Base L2: More Than Just Meme Coins, Coinbase's Integration Edge Could Bring New Influence

TechFlow Selected TechFlow Selected

Base L2: More Than Just Meme Coins, Coinbase's Integration Edge Could Bring New Influence

Regardless, Base's success extends far beyond this peak of Memecoins.

Author: 563

Compiled by: TechFlow

While many were focused on and worried about the DeFi downturn this week, some Degens were immersed in the frenzy of Base memecoins.

Although memecoins like $BALD have already experienced their rise and fall, many in crypto hope that early activity signals a promising future for Coinbase's Base L2.

Despite lacking a cross-chain bridge, retail users moved over $50 million worth of ETH into Coinbase’s Layer 2 platform Base within just 24 hours last weekend.

The main driver? Memecoins.

$BALD led the charge, briefly reaching nearly $100 million in market cap—before its deployer suddenly pulled liquidity, causing the price to crash by 99%.

Yes, there have been some interesting theories about the mysterious identity of the $BALD deployer, but we’ll leave that investigation to the all-knowing KOLs of Crypto Twitter.

Today, let’s take a closer look at where all this is happening—Base. Where did the hype come from, and is it justified? Let’s dive in.

Case Study

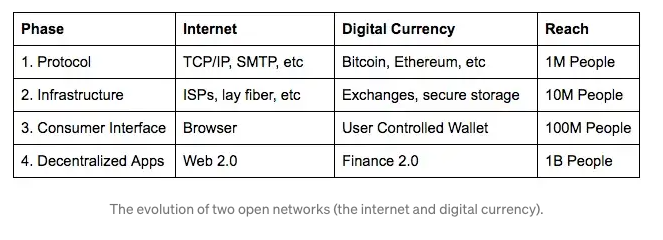

Since 2016, Coinbase’s Secret Master Plan™ has laid out their corporate strategy with a clear goal: building an open financial system for the world. To bring the next billion users onchain, Coinbase outlined their plan in four simple steps—each enabling an order-of-magnitude leap in user scale.

Coinbase is now entering the final step: building dApps for a global financial system. The world of decentralized finance means enabling users to interact permissionlessly with protocols for trading, lending, borrowing, transferring, leveraging (and more), while paying lower fees, accessing services from any device, and trusting only code. While foundational pieces are in place, Coinbase claims Base is leading the charge in completing step four.

Superpowers

Built on Optimism’s open-source OP Stack, Base aims to make the onchain experience as seamless as possible for users. But among numerous Layer 2 solutions, what makes Base stand out? In short: “frictionlessness.”

Coinbase’s superpower lies in systematically removing barriers that prevent retail users from jumping from centralized finance (CeFi) to decentralized finance (DeFi).

-

The Coinbase Wallet is one of the most widely integrated wallets in DeFi, with over 1 million desktop users and more than 10 million mobile users;

-

Alongside Circle, Coinbase helped popularize the USDC stablecoin, now with over $25 billion in market cap;

-

Coinbase’s liquid staking token cbETH is second only to Lido in total staked ETH, with 2.35 million ETH (worth approximately $4.4 billion) securing the Beacon Chain.

Why are these products so popular? Because Coinbase makes it easy for existing retail users to adopt these new technologies.

Now, can Coinbase leverage its established integrations and market penetration to bring this entirely new user base onchain? Given that users already hold around $130 billion in assets on Coinbase, could this integration help funnel fresh capital into Ethereum-based applications?

Builders Are Building

Base has just launched its mainnet for builders, showing early signs of network activity. Coinbase claims that over one million wallets have already deployed smart contracts on this emerging rollup.

In an industry environment that continues to see steady declines in developer activity, such excitement around a new ecosystem is highly encouraging.

OP Stack Superchain

Although trailing Arbitrum in TVL, Optimism has made progress in other key metrics such as network revenue and user transactions—thanks largely to their “Superchain” vision.

Optimism’s vision for the future of DeFi is an internet-like mesh of Ethereum rollups built on the OP Stack, capable of seamless interoperability. Launching your own OP Stack network is permissionless, and builders who contribute to the open-source codebase are eligible for retroactive funding rewards—an attractive incentive for many.

Base is the second core development team working on the OP Stack, but they’re not alone. Binance’s own Ethereum L2, opBNB, launched its testnet this summer, Mantle’s L2 ecosystem is building OP Stack dApps, and many application-specific chains are beginning to emerge.

Beyond Optimism, other Layer 2 solutions are positioning their roadmaps toward similar futures. Polygon revealed during the announcement of its new tokenomics model that Polygon 2.0 will be a connected set of rollups called Supernets. Not to be outdone, zkSync released ZK Stack—a framework for building custom roll-apps known as Hyperchains.

Indeed, the developmental trajectory of Ethereum Layer 2 solutions appears to be converging with Cosmos’ vision of app-specific chains. Compared to today’s first-layer infrastructure landscape, the freedom granted to builders by app-specific chains is unparalleled. It will be fascinating to compare the success of the OP Stack against the Cosmos ecosystem.

Will bringing Ethereum’s broad influence into Base, Optimism, and the OP Stack become the catalyst? We think it’s a strong possibility.

Regardless, Base’s success extends far beyond this recent memecoin peak. Coinbase has proven its value in the crypto industry time and again—and this time, we won’t be betting against them.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News