Blue-chip DeFi New Narrative: Data Analysis of Aave and Compound's Lending Business, Token Emissions, and Protocol Revenue

TechFlow Selected TechFlow Selected

Blue-chip DeFi New Narrative: Data Analysis of Aave and Compound's Lending Business, Token Emissions, and Protocol Revenue

Aave's capital size is 2.6 times that of Compound, making it the largest protocol in the current DeFi lending space.

Author: Jill, LD Capital

Introduction

Recently, Robert, the founder of Compound, announced the launch of a new company focused on tokenizing U.S. Treasury bonds, triggering a surge in RWA (Real World Assets) narratives and causing the price of COMP, Compound’s native token, to skyrocket. In addition, leading RWA protocol MakerDAO and top lending platform Aave have also seen significant increases in their token prices recently.

Given that Compound and Aave share similar product models—and since we’ve previously published data on MakerDAO—this article focuses on analyzing the fundamental metrics of Aave and Compound across three key areas: lending operations, token emissions, and protocol revenue and expenses.

Summary

Aave manages 2.6 times more capital than Compound, making it currently the largest lending protocol in DeFi. Although Compound was the first to introduce the liquidity pool model for lending, its conservative team and delayed business expansion have hindered its long-term growth. Aave, by contrast, seized the opportunity of multi-chain development with an innovative team, enabling it to surpass Compound over time.

Security is foundational to any DeFi protocol’s success, and minimizing potential risks is a top priority for teams. Both Aave and Compound incorporate risk isolation mechanisms in their designs. However, Compound has taken a more aggressive approach by reducing overall system complexity—isolating asset pools based on underlying assets, which effectively means forfeiting part of the market share involving altcoins as base assets. Aave aims to be a comprehensive, all-in-one lending protocol, capturing broader market share by isolating new assets from the core pool to minimize potential risks associated with using new tokens as collateral.

In terms of risk controls, both protocols allocate reserves to cover potential debt losses. Additionally, Aave includes a built-in safety module where token stakers backstop the entire protocol’s security—adding utility to the protocol token while locking up some supply to reduce market inflation.

Regarding token emissions, both protocols currently have relatively low emission rates, meaning selling pressure from token distributions has minimal impact on secondary market prices. Aave launched earlier, with 90.5% of its tokens already in circulation; however, the safety module locks up a portion of circulating supply. Compound pioneered liquidity mining, but this model led to large sell-offs once users received substantial rewards, negatively impacting the protocol. As a result, Compound shifted its incentive strategy, distributing tokens directly to real users. Currently, 68.6% of COMP tokens are in circulation.

Both COMP and AAVE token prices have risen significantly due to recent enthusiasm around RWA narratives. However, Compound’s founder’s new company is still in the application stage, and Aave’s RWA holdings amount to only $7.65 million—just 0.3% of MakerDAO’s RWA scale.

