Big Time Portraits: The Surface Frenzy of a Few, the Hidden Battle Between Project Teams and Exchanges

TechFlow Selected TechFlow Selected

Big Time Portraits: The Surface Frenzy of a Few, the Hidden Battle Between Project Teams and Exchanges

When blockchain games truly become AAA, have the core gameplay, participation barriers, profit distribution, and underlying operational models really undergone a fundamental transformation?

Yet, a quick tour of social media reveals a stark contrast between soaring prices and participants' actual awkward experiences — **can't get in, can't get out, low liquidity, high costs**.

Can't get in: A large number of players who missed early access are desperately seeking activation codes, while the game's hardware requirements have discouraged users with lower-end devices;

Can't get out: Players already grinding in-game assets have discovered that withdrawals require KYC verification, lengthy review periods, and strict rules;

Low liquidity: Players participating in the secondary market face poor liquidity, making early trading attempts difficult;

High cost: For latecomers aiming to farm, the cost of acquiring necessary in-game items continues to rise.

Meanwhile, while we're easily drawn to price surges, we often overlook the differing interests and strategic games behind various market participants — **when blockchain games truly become AAA-grade, have their core gameplay, entry barriers, profit distribution, and underlying operational models actually undergone fundamental change?**

### Big Production, Same Old Taste

Undeniably, compared to other blockchain games, Big Time represents a significant leap forward in production quality and visual presentation.

Yet, a quick tour of social media reveals a stark contrast between soaring prices and participants' actual awkward experiences — **can't get in, can't get out, low liquidity, high costs**.

Can't get in: A large number of players who missed early access are desperately seeking activation codes, while the game's hardware requirements have discouraged users with lower-end devices;

Can't get out: Players already grinding in-game assets have discovered that withdrawals require KYC verification, lengthy review periods, and strict rules;

Low liquidity: Players participating in the secondary market face poor liquidity, making early trading attempts difficult;

High cost: For latecomers aiming to farm, the cost of acquiring necessary in-game items continues to rise.

Meanwhile, while we're easily drawn to price surges, we often overlook the differing interests and strategic games behind various market participants — **when blockchain games truly become AAA-grade, have their core gameplay, entry barriers, profit distribution, and underlying operational models actually undergone fundamental change?**

### Big Production, Same Old Taste

Undeniably, compared to other blockchain games, Big Time represents a significant leap forward in production quality and visual presentation.

Anyone who has watched live streams or tried the game firsthand will find its overall feel nearly indistinguishable from traditional MMORPGs — smooth graphics, fluid combat mechanics, mature character progression systems, and comprehensive gear systems... everything aligns with high-end game development standards.

From a gameplay perspective, the core loop revolves around character progression: accepting quests → fighting → earning resources/loot/experience/skills → leveling up → obtaining better rewards → tackling harder challenges.

And within this central gameplay cycle, the familiar flavor of blockchain gaming remains — **playable for free, but earning money comes with barriers**.

Free players can experience similar content during gameplay, but rarely gain access to monetization features. Due to low drop rates for NFT items from regular monsters and standard dungeons, ordinary players must invest massive amounts of time grinding for slim chances of rewards.

Moreover, without owning required NFT items, free players cannot generate any Big Time tokens through gameplay.

For paying players, it’s back to the same old familiar loop: calculating investment returns and planning token yields.

According to official game documentation and research reports such as those from First Class Capital, players aiming to earn need at minimum:

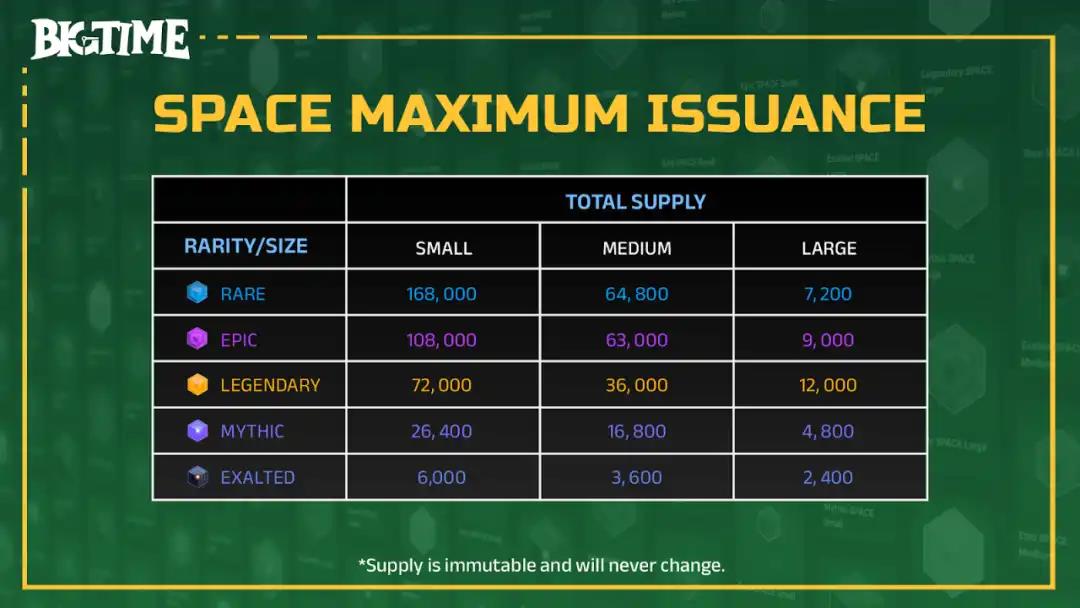

- Space NFT: Acts as personal space where farming-related NFTs and items can be placed;

- Time Hourglass: Must equip this item to start generating Big Time tokens;

- Time Crystal: Consumed to craft the above-mentioned Time Hourglass;

- Time Guardian NFT: Functions as a "recharging station" — when the Time Hourglass is depleted, players use Time Crystals here to refill it.

Anyone who has watched live streams or tried the game firsthand will find its overall feel nearly indistinguishable from traditional MMORPGs — smooth graphics, fluid combat mechanics, mature character progression systems, and comprehensive gear systems... everything aligns with high-end game development standards.

From a gameplay perspective, the core loop revolves around character progression: accepting quests → fighting → earning resources/loot/experience/skills → leveling up → obtaining better rewards → tackling harder challenges.

And within this central gameplay cycle, the familiar flavor of blockchain gaming remains — **playable for free, but earning money comes with barriers**.

Free players can experience similar content during gameplay, but rarely gain access to monetization features. Due to low drop rates for NFT items from regular monsters and standard dungeons, ordinary players must invest massive amounts of time grinding for slim chances of rewards.

Moreover, without owning required NFT items, free players cannot generate any Big Time tokens through gameplay.

For paying players, it’s back to the same old familiar loop: calculating investment returns and planning token yields.

According to official game documentation and research reports such as those from First Class Capital, players aiming to earn need at minimum:

- Space NFT: Acts as personal space where farming-related NFTs and items can be placed;

- Time Hourglass: Must equip this item to start generating Big Time tokens;

- Time Crystal: Consumed to craft the above-mentioned Time Hourglass;

- Time Guardian NFT: Functions as a "recharging station" — when the Time Hourglass is depleted, players use Time Crystals here to refill it.

All these items are priced transparently based on market supply and demand, and are designed to be repeatedly consumed and repurchased.

For players focused purely on earning, whether the game is AAA-quality becomes irrelevant — what matters is solving a math problem: racing against time, optimizing ROI, and cashing out before others do.

### A Party for the Few, Barriers for the Many

It’s no secret that Big Time isn’t a new game — it’s been two years since its initial announcement. So why all the sudden attention now?

On October 10, Big Time launched its preseason event. In addition to earning tokens through gameplay, participants also received eligibility for future token airdrops. Combined with the listing of its token on exchanges, the game’s popularity skyrocketed almost overnight.

All these items are priced transparently based on market supply and demand, and are designed to be repeatedly consumed and repurchased.

For players focused purely on earning, whether the game is AAA-quality becomes irrelevant — what matters is solving a math problem: racing against time, optimizing ROI, and cashing out before others do.

### A Party for the Few, Barriers for the Many

It’s no secret that Big Time isn’t a new game — it’s been two years since its initial announcement. So why all the sudden attention now?

On October 10, Big Time launched its preseason event. In addition to earning tokens through gameplay, participants also received eligibility for future token airdrops. Combined with the listing of its token on exchanges, the game’s popularity skyrocketed almost overnight.

