Base: The Rising Force in the Layer 2 Arena Under Coinbase's Wing

TechFlow Selected TechFlow Selected

Base: The Rising Force in the Layer 2 Arena Under Coinbase's Wing

Base can seamlessly interconnect with all projects that have adopted the same technology stack, while also benefiting from the ecosystem support of other OP Stack projects, significantly enhancing the prosperity of Base's ecosystem.

Abstract:

Recently, Base—a Layer2 project backed by Coinbase—officially launched its mainnet. Many projects on Base have received strong community support. Additionally, prior to the mainnet launch, a so-called "BALD" phenomenon emerged involving a token that surged a thousandfold, further fueling market enthusiasm.

This article provides an in-depth analysis of Base from multiple perspectives, including project fundamentals, competitive landscape, unique strengths, and ecosystem development.

I. Key Project Highlights

1. Project Advantages

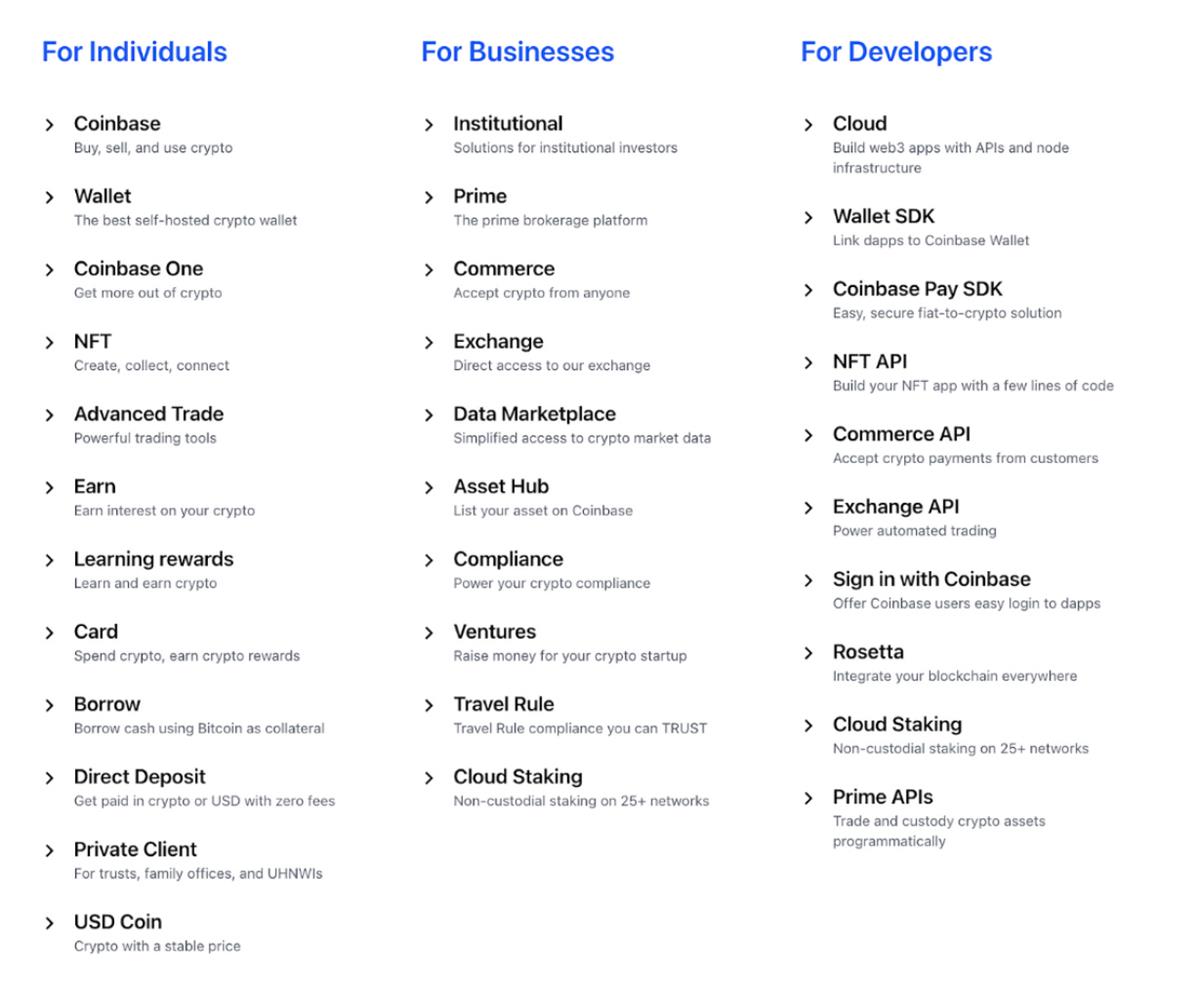

1.1 Strong Corporate Backing: Leveraging Coinbase as its foundation, Base benefits from substantial user resources and financial support. Moreover, developers can easily build decentralized applications (dApps) that access Coinbase’s products, users, and tools, enabling seamless integration with Coinbase's suite of offerings.