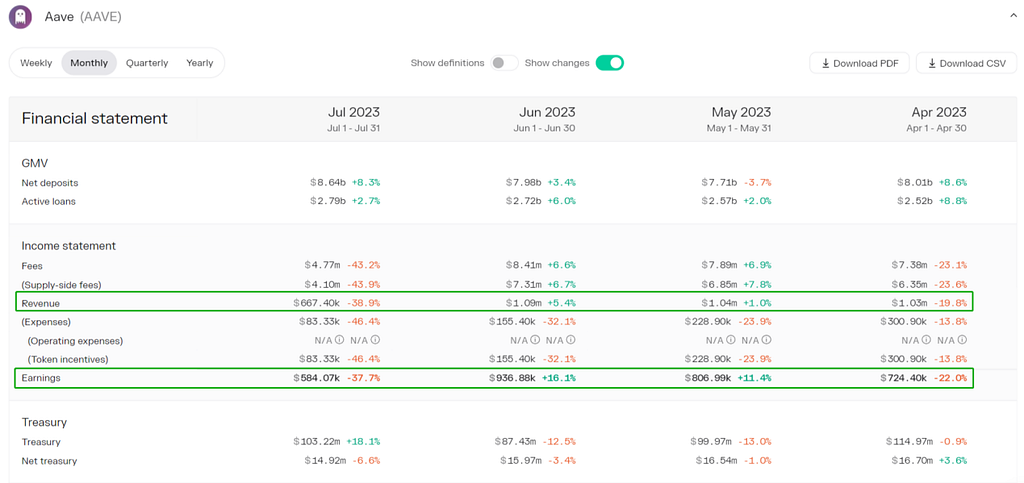

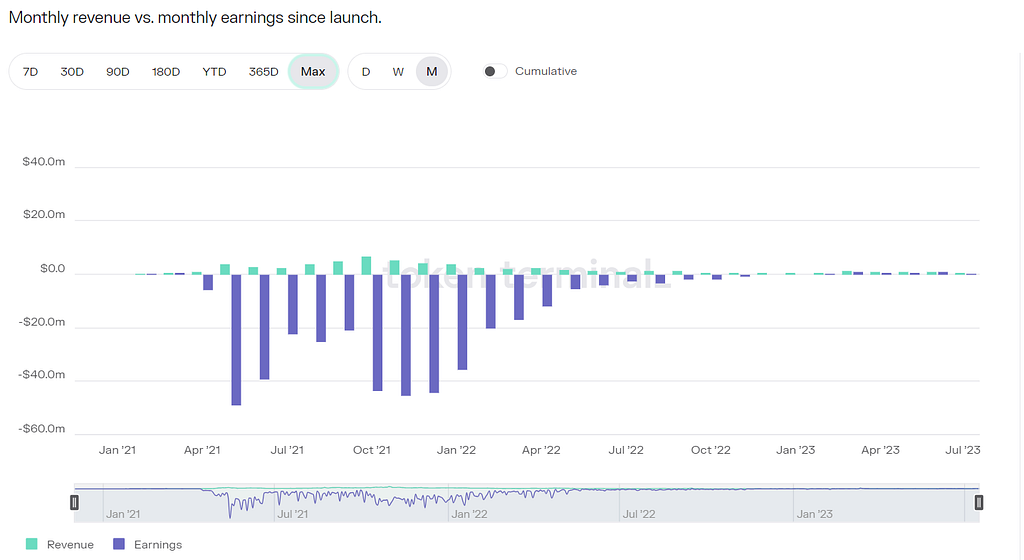

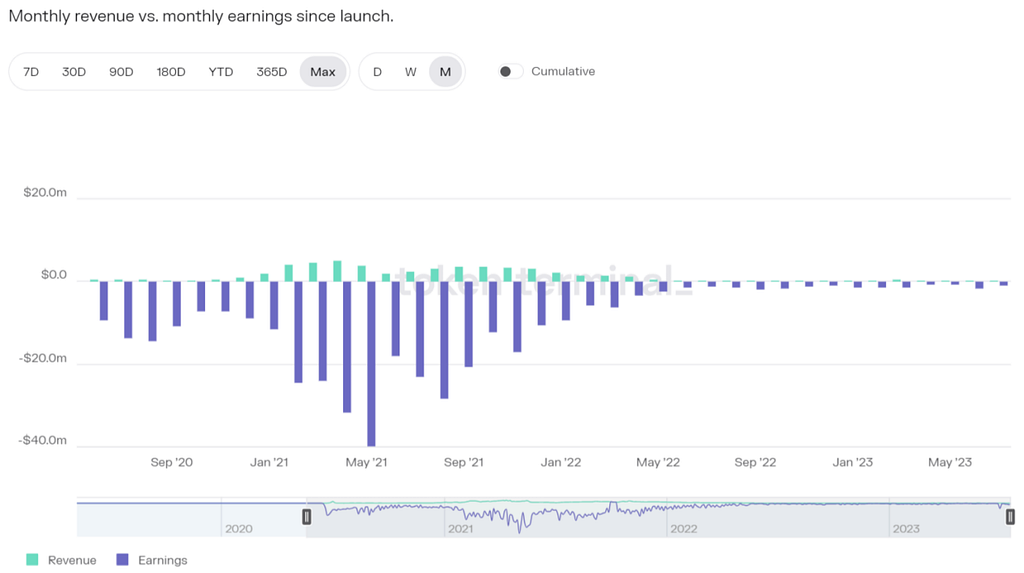

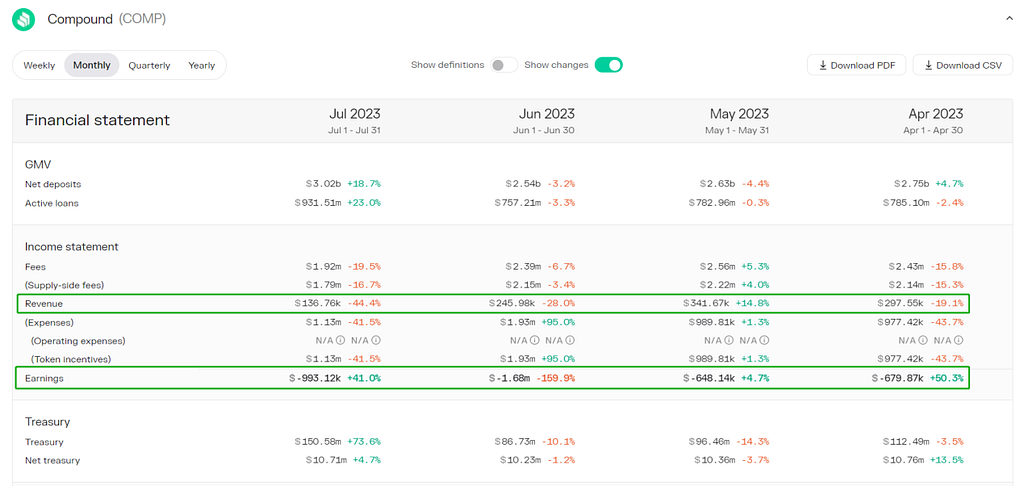

In terms of protocol revenue and expenses, Aave has more diversified income streams, including interest from borrowing its stablecoin GHO, all of which goes directly to the treasury. Revenue trends show that after the previous bull market, Aave’s income sharply declined. However, current revenues now exceed expenditures. In contrast, Compound still relies on COMP token incentives to subsidize operations. Compound’s revenue sources are narrow, with Aave generating approximately four times more protocol revenue than Compound.

1. Product Fundamentals

1.1 Product Versions

Aave initially used peer-to-peer lending but later transitioned to a pooled model inspired by Compound, offering higher liquidity due to inefficient matching in P2P. Aave is currently on version V3, designed to improve capital efficiency, enhance security, and enable cross-chain lending.

Higher capital efficiency refers to “Efficiency Mode” (eMode), which categorizes assets and sets risk parameters accordingly. When borrowers use collateral and borrow assets within the same category, they can access higher loan-to-value ratios. Higher security is achieved through “Isolation Mode,” where newly listed assets via governance proposals are first placed into isolation. These assets face debt caps, and when used as collateral, only allow borrowing of approved stablecoins. This allows Aave to list more long-tail assets while maintaining protocol safety.

These features are already active in V3, while the cross-chain lending feature (Portal) has been technically ready since March 2022 when V3 launched. However, due to security concerns, the team has proceeded cautiously and has not yet deployed it officially. Notably, Aave's cross-chain functionality depends on third-party bridge protocols rather than being fully controlled by Aave itself.

Compound was the first DeFi protocol to introduce pooled lending, allowing borrowing between major crypto assets. However, its V3 version departs from the universal lending model by isolating pools based on different underlying assets—a design choice aimed at mitigating systemic risk and preventing irreversible damage from issues related to a single asset.

Specifically, in Compound V2, users could freely deposit (as collateral) or borrow any supported asset—the underlying asset being what users borrowed. In V3, each pool contains only one base asset, though collateral options remain unrestricted. The first V3 pool launched with USDC as the base asset, allowing users to pledge major cryptocurrencies to borrow USDC.

