Why has SOL increased 4x in a year, yet Solana's ecosystem development still lag behind?

TechFlow Selected TechFlow Selected

Why has SOL increased 4x in a year, yet Solana's ecosystem development still lag behind?

For the network, it's not all doom and gloom. A batch of new projects has already begun injecting fresh liquidity into the ecosystem and could address the issues hindering Solana's development.

Written by: Kodi

Compiled by: TechFlow

Solana (SOL) has surged over the past few weeks, triggering intense FOMO among many investors. Even Arthur Hayes and Raoul Pal have joined in. If this doesn’t mark a local peak, then I don’t know what does—though judging from recent price action, it indeed appears to be one.

Regardless, SOL’s performance this year has been remarkable so far. It climbed from $10 to $40, briefly even reaching $47.

Bear market? Never heard of it.

So, you might assume that as SOL's price surges, its ecosystem must be flourishing, right? Wrong.

For most of Solana’s history, the price of SOL closely tracked the total value locked (TVL) on the network—almost a 1:1 correlation.

However, during this latest rally, while the token price increased fourfold, Solana’s TVL only doubled. Below is a zoomed-in version of the chart so you can clearly see how ecosystem growth has significantly lagged behind the surge in SOL’s price.

What’s behind this? Why hasn’t Solana’s ecosystem gained momentum in 2023?

The answer is actually quite simple. And it’s not all doom and gloom for the network. A wave of new projects is injecting fresh liquidity into the ecosystem and may resolve some of the issues holding Solana back.

