How can Chainlink unlock the full potential of capital markets tokenization?

TechFlow Selected TechFlow Selected

How can Chainlink unlock the full potential of capital markets tokenization?

How can financial institutions leverage Chainlink to unlock the full potential of tokenization?

Written by: Ryan Lovell

Compiled by: TechFlow

Chainlink is the core infrastructure that capital markets need to move tokenization from proof-of-concept to production. Chainlink’s role in supporting capital markets is essential for three key tokenization use cases:

-

Enabling secondary markets for tokenized assets by allowing settlement on any blockchain (public or private).

-

Facilitating delivery versus payment (DvP) workflows by executing single-chain or cross-chain atomic transactions and ensuring irreversible exchange of assets across blockchains, thereby eliminating transaction failures.

-

Achieving synchronization between on-chain and off-chain systems by enabling communication between traditional infrastructure and blockchains.

Next, we will explore the current state of tokenization in capital markets, introduce Chainlink, and examine real-world examples of how financial institutions are leveraging Chainlink to unlock the full potential of tokenization.

Current State of Tokenization

Since 2017, efforts around tokenization in capital markets have largely remained at the proof-of-concept stage. While some institutions have announced tokenization of traditional assets such as bonds, these experiments have primarily focused on the initial issuance of assets. For example, an investment bank acting as an issuer might tokenize a bond note, acquire it, and quickly mature it. Other successful use cases, particularly related to banks and financial transactions (such as Broadridge’s DLR and HQLAx), are application-specific and managed entirely by a single central entity.

Both examples highlight a common issue: friction caused by the lack of seamless connectivity between different ecosystems and applications. Notably, asset managers and asset owners have been relatively absent in active participation, despite being crucial for creating sufficient liquidity. Their involvement requires robust enterprise-grade infrastructure to establish necessary connections and foster secondary market formation. This interoperability infrastructure should integrate seamlessly into existing internal systems without causing major disruptions. Ultimately, each additional connection enhances the overall utility of blockchain-based financial products.

