lies in three top universities actively promoting blockchain development, offering high-quality education and steady talent output.

-

China: Government policy explicitly prohibits most crypto activities, allowing only consortium chains and blockchain applications in real economies. Event frequency varies by region, but outside major conferences, major cities average one offline event every one to two weeks—relatively low. Strengths include a large population base and abundant developers, with growing numbers of Web3 professionals.

-

Hong Kong: The government began supporting Web3 in 2022, and the ecosystem is gradually gaining vitality. Bordering Shenzhen, it attracts innovative talent from mainland China seeking entry into Web3. But drawbacks are evident: First, obtaining a license requires sacrificing too much flexibility and limits profitability, with high compliance costs. Second, Hong Kong has the world’s most expensive housing. According to Mercer, considering housing, transportation, food, and entertainment, Hong Kong ranks as the most expensive city for expatriates. Third, proximity to mainland China brings both convenience and risk.

-

Dubai: Open policies and clear regulations have enabled most major exchanges to obtain licenses. Events are the most frequent among the four regions—almost daily—with high quality. Cost of living is lower than in Singapore or Hong Kong. Visa processing is fast and efficient. Drawbacks include hot, dry climate unsuitable for habitation, small population, and insufficient developer pool.

Regarding developers, a clear trend emerges: The U.S. loses nearly 2% of its Web3 developer share annually. High-quality, high-paying jobs are relocating from the U.S. to more welcoming jurisdictions. Yet instead of providing clear, common-sense regulation, the SEC has taken enforcement actions against compliant American firms like Coinbase and Grayscale—companies doing their best to follow existing rules.

In 2023, three major exchanges—Binance, Bybit, and OKX—completely exited Canada. Gemini announced significant expansion in Singapore. Venture capital firm Andreessen Horowitz (a16z) opened its first non-U.S. office in London.

For crypto companies, the landscape is shifting due to unstable regulatory environments. In 2023, activity is moving eastward from North America, with both the U.S. and Canada seen as hostile. Over the past year, Dubai established the Virtual Assets Regulatory Authority (VARA); neighboring Abu Dhabi is developing its own crypto-friendly framework; the European Union passed MiCA in April; and this month, Hong Kong’s Securities and Futures Commission began accepting exchange license applications.

Therefore, for the crypto industry, a critical indicator is assessing regional crypto futures through regulatory clarity—a factor that triggers widespread ripple effects. Let’s examine regulatory policies in other major crypto nations:

-

United States: As the most advanced financial market globally, the U.S. has detailed crypto regulations. Multiple agencies regulate based on crypto classification—for example, the SEC treats certain tokens as “securities,” the CFTC calls them “commodities,” and the IRS views them as “property.” Recently, the SEC has shifted focus toward DeFi, with its chair stating that any DeFi project offering securities-like token services falls under SEC jurisdiction. Any stock tokens or crypto tokens providing exposure to underlying securities are subject to securities laws—sparking major controversy in the crypto market.

-

Singapore: One of the most crypto-friendly countries globally, with comprehensive regulatory policies. The Monetary Authority of Singapore (MAS) is the primary regulator. In 2018, MAS officials categorized tokens into utility, payment, and security tokens. In 2019, MAS launched a regulatory sandbox, enabling financial institutions and fintech players to test innovative products/services in real-world conditions within defined boundaries and timeframes.

-

South Korea: One of the most active crypto trading markets, where investor enthusiasm drives higher Bitcoin prices than elsewhere—known as the “Kimchi premium.” In September 2017, the Financial Services Commission (FSC), responsible for digital asset oversight, banned all ICOs but did not impose exchange-specific regulations, allowing crypto exchanges to flourish. In December 2020, the government announced taxes on investor gains: Anyone earning over 2.5 million KRW (~$2,200) annually from crypto must pay a 20% tax.

-

United Kingdom: The Financial Conduct Authority (FCA) is the main crypto regulator, focusing solely on anti-money laundering and counter-terrorism financing. The FCA does not directly regulate specific crypto assets or related businesses but oversees crypto derivatives (e.g., futures, CFDs, options) and crypto assets deemed securities. Due to concerns about volatility and valuation, the FCA has banned retail sale of crypto derivatives.

