MakerDAO's future belongs to Cosmos, not Solana?

TechFlow Selected TechFlow Selected

MakerDAO's future belongs to Cosmos, not Solana?

If more developers realize the synergies between these networks, we may see a wave of innovative Cosmos-based applications emerge, using Ethereum as a window to interact with users.

Author: KODI

Translation: TechFlow

When even Vitalik starts selling, you know the bear market is truly bad.

Last week, Ethereum's (ETH) co-founder sold around $580,000 worth of his holdings.

But here’s the twist: he didn’t sell ETH. Instead, he sold MakerDAO’s governance token, MKR.

Why?

Because Rune Christensen, Maker’s co-founder, recently stirred up the crypto community.

We’ve known that Maker’s team has been considering launching its own chain as the final step in their Endgame plan.

However, no one—myself included—expected that instead of choosing an L2 on Ethereum, Maker would opt to fork Solana as its foundational infrastructure.

This latest bold move isn’t unusual for Rune. No one really knows his intentions or next steps. But it’s provocative—and it’s grabbing attention.

Don’t get me wrong—I like Solana and welcome more projects launching new chains there.

But this decision is somewhat surprising, especially given the range of ecosystems that might have been better fits.

In fact, Rune even mentioned that Cosmos (ATOM) was among the networks he considered.

He ultimately chose Solana because “the core of Cosmos isn’t built around efficiency… maintenance and performance upkeep are more costly.”

Solana’s design philosophy assumes exponential growth in hardware capacity, believing blockchains should scale alongside hardware. As hardware improves, so does Solana. Thus, Solana consistently outperforms Cosmos in efficiency and speed.

Yet, Cosmos holds distinct advantages in building AppChains—advantages unmatched by other ecosystems.

The Strengths of Cosmos

Cosmos aims to build an interconnected network of blockchains. This ecosystem consists of CometBFT (formerly Tendermint), the Inter-Blockchain Communication protocol (IBC), and the Cosmos SDK.

CometBFT is the consensus algorithm through which nodes achieve network agreement. While perhaps not cutting-edge today, it remains the most widely used consensus mechanism in crypto—even adopted by non-Cosmos chains like Binance Smart Chain. It’s battle-tested and reliable.

And it still delivers strong performance. Sei, a Cosmos chain focused on trading, recently launched with 20,000 transactions per second and 50-millisecond finality. By comparison, Solana—one of the fastest chains—has a maximum throughput of 10,000 TPS and finality at 2.5 seconds.

But the Cosmos SDK and IBC may be its most important features.

IBC can be considered revolutionary technology.

If you've ever bridged from Ethereum to an L2 like Arbitrum or Optimism, you know you must transfer assets from the mainnet to the L2 to trade.

But bridges rely on centralized validators who must "honor" asset transfers. If attacked, these validators put funds at risk—as seen in exploits like Wormhole and Nomad.

Building secure bridges is extremely difficult. No wonder four of the top five largest hacks on rekt’s leaderboard involve cross-chain bridges.

IBC eliminates all these issues. IBC messages are trustless—no intermediaries need to be trusted for them to work. The IBC protocol itself handles verification of cross-chain messages.

This allows seamless communication channels between different blockchains.

Meanwhile, the Cosmos SDK enables rapid, easy customization of blockchains tailored to specific application needs. It offers various modules, each handling a specific domain—such as governance or IBC connectivity.

This means developers don’t have to reinvent the wheel when launching a new chain. They can focus on core application logic while the SDK handles the heavy lifting in the background.

So why would Maker build a new chain on Cosmos (or Solana) when Ethereum remains the most popular DeFi chain?

Ironically, that’s exactly part of the problem.

The Burden of Dominance

The data makes it clear: Ethereum still dominates the crypto landscape. Its DeFi ecosystem leads in TVL, stablecoins, and overall activity across blockchains.

