Instadapp: The Ultimate Aggregator in DeFi

TechFlow Selected TechFlow Selected

Instadapp: The Ultimate Aggregator in DeFi

It's only a matter of time before Instadapp achieves the same network scalability as its Web2 counterparts.

Author: VIKTOR DEFI

Compiled by: TechFlow

The internet we use today differs from the internet of the 90s. Back then, discovering online content was difficult until Google solved the discovery problem with its aggregator.

Today, we are witnessing the rise of billion-dollar aggregator platforms that solve critical discovery problems across the internet—Amazon for finding products, Facebook for connecting people, and Google for discovering content, among others.

To advance the blockchain industry, key aggregation platforms are needed to solve users' discovery challenges. This is where Instadapp comes in. Instadapp aims to become the ultimate aggregation layer in DeFi by consolidating various DeFi protocols.

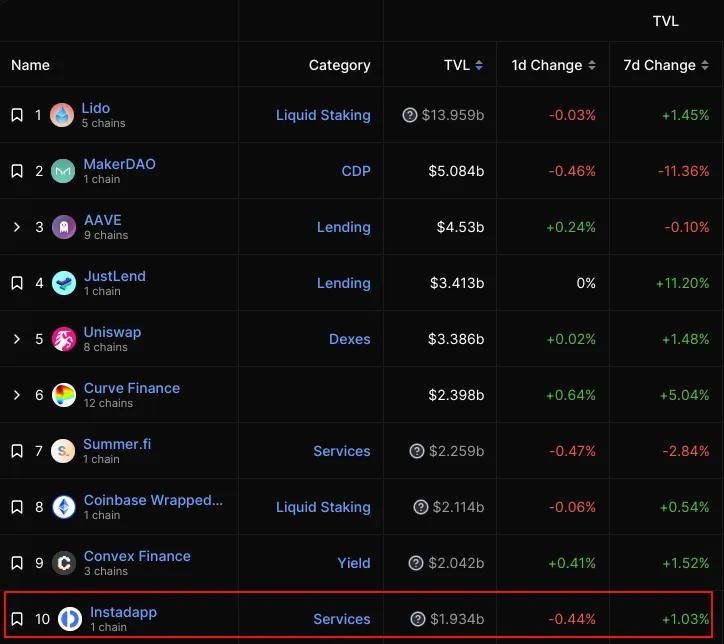

Instadapp is one of the leading protocols in DeFi, consistently outpacing competitors by launching timely products that meet industry demands. Want to learn more? Let’s dive in.

What is Instadapp?

Instadapp is a middleware protocol that simplifies and unifies DeFi frontends. Like the Web2 aggregators mentioned earlier, Instadapp brings together top DeFi platforms into a single interface, enabling seamless access and a unified user experience. The platform currently integrates eight protocols: MakerDAO, Liquity, Morpho, Aave, Compound, Lido, Uniswap, and Hop Protocol.

Users no longer need to switch between different protocols—everything can be done with just a few clicks. Best of all, Instadapp is available on Ethereum, Polygon, Arbitrum, Avalanche, Optimism, Fantom, and Base, helping users maximize efficiency and minimize costs across chains.