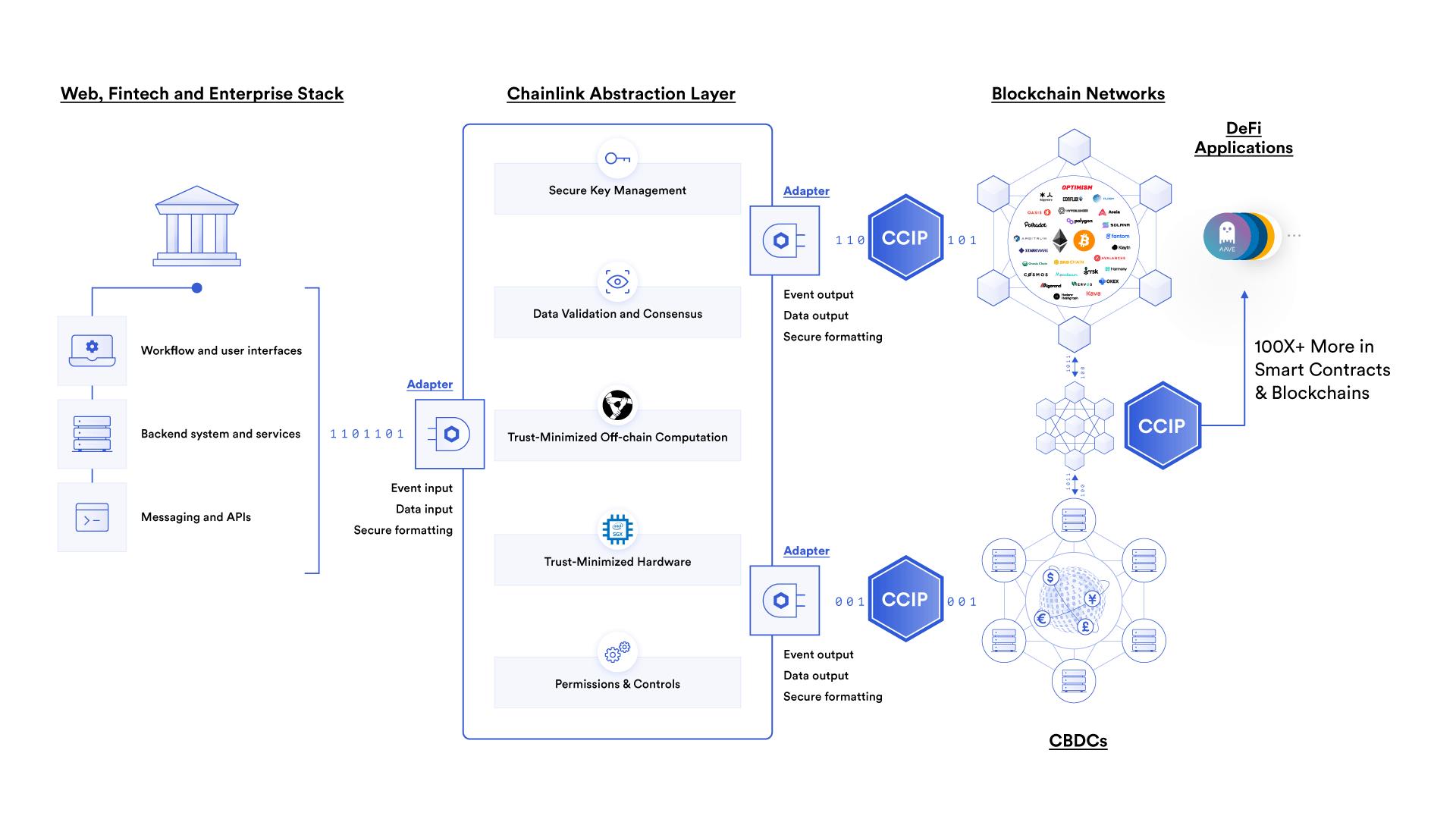

Chainlink: Bridging Existing Infrastructure with Blockchain Networks

Chainlink is enterprise-grade infrastructure that enables financial institutions to build the necessary connections between blockchains (on-chain) and existing infrastructure (off-chain). If your existing technology stack needs to perform “blockchain operations,” simply integrate it with Chainlink to connect with public and private blockchains.

Chainlink offers a suite of services that facilitate data and token transfer across blockchains, enable two-way communication between blockchains and external systems, and provide computational services for privacy, automation, and more. Three Chainlink services particularly relevant to tokenization in capital markets include:

-

Cross-Chain Interoperability Protocol (CCIP) – A blockchain interoperability protocol that acts as an abstraction layer and cross-chain messaging protocol, enabling existing infrastructure to communicate with any public or private blockchain and instruct smart contracts to send arbitrary data and transfer tokens across blockchains.

-

Proof of Reserve – A decentralized network that verifies or proves the off-chain or cross-chain reserves backing tokenized assets, providing transparent on-chain audit trails for consumers, asset issuers, and smart contract-based applications.

-

Functions – Institutions can service any asset on any blockchain by synchronizing off-chain events or data with on-chain operations. Any off-chain event or data can be synchronized, such as position settlement instructions, corporate actions, proxy voting, ESG data, dividends and interest, and net asset value.

Chainlink has successfully enabled over $8 trillion in transaction volume for blockchain applications. The high security standards of the Chainlink network were pioneered by a world-class research team and are enforced by decentralized oracle networks (DONs) operated independently by leading enterprises such as Deutsche Telekom MMS, LexisNexis, and Swisscom. Chainlink employs a defense-in-depth approach to development, maintaining high availability and tamper-proof security over many years—even during the most turbulent and unpredictable periods in the industry.

Real-World Use Cases of Tokenization Enabled by Chainlink

The following sections are divided into three use cases: secondary markets, DvP, and on-chain/off-chain synchronization.

Secondary Markets

Secondary markets are critical for the efficient functioning of capital markets. They promote liquidity and price discovery by providing investors with a platform to buy and sell previously issued financial instruments. Currently, financial markets rely on Central Securities Depositories (CSDs) and custodian banks to maintain records of securities holdings. These securities can freely transfer from one custodian bank to another via standardized messaging protocols across various front-, middle-, and back-office systems. This interconnected infrastructure not only supports secondary market operations but also contributes to the overall stability and resilience of the global financial system.

