Crypto Guide: Scientifically Improving Capital Efficiency to Keep Assets Always Active

TechFlow Selected TechFlow Selected

Crypto Guide: Scientifically Improving Capital Efficiency to Keep Assets Always Active

For investors, the top priority at present is to prudently manage risks, seize the tail end of the bear market, scientifically improve capital efficiency (increasing holdings), and then wait for opportunities to emerge.

Author: 0xFat

From July 12 to August 17, Bitcoin fluctuated slightly within the range of $31,000–$29,000. On August 17, it began breaking below its half-month support level, dropping as low as $24,300. On the 18th, the Fear & Greed Index fell to 37, shifting from neutral to fearful—the lowest level since March 19.

Since June 2022, Web3 innovation narratives have sharply declined. Neither Ethereum-centric Layer 2 developments nor the Bitcoin inscriptions boom have acted as flywheels driving overall market growth. Now, even yield farming—once the sole activity attracting incremental capital—is facing a winter. Macroscopically, the Federal Reserve continues hiking interest rates, contributing to an overall pessimistic outlook.

Alex Thorn, Head of Research at Galaxy Digital, pointed out that this rapid downturn has cleared excessive leverage, marking the most thorough market reset since the FTX collapse. In the absence of strong positive catalysts, downside risks remain dominant in the short term. $24,000 and $25,000 are now seen as critical support levels. If prices fail to rebound quickly, nearly 90% of short-term holders will remain underwater, potentially increasing downward pressure. However, long-term and small-balance holders continue accumulating steadily.

Although leverage has been largely liquidated and macro policies remain contractionary, compared to the previous bear market, crypto industry infrastructure is now far more mature. Technological innovations persist, and many believe tokenized U.S. Treasuries (RWA) may attract new capital. The approval of a Bitcoin ETF is also widely expected—a clear bullish signal—requiring only patience. Additionally, with payment giant PayPal entering the stablecoin space and Hong Kong’s new crypto regulations rolling out, significant growth potential remains for the market.

For investors, the top priority now is managing risk prudently, seizing the tail end of the bear market to scientifically improve capital efficiency (increasing holdings), and preparing for future opportunities.

Below is a guide on improving capital efficiency, for your reference.

1. For Trapped Investors: Earning More Coins Should Be the Priority

Xiao Mei, who entered the space in 2017, heavily invested in projects she believed in during the first half of the year. "I thought it was the bottom! Now my position has shrunk by over 40%," she said, adding that being trapped is painful, but because she strongly believes in the founding team, she can’t bring herself to cut losses.

Investors like Xiao Mei are common, especially newcomers drawn in by Meme coins like Pepe in May. Most are hopeful despite being trapped, with no concept of cutting losses in their minds. In such cases, choosing high-safety platforms and using coin-earning financial tools to accumulate more coins makes sense. The more coins you hold, the faster you’ll recover when the market rebounds, and profit expectations rise accordingly.

OKX's Simple Earn, On-Chain Earn, and Dollar-Cost Averaging (DCA) Bot are excellent options.

Simple Earn is a low-threshold product designed for idle digital asset holders to earn passive income. It offers flexible terms: Flexible Simple Earn (equivalent to a spare-change wallet) generates returns by lending assets to leveraged traders; Fixed-Term Simple Earn earns PoS rewards or project incentives through locked staking. Subscriptions and redemptions are available 24/7, with instant redemption for flexible products and settlements within 30 minutes for fixed-term ones.

Link: https://www.okx.com/cn/earn/simple-earn

On-Chain Earn provides coin holders with opportunities to earn on-chain yields via Proof-of-Stake (PoS) and DeFi protocols. Users can participate in PoS staking or DeFi projects directly on OKX without paying network fees.

Link: https://www.okx.com/cn/earn/onchain-earn

Dollar-Cost Averaging (DCA) Bot is an automated strategy that intelligently rebalances selected coin portfolios based on exchange rate fluctuations, locking in profits while increasing exposure to high-potential assets for excess returns.

Note: Once a DCA strategy is created, funds are isolated from the trading account and used independently within the strategy. Investors should monitor the impact on their overall portfolio risk after fund transfers. Additionally, if any coin in the strategy faces suspension or delisting, the DCA strategy will automatically stop.