However, actually joining the game isn’t simple.

The game remains closed to the general public, and monetization requires both financial investment and understanding of complex rules.

Even those who just want to try the game without farming must rely on invitation codes from select streamers and KOLs. As hype builds, countless regular users are scrambling across platforms for access.

This scenario appears more like a calculated marketing strategy — scarcity fuels perception of exclusivity, echoing classic tactics of hunger marketing.

However, actually joining the game isn’t simple.

The game remains closed to the general public, and monetization requires both financial investment and understanding of complex rules.

Even those who just want to try the game without farming must rely on invitation codes from select streamers and KOLs. As hype builds, countless regular users are scrambling across platforms for access.

This scenario appears more like a calculated marketing strategy — scarcity fuels perception of exclusivity, echoing classic tactics of hunger marketing.

At the same time, early entrants among the few already inside the game are enjoying substantial play-to-earn returns. Twitter posts show KOLs sharing detailed input-output data. Based on calculations from various players, current ROI suggests potential payback within 1–2 days (note: as of publication, Big Time has adjusted its in-game drop mechanisms, so actual breakeven times may now be longer).

Admittedly, this cycle of investing and quickly turning a profit feels reminiscent of the blockchain gaming craze one year ago. But this time, the party belongs only to a select few — while barriers remain for the majority.

To participate in the preseason, you either need to directly purchase in-game SPACE NFTs and passes, or you must have been an early player of Big Time.

At the same time, early entrants among the few already inside the game are enjoying substantial play-to-earn returns. Twitter posts show KOLs sharing detailed input-output data. Based on calculations from various players, current ROI suggests potential payback within 1–2 days (note: as of publication, Big Time has adjusted its in-game drop mechanisms, so actual breakeven times may now be longer).

Admittedly, this cycle of investing and quickly turning a profit feels reminiscent of the blockchain gaming craze one year ago. But this time, the party belongs only to a select few — while barriers remain for the majority.

To participate in the preseason, you either need to directly purchase in-game SPACE NFTs and passes, or you must have been an early player of Big Time.

The former implies a financial barrier — under promotional hype and rising token value, prices for SPACE and passes are inevitably inflated;

The latter represents a knowledge and time barrier — not everyone had deep involvement with Big Time previously.

Additionally, one often overlooked aspect is that the term “AAA” brings considerable **hardware barriers**.

According to Big Time’s official website, the minimum system requirement includes a GTX 1060 GPU and at least 50GB of disk space. For seasoned gamers, these specs may seem modest;

The former implies a financial barrier — under promotional hype and rising token value, prices for SPACE and passes are inevitably inflated;

The latter represents a knowledge and time barrier — not everyone had deep involvement with Big Time previously.

Additionally, one often overlooked aspect is that the term “AAA” brings considerable **hardware barriers**.

According to Big Time’s official website, the minimum system requirement includes a GTX 1060 GPU and at least 50GB of disk space. For seasoned gamers, these specs may seem modest;

But for crypto users, entry-level gaming GPUs and large storage demands might strain the typical digital nomad’s primary work laptop. It could also trigger severe memory anxiety — normally cautious about internet usage and downloads, suddenly installing a non-open-source game client can feel deeply unsettling.

But for crypto users, entry-level gaming GPUs and large storage demands might strain the typical digital nomad’s primary work laptop. It could also trigger severe memory anxiety — normally cautious about internet usage and downloads, suddenly installing a non-open-source game client can feel deeply unsettling.

These hardware requirements give professional studios a natural advantage — yet their joy doesn’t come from gaming pleasure, but purely from profit generation.

When a game first creates barriers for insiders, how can mass adoption ever happen?

If the game isn’t primarily targeting the crypto community, checking Twitch viewership reveals relatively low audience numbers — suggesting limited external traction so far.

These hardware requirements give professional studios a natural advantage — yet their joy doesn’t come from gaming pleasure, but purely from profit generation.

When a game first creates barriers for insiders, how can mass adoption ever happen?

If the game isn’t primarily targeting the crypto community, checking Twitch viewership reveals relatively low audience numbers — suggesting limited external traction so far.

**Thus, we observe a clear split: the game goes viral, yet only a few can play; its token grabs headlines, but farming access remains high for crypto natives.**

### The Calculated Moves of Project Teams, Market Makers, and Exchanges

Want to earn? You can’t get in. Already earning? You can’t cash out.