The Technology Behind Instadapp

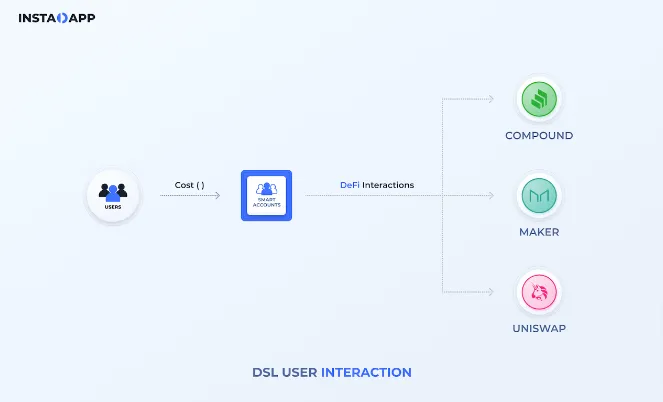

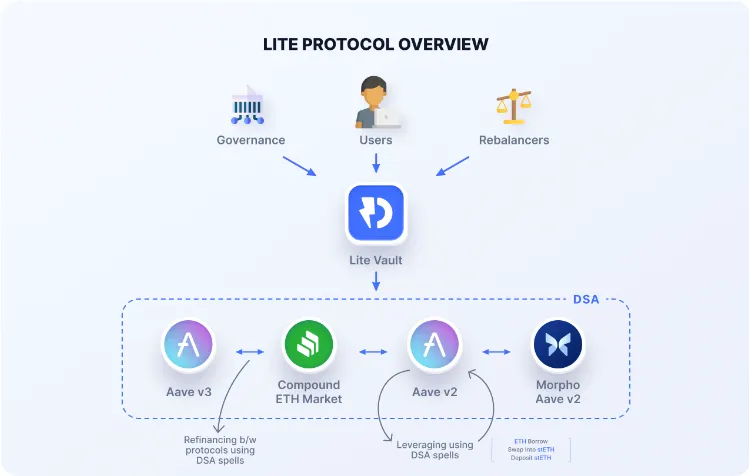

Instadapp leverages a technology called DeFi Smart Accounts (DSA), offering users greater flexibility and accessibility. DSAs are smart contracts controlled by users, allowing them to execute multiple operations within a single blockchain transaction. Think of a DSA as a sub-account on Instadapp, enabling users to manage positions and interact with DeFi protocols in a trustless and streamlined manner.

These DSAs are created using standard Ethereum accounts. Simply connect your Ethereum wallet to Instadapp Pro to instantly generate your DSA account—immediately unlocking access to the multiverse of DeFi. Interestingly, users can create an unlimited number of such accounts in a trustless manner. Moreover, funds can be withdrawn back to their Ethereum wallet at any time without restrictions.

Another powerful aspect of DSAs is their extensibility through connectors. Connectors allow developers to build additional functionalities, operations, and use cases on top of DSAs. These connectors can range from protocol integrations to authentication modules.

Thanks to Instadapp’s unified experience, users can perform the following:

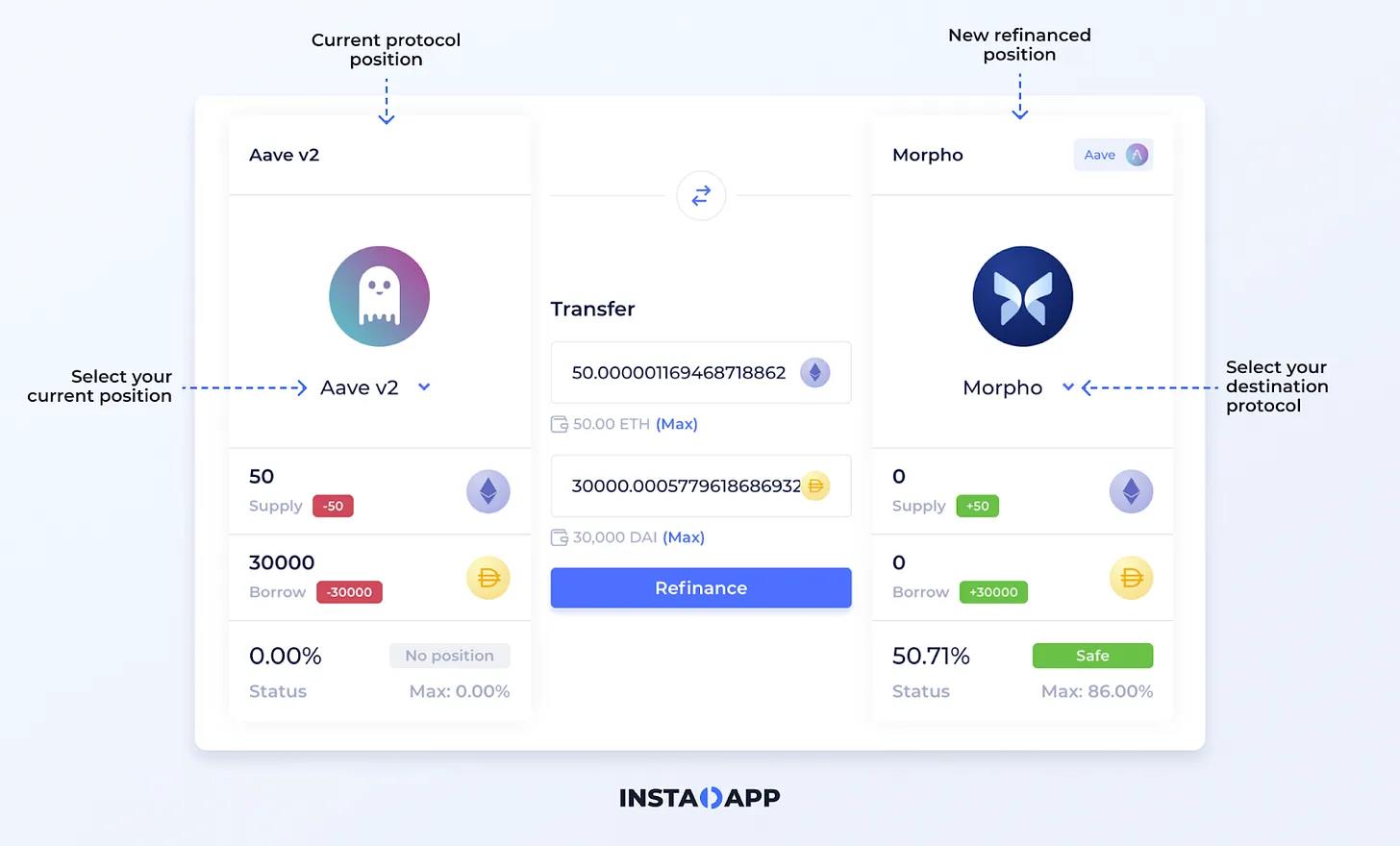

Multi-Protocol Refinancing

Lending is one of the primary use cases in decentralized finance. Users open and fund debt positions across multiple lending protocols that fit their strategies. Instadapp’s multi-protocol refinancing feature enables users to migrate positions and refinance across top lending protocols with just a few clicks.

Cross-Chain Bridging

Blockchain bridges exist to transfer crypto assets from one network to another. With Instadapp, users can easily withdraw funds from their DSA account to another network, saving both gas fees and time.

Sweep Swap

We all have those tokens sitting unused or that we’re tired of holding. You can use Instadapp’s Sweep Swap feature to exchange these tokens into a single preferred token.

Protection Automation

Automation is disrupting every industry, and DeFi is no exception. The Protection Automation feature allows users to automatically repay debts during market volatility. Each automation event incurs only a small fee of 0.3% to 0.4%.

