August DeFi Market Review and Outlook: Which Protocols and Airdrops to Watch?

TechFlow Selected TechFlow Selected

August DeFi Market Review and Outlook: Which Protocols and Airdrops to Watch?

This article will delve into recent market performance, analyzing the highest-revenue protocols over the past month.

Author: THOR HARTVIGSEN

Compiled by: TechFlow

This article will delve into recent market performance and analyze the highest-earning protocols over the past month. The article is divided into the following sections:

-

Market;

-

News and Catalysts;

-

DeFi Airdrops and Strategies.

Market

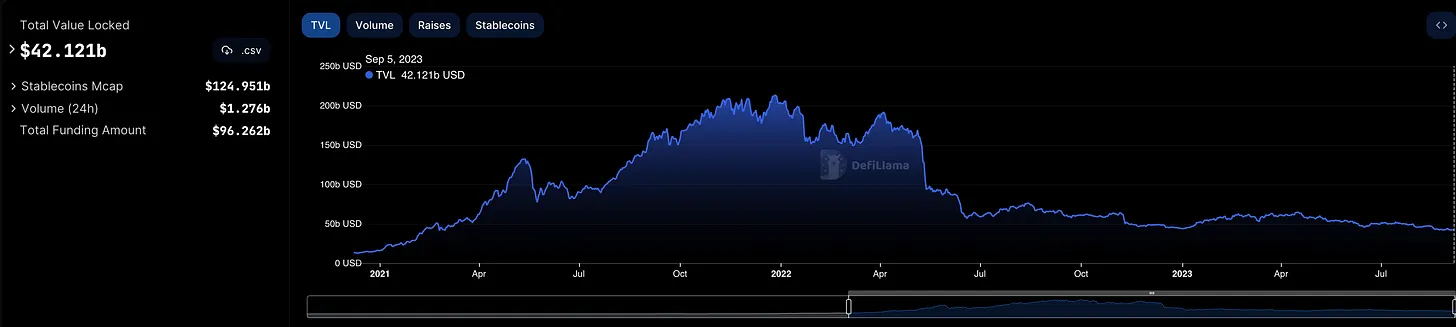

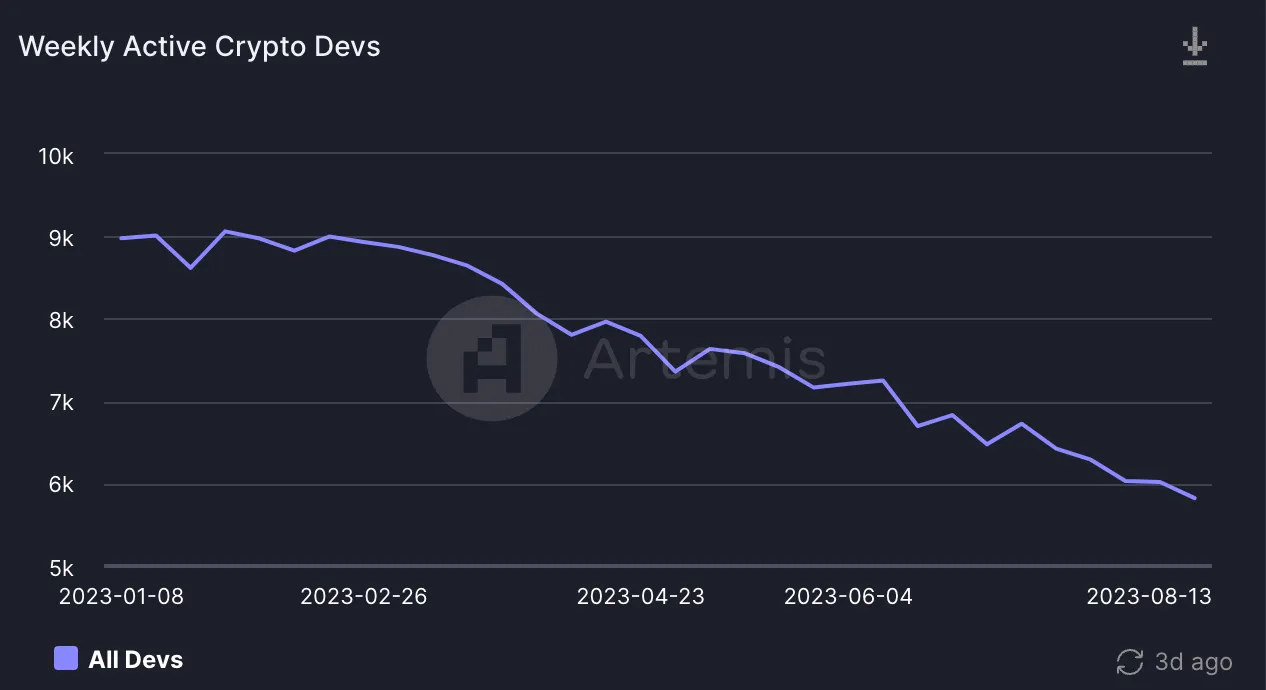

These three charts outline the current performance of blockchain and DeFi adoption metrics.

The charts paint a fairly clear picture. Capital is flowing out of DeFi. As demand for on-chain products declines, fewer developers are needed, leading to a downturn. While prices and these metrics continue to fall, this is more due to adverse macroeconomic conditions than any unique risks within crypto. If you're still here—after two years in a bear market—and believe the future can be better, let’s identify who the current winners are.

Revenue Winners

Below is a table ranking top protocols by 30-day revenue, along with their respective valuations.

As you can see, Ethereum remains the leading application by revenue, generating $166.5 million over 30 days. Other protocols earning six-figure monthly revenues include Maker and Rollbit.

Maker earns fees from all collateral backing the $DAI stablecoin. Currently, over 50% of its revenue comes from real-world asset (RWA) collateral supporting DAI, such as U.S. Treasury yields. This business model is straightforward: to increase revenue, Maker must grow the supply of $DAI. Relative to its revenue, $MKR also has a relatively low valuation. Price-to-revenue (P/R) is calculated as FDV divided by annualized 30-day revenue.