Although players can currently recoup investments rapidly, actually withdrawing earnings requires passing Big Time’s KYC process.

According to some player feedback, KYC currently involves a 3–5 day review period, delaying withdrawals (note: as of publication, KYC processing speed has improved).

You’ve earned money — but not quite.

From an asset standpoint, when large volumes of mined tokens cannot be withdrawn, the source of “mine-sell-dump” activities is restricted — effectively reducing selling pressure on BIGTIME in the open market. This serves as a favorable strategy for the project team to maintain token price stability.

**Thus, we observe a clear split: the game goes viral, yet only a few can play; its token grabs headlines, but farming access remains high for crypto natives.**

### The Calculated Moves of Project Teams, Market Makers, and Exchanges

Want to earn? You can’t get in. Already earning? You can’t cash out.

Although players can currently recoup investments rapidly, actually withdrawing earnings requires passing Big Time’s KYC process.

According to some player feedback, KYC currently involves a 3–5 day review period, delaying withdrawals (note: as of publication, KYC processing speed has improved).

You’ve earned money — but not quite.

From an asset standpoint, when large volumes of mined tokens cannot be withdrawn, the source of “mine-sell-dump” activities is restricted — effectively reducing selling pressure on BIGTIME in the open market. This serves as a favorable strategy for the project team to maintain token price stability.

However, after several days of waiting, the value of earned BIGTIME tokens might have significantly diluted, meaning paper profits may shrink upon realization. Meanwhile, rising NFT input costs, changes in drop rate rules, and increasing competition further reduce farming ROI.

However, after several days of waiting, the value of earned BIGTIME tokens might have significantly diluted, meaning paper profits may shrink upon realization. Meanwhile, rising NFT input costs, changes in drop rate rules, and increasing competition further reduce farming ROI.

So, what if instead of farming, you simply buy BIGTIME tokens?