Flash Loan Aggregator

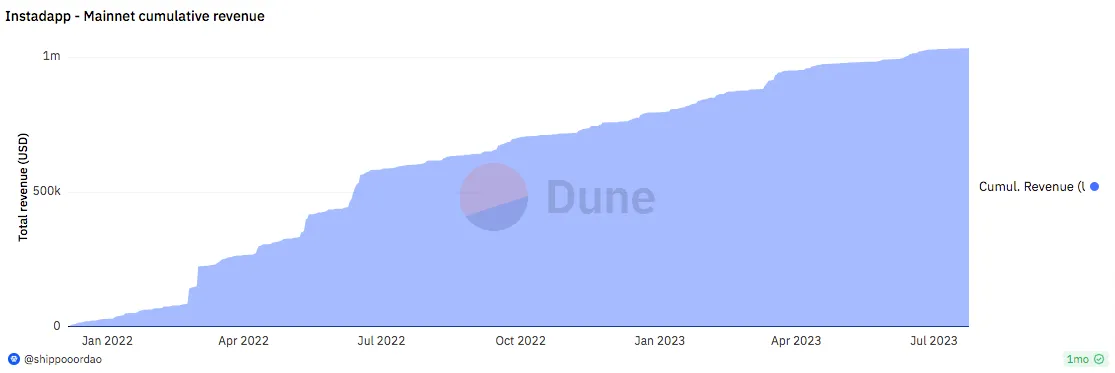

Instadapp’s Flash Loan Aggregator uses advanced routing mechanisms to find the best flash loan rates across major providers like Aave, MakerDAO, Balancer, and Compound. Launched with seven routes, it offers users broader liquidity and token options at lower costs.

But that’s not all—Instadapp also manages a flash loan pool used as a funding source for the aggregator. This makes the aggregator a competitive and cost-efficient flash loan platform. Since launch, Instadapp’s Flash Loan Aggregator has shown consistent revenue growth.

Instadapp Lite

Instadapp Lite is the DeFi yield powerhouse of the Instadapp platform. It scans multiple lending platforms to identify optimal strategies and annual percentage yields (APYs), giving users one-click access to the best returns. Accessibility and simplicity are at the core of Instadapp Lite.

Earlier this year, the team launched Lite v2 with ETH-only vaults. Given the rise of liquid staking, this vault is both strategic and timely. It supports ETH markets on Aave v2, Compound, Morpho, and Aave v3, and has already accumulated over $311 million in total value locked (TVL).