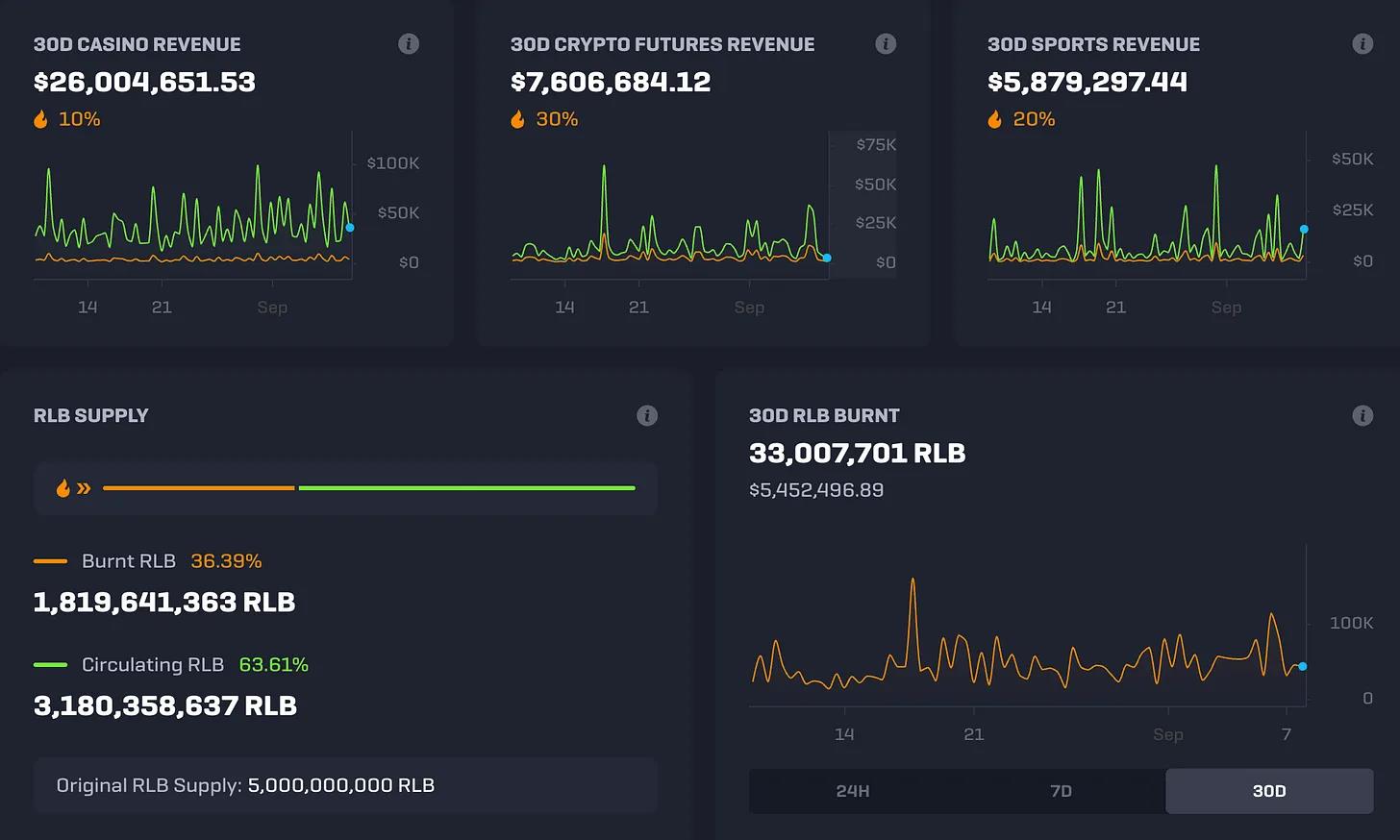

Rollbit is another protocol with impressive 30-day revenue, with a P/R multiple of 1.1 for $RLB. Rollbit generates revenue through its casino, sports betting platform, and cryptocurrency futures trading. Notably, its revenue cannot be verified on-chain and must be taken at face value from its revenue dashboard (shown below). A portion of revenue from these products is used to buy back and burn $RLB tokens, creating deflationary pressure on the token.

Other recent revenue leaders include Synthetix, dYdX, Lido, and Arbitrum, as shown in the table.

News and Catalysts

This section highlights three protocols undergoing major upcoming upgrades.

Frax Finance

The Frax Finance ecosystem is set for a series of significant upgrades:

frxETH V2

Frax's liquid staking solution for ETH, frxETH, continues to offer the highest yields among LSDs due to its dual-token structure (frxETH and sfrxETH). V2 will introduce permissionless validator onboarding instead of relying on a team-curated subset. It will function as a lending market between ETH stakers (lenders) and ETH validators (borrowers), aiming to create a capital-efficient yet decentralized staking system.

FRAX V3

Frax recently passed a proposal to accept real-world assets (RWAs) as collateral for $FRAX. This upgrade, known as Frax V3, is expected to launch later this month. Yields generated from these RWAs will be distributed to $FRAX holders via "Frax Bonds" with varying annual maturities.

Frax Chain

A yet-unnamed custom hybrid rollup will launch later, hosting various Frax applications such as FraxSwap, FraxLend, frxETH, and FraxFerry—not limited only to native Frax apps. The chain will use frxETH as native gas, which could significantly boost staking yields for sfrxETH holders.

“Fraxchain is not an app chain—we aim to become the largest L2 on Ethereum. We want it to be the biggest L2. The way we’re actually trying to do that is by making it the most useful yield from federal rates, the best ETH staking rate, and the best inflation-protected rate. All these extremely useful ways to earn yield are the hallmark and core of Fraxchain.” — Sam Kazemian.