Chainlink enables secondary markets for tokenized assets in three distinct ways:

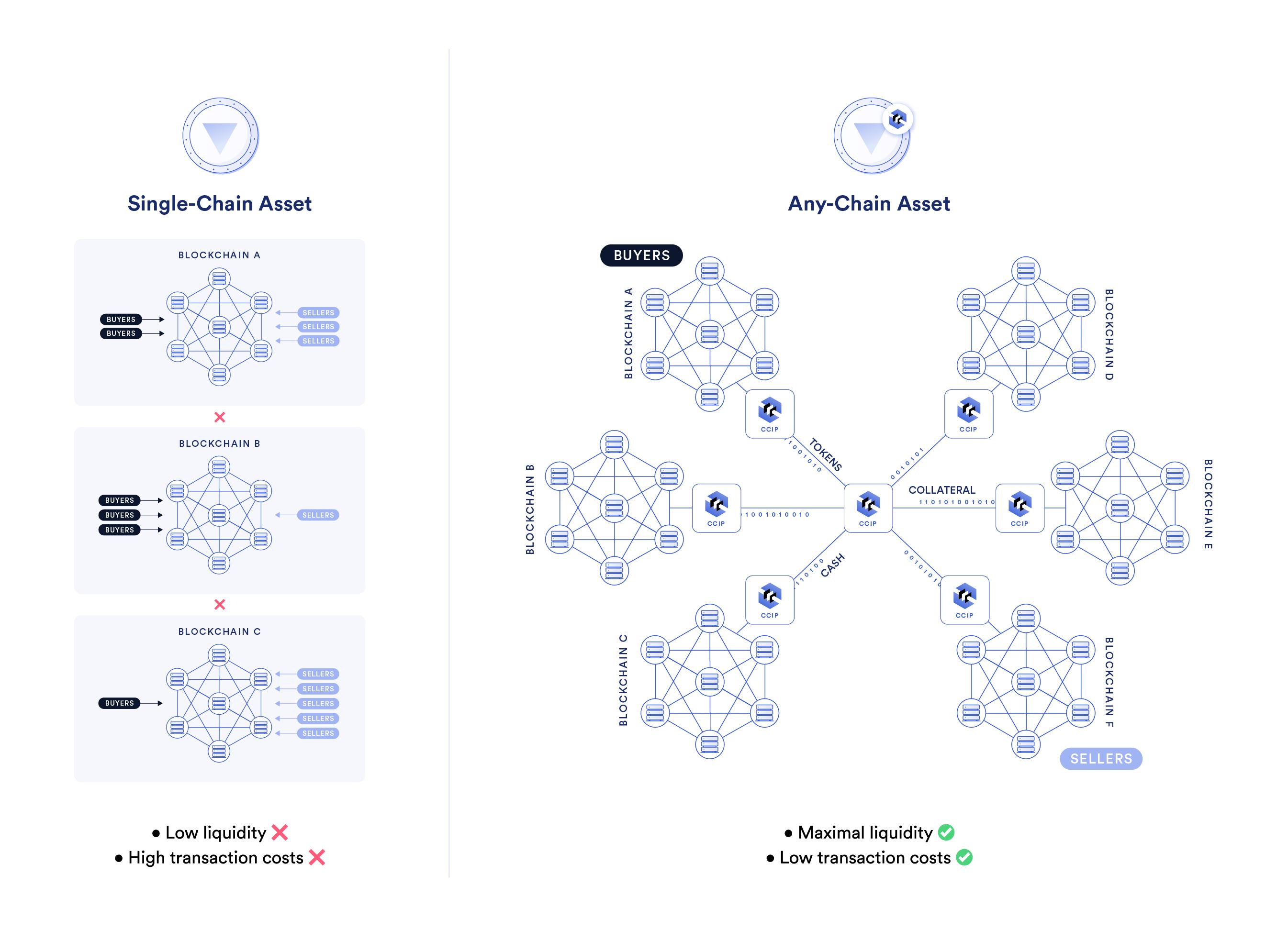

1. Connecting Buyers and Sellers Across Different Blockchain Platforms

Business Context

Most bonds and illiquid assets are traded over-the-counter due to their heterogeneous nature. To bring tokenization of bonds and illiquid assets to production, the same liquidity platforms (e.g., MarketAxess and TradeWeb) need to be able to list these tokens from market makers’ inventories or allow them to set prices. One component of how market makers set prices is based on liquidity risk—how quickly can they offload inventory to clear their books by the end of the trading day? To maximize liquidity and achieve attractive bid-ask spreads matching or exceeding those of traditionally issued assets, tokenized assets must be able to settle on any blockchain preferred by asset managers and owners.