Solana’s New Achievements

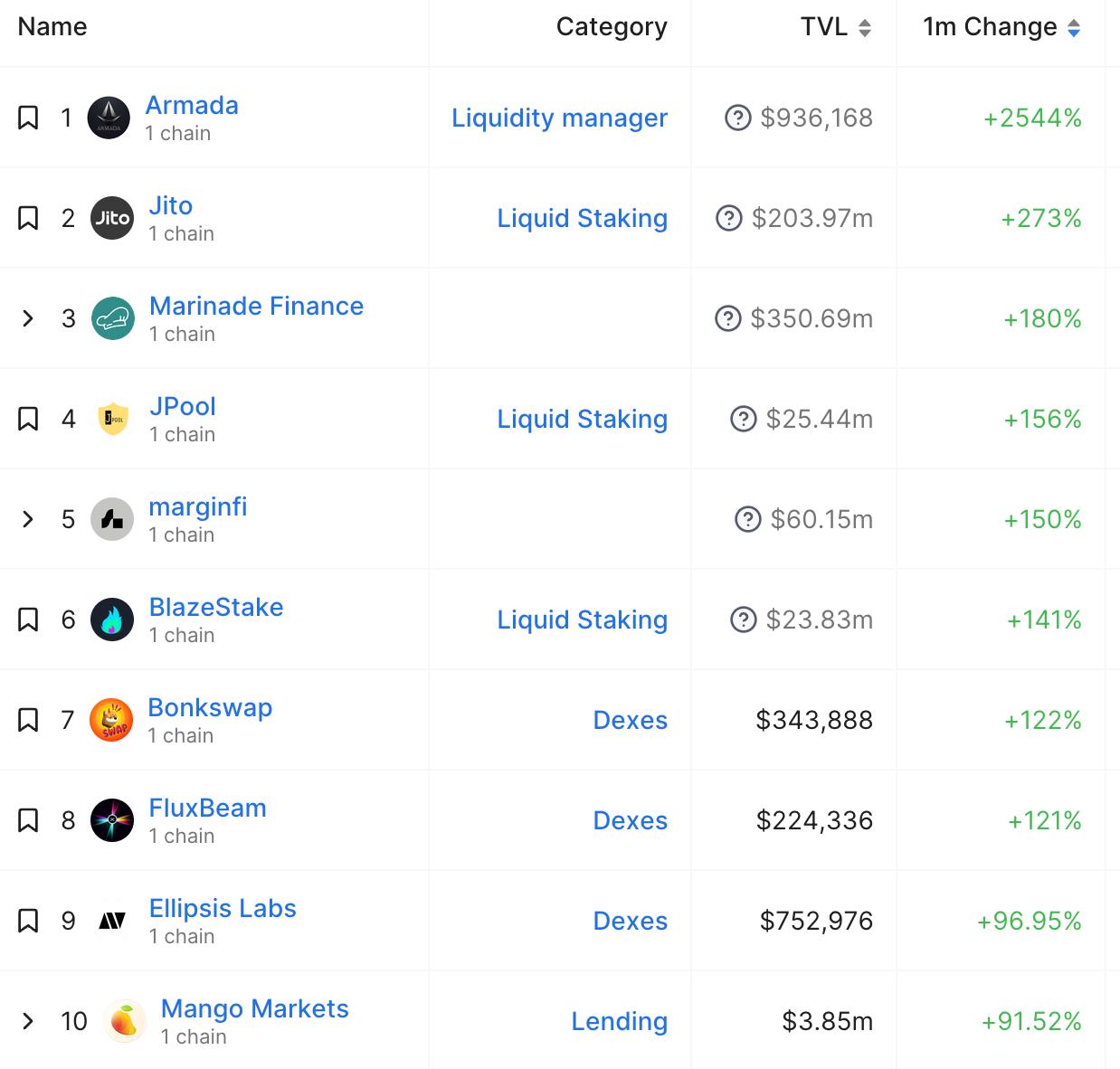

Although overall growth on Solana this year has been modest, the encouraging part is that most of this growth comes from new protocols rather than established ones. In the past month, seven out of the top ten TVL gainers were projects launched within the last year.

As evident from the categorization above, these projects are helping build a diversified ecosystem on Solana instead of all doing the same thing.

By TVL, the most successful project is Jito, a liquid staking provider offering liquid staking tokens and MEV rewards.

Marginfi offers another lending service based on jitoSOL (Jito’s LST), with a focus on risk management.

Among projects outside the top ten, several are also performing strongly.

Phoenix (by Ellipsis Labs) is a fully on-chain limit order book aiming to fill the void left by Serum and become a central liquidity hub across Solana. Jupiter is a swap and cross-chain bridge aggregator that recently launched its perpetuals protocol (I don’t want to oversell Jupiter, but at least for now, it’s my only choice when swapping on Solana—the product is excellent).

There are many other types of projects too. Tensor is Solana’s answer to Blur, serving as a marketplace for NFT traders. Finally, Squads is a multisig protocol used by most Solana projects, securing over $500 million in funds.

Do you know what these protocols have in common?

They don’t have tokens yet. At least, not yet.

This is precisely why Solana’s TVL has lagged despite the surge in SOL’s price. Previously, most assets locked on Solana were either SOL or related altcoins. But although these protocols have succeeded this year, their reluctance to launch tokens has constrained ecosystem growth.

Why is that?

Let’s take a step back in time.

Why Is Solana So Cautious About Tokens?

It’s 2021. SBF is still seen as an infallible genius, and FTX is becoming the crypto super-app.

The blockchain SBF chose was Solana, where he deployed massive capital.

Before SBF’s interest, Solana was relatively barren. FTX/Alameda supported many projects in the ecosystem, especially in its early days.

But their support came at a cost. They allocated large portions of token supplies to themselves and insiders and dictated the tokenomics for each project—all following the same blueprint.

This blueprint and its predatory nature have been widely discussed. In short, these projects launched with low initial float (few tradable tokens). Due to the low float, these tokens traded primarily on FTX, making them easy for Alameda to manipulate and keep prices high...

...if all tokens were unlocked, these projects would command extremely high valuations—but they weren’t unlocked. Most of each project’s token supply remained locked for years.