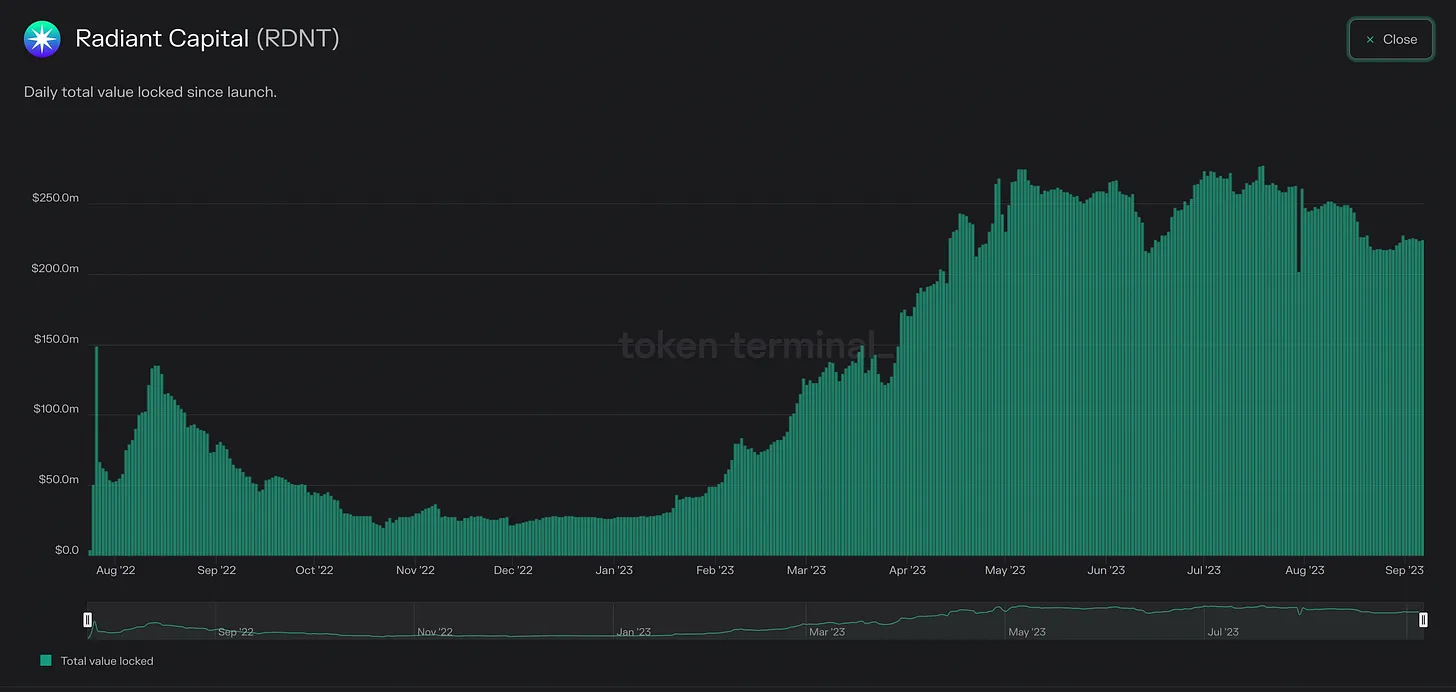

Radiant Capital

Radiant Capital is a cross-chain lending market operating on Arbitrum and BNB Chain. They launched V2 earlier this year, introducing new assets into their money markets and a redesigned RDNT emission structure for greater sustainability. This led to a surge in TVL and broader adoption, as shown in the chart below.

Radiant plans to expand to a third chain in early October with a launch on the Ethereum mainnet. This could attract significant additional capital, as Ethereum remains the liquidity hub of DeFi. It remains unclear which assets will be supported on Ethereum at launch.

Synthetix

Synthetix is preparing to fully launch Synthetix V3, designed to position Synthetix as the liquidity layer for all protocols across the EVM ecosystem. Frontends like perpetuals, options protocols, and DEXs will be able to easily tap into Synthetix’s deep liquidity across chains.

-

Potential multi-collateral staking;

-

Permissionless liquidity layer;

-

Developer-friendly ecosystem;

-

Seamless cross-chain functionality (collateral on one chain can be used to issue debt on another)—powered by Chainlink CCIP.

In a recent post, Kain Warwick discussed V3’s next steps for cross-chain expansion and whether other tokens should be enabled as collateral. On one hand, this could unlock deeper liquidity; on the other, it may reduce the utility of SNX. The post suggested launching first on Base, using ETH as the staking asset there:

“If we launch ETH collateral on a new network, I think Base is the best choice. This would allow us to increase volume without threatening trading revenue on Optimism. It’s also lower risk than Arbitrum. The counterpoint is: if we let people migrate SNX to Base and provide liquidity there, SNX would capture 100% of fees on both networks instead of sharing them. That’s true, but the risk to SNX LPs is small because we control governance. We can run this controlled experiment and then decide what’s best for SNX holders based on the data.”