Chainlink's Role:

-

Chainlink CCIP provides financial institutions with a single integration gateway to communicate with any public or private blockchain.

-

Chainlink CCIP makes tokenized assets available on any blockchain, transforming them from single-chain assets into any-chain assets.

-

Chainlink CCIP facilitates secure cross-chain DvP settlement through atomic transactions.

Example Workflow Using Chainlink CCIP:

-

Asset Management Company A needs to sell BondToken, currently issued on Public Chain 1 and held by a fund custodian.

-

A trader from Asset Management Company A logs into MarketAxess to view dealer bid-ask spreads in the OTC market. Dealers can offer tighter spreads because they know this asset is enabled with Chainlink CCIP, meaning it is an any-chain asset that can settle on any public or private chain.

-

The trader pays a small spread to transfer BondToken from Public Chain 1 to Private Chain 1 for the dealer to hold.

-

Asset Management Company B, using Private Chain 2, wants to purchase BondToken.

-

The dealer quotes a price and agreement is reached. CCIP transfers BondToken from Private Chain 1 to Private Chain 2.

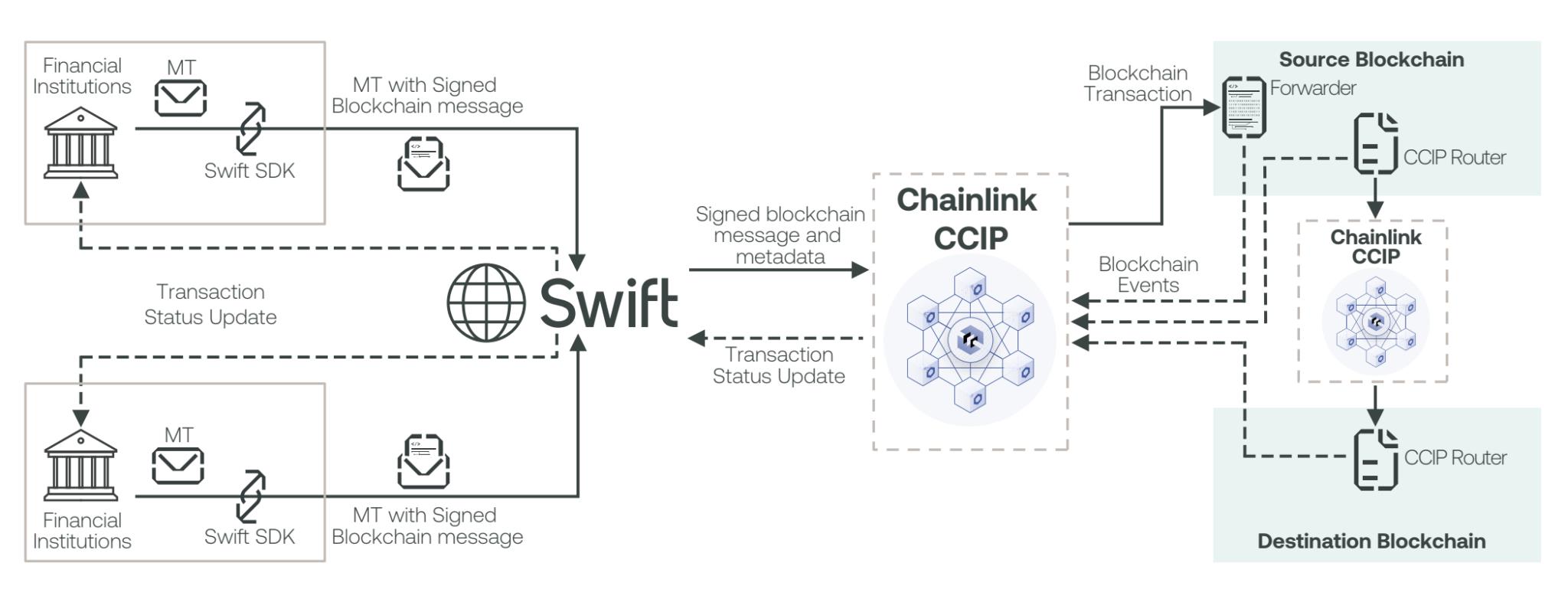

2. Seamlessly Integrating Traditional Infrastructure with Blockchain Networks

Business Context

Market participants in finance have been slow to adopt new technologies like blockchain, as many still rely on legacy systems. These systems safeguard enormous value, and the cost and risk of replacing or developing new connections are exceptionally high.