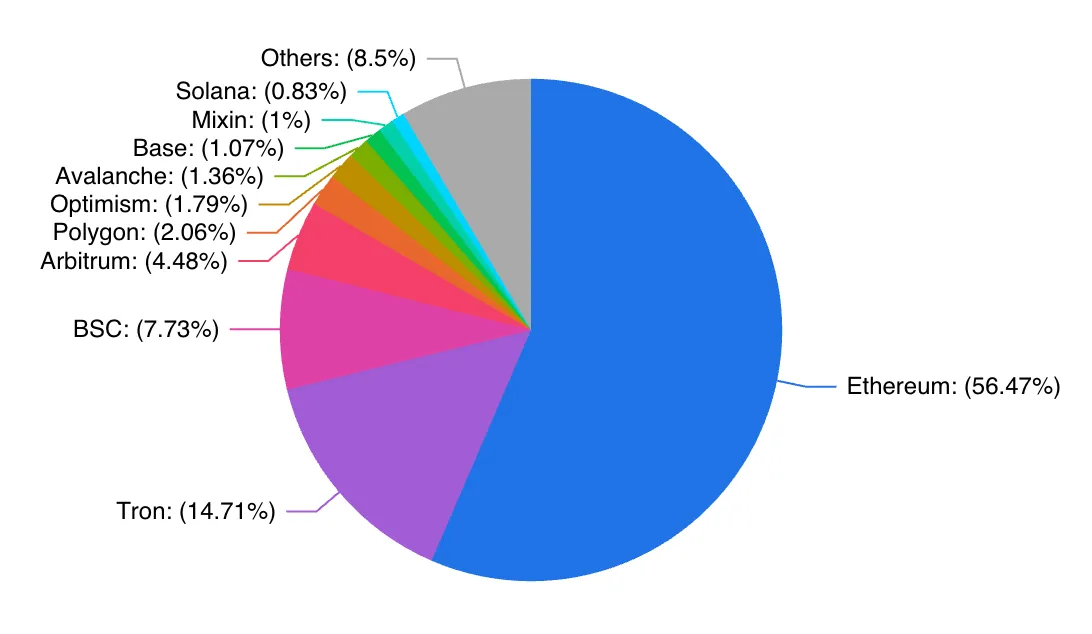

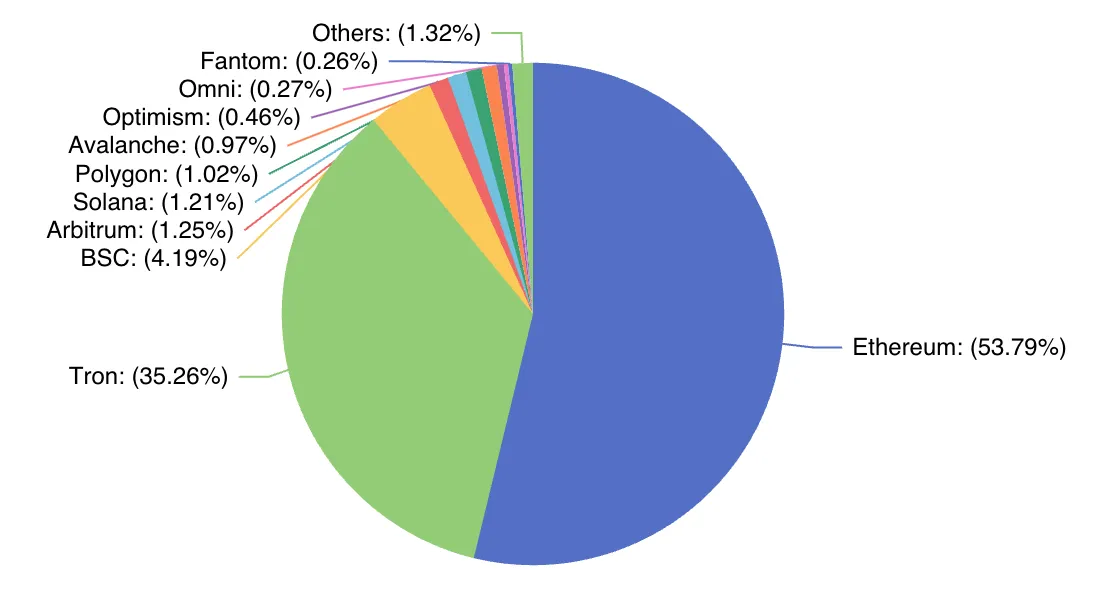

Total value locked on Ethereum exceeds $21 billion; including all Ethereum L2s and rollups, this number surpasses $24 billion—far ahead of any other chain, including Binance Smart Chain ($5.5 billion), Polygon ($770 million), or Avalanche ($500 million).

