YGG Research Report: In-Depth Understanding of Operational Model and Investment Philosophy

TechFlow Selected TechFlow Selected

YGG Research Report: In-Depth Understanding of Operational Model and Investment Philosophy

YGG's invested gaming assets significantly shrank throughout 2022, leading its investment approach to gradually shift toward caution.

Project Overview

YGG operates in the blockchain gaming guild sector.

The GameFi sector surged in 2021, and the explosive popularity of Axie Infinity triggered a gold-rush mentality among blockchain gamers. However, for most low-income players in developing countries, acquiring even one $600 pet—and needing three just to start battling—was financially out of reach. This environment led to the emergence of blockchain gaming guilds, which drastically lowered the barrier to entry for P2E games. Yield Guild Games (YGG) pioneered the scholarship model that catalyzed the rise of this entire sector. In both 2021 and 2022, funding within this sector saw significant growth.

Yield Guild Games (YGG) is a decentralized gaming guild built on Ethereum and Polygon. It pioneered the scholarship model, driving the rise of blockchain gaming guilds. However, as the current GameFi market cools down, the limitations of the scholarship model have become increasingly apparent. As a result, YGG has shifted its development strategy toward investing in high-quality games rather than focusing solely on P2E titles.

As of Q3 2022, YGG had partnered with 55 GameFi projects. Its investment portfolio spans a broad and diverse range of game ecosystems, positioning it well for potential future growth when the GameFi sector rebounds.

Beyond investing in game assets, YGG actively expands its community by establishing SubDAOs, identifying suitable marketing and outreach channels in each country to strengthen its global presence and build localized communities. This strategic approach gives YGG a distinct advantage over other guilds in terms of overall community scale.

It should be noted that according to available data, the value of YGG's invested game assets shrank significantly throughout 2022. The organization has gradually adopted a more cautious investment stance. With fewer profitable P2E games currently available, investment returns will be a key source of treasury revenue. Going forward, continuous monitoring of treasury changes will be essential to assess whether YGG can survive the upcoming bear market phase. Additionally, if the broader GameFi sector fails to recover, this would severely limit the project’s long-term growth potential.

1. Basic Information

1.1 Project Introduction

Yield Guild Games (YGG) is a decentralized autonomous organization (DAO) focused on investing in virtual world and blockchain game assets or tokens, optimizing their value and maximizing utility for its community.

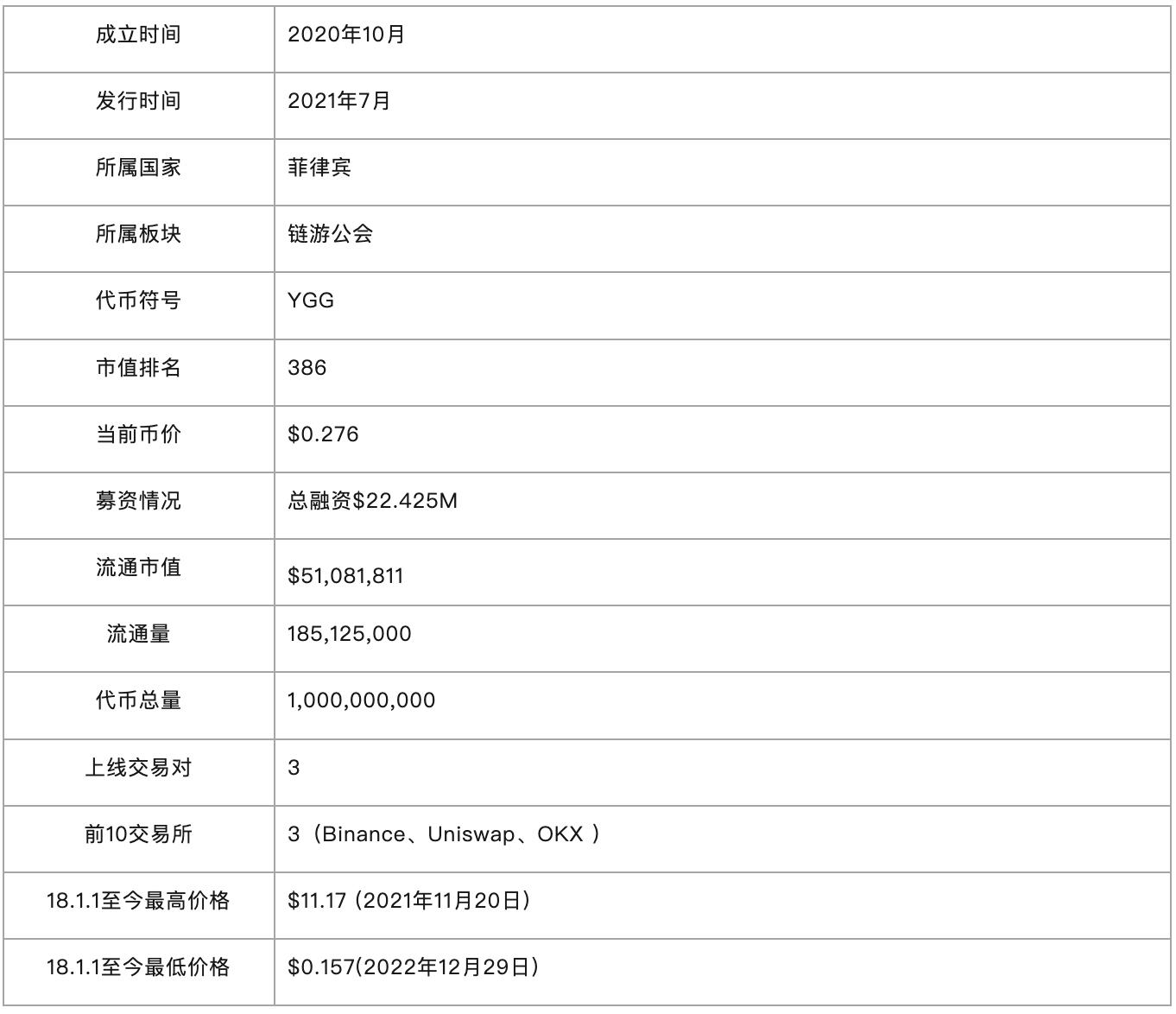

1.2 Basic Details

2. Project Details

2.1 Team

According to official reports, YGG has a team of 48 members. Most come from backgrounds in blockchain and traditional gaming industries, with many being deeply involved in the Axie Infinity ecosystem.

Gabby Dizon, CEO and Co-Founder of YGG. Active in mobile gaming since 2004, he entered the blockchain space in 2018. In 2014, Gabby founded Altitude Games, a Manila-based studio that released the blockchain game Battle Racers in 2019. He is an active member of both the Axie Infinity and Yearn Finance communities and serves on the board of the Blockchain Gaming Alliance.

Beryl Li, CFO and Co-Founder of YGG. A Cambridge University graduate, Beryl has been involved in blockchain since 2014 and served as Chair of the 2016 Cambridge University Cryptocurrency Society. She previously worked at BlackRock Asset Management and was a co-founder of CapchainX (acquired by SMKG OTC US), as well as a licensed financial advisor.

Owl of Moistness, CTO and Co-Founder of YGG. Entered the blockchain industry in 2018. Owl developed breeding algorithms for Axie Infinity and many bots on its Discord server, wrote smart contracts integrating Discord tipping systems, wrapped deflationary tokens, and created mining strategy contracts compliant with yVault standards.

Alexei Udall aka Sarutobi, Head of Partnerships at YGG. Joined the blockchain industry in 2017, with over five years of experience in SaaS sales and partnerships.

Nolan Manalo aka Nate, Head of Gaming Operations at YGG. Entered the blockchain space in 2016, he is an active member of the Axie Infinity community and head coach for YGG’s esports teams across various platforms.

Advisory Team:

Anil Lulla, Co-Founder and COO of Delphi. Anil has a strong reputation in crypto asset research and technology consulting. Delphi oversaw YGG’s token design, and Anil continues to provide guidance on governance and effective treasury management during the transition toward full decentralization.

Eric Arsenault, Partner at Metacartel Ventures. Eric has been a leader in the DAO space since 2018. He is a partner and investor at Metacartel Ventures and leads the Rarible DAO ecosystem. Previously, he worked at DAOstack, advising many leading DAO projects. Eric provides strategic consultation to YGG on DAO structure and the path to decentralization.