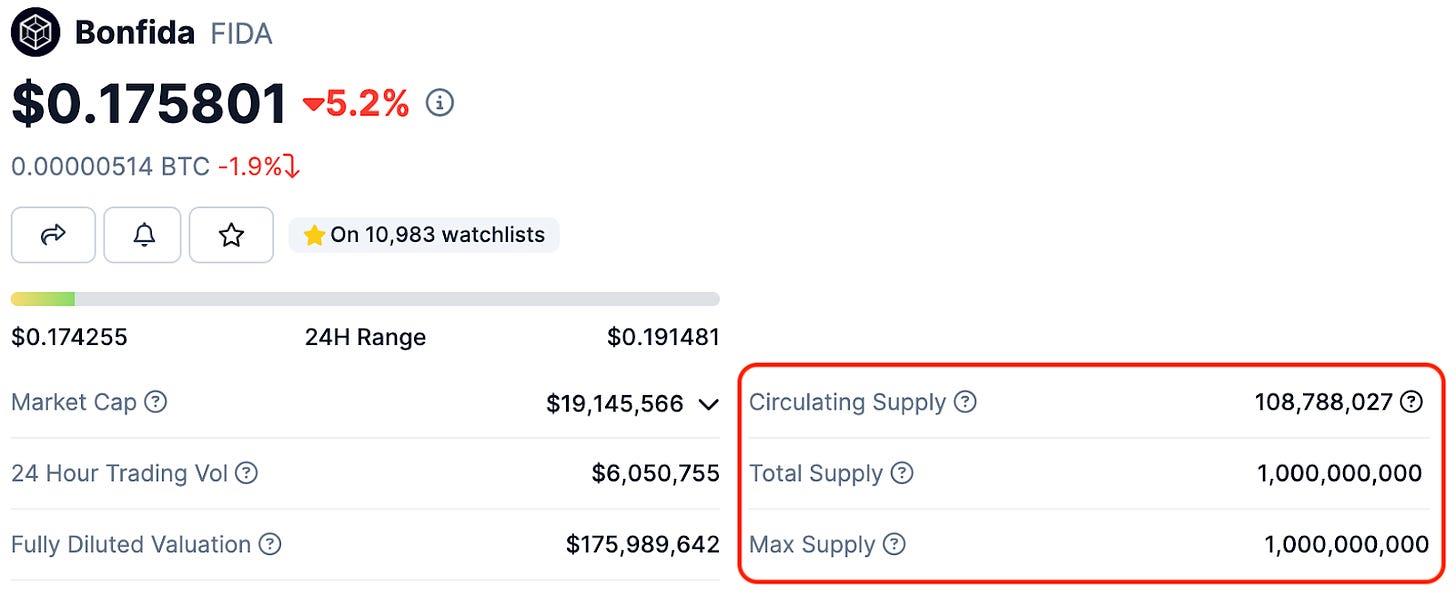

For example, compare Bonfida’s (FIDA) circulating supply (tokens currently tradeable) with its total supply—one of the earliest “Sam tokens.” Three years after launch, only 10% of the total supply has been unlocked.

Of course, this didn’t stop FTX/Alameda from treating these projects as if all tokens were already unlocked, assigning them much higher valuations.

FTX/Alameda then used the tokens they controlled (surprisingly, most were always distributed to insiders) as collateral. They stuffed high-valued, essentially worthless tokens into unsuspecting borrowers’ hands and pulled out dollars.

After FTX collapsed, the entire scheme unraveled. These tokens now trade at a fraction of their former prices.

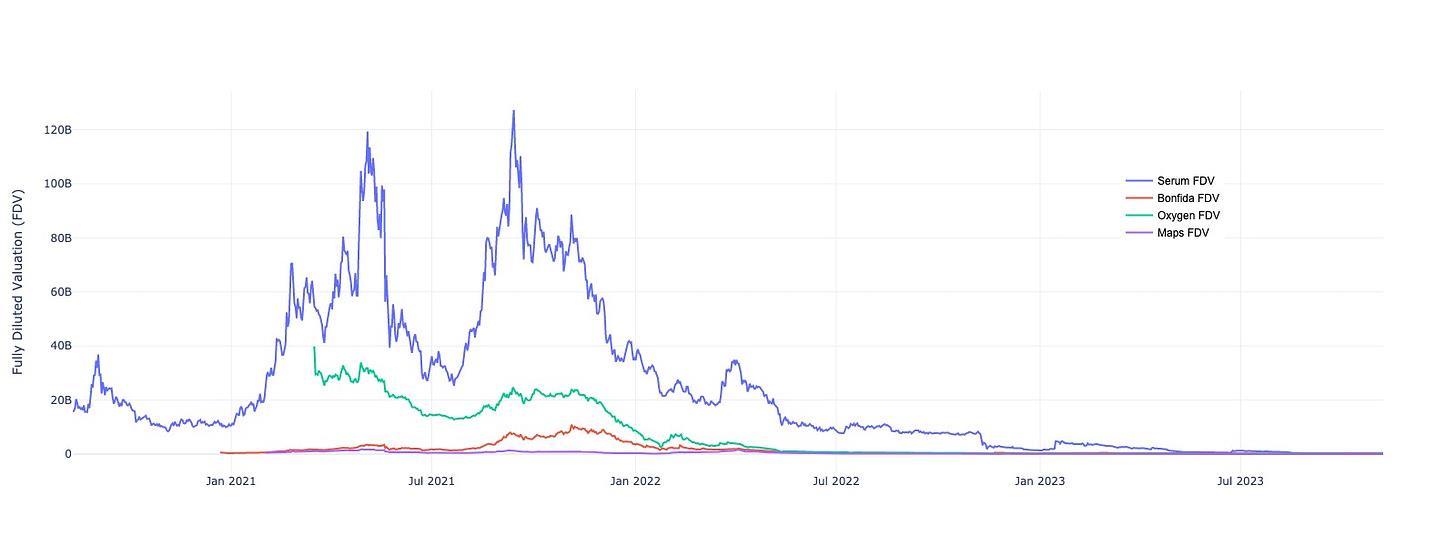

In May 2021 and October 2021, Serum’s fully diluted valuation (FDV)—the project’s value if all tokens were in circulation—traded at $120 billion. Today, its market cap is $40 million. Even by crypto standards, that’s an impressive collapse.