1.2 Lending Operations

When choosing a lending protocol, users prioritize asset security. Assuming equal safety, users generally prefer larger protocols because higher total value locked (TVL) typically indicates better liquidity. Other factors include favorable interest rates, variety of supported assets, and lending incentives. We compare Aave and Compound across these dimensions below.

TVL data comes from defillama.com. Since the last bull market, most DeFi protocols have experienced significant drawdowns. As leaders in DeFi lending, Aave currently holds 2.6 times more capital than Compound, making it the largest lending protocol in the space.

Both Aave and Compound are now deployed across multiple chains. However, Aave entered chains like Polygon early in 2021 and maintains a leading position on many of them, securing greater market share. Compound only began expanding to other chains this year. That said, Ethereum remains the primary lending environment. Aave supports more altcoins, although some have been frozen due to potential risks, resulting in a count similar to Compound V2. Compound V3 supports far fewer assets: the USDC market accepts ETH, WBTC, COMP, UNI, and LINK as collateral, while the ETH market only accepts wstETH and cbETH. Moreover, Aave supported stETH as collateral in February 2022, whereas Compound did not list wstETH and cbETH until January of this year. This illustrates Compound’s slower pace in multi-chain expansion and less aggressive business development compared to Aave, which has steadily pulled ahead.

Both protocols use dynamic interest rate models, with block-level accruals on Ethereum, a mechanism first introduced by Compound. The core of both models revolves around utilization rate—algorithmically adjusting rates based on borrowing demand, with little difference between them. When utilization is high, rates increase accordingly. Both also implement "optimal utilization" thresholds, beyond which borrowing rates spike sharply to discourage excessive borrowing and prevent liquidity depletion. In general, Aave achieves higher capital utilization efficiency for both stablecoins and altcoins compared to Compound.

From a pool architecture perspective, both employ risk mitigation measures, but Aave still operates under a full-pool risk model. To protect safety, newly added assets are initially placed in Isolation Mode, with specific risk parameters and permitted base assets to limit potential risks from new collateral types. Compound V3, however, isolates pools entirely based on different base assets—at the architectural level—effectively sacrificing market opportunities involving altcoins as base assets.

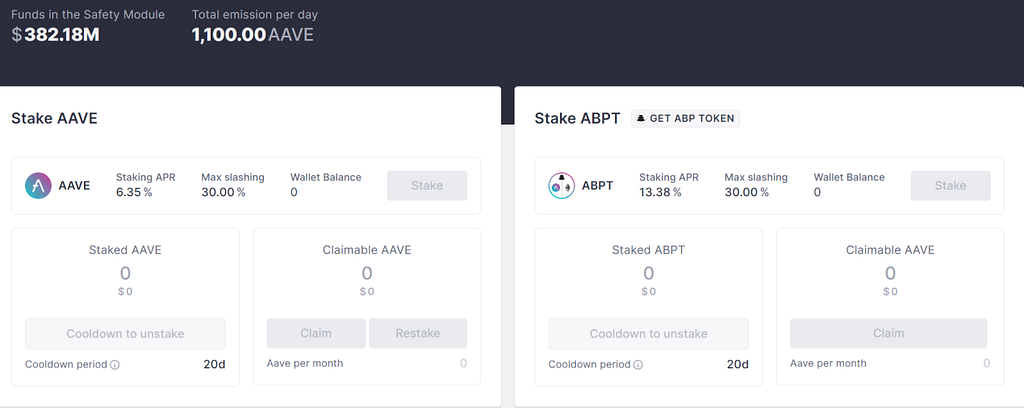

To mitigate potential system risks, Compound introduced the concept of “reserves,” allocating a portion of borrowing interest according to a reserve factor to cover potential losses. Beyond collecting reserves, Aave implements a Safety Module where AAVE token stakers absorb up to 30% of protocol losses. In return, stakers receive AAVE token rewards and a share of protocol revenues.