2.2 Funding

To date, YGG has completed four funding rounds totaling $22.425M. Details are as follows:

Table 2-1 YGG Funding History

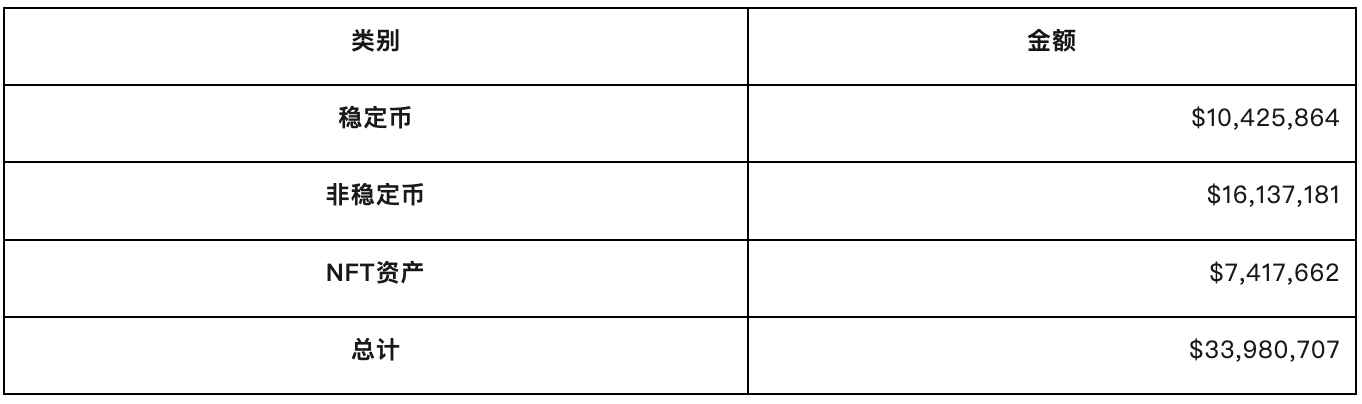

Based on on-chain treasury address statistics provided by YGG, the current state of its treasury funds is shown below. Given YGG’s current team size, its financial reserves appear sufficient to sustain operations through the current bear market.

Table 2-2 YGG Treasury Assets

2.3 Codebase

YGG’s codebase is not open source.

2.4 Products

Yield Guild Games (YGG) is a decentralized gaming guild operating on Ethereum and Polygon. It pioneered the scholarship model that helped launch the blockchain gaming guild sector. However, due to the current downturn in the GameFi space, the limitations of the scholarship model have become evident. YGG has since pivoted its strategy from purely supporting P2E games to investing in high-quality games. It also employs various community expansion strategies to enhance its influence. We will now explore the project through YGG’s investment landscape and community structure.

2.4.1 YGG Scholarship Model

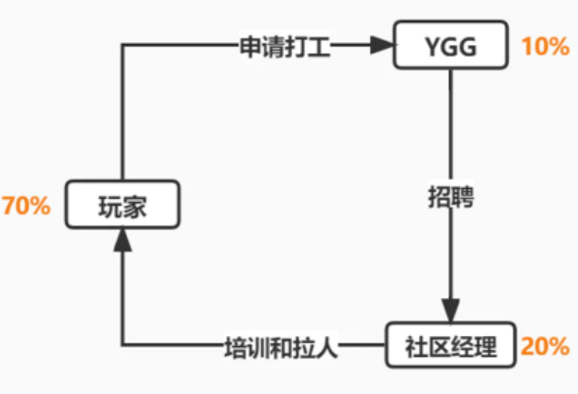

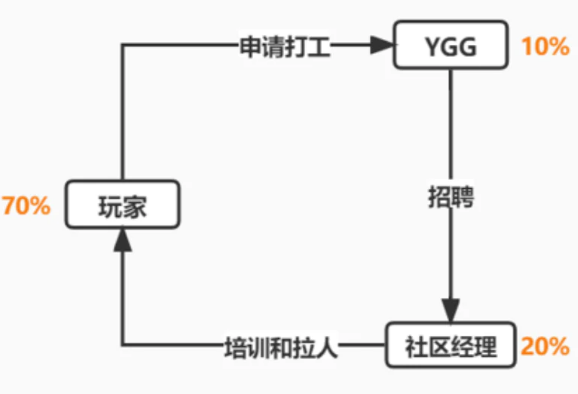

As illustrated below, YGG’s scholarship system operates via a three-party mechanism:

Players who lack the NFT assets required to enter a game can apply via Discord to “work” for the guild and borrow NFTs, spending time playing to earn in-game token rewards. The guild must purchase a certain number of NFT assets to lend to approved applicants. Community managers are responsible for recruiting, screening, and training qualified play-to-earn players. Earnings from gameplay are shared between the player, the community manager, and the guild. Currently, YGG’s revenue split is 7:2:1—players receive 70% of earnings, community managers 20%, and the guild 10%.

Figure 2-1 Scholarship System Workflow

The scholarship model essentially attracts a workforce primarily focused on earning income from GameFi. While these players help generate early traction and expand game communities, once the ecosystem matures, their large-scale presence becomes detrimental—especially given the immaturity of most GameFi tokenomics models, which often fall into death spirals. A massive influx of profit-driven users accelerates the collapse of a GameFi economy.

This implies that the scholarship model cannot be sustained indefinitely within a single GameFi project. Guilds must constantly seek out new profitable games to generate revenue. During bear markets, however, such opportunities are scarce, potentially leaving guilds without income for extended periods.

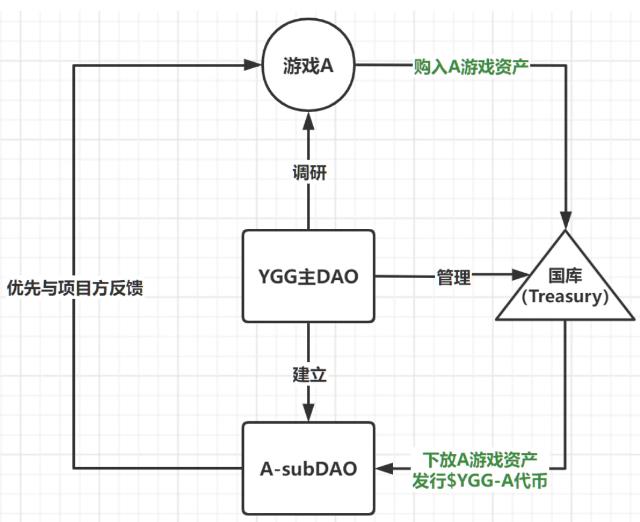

2.4.2 YGG DAO Operation Mechanism

YGG DAO’s treasury assets (tokens, NFTs, virtual land) are managed by the YGG Treasury, currently overseen by YGG’s three co-founders. These assets can only be accessed when two of the three co-founders sign a transaction, or when a community proposal to use the assets is approved by the DAO.

Another core feature of YGG is the creation of SubDAOs—secondary guilds organized by region or specific game. Each SubDAO focuses on a particular game or geographic area and can establish its own governance rules. Through localized operations, SubDAOs allow YGG to operate efficiently at scale. When a new SubDAO is formed—for example, one dedicated to a specific game—YGG first conducts research on the game, purchases relevant in-game NFTs, deposits them into a treasury wallet, and then appoints SubDAO managers who control the assets via a smart contract wallet.

Additionally, YGG issues SubDAO-specific tokens. For instance, the SubDAO for League of Kingdoms uses the token YGGLOK. After issuing SubDAO tokens, YGG retains a portion to participate in future governance decisions. SubDAO token holders can vote on governance matters specific to their SubDAO, giving them direct influence over its operations.

Functionally, the main YGG DAO focuses on forming partnerships with game developers, making investments, and managing treasury assets. Meanwhile, tasks related to incubating and promoting specific games are delegated to the relevant SubDAO. Regional SubDAOs like YGGJapan and YGGSEA focus on investing in and building communities around Japanese and Southeast Asian games, respectively. They recruit local talent, organize regular events, and aim to localize operations to expand YGG’s regional influence.