Link: https://www.okx.com/cn/trading-bot

2. For Experienced Traders: Focus on the Power of Compounding

Einstein called compounding the eighth wonder of the world, more powerful than atomic bombs. Buffett calls it the greatest invention in the world.

In traditional financial secondary markets, grid trading bots are the most commonly used arbitrage tools. They automatically execute strategies, enabling programmed low-buy-high-sell cycles within predefined price ranges. Historically used by large market-making teams, these players achieve arbitrage through high-frequency grid trading.

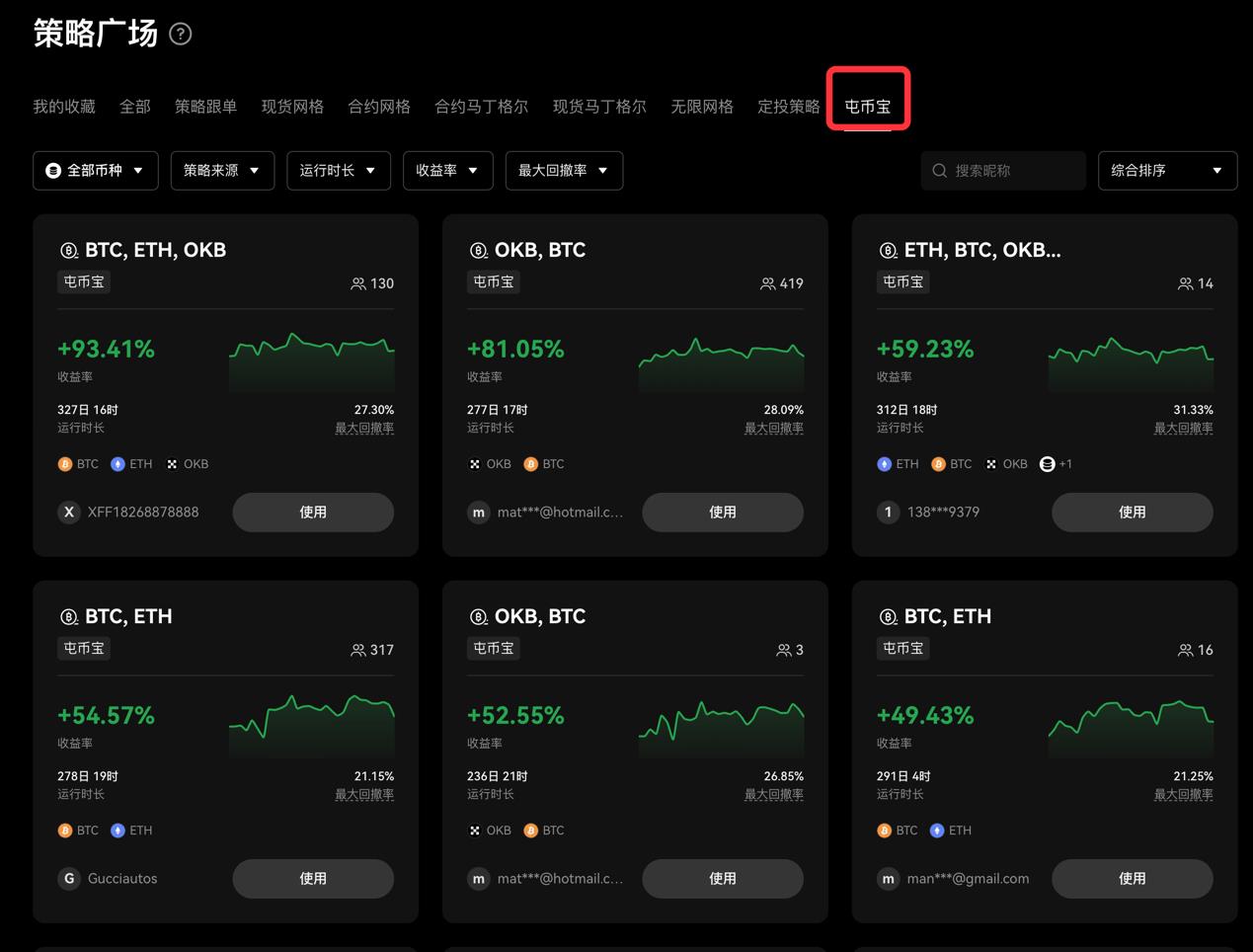

Compared to traditional finance, crypto grid trading has evolved. Taking OKX—the platform with the most comprehensive grid offerings—as an example, its grid strategies include Spot Grid, Infinite Grid, Contract Grid, and Sky-Earth Grid.