Over the past few years, financial institutions have conducted hundreds of blockchain proofs-of-concept. However, very few projects have moved into production, primarily due to challenges integrating blockchain into core business infrastructure. This connectivity challenge is exacerbated by the growing number of blockchain ecosystems they may need to interact with.

Chainlink's Role:

-

Chainlink CCIP connects existing infrastructure to any blockchain, enabling financial institutions to interact with tokenized assets through their legacy systems without modification. This allows interaction via Swift messages, APIs, mainframes, and other traditional formats.

Example Scenarios Enabled by CCIP:

-

My order management system only communicates instructions via Swift messages, so I want to be able to communicate with any blockchain via Swift.

-

As a bank custodian, I want to be able to communicate with any blockchain through my wallet infrastructure or client applications.

-

My middle office needs confirmation and status updates regarding token transfers—such as pending, completed, or failed.

-

I want to publish data from an FTP server or Excel spreadsheet to a smart contract on a blockchain.

-

I want to publish data from a mainframe MQ connection to a smart contract on a blockchain.

3. Providing a Blockchain Interoperability Standard for the Capital Markets Industry

Business Context

In the ever-evolving landscape of information technology, large financial institutions instinctively rely on three foundational pillars: standards, reliability, and security. Standards provide a common language for collaboration, reliability builds confidence in service continuity, and security protects against malicious threats.

A blockchain interoperability standard is crucial for supporting a globalized market for tokenized assets. Yet, attempts at achieving interoperability so far have typically been controlled by central entities, involve fragmented tech stacks, or require financial institutions to conduct point-to-point integrations with each new private or public chain. With hundreds of blockchains already in existence and potentially many more emerging, financial institutions need a blockchain interoperability standard widely adopted across the industry.

Chainlink's Role:

-

Chainlink CCIP is enterprise-grade infrastructure that enables financial institutions to standardize the issuance, acquisition, and settlement of tokenized assets with one another.

Adopting CCIP as a blockchain interoperability standard for capital markets would deliver multiple benefits to financial institutions:

-

Standardized Communication: Consistent communication reduces errors, misunderstandings, and the need for manual intervention.

-

Automation and Straight-Through Processing (STP): Transactions can flow seamlessly from initiation to settlement without manual intervention at each step.

-

Global Reach: Seamless communication and transactions between entities in different countries promote cross-border transactions, payments, and investments.

-

Lower Operational Costs: Standardized communication and automation reduce operational costs by minimizing manual data entry and verification.

-

Integration with Other Systems: Messages can be integrated with other financial systems and platforms such as trade matching, risk management, and order management systems.