Figure 2-2 SubDAO Formation Flowchart

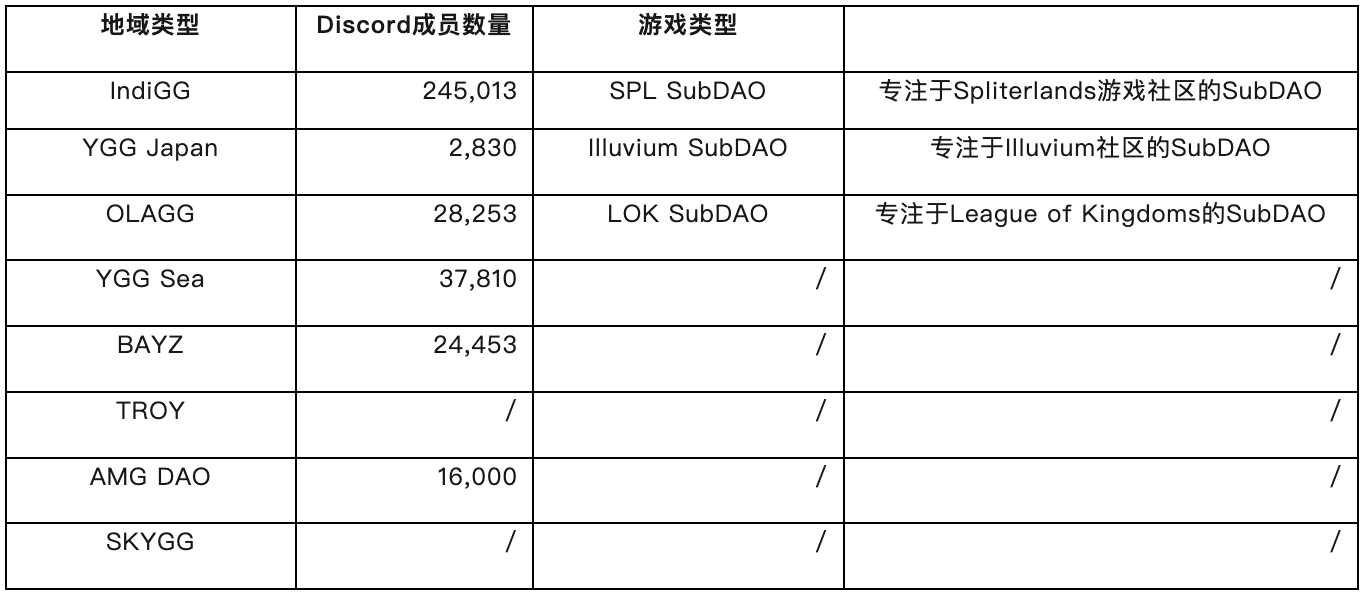

Currently, YGG oversees 12 SubDAOs, listed below:

Table 2-3 YGG SubDAO Landscape

As shown above, the total membership across all YGG SubDAOs exceeds 350,000. Below are highlights of key SubDAOs:

YGG SEA: YGG SEA was YGG’s first regional SubDAO, serving Southeast Asian countries beyond the Philippines. In late 2021, YGG SEA raised $15 million. Since its launch in November 2021, it has hosted over 1,000 online events, participated in more than 500 speaking engagements (including AMAs, interviews, and podcasts), held four major live events in Indonesia, Vietnam, Thailand, and Malaysia, and conducted over 20 roadshows in Indonesia and Singapore.

YGG Japan: Focused on the Japanese market, YGG Japan secured $2.8 million in funding led by Animoca Brands in July 2022. It primarily supports Japanese IP-driven blockchain games with development and marketing resources.

BAYZ: BAYZ is YGG’s Brazilian SubDAO, receiving a $4 million investment led by YGG DAO in July 2022. It expanded its community by launching an educational platform on crypto and P2E concepts, creating content on Twitch and TikTok. BAYZ now includes over 40 content creators and accounts for over 70% of Web3 gaming watch time on Twitch in Brazil.

IndiGG: IndiGG is YGG’s Indian SubDAO, building its community through offline and online nodes—micro-influencers or sub-communities within the guild. Offline nodes include college campuses across India, while online nodes consist of mini-communities of 5,000–15,000 Discord users.

OlaGG: OlaGG focuses on Spanish-speaking regions such as Mexico, Colombia, and Argentina. Its founder is a partner at a family office managing over $20 billion in assets. OlaGG raised $8 million in June 2022.

AMG DAO: AMG DAO serves Central and Eastern Europe, with members across 11 European countries, making it the largest gaming guild in the region. Troy and SKYGG are SubDAOs focused on Turkey and South Korea, respectively.