1.2 Integration into the Superchain Ecosystem: As an OP Stack-based chain, Base enjoys interoperability with all other chains using the same technology stack. It also gains ecosystem support from other OP Stack projects, contributing significantly to the growth and vitality of Base’s own ecosystem.

1.3 Strong Business Performance: Although still in its early stages—Base officially launched its mainnet on August 9, 2023—its business metrics already surpass those of Linea, which went live on July 18, 2023. Base’s TVL has even overtaken Starknet to rank fifth among Layer2 networks by total value locked, indicating stronger market favorability.

1.4 High Community Engagement: With users able to access Base early via contract interactions, a significant wealth effect occurred on the network. The emergence of the thousandfold-gaining token "$BALD" ignited widespread excitement around Base, drawing considerable attention from the crypto community.

2. Potential Risks

2.1 Lack of Core Technical Competitive Advantage: Base’s emergence does not appear to bring groundbreaking innovation. It seems like just another Layer2 project among many, despite strong backing. Its impact on the broader industry remains minimal. (Does this refer specifically to technological differentiation?)

2.2 Uncertain Token Launch Due to Regulatory Pressure: Given unclear regulatory conditions, it is difficult for Base to issue its own token. The official roadmap explicitly states there are currently no plans for token issuance. Compared to other Layer2 platforms expected to conduct token airdrops, Base holds less appeal for airdrop hunters.

However, the project’s whitepaper clearly mentions: “Gradual decentralization will follow.” In web3, common paths toward decentralization include launching a governance token and establishing a decentralized autonomous organization (DAO). Furthermore, numerous projects have previously claimed they wouldn’t issue tokens but later did so, often distributing them through airdrops. Therefore, some believe that as a public blockchain, Base is highly likely to eventually launch a governance token.

II. Project Fundamentals

1. Project Overview

Base is an Ethereum Layer2 network built on the OP Stack and incubated by Coinbase. A portion of transaction fees generated on Base will be returned to the Optimism Collective treasury. Base aims to onboard the next billion users into the world of cryptocurrency.

As shown in the figure above, Coinbase co-founder Brian Armstrong outlined a master plan describing four phases of crypto adoption:

-

Develop new protocols such as Bitcoin and Ethereum. (Completed) — 1 million users

-

Build exchanges to facilitate trading. (Completed) — 10 million users

-

Create mass-market interfaces for dApps. (Completed) — 100 million users

-

Build dApps powering an open financial system — 1 billion users

The final phase is precisely what Base aims to achieve. The Coinbase team views Base as the next step toward fulfilling its mission of enhancing global economic freedom. Base will serve as the home for Coinbase’s on-chain products and provide an open ecosystem for anyone building Ethereum scaling solutions and dApps. The team hopes Base becomes a seamless gateway for Coinbase users to access the broader crypto economy, ultimately making web3 more accessible to everyone.

Base is a fork of the OP codebase. The Base team chose Optimism because the EVM offers the “path of least resistance,” and the OP codebase enables rapid deployment.

The Coinbase and Optimism teams have collaborated for over a year, making major contributions to the development of EIP-4844 (also known as Proto-Danksharding), which could reduce L2 transaction fees by 10–100x. Coinbase is now a core contributor to OP Stack, joining as the second core project team.

2. Project Team

Base was internally incubated by Coinbase, one of the world’s largest cryptocurrency exchanges, founded in June 2012 by former Airbnb engineer Brian Armstrong.

To date, approximately 245,000 ecosystem partners across more than 100 countries and regions trust Coinbase to securely invest, spend, save, earn, and use cryptocurrencies. As shown in the chart above, Coinbase manages platform assets totaling $128B, achieved quarterly trading volume of $92B, and employs over 3,400 people.

Notably, Coinbase raised $300 million in an E round at an $8 billion valuation on October 30, 2018, and went public on Nasdaq on April 14, 2021, under the ticker symbol “COIN,” with a current market cap of $20.65B.