DeFi Airdrops and Strategies

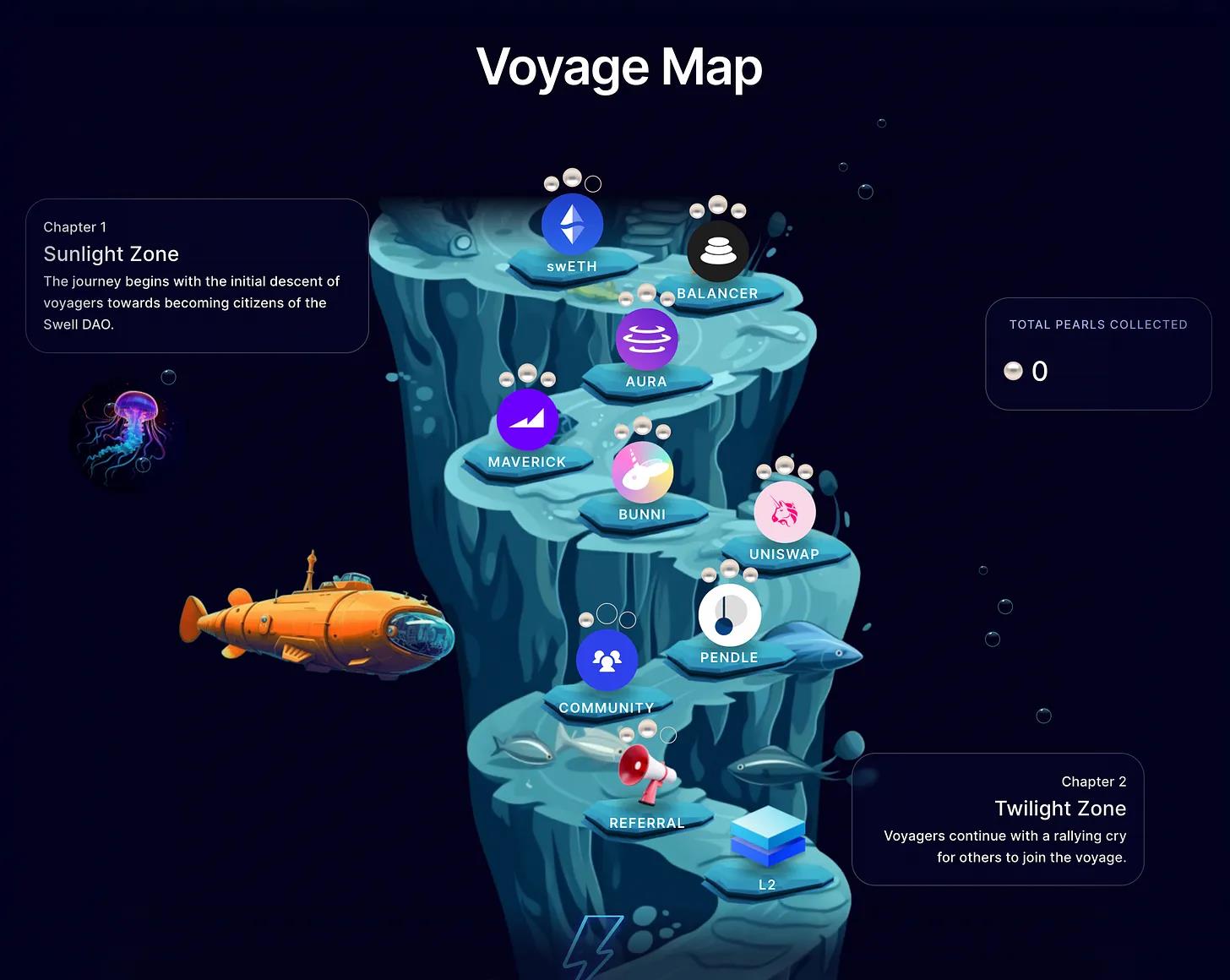

Swell Network and $SWELL Airdrop

Swell is an Ethereum liquid staking provider offering swETH, its native LSD. Holders of this token accumulate “pearls” over time (more ETH and longer holding periods = more pearls). These pearls will be converted into $SWELL tokens when they are launched later this year or next year.

Additionally, users can boost their pearl accumulation by depositing $swETH into various DeFi protocols such as Pendle Finance, Maverick, or Balancer.

Risk: Smart contract risk from Swell, plus additional smart contract risks if deposited into other DeFi protocols.