Figure 2-4 YGG SubDAO Map

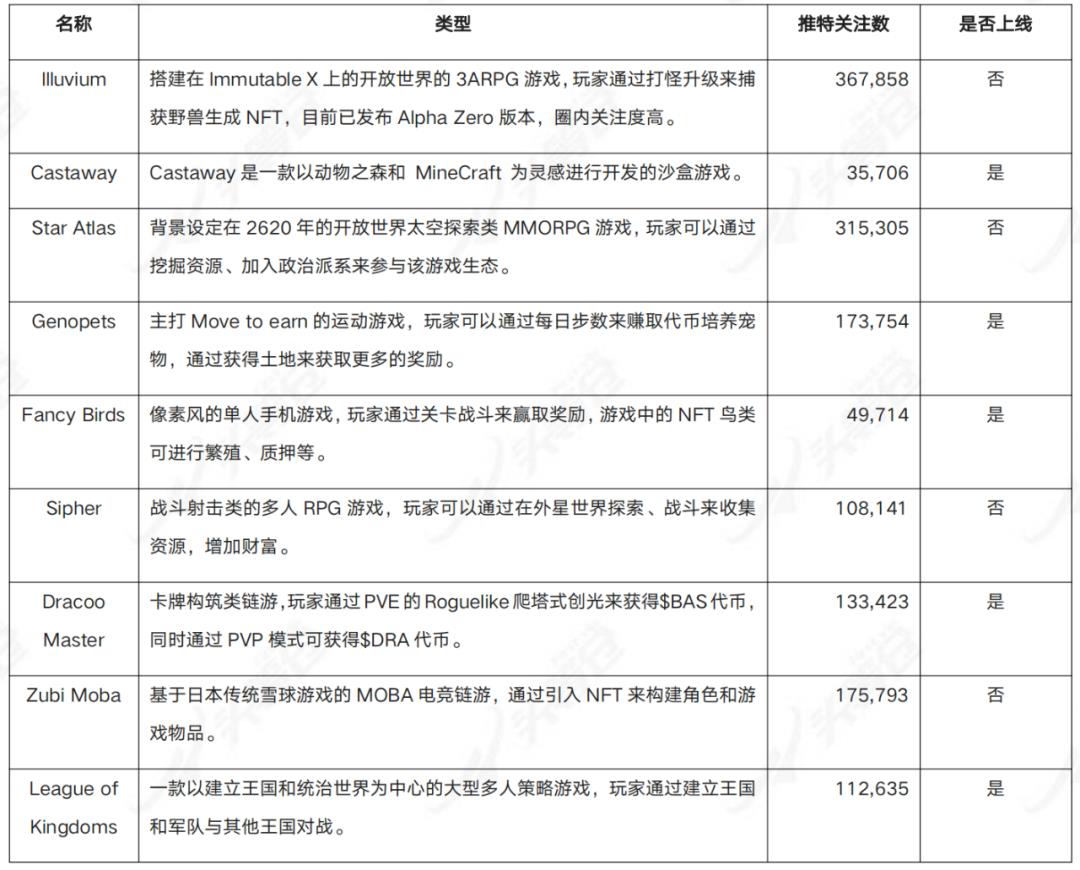

2.4.3 YGG Investment Portfolio

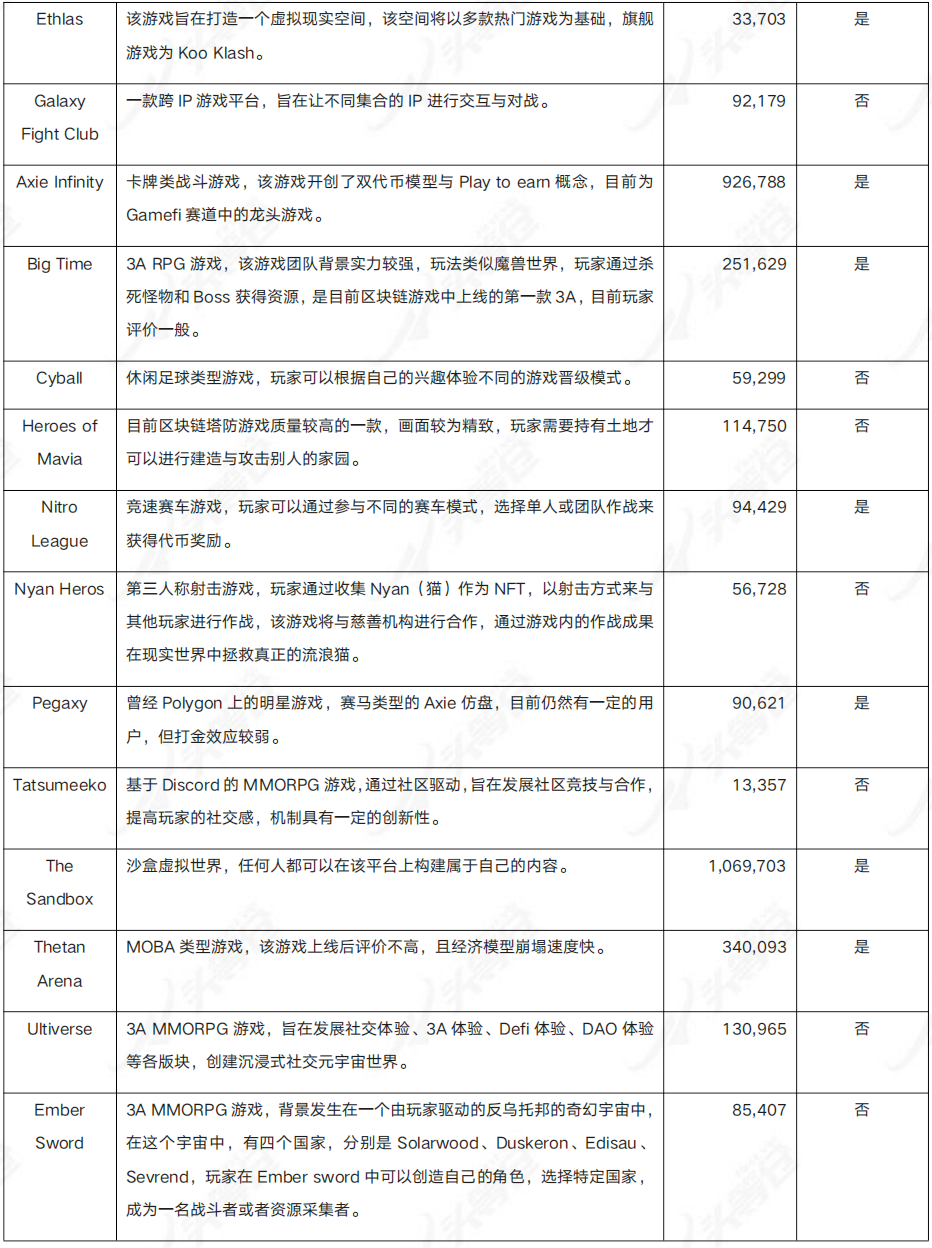

As of Q3 2022, according to YGG’s Q3 community report, the organization had partnered with 55 GameFi projects. Below is a list of its primary investments:

Table 2-4 List of YGG Partnered Projects

2.4.4 YGG Community Operations

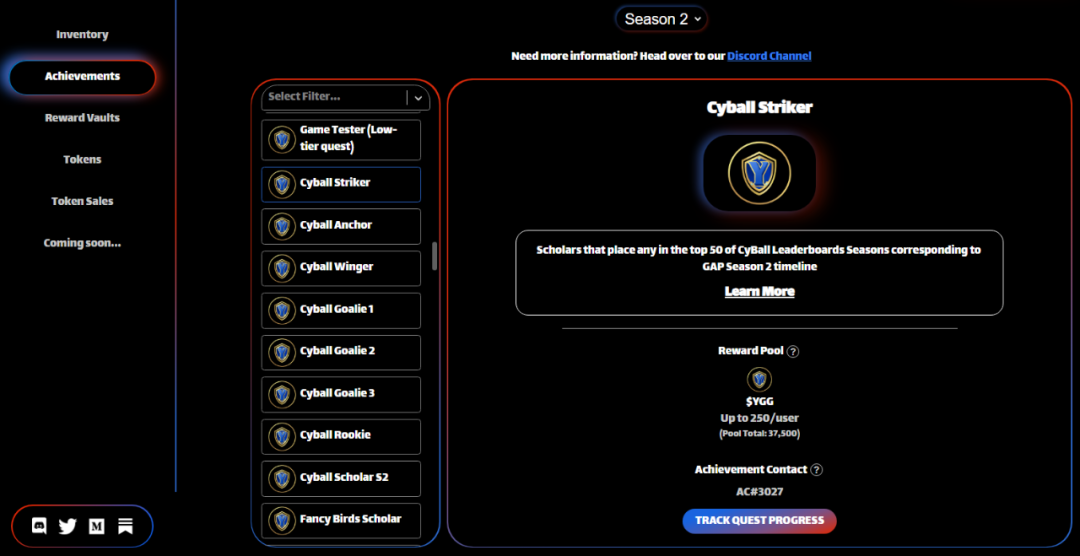

YGG runs the GAP program (Guild Advancement Program) to grow and strengthen its community, fostering collaboration between members and partner games. Participants complete achievement tasks published by YGG—such as playing partner games for a set duration, recruiting new players, or hosting high-quality livestreams—to earn YGG tokens and corresponding achievement NFTs. This program is a key focus area for YGG’s ongoing development.

Season One of the GAP Program (Guild Advancement Program): Most achievement tasks were created by YGGDAO’s gaming operations and community marketing managers. Season One featured 45 achievements, attracted over 500 participants, and distributed 102,160 YGG tokens and 1,030 achievement NFTs. It ran from April to July 2022—a period of three months.

Season Two of the GAP Program (Guild Advancement Program): In addition to contributions from YGGDAO managers, partner ambassadors also helped design game-specific tasks. Season Two included 116 achievements across 13 partner games, with a broader scope including content creation, community tool development, and tutorial videos. There were 603 participating wallets, and the program distributed 225,226 YGG tokens and 2,063 achievement NFTs. Season Two ran from September to December 2022.

Figure 2-5 YGG Achievement Task Interface

In addition to the GAP program, YGG offers Reward Vaults in partnership with game projects to incentivize players who stake $YGG tokens while holding the guild badge. The second season of Reward Vaults is currently live.

First Reward Vault: Lasted 90 days, opened for staking on July 28, 2022, with rewards starting August 1. This vault included Aavegotchi and Crypto Unicorns, offering $GHST and $RBW tokens. Over 3.5 million YGG tokens were staked by the end of the campaign.

Second Reward Vault: Also lasted 90 days, opened on November 13, 2022, with rewards distributed until February 12, 2023. Users holding the YGG guild badge could stake YGG tokens on Polygon Reward Vaults to earn $THG and $LOKA tokens from League of Kingdoms and Thetan Arena.

Summary:

As a pioneer in the blockchain gaming guild space, YGG focused heavily in 2021 on promoting Axie Infinity and its scholarship model. However, as the GameFi sector declined in 2022, YGG began shifting toward investing in high-quality games—evolving into a fund-like model—while simultaneously nurturing games and expanding its community footprint to prepare for future user acquisition.

By establishing SubDAOs and tailoring marketing and outreach strategies per region, YGG has successfully increased awareness and influence of both itself and blockchain gaming globally, building dedicated communities across different countries. This strategic move positions YGG favorably to rapidly scale its community once the GameFi sector rebounds.