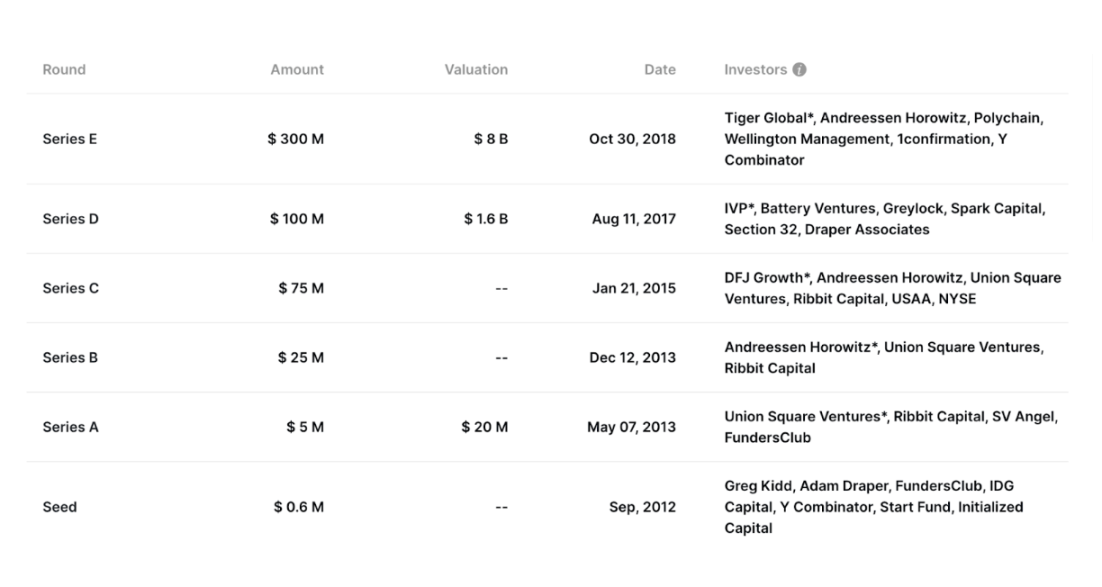

3. Funding Status

Currently, Base has not conducted independent fundraising. However, its parent company, Coinbase, successfully raised $505.6 million. As one of the largest centralized exchanges, Coinbase possesses strong financial resources and cash flow. Given that Base plays a critical role in Coinbase’s “Master Plan” (Phase Four), it is highly likely to receive ongoing financial support from Coinbase, eliminating concerns about funding shortages.

4. Development Progress and Roadmap

Base launched its testnet on February 23, 2023, offered a $15,000 bounty to developers at ETHDenver on March 4, 2023, and then announced preparations required before mainnet launch on May 24, 2023 (all shown in the image above, now completed):

-

Successfully completed the Regolith hard fork on testnet

-

Conducted successful infrastructure review with OP Labs team

-

Successful completion of Optimism Bedrock upgrade

-

Completed internal and external audits with no critical issues found

-

Demonstrated stability of the testnet

After meeting these criteria, on July 13, 2023, Base officially opened its mainnet to builders. This first phase allowed developers to deploy their products onto Base.

Then on August 3, Base announced the mainnet would fully open to all users on August 9. To celebrate, Base hosted an event called “OnChain Summer”—a month-long on-chain initiative featuring 50 top builders, brands, creators, and artists. Each day brought engaging on-chain activities, including:

-

Onchain Summer – August 9–18: Create art, websites, or anything inspired by Onchain Summer on Base.

-

Build on Base – August 12–23: Deploy protocols, build infrastructure, or create new applications on Base.

-

Stand with Crypto – August 14–24: Create a one-minute video sharing stories about on-chain use cases or advocating for sensible regulation.

-

Based Accounts – August 16–September 13: Use account abstraction to build experiences that unlock new or improved UX on Base.

In addition to grants, Base partnered with other Superchain (OP Stack) members to host a virtual hackathon called Superhack from August 4 to 18, offering a prize pool of $125,000.

III. Competitive Analysis

1. Funding Comparison:

While Base itself has not raised funds independently, its parent company Coinbase has secured $505.6 million in funding, as illustrated below, indicating strong financial backing.

Additionally, as one of the top five centralized exchanges globally, Coinbase commands robust capital reserves and cash flow. It can supply Base with both extensive user resources and solid financial support. As mentioned earlier, Base plays a pivotal role in Coinbase’s fourth-phase strategy (targeting over 1 billion users), ensuring it will receive ample institutional backing.