Stablecoin Yield Farming

There are several ways to earn yield on stablecoins across chains. Some of these include:

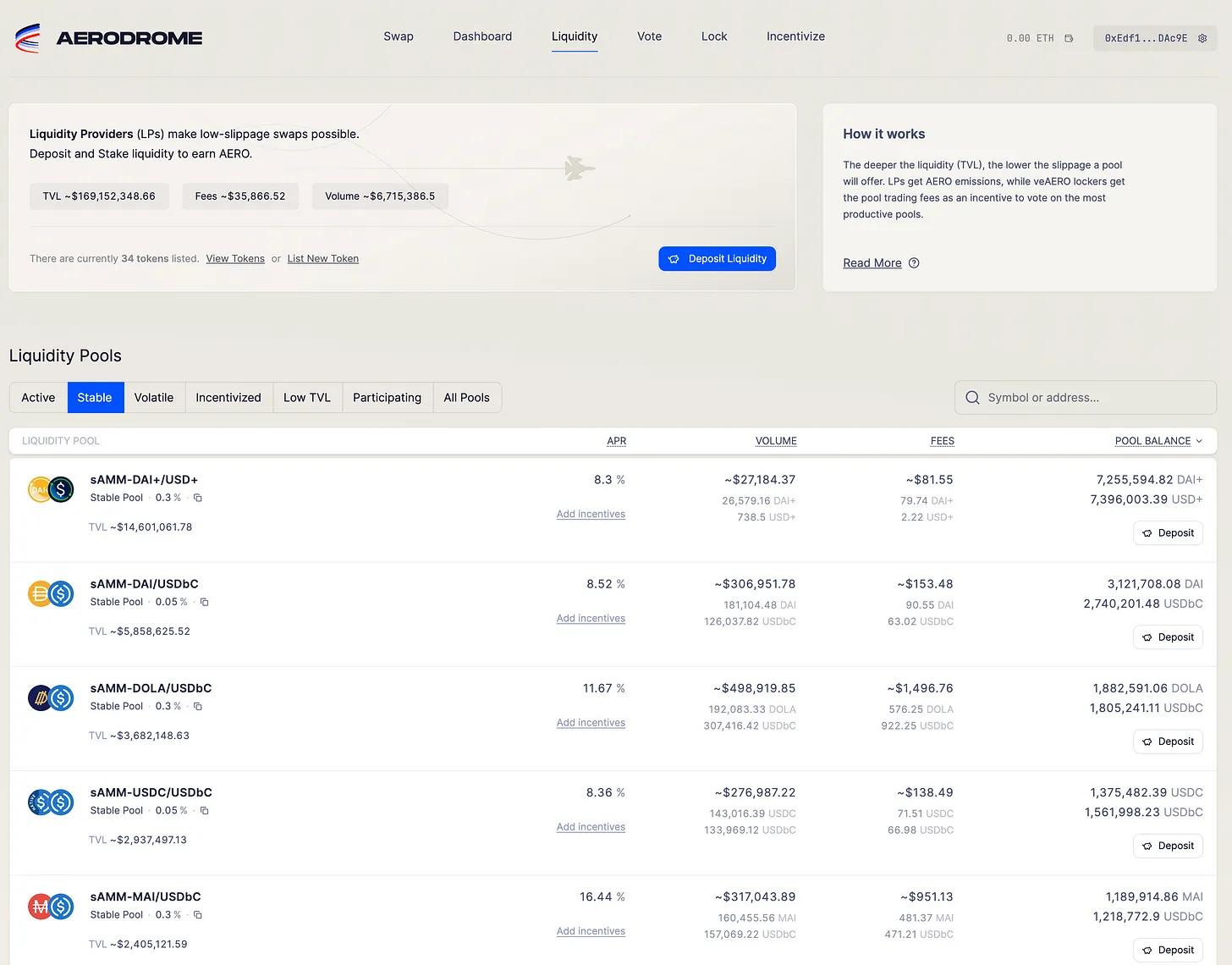

Aerodrome

Aerodrome is a recent Velodrome fork launched on the Base L2, attracting approximately $170 million in total value locked (TVL). Several stablecoin pools are incentivized with $AERO emissions, offering yields between 8–16% with no impermanent loss.

Risk: Smart contract risk. Note that yields are paid in $AERO and may therefore be volatile.