3. Development

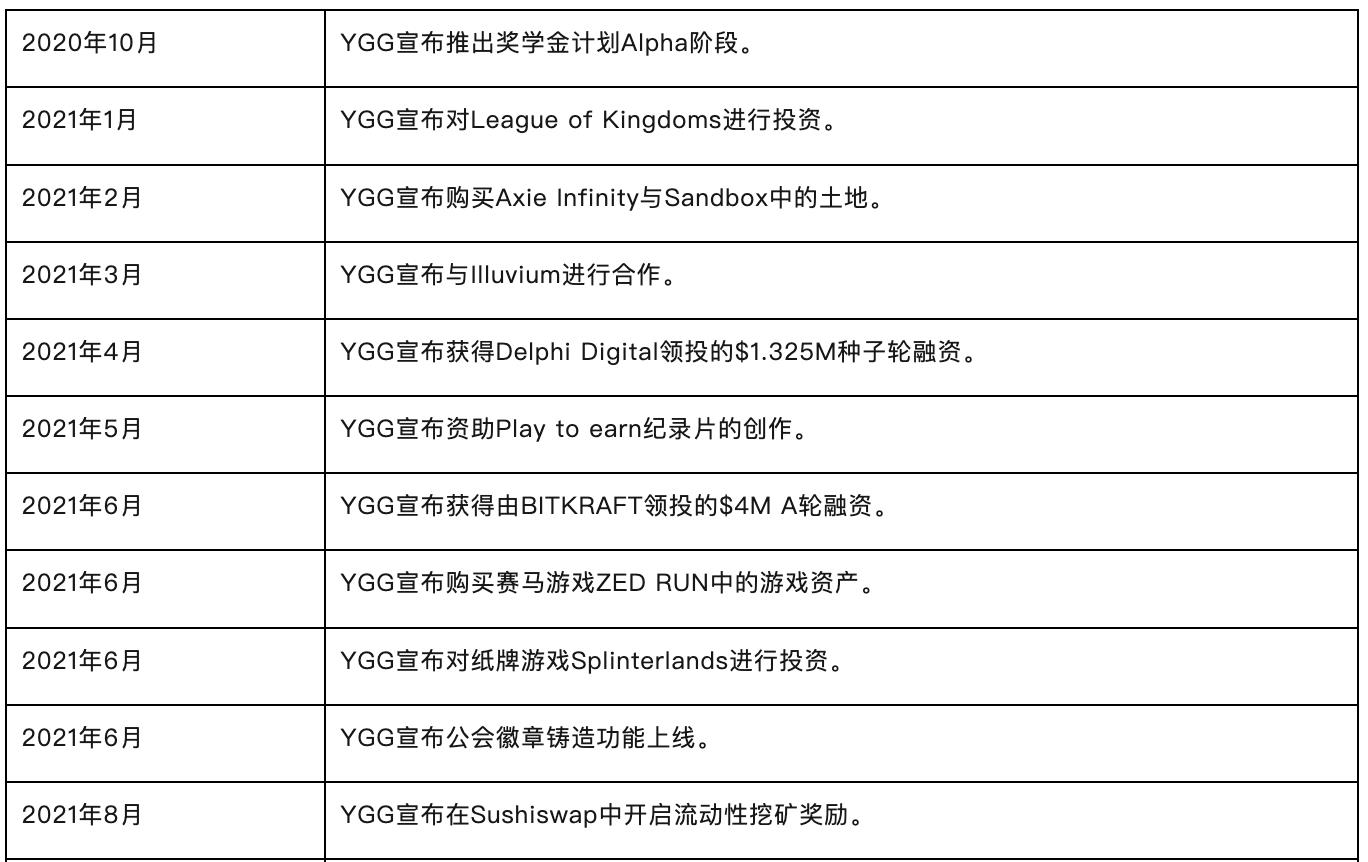

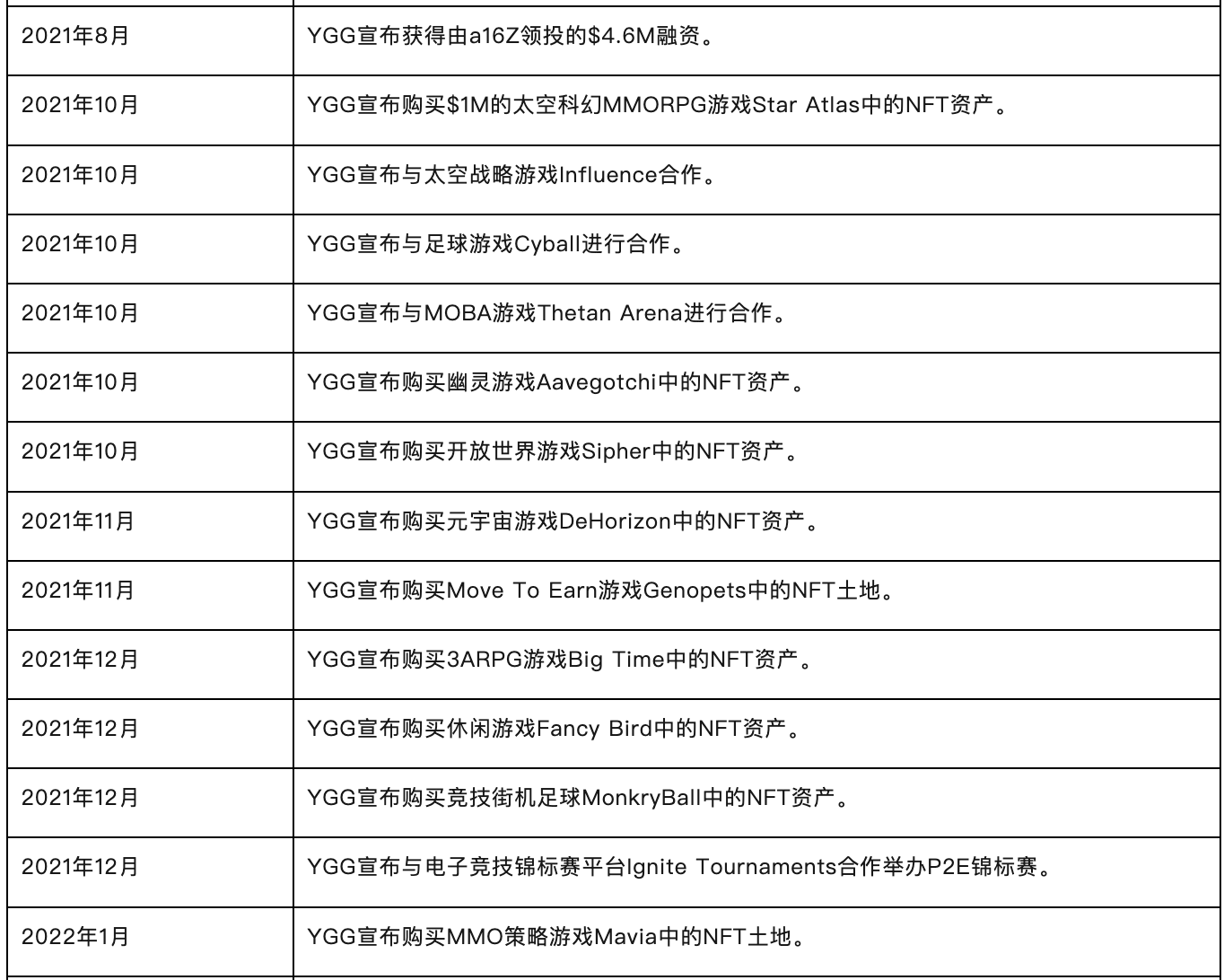

3.1 History

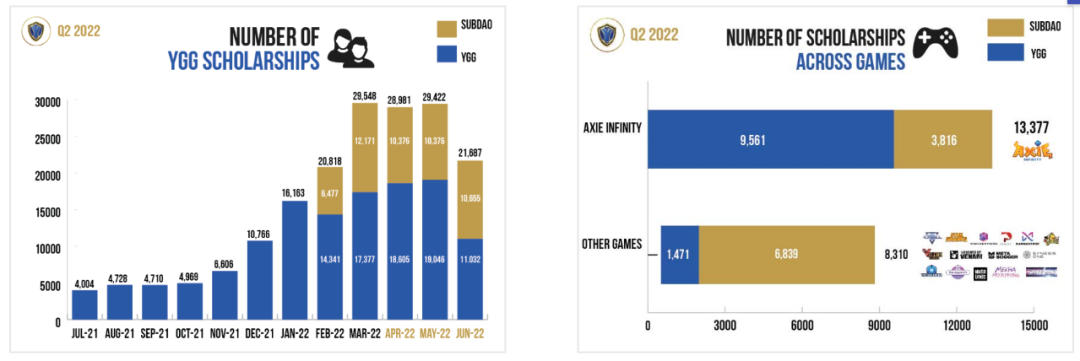

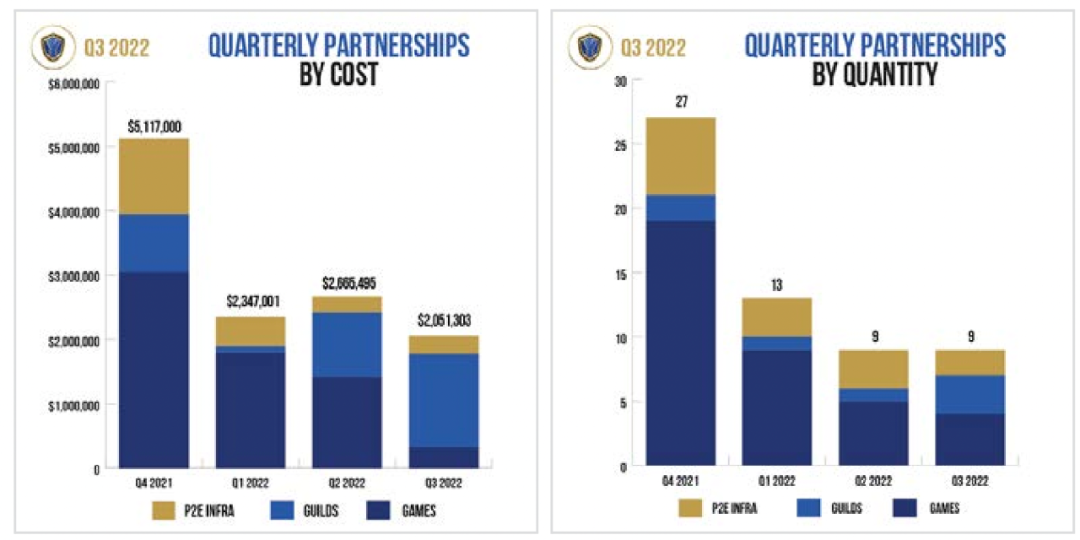

Table 3-1 Major YGG Milestones

3.2 Current Status

3.2.1 Operational Data

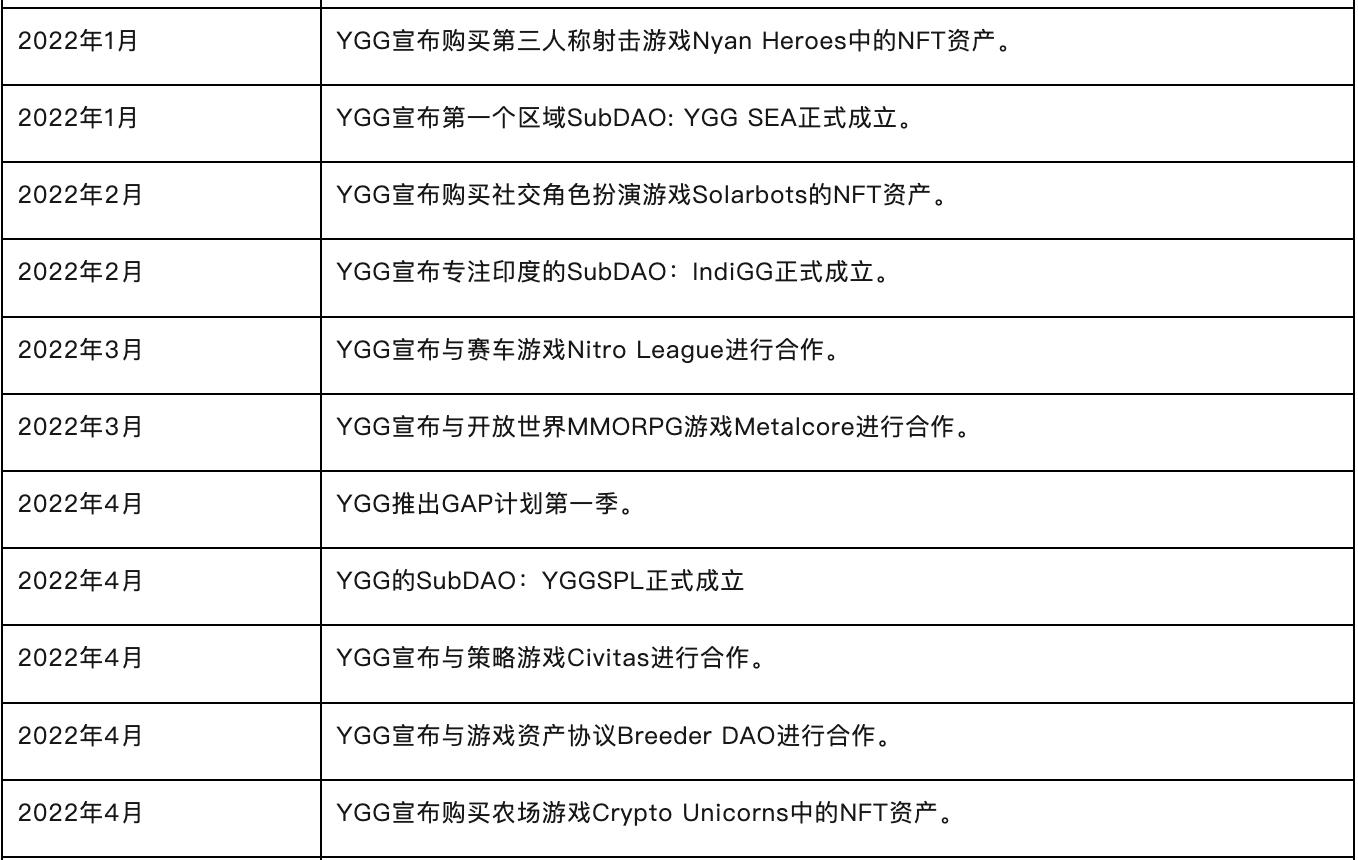

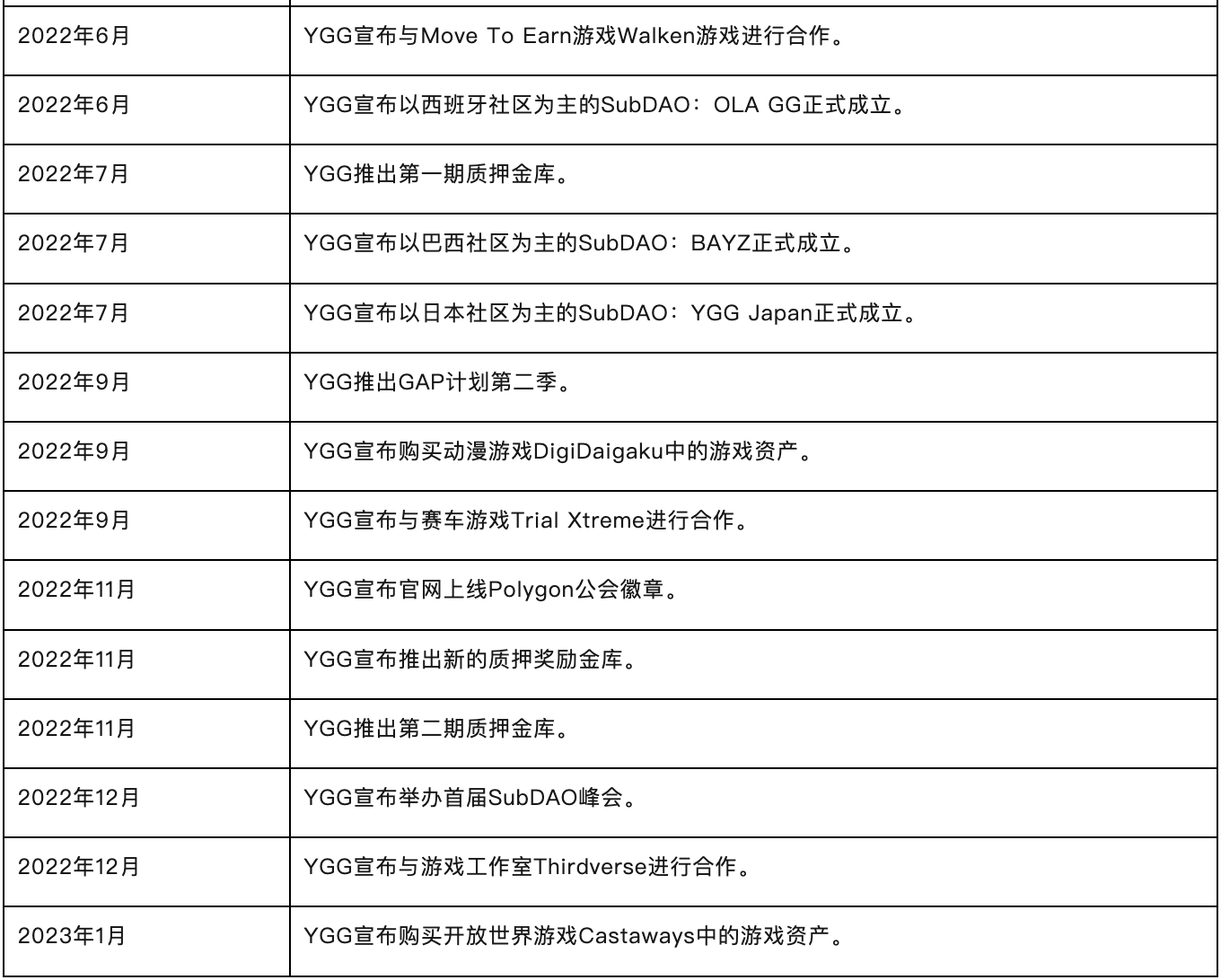

From the table above, we see that the number of YGG badge holders is slowly increasing, indicating gradual community growth. However, scholarship participant numbers have declined over two consecutive quarters, primarily because no breakout P2E games emerged in the second half of 2022, reducing incentives for new players. Looking at YGG’s investment performance, the total value of its invested assets dropped from over $100 million in Q4 2021 to $30 million by Q3 2022—a 66.3% decline. This reflects significant bear-market-related drawdowns. However, based on return metrics, much of the loss stems from profit retractions; the overall portfolio remains in positive territory.

Figure 3-1 Number of YGG Scholarship Scholars

Figure 3-2 YGG Investment Trends

As seen in the charts, YGG’s scholarship participation began declining in 2022. However, expansion via SubDAOs stabilized participant numbers for several months afterward. Since mid-2022, though, the trend has resumed downward. Regarding investment activity, both the number and amount of YGG’s game investments declined throughout 2022, indicating a more cautious investment strategy during the bear market.