Other Layer2 projects have also raised significant capital: Arbitrum One raised $143.7 million, OP Mainnet raised $178.5 million, zkSync raised $458 million, StarkNet raised $273 million, Polygon zkEVM raised $450 million. Notably, Linea—like Base—has not conducted separate fundraising, though its parent company ConsenSys raised $726 million.

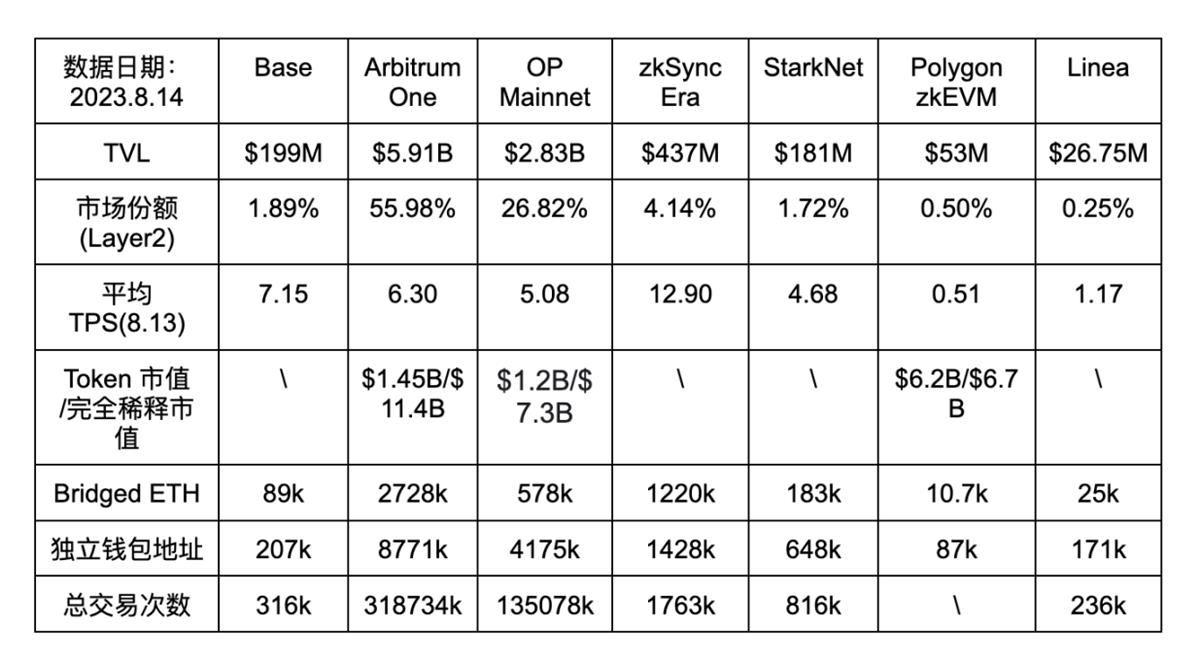

2. Business Metrics:

Data source: Compiled from Dune

Note: Base’s mainnet only launched on August 9, so current data should be considered preliminary.

From the data above, Arbitrum One clearly leads the current Layer2 landscape in terms of business performance. In terms of Total Value Locked (TVL), Arbitrum One controls over 55% of the market share, followed by OP Mainnet with over 26%. Together, these two projects account for more than 80% of the market, and like Base, they belong to the Optimistic Rollup category.

Beyond TVL, Arbitrum One maintains a clear lead across other metrics, with OP Mainnet again in second place. Compared to current Layer2 leaders, Base still has considerable room for growth—its TVL is over 50 times smaller than Arbitrum One’s, and on-chain activity lags significantly.

However, compared to Linea—an almost one-month-old competitor—Base has already surpassed it across key business metrics despite launching later on August 9. Base’s TVL is nearly three times larger than Linea’s, and all on-chain data points show superior performance. This suggests greater market confidence in Base, with more investors willing to allocate capital on the Base chain.

Notably, even before the official bridge launched or the mainnet went live, several third-party bridges began supporting cross-chain transfers to Base, such as Orbiter Finance.

Prior to bridge support, users could manually deposit funds into Base by sending transactions directly to contracts, sparking a meme coin frenzy and giving rise to the 1,000x token $BALD. For details, see this article.