Compound pioneered the concept of liquidity mining, rewarding users with COMP tokens, though these incentives are now being gradually reduced. Aave launched earlier, and its tokens are nearly fully circulated. Currently, Aave mainly partners with other projects to incentivize liquidity—for example, in June 2021, it partnered with Polygon to offer over $85 million in token incentives for liquidity providers on Aave’s Polygon markets.

1.3 Other Business Lines

Stablecoin: Aave launched its native stablecoin GHO on mainnet on July 15, with a competitive 1.5% borrowing rate. All interest earned from GHO loans goes directly to the treasury. Within two days of launch, over 2.21 million GHO were borrowed. Future growth will depend on the team’s ability to drive liquidity. Compound currently has no plans to issue a stablecoin.

RWA: Aave became the second major DeFi protocol after MakerDAO to integrate RWA assets, partnering with Centrifuge’s Tinlake. The RWA market operates independently from Aave’s main lending markets. Current funding stands at approximately $7.65 million—far smaller than MakerDAO’s $2.3 billion RWA exposure. Only the USDC market currently offers APY for deposits and borrowing; others have discontinued incentives. KYC-approved users who deposit USDC in the USDC market earn a base annual yield of 2.83% plus a 4.09% wCFG liquidity mining reward.

On June 29, Compound’s founder announced he had filed documents with U.S. securities regulators to establish Superstate, a bond fund company—but the application remains pending.

In summary, while Compound pioneered the liquidity pool lending model, its laid-back team and slow business development have allowed Aave—through proactive multi-chain expansion and continuous innovation—to pull ahead and become the dominant player.

2. Token Demand and Emissions

In July 2020, Aave released an updated economic model, converting the original LEND token to AAVE at a 100:1 ratio. LEND was fully circulating. The total supply of AAVE is 16 million, with 13 million available for conversion from LEND and the remaining 3 million allocated as protocol-issued tokens for ecosystem reserves.

AAVE’s primary uses within the protocol are governance and staking. Aave includes a built-in Safety Module (SM), allowing token holders to stake AAVE to backstop potential shortfalls in the protocol. In return, stakers receive AAVE token rewards and a share of protocol revenues.

From the official staking dashboard, the current daily AAVE emission is 1,100 tokens. At a price of $80.56 on July 15 (per Coingecko), this amounts to ~$886,000 per day. The current circulating supply of AAVE has reached 90.52%.

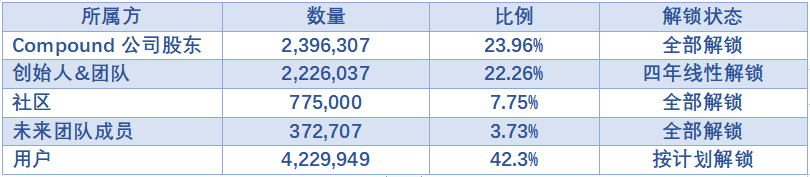

Compound’s token is COMP, launched in June 2020 with a total supply of 10 million. As the governance token of the Compound protocol, COMP is primarily used for governance participation (proposal voting) and as incentives in the lending markets. The initial distribution of COMP was as follows:

Current unlocking pressure mainly stems from allocations to founders, team members, and users. The release schedule for the team allocation is unclear, while user allocations are primarily tied to lending activity incentives.

According to a proposal passed on July 15, 2023, incentives for participating in USDC and DAI supply/borrowing in V2 markets were reduced from 161.2 COMP to 111.2 COMP. Total daily rewards in V2 markets are now 111.2 × 4 = 444.8 COMP (with 0.015 COMP per block for both supply and borrow). Concurrently, another proposal reduced borrowing incentives in V3 markets from 481.41 COMP to 381.41 COMP per day, while increasing supply-side rewards from 0 to 100 COMP/day—shifting some borrowing incentives to supply-side activities. Thus, total daily rewards in V3 remain unchanged at 481.41 COMP.

Based on these proposals, the current deterministic daily emission of COMP is 926.21 tokens. At a price of $74 on July 15 (Coingecko), this equates to ~$685,000 per day. The current circulating supply of COMP stands at 68.56%.