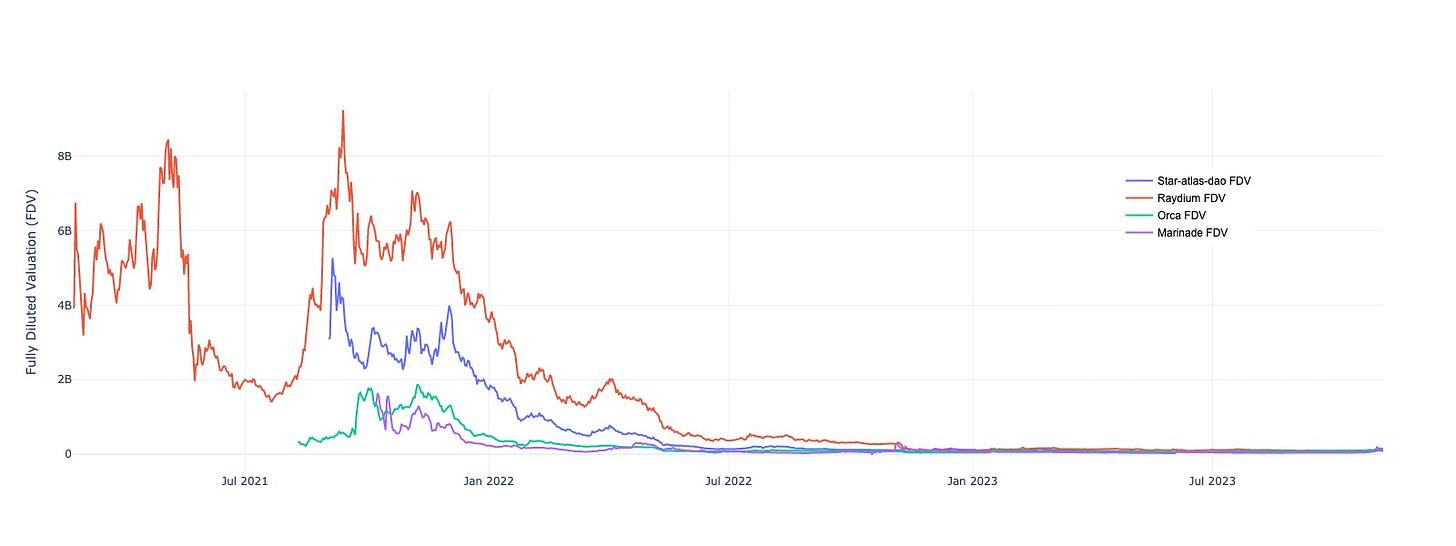

But it wasn’t just the “Sam tokens” that suffered. When FTX/Alameda fell, most Solana ecosystem tokens crashed and have barely recovered since.

All of this left Solana developers deeply skeptical about tokens.

But here’s the truth: tokens aren’t the villain.

Make Tokens Great Again

When used properly, tokens can be incredibly useful—they can reward founders, investors, and users, and drive ecosystem-wide growth.

Just look at Ethereum and ETH, which powered an entire token economy and funded the growth of the Ethereum ecosystem.

The incentives are clear. Most of the Solana projects I mentioned earlier will eventually launch tokens. This will benefit the entire Solana ecosystem.

In fact, I slightly lied earlier. One of them, Jupiter, just announced a token at last week’s Solana Breakpoint conference. Another project, Pyth (Solana’s primary oracle), has also recently announced plans to launch a token.

Guess what? Both are conducting airdrops and allocating a significant portion of tokens to past users.

Yes, if you’ve been using these protocols, one day you might find a stash of tokens waiting for you. If not, now might be a good time to reactivate your Solana wallet and start trying out these platforms. Of course, do it naturally—and use just one wallet.

But let’s not forget the lessons of the past. Protocols should strive to launch sustainable tokens—not just any token.

A sustainable token design should include fair distribution, reasonable supply, and clear utility. It’s not just about creating a token, but about creating one that adds value to the ecosystem.

The blueprint for good token design hasn’t been fully written yet, but we know a few things. First, forget FTX’s high-FDV, low-float scam.

If you’re (justifiably) hesitant to share revenue with token holders, explore other useful roles tokens can play within the protocol’s economy. But leave room for potential regulatory clarity down the line.

So to all Solana protocols: make tokens great again. Let’s create more tokens that aren’t just quick cash grabs, but ones that contribute to the growth and sustainability of the ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News