IV. Base’s Unique Strengths and OP Stack Analysis

1. Backed by Coinbase

1.1 Financial and Resource Support

Coinbase boasts over 100 million verified users and manages billions in digital assets. As one of the top-five crypto exchanges, it brings immense user reach and financial strength, providing Base with substantial resource and capital backing.

1.2 Seamless Integration with Coinbase Products:

Coinbase systematically removes barriers that retail users face when transitioning from centralized finance (CeFi) to decentralized finance (DeFi).

-

Coinbase Wallet is one of the most integrated wallets in DeFi, with over 1 million desktop users and over 10 million mobile users

-

Coinbase collaborates closely with Circle to expand USDC stablecoin’s market cap beyond $25B.

-

Coinbase’s liquid staking token cbETH ranks second only to Lido, with 2.33 million ETH staked, helping secure the Beacon Chain.

Moreover, developers can easily build dApps on Base that access Coinbase’s products, users, and tools, achieving seamless integration. As shown below, similar to how MetaMask automatically includes the Linea mainnet, Coinbase Wallet natively integrates the Base mainnet, requiring no manual configuration from users.

Furthermore, Coinbase is more than just an exchange—it offers staking solutions, liquid staking derivatives, institutional custody, non-custodial wallets, and in-app DeFi integrations. Base represents a natural extension of this product line, offering Coinbase users a direct path into the Web3 world.

1.3 Capital Security Assurance:

Currently, the crypto market remains relatively small, causing hesitation among large investors and institutions about allocating significant capital. They may remain cautious about storing assets on blockchains.

However, Coinbase—the entity behind Base—is a publicly traded company listed on Nasdaq. As a mature market participant, Coinbase offers reliable fiat on-ramps and operates under stricter regulatory oversight. This enhances trust in fund security and may attract greater participation from institutional investors.

2. OP Stack

As mentioned earlier, Base is an Ethereum Layer2 built on OP Stack, and part of its transaction fees will be directed to the Optimism Collective treasury. But what exactly is OP Stack, and what advantages does building on it offer Base?

2.1 What Is Optimism Collective?

According to official documentation, the Optimism Collective consists of communities, companies, and citizens governed jointly by the Citizens’ House and Token House. This dual structure aims to avoid governance pitfalls seen in other Ethereum models. Both bodies balance short-term incentives with long-term vision. The goal of the Optimism Collective is to develop robust public goods infrastructure for OP, enhance L2 utility, and establish an efficient and sustainable crypto-economic foundation.

2.2 What Is OP Stack?

Officially, OP Stack is a standardized, shared, and open-source development stack supporting Optimism, maintained by the Optimism Collective. Composed of various software components managed by the collective, OP Stack forms the foundational pillars of Optimism. It is designed as a public good for the Ethereum and Optimism ecosystems.

In late 2022, the Optimism team broke down its original development work into modular layers (Data Availability Layer, Derivation Layer, Execution Layer, and Settlement Layer), forming OP Stack. In short, OP Stack is a standardized, open-source modular framework developed by Optimism that can be assembled into a customized blockchain. Any developer can use OP Stack to innovate and launch a new chain.

Using OP Stack, developers can plug into its data layer to create a Layer2, Layer3, or even Layer4 solution. “Standardized” means the modules follow widely accepted consensus standards. “Open-source” ensures free access, iteration, and contribution by anyone.