Moreover, Ethereum dominates the stablecoin market, settling over $69 billion in stablecoins—more than half of the total $130 billion stablecoin market cap. The only comparable chain is Tron, with $44 billion in settled stablecoins, 92% of which is USDT.

This solidifies Ethereum’s role as the clearing layer for crypto assets.

But all this activity brings problems. Congestion, gas fees, and scalability constraints hinder user experience on Ethereum, especially as applications multiply.

To accommodate as many apps as possible on a single chain while maintaining functionality, we need to scale via rollups, bridges, state channels, etc.—which, as we’ve seen with Ethereum, is far from simple.

This is where Cosmos comes in.

Cosmos is built around the AppChain thesis: instead of cramming all applications into a single blockchain, why shouldn’t each app have its own chain?

Cosmos proposes that applications form numerous specialized chains, each designed to host a specific app, all connected via shared communication standards.

Letting Cosmos handle the complex backend tasks—logic processing, security, governance—enables truly exceptional product experiences on Ethereum.

A project can leverage Ethereum’s network effects and deeper capitalization while using Cosmos for backend logic, interoperability with other IBC chains, faster transactions, and lower costs.

This hybrid model could become increasingly common—a future where Cosmos chains act as “co-processors” for Ethereum, activating idle liquidity, reducing costs, and automating trades.

And already, one project has realized Rune’s vision—launching products on Ethereum while running its backend on a separate chain.

Best of Both Worlds

Sommelier Finance is a protocol built on a Cosmos blockchain aimed at enhancing the capabilities of Ethereum-based DeFi.

With Ethereum gas fees often pricier than a bottle of Dom Pérignon, Sommelier seeks to open opportunities for smaller investors.

The project currently offers two main services—liquidity mining and algorithmic trading strategies. For users, it’s simple: pick a strategy, deposit funds into a vault, and watch your crypto assets grow.