3.2.2 Social Media Metrics

Table 3-3 YGG Social Media Statistics

3.3 Future Outlook

YGG has not released an official roadmap.

Summary:

While YGG’s community has grown slowly during the bear market, its invested game assets have shrunk significantly throughout 2022, reflecting a shift toward more conservative investment practices. With few profitable P2E games currently available, investment returns are becoming a critical component of treasury income. Going forward, continued monitoring of treasury health will be vital to determine whether YGG can endure the next bear market phase.

4. Economic Model

Yield Guild Games’ native token is YGG, with a total supply of 1,000,000,000.

4.1 Token Distribution

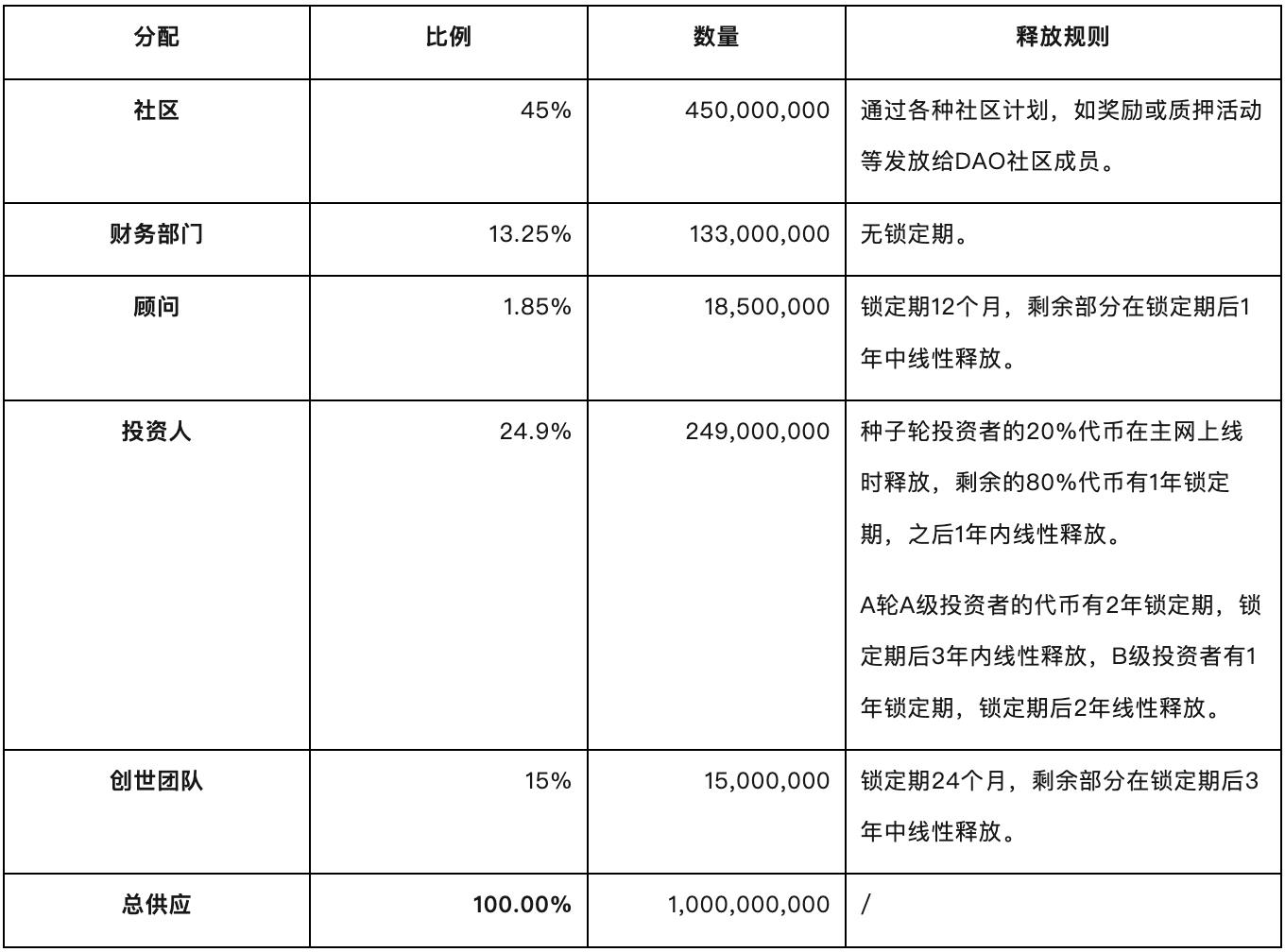

YGG token distribution is outlined in the table below:

Table 4-1 YGG Token Distribution

Figure 4-1 Detailed YGG Token Distribution

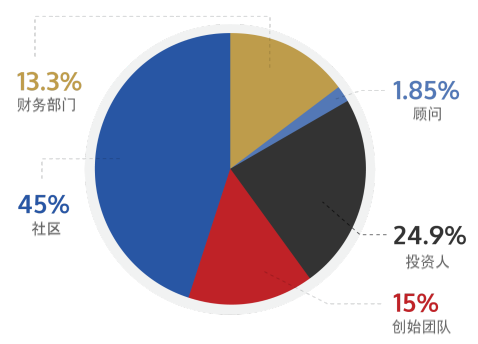

Figure 4-2 YGG Token Unlock Schedule

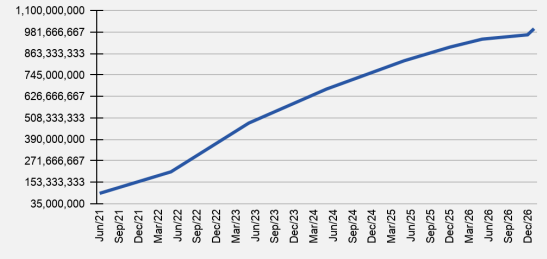

4.2 Holder Address Analysis

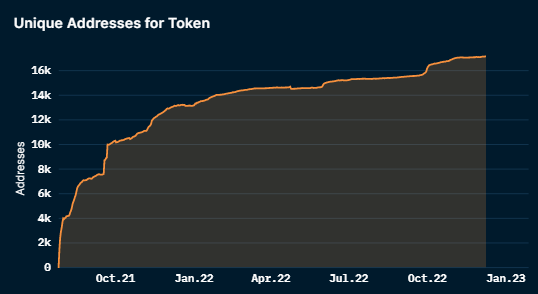

According to Ethereum explorer data, as of January 16, 2022, there were 18,726 YGG token holder addresses on Ethereum. The top 10 addresses held 91.86% of the supply, while the top 100 held 98.59%. Most top addresses are contracts or exchanges. Excluding those, the top 10 individual holders owned approximately 4.52% of the circulating supply, indicating relatively low concentration.

Figure 4-3 YGG Holder Address Distribution

Figure 4-4 YGG Holder Address Trend

From Nascent blockchain data, the number of YGG holders grew rapidly before 2022 but has since slowed to a steady pace.

4.3 Token Utility

The YGG token currently serves the following purposes:

1. Staking tokens grants rewards in SubDAO tokens or partner game tokens;

2. YGG token holders can submit and vote on proposals via the website, covering topics such as: 1) technology; 2) products and projects; 3) token allocation; 4) governance structure.

5. Competition

5.1 Industry Analysis

YGG operates in the blockchain gaming guild sector.

5.1.1 Industry Overview

In traditional gaming, guilds form to enable players to gather, cooperate, and tackle difficult content such as raid bosses. For example, in World of Warcraft, top-tier guilds compete for first clears or first kills. Beyond cooperation, traditional guilds also serve social functions or content-sharing hubs, acting as central community spaces.

In Web3, the GameFi sector surged in 2021, with Axie Infinity’s success sparking a wave of blockchain gamers seeking to earn income. Yet for most players in low-income countries, the $600 cost of a single pet—and needing three to begin battling—was prohibitively expensive. This gap gave rise to blockchain gaming guilds, which dramatically lowered the entry barrier for P2E games. Yield Guild Games pioneered the scholarship model that launched the entire guild movement.

The scholarship model is a core mechanism among blockchain gaming guilds. As illustrated below, it involves three parties:

Players lacking the NFT assets required to play can apply to the guild to borrow assets and earn in-game tokens through gameplay. The guild purchases NFTs to lend to approved applicants. Community managers recruit, screen, and train qualified players. Earnings are shared between the player, manager, and guild. YGG’s current split is 7:2:1—players receive 70%, managers 20%, and the guild 10%.