2.3 The Superchain

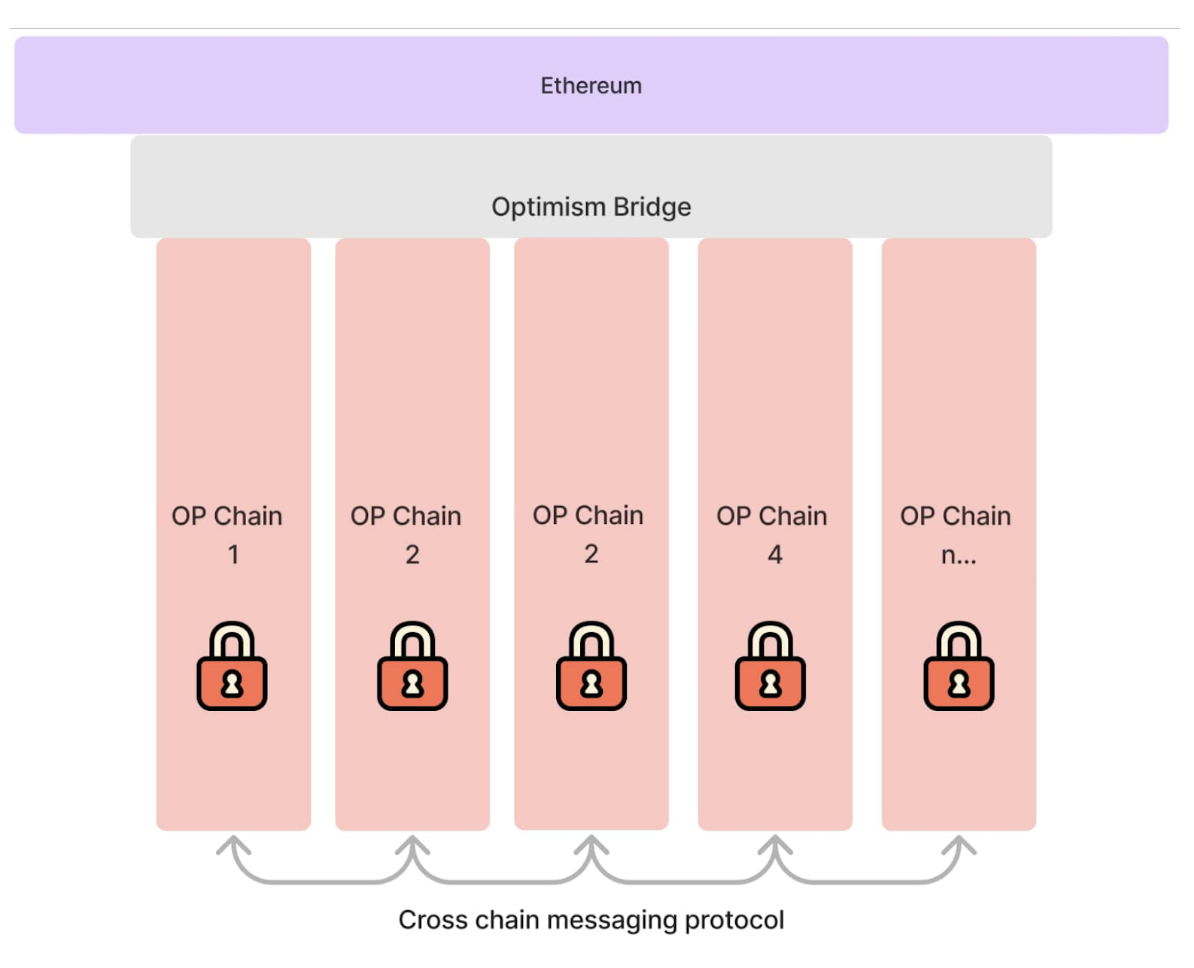

OP Stack’s goal is to unify isolated L2 networks into a single Superchain—a cohesive system with interoperability and composability. Launching an L2 should become as simple as deploying a smart contract on Ethereum today.

Essentially, as shown in the diagram, the Superchain is a horizontally scalable blockchain network where chains share security, communication layers, and development toolkits. OP Stack serves as the modular engine behind the Superchain, while within it reside countless interconnected, communicative blockchains.

A Superchain based on OP Stack will possess the following shared properties:

Once Optimism satisfies these properties, it can be considered a true Superchain.

2.4 Base’s Collaboration with OP Labs and Optimism Collective

2.4.1 Accelerating Superchain Activity: Base is the second L2 after the Optimism mainnet to deploy on OP Stack and intends to join the Superchain. Base will bring Coinbase’s on-chain products and user base into the Superchain ecosystem, increasing overall activity while enabling seamless dApp interaction and asset transfers for Coinbase users.

2.4.2 Adding Value to the Superchain: Base will contribute a portion of its earned transaction fees to the Optimism Collective, becoming part of the Superchain and funding core public goods infrastructure for the broader crypto economy.

2.4.3 Advancing the Developer Ecosystem: Base will continue close collaboration with OP Labs and the Optimism Collective to make it easier for developers to build new L2s and rollups and deploy apps across the Superchain. For example, Base will work with the Optimism Collective to create primitives (e.g., identity systems) usable across Superchain-integrated L2s, including Base and Optimism Mainnet.

2.4.4 Building an Interoperable Crypto Economy: In the short term, Base and Optimism mainnets will operate as independent L2 platforms offering products like swaps and lending. Long-term, more use cases are expected to deploy on either Optimism or Base depending on specific needs, allowing developers flexibility to choose the optimal L2 platform for their application.