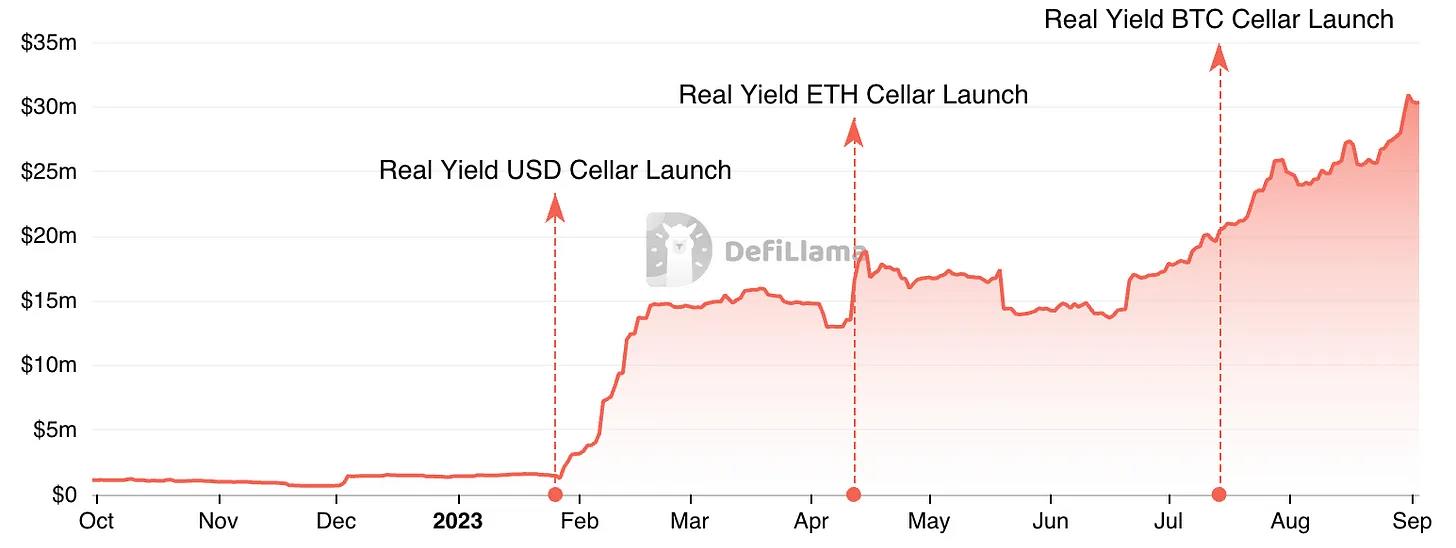

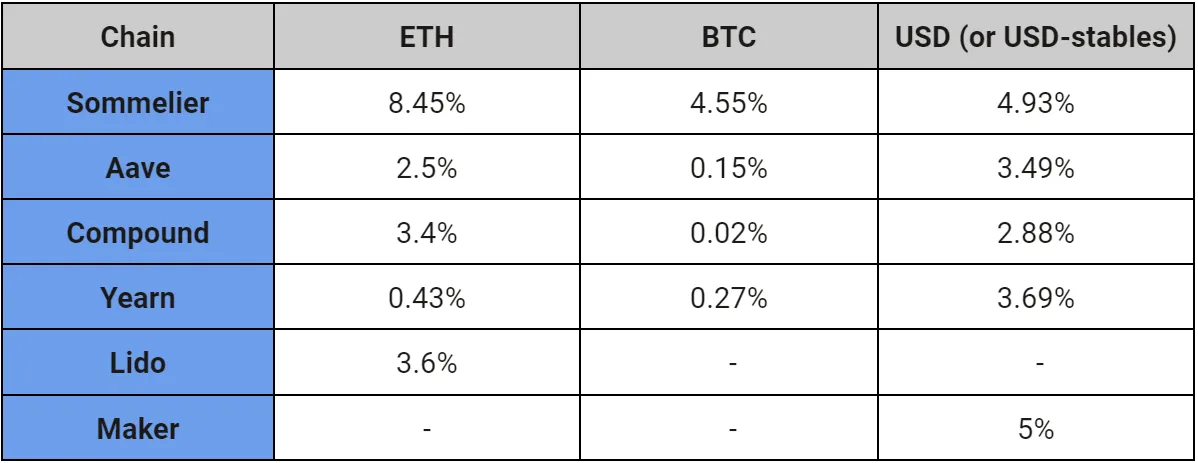

Algorithmic trading vaults saw some initial inflows, but TVL only exploded with the launch of the main yield vault. That’s no surprise. Here’s how Sommelier’s “real yield strategy” compares to blue-chip DeFi protocols:

Beyond Maker, Sommelier outperforms any blue-chip protocol in yield on ETH, BTC, and stablecoins. Even Maker’s 5% yield on DAI is just a temporary measure to attract TVL and will drop to 3.19% in the coming weeks.

To earn higher yields, the only alternative is riskier, more exotic strategies—like selling call options or providing liquidity, both of which carry potential losses.

Unsurprisingly, Sommelier’s yield vaults dominate its TVL, holding over $30 million compared to just $200,000 in algorithmic trading vaults.

So what’s Sommelier’s secret weapon?

One advantage is that its strategies run off-chain, allowing resource-intensive algorithms to operate while preserving privacy.

But I believe its key strength lies in leveraging the best of both Ethereum and Cosmos.

The Cosmos backend provides a sovereign foundation, handling governance, security, and cross-chain communication—reducing on-chain activity and lowering fees on Ethereum. Meanwhile, the user-facing frontend taps into Ethereum’s vibrant ecosystem.

If more developers recognize this synergy between networks, we may see a wave of innovative Cosmos-based applications emerge—using Ethereum as their user interface. Just as liquid staking brought much-needed liquidity to Cosmos, Ethereum-Cosmos hybrids could inject fresh energy into the entire ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News