-

Japan: The Prime Minister has included Web3 in the government’s “New Capitalism” economic policy, aiming to solve social issues through innovation and growth. Japan’s Payment Services Act, effective April 2017, added a chapter on “virtual currency,” defining it as a means of settlement/payment with property value. The law also established an exchange supervision mechanism—only firms registered with Japan’s Financial Services Agency (FSA) can provide crypto exchange services. Additionally, Japan has implemented a tax regime: Individuals with annual salary income exceeding 20 million JPY or non-salary income exceeding 200,000 JPY must declare crypto trading profits, taxed at rates between 15% and 55%.

-

UAE: Nearly 30% of the population owns crypto. Three major regulatory bodies have introduced frameworks positioning the country as a global crypto hub.

-

Brazil: The current president plans to position Brazil as Latin America’s crypto hub, building on legislation passed during the previous administration.

-

Hong Kong: Established a crypto regulatory framework effective June 2023. This “new crypto policy” allows retail investors to trade cryptocurrencies starting June 1.

-

Australia: Completed comprehensive token mapping consultations, expecting to propose a licensing framework in Q4 this year.

-

European Union: Adopted the Markets in Crypto-Assets (MiCA) regulation, bringing clear rules across all 27 EU member states.

IV. Status of Exchange Licensing Approvals in Dubai

Major exchanges play a pivotal role in Web3 and cannot be overlooked. As many exchanges move to establish headquarters in Dubai, here is some collected information:

In 2022, Binance received a Minimal Viable Product (MVP) license from Dubai’s Virtual Assets Regulatory Authority (VARA), allowing it to open domestic bank accounts, hold customer funds locally, operate a crypto exchange, and offer payment and custody services.

"The transition from the initial provisional license to the MVP operational license means qualified users in Dubai can now access authorized services, including securely converting virtual assets to fiat currency in compliance with FATF standards as specified by VARA."

Dubai has a four-stage licensing process. Binance has passed three stages; Full Market Product (FMP) license remains pending, expected after demonstrating full compliance.

OKX (the second-largest crypto exchange by volume)’s Middle East branch has obtained MVP Readiness Approval from VARA, allowing it to prepare for operations upon license activation.

OKX Middle East has set up a new office at Dubai World Trade Centre and plans to expand its team to 30 employees, focusing on local hiring and senior management.

The company stated in a press release that once the MVP license becomes fully effective, OKX Middle East will offer spot trading, derivatives, and fiat services, including deposits, withdrawals, and spot pairs in USD and AED.

Tim Byun, OKX’s Global Head of Government Relations, said in an interview: "We view Dubai as critically important for the UAE and MENA region, serving as our regional hub." "Dubai may be the most comprehensive and timely regulator so far. It has a responsible, dedicated regulatory body—VARA. We believe having a clear, final authority on regulation is a huge advantage."

Bybit opened its global headquarters in Dubai in April 2023, hiring around 60 staff in the region and continuing recruitment. It has formally partnered with local governments and universities, hosting hackathons to support Dubai’s developer ecosystem. Bybit is poised to become the first crypto company to complete all four stages of Dubai’s licensing process.

Other Exchanges:

Singapore-based crypto platform Crypto.com received MVP Readiness Approval from VARA this March.

Bitget plans to expand into the Middle East, hiring up to 60 new employees in the region. The company says it has opened an office in downtown Dubai to support expansion and will explore opportunities in Bahrain and the UAE, potentially setting up a regional headquarters.

Various large and small exchanges have successively obtained MVP licenses from VARA in Dubai.

V. Living in Dubai

Climate: Dubai (UAE) has a tropical desert climate with two seasons: May to October is the hot season (summer), characterized by intense heat and humidity, temperatures exceeding 40°C, coastal daytime highs above 45°C, and humidity around 90%. November to April is the cool season (winter), featuring mild, sunny weather with occasional rain and temperatures ranging from 15–35°C. Average annual rainfall is about 100mm, mostly concentrated in January and February.