3. Other Projects Using OP Stack

3.1 Worldcoin

In May, the Worldcoin Foundation and Tools for Humanity (TFH), early contributors to the protocol, announced support for the Optimism Collective to jointly build a scalable blockchain ecosystem based on OP Stack.

As the first step, Worldcoin’s decentralized privacy identity protocol, World ID, will launch on the OP mainnet. Its native wallet, World App, will subsequently migrate to the OP mainnet.

In fact, back in 2020, Worldcoin developed and launched Hubble, an Optimistic Rollup appchain limited to simple payments. After launch, the team found demand exceeded Hubble’s capabilities, leading them to migrate temporarily to Polygon PoS.

Now, Worldcoin is rebuilding its appchain using OP Stack. However, this partnership focuses primarily on developing on-chain identity systems. For Optimism, a decentralized on-chain identity system is crucial for organic economic growth—unlocking democratic governance and innovation while empowering individuals to control their finances and participate in the global economy on their own terms. To this end, Optimism deployed AttestationStation, an experimental identity system allowing anyone to make arbitrary attestations about other addresses, assigning trust scores based on real social connections (influence).

For Worldcoin, identity is equally vital. To fairly distribute digital currency to 7.9 billion people and ensure equitable wealth distribution, a method is needed to verify unique identities and prevent duplicate claims. To address this, the team developed World ID, the underlying identity protocol guaranteeing one iris scan per person. They also created biometric devices that scan irises to verify uniqueness while preserving privacy through zero-knowledge proofs.

On July 13, 2023, World ID registrations surpassed 2 million during testing.

Additionally, on August 6, 2023, the official announcement noted a surge in global activity for the World App (the first wallet built for the Worldcoin network) following its release. Within seven days, weekly active users tripled, and weekly account creations increased more than tenfold.

3.2 BNB Chain Application Chain opBNB

Beyond Ethereum, other blockchains can leverage OP Stack to build their own Layer2 solutions—for instance, opBNB, a second-layer application chain built on OP Stack.

On June 19, BNB Chain launched the testnet for its OP Stack-based Layer2 (mainnet expected Q3 2023). By adopting OP Stack rollups, opBNB offloads computation and state storage off-chain, reducing congestion and lowering transaction costs.

opBNB delivers enhanced performance exceeding that of BNB Chain. Official figures indicate a 1-second block time, gas fees as low as $0.005, and TPS exceeding 4,000. In comparison, BNB Smart Chain currently handles 2,000 TPS at an average cost of ~$0.109 per transaction. Thus, opBNB achieves nearly double the speed and drastically reduced costs.

opBNB is a Layer2 network on BSC built using OP Stack. Like Optimism Rollup, opBNB processes transaction data off-chain and batches submissions to Layer1, achieving high TPS, low gas fees, and Layer1-level security.

Why did opBNB choose OP Stack for its appchain?

In reality, L2 solutions aren't exclusive to Ethereum. With rising transaction volumes from GameFi and similar sectors, even high-performance chains like BNB Chain face network congestion and high gas fees. When existing architectures fail to meet scalability demands, solutions like opBNB emerge.

Back in September last year, BNB Chain launched the zkBNB testnet (a zero-knowledge proof-based Layer2). However, due to zkBNB’s lack of EVM compatibility—which prevents interaction with Ethereum-based applications—BNB Chain pivoted to develop a new L2 solution: opBNB.

opBNB introduces improved data availability, batch transactions, and up to 100M gas limit on BNB’s public chain. Additionally, EVM-compatible OP Stack simplifies porting Ethereum Virtual Machine (EVM) code from Ethereum to BNB Chain, enabling faster and easier creation of open ecosystems and expanding the user base.

Unlike Optimism and Coinbase’s Base, opBNB runs on BSC (not Ethereum). Since BSC already outperforms Ethereum in speed, opBNB further amplifies performance—surpassing even BSC and potentially outpacing Optimism and other scaling solutions in speed.

Most importantly, BNB Chain’s decision to adopt OP Stack carries strategic significance. For BNB Chain, using OP Stack to build application chains allows continued use of BNB as the gas fee token. As more use cases emerge, this greatly expands BNB’s utility, capturing value for BNB holders. In the long run, BNB Chain could become a formidable competitor to Ethereum’s growing L2 ecosystem.

3.3 Zora Network

Zora Network launched a Layer2 NFT minting platform based on OP Stack, targeting NFT creators, brands, and collectors. It provides a suite of creator tools and reduces minting costs to under $3.