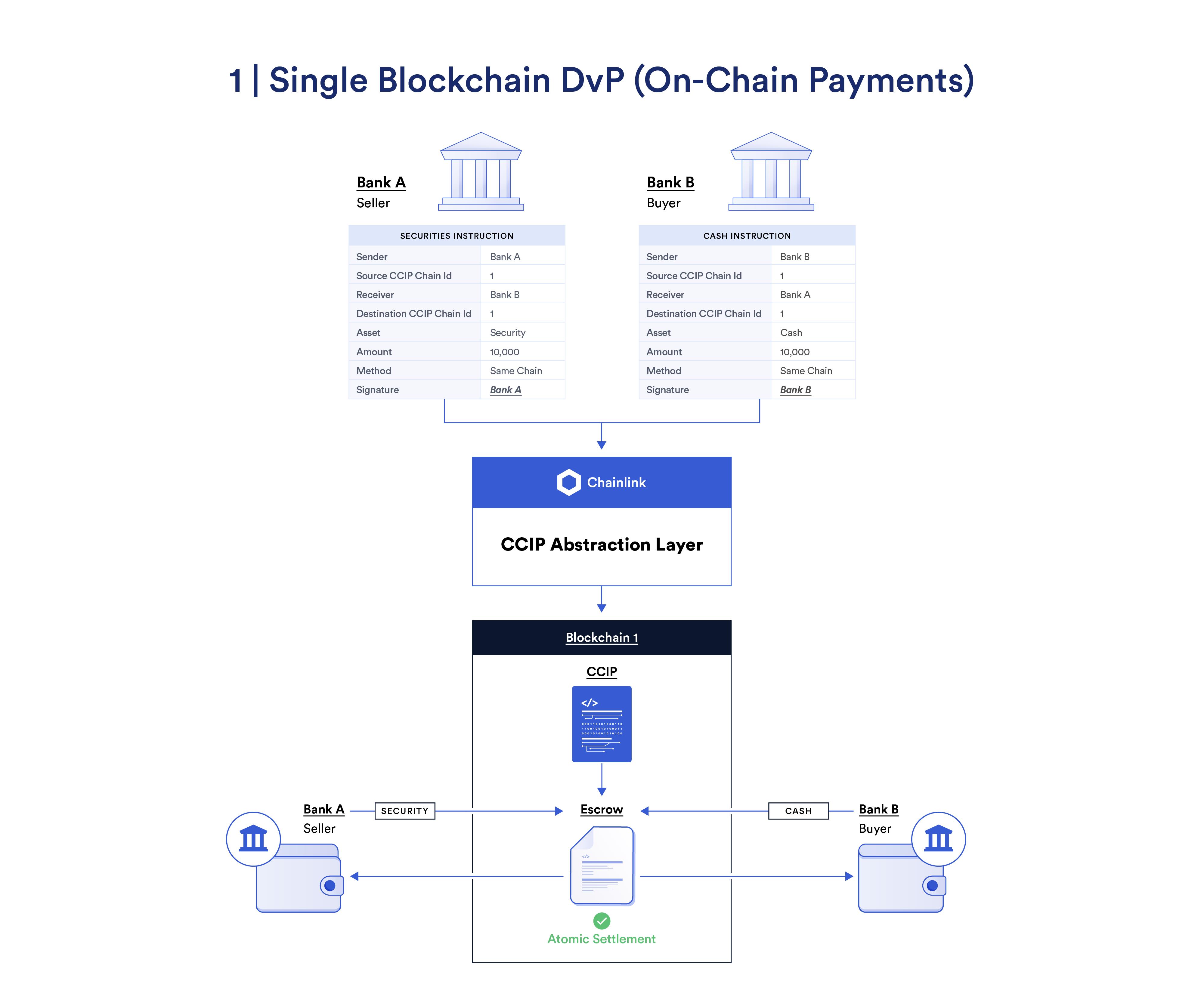

Delivery versus Payment (DvP)

Delivery versus Payment (DvP) is a critical concept in financial transactions, especially within securities markets. It mitigates counterparty and settlement risk by ensuring that the transfer of an asset and the corresponding payment occur simultaneously. DvP plays a vital role in maintaining transaction integrity, preventing scenarios where one party delivers an asset without receiving the agreed-upon payment, or vice versa. Solving DvP on blockchain is essential to unlocking the full potential of tokenized assets, as it enables a broader range of asset classes to be issued on-chain.

Real-World Example

To realize a fully functional digital asset ecosystem, cash trades must be incorporated into various DvP workflows. Banks and central banks are preparing to issue cash tokens—such as tokenized cash deposits and central bank digital currencies (CBDCs)—potentially starting on their own proprietary private chains. Their clients, primarily asset managers and owners, must be able to freely use these cash tokens to purchase assets on other blockchain ecosystems. However, to increase the utility of cash tokens, settlement risk must first be minimized.

