Maker and Frax Data Showdown: Which DeFi Titan Comes Out on Top?

TechFlow Selected TechFlow Selected

Maker and Frax Data Showdown: Which DeFi Titan Comes Out on Top?

Both are excellent protocols, with Maker still reigning as king of cash, while Frax continues adding innovative products to its components.

Author: Wajahat Mughal

Compiled by: TechFlow

In this article, DeFi researcher Wajahat Mughal compares Maker and Frax Finance—two leading projects in the DeFi and RWA sectors—from multiple dimensions, including core businesses, yields, revenue sources, protocol income, governance tokens, and future developments. Which one is better?

Maker and Frax are two major leaders in the DeFi space.

Maker offers DAI, an over-collateralized decentralized stablecoin backed by ETH, stablecoins, and RWAs (mostly U.S. Treasuries); Frax provides the decentralized stablecoin FRAX and a suite of financial products built around it.

DAI's collateral includes ETH, stablecoins, and RWAs—primarily U.S. Treasuries.

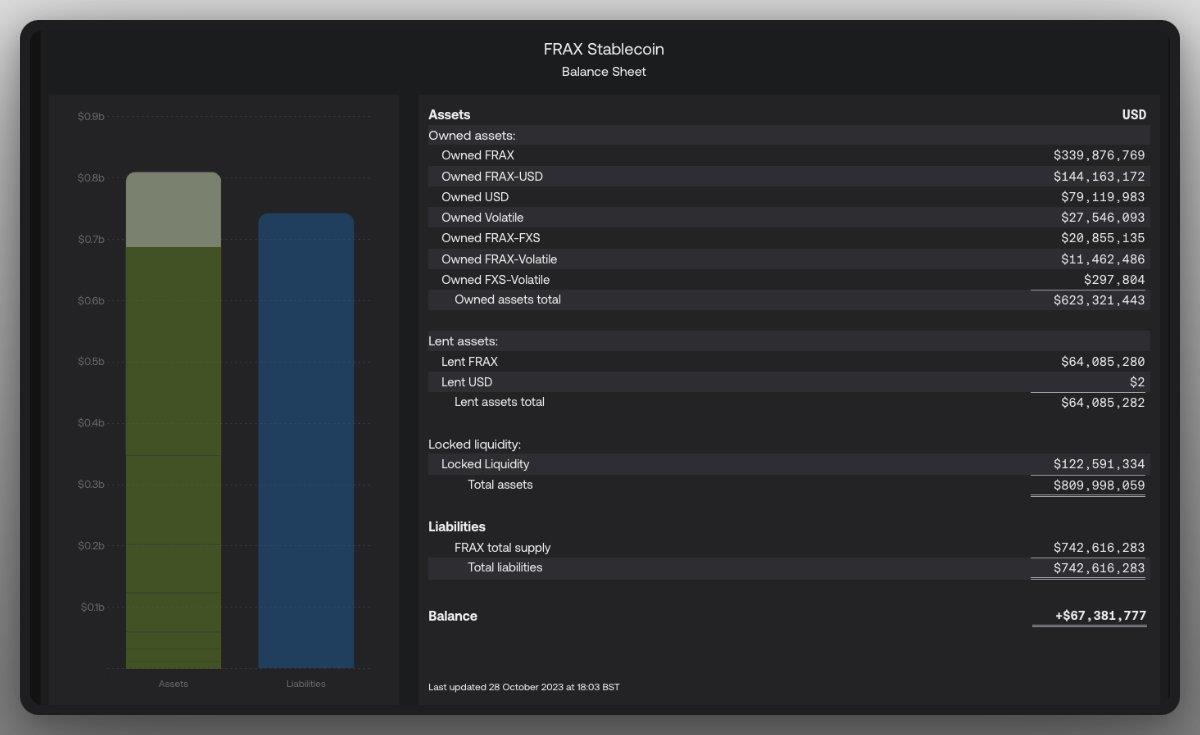

FRAX's collateral structure is undergoing transformation. It is moving toward 100% CR (Collateral Ratio), no longer backed by FXS. The recently introduced sFRAX and the upcoming FXB (bonds) will provide RWA backing.