DAI Savings Rate (DSR)

As previously mentioned, Maker generates substantial revenue from collateral backing DAI. A large portion of this revenue funds a fixed 5% yield for single-sided $DAI deposits in Spark Protocol’s DSR vault. Returns come from sustainable revenue streams and are distributed in $DAI itself.

Risk: Smart contract risk from Spark Protocol.

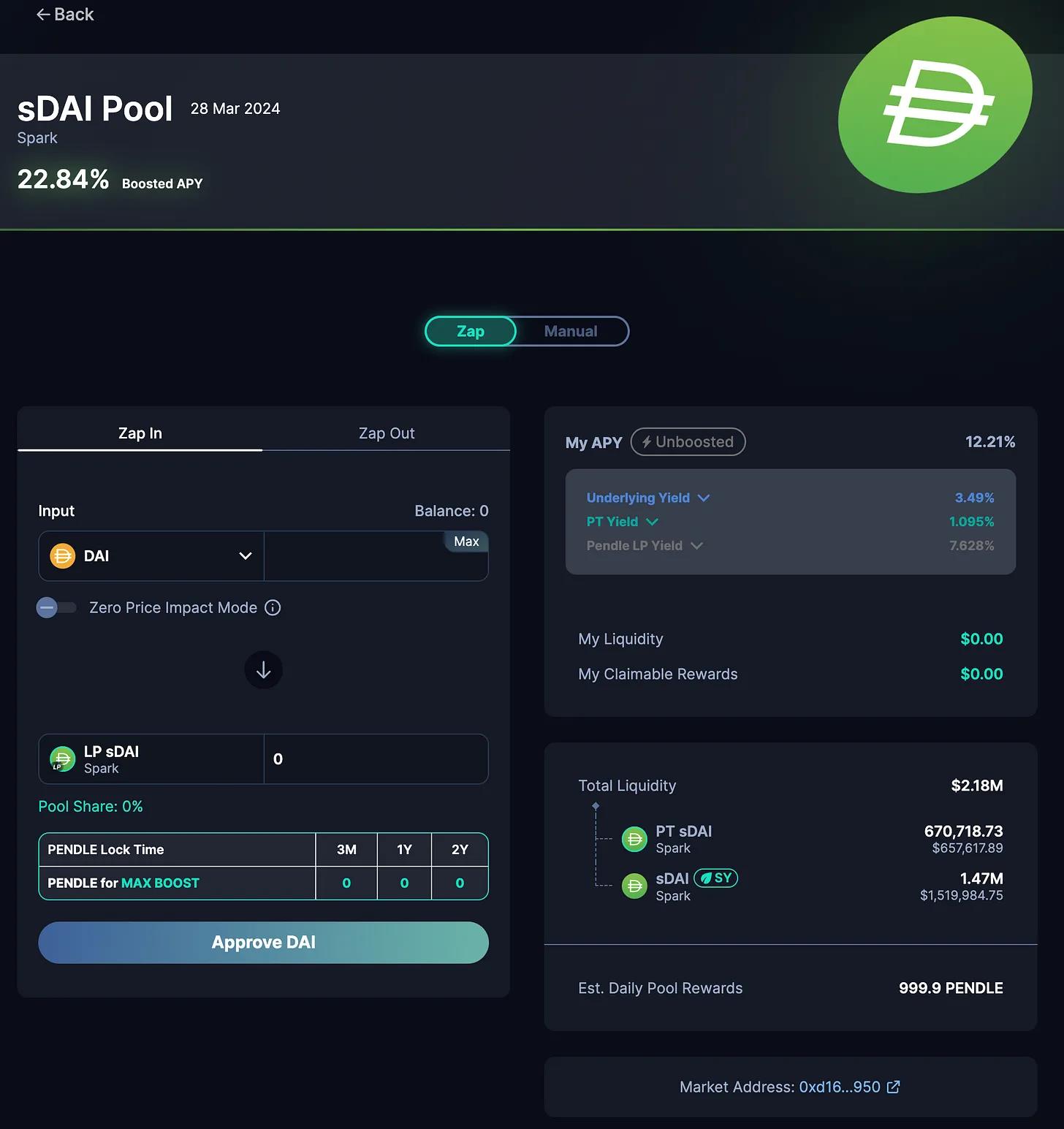

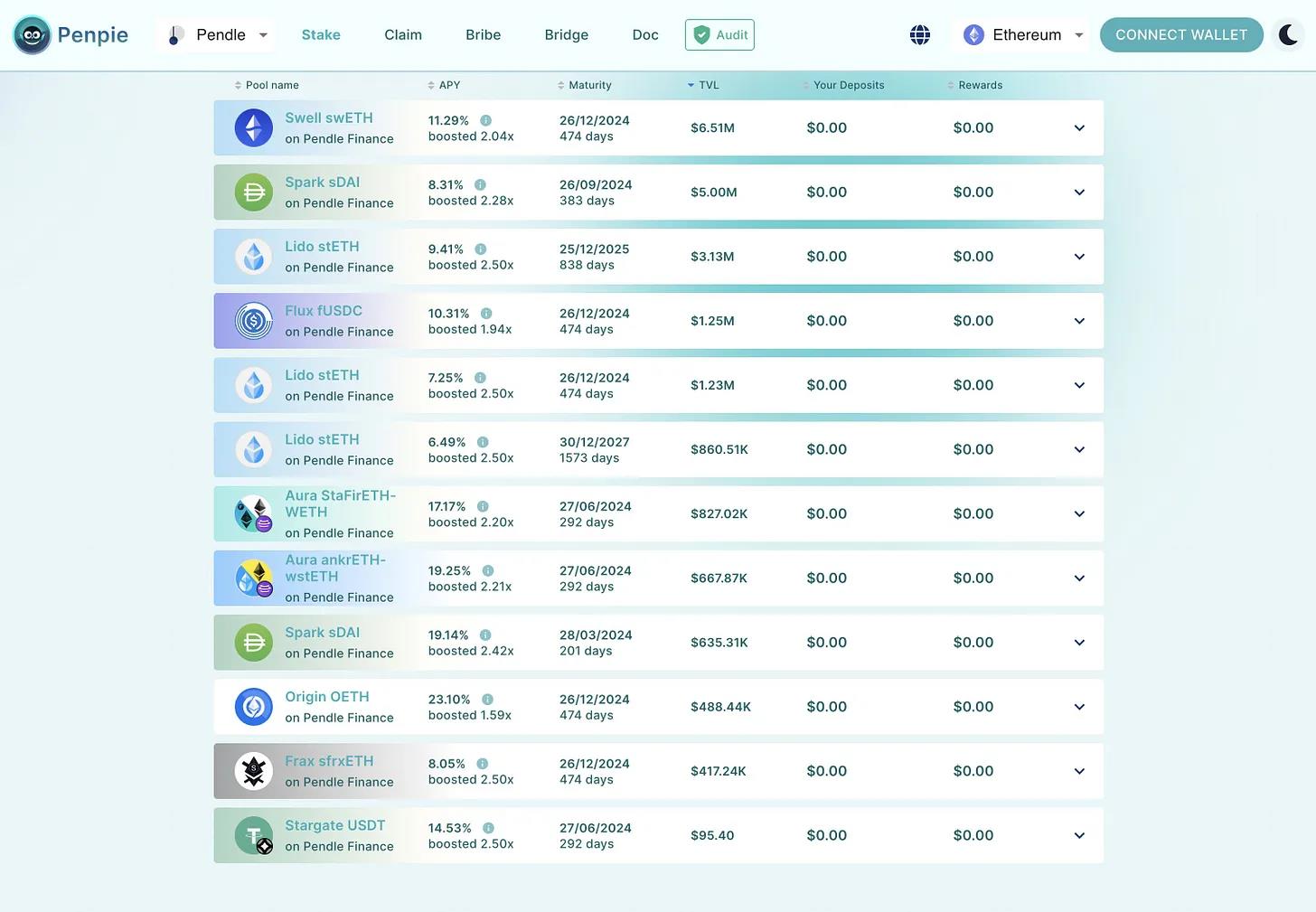

Pendle Finance

For higher yields, users can deposit sDAI (the liquid representation of $DAI in DSR) into liquidity pools on Pendle Finance. Current yields reach up to 12% APY unboosted, and up to 22.8% APY when $PENDLE is locked as vePENDLE. Returns are derived from the underlying 5% yield + trading fees + PENDLE emissions.

Risk: Smart contract risks from both Spark Protocol and Pendle Finance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News