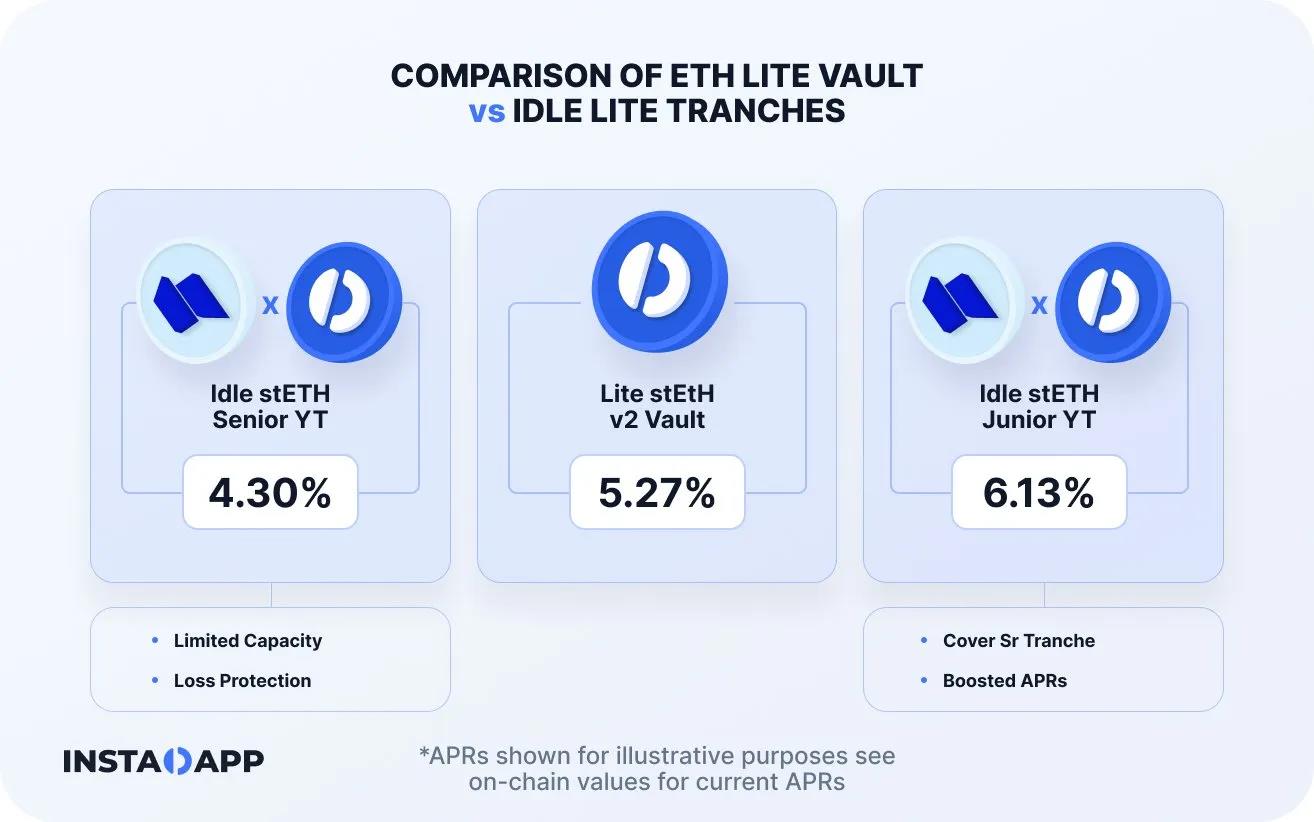

ETH Lite Vaults on Idle Finance

The yield automation protocol Idle Finance recently announced integration with Lite Vaults. First, Idle Finance employs a tiered system, offering Lite Vault users more personalized risk strategies and choices. Second, it provides two options—new and existing users can choose based on their risk tolerance to earn real yields.

The senior tranche sits slightly below the standard Lite Vault and includes a custom loss-protection mechanism, while the junior tranche earns higher APYs by absorbing risk from the senior tranche. Individuals and institutions seeking extra protection for their assets may prefer the senior tranche, while higher-risk-tolerant users may opt for the junior tranche.

Avocado

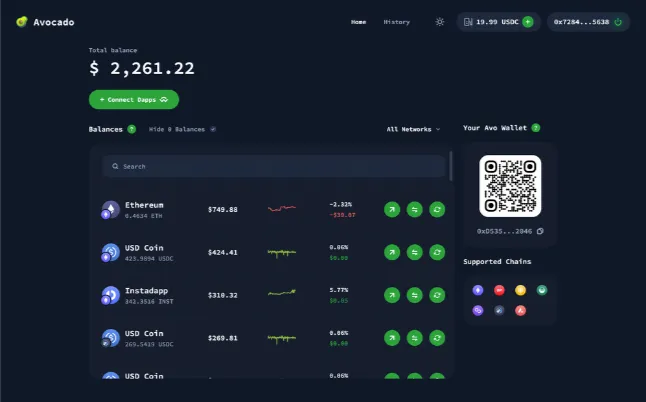

Avocado is Instadapp’s latest innovation, pioneering advancements in account abstraction. If you’ve been a DeFi user for a while, you're likely familiar with connecting your wallet to dApps, switching networks, paying gas fees in native tokens, and adding new chains via Chainlist to interact across networks.

Avocado changes all that. It’s an innovative smart contract wallet that enables multi-network transactions via the Avocado Network. There’s no need to switch between networks, and gas fees are saved in the process.