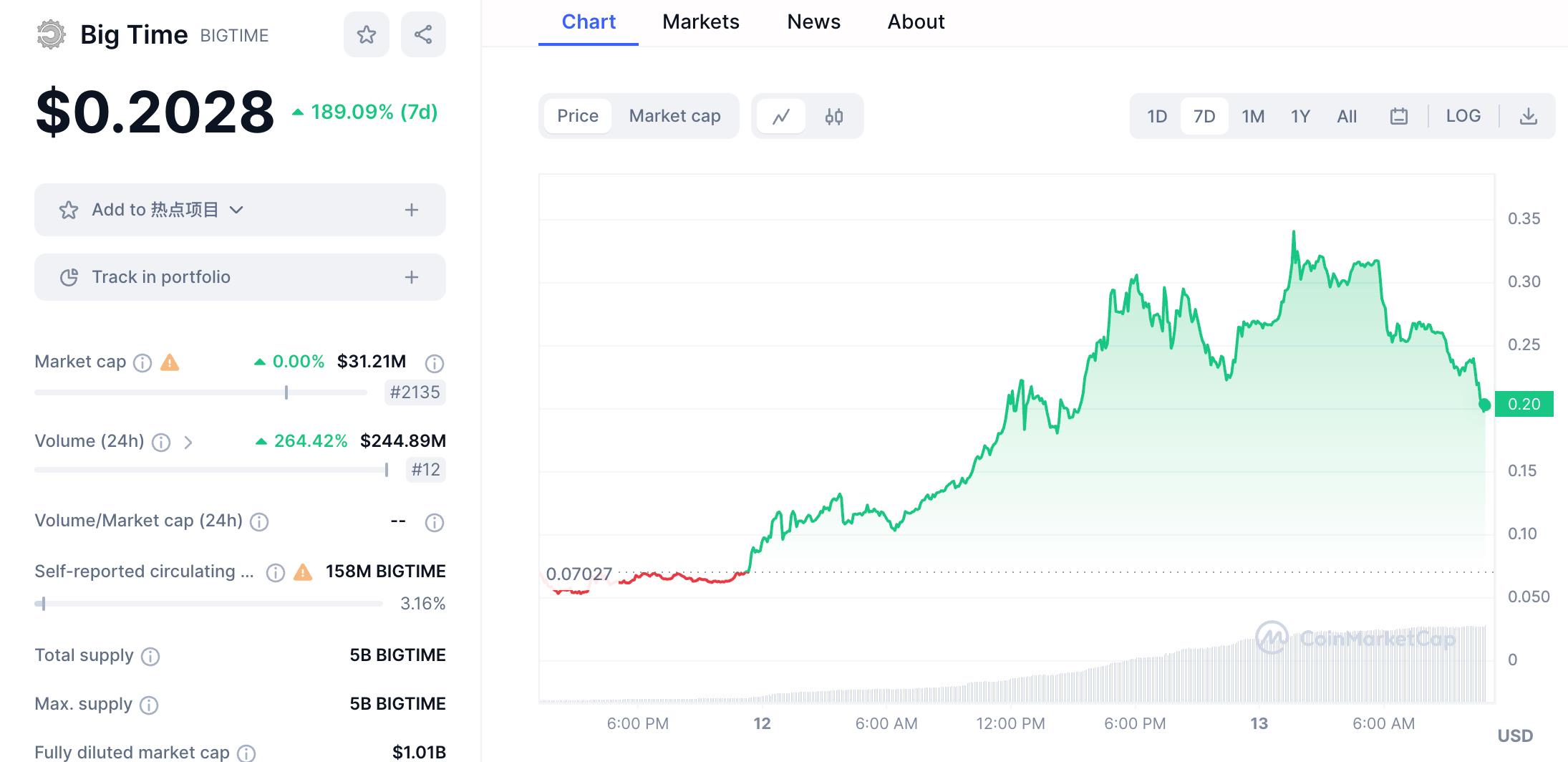

In terms of price alone, the token surged 20x within two days of launch — clearly attractive for quick trades.

**But only if you can find counterparties and trading channels.**

According to on-chain analyst Yujin’s research, BIGTIME is currently highly centralized, with market makers holding 90 million circulating tokens. Given that KYC delays withdrawals from farming, actual token liquidity is extremely limited — with total circulating market cap estimated around $30 million at publication (data from CoinMarketCap).

So, what if instead of farming, you simply buy BIGTIME tokens?

In terms of price alone, the token surged 20x within two days of launch — clearly attractive for quick trades.

**But only if you can find counterparties and trading channels.**

According to on-chain analyst Yujin’s research, BIGTIME is currently highly centralized, with market makers holding 90 million circulating tokens. Given that KYC delays withdrawals from farming, actual token liquidity is extremely limited — with total circulating market cap estimated around $30 million at publication (data from CoinMarketCap).

Under these conditions, early buyers attempting limit orders may struggle due to insufficient liquidity. Concentrated liquidity means greater control for market makers, enabling rapid price pumps followed by stabilization.

And buying BIGTIME isn’t straightforward either.

On OKX — currently the exchange with the deepest spot liquidity — searching “BIGTIME” directly in the Asian region yields no results, as the spot trading pair is disabled.

Under these conditions, early buyers attempting limit orders may struggle due to insufficient liquidity. Concentrated liquidity means greater control for market makers, enabling rapid price pumps followed by stabilization.

And buying BIGTIME isn’t straightforward either.

On OKX — currently the exchange with the deepest spot liquidity — searching “BIGTIME” directly in the Asian region yields no results, as the spot trading pair is disabled.

The workaround? Deposit some BIGTIME into your OKX receiving address from elsewhere to unlock access.

BIGTIME launched during peak Asian trading hours, yet OKX lacked visible spot entry. Then, during U.S. trading hours (early morning Beijing time), Coinbase listed BIGTIME, sending prices sharply upward.

Those who timed it right were lucky — but due to timing and access issues, most players likely missed this rapid price surge.

Meanwhile, as new tokens bring traffic to OKX and Coinbase, Binance won’t sit idle.

On the evening of the 12th, Binance launched perpetual contracts for BIGTIME. Notably, **there is no spot market — only derivatives**.

The workaround? Deposit some BIGTIME into your OKX receiving address from elsewhere to unlock access.

BIGTIME launched during peak Asian trading hours, yet OKX lacked visible spot entry. Then, during U.S. trading hours (early morning Beijing time), Coinbase listed BIGTIME, sending prices sharply upward.

Those who timed it right were lucky — but due to timing and access issues, most players likely missed this rapid price surge.