Payment methods: Credit cards are widely accepted. Chinese-issued Visa and MasterCard work in most malls and supermarkets. UnionPay cards have achieved full coverage and offer discounts in specific areas like airports. Alipay and WeChat Pay have partnered with UAE banks Mashreq, Noor Bank, and the Dubai Tourism Board to promote their online payment tools. Most international payment methods are viable. With over 80% expatriates, Dubai excels in payment internationalization.

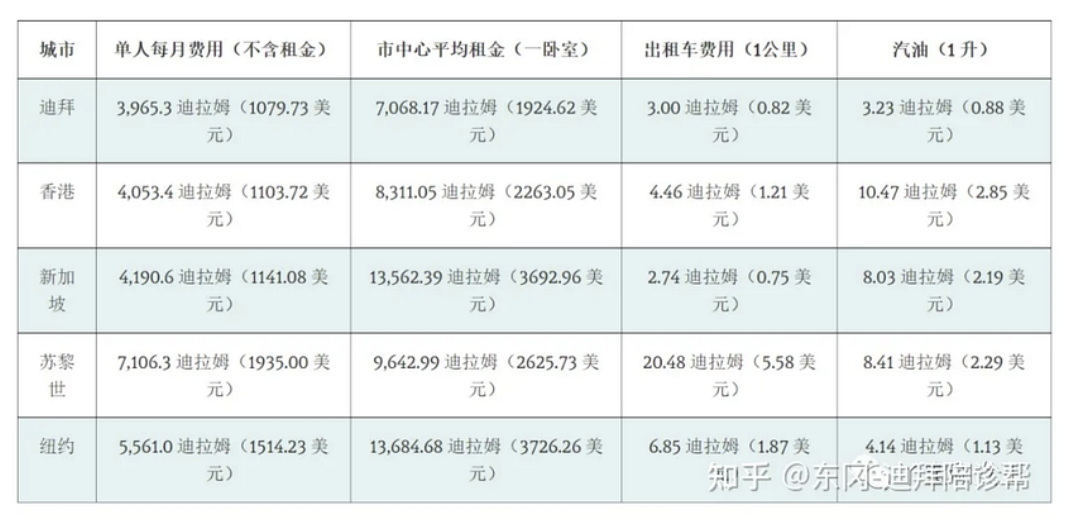

Cost of living: Dubai’s cost of living rose slightly in 2023 but remains significantly lower than in other popular expat destinations like Hong Kong and Singapore. This is reflected in Mercer’s latest 2023 Cost of Living Survey.

Visa Processing:

Over recent years, the UAE (Dubai) has increasingly become one of the most desirable residency destinations for high-net-worth individuals (HNWIs), emerging as a strong competitor to traditional jurisdictions like the UK, Switzerland, Monaco, and Singapore.

No personal income tax, no property or capital gains tax, no net worth tax, straightforward administrative requirements, low processing costs, political stability, excellent connectivity, and year-round sunshine—all contribute to the UAE’s appeal among crypto market participants.

For those without employment contracts, two pathways exist to obtain UAE residency: investing in real estate (property-based residence visa) or establishing a company structure that can act as a sponsor.

-

Option 1: Obtain residency through property ownership. To qualify, the property must be valued at least 1 million AED (~$272,000). This visa is typically valid for two years but does not permit employment in the UAE.

-

Option 2: Register a free zone company to become a UAE resident. This route allows shareholders and employees to apply for residency.

Registering a company is the more popular path, as it imposes no minimum investment, offers longer visa validity (three years), and enables commercial activities and access to UAE tax benefits.

Additionally, in March 2021, Dubai launched a “Digital Nomad Visa” program allowing foreign nationals earning above a certain threshold to live and work in Dubai for one to two years ("minimum monthly income of $5,000").

In conclusion, for the crypto industry, 2023 will not mark the end of Dubai’s Web3 journey—it is merely the beginning.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News