Chainlink's Role

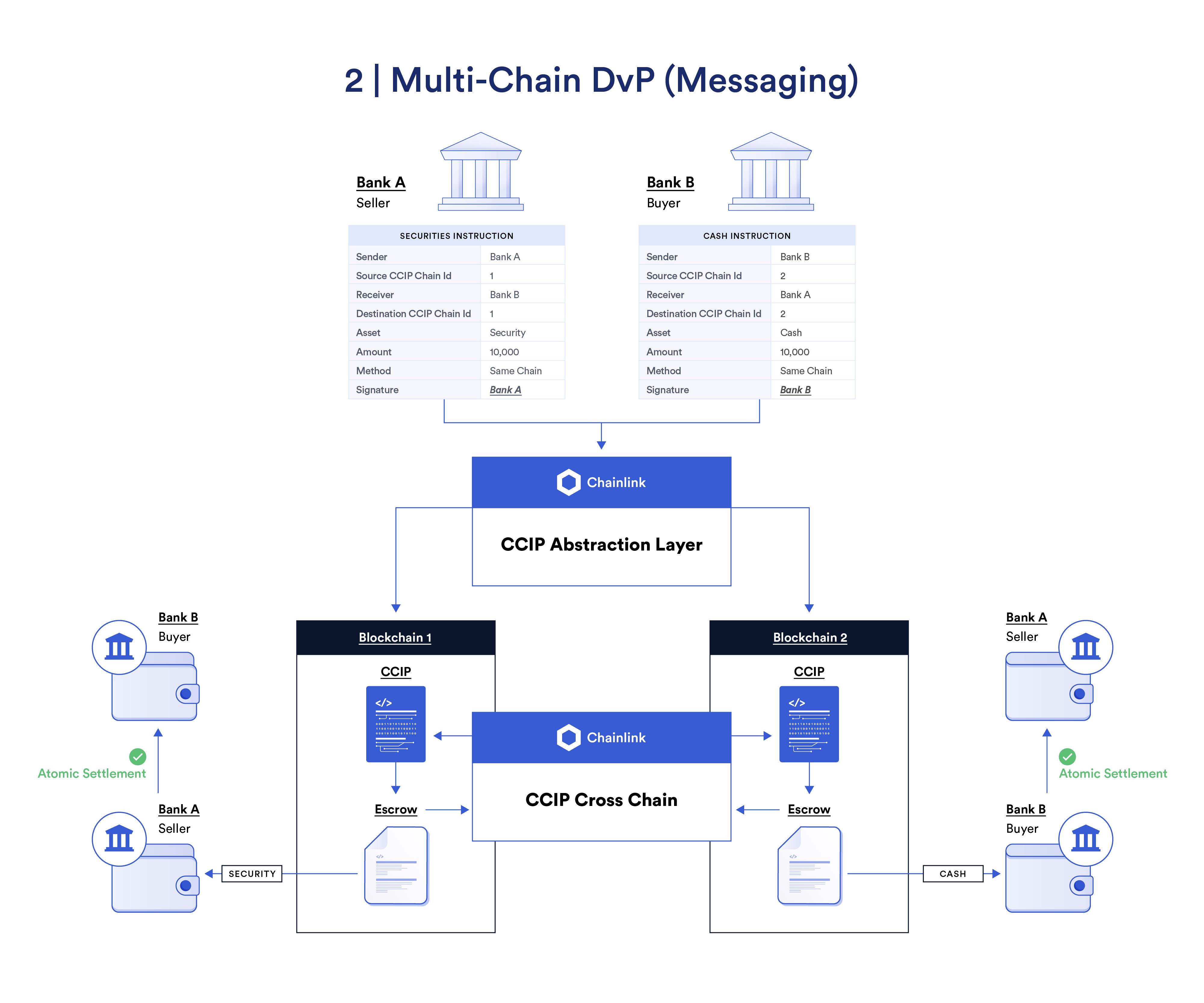

CCIP manages both single-chain and cross-chain atomic settlement scenarios involving tokenized securities and tokenized cash. CCIP supports multiple interoperability primitives that can be used to build various cross-chain workflows (see example diagrams below), eliminating transaction failures in cross-chain asset exchanges.

Key Steps:

-

Bank A issues an institutional deposit token called BankCoin on a private chain (i.e., cash chain), backed by cash and short-term fixed-income instruments.

-

Asset Manager A, a client of Bank A, maintains a $5 million cash position in their fund held on the private chain in the form of BankCoin.

-

Bank B issues BondToken on Public Chain 1 (i.e., token chain).

-

Asset Management Company B, a client of Bank B, purchases BondToken during the initial issuance and holds it in one of its funds.

-

Asset Management Company B wants to sell BondToken because their fund has net redemptions on the day, and investors want cash quickly.

-

Asset Management Company A and Asset Management Company B match a trade on an OTC platform. Token instructions are then sent to CCIP to facilitate an atomic DvP transaction between BondToken and BankCoin.

On-Chain and Off-Chain Synchronization

Establishing synchronization between off-chain legacy systems and on-chain blockchain ecosystems offers profound benefits, serving as a critical foundation for improving operational efficiency, transparency, compliance, and enhanced customer experience. Below are some examples:

-

Operational Efficiency: Real-time updates of internal systems based on blockchain events or reconciliation of assets between off-chain and on-chain records.