Yields

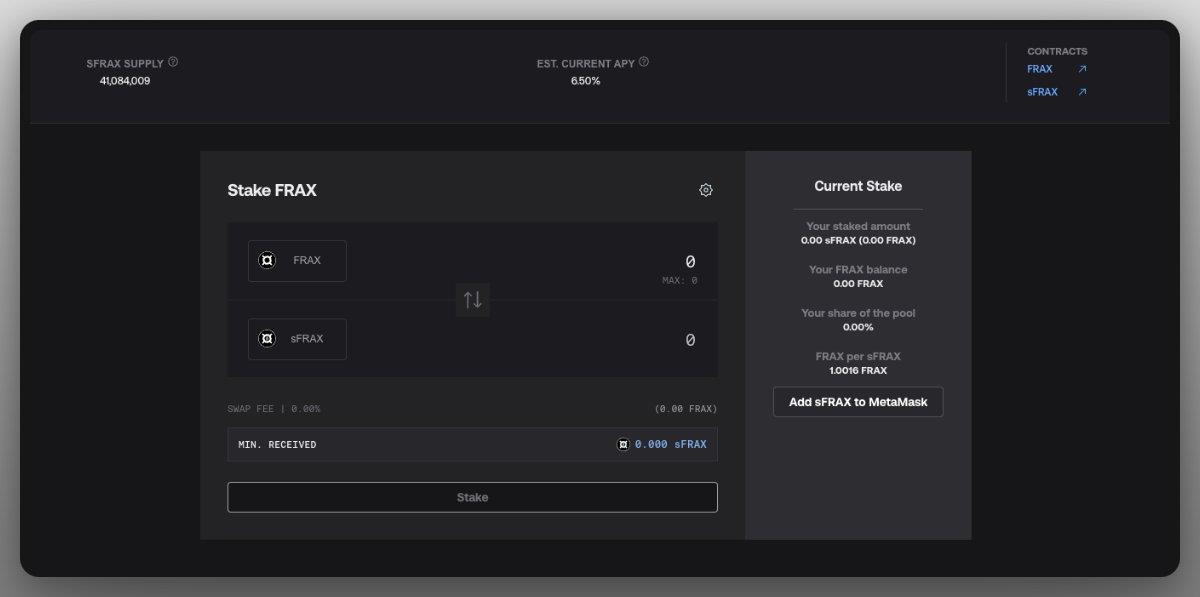

The current supply of sDAI is 1.73 billion with a yield of 5%; the current supply of sFRAX is 41 million with a yield exceeding 6.5%.

Clearly, DAI holds massive dominance in terms of supply, but currently Frax leads in yield.

Yield Sources

sDAI's yield comes from various RWA T-Bill returns, evident from custodial institutions.

sFRAX earns the IORB rate from overnight interest accounts held via FinresPBC, which then passes the returns to sFRAX.

Maker is currently one of the most profitable protocols in DeFi, generating over $80 million in revenue, driven by consistent growth in its supply.

FRAX has multiple revenue streams, including T-Bills, AMOs, and of course ETH LSDs—currently generating $20 million annually.

MKR and FXS

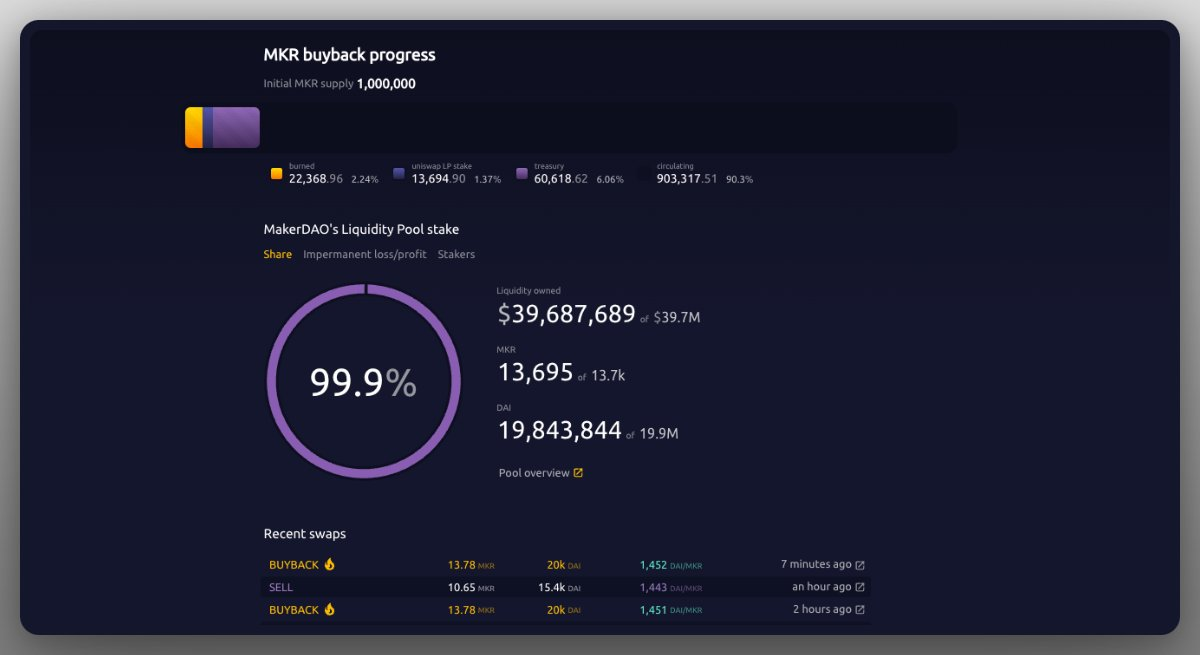

MKR has a market cap of $1.3 billion and uses protocol revenue for continuous buybacks.