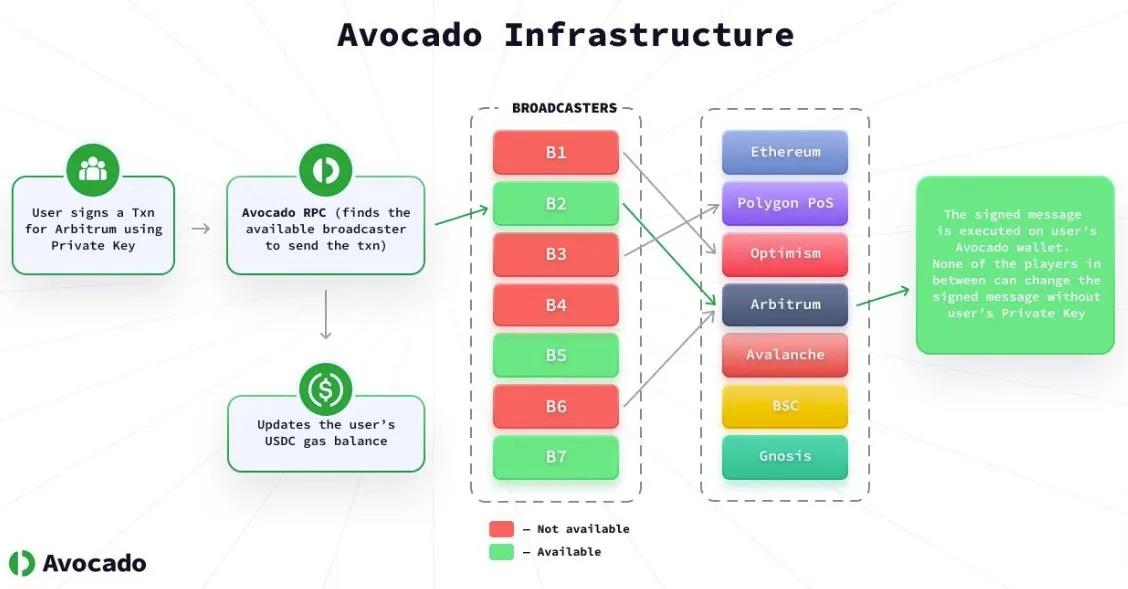

Avocado has its own RPC (Remote Procedure Call). However, it is not a blockchain. The Avocado RPC acts as a network aggregator, searching for available broadcasters to process transactions on specific chains, as illustrated. Avocado’s greatest strength lies in its triple abstraction model: network abstraction, gas abstraction, and account abstraction.

Network abstraction ensures all network balances are accessible from a single dashboard. Gas abstraction allows transactions to be paid in USDC instead of native chain tokens. Account abstraction offers enhanced modularity and unlocks new use cases on the platform. With these features, Instadapp is well-positioned to become the leading abstraction and aggregation layer in DeFi.

Once you connect to Avocado’s RPC network, the platform generates a native Avo wallet address for you. With this address, you can perform all operations while enjoying the same level of security as your externally owned account (EOA), such as MetaMask. The team has also hinted at upcoming Avocado features, including 2FA security, balance unification, role-based access, DeFi strategies, and developer incentive programs.

Tokenomics

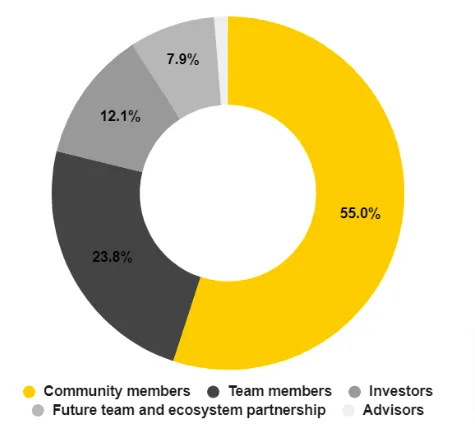

$INST is Instadapp’s governance and utility token. It has a maximum supply of 100 million INST, with a current market cap of approximately $30 million. Of this, 55% is allocated to the community, 23.8% to the team, 12.1% to investors, and 7.9% to future team members and advisors.

The current price of $INST is $1.20, which I believe is undervalued. Instadapp has a TVL of $1.9 billion, and the token reached an all-time high of $24.40 during the last bull market. Considering Instadapp’s recent and upcoming product launches, it’s easy to anticipate even greater gains in the next bull run.

Conclusion

As I mentioned earlier, we are seeing the emergence of innovative blockchain aggregators. Like Google and Amazon, these platforms aim to serve as intermediaries between DeFi protocols and users, attracting users and driving ecosystem growth.

My research shows that Instadapp is relentlessly establishing itself as the ultimate aggregation layer in DeFi across multiple verticals. At this pace, it's only a matter of time before Instadapp achieves the same network effects seen in its Web2 counterparts.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News