-

Transparency and Auditability: Provide real-time, on-chain proof of off-chain asset reserves through cryptographic verification of wallet-held assets or attestations from top accounting firms.

-

Compliance: Compliance oracles enable transactions between verified wallet addresses on any blockchain.

-

Better Customer Experience: Deliver real-time financial market data (e.g., pricing) of reserve assets both on-chain and off-chain, increasing user confidence in using blockchain-based financial products.

Business Context

Banks need infrastructure to verify ownership of off-chain reserve assets backing on-chain tokenized assets. There is also a need to verify that these off-chain reserve assets are stored and managed appropriately. This requires a robust and independent monitoring framework unaffected by individual bank infrastructures and free from conflicts of interest (i.e., verifiers of asset issuers' claims about collateral assets should have no vested interest). The composition, valuation, and valuation frequency of reserve assets are critical to ensuring tokenization is reliable enough for production use.

Chainlink's Role

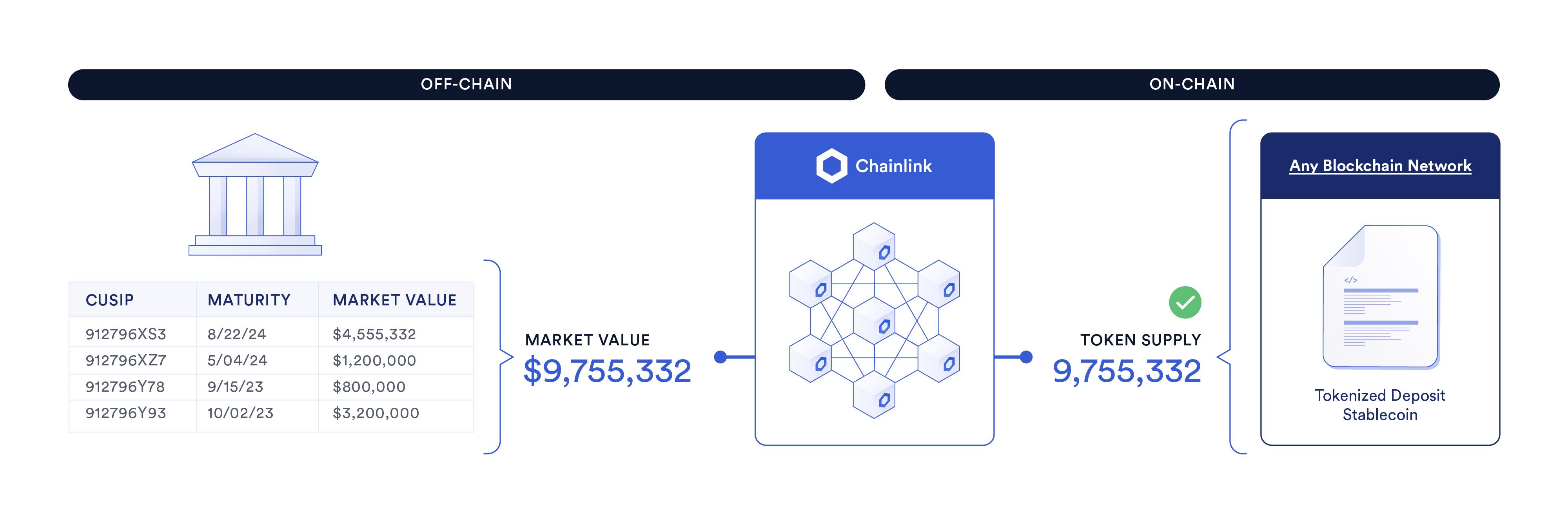

Chainlink’s Proof of Reserve provides data for various tokenized assets on blockchains, while Chainlink Functions enable off-chain data required for financial processes to enter on-chain environments.

Real-World Case

-

Bank A wants to enable its clients to use cash/deposit tokens across various blockchains.

-

Bank A selects a custodial bank account to manage the traditional asset portfolio backing the deposit tokens. A portfolio consisting of cash and short-term treasury bills is chosen.

-

Bank A leverages Chainlink’s Proof of Reserve to provide clients with real-time market values of the assets backing the deposit tokens. The bank can either self-report values or grant third-party auditors access to its custodial accounts. This provides transparency and confidence for clients using deposit tokens in capital market activities and ensures token supply does not exceed the market value of the underlying assets (e.g., preventing infinite minting attacks).

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News