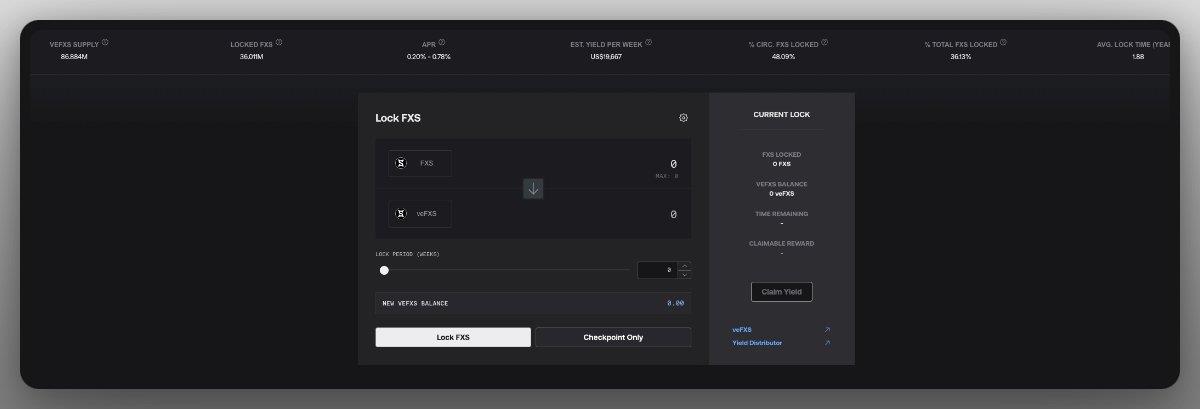

FXS has a market cap of $450 million and earns income from the protocol (with current efforts focused on increasing the collateral ratio to 100%).

Future Outlook

Both are exceptional protocols. Maker remains king of cash flow, while Frax continues innovating across its ecosystem components.

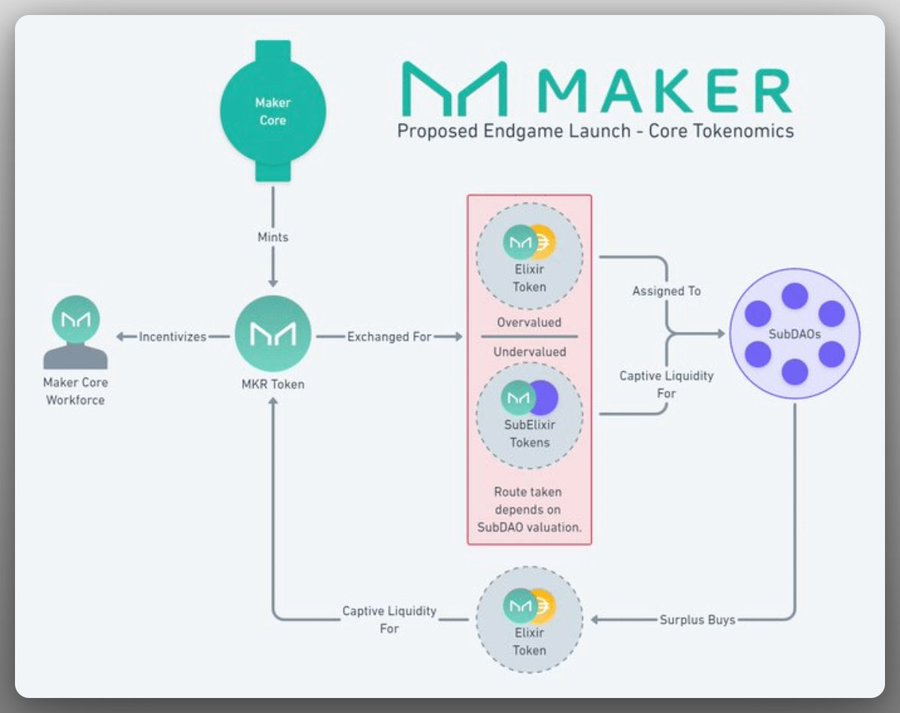

What’s next? Maker’s Endgame plan includes token rebranding, phasing out centralized stablecoins, launching subDAOs, integrating AI, and ultimately building the Maker Chain; Frax’s roadmap includes Frax Bonds, updates to the frxETH staking product, and a new L2 on Ethereum called Frax Chain.

Personally, I prefer Frax—I like the ecosystem they’re building.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News