LDO and RPL Token Supply and Demand Comparison: How to Make the Right Choice?

TechFlow Selected TechFlow Selected

LDO and RPL Token Supply and Demand Comparison: How to Make the Right Choice?

This article aims to analyze, from a capital perspective, the token selling pressure and demand for Lido and RocketPool—the two largest LSD projects—arising from non-secondary market transactions, providing reference for selecting investment targets across different investment horizons.

Author: Yuuki, LD Capital

Currently, ETH's staking rate has surpassed 20%, while maintaining strong growth momentum. In previous reports, we have thoroughly discussed the LSD sector and fundamentals of various projects. This article aims to analyze, from a capital perspective, the token selling pressure and demand for Lido and Rocket Pool—the two leading LSD projects—stemming from non-secondary market transactions, providing reference for selecting investment targets across different time horizons. (FXS is not included in this analysis due to its diversified product positioning, which makes it unsuitable to categorize simply under the LSD sector; its fundamentals differ significantly from LDO and RPL.)

1. LDO Token Distribution and Sources of Selling Pressure:

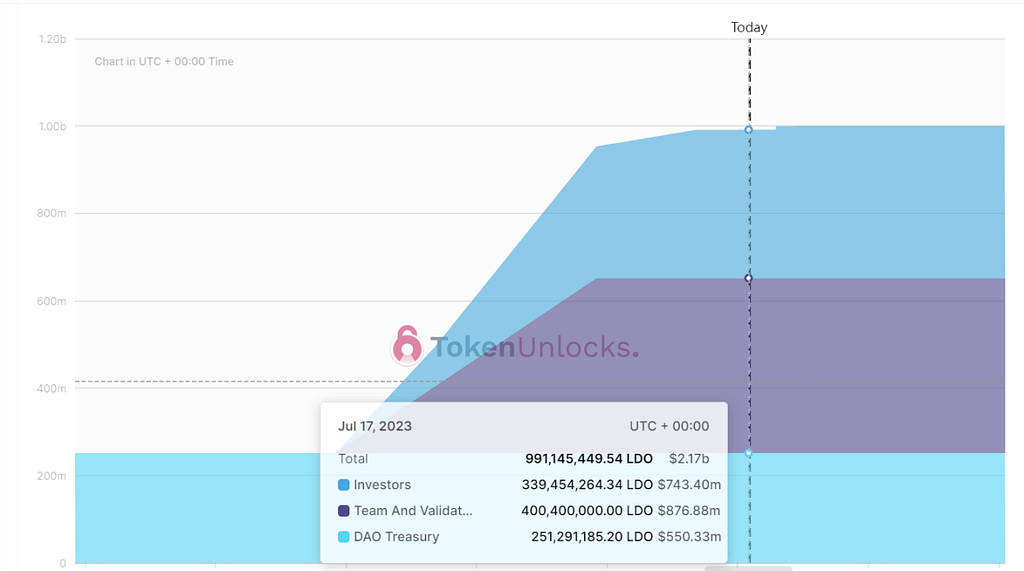

The total supply of LDO is 1 billion, with a current circulating supply of 879 million. According to recent data from Token Unlocks (not the initial distribution), the token allocation is as follows: 40.2% allocated to the team and validators, 34.6% to investors, and 25.2% to the treasury. The next major LDO unlock will occur on August 26, 2023, releasing 8.5 million LDO tokens belonging to Dragonfly, with a cost basis of $2.43 per token. The chart below illustrates LDO's distribution and unlocking schedule:

Source: Token Unlocks, LD Capital

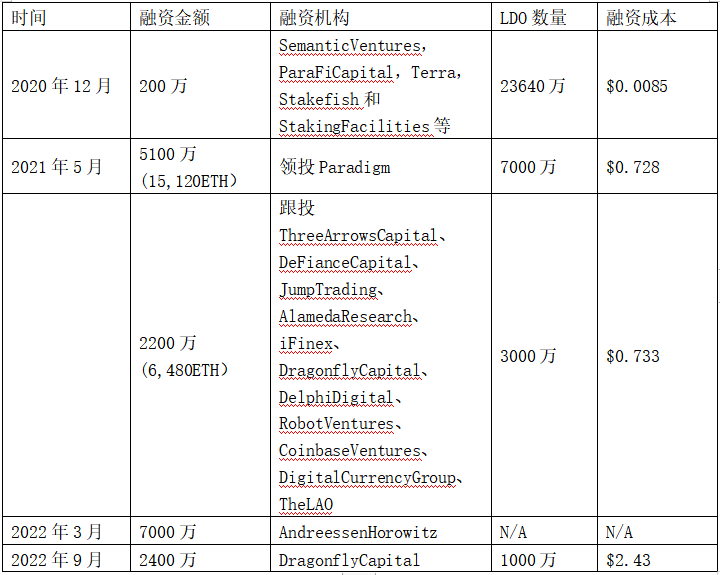

Lido has completed five funding rounds historically, with the first round taking place before the token launch at an extremely low cost of $0.0085/LDO. A detailed breakdown is shown below:

Source: LD Capital

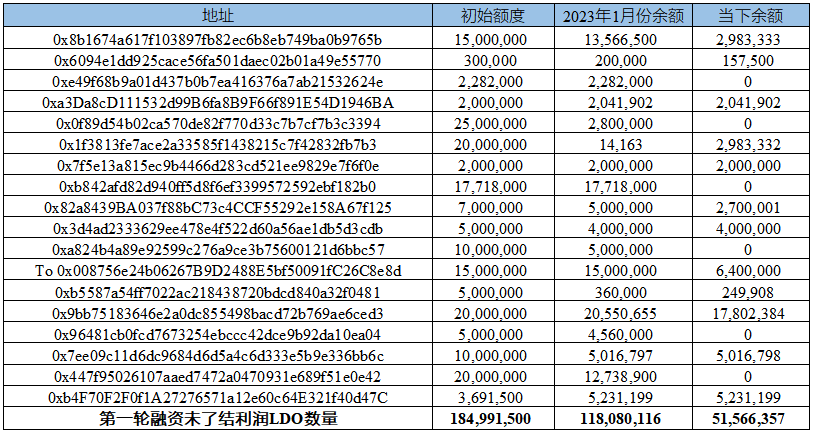

The main factor currently affecting LDO’s secondary market price is that the majority of early-stage investor allocations have already been unlocked, resulting in sustained profit-taking and significant selling pressure on the secondary market. Notably, the first-round investors acquired tokens at an average cost of approximately $0.0085—over 200x lower than current prices—making their sell-offs particularly impactful. The table below summarizes wallet addresses associated with first-round investors and their current token balances:

Source: LD Capital

The table above covers over 90% of first-round investor addresses. Aggregated data shows these low-cost holders continuously selling tokens. First-round investor tokens began linear vesting in December 2021 and were fully unlocked by December 2022. Due to their negligible cost basis, they are relatively insensitive to current secondary market prices. Based on initial allocation, balance statistics from January 2023, and current holdings, first-round investors have been selling approximately 7.41 million LDO monthly. There remain about 51.57 million LDO yet to be sold from this round; at the current pace, selling pressure will persist for another seven months.

From this perspective, unless there is a significant shift in Lido’s fundamentals or new capital inflows into the market, LDO’s secondary market performance will remain under persistent downward pressure until early investor holdings are fully liquidated. (Recently, following XRP's legal victory against the SEC, market expectations regarding SEC regulation of Ethereum staking have decreased, leading to sharp price increases for "security-like" tokens such as XRP, SOL, and ADA—including LDO. During this rally, Certus One, a first-round investor, sold 4 million LDO at elevated prices. Since then, LDO has declined 16.3% from its recent peak.)

2. RPL Token Distribution and Supply-Demand Dynamics

RPL is fully circulating with a total supply of 19.55 million. The initial supply was 18 million: 9.72 million (54%) raised through private sale at $0.21 per token, 5.58 million (31%) through public sale at $0.98 per token, and 2.7 million (15%) allocated to the team. The RPL public sale concluded in January 2018. Given the long timeframe and multiple market cycles since then, early investor holdings have largely turned over. On-chain holder analysis indicates no meaningful selling pressure from initial investors. Instead, attention should focus on inflationary pressures from ongoing emissions. The chart below shows RPL's distribution and inflation schedule:

Source: Token Unlocks, LD Capital

Since October 2021, RPL has undergone linear inflation at a rate of 73,302 tokens every 28 days, lasting for 10 years, resulting in a 5% annual inflation rate. The total supply will eventually reach 30 million. Of the newly emitted tokens, 15% go to oDAO (oracle node DAO), 15% to the protocol DAO, and the remaining 70% to node operators. The breakdown is shown below:

Source: LD Capital, Rocket Pool

Node operators receive 70% of RPL emissions. To qualify for emissions, operators must stake RPL—between 10% and 150% of the value of user ETH they manage—with higher stakes yielding greater rewards. Most large node operators stake at the maximum allowed ratio. Currently, the RPL staking rate stands at 46.97% and continues to rise. From this perspective, RPL functions similarly to leveraged exposure to the platform’s staked ETH value. As the platform’s staked ETH amount grows or ETH price rises, RPL gains strong fundamental support due to the protocol’s staking mechanism. The chart below shows the rising RPL staking rate:

Source: Rocket Pool, LD Capital

Overall, from a data standpoint, RPL faces no selling pressure from early investors. Since October 2021, although 1.55 million RPL have been inflated, 9.18 million RPL have been newly staked, reducing the actual circulating supply by 7.63 million. Absent any signs of declining business activity, protocol-driven buying demand is expected to consistently exceed inflationary supply. (For updates on Rocket Pool’s growth metrics, refer to LD Capital’s weekly sector reports.)

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News