Figure 5-1 Scholarship System Workflow

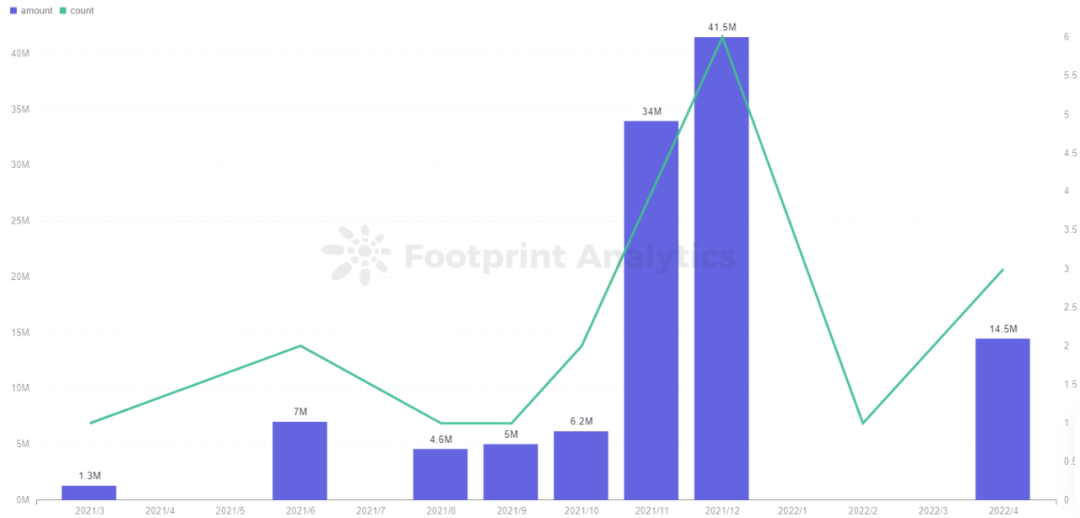

Because Axie Infinity generated substantial profits for earning players in early 2021, the guild-based revenue model was proven viable. As YGG’s community expanded, more guilds emerged to tap into the potential of blockchain gamers. As shown below, funding in the blockchain gaming guild sector rose sharply in 2021, exceeding $40 million in December alone—an exponential increase. However, fundraising slowed significantly in 2022.

Figure 5-2 Blockchain Gaming Guild Funding (2021–2022)

5.1.2 Characteristics of Blockchain Gaming Guilds

Beyond lowering entry barriers, gaming guilds play a crucial role in onboarding new users. Under the scholarship model, community managers teach players how to create wallets, use them, and trade on DEXs—providing foundational crypto knowledge. This helps traditional gamers onboard quickly, expanding the blockchain gaming user base.

Over the past year, blockchain gaming guilds have begun to exhibit several trends:

1. Limitations of the Scholarship Model: While scholarships attract income-focused players who boost early engagement and community growth, they become harmful in later stages. Given the general immaturity of GameFi token models—often trapped in death spirals—large numbers of earning players can severely damage game economies, accelerating collapse.

This means the scholarship model is unsustainable within any single GameFi project. Guilds must continuously hunt for profitable games to generate revenue. During bear markets, such opportunities dwindle, potentially causing prolonged income droughts.

Moreover, standard scholarship programs only work for P2E games—all of which are currently in decline. Whether P2E will persist long-term or fade away remains uncertain.

As the GameFi space matures, more games now offer built-in rental systems (e.g., Starsharks, Pegaxy). These systems compete directly with scholarship models. If players increasingly opt for rentals instead of guild-based revenue sharing, guild revenues could drop sharply.

2. Strong Regional Focus: Most major guilds are concentrated in Southeast Asia. For example, YGG—the largest guild—has its core community in the Philippines. GuildFi, focused on Gaas (Guild-as-a-Service), is centered in Thailand. Ancient8 is Vietnam’s largest blockchain gaming guild.

3. Evolution Toward Fund-Like and Functional Models: After the success of the scholarship model, guilds began searching for the next “Axie Infinity.” Today, most guilds participate in early NFT presales of GameFi projects, securing allocations to prepare for future launches.

Beyond NFTs, guilds now act as early investors in GameFi projects, evolving from NFT lenders and player communities into venture funds within the GameFi space.

Beyond fund-like evolution, some guilds are exploring functional paths—offering data services, community support, user acquisition, and systematic management tools for scholarship and revenue systems.

4. Heavy Dependence on GameFi Sector Growth: Whether revenue comes from scholarship fees or investment returns, both rely entirely on the health of the GameFi sector. The sector is still nascent, offering significant growth potential. For guilds, the key challenge is growing alongside it and ensuring their investment portfolios remain profitable.

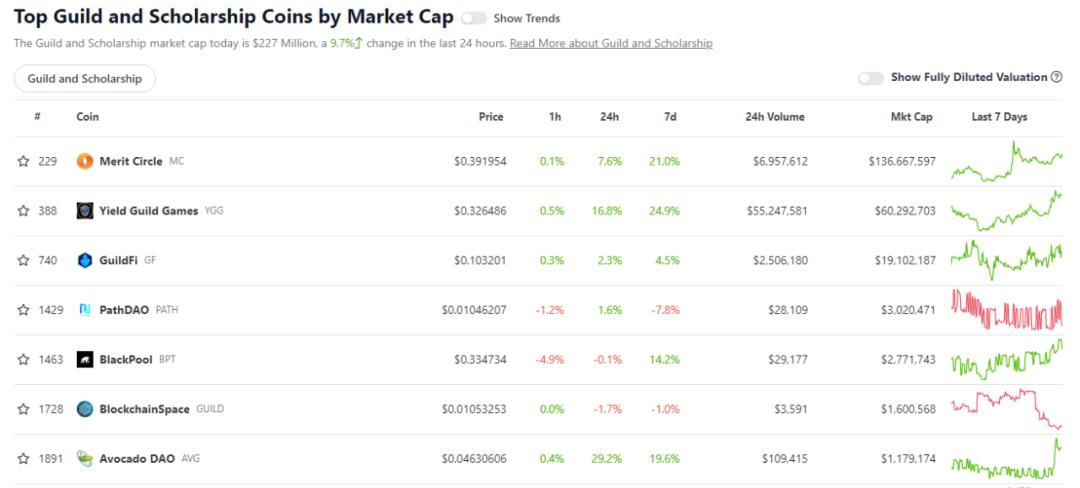

5.2 Competitor Projects

As shown below, the top 1000 market cap projects in the blockchain gaming guild sector include Merit Circle, Yield Guild Games, and GuildFi. While Merit Circle’s mechanics are similar to YGG’s but less mature, the following analysis will focus on comparing Yield Guild Games and GuildFi.

Figure 5-3 Blockchain Gaming Guild Market Cap Rankings

5.3 Competitive Comparison

5.3.1 Competitor Project Mechanisms

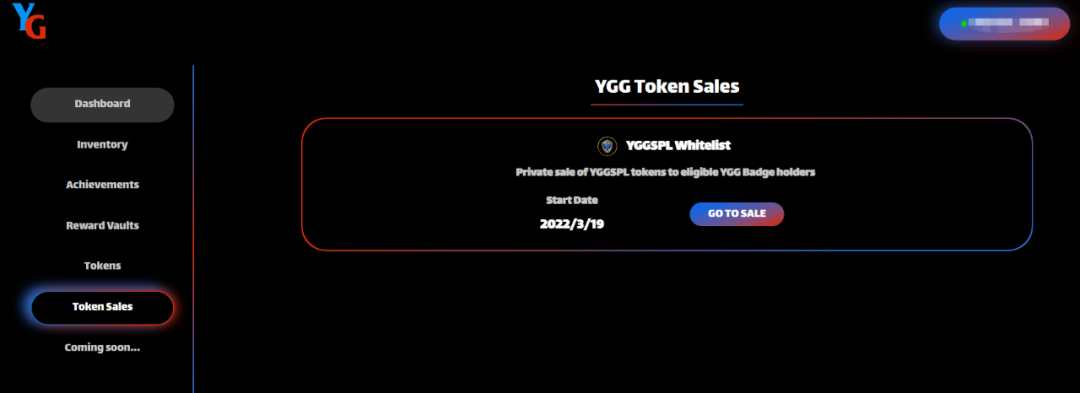

Yield Guild Games: Founded by three individuals with deep experience in mobile and blockchain gaming, YGG is currently the largest blockchain gaming guild in the crypto space. It features a mature scholarship system and SubDAO framework. To join YGG, players must first mint a YGG Guild Badge on the official website. This badge acts as a gateway to the YGG platform, required for registering scholarships, tracking achievements, and participating in SubDAO token sales.

Figure 5-4 YGG Official Website

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News