Currently, Spot Grid is widely adopted. Its logic involves setting upper and lower price bounds, dividing the range into N segments: selling a portion upon each upward move and buying upon each downward move. Ideal for volatile sideways markets, it enables automatic compounding through buy-low-sell-high cycles. Advantages include maintaining coin ownership, capturing both grid profits and floating spreads, withdrawing profits anytime for other trades, and reducing manual monitoring effort. However, drawbacks include inactivity during narrow volatility or prolonged one-way trends leading to idle assets. Note: Under current conditions, standard spot grids have low capital efficiency, but OKX’s Spot Grid supports a mobile grid feature that dynamically shifts the grid range based on market movements, significantly boosting capital utilization.

The image above shows my ongoing Spot Grid experiment. With $20,000 principal under mild oscillation, I earned ~$250 in nine days. While returns aren't high, capital efficiency of idle assets improves noticeably. Overall experience is positive, though proper price range setup is crucial.

3. For Bottom-Fishers: Smarter Allocation Strategies

Besides compounding, many cash-holding investors await bottom-fishing opportunities, yet share a common anxiety—fearing they’ll either buy too early or miss the entry entirely.

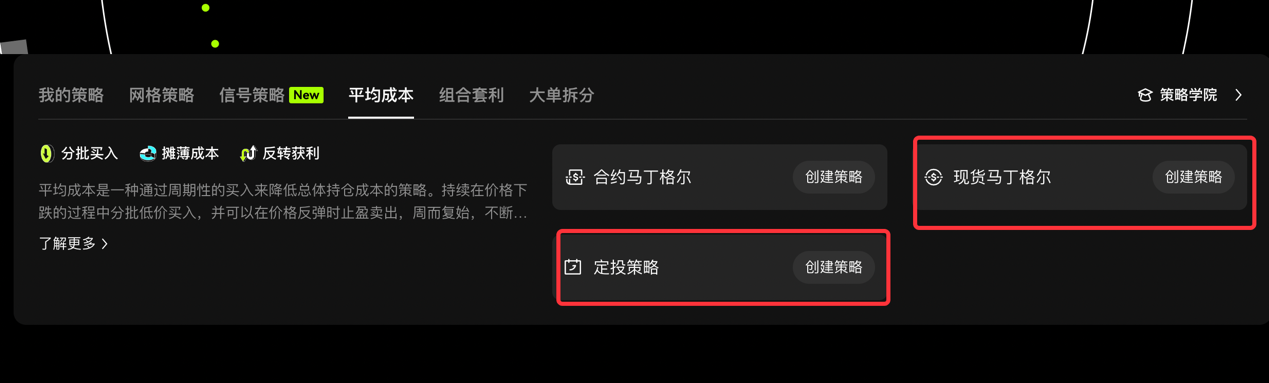

History teaches us not to aim for the absolute bottom. Gradual position building with appropriate tools may be wiser. Products like OKX’s Bottom Fishing Bot, Spot DCA, and Spot Martingale Strategy offer solid “bottom-hunting” solutions. Alternatively, holding spot positions allows hedging via coin-margined futures contracts.

First, the Martingale Strategy: Commonly used in traditional forex markets, it involves doubling down on losing trades in a two-way market until reversal occurs, profiting from recovery. OKX’s Spot Martingale optimizes this classic approach for crypto, helping users average down costs effectively.

Under current conditions, investors might consider buying spot DCA every 1–5% drop, using remaining funds to gradually accumulate and lower average cost, then taking profit when prices rebound. Compared to simple holding, this strategy is more flexible, captures minor rallies, and continuously realizes floating profits.

Next, the Bottom Fishing Bot: A structured product derived from OKX’s options functionality. It suits investors who want to buy assets below market price but worry about unfilled limit orders. With this tool, even if the target price isn’t reached by expiry, the system still guarantees partial purchase at your preset lower price.