Meanwhile, as new tokens bring traffic to OKX and Coinbase, Binance won’t sit idle.

On the evening of the 12th, Binance launched perpetual contracts for BIGTIME. Notably, **there is no spot market — only derivatives**.

This “contracts-only” listing strategy recalls Binance’s prior treatment of Blur tokens.

Back then, rumors circulated about internal views questioning Blur’s fundamentals for spot listing;

This “contracts-only” listing strategy recalls Binance’s prior treatment of Blur tokens.

Back then, rumors circulated about internal views questioning Blur’s fundamentals for spot listing;

Today, given BIGTIME’s high FDV, low float, and extreme centralization, Binance may share similar reservations about spot listing — though exact reasoning remains unknown.

Yet launching contracts at this critical moment sends a clear signal:

For players actively farming but unable to withdraw, futures provide hedging tools — allowing short positions to offset potential price drops once withdrawals are permitted.

Where there’s demand, there’s a market. Even without spot listings, exchanges can still profit from trading fees and liquidations, capturing a slice of the new token’s spotlight.

Thus, amid the Big Time launch frenzy, we see each player — project team, market makers, exchanges — playing their own calculated game.

The project’s KYC rules inadvertently stabilize selling pressure; market makers consolidate holdings to drive pump-and-dump dynamics; one exchange leads with spot to capture traffic; another counters with derivatives to claim its share...

When everything appears meticulously orchestrated, will you still be the one happily making money?

### Tools Are Just Tools

From unplayable to playable, from AAA concept to real gameplay, GameFi projects have indeed evolved in quality.

Yet their core economic models and manipulation tactics remain largely unchanged — the same套路 as projects from years past.

In traditional markets, games are mass-market consumer products where content itself is paramount.

But within this complex interplay among studios, project teams, market makers, and exchanges, every move orbits around profit — the game itself becomes merely a vehicle for value extraction.

After securing sufficient funds via early NFT sales, from a business perspective, spending heavily refining gameplay is no longer a rational investment.

Profits need to be realized, investors seek exits, bull markets await — what would you do?

Therefore, we shouldn’t approach current blockchain games idealistically, nor judge them purely from a gamer’s perspective demanding perfect experiences.

Within this multi-party game, a tool-oriented mindset remains pragmatic and realistic — recognize it, use it, and preferably, forget it.

And if you still choose to join without fully understanding, at least hope you’re not the one being used to make others rich.

Today, given BIGTIME’s high FDV, low float, and extreme centralization, Binance may share similar reservations about spot listing — though exact reasoning remains unknown.

Yet launching contracts at this critical moment sends a clear signal:

For players actively farming but unable to withdraw, futures provide hedging tools — allowing short positions to offset potential price drops once withdrawals are permitted.

Where there’s demand, there’s a market. Even without spot listings, exchanges can still profit from trading fees and liquidations, capturing a slice of the new token’s spotlight.

Thus, amid the Big Time launch frenzy, we see each player — project team, market makers, exchanges — playing their own calculated game.

The project’s KYC rules inadvertently stabilize selling pressure; market makers consolidate holdings to drive pump-and-dump dynamics; one exchange leads with spot to capture traffic; another counters with derivatives to claim its share...

When everything appears meticulously orchestrated, will you still be the one happily making money?

### Tools Are Just Tools

From unplayable to playable, from AAA concept to real gameplay, GameFi projects have indeed evolved in quality.

Yet their core economic models and manipulation tactics remain largely unchanged — the same套路 as projects from years past.

In traditional markets, games are mass-market consumer products where content itself is paramount.

But within this complex interplay among studios, project teams, market makers, and exchanges, every move orbits around profit — the game itself becomes merely a vehicle for value extraction.

After securing sufficient funds via early NFT sales, from a business perspective, spending heavily refining gameplay is no longer a rational investment.

Profits need to be realized, investors seek exits, bull markets await — what would you do?

Therefore, we shouldn’t approach current blockchain games idealistically, nor judge them purely from a gamer’s perspective demanding perfect experiences.

Within this multi-party game, a tool-oriented mindset remains pragmatic and realistic — recognize it, use it, and preferably, forget it.

And if you still choose to join without fully understanding, at least hope you’re not the one being used to make others rich.Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News