As early-launched DeFi protocols, both Compound and Aave currently have low token emissions, so selling pressure has minimal impact on secondary market prices. Both use their tokens for governance and user incentives, but differ in approach: Compound distributes tokens directly to active lenders and borrowers to attract liquidity, while Aave incentivizes token holders to stake, thereby securing the protocol against risks and reducing circulating supply to combat inflation. With approximately 4.68 million AAVE tokens staked in the Safety Module, the effective circulating supply of AAVE is around 61.3%.

3. Protocol Revenue and Expenses

Aave’s treasury consists of system reserves and treasury collectors. Aave generates revenue from multiple sources: 1) interest rate spreads between deposits and loans, varying by market; 2) flash loan fees (typically 0.09% of the borrowed amount), with 30% going to the protocol treasury and 70% distributed to depositors; 3) GHO minting fees; and 4) in V3, additional potential revenue streams include instant liquidity fees, liquidation fees, and portal fees paid through bridge protocols—though the latter two are not yet activated.

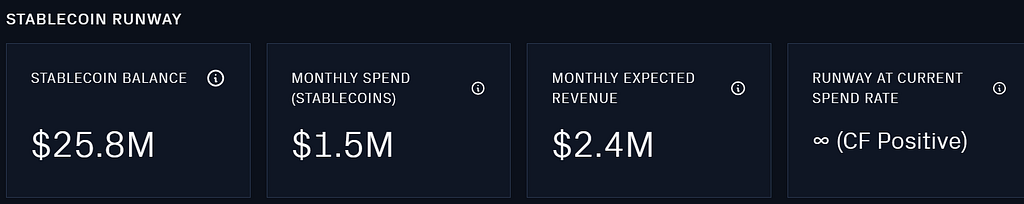

The Aave treasury currently holds assets worth $130 million: $91.5 million (1.2 million AAVE tokens) held as ecosystem reserves in AAVE, and $25.8 million in stablecoins.

Data above sourced from llama.xyz, an officially recognized source for Aave. Note that data collection starts from January 2022. For example, in June 2023, monthly expenses (token incentives) totaled $1.5 million, monthly revenue was $2.4 million, resulting in a surplus of $900,000—consistent with figures from Token Terminal.

Compound’s sole revenue source is the interest rate spread between borrowing and lending. As there is no official statistics site, we reference Token Terminal for consistency.

In Token Terminal’s calculation, protocol revenue = borrowing fees – deposit interest (supply-side costs); earnings = protocol revenue – liquidity incentives.

Aave’s revenue began rising gradually from May 2021, peaking between September and November 2021. Afterward, revenue declined sharply, falling to $1.9 million per month by April 2022, then down to $860,000 by October 2022—just 12.6% of peak levels—and continued declining. Starting March 2023, revenue rebounded to $1.3 million per month.

Earnings are influenced by token price and emission volume: the higher the token price, the lower the reported earnings. By December 2022, Aave’s revenue exceeded incentive costs—primarily due to the decline in AAVE’s token price—marking the beginning of sustained profitability from that point onward.

Compound’s revenue began growing from January 2021, peaking in March–April 2021 at around $5 million per month. From February 2022, revenue dropped sharply, stabilizing around $1 million per month before declining further to $460,000 in May 2022, continuing downward.

Compound pioneered the “lending-as-mining” model, offering generous token incentives, which kept earnings low. After April 2022, Compound revised its incentive model, gradually reducing COMP rewards. Combined with a significant drop in COMP’s price, earnings began to recover. However, protocol revenue still falls far short of covering incentive payouts.

According to LinkedIn, Aave currently employs 98 people, while Compound has 18. Aave’s team size is over five times larger, implying potentially much higher operational expenses.

Comparing both protocols’ revenues, Aave benefits from diverse income streams, whereas Compound relies on a single source. Based on June’s figures, Aave’s monthly revenue is approximately 4.4 times that of Compound (105/24.5). Aave’s revenue now exceeds its incentive costs, while Compound continues to rely on COMP token subsidies.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News