Web operation path:

Lastly, Spot DCA: A strategy investing fixed amounts at regular intervals into selected coin baskets. During high volatility, proper DCA allows acquiring more tokens at lower prices, enhancing overall returns. Suitable for all, especially long-term investors. Supports one-click setup, anytime redemption, and customizable coin combinations.

To create a DCA strategy: On OKX homepage, click [Trade] → [Strategy Trading], select [Create Strategy] → [Average Cost] → [DCA Strategy], set coins, cycle, etc., then click [Create Strategy].

Both Spot Martingale and Spot DCA fall under the Average Cost category—an approach that systematically lowers average holding cost through periodic purchases. By consistently buying low during dips and selling high during rebounds, the cycle repeats, generating continuous arbitrage.

4. For Large Capital: Choose a Reliable Platform First

Whether in traditional or crypto markets, wealth management products remain top choices for improving capital efficiency—especially for large holders. However, due to low on-chain liquidity and frequent hacks, DeFi products are less favored. Most large-capital investors still prefer CeFi platforms. Yet after blowups like Fcoin, FTX, and AnYin, demands for transparency and security have risen sharply.

Currently, OKX stands out in brand reputation, risk control, transparency, and user experience—all validated by years of market performance. Notably, it continues monthly POR (Proof of Reserves) disclosures, making it arguably the top choice for large capital.

More importantly, OKX is among the few CeFi platforms with a systematic wealth product matrix. This includes Sharkfin—ultra-short-term principal-guaranteed options popular with beginners; Dual Asset—fixed-income products ideal for stable volatility periods; and Snowball—a customized strategy favored by mid-sized professional traders.

These three products broadly meet diverse investor needs across market conditions. Currently, the first two see higher adoption. Recently, usage of Dual Asset has increased amid unique market dynamics. Below is a screenshot of actual Dual Asset returns shared by a user—for reference only.

5. For Professional Traders: Read On!

By now, you’ve likely noticed all discussed products are from OKX.

Yes, indeed. Over the past two years, OKX has stood out in both product experience and risk management. Beyond its cutting-edge Web3 team, OKX’s CeFi innovation remains strong. In addition to the above, last week the CeFi team launched Signal Strategies tailored for professional traders.

Simply put, OKX’s Signal Strategy allows traders full freedom to customize trading signals on TradingView, meeting specific needs and truly achieving trading freedom—greatly enhancing efficiency and accuracy while reducing irrational execution risks.

Image: Custom signal entry point

The core idea behind OKX Signal Strategy is using historical data and market patterns to predict future price movements. Traders analyze these signals to identify potential buy/sell opportunities.

Its advantages can be summarized in three keywords: First, signal-driven—OKX aggregates top-tier signal providers from the world’s smartest investors and institutions, delivering premium trading signals that reduce learning curves and emotional errors. Second, auto-execution—once a signal is confirmed, trades are executed instantly, minimizing delays and avoiding missed opportunities. Third, ultra-low latency—while others suffer second-level delays, OKX delivers millisecond-level response, helping traders seize fleeting market moves. Overall, Signal Strategy provides professionals with a rational, intelligent operating system—ultimately boosting capital efficiency.

Currently, Signal Strategy connects three parties: professional traders, nodes, and retail users. Retail users can let experts/institutions trade for them by paying subscription fees or revenue sharing. Signal providers apply to become OKX partners, monetizing their expertise. Nodes can collaborate with signal providers for profit-sharing. Together, they form a closed-loop trading ecosystem. According to insiders, OKX plans to launch a public Signal Square, showcasing completed trades from providers. Retail users will be able to subscribe, use these signals, and even build their own strategies based on them.

Looking back, every OKX product reflects a grounded, rigorous attitude. Insiders say this stems from two forces within the CeFi team: one, rationality and discipline from members with deep traditional finance backgrounds; the other, sharpness and pragmatism from internet veterans skilled in user operations. It’s refreshing—platforms embracing rigor, users valuing science. Finally, order begins to bloom in crypto’s otherwise irrational market.

Risk Warning: This article is for informational purposes only and does not constitute any investment advice. The market involves risks; invest cautiously!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News