Focused on delivering the best experience for creators and collectors, Zora offers faster speeds, lower costs, and improved usability. As Zora Engineering tweeted: “An interesting fact: the combined cost of ‘bridging to L2’ + ‘minting’ is still less than a single mint on the mainnet.”

Zora Network will seamlessly integrate with existing Zora marketplace infrastructure. This means current users—including artists, brands, and collectors—can smoothly transition to the new L2. Over 35 Web3 entities, including Sound.XYZ, Rainbow Wallet, Seed Club, and PleasrDAO, along with 130,000 existing users, will be onboarded. To commemorate the launch, Zora released an open-edition NFT titled “Energy,” available for minting over the coming days.

Additionally, data shows that since its August 21 launch, Zora Network has seen over 164K bridged addresses and accumulated 1,706 ETH (~$3.1M) in TVL.

Also, Zora has already deployed on Base.

3.4 a16z’s Rollup Client Magi

Magi is a Layer2 rollup client solution launched in April by a16z Crypto. Written in Rust and built on OP Stack, Magi acts as a consensus client in Ethereum’s traditional execution/consensus split, providing new blocks to execution clients to advance on-chain transactions. Magi performs the same core functions as the reference implementation (op-node) and works alongside execution nodes (e.g., op-geth) to sync with any OP Stack chain.

Magi aims to serve as an independent alternative to op-node, enhancing rollup client diversity. a16z hopes that building a Rust-based client will strengthen the overall OP stack’s security and vibrancy, encouraging more contributors to the ecosystem.

As one of the most prominent investors in crypto—with over $7.6 billion allocated to the sector (as of May last year)—a16z Crypto’s leadership in developing the Magi client on OP Stack marks its transition from investor to developer, representing its first step into the Optimism Collective.

3.5 On-chain Gaming

Games like OPCraft, Keystone, and Loot often involve frequent interactions, demanding high speed and low cost. This necessitates customized blockchain infrastructure, prompting many scaling solutions to develop gaming-specific variants.

OP Stack is one of the most popular infrastructures for on-chain games. A prime example is OPcraft, built entirely on OP Stack.

OPCraft is a fully on-chain voxel game (a fully on-chain game) set in a virtual world. Every element—from rivers to grass blades and snow atop mountains—exists on-chain, and every in-game action occurs as an Ethereum transaction.

Keystone is another chain built with OP Stack, using custom precompiles to embed game ticks and ECS directly into the chain, boosting on-chain game speed by 100x and delivering richer gameplay.

Additionally, Adventure Gold DAO from the Loot ecosystem recently announced it will use OP Stack to build Loot Chain, a new Ethereum L2 dedicated to the Loot community, aiming to reduce gas fees and use its native token AGLD as gas. The chain uses Polygon as a data availability layer, significantly lowering development, deployment, and operational costs.

3.6 DeBank Chain

On August 11, 2023, the all-in-one wallet DeBank announced DeBank Chain, a new chain built on OP Stack. The testnet is live, with mainnet planned for next year. DeBank Chain aims to become a social asset layer, natively integrating Account Abstraction-like systems to deliver near-Web2 user experiences while maintaining full EVM compatibility. The new account system supports dedicated L2 private key signing, reducing exposure of L1 private keys in social scenarios and enhancing L1 asset security.

V. Ecosystem Development

1. Base Ecosystem Fund

On February 23, Coinbase announced the creation of the Base Ecosystem Fund—a capital pool investing in early-stage projects built on Base—alongside dedicated team support to help them succeed.

The Base Ecosystem Fund has provided four focus areas for builders (from Base):

Inflation-tracking Stablecoins ("Flatcoins"): Deeply exploring decentralized stablecoin design, Base is interested in “flatcoins” that track inflation, preserving purchasing power while offering resilience against economic uncertainty caused by traditional financial systems.

Base welcomes other forms of “flatcoins” not pegged to fiat, aiming to fill the gap between fiat-pegged tokens and volatile crypto assets. Given recent challenges in the global banking system, Base believes these explorations are more important than ever.

On-chain Reputation Platforms: Base believes blockchain is the next internet, and decentralized identity and reputation will play a key role in defining each individual’s on-chain presence. Supporting native on-chain reputation protocols presents opportunities to build greater trust on-chain.

This might resemble FICO or Google PageRank-style scoring on ENS names, merchant ratings/reviews, and other mechanisms that foster on-chain trust. Base encourages teams to deeply consider what on-chain reputation and credit might look like, leveraging these systems while protecting user privacy and autonomy.

On-chain

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News